- Dogecoin has experienced a 14.98% decline in the last seven days.

- Despite the price decline, Doge enjoys low liquidation rates and increased whale activity

Dogecoin [DOGE] has experienced a sharp decline in the last month. Over the last 30 days, Doge has reported a 14.98% price decline and a 7.46% decline in the last seven days.

DOGE was trading at $0.1342, a 1% reduction in the last 24 hours, according to CoinMarketCap.

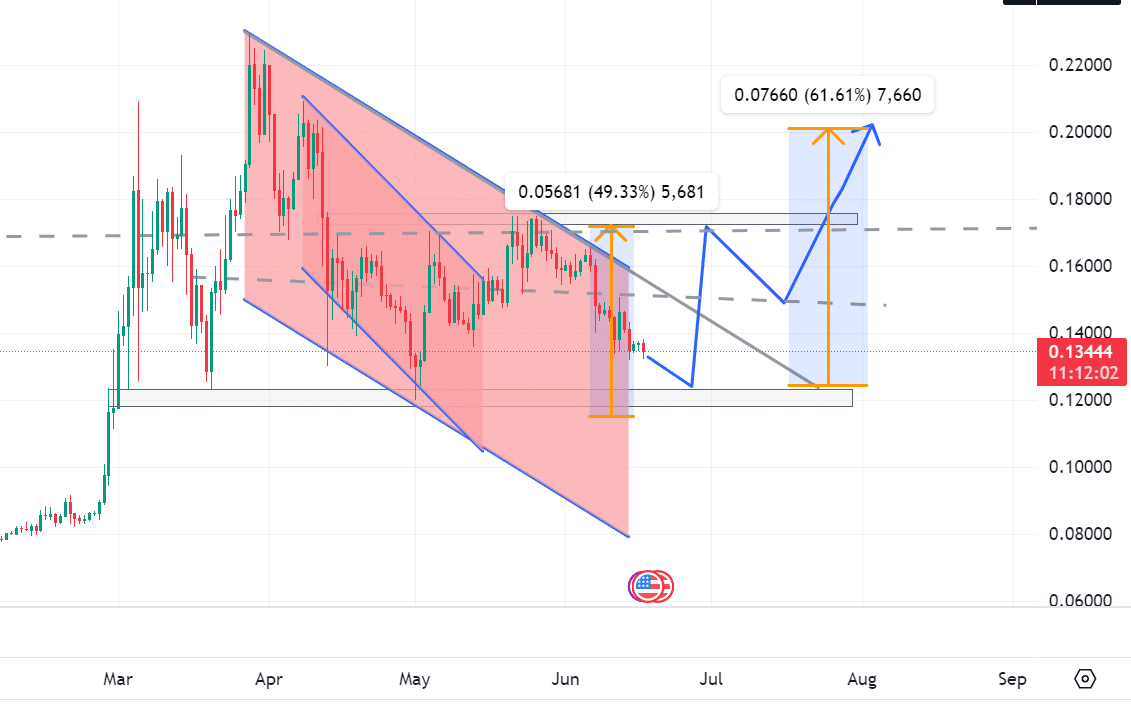

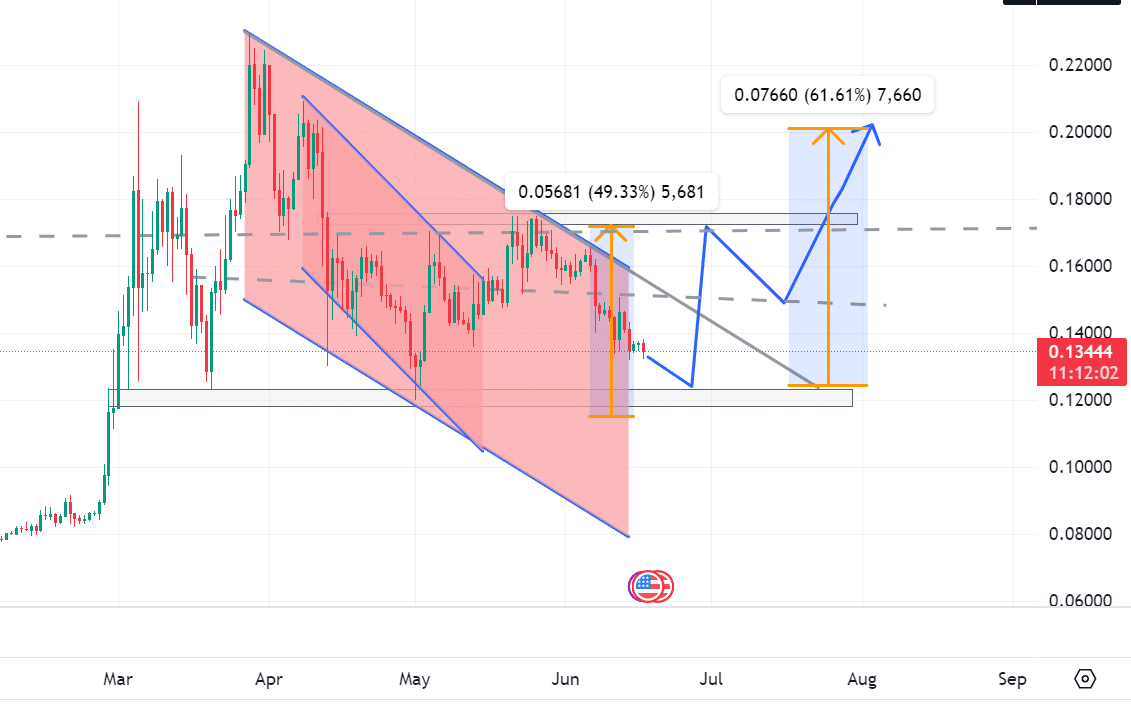

Source: Tradingview

According to AMBCrypto’s analysis, DOGE is set to stabilize around $0.123. In the short run, DOGE prices will likely consolidate between $0.12 and $0.15.

However, analysis indicates it’s likely to hit $0.17 to $0.2 in a bullish long-run scenario.

Thus, with higher sell-offs, DOGE is likely to test the $0.12 support level, while continued market activity would lead to a breakout above the $0.169 resistance level.

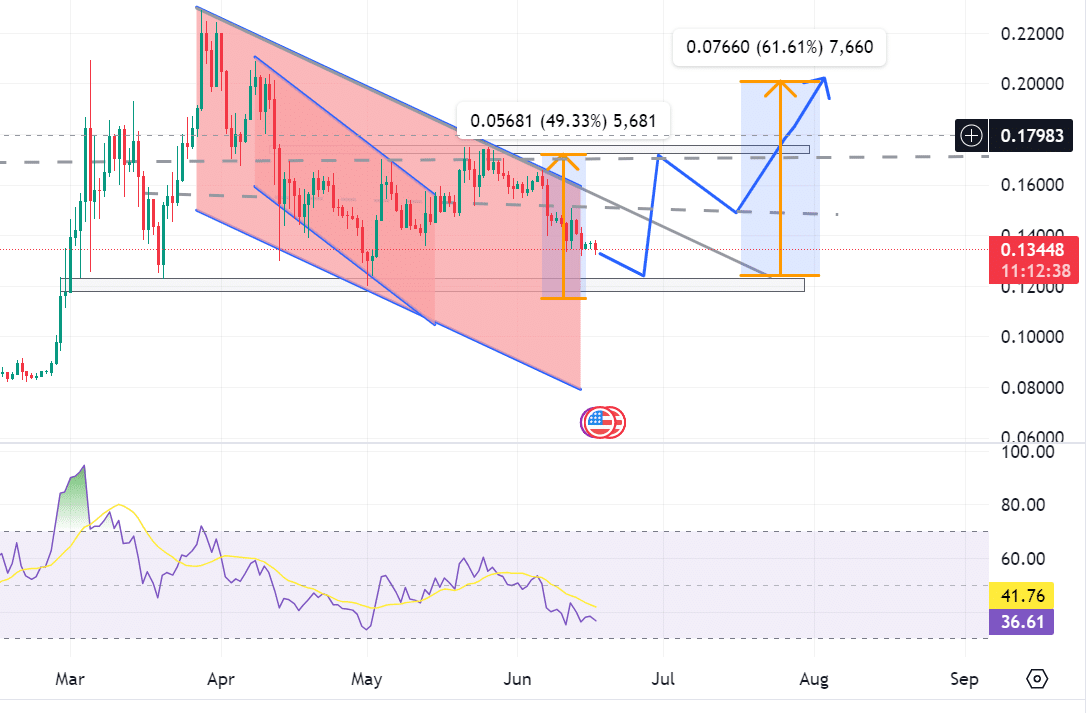

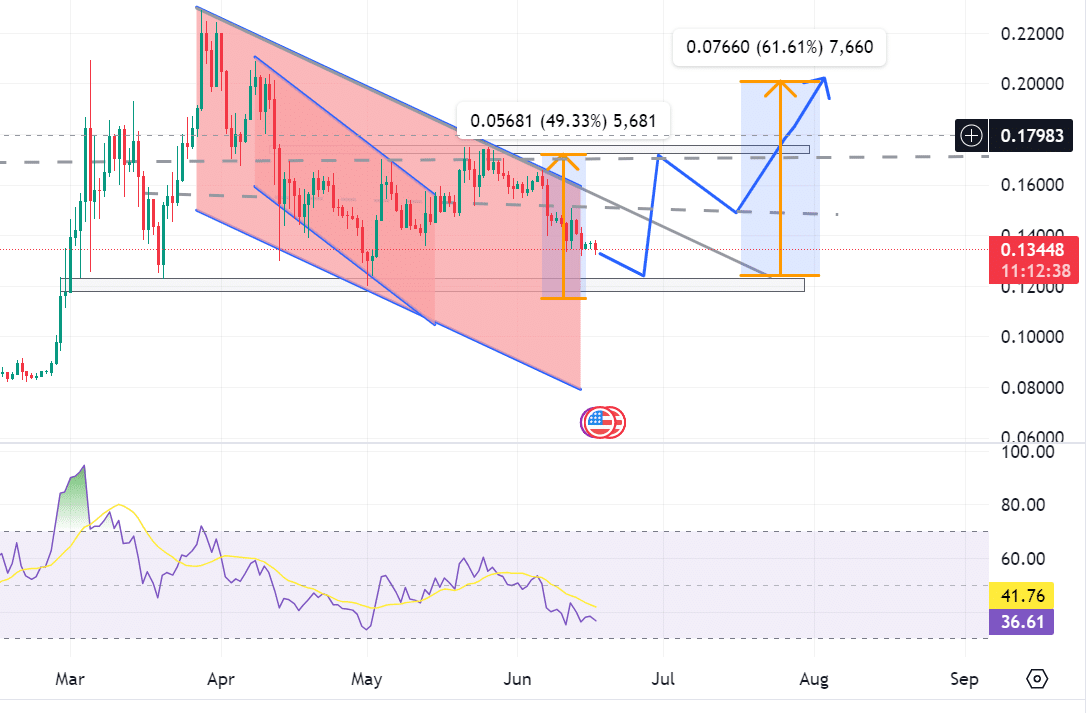

Source: Tradingview

Looking further, the RSI at 36 indicates the possibility of an upcoming bullish run. The indicator shows a potential reversal if the market holds and the RSI rises. Despite the existing bearish trend, future reversal is a possibility.

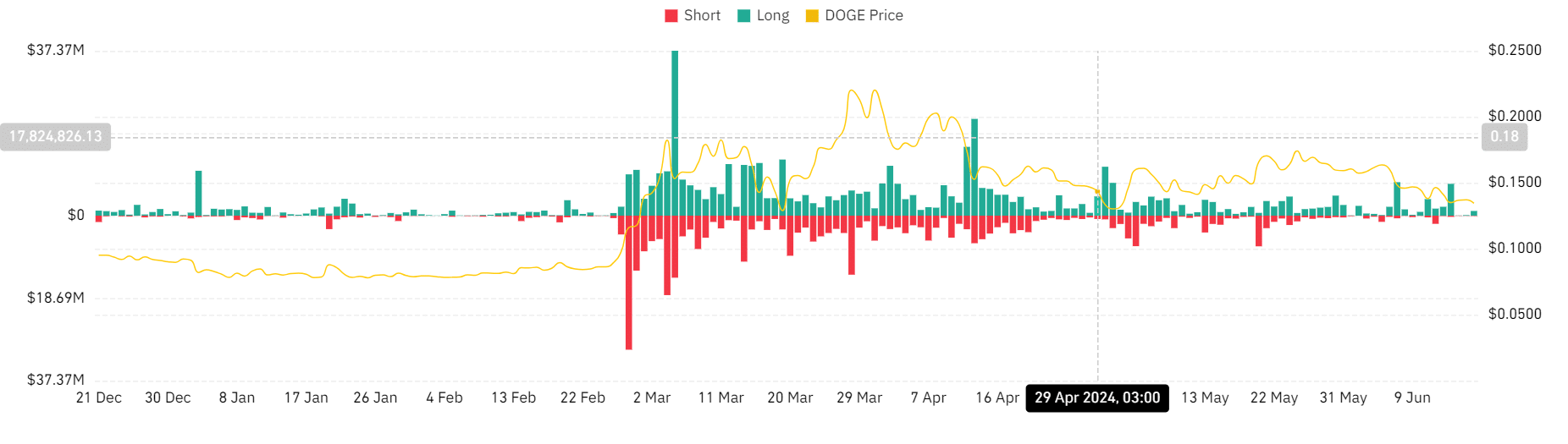

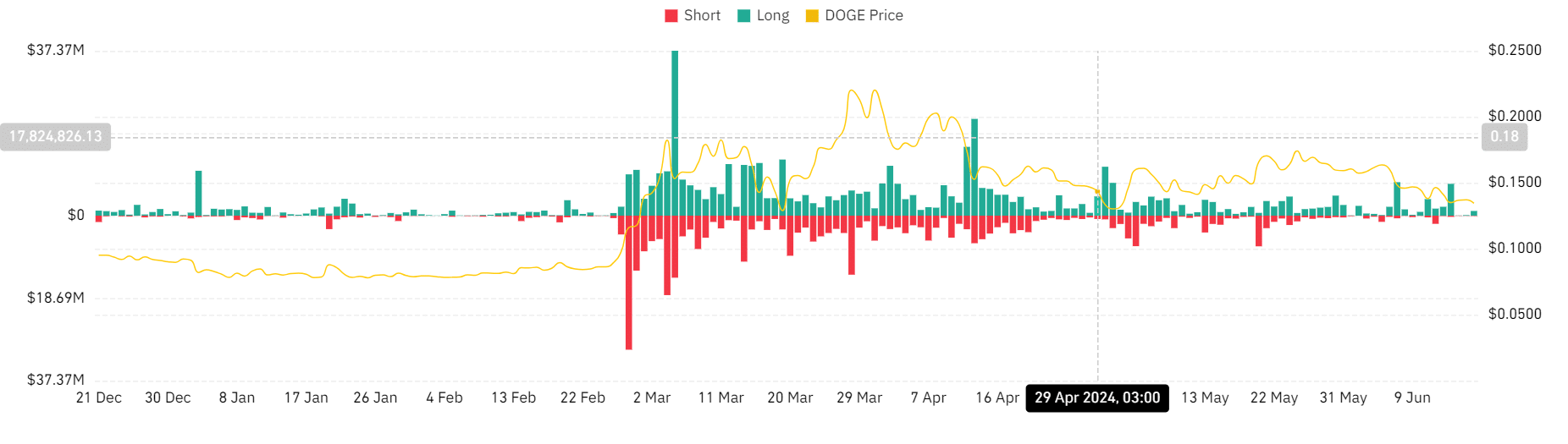

Equally, data from Coinglass indicates low liquidity levels in the last seven days. On 15th June, DOGE reported meager liquidation rates for both shorts and long positions, each reporting $61.6k and $139.2k, respectively.

Short positions report $105.7k at press time, while long positions have $1.07 million. Short and long positions liquidation shows that the market is consolidating at the current rates while enjoying stability.

Source: Coinglass

However, short-position investors are in more favorable conditions. This has resulted in increased accumulation for both sides and positive future price sentiment.

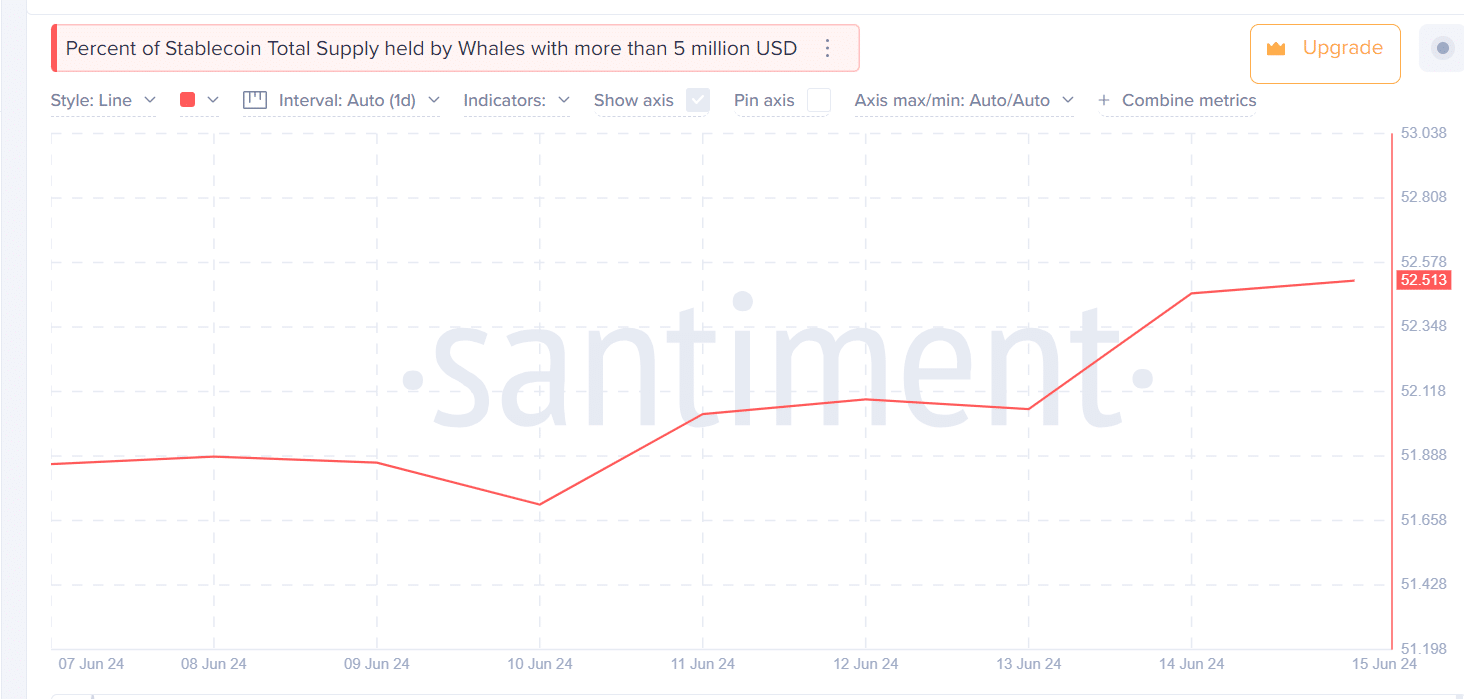

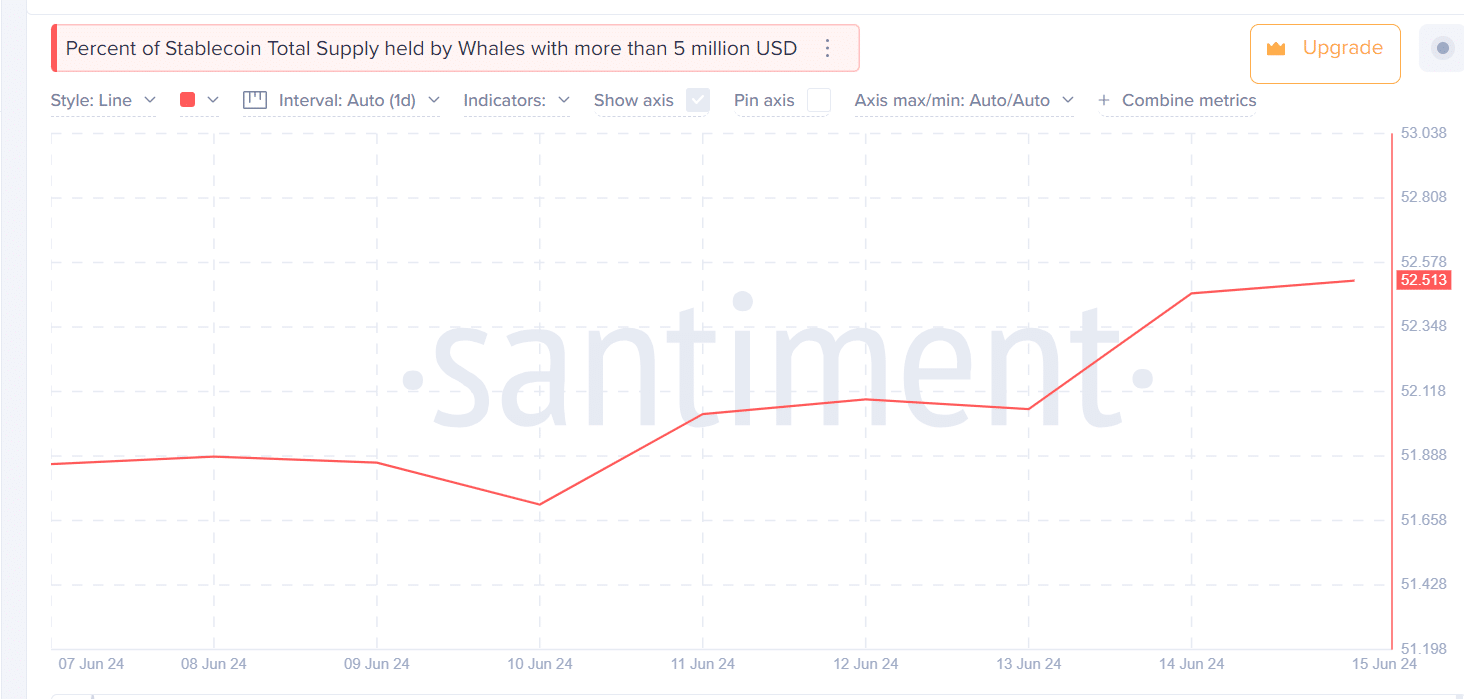

In detail, according to Santiment, Whales with over $5 million are increasingly accumulating their assets. At press time, over 52% of assets are accumulated by whales with over $5 million.

The accumulation by whales and reduced liquidation implies positive market sentiment.

Source: Santiment

DOGE market sentiment

DOGE has continually declined in the past seven days. However, investors remain optimistic, with increased accumulation by whales of over $5 million and reduced liquidation.

Is your portfolio green? Check the Dogecoin Profit Calculator

If a negative market sentiment persists, DOGE will need to test the local weak support level of around $0.12.

However, if the selling pressure persists, the market will get a reversal and breakout off the resistance level of around $0.169.

- Dogecoin has experienced a 14.98% decline in the last seven days.

- Despite the price decline, Doge enjoys low liquidation rates and increased whale activity

Dogecoin [DOGE] has experienced a sharp decline in the last month. Over the last 30 days, Doge has reported a 14.98% price decline and a 7.46% decline in the last seven days.

DOGE was trading at $0.1342, a 1% reduction in the last 24 hours, according to CoinMarketCap.

Source: Tradingview

According to AMBCrypto’s analysis, DOGE is set to stabilize around $0.123. In the short run, DOGE prices will likely consolidate between $0.12 and $0.15.

However, analysis indicates it’s likely to hit $0.17 to $0.2 in a bullish long-run scenario.

Thus, with higher sell-offs, DOGE is likely to test the $0.12 support level, while continued market activity would lead to a breakout above the $0.169 resistance level.

Source: Tradingview

Looking further, the RSI at 36 indicates the possibility of an upcoming bullish run. The indicator shows a potential reversal if the market holds and the RSI rises. Despite the existing bearish trend, future reversal is a possibility.

Equally, data from Coinglass indicates low liquidity levels in the last seven days. On 15th June, DOGE reported meager liquidation rates for both shorts and long positions, each reporting $61.6k and $139.2k, respectively.

Short positions report $105.7k at press time, while long positions have $1.07 million. Short and long positions liquidation shows that the market is consolidating at the current rates while enjoying stability.

Source: Coinglass

However, short-position investors are in more favorable conditions. This has resulted in increased accumulation for both sides and positive future price sentiment.

In detail, according to Santiment, Whales with over $5 million are increasingly accumulating their assets. At press time, over 52% of assets are accumulated by whales with over $5 million.

The accumulation by whales and reduced liquidation implies positive market sentiment.

Source: Santiment

DOGE market sentiment

DOGE has continually declined in the past seven days. However, investors remain optimistic, with increased accumulation by whales of over $5 million and reduced liquidation.

Is your portfolio green? Check the Dogecoin Profit Calculator

If a negative market sentiment persists, DOGE will need to test the local weak support level of around $0.12.

However, if the selling pressure persists, the market will get a reversal and breakout off the resistance level of around $0.169.

clomid calculator where to buy cheap clomiphene tablets clomid risks generic clomid pill can you get generic clomid without insurance clomiphene for low testosterone where buy cheap clomiphene no prescription

This is the tolerant of enter I recoup helpful.

I am in truth thrilled to gleam at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data.

order azithromycin sale – zithromax 500mg sale flagyl 200mg ca

buy domperidone tablets – order cyclobenzaprine generic cyclobenzaprine 15mg drug

inderal 20mg uk – buy plavix without a prescription order methotrexate 10mg sale

buy generic augmentin 1000mg – atbioinfo generic ampicillin

esomeprazole order online – https://anexamate.com/ how to buy esomeprazole

buy coumadin online – https://coumamide.com/ buy cozaar cheap

order meloxicam without prescription – relieve pain mobic order online

order deltasone online – corticosteroid prednisone 20mg tablet

the best ed pill – https://fastedtotake.com/ buy erectile dysfunction drugs

buy amoxicillin without prescription – amoxil tablet amoxil pills

brand diflucan – this fluconazole 200mg cheap

cenforce where to buy – cenforce 50mg without prescription cenforce 100mg pill

what are the side effect of cialis – https://ciltadgn.com/ cialis 20 mg how long does it take to work

order zantac generic – on this site purchase ranitidine online

what doe cialis look like – this cialis tadalafil 10 mg

I am in truth happy to glance at this blog posts which consists of tons of profitable facts, thanks object of providing such data. online

sildenafil 100 mg blue pill – https://strongvpls.com/ viagra 50mg buy

This website really has all of the low-down and facts I needed to this participant and didn’t know who to ask. https://buyfastonl.com/furosemide.html

This website positively has all of the information and facts I needed there this case and didn’t know who to ask. https://ursxdol.com/furosemide-diuretic/

Greetings! Utter useful suggestion within this article! It’s the crumb changes which will make the largest changes. Thanks a portion for sharing! https://prohnrg.com/

The depth in this serving is exceptional. https://aranitidine.com/fr/ciagra-professional-20-mg/

More posts like this would add up to the online elbow-room more useful. https://ondactone.com/simvastatin/

I couldn’t hold back commenting. Adequately written!

cost tetracycline without a prescription

More text pieces like this would insinuate the web better. http://vodotehna.hr/?URL=https://hackmd.io/@adip/S1nI1FQ_xe

More peace pieces like this would make the интернет better. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4271946&do=profile

order dapagliflozin 10 mg generic – https://janozin.com/ forxiga 10 mg for sale

buy xenical generic – on this site xenical online buy

I couldn’t hold back commenting. Warmly written! http://seafishzone.com/home.php?mod=space&uid=2331327