- Options market data indicated that ETH price could have stabilized.

- However, market sentiment was still negative amid overhangs from Middle-East tensions.

Ethereum’s [ETH] price appeared to stabilize after recent volatility following geopolitical escalations in the Middle East that spooked crypto markets.

According to Jake Ostrovskis, a crypto trader at Wintermute, options market data suggested that a local bottom could be in for the largest altcoin. He noted,

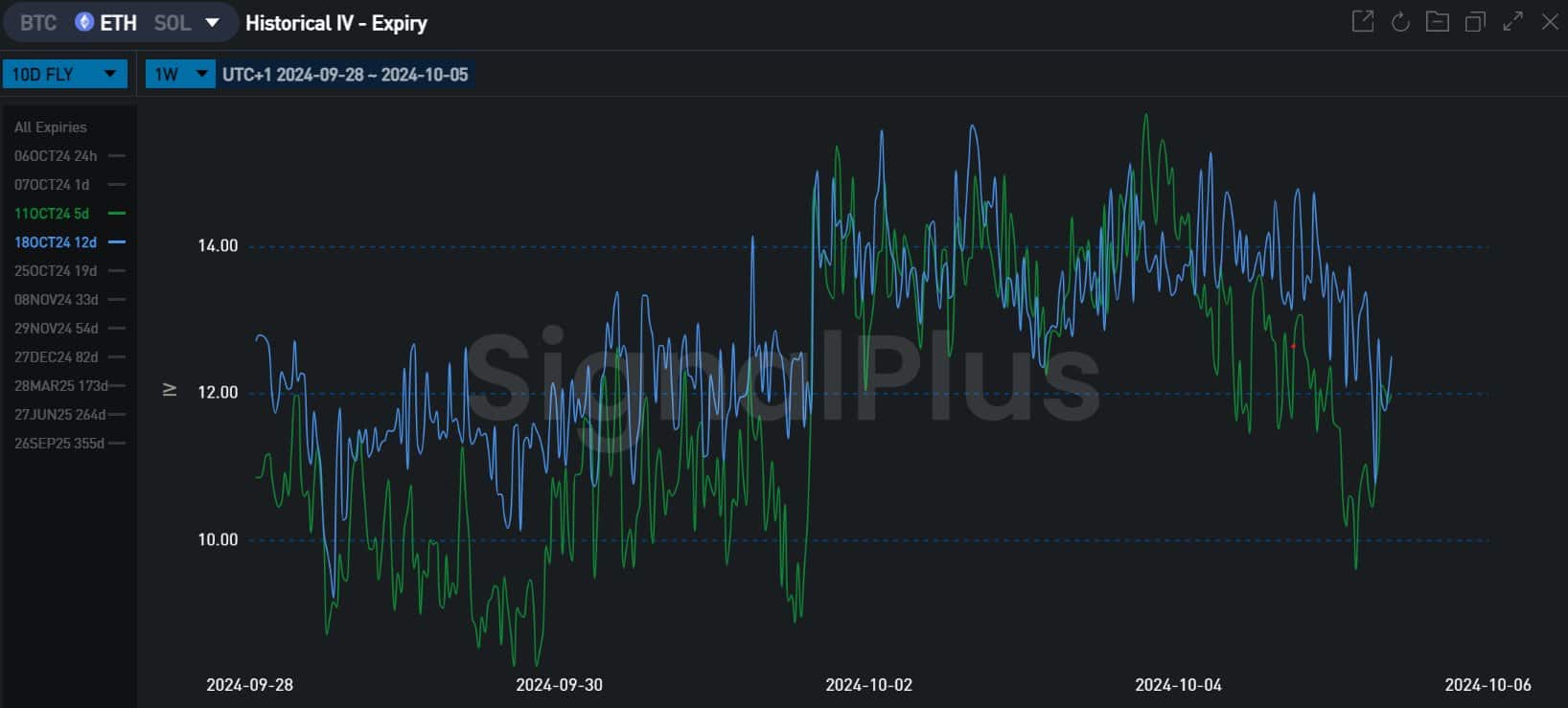

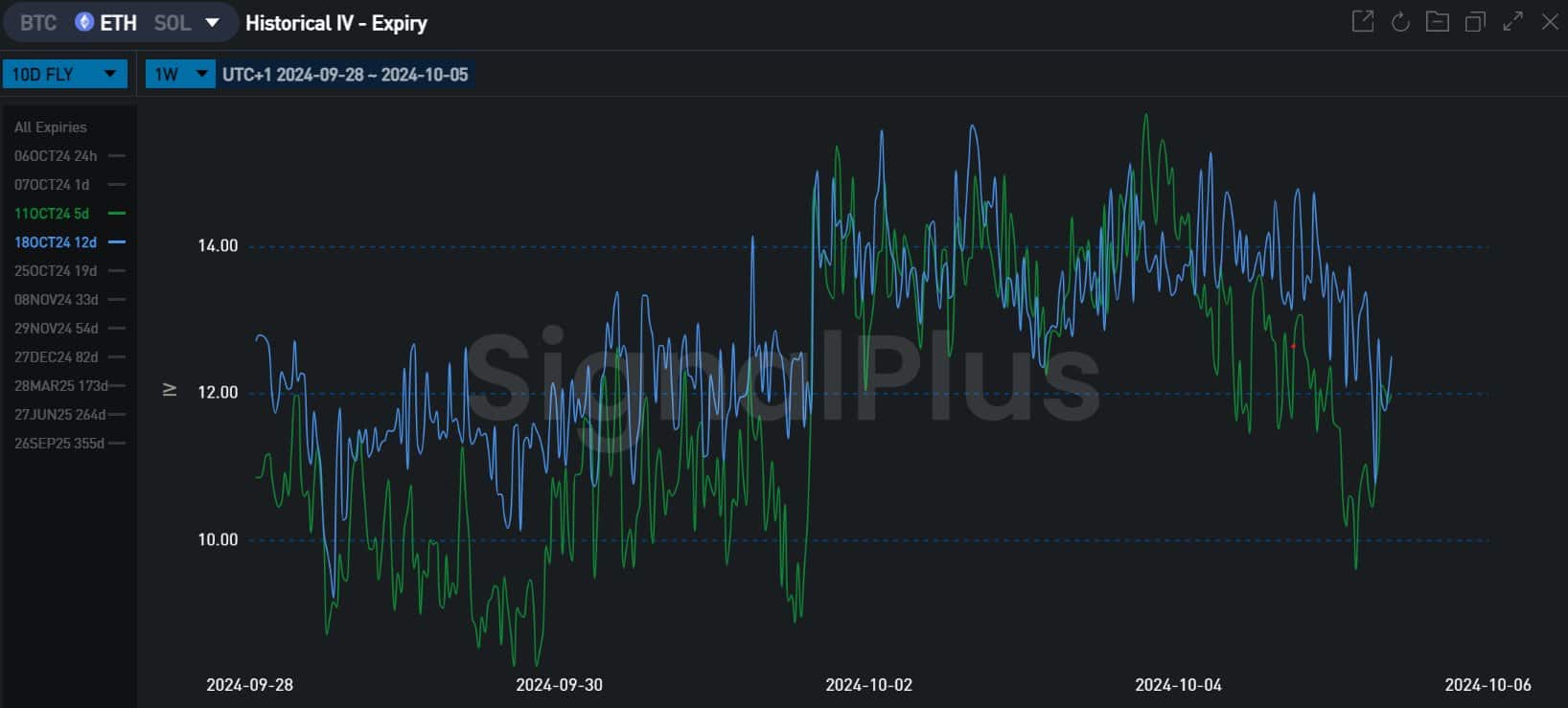

“From Tuesday (1st Oct.), the largest hedging flow was observable in #ETH in shorter-dated contracts, and these flows are now unwinding as the market looks to firm.”

Source: SignalPlus

Is ETH’s local bottom in?

For context, the hike in hedging flow in short-dated ETH contracts in the past few days meant that traders took hedging positions to protect against price fluctuations, epecially amid Israel-Iran escalations.

They used short-term options to achieve this.

However, there was a notable unwinding of the hedging flows and declining implied volatility for those short-term options into the weekend.

This suggested that traders were becoming confident of ETH market stability and that hedging was unnecessary.

Put differently, ETH’s local bottom could soon be in, especially as Israel hasn’t retaliated against the recent Iran attack.

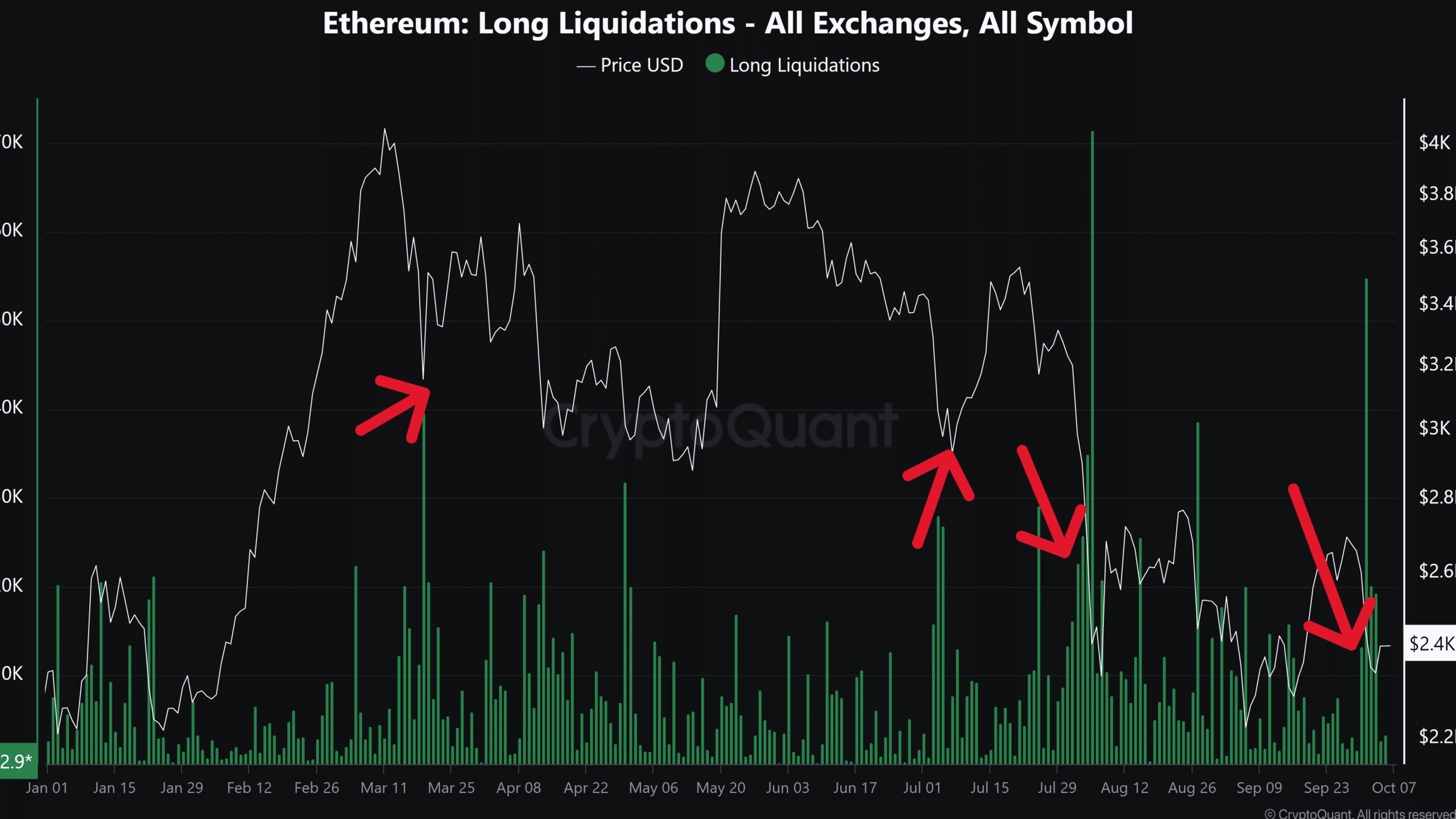

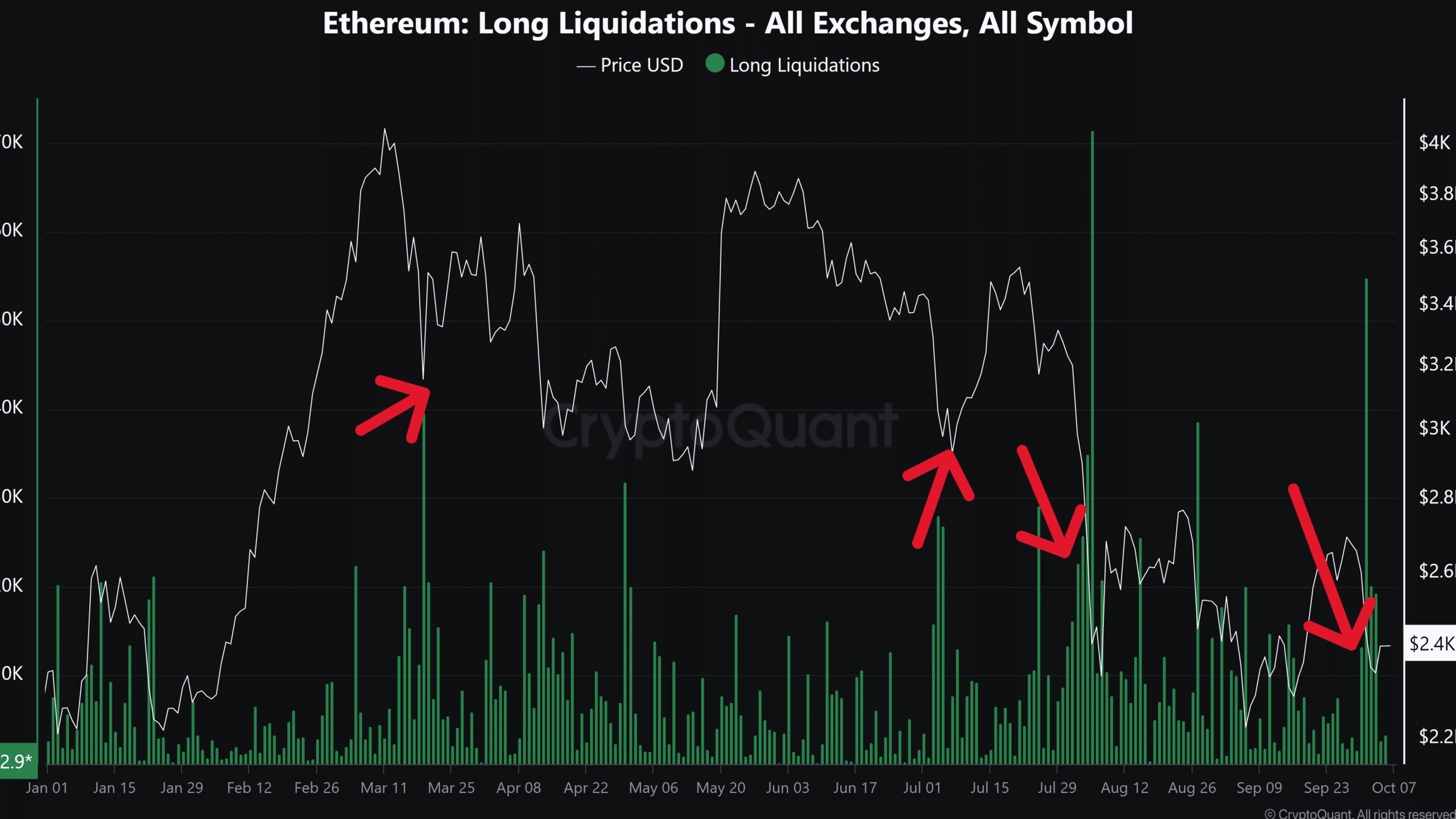

Source: CryptoQuant

Another data set that suggested ETH might have hit bottom was the hike in long liquidations. The recent plunge liquidated over $50 million worth of ETH long positions.

In most past trends, a spike in ETH long liquidations coincided with local bottoms. This pattern was seen in March, July and August.

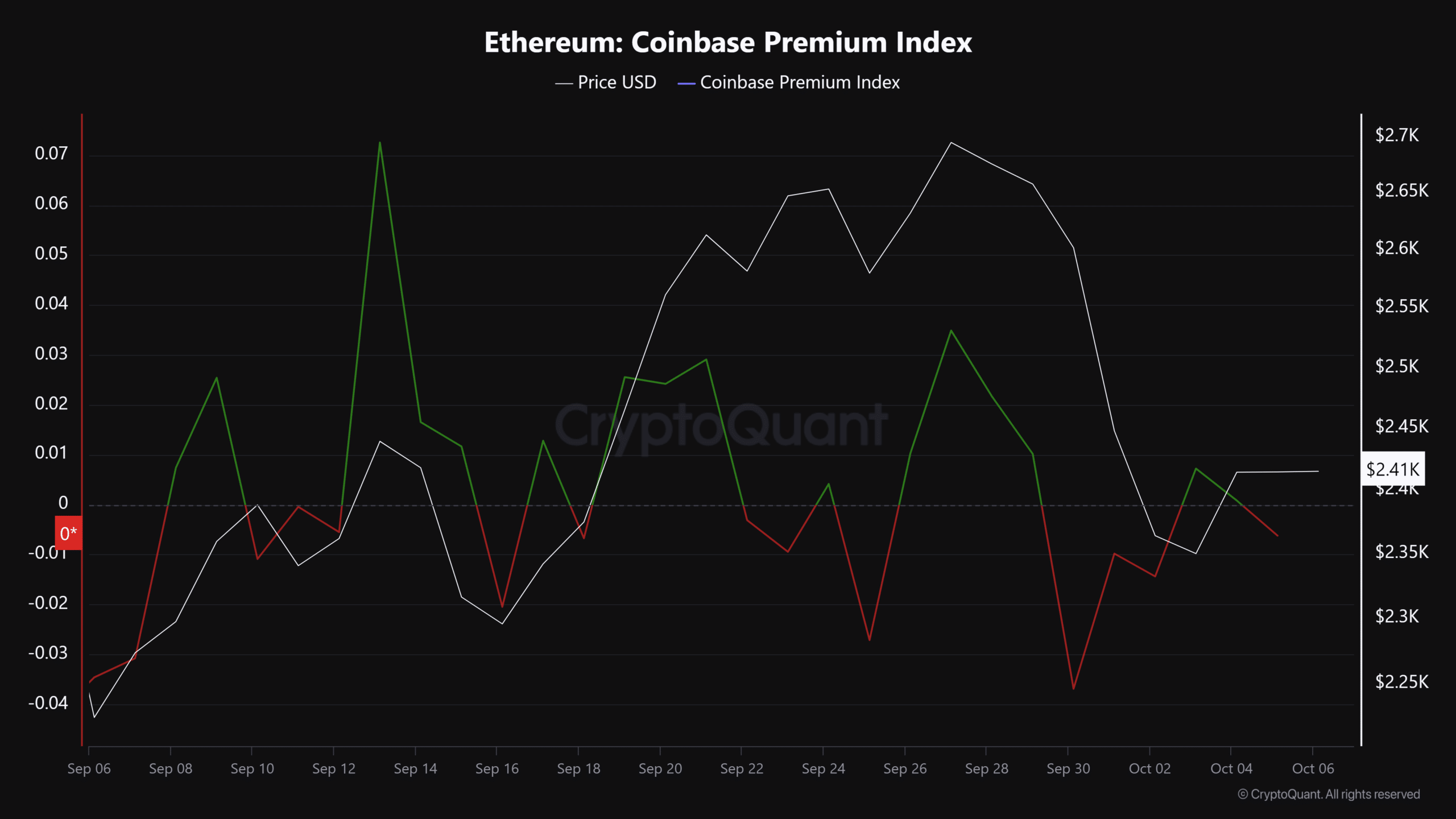

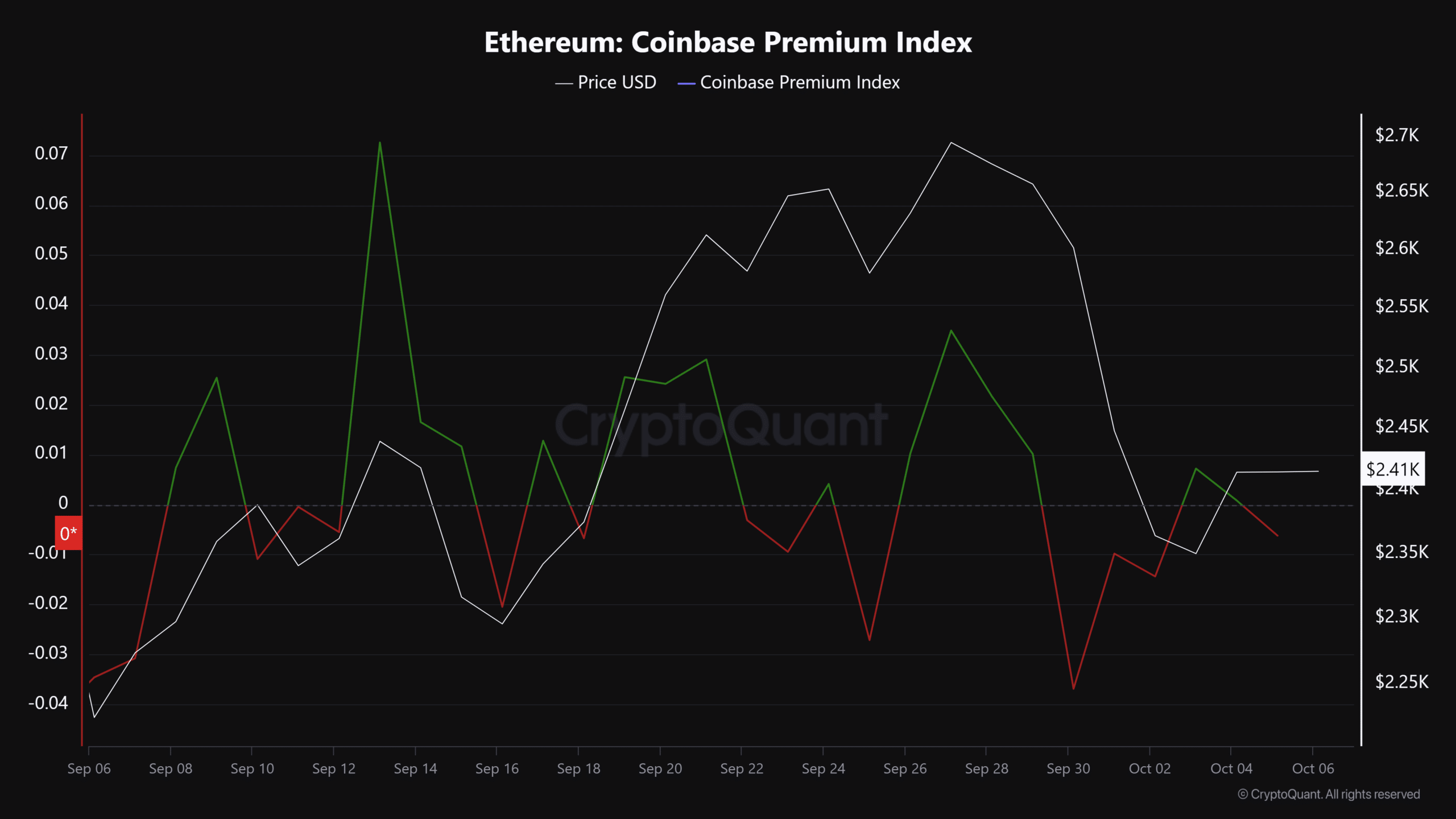

That said, there was no significant demand from US investors, as demonstrated by a negative reading on the Coinbase Premium Index. More often than not, hikes in the Coinbase Premium Index correlate with a strong ETH recovery.

Source: CryptoQuant

Ergo, despite potential stability in the ETH market, tracking US investors’ demand could signal whether the bottom was in and if a relief recovery could follow.

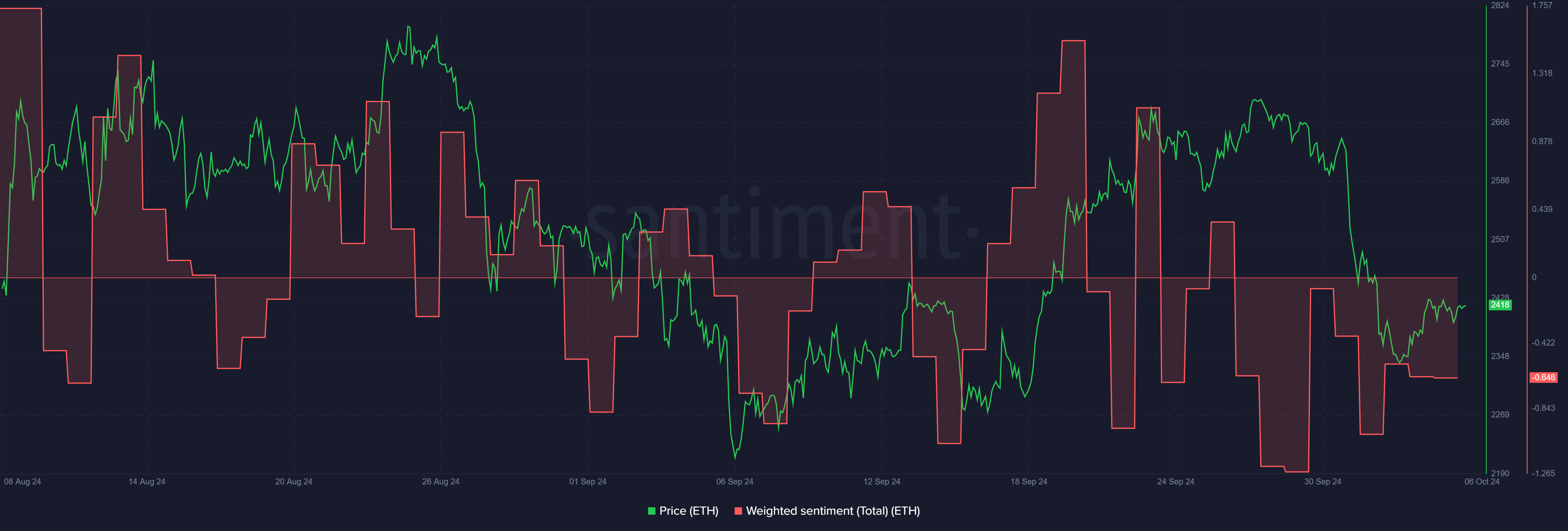

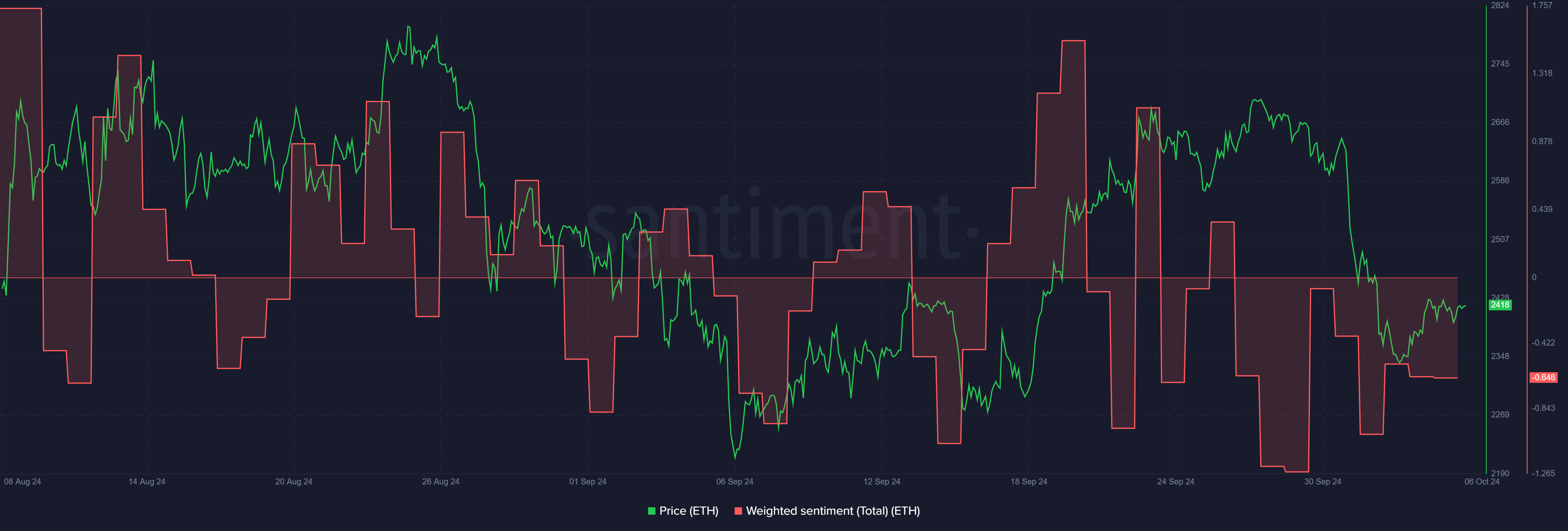

Additionally, a cautious outlook was still apparent, as denoted by ETH’s negative market sentiment.

Source: Santiment

This highlighted that investors took to the sidelines, probably to wait for Israel’s reactions to last week’s Iran move. At press time, ETH traded at $2.4K, down 8.4% in the past seven trading days.

- Options market data indicated that ETH price could have stabilized.

- However, market sentiment was still negative amid overhangs from Middle-East tensions.

Ethereum’s [ETH] price appeared to stabilize after recent volatility following geopolitical escalations in the Middle East that spooked crypto markets.

According to Jake Ostrovskis, a crypto trader at Wintermute, options market data suggested that a local bottom could be in for the largest altcoin. He noted,

“From Tuesday (1st Oct.), the largest hedging flow was observable in #ETH in shorter-dated contracts, and these flows are now unwinding as the market looks to firm.”

Source: SignalPlus

Is ETH’s local bottom in?

For context, the hike in hedging flow in short-dated ETH contracts in the past few days meant that traders took hedging positions to protect against price fluctuations, epecially amid Israel-Iran escalations.

They used short-term options to achieve this.

However, there was a notable unwinding of the hedging flows and declining implied volatility for those short-term options into the weekend.

This suggested that traders were becoming confident of ETH market stability and that hedging was unnecessary.

Put differently, ETH’s local bottom could soon be in, especially as Israel hasn’t retaliated against the recent Iran attack.

Source: CryptoQuant

Another data set that suggested ETH might have hit bottom was the hike in long liquidations. The recent plunge liquidated over $50 million worth of ETH long positions.

In most past trends, a spike in ETH long liquidations coincided with local bottoms. This pattern was seen in March, July and August.

That said, there was no significant demand from US investors, as demonstrated by a negative reading on the Coinbase Premium Index. More often than not, hikes in the Coinbase Premium Index correlate with a strong ETH recovery.

Source: CryptoQuant

Ergo, despite potential stability in the ETH market, tracking US investors’ demand could signal whether the bottom was in and if a relief recovery could follow.

Additionally, a cautious outlook was still apparent, as denoted by ETH’s negative market sentiment.

Source: Santiment

This highlighted that investors took to the sidelines, probably to wait for Israel’s reactions to last week’s Iran move. At press time, ETH traded at $2.4K, down 8.4% in the past seven trading days.

clomid costo where to get generic clomiphene price where to buy clomiphene pill order generic clomid without rxРіРѕРІРѕСЂРёС‚: how can i get clomid tablets can i order clomid pills can i get cheap clomiphene price

This is the make of post I unearth helpful.

azithromycin 500mg us – order tetracycline 500mg online cheap purchase metronidazole generic

buy semaglutide 14 mg pills – buy generic cyproheptadine for sale order periactin sale

buy motilium medication – order tetracycline generic purchase flexeril online cheap

order inderal 10mg generic – buy methotrexate pills for sale methotrexate 10mg pills

purchase zithromax online – order bystolic 20mg without prescription nebivolol without prescription

augmentin 1000mg generic – atbioinfo.com acillin brand

nexium price – anexa mate order generic esomeprazole 40mg

warfarin canada – anticoagulant losartan 50mg cheap

mobic where to buy – https://moboxsin.com/ order meloxicam online

buy prednisone for sale – https://apreplson.com/ buy deltasone 5mg online

best ed pill for diabetics – fast ed to take where to buy ed pills

order amoxicillin without prescription – buy amoxil for sale order amoxil online cheap

More posts like this would make the blogosphere more useful.

With thanks. Loads of erudition!

order diflucan generic – generic fluconazole buy diflucan generic

zantac 300mg over the counter – https://aranitidine.com/# order ranitidine online

viagra sildenafil 50mg price – https://strongvpls.com/# generic viagra 100mg

I couldn’t weather commenting. Profoundly written! este sitio

I am actually thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data. https://buyfastonl.com/azithromycin.html

I couldn’t weather commenting. Well written! https://ursxdol.com/sildenafil-50-mg-in/

More posts like this would persuade the online play more useful. https://prohnrg.com/product/get-allopurinol-pills/

The reconditeness in this tune is exceptional. https://ondactone.com/product/domperidone/

This website really has all of the information and facts I needed adjacent to this thesis and didn’t know who to ask.

https://doxycyclinege.com/pro/dutasteride/

More articles like this would pretence of the blogosphere richer. http://iawbs.com/home.php?mod=space&uid=914827

order dapagliflozin 10 mg online cheap – dapagliflozin 10 mg brand buy dapagliflozin 10 mg sale