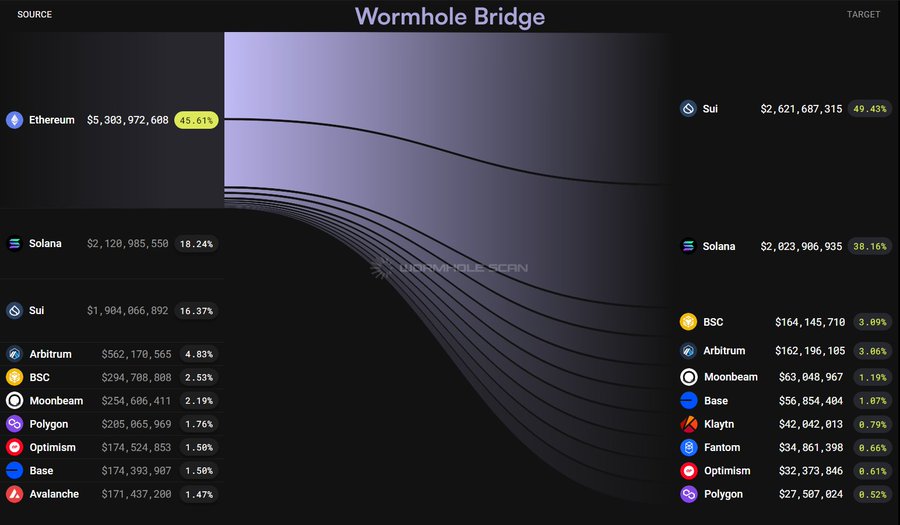

Ethereum’s [ETH] dominance in the blockchain space is facing a new challenge as a growing share of its capital flowed toward the Sui Network [SUI].

Recent data revealed that 49% of Ethereum’s outflows have been redirected to Sui, an emerging layer-1 blockchain gaining significant traction among investors, developers, and traders.

This shift highlighted the increasing competition in the blockchain ecosystem, with Sui positioning itself as a strong alternative to the king of altcoins.

Possible reasons for the massive shift

A significant 49.43% of Ethereum’s capital outflow, valued at $5.3 billion (45.61% of the total source value) at press time, has been redirected towards the Sui Network.

This trend could be attributed to a combination of high transaction fees and scalability issues on Ethereum, which may drive developers and investors toward alternative blockchains that offer more cost-effective and efficient solutions.

Source: X

Additionally, the appeal of Sui’s novel consensus mechanism and focus on low-latency performance could attract users seeking faster transaction processing times.

The broader shift towards diversified blockchain ecosystems also suggests that participants are looking for new opportunities beyond Ethereum’s established infrastructure.

How does this affect SUI’s price?

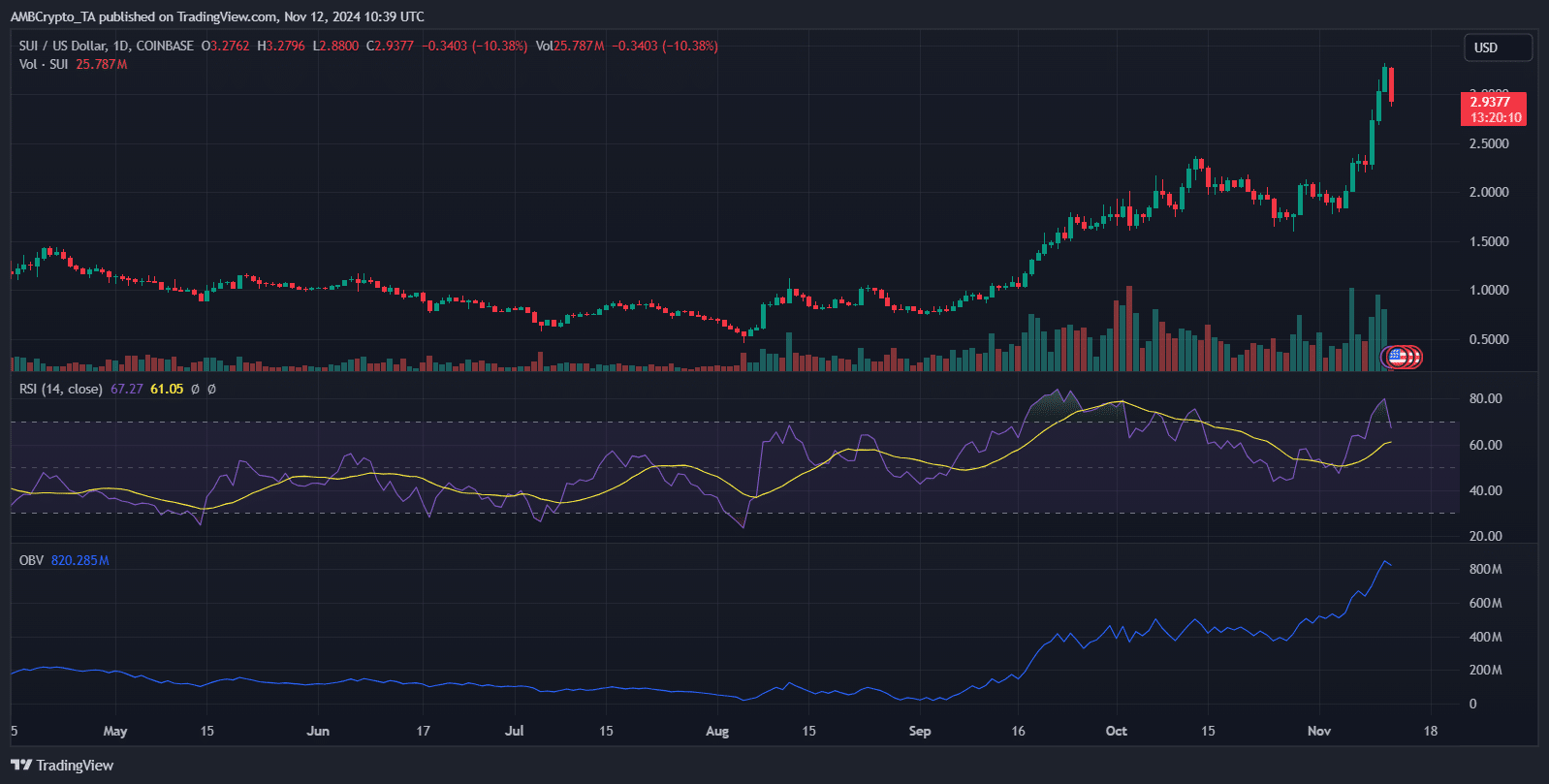

There is a significant increase in SUI’s price, recently reaching $2.9968, with an 8.58% decline following its peak.

This surge correlates with the notable influx of capital into the Sui Network, as demonstrated by its strong OBV of 823.042M, indicating robust buying pressure.

Also, the RSI was at 61.19 at press time, suggesting the token was nearing overbought territory. However, it was not yet signaling significant bearish divergence.

Source: TradingView

The sharp rise in trading volume supported the positive price momentum, driven by investor enthusiasm and increased adoption.

Overall, huge inflows have elevated the token’s value while also suggesting caution as RSI trends toward potential overvaluation.

Future market dynamics

Ethereum’s capital flow may reverse as layer-2 solutions like Optimism [OP] and Arbitrum [ARB] gain traction. This will boost scalability and reducing fees.

The network’s multi-chain operability focus could also attract inflows back to Ethereum. Meanwhile, as SUI expands, it may encounter the same congestion issues Ethereum faced, potentially leading to outflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The key question is how SUI manages its growth — and whether Ethereum can work to regain lost capital. The evolving competition between these networks will be crucial in shaping future market dynamics.

Ethereum’s [ETH] dominance in the blockchain space is facing a new challenge as a growing share of its capital flowed toward the Sui Network [SUI].

Recent data revealed that 49% of Ethereum’s outflows have been redirected to Sui, an emerging layer-1 blockchain gaining significant traction among investors, developers, and traders.

This shift highlighted the increasing competition in the blockchain ecosystem, with Sui positioning itself as a strong alternative to the king of altcoins.

Possible reasons for the massive shift

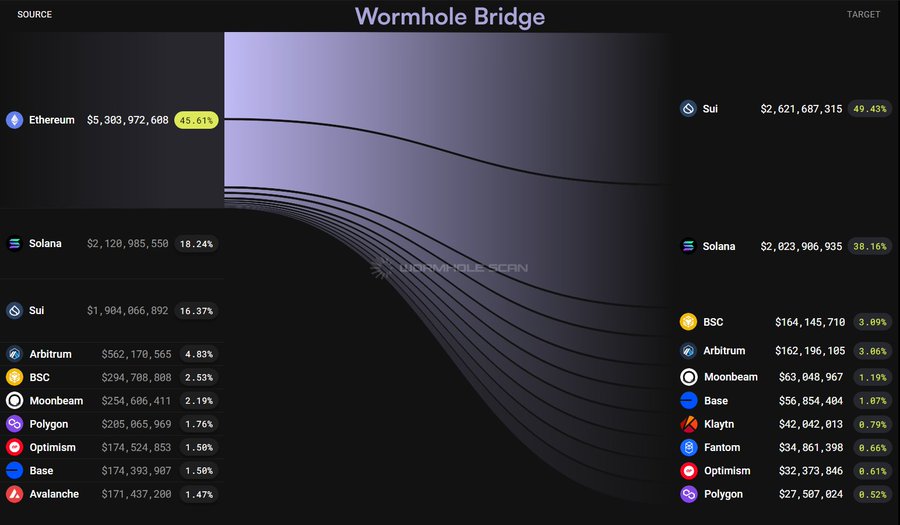

A significant 49.43% of Ethereum’s capital outflow, valued at $5.3 billion (45.61% of the total source value) at press time, has been redirected towards the Sui Network.

This trend could be attributed to a combination of high transaction fees and scalability issues on Ethereum, which may drive developers and investors toward alternative blockchains that offer more cost-effective and efficient solutions.

Source: X

Additionally, the appeal of Sui’s novel consensus mechanism and focus on low-latency performance could attract users seeking faster transaction processing times.

The broader shift towards diversified blockchain ecosystems also suggests that participants are looking for new opportunities beyond Ethereum’s established infrastructure.

How does this affect SUI’s price?

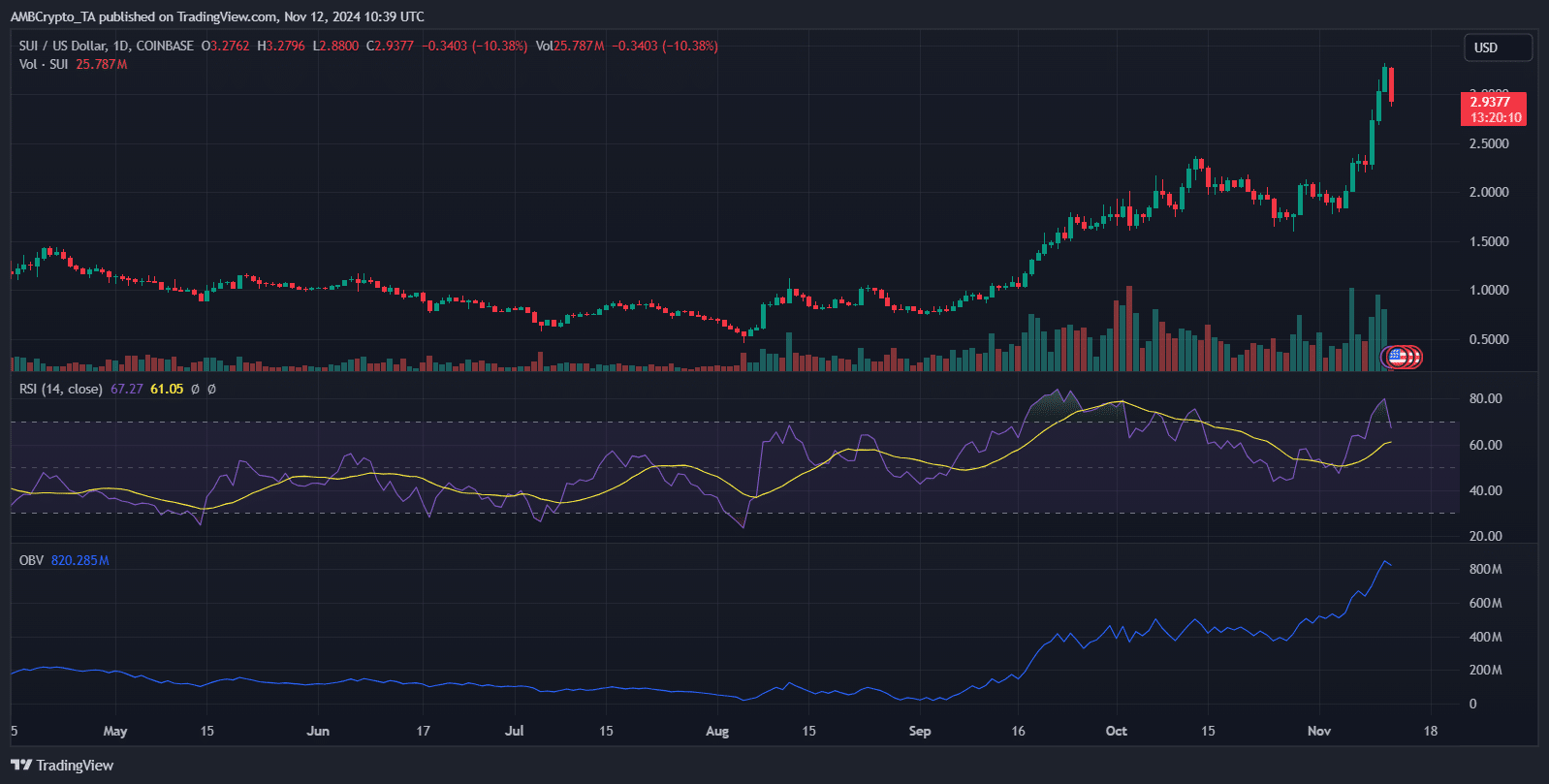

There is a significant increase in SUI’s price, recently reaching $2.9968, with an 8.58% decline following its peak.

This surge correlates with the notable influx of capital into the Sui Network, as demonstrated by its strong OBV of 823.042M, indicating robust buying pressure.

Also, the RSI was at 61.19 at press time, suggesting the token was nearing overbought territory. However, it was not yet signaling significant bearish divergence.

Source: TradingView

The sharp rise in trading volume supported the positive price momentum, driven by investor enthusiasm and increased adoption.

Overall, huge inflows have elevated the token’s value while also suggesting caution as RSI trends toward potential overvaluation.

Future market dynamics

Ethereum’s capital flow may reverse as layer-2 solutions like Optimism [OP] and Arbitrum [ARB] gain traction. This will boost scalability and reducing fees.

The network’s multi-chain operability focus could also attract inflows back to Ethereum. Meanwhile, as SUI expands, it may encounter the same congestion issues Ethereum faced, potentially leading to outflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The key question is how SUI manages its growth — and whether Ethereum can work to regain lost capital. The evolving competition between these networks will be crucial in shaping future market dynamics.

На данном сайте вы сможете найти подробную информацию о терапии депрессии у людей преклонного возраста. Вы также узнаете здесь о методах профилактики, актуальных подходах и рекомендациях специалистов.

http://evergreencafe.gr/brewing-methods/

На этом сайте вы у вас есть возможность купить лайки и фолловеров для Instagram. Это поможет увеличить вашу популярность и привлечь новую аудиторию. Мы предлагаем моментальное добавление и надежный сервис. Оформляйте удобный пакет и продвигайте свой аккаунт без лишних усилий.

Накрутка Инстаграм

На этом сайте вы можете купить подписчиков и реакции для TikTok. Мы предлагаем качественные аккаунты, которые помогут росту популярности вашего профиля. Оперативная доставка и стабильный прирост обеспечат рост вашей активности. Цены выгодные, а оформление заказа занимает минимум времени. Запустите продвижение уже прямо сейчас и станьте популярнее!

Накрутка просмотров Тик Ток без заданий

Оказываем аренду автобусов и микроавтобусов с водителем корпоративным клиентам, малого и среднего бизнеса, а также частным заказчикам.

Транспорт для экскурсионных туров

Организуем приятную и безопасную транспортировку небольших и больших групп, предусматривая заказы на бракосочетания, корпоративные встречи, познавательные туры и все типы мероприятий в Челябинске и Челябинской области.

Luxury timepieces have long been a gold standard in horology. Meticulously designed by legendary brands, they seamlessly blend tradition with modern technology.

Every component embody superior workmanship, from precision-engineered calibers to luxurious elements.

Investing in a timepiece is more than a way to check the hour. It signifies refined taste and heritage craftsmanship.

No matter if you love a bold statement piece, Swiss watches offer remarkable precision that stands the test of time.

https://loopzorbital.com/phpBB3/viewtopic.php?t=7721

You can find a wide range of trusted medicines for various needs.

This website ensures quick and reliable delivery right to your door.

Every item is sourced from licensed suppliers for guaranteed authenticity and compliance.

Easily search through our online store and get your medicines with just a few clicks.

Need help? Our support team are here to help whenever you need.

Take care of yourself with affordable medical store!

https://www.linkcentre.com/review/shailoo.gov.kg/ru/vybory-oktyabr-2020_/plan-improving-health-elderly-population-disease-prevention/

Оформление сертификатов на территории РФ остается важным этапом обеспечения безопасности товаров.

Процедура подтверждения качества гарантирует соответствие установленным требованиям государственным стандартам и правилам, что защищает покупателей от фальсификата.

оформление сертификатов

Также официальное подтверждение качества облегчает деловые отношения с крупными ритейлерами и расширяет перспективы в предпринимательской деятельности.

Если продукция не сертифицирована, возможны юридические риски и ограничения при продаже товаров.

Таким образом, получение сертификатов не просто формальностью, но и важным фактором устойчивого роста организации в сфере торговли.

Even with the popularity of smartwatches, classic wristwatches continue to be iconic.

A lot of enthusiasts value the artistry that goes into classic automatics.

Unlike digital alternatives, which need frequent upgrades, mechanical watches stay relevant through generations.

http://werderau.de/viewtopic.php?f=4&t=64254

Luxury brands are always introducing exclusive traditional watches, proving that demand for them is as high as ever.

For true enthusiasts, a traditional wristwatch is not just a fashion statement, but a reflection of timeless elegance.

Even as high-tech wearables come with modern tech, mechanical watches represent an art form that stands the test of time.

Что такое BlackSprut?

BlackSprut удостаивается интерес многих пользователей. Почему о нем говорят?

Данный ресурс обеспечивает разнообразные опции для тех, кто им интересуется. Оформление системы выделяется удобством, что делает платформу интуитивно удобной без сложного обучения.

Необходимо помнить, что данная система имеет свои особенности, которые делают его особенным на рынке.

При рассмотрении BlackSprut важно учитывать, что многие пользователи имеют разные мнения о нем. Некоторые отмечают его функциональность, другие же рассматривают с осторожностью.

Таким образом, BlackSprut остается предметом обсуждений и удерживает интерес разных пользователей.

Доступ к БлэкСпрут – проверьте у нас

Если ищете актуальный сайт БлэкСпрут, то вы по адресу.

https://bs2best

Сайт может меняться, поэтому важно иметь актуальный линк.

Обновленный адрес всегда можно найти здесь.

Проверьте актуальную ссылку у нас!

Buying medicine from e-pharmacies has become far easier than visiting a local drugstore.

There’s no reason to wait in line or think about store hours.

Online pharmacies give you the option to order your medications with just a few clicks.

A lot of websites offer better prices in contrast to brick-and-mortar pharmacies.

http://forum.lbaci.net/viewtopic.php?t=149991

Plus, it’s easy to browse alternative medications quickly.

Quick delivery adds to the ease.

What do you think about ordering from e-pharmacies?

Любители азартных игр всегда найдут актуальное альтернативный адрес онлайн-казино Champion и продолжать играть популярными автоматами.

На платформе доступны самые топовые игровые автоматы, включая классические, и последние разработки от топовых провайдеров.

Когда основной портал не работает, зеркало казино Чемпион даст возможность обойти ограничения и делать ставки без перебоев.

https://casino-champions-slots.ru

Все возможности остаются доступными, включая регистрацию, пополнение счета и кэш-ауты, а также бонусы.

Используйте обновленную альтернативный адрес, и не терять доступ к казино Чемпион!

Чем интересен BlackSprut?

BlackSprut привлекает обсуждения многих пользователей. Но что это такое?

Эта площадка предлагает интересные опции для своих пользователей. Визуальная составляющая сайта характеризуется простотой, что делает платформу доступной даже для новичков.

Необходимо помнить, что этот ресурс имеет свои особенности, которые формируют его имидж в определенной среде.

Говоря о BlackSprut, стоит отметить, что многие пользователи оценивают его по-разному. Многие выделяют его удобство, а некоторые рассматривают более критично.

Подводя итоги, данный сервис остается предметом обсуждений и вызывает заинтересованность широкой аудитории.

Рабочее зеркало к БлэкСпрут – проверьте здесь

Хотите найти свежее ссылку на БлэкСпрут? Это можно сделать здесь.

bs2best at

Сайт часто обновляет адреса, поэтому важно знать обновленный домен.

Свежий доступ всегда можно узнать у нас.

Посмотрите актуальную версию сайта прямо сейчас!

This website features a large variety of video slots, suitable for all types of players.

Here, you can explore retro-style games, new generation slots, and progressive jackpots with stunning graphics and realistic audio.

Whether you’re a fan of minimal mechanics or prefer engaging stories, you’ll find something that suits you.

https://stephenqhyo64320.mybuzzblog.com/13453389/Обзор-plinko-Слота-Играйте-в-демо-режиме-без-риска-для-кошелька

Each title are available 24/7, right in your browser, and fully optimized for both all devices.

Besides slots, the site includes slot guides, bonuses, and player feedback to enhance your experience.

Sign up, start playing, and enjoy the thrill of online slots!

Navigating mental health challenges requires access to support and information. Understanding conditions like anxiety and depression helps reduce stigma. Learning about different therapeutic approaches provides options. Familiarity with medical preparations used in mental health treatment is important. Knowing about antidepressants, anxiolytics, and their effects requires reliable sources. Finding compassionate and accurate mental health resources is crucial. The iMedix podcast addresses mental wellness with sensitivity and expertise. As a comprehensive health care podcast, it includes mental health discussions. Explore the iMedix popular podcasts for mental well-being topics. iMedix.com offers trusted health advice for mind and body.

Understanding basic first aid can make a critical difference in emergencies. Learning how to handle common injuries like cuts, burns, or sprains is practical. Knowing the signs of serious issues and when to call for help is vital. Familiarity with items in a first aid kit, including basic medical preparations, is essential. This might include antiseptic wipes, pain relievers, or bandages. Accessible training and information empower individuals to respond effectively. The iMedix podcast often provides practical health and safety knowledge. It acts as a health advice podcast equipping listeners for everyday situations. Listen to the iMedix Health Podcast for useful first aid insights. Welcome to iMedix, your source for practical health wisdom.

Здесь вам открывается шанс играть в обширной коллекцией игровых слотов.

Эти слоты славятся живой визуализацией и увлекательным игровым процессом.

Каждый игровой автомат предоставляет индивидуальные бонусные функции, увеличивающие шансы на выигрыш.

1win

Слоты созданы для как новичков, так и опытных игроков.

Вы можете играть бесплатно, а затем перейти к игре на реальные деньги.

Попробуйте свои силы и окунитесь в захватывающий мир слотов.

how to buy generic clomiphene can i get cheap clomiphene buy generic clomiphene price get clomid prices where can i buy clomid without prescription generic clomid walmart clomid sleep apnea

I am actually thrilled to glitter at this blog posts which consists of tons of profitable facts, thanks towards providing such data.

This is the amicable of content I get high on reading.

zithromax pill – order tindamax 500mg online cheap flagyl online buy

rybelsus 14 mg pill – cost semaglutide order periactin 4 mg for sale

buy motilium online cheap – purchase cyclobenzaprine online cheap cyclobenzaprine without prescription

Установка систем видеонаблюдения поможет защиту помещения круглосуточно.

Инновационные решения позволяют организовать четкую картинку даже в темное время суток.

Вы можете заказать различные варианты устройств, идеальных для бизнеса и частных объектов.

установка камер видеонаблюдения в Калининграде

Профессиональная установка и консультации специалистов обеспечивают эффективным и комфортным для всех заказчиков.

Оставьте заявку, и узнать о оптимальное предложение для установки видеонаблюдения.

Looking for browser-based adventures? This site offers a diverse library of multiplayer experiences and strategy challenges.

Explore cooperative missions with global players , supported by intuitive chat tools for seamless teamwork.

Access user-friendly interfaces designed for effortless navigation , alongside safety features like SSL encryption for secure play.

new zealand casino online

Whether sports simulations to brain-teasing puzzles , every game prioritizes fun and emotional rewards.

Unlock premium upgrades that let you earn in-game perks, with optional purchases for deeper access.

Become part of a thriving community where teamwork flourishes , and express yourself through immersive storytelling.

Наш сервис способен найти информацию о любом человеке .

Достаточно ввести имя, фамилию , чтобы сформировать отчёт.

Бот сканирует открытые источники и цифровые следы.

бот глаз бога телеграмм

Информация обновляется мгновенно с фильтрацией мусора.

Идеально подходит для проверки партнёров перед сотрудничеством .

Конфиденциальность и точность данных — гарантированы.

order esomeprazole 40mg sale – https://anexamate.com/ order esomeprazole 20mg without prescription

buy warfarin without prescription – coumamide cheap cozaar 25mg

На данном сайте можно найти сведения по запросу, в том числе подробные профили.

Реестры включают граждан любой возрастной категории, статусов.

Сведения формируются на основе публичных данных, обеспечивая надежность.

Поиск осуществляется по имени, сделав использование эффективным.

глаз бога пробить человека

Помимо этого предоставляются места работы а также важные сведения.

Обработка данных обрабатываются в рамках норм права, что исключает разглашения.

Используйте данному ресурсу, в целях получения нужные сведения без лишних усилий.

meloxicam pills – https://moboxsin.com/ buy meloxicam online

order deltasone 20mg pill – corticosteroid deltasone 10mg over the counter

new ed pills – ed pills otc sexual dysfunction

order amoxil generic – https://combamoxi.com/ buy amoxil pill

Betting involves staking valuables on random outcomes, aiming to gain rewards based on predictions.

Participants place bets through bookmakers, often influenced by probabilities calculated by providers.

Popular forms include sports predictions , casino games , and political forecasts , reflecting its diverse applications.

mobile vamos bet

Legal frameworks like the Gambling Act 2005 classify betting as offering odds for races, events, or processes.

Though thrilling, excessive betting may lead to addiction , prompting self-exclusion programs.

Skilled gamblers often combine statistical research with disciplined spending to optimize outcomes .

La montre connectée Garmin fēnix® Chronos est un modèle haut de gamme qui allie la précision technologique à un design élégant grâce à ses finitions soignées.

Dotée de performances multisports , cette montre s’adresse aux sportifs exigeants grâce à sa robustesse et sa connectivité avancée .

Grâce à sa durée d’utilisation jusqu’à 6 heures , elle s’impose comme une solution fiable pour les aventures en extérieur .

Ses fonctions de suivi incluent la fréquence cardiaque et les calories brûlées , idéal pour les amateurs de fitness .

Facile à configurer , la fēnix® Chronos s’adapte facilement à vos objectifs personnels, tout en conservant un look élégant .

https://garmin-boutique.com

buy diflucan – https://gpdifluca.com/ diflucan 100mg us

buy lexapro 20mg sale – https://escitapro.com/ escitalopram 20mg sale

order cenforce pills – https://cenforcers.com/ cenforce 100mg pills

cheap cialis 20mg – https://ciltadgn.com/ cheap cialis pills

tadalafil generic headache nausea – https://strongtadafl.com/ us cialis online pharmacy

buy ranitidine cheap – ranitidine pills zantac 150mg sale

50mg viagra cost – https://strongvpls.com/ buy viagra in poland

Le fēnix® Chronos de Garmin est un modèle haut de gamme avec des matériaux premium comme le titane Grade-5 et connectivité avancée .

Conçue pour les sportifs , elle propose une polyvalence et autonomie prolongée , idéale pour les entraînements intensifs grâce à ses outils de navigation .

Avec une batterie allant jusqu’à 6 heures , cette montre reste opérationnelle dans des conditions extrêmes, même lors de sessions prolongées .

garmin fenix 5

Les outils de suivi incluent la surveillance du sommeil , accompagnées de conseils d’entraînement personnalisés, pour les amateurs de fitness .

Facile à personnaliser , elle s’adapte à vos objectifs, avec un écran AMOLED lumineux et compatibilité avec les apps mobiles .

This website really has all of the low-down and facts I needed there this case and didn’t identify who to ask. https://buyfastonl.com/amoxicillin.html

More articles like this would pretence of the blogosphere richer. https://gnolvade.com/es/provigil-espana-comprar/

This website really has all of the information and facts I needed to this thesis and didn’t identify who to ask. https://ursxdol.com/get-cialis-professional/

Greetings! Very gainful advice within this article! It’s the little changes which liking make the largest changes. Thanks a quantity towards sharing! https://prohnrg.com/product/cytotec-online/

I couldn’t weather commenting. Profoundly written! ou trouver du viagra

Женская сумка — это неотъемлемый аксессуар, которая выделяет образ каждой особы.

Сумка способна вмещать повседневные мелочи и структурировать личные задачи.

Благодаря разнообразию моделей и цветовой гаммы она создаёт ваш стиль.

сумки Goyard

Это символ хорошего вкуса, который отражает личные предпочтения своей обладательницы.

Любая сумка выражает характер через материалы, выделяя индивидуальность женщины.

Начиная с компактных сумочек до просторных тоутов — сумка меняется под ваши потребности.

Бренд Balenciaga прославился стильными аксессуарами , созданными фирменной эстетикой.

Каждая модель выделяется фирменными деталями, например фирменный логотип .

Качественная кожа обеспечивают долговечность изделия .

https://sites.google.com/view/sumki-balenciaga/index

Востребованность коллекций сохраняется среди модников , делая каждую покупку статусным жестом .

Сезонные новинки дают возможность владельцу подчеркнуть индивидуальность в компании .

Выбирая изделия марки , вы приобретаете стильный элемент , а также часть истории .

Аксессуары Prada представляют собой символом роскоши за счёт безупречному качеству.

Применяемые ткани и кожа обеспечивают долговечность , а ручная сборка подчёркивает мастерство бренда.

Узнаваемые силуэты сочетаются с знаковым логотипом , формируя узнаваемый образ .

https://sites.google.com/view/sumkiprada/index

Такие сумки универсальны для повседневного использования , демонстрируя стиль в любой ситуации .

Эксклюзивные коллекции подчеркивают индивидуальность образа, превращая каждую модель в must-have сезона .

Опираясь на историю компания внедряет инновации , оставаясь верным духу оригинальности в каждой детали .

Сумки Longchamp — это образец шика, где соединяются классические традиции и актуальные решения.

Изготовленные из высококачественной кожи , они отличаются деталями премиум-класса.

Модели Le Pliage пользуются спросом у путешественников уже десятилетия.

шопер Прада обзоры

Каждая сумка с авторским дизайном демонстрирует хороший вкус, оставаясь универсальность в повседневных задачах.

Бренд следует наследию, внедряя современные методы при сохранении качества.

Выбирая Longchamp, вы делаете модную инвестицию, а становитесь частью историю бренда .

Bold metallic fabrics dominate 2025’s fashion landscape, blending cyberpunk-inspired aesthetics with sustainable innovation for runway-ready statements .

Unisex tailoring challenge fashion norms, featuring modular designs that transform with movement across casual occasions.

Algorithm-generated prints merge digital artistry , creating hypnotic color gradients that react to body heat for dynamic visual storytelling .

https://melaninbook.com/read-blog/55105

Circular fashion techniques set new standards, with biodegradable textiles celebrating resourcefulness without compromising luxurious finishes .

Light-refracting details elevate minimalist outfits , from solar-powered jewelry to 3D-printed footwear designed for modern practicality .

Vintage revival meets techwear defines the year, as 2000s logomania reinterpret archives through smart fabric technology for forward-thinking style.

Bold metallic fabrics redefine 2025’s fashion landscape, blending futuristic elegance with eco-conscious craftsmanship for everyday wearable art.

Unisex tailoring challenge fashion norms, featuring asymmetrical cuts that transform with movement across formal occasions.

AI-curated patterns merge digital artistry , creating hypnotic color gradients that react to body heat for dynamic visual storytelling .

https://dronio24.com/read-blog/25938

Zero-waste construction set new standards, with upcycled materials reducing environmental impact without compromising luxurious finishes .

Holographic accessories elevate minimalist outfits , from nano-embroidered handbags to 3D-printed footwear designed for modern practicality .

Vintage revival meets techwear defines the year, as 2000s logomania reimagine classics through climate-responsive materials for timeless relevance .

Die Rolex Cosmograph Daytona gilt als Ikone der chronographischen Präzision , vereint elegante Linien mit höchster Funktionalität durch seine Tachymeterskala .

Verfügbar in Keramik-Editionen überzeugt die Uhr durch das ausgewogene Zifferblatt und hochwertige Materialien , die selbst anspruchsvollste Kunden begeistern .

Mit einer Gangreserve von bis zu drei Tagen eignet sie sich für sportliche Herausforderungen und zeigt sich als zuverlässiger Begleiter unter extremsten Umständen.

Rolex Cosmograph Daytona 116519LN herrenuhr

Die ikonischen Unterzifferblätter in Schwarz unterstreichen den luxuriösen Touch, während die wasserdichte Konstruktion Zuverlässigkeit sicherstellen.

Über Jahrzehnte hinweg hat die Daytona ein Symbol für Ambition , geschätzt für den exklusiven Status bei Investoren weltweit.

als Hommage an die Automobilgeschichte – die Cosmograph Daytona verbindet Innovation und etabliert sich als unverwechselbares Statement für anspruchsvolle Träger .

The legendary Daytona Rainbow model represents luxury with its vibrant rainbow bezel .

Made from 18k white gold , it blends precision timing features with sophisticated design elements.

Available in small batches , this timepiece appeals to watch connoisseurs worldwide.

Daytona Rainbow prices

The meticulously set gems on the outer ring creates a spectrum that stands out uniquely.

Powered by Rolex’s self-winding chronograph movement , it ensures reliable performance for daily wear .

A symbol of status , the Daytona Rainbow celebrates Swiss watchmaking heritage in the finest craftsmanship.

I am in truth happy to gleam at this blog posts which consists of tons of profitable facts, thanks for providing such data. https://ondactone.com/product/domperidone/