- Ethereum saw a huge drop in Open Interest in April following the rejection at $3.7k

- The on-chain metrics were still healthy, hinting at the possibility of an uptrend

Ethereum [ETH] was trading at $3.2k at press time. The $3k psychological level was breached multiple times since the 13th of April on the lower timeframes, and sentiment behind the altcoin king has weakened considerably.

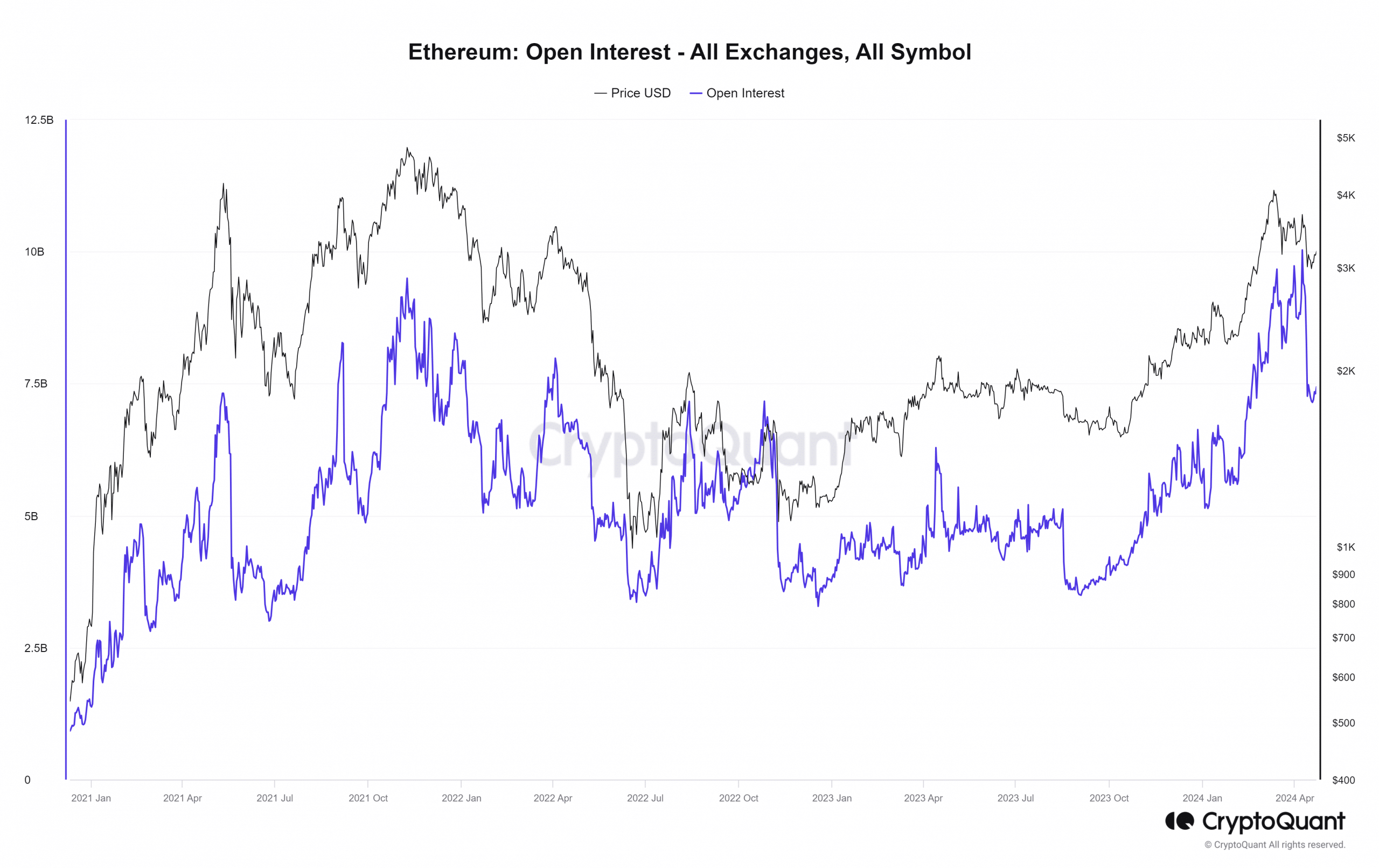

This was evident by the sheer drop in the Open Interest behind ETH. Combined with the price trajectory of the past couple of weeks, it appeared that a downtrend was possible.

Yet, with $3k defended on the higher timeframes, there was also the possibility of a resurgence for the bulls. AMBCrypto investigated on-chain metrics to understand which path is more likely.

Similarities to Feb 2021

Source: CryptoQuant

During the previous bull run, in mid-February 2021, the price of Ethereum corrected from $1.9k (an ATH at that time) to $1.4k. It was followed by a V-reversal, but it showed that there are many times when the futures market gets overheated.

Impatient bulls want to make a quick buck going long on leverage. This does work, but after a point, the lack of spot demand and the overwhelming longs in the futures market get reset.

The drop in OI from $10 billion to $7.17 billion in April was likely one more such reset. It is unclear whether a similar V-reversal would commence, given the selling pressure behind Bitcoin also in recent weeks.

User adoption has fallen alongside prices, sentiment

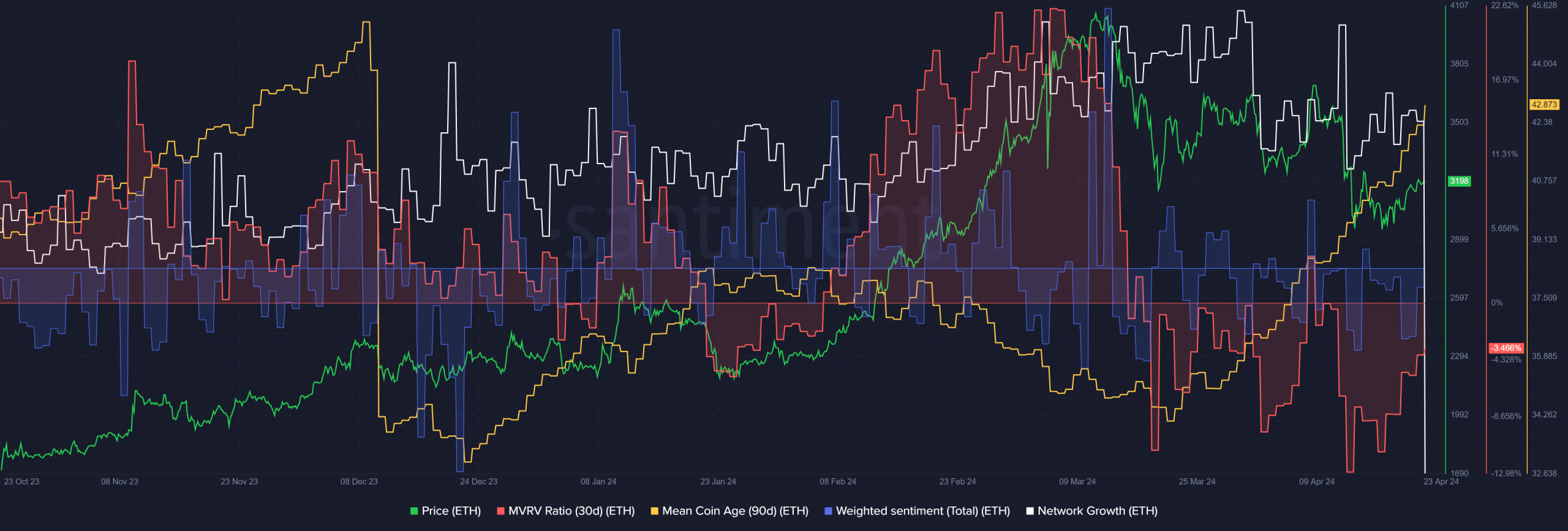

Source: Santiment

The weighted social sentiment had been strongly positive in February and for a couple of days in mid-March. Since then, it has been negative for the most part as prices entered a correction. The sentiment before the price peak could also revolve around the high gas fees on the network.

The network growth metric also slowed down in the past three months. An uptick would be a sign of growing demand, but it will more likely follow an uptrend than precede it.

Is your portfolio green? Check the Ethereum Profit Calculator

The 90-day mean coin age has trended steadily higher since 27th March. This showed a network-wide accumulation of ETH. Meanwhile, the 30-day MVRV ratio has been negative for nearly a month now, showing holders at a loss.

It presented a good buying opportunity, but some uncertainty remained. If ETH can climb back above the $3.3k resistance, swing traders and investors will be more confident of continued gains.

- Ethereum saw a huge drop in Open Interest in April following the rejection at $3.7k

- The on-chain metrics were still healthy, hinting at the possibility of an uptrend

Ethereum [ETH] was trading at $3.2k at press time. The $3k psychological level was breached multiple times since the 13th of April on the lower timeframes, and sentiment behind the altcoin king has weakened considerably.

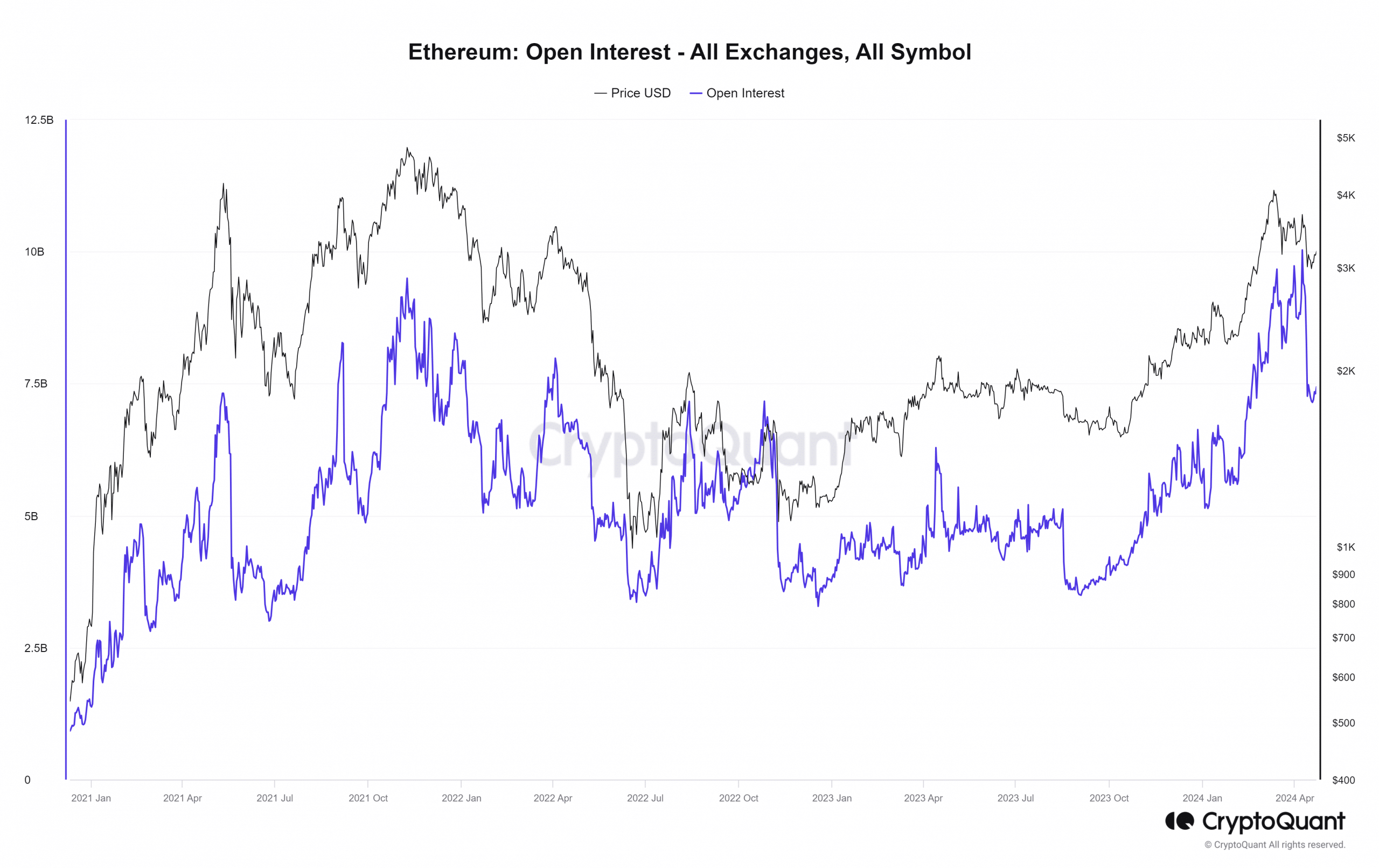

This was evident by the sheer drop in the Open Interest behind ETH. Combined with the price trajectory of the past couple of weeks, it appeared that a downtrend was possible.

Yet, with $3k defended on the higher timeframes, there was also the possibility of a resurgence for the bulls. AMBCrypto investigated on-chain metrics to understand which path is more likely.

Similarities to Feb 2021

Source: CryptoQuant

During the previous bull run, in mid-February 2021, the price of Ethereum corrected from $1.9k (an ATH at that time) to $1.4k. It was followed by a V-reversal, but it showed that there are many times when the futures market gets overheated.

Impatient bulls want to make a quick buck going long on leverage. This does work, but after a point, the lack of spot demand and the overwhelming longs in the futures market get reset.

The drop in OI from $10 billion to $7.17 billion in April was likely one more such reset. It is unclear whether a similar V-reversal would commence, given the selling pressure behind Bitcoin also in recent weeks.

User adoption has fallen alongside prices, sentiment

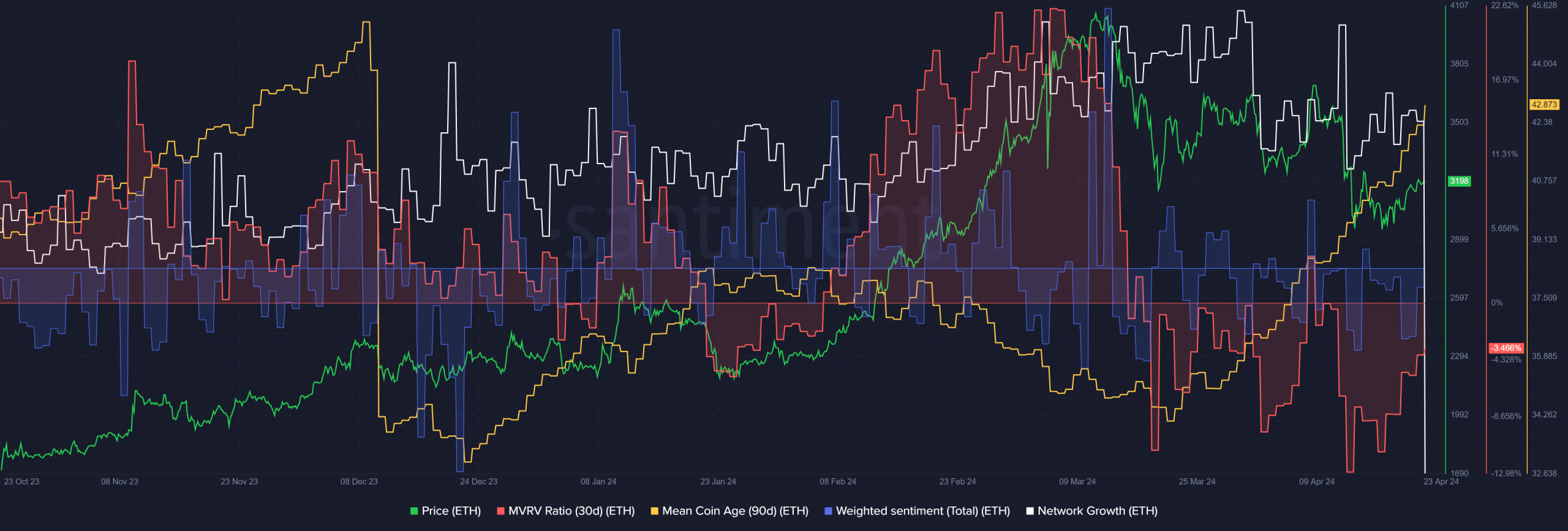

Source: Santiment

The weighted social sentiment had been strongly positive in February and for a couple of days in mid-March. Since then, it has been negative for the most part as prices entered a correction. The sentiment before the price peak could also revolve around the high gas fees on the network.

The network growth metric also slowed down in the past three months. An uptick would be a sign of growing demand, but it will more likely follow an uptrend than precede it.

Is your portfolio green? Check the Ethereum Profit Calculator

The 90-day mean coin age has trended steadily higher since 27th March. This showed a network-wide accumulation of ETH. Meanwhile, the 30-day MVRV ratio has been negative for nearly a month now, showing holders at a loss.

It presented a good buying opportunity, but some uncertainty remained. If ETH can climb back above the $3.3k resistance, swing traders and investors will be more confident of continued gains.

how can i get cheap clomid pill order clomid pills cost of clomid without a prescription can you buy clomid without rx clomiphene without rx order generic clomiphene without rxРіРѕРІРѕСЂРёС‚: cost generic clomiphene for sale

This website positively has all of the low-down and facts I needed adjacent to this thesis and didn’t positive who to ask.

I’ll certainly return to review more.

zithromax us – sumycin 250mg drug metronidazole medication

order semaglutide 14mg – semaglutide 14mg uk where can i buy periactin

buy generic motilium – buy cheap motilium order cyclobenzaprine pill

buy amoxicillin sale – amoxil usa buy ipratropium 100 mcg for sale

order azithromycin 500mg pills – cost tindamax nebivolol sale

augmentin 375mg canada – https://atbioinfo.com/ ampicillin price

esomeprazole 40mg tablet – https://anexamate.com/ esomeprazole uk

generic warfarin – https://coumamide.com/ purchase cozaar online

buy meloxicam 7.5mg without prescription – https://moboxsin.com/ buy mobic online

order generic prednisone 5mg – asthma deltasone 5mg for sale

men’s ed pills – https://fastedtotake.com/ cheap ed drugs

amoxicillin generic – combamoxi.com buy amoxicillin generic

generic diflucan – on this site how to buy diflucan

lexapro 20mg tablet – escita pro buy generic escitalopram for sale

cenforce 100mg canada – this cheap cenforce 100mg

cialis professional – ciltad genesis how long i have to wait to take tadalafil after antifugal

buy tadalafil online canada – this best price for tadalafil

buy cheap generic zantac – click buy cheap generic ranitidine

cheap viagra next day delivery uk – strongvpls order cialis and viagra

More content pieces like this would urge the интернет better. amoxile

I couldn’t turn down commenting. Well written! amoxil for sale online

Greetings! Extremely productive suggestion within this article! It’s the little changes which liking espy the largest changes. Thanks a quantity for sharing! https://ursxdol.com/azithromycin-pill-online/

Thanks on putting this up. It’s understandably done. https://prohnrg.com/product/acyclovir-pills/

Facts blog you be undergoing here.. It’s obdurate to espy high calibre writing like yours these days. I justifiably appreciate individuals like you! Withstand vigilance!! https://ondactone.com/product/domperidone/

Palatable blog you have here.. It’s severely to espy elevated quality writing like yours these days. I truly respect individuals like you! Go through mindfulness!!

order levaquin 250mg generic

I couldn’t turn down commenting. Warmly written! https://sportavesti.ru/forums/users/lvkqv-2/

order forxiga 10 mg for sale – dapagliflozin 10 mg for sale buy forxiga cheap

xenical canada – this buy generic orlistat