- Social media engagement and user activity have been falling in the past six weeks.

- The NVT and mean coin age metrics posed a dilemma to investors.

Cardano [ADA] was unable to shake off its bearish bias. Technical analysis revealed that further losses remained likely for the token.

A lack of demand was a major reason, and bullish sentiment has also been negligible.

Bitcoin [BTC] was unable to break out of the $60.8k-$63.3k region, and Cardano was also stuck within the $0.43-$0.47 area. Do on-chain metrics hint at a bullish breakout, or reinforce the bearish expectations?

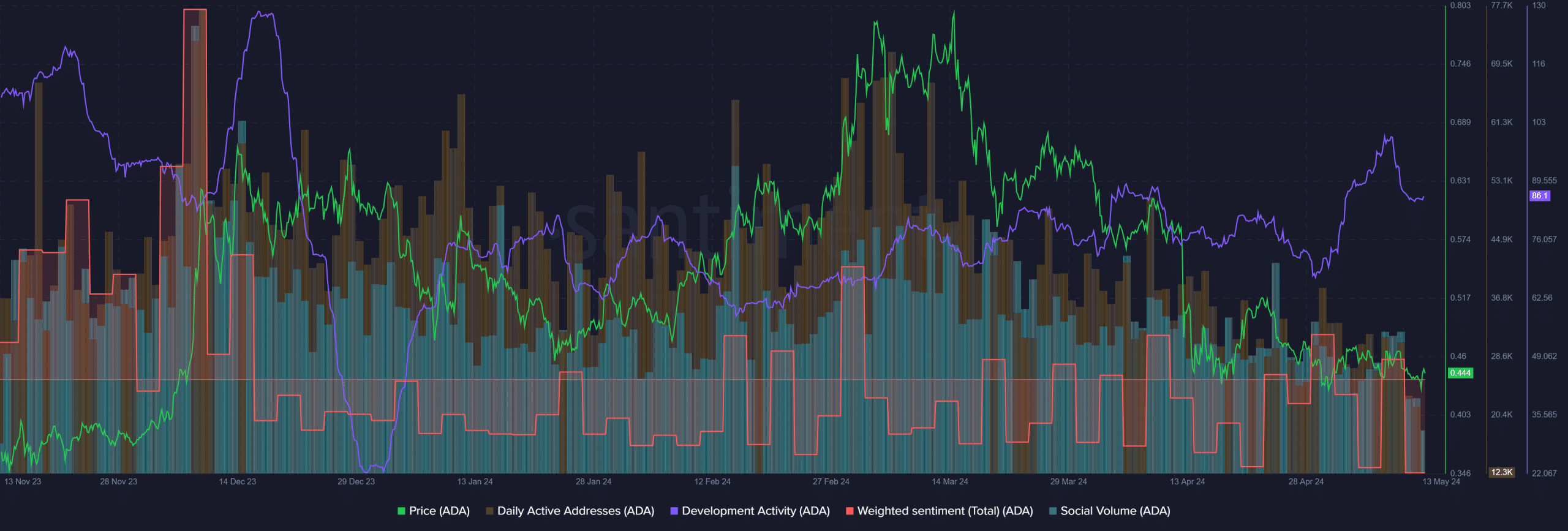

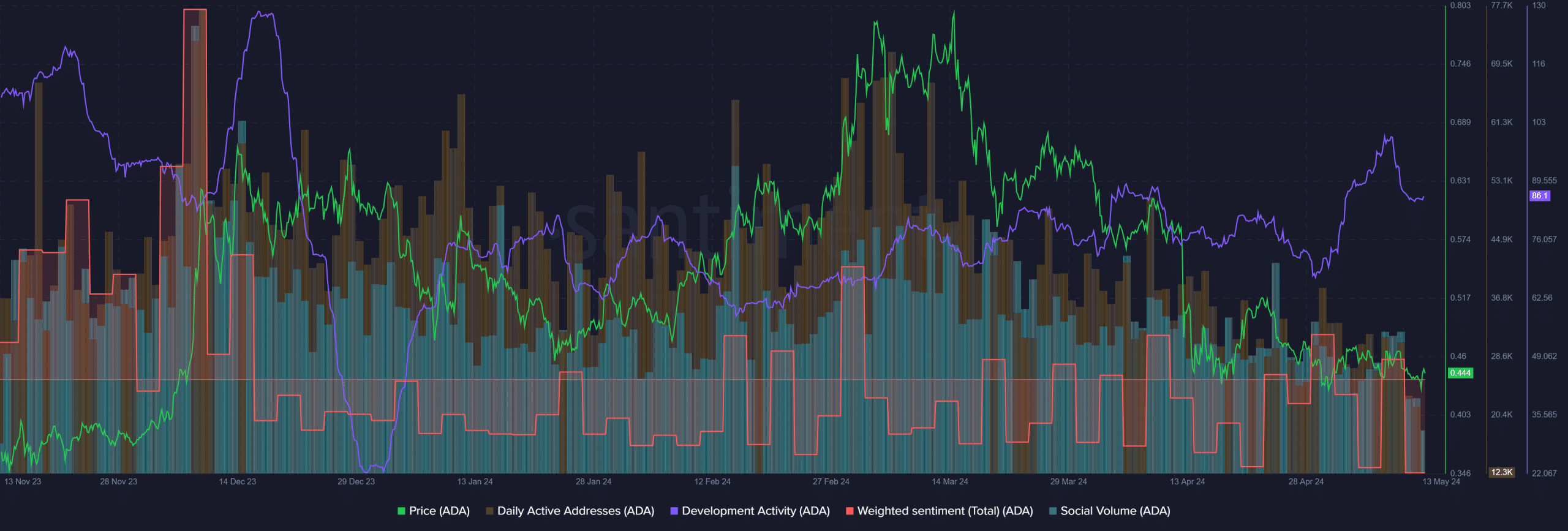

Development activity was high but the good news stops there

Source: Santiment

A high development activity shows that the project is continually fixing issues or otherwise preparing to ship new features.

Overall, it is a good sign for long-term investors, and Cardano did not slouch in this department.

Yet, the other metrics like daily active addresses and social volume have been in a decline since mid-March.

It indicated fewer users were utilizing the network for transactions and that social media engagements had fallen off. Moreover, the Weighted Sentiment has been negative for a good chunk of the past six weeks.

The online engagement has been negative or bearish, which does not bode well for the short-term price prospects. However, these factors alone do not indicate a drop is inbound.

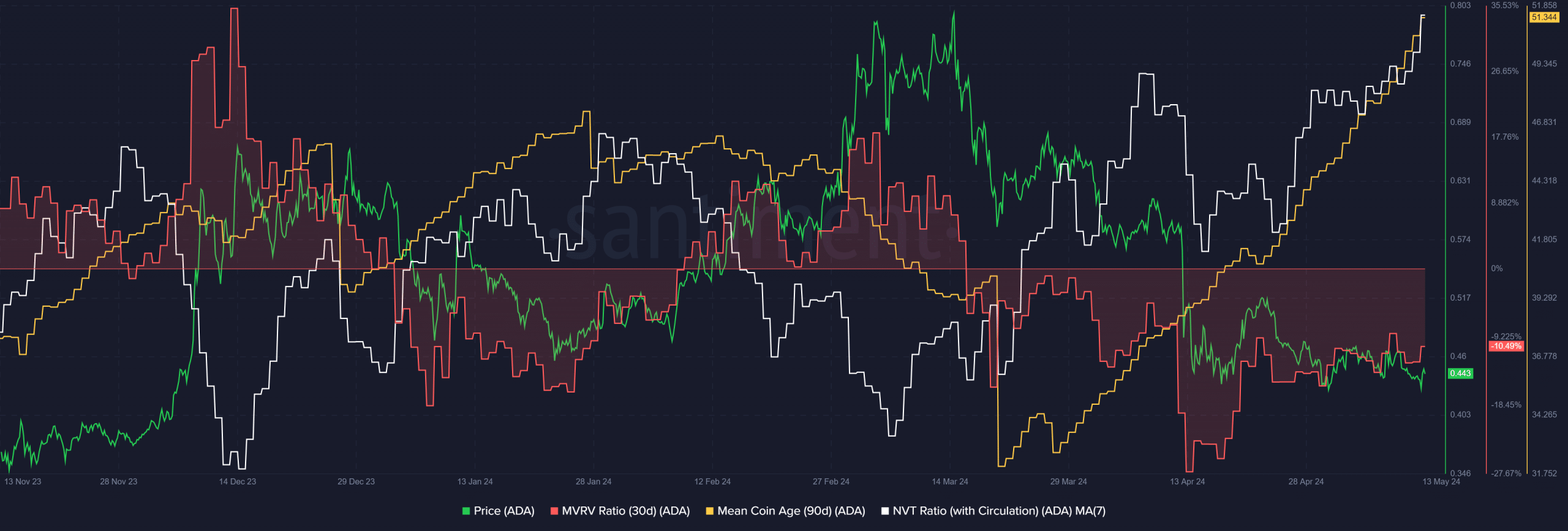

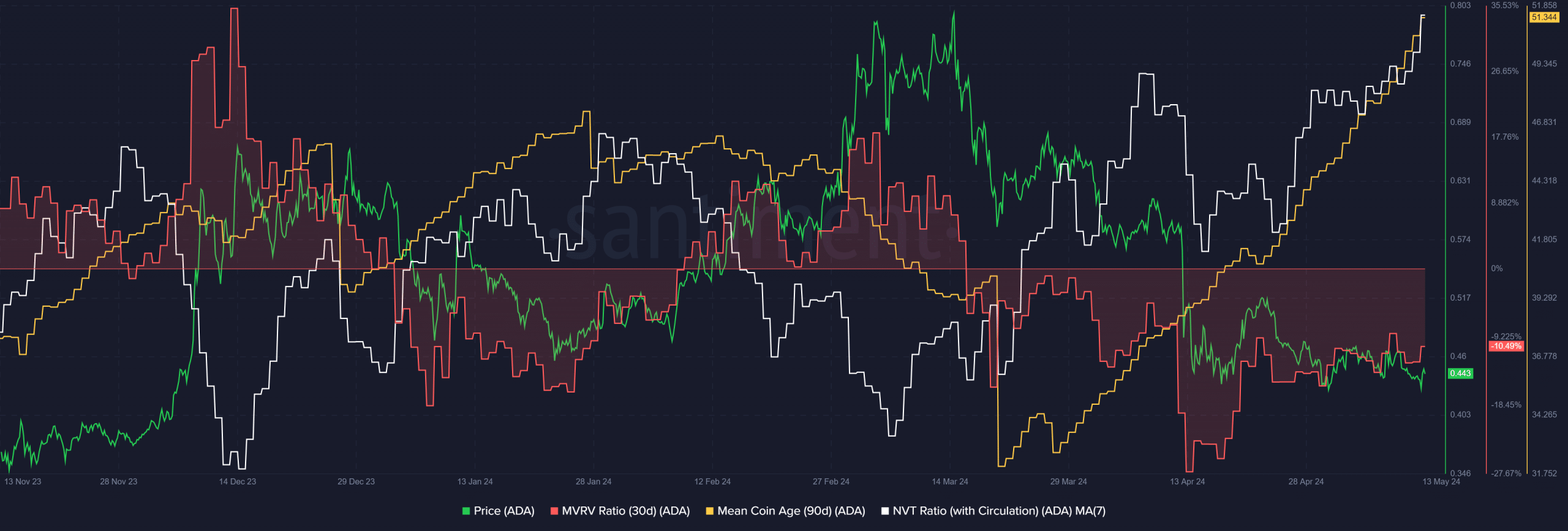

The contradicting signs — is ADA undervalued or not?

Source: Santiment

The 30-day MVRV ratio has been negative since mid-March, showing an extremely undervalued asset in the short-term.

However, despite this development, the price trend has been bearish. During this time, the mean coin age has trended rapidly higher, showing accumulation in place.

It presented a good opportunity for swing traders to buy, as ADA was also at the range low. Yet, the NVT revealed something else.

The Network Value to Transactions (NVT) ratio calculated using the daily circulation has also trended higher since mid-March.

This indicated that the network was likely overvalued, or expensive, compared to its low ability to transact tokens. This has bearish implication for the network usage, and in turn, the future demand.

Read Cardano’s [ADA] Price Prediction 2024-25

Therefore, putting these clues together with the technical analysis, it appeared that Cardano is likely headed for more losses.

A Bitcoin breakout might halt or reverse the downtrend, but the evidence at hand was not bullish.

- Social media engagement and user activity have been falling in the past six weeks.

- The NVT and mean coin age metrics posed a dilemma to investors.

Cardano [ADA] was unable to shake off its bearish bias. Technical analysis revealed that further losses remained likely for the token.

A lack of demand was a major reason, and bullish sentiment has also been negligible.

Bitcoin [BTC] was unable to break out of the $60.8k-$63.3k region, and Cardano was also stuck within the $0.43-$0.47 area. Do on-chain metrics hint at a bullish breakout, or reinforce the bearish expectations?

Development activity was high but the good news stops there

Source: Santiment

A high development activity shows that the project is continually fixing issues or otherwise preparing to ship new features.

Overall, it is a good sign for long-term investors, and Cardano did not slouch in this department.

Yet, the other metrics like daily active addresses and social volume have been in a decline since mid-March.

It indicated fewer users were utilizing the network for transactions and that social media engagements had fallen off. Moreover, the Weighted Sentiment has been negative for a good chunk of the past six weeks.

The online engagement has been negative or bearish, which does not bode well for the short-term price prospects. However, these factors alone do not indicate a drop is inbound.

The contradicting signs — is ADA undervalued or not?

Source: Santiment

The 30-day MVRV ratio has been negative since mid-March, showing an extremely undervalued asset in the short-term.

However, despite this development, the price trend has been bearish. During this time, the mean coin age has trended rapidly higher, showing accumulation in place.

It presented a good opportunity for swing traders to buy, as ADA was also at the range low. Yet, the NVT revealed something else.

The Network Value to Transactions (NVT) ratio calculated using the daily circulation has also trended higher since mid-March.

This indicated that the network was likely overvalued, or expensive, compared to its low ability to transact tokens. This has bearish implication for the network usage, and in turn, the future demand.

Read Cardano’s [ADA] Price Prediction 2024-25

Therefore, putting these clues together with the technical analysis, it appeared that Cardano is likely headed for more losses.

A Bitcoin breakout might halt or reverse the downtrend, but the evidence at hand was not bullish.

buy cheap clomid tablets can i buy cheap clomiphene tablets where buy generic clomid tablets order generic clomid without rx can i purchase cheap clomiphene without a prescription get cheap clomiphene without a prescription where to get clomid no prescription

Good blog you have here.. It’s obdurate to assign strong quality script like yours these days. I really appreciate individuals like you! Withstand guardianship!!

More peace pieces like this would urge the интернет better.

zithromax 500mg tablet – ofloxacin cheap flagyl 400mg cheap

rybelsus order – order rybelsus 14 mg pills periactin 4 mg brand

generic domperidone – order motilium 10mg buy flexeril online cheap

buy inderal 20mg for sale – plavix oral methotrexate 2.5mg sale

buy amoxicillin pills – purchase combivent sale where can i buy ipratropium

azithromycin 500mg without prescription – order zithromax generic order nebivolol 20mg sale

oral augmentin – at bio info ampicillin buy online

order nexium for sale – nexiumtous esomeprazole order online

meloxicam drug – mobo sin order mobic for sale

purchase prednisone online cheap – aprep lson order deltasone 10mg online

ed pills that work quickly – buy erectile dysfunction medication best otc ed pills

cheap amoxil – how to buy amoxil buy amoxil cheap

buy cheap diflucan – https://gpdifluca.com/# diflucan medication

tadalafil no prescription forum – cialis online without pres buying cialis online safely

buy zantac 150mg online – online order zantac 150mg pills

cialis free samples – https://strongtadafl.com/ cialis from canada

cheap viagra no prescription online – buy viagra cheap online no prescription where to buy cheap viagra online

More posts like this would bring about the blogosphere more useful. https://ursxdol.com/sildenafil-50-mg-in/

Greetings! Very serviceable recommendation within this article! It’s the petty changes which choice obtain the largest changes. Thanks a lot in the direction of sharing! https://prohnrg.com/product/get-allopurinol-pills/

Greetings! Very useful par‘nesis within this article! It’s the petty changes which wish obtain the largest changes. Thanks a a quantity for sharing! acheter lasix pas cher

Greetings! Utter serviceable advice within this article! It’s the little changes which choice make the largest changes. Thanks a quantity towards sharing!

https://doxycyclinege.com/pro/esomeprazole/

Greetings! Extremely useful recommendation within this article! It’s the scarcely changes which liking obtain the largest changes. Thanks a portion in the direction of sharing! http://www.01.com.hk/member.php?Action=viewprofile&username=Epqxeu

buy cheap dapagliflozin – https://janozin.com/# dapagliflozin 10mg over the counter

orlistat online order – https://asacostat.com/# brand xenical

The depth in this piece is exceptional. http://www.gearcup.cn/home.php?mod=space&uid=146373