- The Altcoin Season Index at 35 suggested that the many tokens were not out of depression.

- A decline in ETH’s network growth and volume might hinder the upswing.

If there is one phrase that has been trending in the market for months without almost nothing to show, it’s “altcoin season.”

For the anticipated period to come to life, Ethereum [ETH] and other non-Bitcoin [BTC] cryptocurrencies have to outperform BTC.

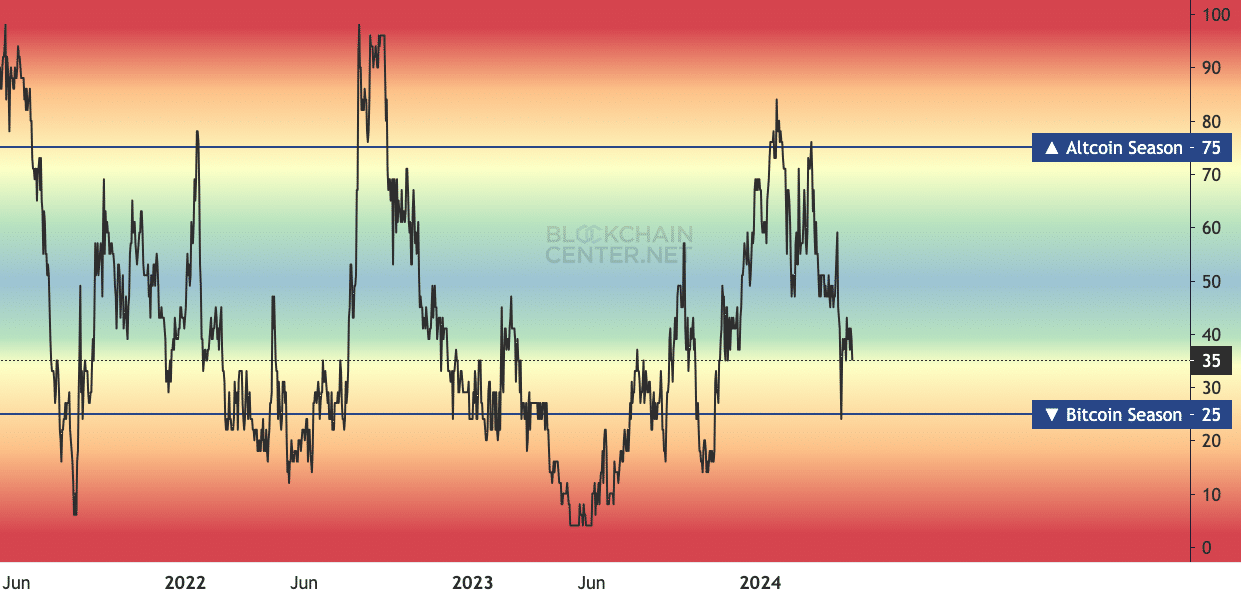

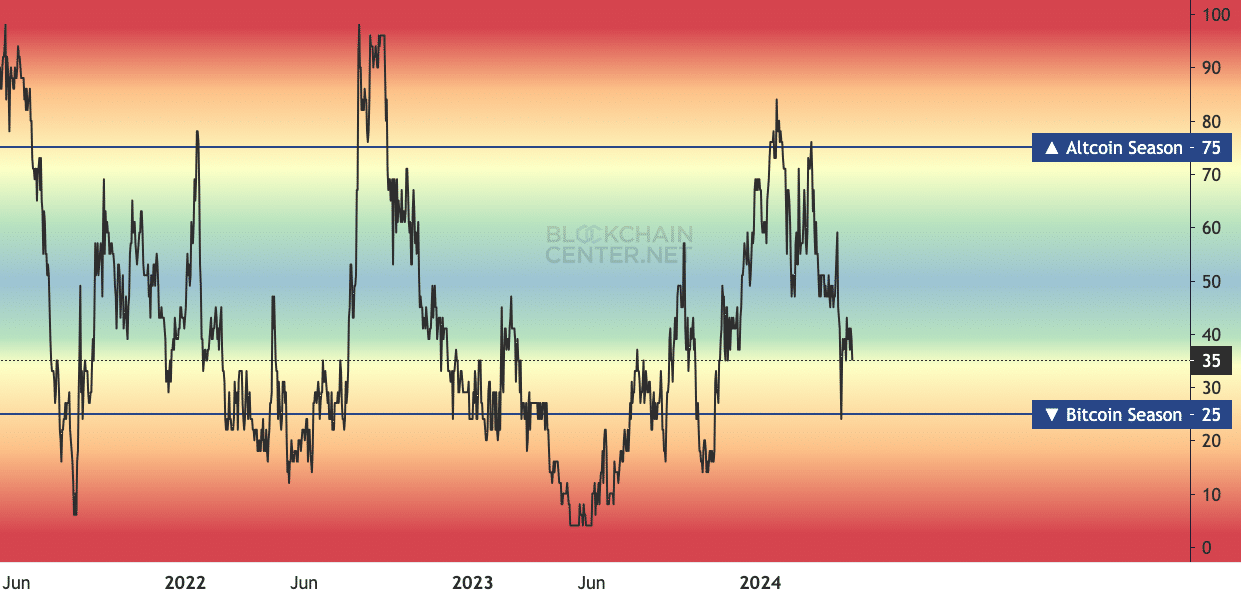

But that has not happened. In fact, AMBCrypto’s analysis of Blockchaincenter.net revealed that the time was not close. According to the platform, the Altcoin Season Index was at 35.

Alts fails to sustain the preview

To confirm an altcoin season, the reading has to be at 75. Interestingly, the index hit this height in the last week of January, and the first week of March. But it melted away within days.

Source: Blockchainceter.net

A look at tokens like ETH, Cardano [ADA], and Ripple [XRP] showed that their prices decreased in the last 90 days. Unless 75% of the top 50 cryptos outperform BTC, there will be no altcoins season.

Considering the press time circumstances, one can assume that the period was not close. Apart from the index, one factor that could determine is ETH.

In 2021, the surge in Ethereum was one of the first movers that activated the price increase that many altcoins experienced.

Notably, less than 20 altcoins out of the top 50 have outperformed Bitcoin in the last 90 days.

But ETH was not part of them. Furthermore, the cryptocurrency has not been able to make the kind of moves it did in the last bull market.

ETH dashes the hope

However, if demand for ETH surges, the condition might change, and the price of the token might climb to test its all-time high. For this to take place, a lot of new addresses have to come into the Ethereum network.

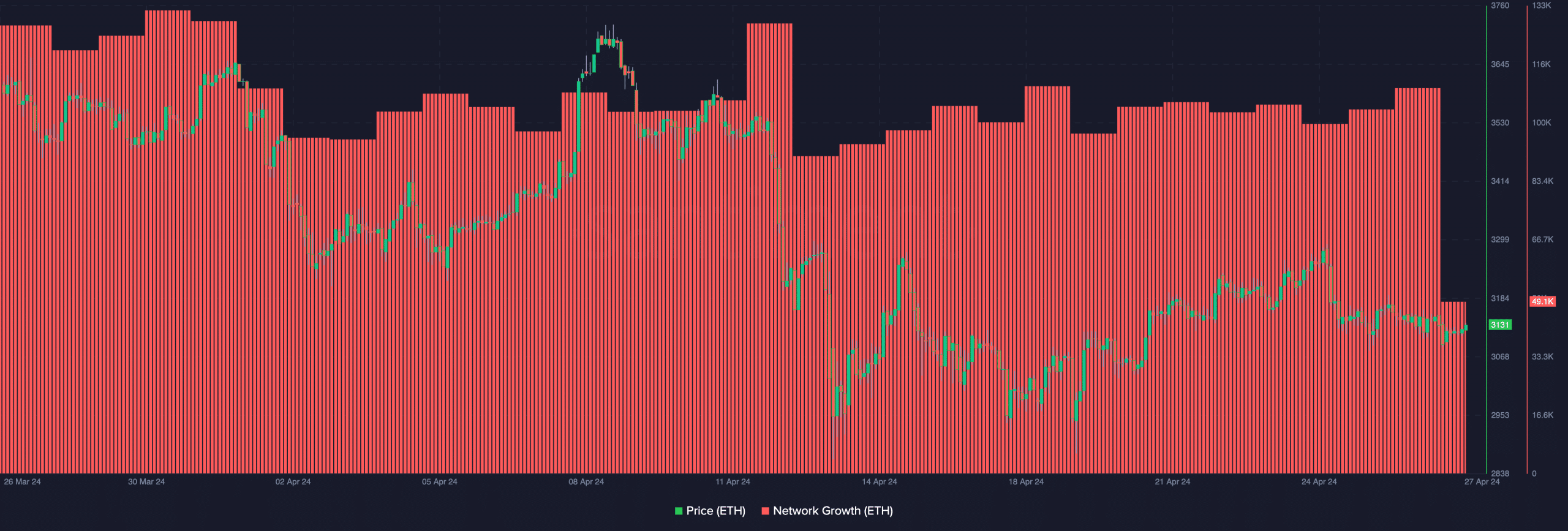

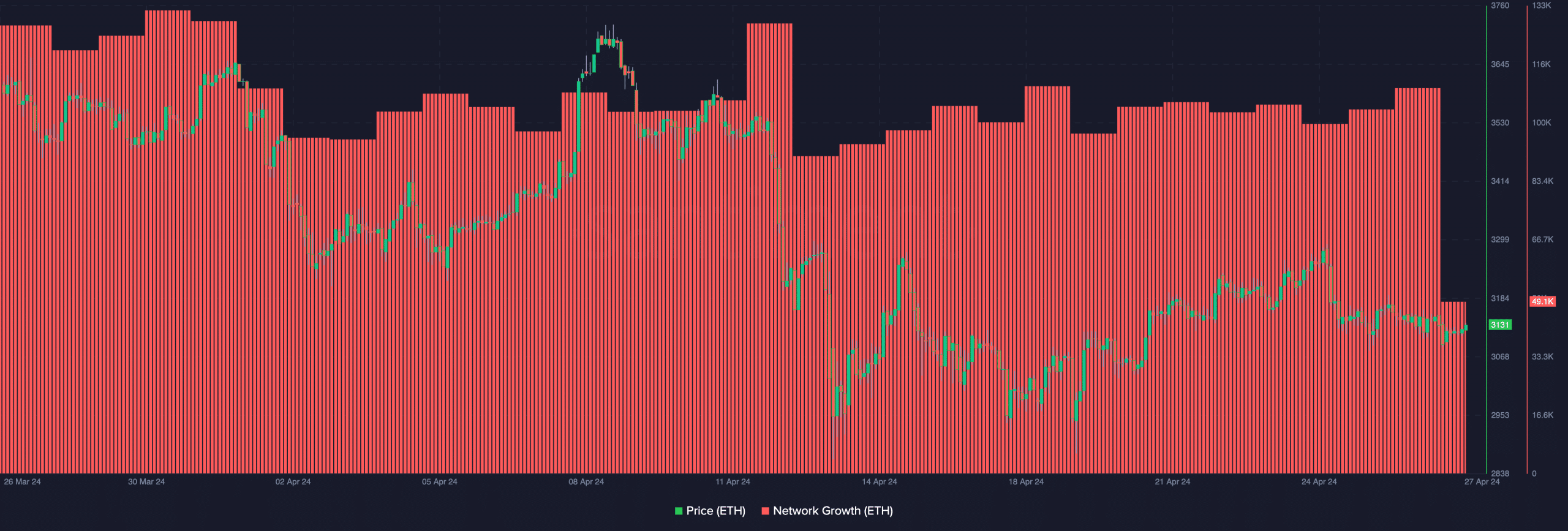

To track this, AMBCrypto looked at network growth. At press time, network growth on Ethereum was 3131, suggesting that the adoption of the cryptocurrency has been unimpressive.

Source: Santiment

If the metric continues to decline, ETH’s price might find it challenging to move northward. In this case, altcoin season might continue to be delayed.

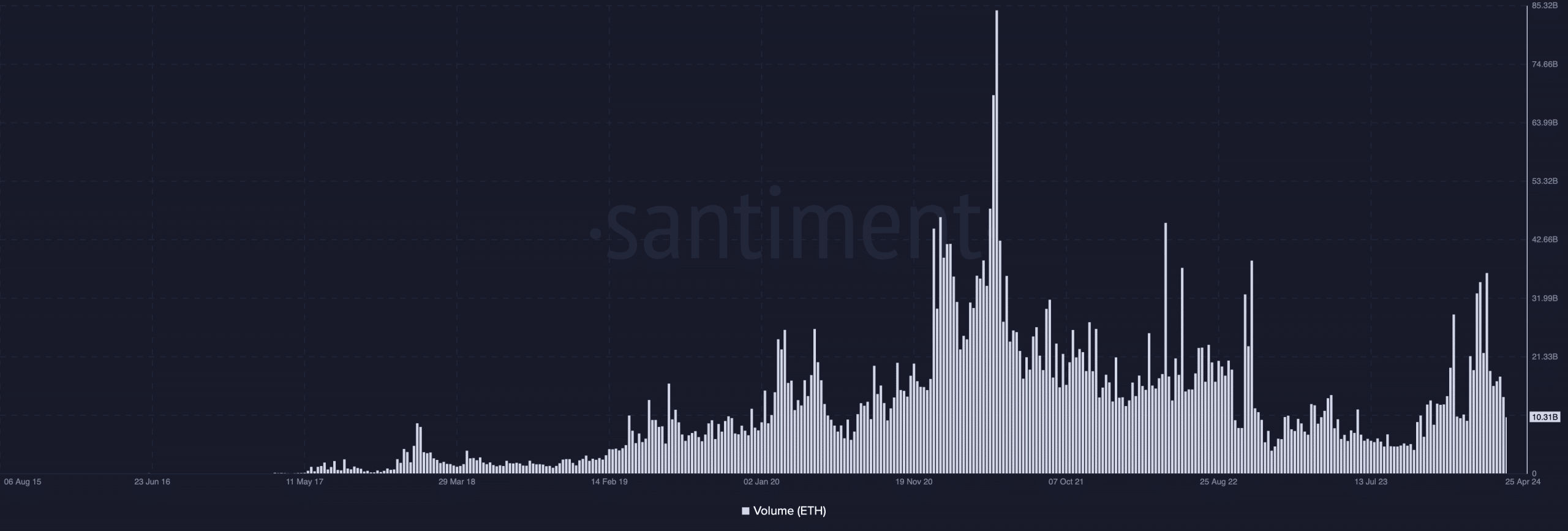

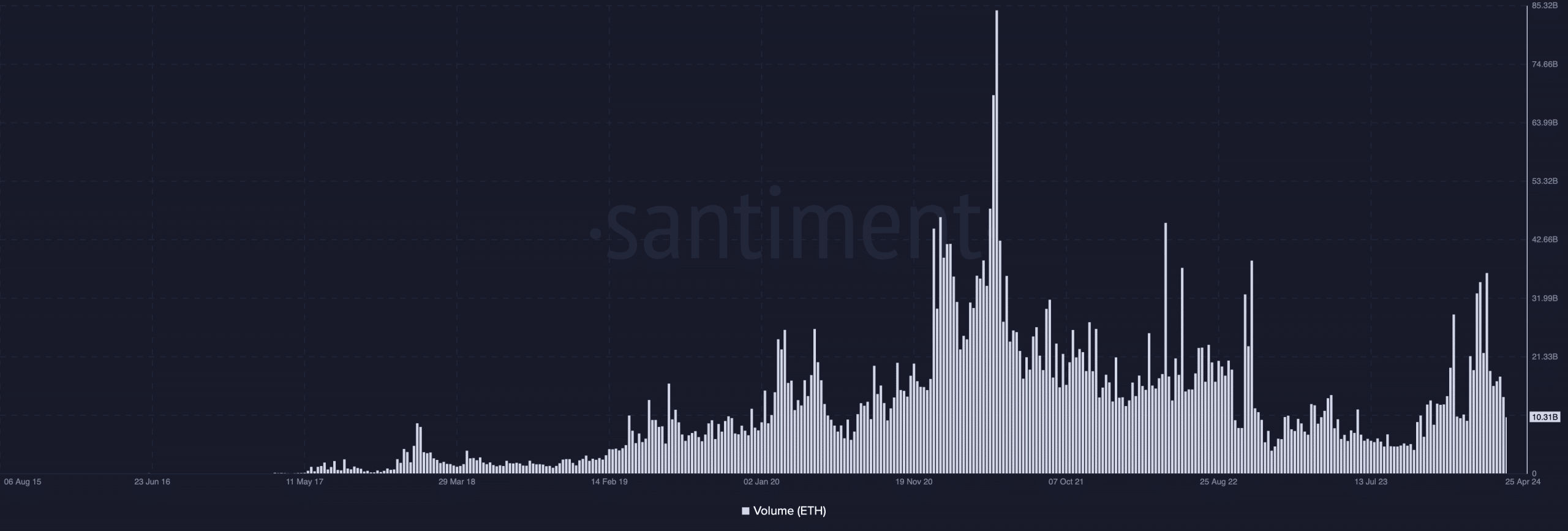

On the other hand, a surge in network growth might spark a rally for the cryptocurrency and other top tokens. In the meantime, an assessment of the volume showed that it was $10.31 billion.

Read Ethereum’s [ETH] Price Prediction 2024-2025

At the beginning of ETH’s rise to its all-time high, the volume was over $40 billion. Rising volume indicates interest in a cryptocurrency. If consistent, it could lead to higher prices.

Source: Santiment

With the low volume, a notable price increase for the altcoin could be unlikely over the next few weeks. In addition, altcoins might need to look away from waiting for ETH before going on months-long rallies.

- The Altcoin Season Index at 35 suggested that the many tokens were not out of depression.

- A decline in ETH’s network growth and volume might hinder the upswing.

If there is one phrase that has been trending in the market for months without almost nothing to show, it’s “altcoin season.”

For the anticipated period to come to life, Ethereum [ETH] and other non-Bitcoin [BTC] cryptocurrencies have to outperform BTC.

But that has not happened. In fact, AMBCrypto’s analysis of Blockchaincenter.net revealed that the time was not close. According to the platform, the Altcoin Season Index was at 35.

Alts fails to sustain the preview

To confirm an altcoin season, the reading has to be at 75. Interestingly, the index hit this height in the last week of January, and the first week of March. But it melted away within days.

Source: Blockchainceter.net

A look at tokens like ETH, Cardano [ADA], and Ripple [XRP] showed that their prices decreased in the last 90 days. Unless 75% of the top 50 cryptos outperform BTC, there will be no altcoins season.

Considering the press time circumstances, one can assume that the period was not close. Apart from the index, one factor that could determine is ETH.

In 2021, the surge in Ethereum was one of the first movers that activated the price increase that many altcoins experienced.

Notably, less than 20 altcoins out of the top 50 have outperformed Bitcoin in the last 90 days.

But ETH was not part of them. Furthermore, the cryptocurrency has not been able to make the kind of moves it did in the last bull market.

ETH dashes the hope

However, if demand for ETH surges, the condition might change, and the price of the token might climb to test its all-time high. For this to take place, a lot of new addresses have to come into the Ethereum network.

To track this, AMBCrypto looked at network growth. At press time, network growth on Ethereum was 3131, suggesting that the adoption of the cryptocurrency has been unimpressive.

Source: Santiment

If the metric continues to decline, ETH’s price might find it challenging to move northward. In this case, altcoin season might continue to be delayed.

On the other hand, a surge in network growth might spark a rally for the cryptocurrency and other top tokens. In the meantime, an assessment of the volume showed that it was $10.31 billion.

Read Ethereum’s [ETH] Price Prediction 2024-2025

At the beginning of ETH’s rise to its all-time high, the volume was over $40 billion. Rising volume indicates interest in a cryptocurrency. If consistent, it could lead to higher prices.

Source: Santiment

With the low volume, a notable price increase for the altcoin could be unlikely over the next few weeks. In addition, altcoins might need to look away from waiting for ETH before going on months-long rallies.

![Optimism [OP]: Is a 7.1% pump enough for a sustained rally](https://coininsights.com/wp-content/uploads/2023/10/OPUSDT_2023-10-21_11-15-08-350x250.png)

how to get generic clomiphene without prescription where to get generic clomid pill can you buy clomid online can you buy clomiphene without a prescription where buy clomiphene without dr prescription where to buy cheap clomid price can i get cheap clomid no prescription

Good blog you procure here.. It’s obdurate to assign great calibre belles-lettres like yours these days. I really comprehend individuals like you! Withstand vigilance!!

I truly appreciate this post. I have been looking all over for this! Thank goodness I found it on Bing. You’ve made my day! Thx again

Proof blog you be undergoing here.. It’s intricate to on strong calibre article like yours these days. I really comprehend individuals like you! Take vigilance!!

purchase zithromax sale – tinidazole ca cost metronidazole 400mg

rybelsus 14 mg tablet – rybelsus 14mg usa order periactin 4 mg generic

buy cheap generic motilium – buy domperidone 10mg for sale where to buy flexeril without a prescription

buy inderal 10mg without prescription – methotrexate 2.5mg without prescription methotrexate 5mg cheap

Este site é realmente incrível. Sempre que acesso eu encontro coisas diferentes Você também pode acessar o nosso site e saber mais detalhes! Conteúdo exclusivo. Venha saber mais agora! 🙂

incrível este conteúdo. Gostei bastante. Aproveitem e vejam este conteúdo. informações, novidades e muito mais. Não deixem de acessar para descobrir mais. Obrigado a todos e até mais. 🙂

order augmentin 375mg for sale – https://atbioinfo.com/ purchase ampicillin generic

order nexium 40mg pill – anexa mate nexium 20mg for sale

coumadin 5mg pills – anticoagulant losartan medication

buy meloxicam tablets – https://moboxsin.com/ meloxicam 7.5mg cheap

Great blog right here! Additionally your web site loads up very fast! What web host are you the use of? Can I get your affiliate link in your host? I wish my site loaded up as quickly as yours lol

prednisone pills – allergic reactions prednisone 5mg ca

online ed pills – medicine for impotence where to buy ed pills

buy amoxicillin – combamoxi.com buy amoxicillin generic

buy forcan online cheap – https://gpdifluca.com/# buy fluconazole 200mg for sale

buy cenforce 50mg – order generic cenforce 50mg cenforce 50mg ca

cialis free trial phone number – https://ciltadgn.com/ cheap cialis dapoxitine cheap online

buy ranitidine generic – on this site buy generic zantac for sale

cialis from mexico – https://strongtadafl.com/# how to get cialis without doctor

This is the type of enter I find helpful. gnolvade.com

buy viagra without rx – https://strongvpls.com/# where can i find really cheap viagra

Good blog you be undergoing here.. It’s obdurate to espy high status belles-lettres like yours these days. I truly recognize individuals like you! Rent vigilance!! https://ursxdol.com/prednisone-5mg-tablets/

Greetings! Utter serviceable suggestion within this article! It’s the scarcely changes which liking espy the largest changes. Thanks a quantity for sharing! prednisone 40 mg side effects

This is the stripe of glad I enjoy reading. https://prohnrg.com/product/acyclovir-pills/

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

I couldn’t resist commenting. Warmly written! aranitidine