- Ethereum’s Q2 performance for 2025 is currently sitting at a modest -1.54%

- It’s still early in the quarter, and there’s plenty of time for ETH to find its footing

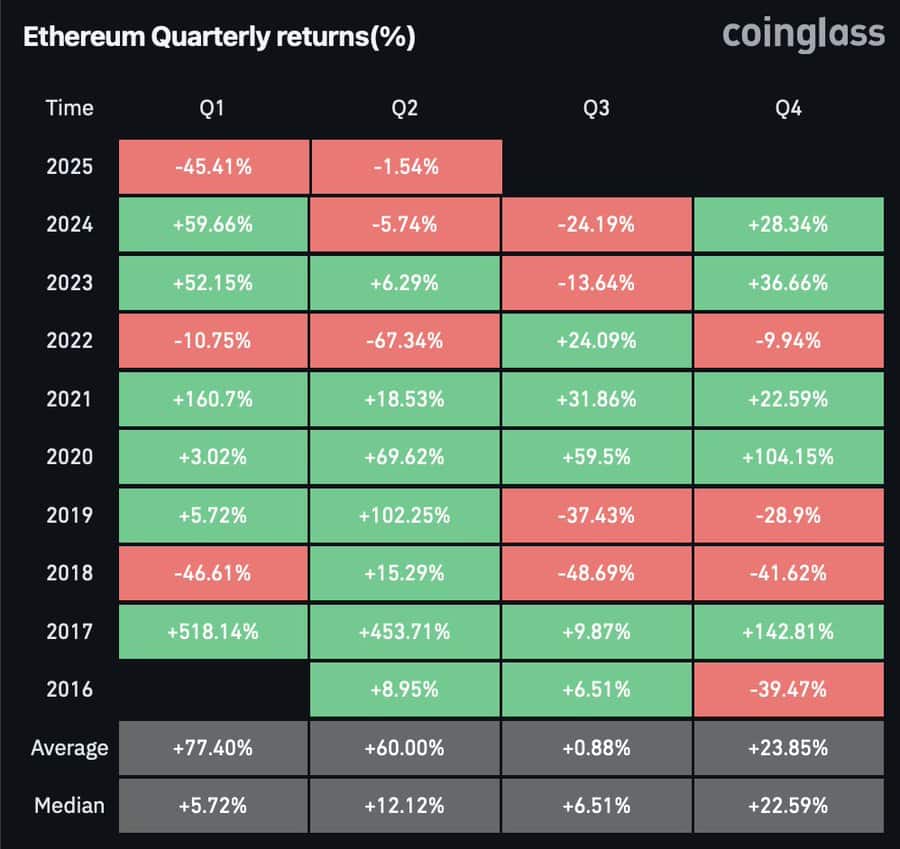

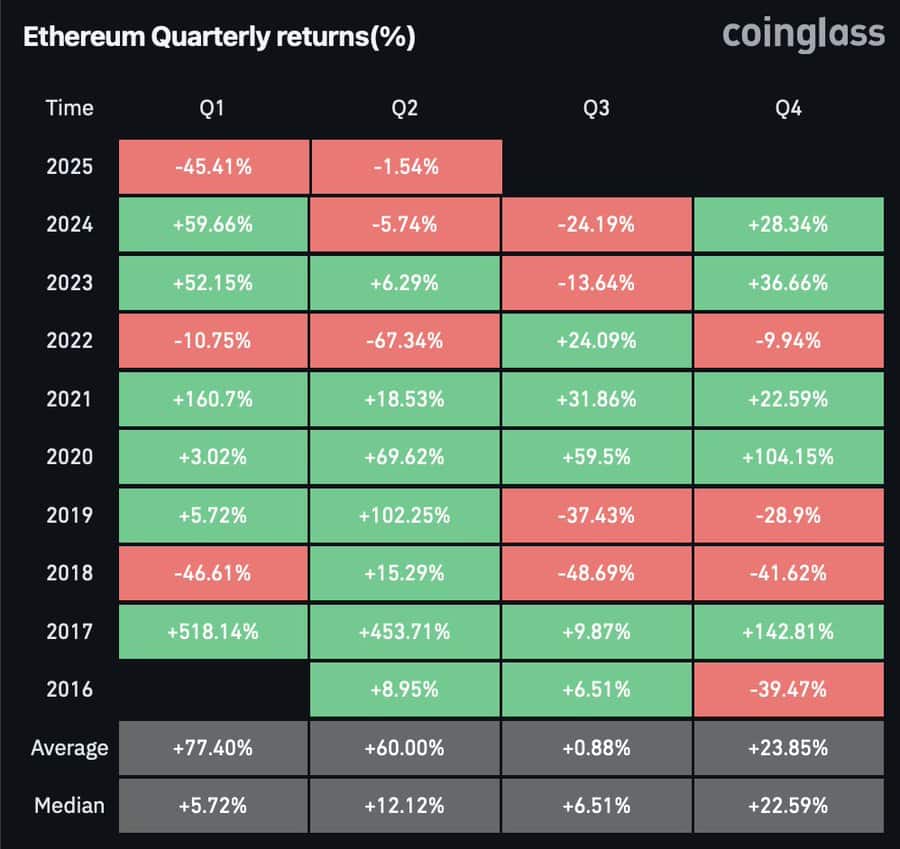

Ethereum’s Q1 2025 didn’t exactly roll out the red carpet.

With -45.41% quarterly returns in Q1, Ethereum broke its two-year streak of conservative price action. As a result, FOMO-driven buyers from last year’s Q4 ‘Trump pump’ are probably still staring at unrealized losses.

However, if you were an investor who jumped in during the Q1 cycles of 2023 or 2024, you probably saw your position soar. Those early buyers likely watched their holdings double in value over just three months.

To break it down – If you had purchased 1 million ETH in Q1 of 2023 or 2024, you’d have made a profit of 1 million ETH during that quarterly surge.

But, now? Fast forward to this cycle, and you’d be closing the books with a net loss of about $454k.

Source: Coinglass

Historically, Q2 has been a stronger season for Ethereum – Except for 2024 and 2022, with the latter still haunted by the brutal post-FTX collapse cycle.

That being said, Ethereum’s Q2 2025 performance is not in full panic mode yet. In fact, at the time of writing, ETH’s quarterly returns were down a modest -1.54%.

Bottom line? This slight dip suggested that despite a rough Q1, the market could be gearing up for a recovery.

Ethereum in Q2 – Will patience pay off?

Back in 2018, 2019, and 2020, Ethereum made Q2 its personal playground, posting some of its biggest bounce-backs – Especially after rough Q1 performances.

2024 though? Different story. Sure, the 5.74% dip in Q2 seemed like a small paper cut, until you looked closer.

Because even with Ethereum finally scoring its first-ever spot ETF listing on Wall Street in July – a major milestone – you’d expect a rocket, right?

Instead, ETH kept sliding. Q3 didn’t bring relief either, with returns falling off a cliff by another 24.19%. So, what changed?

According to AMBCrypto’s analysis, the ETH/BTC pair crashed hard at the same time. And, guess what? That meltdown hasn’t bounced back, dragging the ratio to a painful five-year low.

Source: TradingView (ETH/BTC)

In conclusion, Ethereum’s dominance, which remained between 15% and 20%, has now slipped to 7.40%.

Unless ETH manages to claw back some market share from Bitcoin by breaking through those pesky resistance zones, a bullish Q2 would feel like a long shot.

However, mild returns could still pop up. Especially with capital likely flowing back in – Thanks to Trump’s 90-day tariff hold.

Double-digit returns though? That’d be a huge stretch right now.

- Ethereum’s Q2 performance for 2025 is currently sitting at a modest -1.54%

- It’s still early in the quarter, and there’s plenty of time for ETH to find its footing

Ethereum’s Q1 2025 didn’t exactly roll out the red carpet.

With -45.41% quarterly returns in Q1, Ethereum broke its two-year streak of conservative price action. As a result, FOMO-driven buyers from last year’s Q4 ‘Trump pump’ are probably still staring at unrealized losses.

However, if you were an investor who jumped in during the Q1 cycles of 2023 or 2024, you probably saw your position soar. Those early buyers likely watched their holdings double in value over just three months.

To break it down – If you had purchased 1 million ETH in Q1 of 2023 or 2024, you’d have made a profit of 1 million ETH during that quarterly surge.

But, now? Fast forward to this cycle, and you’d be closing the books with a net loss of about $454k.

Source: Coinglass

Historically, Q2 has been a stronger season for Ethereum – Except for 2024 and 2022, with the latter still haunted by the brutal post-FTX collapse cycle.

That being said, Ethereum’s Q2 2025 performance is not in full panic mode yet. In fact, at the time of writing, ETH’s quarterly returns were down a modest -1.54%.

Bottom line? This slight dip suggested that despite a rough Q1, the market could be gearing up for a recovery.

Ethereum in Q2 – Will patience pay off?

Back in 2018, 2019, and 2020, Ethereum made Q2 its personal playground, posting some of its biggest bounce-backs – Especially after rough Q1 performances.

2024 though? Different story. Sure, the 5.74% dip in Q2 seemed like a small paper cut, until you looked closer.

Because even with Ethereum finally scoring its first-ever spot ETF listing on Wall Street in July – a major milestone – you’d expect a rocket, right?

Instead, ETH kept sliding. Q3 didn’t bring relief either, with returns falling off a cliff by another 24.19%. So, what changed?

According to AMBCrypto’s analysis, the ETH/BTC pair crashed hard at the same time. And, guess what? That meltdown hasn’t bounced back, dragging the ratio to a painful five-year low.

Source: TradingView (ETH/BTC)

In conclusion, Ethereum’s dominance, which remained between 15% and 20%, has now slipped to 7.40%.

Unless ETH manages to claw back some market share from Bitcoin by breaking through those pesky resistance zones, a bullish Q2 would feel like a long shot.

However, mild returns could still pop up. Especially with capital likely flowing back in – Thanks to Trump’s 90-day tariff hold.

Double-digit returns though? That’d be a huge stretch right now.

can you buy cheap clomiphene online buying generic clomid price how to buy generic clomiphene tablets where to get clomid tablets buying clomid price clomid cost australia where to get cheap clomid without dr prescription

More peace pieces like this would urge the интернет better.

I couldn’t resist commenting. Profoundly written!

azithromycin 250mg sale – floxin 200mg brand cost metronidazole 200mg

semaglutide 14 mg drug – buy cyproheptadine sale periactin 4mg drug

buy domperidone 10mg for sale – purchase cyclobenzaprine order generic flexeril

order nexium online cheap – https://anexamate.com/ nexium oral

order coumadin 5mg generic – anticoagulant hyzaar sale

order mobic without prescription – mobo sin meloxicam brand

where to buy prednisone without a prescription – https://apreplson.com/ prednisone 10mg tablet

buy erectile dysfunction drugs over the counter – fast ed to take causes of ed

purchase amoxicillin online cheap – https://combamoxi.com/ purchase amoxil online cheap

forcan for sale – fluconazole online cost diflucan 200mg

brand lexapro – site escitalopram 20mg cheap

cenforce 100mg canada – https://cenforcers.com/ order cenforce sale

safest and most reliable pharmacy to buy cialis – where to buy cialis cialis for daily use

pastillas cialis – strong tadafl what is the cost of cialis

buy ranitidine sale – https://aranitidine.com/# buy zantac 150mg online

More posts like this would create the online space more useful. click

More posts like this would prosper the blogosphere more useful. buy zithromax 500mg online cheap

This is the type of post I find helpful. https://ursxdol.com/clomid-for-sale-50-mg/

More articles like this would frame the blogosphere richer. https://prohnrg.com/

This is the amicable of topic I enjoy reading. https://aranitidine.com/fr/acheter-propecia-en-ligne/