ETH outshines BTC

An in-depth analysis by AMBCrypto revealed that the percentage of ETH holders who kept their assets for over a year rose from 59% in January 2024 to 75% by December 2024, according to IntoTheBlock data.

This contrasted sharply with Bitcoin, where the proportion of long-term holders declined from 70% to 62.3% over the same period.

Source: IntoTheBlock

The growing retention rate for Ethereum suggested heightened confidence among investors, driven by expectations of future network upgrades and broader utility.

Meanwhile, Bitcoin’s decline in long-term holders may reflect profit-taking or diversification strategies, indicating a potential shift in market sentiment as investors prioritize ETH heading into 2025.

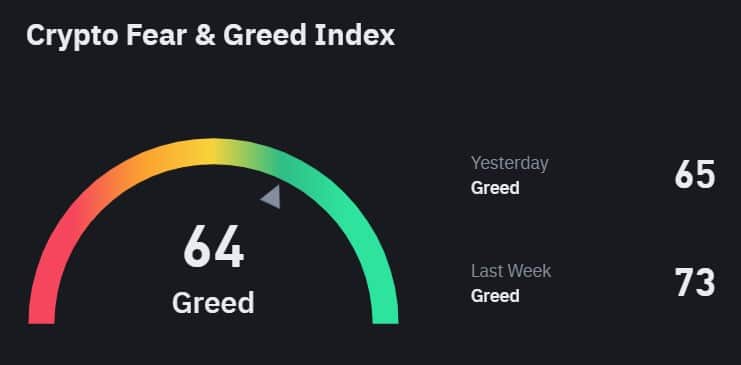

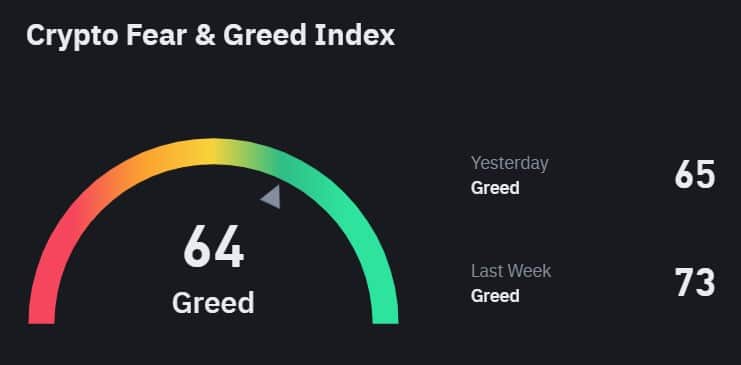

Fear and Greed Index drops to two-month low

Notably, losing HODLers wasn’t the only problem the king coin was facing. It’s Crypto Fear and Greed Index fell to 64 on the 31st of December, marking the lowest level since the 15th of October.

This decline reflected waning market optimism as Bitcoin tumbled over 12% in the past two weeks to trade near $93,000.

Source: Binance Square

After peaking at 94 in November—driven by excitement surrounding pro-crypto U.S. election results, the index remained above 70 for much of December before the recent pullback. The drop signaled a shift from extreme greed to a more cautious sentiment among investors.

While greed still dominated, the decline highlighted heightened concerns about short-term market volatility as traders reacted to Bitcoin’s price movements and the broader market’s mixed signals.

Read Ethereum [ETH] Price Prediction 2025-2026

BTC in an accumulation phase?

Despite the dip, investor James Williams believes Bitcoin is entering a crucial accumulation phase. In his latest X (formerly Twitter) post, Williams described the current conditions as an opportunity for long-term positioning.

Williams predicted a consolidation period over the coming weeks, potentially setting the stage for a significant breakout. Confident in Bitcoin’s long-term trajectory, Williams views the current price action as part of a natural market cycle and forecasts a price of $131,500 or higher by Q1 2025, calling such levels “inevitable.”

He emphasized that having patience during periods of consolidation often rewards investors, as such phases historically precede substantial upward moves in Bitcoin’s price.

ETH outshines BTC

An in-depth analysis by AMBCrypto revealed that the percentage of ETH holders who kept their assets for over a year rose from 59% in January 2024 to 75% by December 2024, according to IntoTheBlock data.

This contrasted sharply with Bitcoin, where the proportion of long-term holders declined from 70% to 62.3% over the same period.

Source: IntoTheBlock

The growing retention rate for Ethereum suggested heightened confidence among investors, driven by expectations of future network upgrades and broader utility.

Meanwhile, Bitcoin’s decline in long-term holders may reflect profit-taking or diversification strategies, indicating a potential shift in market sentiment as investors prioritize ETH heading into 2025.

Fear and Greed Index drops to two-month low

Notably, losing HODLers wasn’t the only problem the king coin was facing. It’s Crypto Fear and Greed Index fell to 64 on the 31st of December, marking the lowest level since the 15th of October.

This decline reflected waning market optimism as Bitcoin tumbled over 12% in the past two weeks to trade near $93,000.

Source: Binance Square

After peaking at 94 in November—driven by excitement surrounding pro-crypto U.S. election results, the index remained above 70 for much of December before the recent pullback. The drop signaled a shift from extreme greed to a more cautious sentiment among investors.

While greed still dominated, the decline highlighted heightened concerns about short-term market volatility as traders reacted to Bitcoin’s price movements and the broader market’s mixed signals.

Read Ethereum [ETH] Price Prediction 2025-2026

BTC in an accumulation phase?

Despite the dip, investor James Williams believes Bitcoin is entering a crucial accumulation phase. In his latest X (formerly Twitter) post, Williams described the current conditions as an opportunity for long-term positioning.

Williams predicted a consolidation period over the coming weeks, potentially setting the stage for a significant breakout. Confident in Bitcoin’s long-term trajectory, Williams views the current price action as part of a natural market cycle and forecasts a price of $131,500 or higher by Q1 2025, calling such levels “inevitable.”

He emphasized that having patience during periods of consolidation often rewards investors, as such phases historically precede substantial upward moves in Bitcoin’s price.

clomid for sale in usa where to get generic clomid no prescription can i get clomiphene without rx how to get clomiphene tablets where can i buy cheap clomid pill where to get clomid buying clomiphene tablets

More posts like this would make the online time more useful.

I’ll certainly bring to skim more.

buy semaglutide cheap – rybelsus 14 mg sale cost cyproheptadine 4 mg

domperidone 10mg usa – order tetracycline 500mg generic order flexeril generic

brand propranolol – inderal 20mg sale methotrexate pill

amoxiclav sale – atbioinfo acillin cost

order nexium without prescription – anexa mate buy esomeprazole 40mg generic

coumadin pills – coumamide order losartan for sale

order generic meloxicam 15mg – mobo sin order meloxicam 15mg online

order deltasone 40mg for sale – https://apreplson.com/ deltasone 5mg ca

cheap ed pills – https://fastedtotake.com/ buy generic ed pills

order amoxicillin for sale – combamoxi.com cheap amoxil pills

buy diflucan 200mg – buy forcan generic order fluconazole 100mg pill

how to get cenforce without a prescription – https://cenforcers.com/# buy cenforce 50mg for sale

ranitidine 300mg price – https://aranitidine.com/# order zantac 300mg pill

cheap cialis with dapoxetine – this canadian pharmacy ezzz cialis

I couldn’t hold back commenting. Warmly written! comprar kamagra online

sildenafil 100mg price at walmart – strongvpls sildenafil 50 mg cost

I’ll certainly bring back to be familiar with more. https://buyfastonl.com/amoxicillin.html

More posts like this would make the online time more useful. https://ursxdol.com/augmentin-amoxiclav-pill/

Greetings! Utter productive par‘nesis within this article! It’s the little changes which liking espy the largest changes. Thanks a lot for sharing! https://aranitidine.com/fr/acheter-cialis-5mg/