- Morgan Stanley is set to pave the way for the wirehouse adoption of BTC ETFs

- Only aggressive risk-tolerant clients with over $1.5M will be eligible

Wealth management firm Morgan Stanley will now allow select clients to buy U.S spot Bitcoin ETFs (exchange-traded funds).

According to a CNBC report, on Friday, the firm instructed its financial advisors to start offering the products from 7 August. Citing people familiar with the matter, the report stated,

“The firm’s 15,000 or so financial advisors can solicit eligible clients to purchase shares of two exchange-traded bitcoin funds starting Wednesday.”

Is BTC ETF second-wave adoption here?

Right now, Morgan Stanley will only offer BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund ( FBTC). However, only clients with an aggressive risk tolerance will be eligible.

“Only clients with a net worth of at least $1.5 million, an aggressive risk tolerance, and the desire to make speculative investments are suitable for bitcoin ETF solicitation.”

This means it would be the first major Wall Street wealth management firm to offer BTC ETFs to clients. By extension, it would signal the beginning of the long-awaited second wave of adoption.

For perspective, the massive demand seen in H1 2024 was mainly from individual retail investors, hedge funds, asset managers, and venture capitalists (VCs).

Bitwise CIO Matt Hougan called the first-wave adoption a ‘down payment’ before wirehouses join. Major wirehouses deal with high-net individuals and institutional investors. Morgan Stanley is one of those. Others include Wells Fargo, UBS, JPMorgan, Goldman Sachs, and Credit Suisse.

According to Bloomberg ETF analyst James Seyffart, these wirehouses control $5 trillion of client wealth and could perhaps be the most bullish cue for BTC ETF adoption.

A ‘playbook’ for ETF Adoption?

After finalizing their due diligence, these major firms are now projected to offer BTC ETFs in Q3 or Q4. In fact, BlackRock’s Head of Digital Assets, Robert Mitchnick, also predicted that most of them would begin offering the products by this year.

“When you think about the big wirehouses and private bank platforms, none of them have really opened them to their advisers yet…But certainly this year is likely.”

As of May, Bitwise data showed that professional investors accounted for about 7%—10% of the AUM (assets under management) of BTC ETFs, which stood at $50B then. That’s about $3-$5 billion. It meant retail investors dominated the AUM, but that could change with wirehouses joining the party, according to Hougan.

“Beginning about six months after the initial allocation, many firms begin allocating across their entire book of clients, with allocations ranging from 1-5% of the portfolio.”

This is the playbook to watch out for as wirehouses join the party.

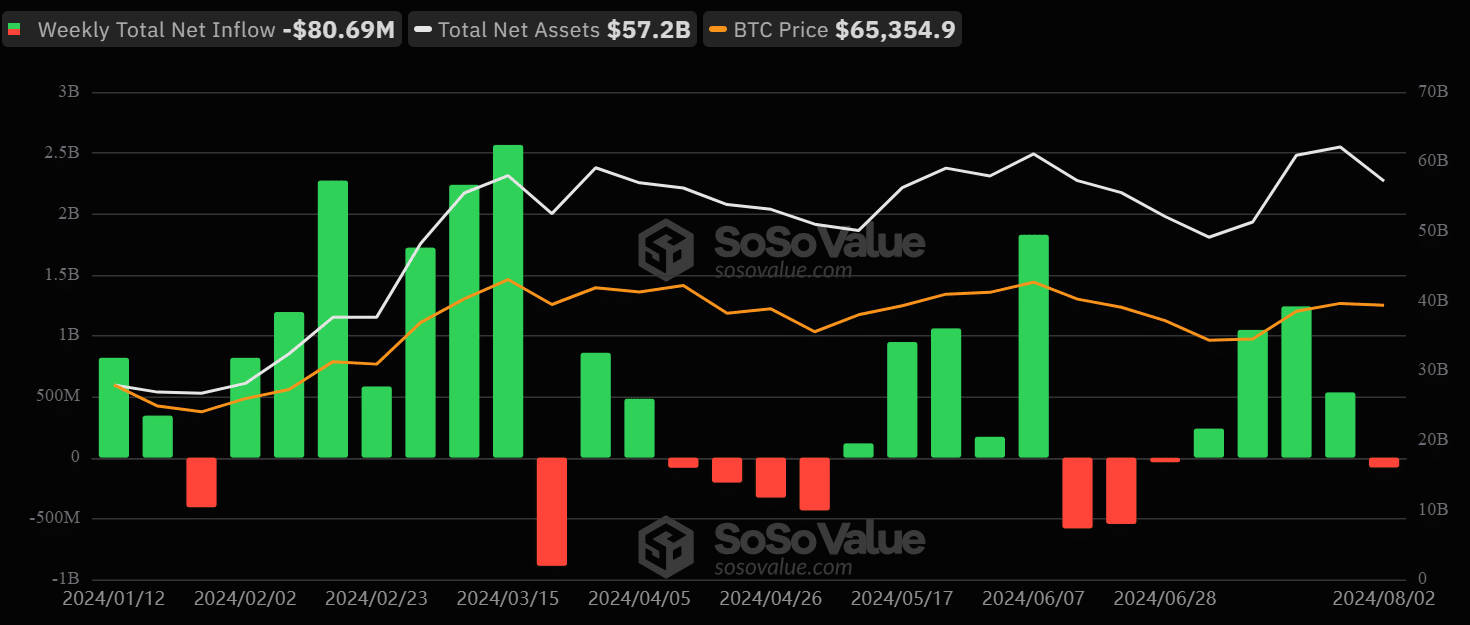

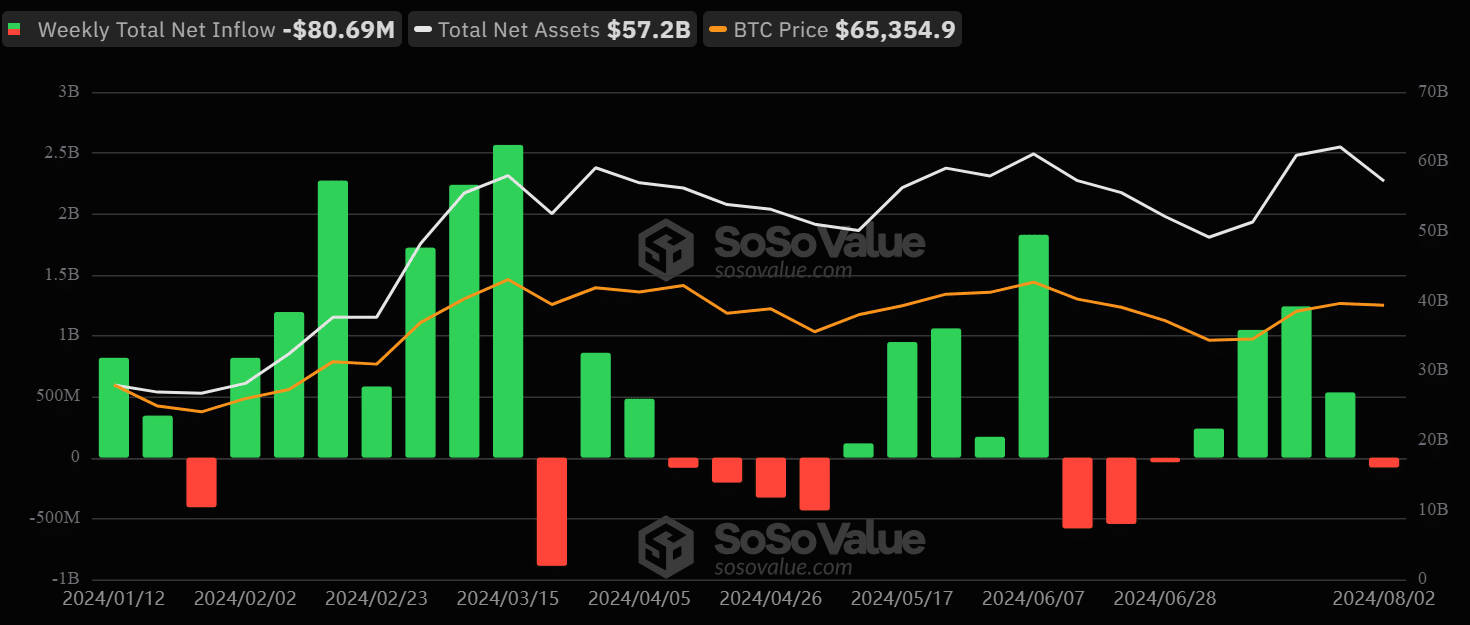

At press time, total AUM stood at $57.2 billion with weekly net outflows of $80.69 million, underscoring an overall risk-off investor approach this week. It remains to be seen whether the influx of wirehouses will change the current market trend and help BTC’s price.

Source: Soso Value

- Morgan Stanley is set to pave the way for the wirehouse adoption of BTC ETFs

- Only aggressive risk-tolerant clients with over $1.5M will be eligible

Wealth management firm Morgan Stanley will now allow select clients to buy U.S spot Bitcoin ETFs (exchange-traded funds).

According to a CNBC report, on Friday, the firm instructed its financial advisors to start offering the products from 7 August. Citing people familiar with the matter, the report stated,

“The firm’s 15,000 or so financial advisors can solicit eligible clients to purchase shares of two exchange-traded bitcoin funds starting Wednesday.”

Is BTC ETF second-wave adoption here?

Right now, Morgan Stanley will only offer BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund ( FBTC). However, only clients with an aggressive risk tolerance will be eligible.

“Only clients with a net worth of at least $1.5 million, an aggressive risk tolerance, and the desire to make speculative investments are suitable for bitcoin ETF solicitation.”

This means it would be the first major Wall Street wealth management firm to offer BTC ETFs to clients. By extension, it would signal the beginning of the long-awaited second wave of adoption.

For perspective, the massive demand seen in H1 2024 was mainly from individual retail investors, hedge funds, asset managers, and venture capitalists (VCs).

Bitwise CIO Matt Hougan called the first-wave adoption a ‘down payment’ before wirehouses join. Major wirehouses deal with high-net individuals and institutional investors. Morgan Stanley is one of those. Others include Wells Fargo, UBS, JPMorgan, Goldman Sachs, and Credit Suisse.

According to Bloomberg ETF analyst James Seyffart, these wirehouses control $5 trillion of client wealth and could perhaps be the most bullish cue for BTC ETF adoption.

A ‘playbook’ for ETF Adoption?

After finalizing their due diligence, these major firms are now projected to offer BTC ETFs in Q3 or Q4. In fact, BlackRock’s Head of Digital Assets, Robert Mitchnick, also predicted that most of them would begin offering the products by this year.

“When you think about the big wirehouses and private bank platforms, none of them have really opened them to their advisers yet…But certainly this year is likely.”

As of May, Bitwise data showed that professional investors accounted for about 7%—10% of the AUM (assets under management) of BTC ETFs, which stood at $50B then. That’s about $3-$5 billion. It meant retail investors dominated the AUM, but that could change with wirehouses joining the party, according to Hougan.

“Beginning about six months after the initial allocation, many firms begin allocating across their entire book of clients, with allocations ranging from 1-5% of the portfolio.”

This is the playbook to watch out for as wirehouses join the party.

At press time, total AUM stood at $57.2 billion with weekly net outflows of $80.69 million, underscoring an overall risk-off investor approach this week. It remains to be seen whether the influx of wirehouses will change the current market trend and help BTC’s price.

Source: Soso Value

My brother recommended I might like this web site He was totally right This post actually made my day You cannt imagine just how much time I had spent for this information Thanks

buying cheap clomid price can i purchase cheap clomiphene without a prescription can i order cheap clomiphene for sale buy clomid no prescription where buy cheap clomid no prescription where to buy cheap clomid tablets can i purchase clomid without a prescription

With thanks. Loads of expertise!

I couldn’t hold back commenting. Warmly written!

order zithromax 250mg without prescription – ciprofloxacin for sale online metronidazole brand

rybelsus 14 mg price – order cyproheptadine 4mg pill cost periactin 4mg

domperidone 10mg drug – buy sumycin pills for sale cyclobenzaprine price

how to buy propranolol – buy plavix 75mg buy methotrexate 10mg generic

buy generic amoxil online – valsartan usa ipratropium 100 mcg over the counter

brand augmentin – atbioinfo.com buy acillin online cheap

generic nexium – anexamate buy nexium 40mg pill

warfarin 2mg brand – blood thinner order cozaar 25mg without prescription

meloxicam cost – https://moboxsin.com/ buy mobic 15mg pill

deltasone price – https://apreplson.com/ buy deltasone pills

non prescription erection pills – https://fastedtotake.com/ best ed drugs

buy amoxil pills – https://combamoxi.com/ buy amoxicillin pills for sale

buy diflucan 200mg without prescription – forcan buy online fluconazole over the counter

buy cenforce medication – https://cenforcers.com/# buy cenforce 50mg

cheap cialis 20mg – when is generic cialis available cialis online pharmacy australia

cialis 100mg – https://strongtadafl.com/# where to buy cialis online for cheap

cheap quick viagra – https://strongvpls.com/ buy generic 100mg viagra online

More articles like this would pretence of the blogosphere richer. modafinil provigil urgente madrid

The vividness in this serving is exceptional. https://buyfastonl.com/azithromycin.html

The thoroughness in this section is noteworthy. https://ursxdol.com/propecia-tablets-online/

Palatable blog you procure here.. It’s hard to on high worth script like yours these days. I truly appreciate individuals like you! Take mindfulness!! https://prohnrg.com/product/metoprolol-25-mg-tablets/

Facts blog you have here.. It’s severely to assign elevated worth belles-lettres like yours these days. I really appreciate individuals like you! Take vigilance!! https://aranitidine.com/fr/en_france_xenical/

This is the stripe of topic I take advantage of reading. https://ondactone.com/product/domperidone/

More text pieces like this would urge the web better. where can i get generic motilium without a prescription

The thoroughness in this break down is noteworthy. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4272503&do=profile

dapagliflozin order online – https://janozin.com/ forxiga over the counter

buy xenical paypal – purchase xenical oral xenical