- India led global crypto adoption, despite regulatory challenges and high trading taxes

- Bitcoin ETF boosted institutional transfers, driving growth in high-income regions like North America

Amidst rising interest in cryptocurrencies, the Chainalysis Global Crypto Adoption Index unveiled its fifth annual report. It captured significant insights into grassroots adoption across the globe.

This year’s report, covering data from Q3 2021 to Q2 2024, introduced a refined methodology that emphasizes DeFi activity while excluding P2P cryptocurrency exchange trade volumes.

Additionally, by integrating both on-chain and off-chain data, Chainalysis identified which countries are leading in cryptocurrency adoption and why these regions are increasingly embracing digital assets.

Chainalysis crypto adoption report – Explained

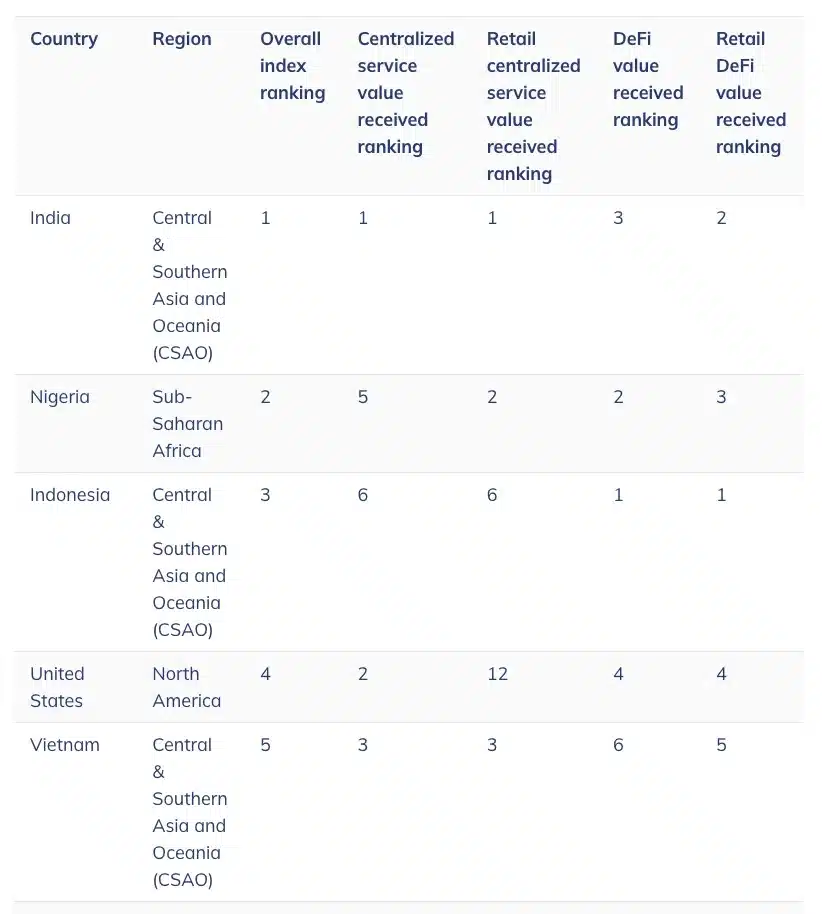

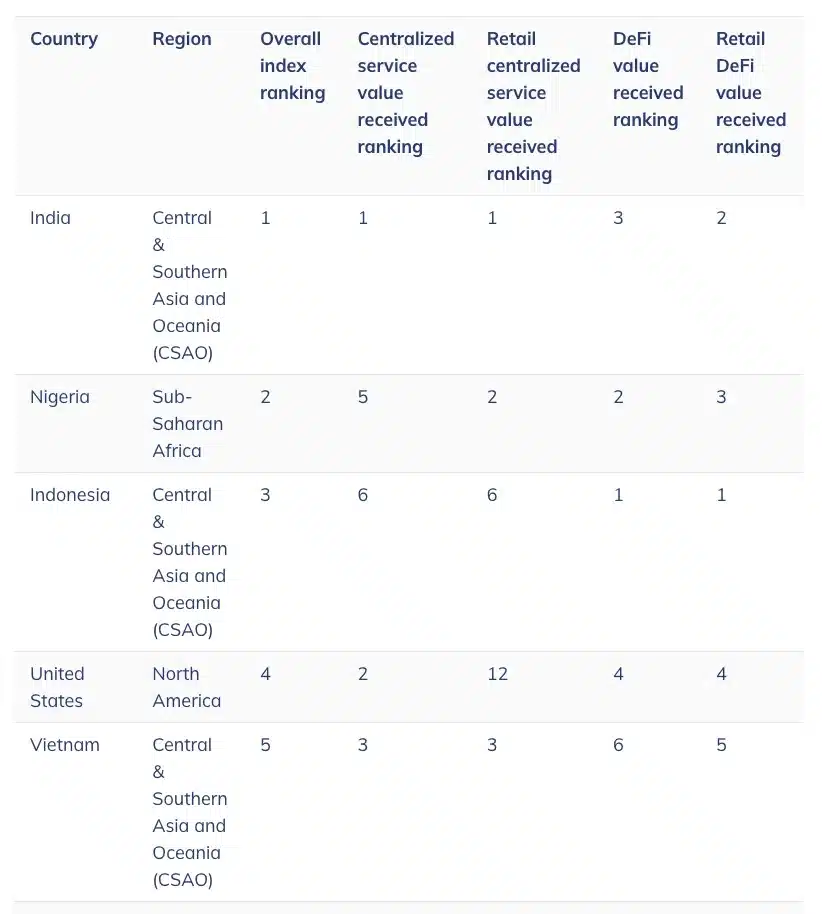

According to the latest findings, India and Nigeria remain at the forefront of global crypto adoption, while Indonesia has emerged as the fastest-growing market.

Source: Chainalysis

India has retained its lead in global cryptocurrency adoption for the second straight year, despite a difficult legal environment and hefty trade taxes.

For those unfamiliar, the country’s stringent regulatory position has been in place since 2018. This includes recent actions by the Financial Intelligence Unit (FIU) in December 2023. Back then, the FIU issued show-cause notices to nine offshore cryptocurrency exchanges for failing to comply with local regulations.

However, this comprehensive regulatory environment has not deterred Indian investors. The aforementioned numbers demonstrate India’s resilience and leadership in the global cryptocurrency market.

Remarking on the same, Eric Jardine, Research Lead at Chainalysis noted,

“India has also got a fairly wide spread level of adoption across different assets of crypto despite restrictions, implying new participants to crypto would have been participating via services that were not banned.”

USA loses ground?

On the contrary, despite significant media attention around cryptocurrencies in the United States—spurred by presidential candidate Donald Trump and ETF developments—the country was only ranked 4th in terms of global crypto adoption.

The country was ranked below India, Nigeria, and Indonesia. This suggested that major discussions and high-profile events do not always translate into leading adoption rankings.

Nevertheless, the report highlighted that the launch of the Spot Bitcoin [BTC] ETF in the United States has significantly spurred BTC activity worldwide. In fact, there has been major year-over-year growth in institutional transfers and notable hikes in high-income regions like North America and Western Europe.

Diving deeper into adoption rates, Chainalysis’ report revealed,

“Between the fourth quarter of 2023 and the first quarter of 2024, the total value of global crypto activity increased substantially, reaching higher levels than those of 2021 during the crypto bull market.”

Source: Chainalysis

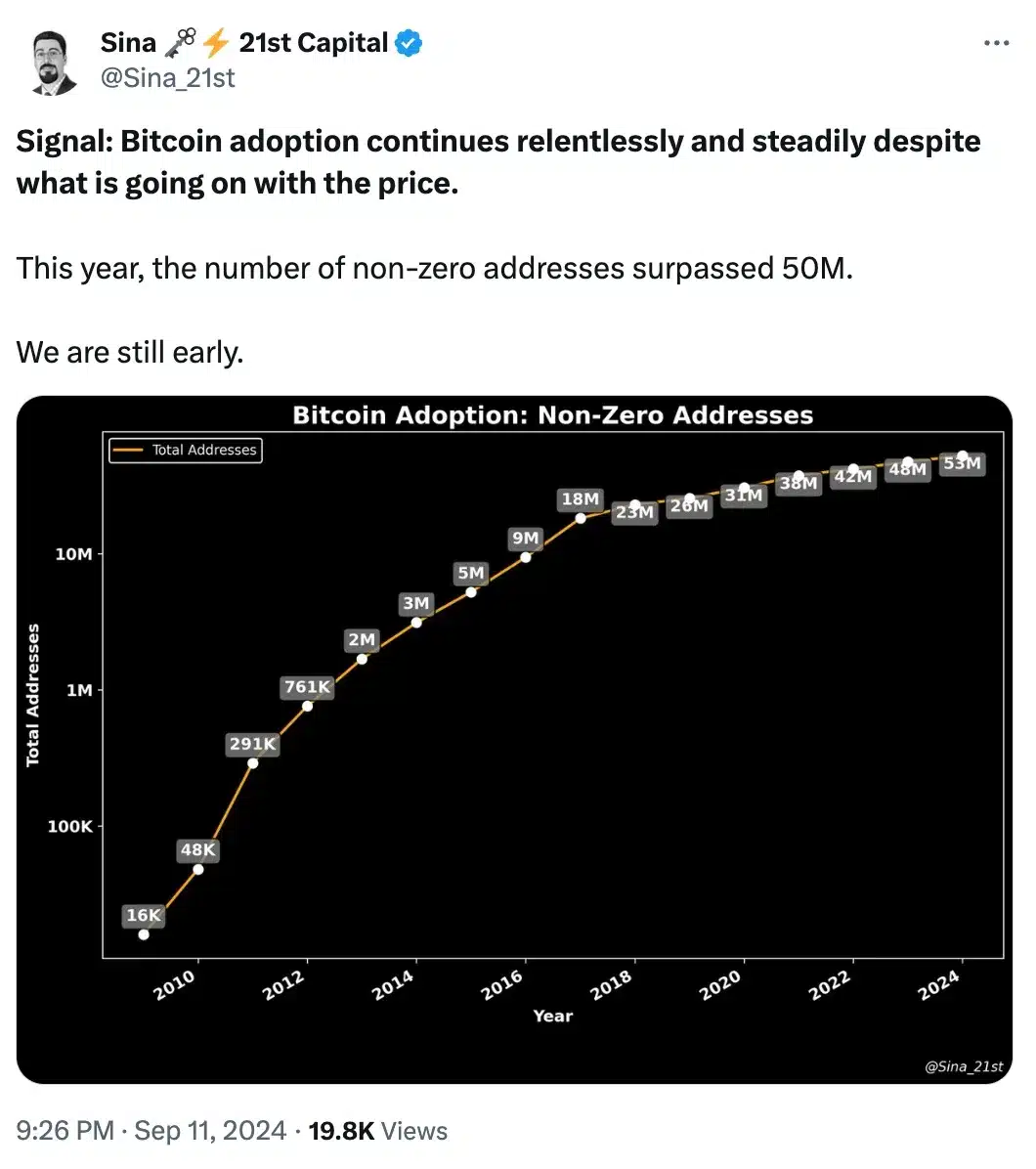

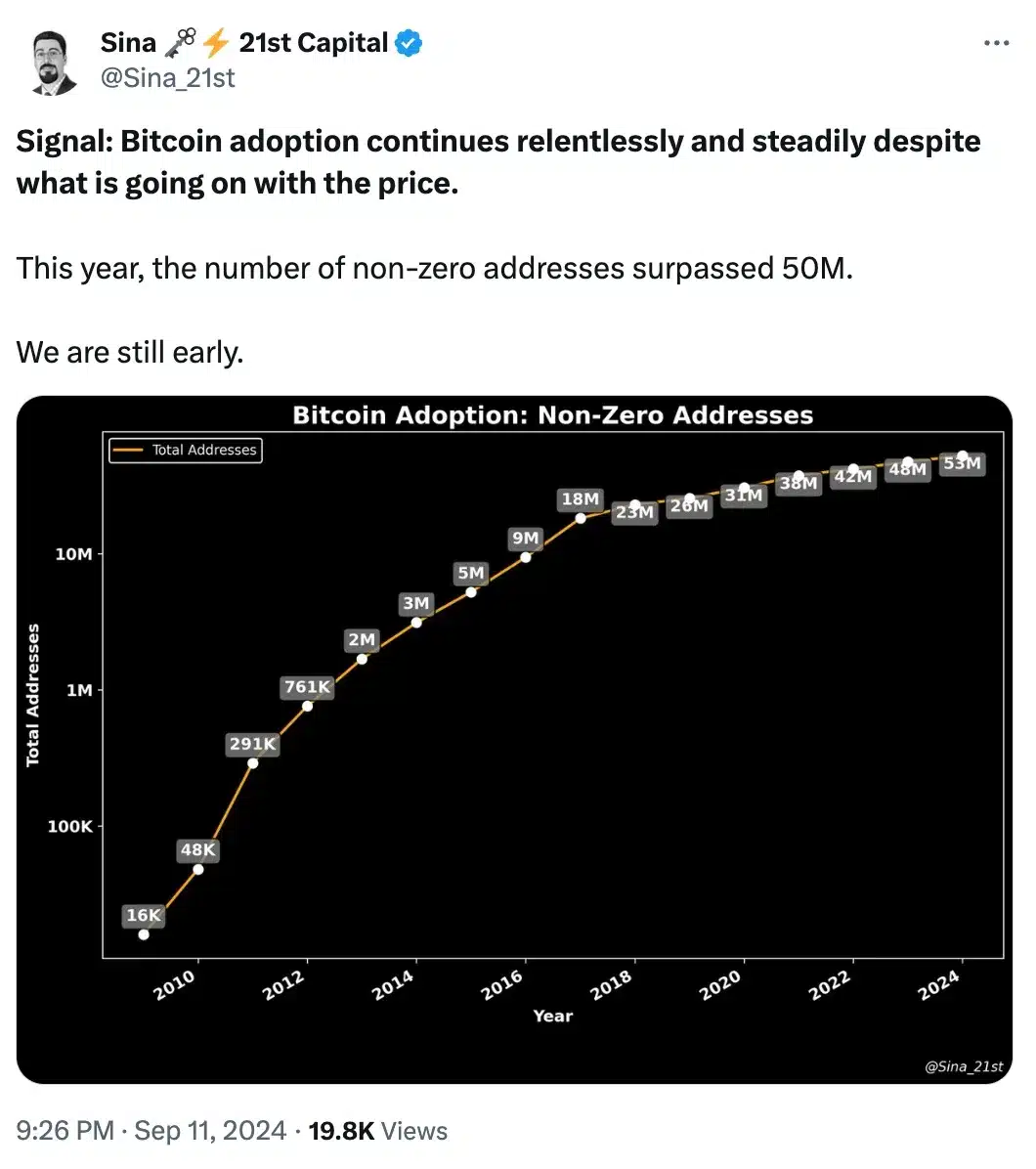

Bitcoin – The most adopted token

As expected, Bitcoin has emerged as the most talked-about cryptocurrency and a driving factor behind crypto adoption.

Whether it’s the surge in interest around Bitcoin ETFs or its growing relevance in political discussions, from elections to institutional strategies, BTC consistently attracts attention.

This was further confirmed by a recent update from a user on X, highlighting its undeniable impact on the broader crypto market.

Source: Sina/X

- India led global crypto adoption, despite regulatory challenges and high trading taxes

- Bitcoin ETF boosted institutional transfers, driving growth in high-income regions like North America

Amidst rising interest in cryptocurrencies, the Chainalysis Global Crypto Adoption Index unveiled its fifth annual report. It captured significant insights into grassroots adoption across the globe.

This year’s report, covering data from Q3 2021 to Q2 2024, introduced a refined methodology that emphasizes DeFi activity while excluding P2P cryptocurrency exchange trade volumes.

Additionally, by integrating both on-chain and off-chain data, Chainalysis identified which countries are leading in cryptocurrency adoption and why these regions are increasingly embracing digital assets.

Chainalysis crypto adoption report – Explained

According to the latest findings, India and Nigeria remain at the forefront of global crypto adoption, while Indonesia has emerged as the fastest-growing market.

Source: Chainalysis

India has retained its lead in global cryptocurrency adoption for the second straight year, despite a difficult legal environment and hefty trade taxes.

For those unfamiliar, the country’s stringent regulatory position has been in place since 2018. This includes recent actions by the Financial Intelligence Unit (FIU) in December 2023. Back then, the FIU issued show-cause notices to nine offshore cryptocurrency exchanges for failing to comply with local regulations.

However, this comprehensive regulatory environment has not deterred Indian investors. The aforementioned numbers demonstrate India’s resilience and leadership in the global cryptocurrency market.

Remarking on the same, Eric Jardine, Research Lead at Chainalysis noted,

“India has also got a fairly wide spread level of adoption across different assets of crypto despite restrictions, implying new participants to crypto would have been participating via services that were not banned.”

USA loses ground?

On the contrary, despite significant media attention around cryptocurrencies in the United States—spurred by presidential candidate Donald Trump and ETF developments—the country was only ranked 4th in terms of global crypto adoption.

The country was ranked below India, Nigeria, and Indonesia. This suggested that major discussions and high-profile events do not always translate into leading adoption rankings.

Nevertheless, the report highlighted that the launch of the Spot Bitcoin [BTC] ETF in the United States has significantly spurred BTC activity worldwide. In fact, there has been major year-over-year growth in institutional transfers and notable hikes in high-income regions like North America and Western Europe.

Diving deeper into adoption rates, Chainalysis’ report revealed,

“Between the fourth quarter of 2023 and the first quarter of 2024, the total value of global crypto activity increased substantially, reaching higher levels than those of 2021 during the crypto bull market.”

Source: Chainalysis

Bitcoin – The most adopted token

As expected, Bitcoin has emerged as the most talked-about cryptocurrency and a driving factor behind crypto adoption.

Whether it’s the surge in interest around Bitcoin ETFs or its growing relevance in political discussions, from elections to institutional strategies, BTC consistently attracts attention.

This was further confirmed by a recent update from a user on X, highlighting its undeniable impact on the broader crypto market.

Source: Sina/X

Ive read several just right stuff here Certainly price bookmarking for revisiting I wonder how a lot effort you place to create this kind of great informative website

where to get generic clomid no prescription good rx clomiphene buy cheap clomid without prescription where to get clomiphene without dr prescription can i get cheap clomid can i get cheap clomiphene no prescription can i get cheap clomid without dr prescription

Thanks for putting this up. It’s well done.

More posts like this would force the blogosphere more useful.

buy azithromycin 250mg – sumycin 250mg sale buy flagyl 400mg sale

rybelsus 14mg usa – buy periactin 4mg pills cyproheptadine generic

motilium 10mg sale – order generic tetracycline order flexeril sale

order augmentin 625mg online – https://atbioinfo.com/ cheap acillin

brand esomeprazole – https://anexamate.com/ esomeprazole cheap

coumadin 5mg pills – https://coumamide.com/ cozaar without prescription

cost mobic 15mg – tenderness order mobic 7.5mg online cheap

order prednisone 5mg online cheap – corticosteroid order generic deltasone 20mg

male ed pills – fastedtotake best over the counter ed pills

cheap amoxicillin – combamoxi cheap generic amoxil

buy forcan without a prescription – fluconazole 200mg sale order diflucan 100mg for sale

cialis 5mg cost per pill – buy cialis on line when will generic cialis be available

cialis super active vs regular cialis – click find tadalafil

ranitidine 150mg price – https://aranitidine.com/# ranitidine 300mg pills

cheap legal viagra – https://strongvpls.com/ viagra 50 off coupon

Thanks recompense sharing. It’s first quality. https://gnolvade.com/

Greetings! Jolly gainful par‘nesis within this article! It’s the little changes which choice make the largest changes. Thanks a a quantity in the direction of sharing! https://ursxdol.com/amoxicillin-antibiotic/

I couldn’t weather commenting. Profoundly written! buy generic diltiazem for sale

More text pieces like this would insinuate the web better. https://aranitidine.com/fr/ciagra-professional-20-mg/