- Ethereum’s monthly transaction volume is at a multi-month high.

- There has been a decline in trading volume in ETH’s futures market.

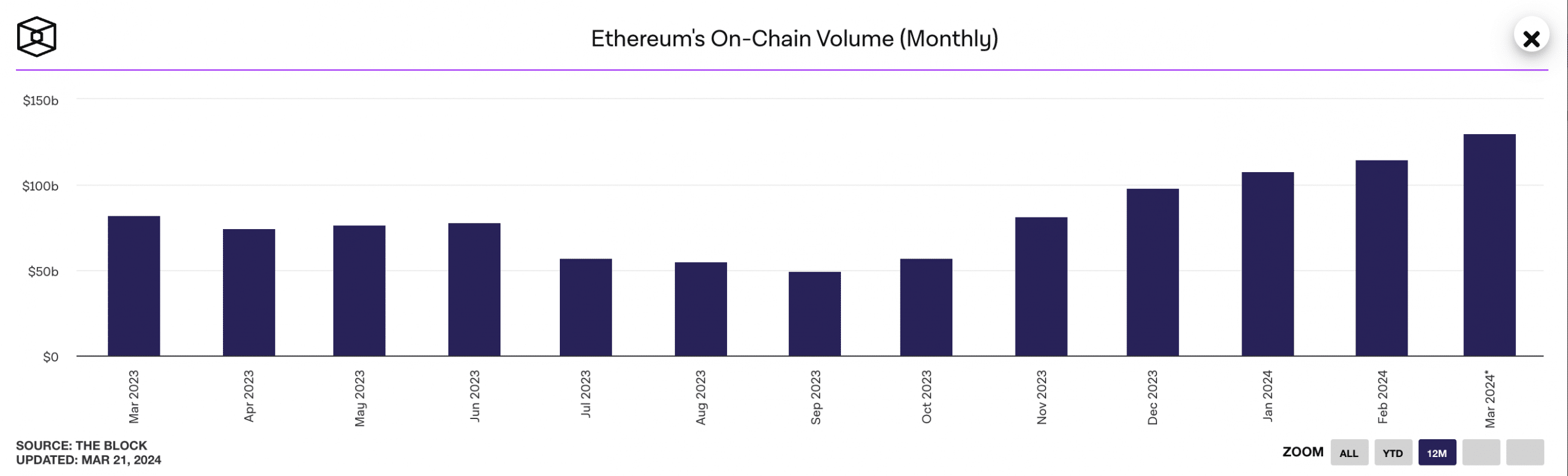

Ethereum’s [ETH] monthly on-chain volume has reached its highest level in 22 months, according to The Block data dashboard.

With eight days until the end of the month, Ethereum’s transaction volume in March has totaled $130 billion. This marks a 14% increase from the $114 billion recorded in February and represents a 21% growth year-to-date.

Source: The Block

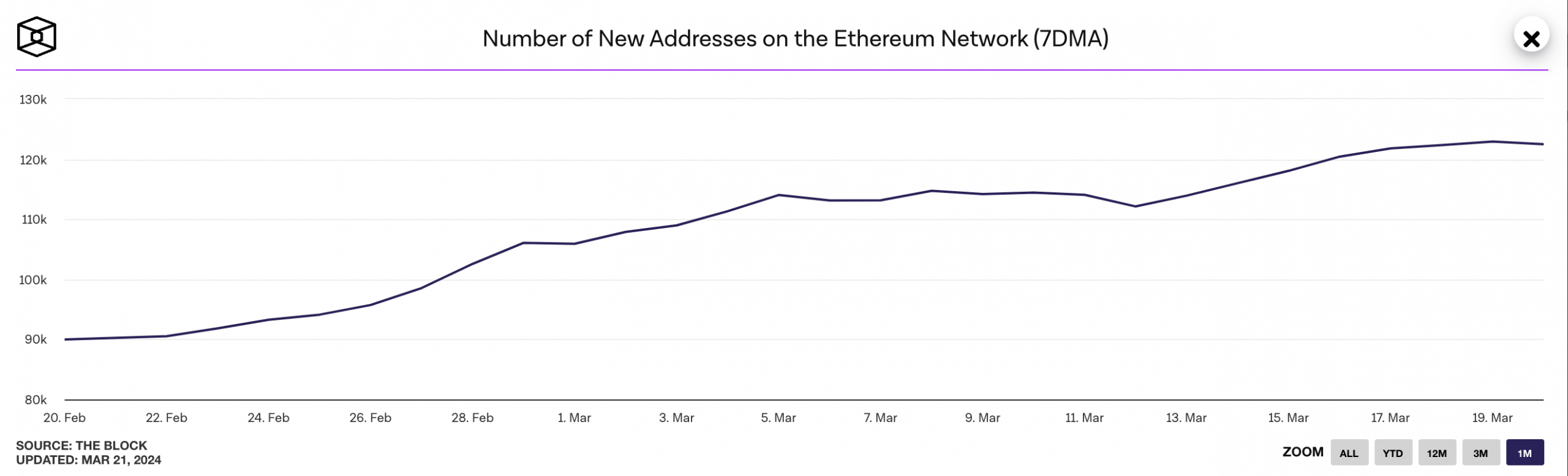

The surge in the total value moved in Ethereum transactions this month has been due to the rally in demand for the Proof-of-Stake (PoS) network. AMBCrypto previously reported that the daily count of new addresses created on the network recently surpassed 116,000, a YTD high.

The growth in user activity on the network has resulted in a high ETH burn rate, pushing the coin’s circulating supply to a new post-merge low.

According to data from Ultrasound.money, 89,036 ETH coins worth around $314 million at ETH’s current price were removed from circulation in the last month. At press time, ETH’s circulating supply was 120.07 million ETH.

Following the recent implementation of Ethereum’s Dencun Upgrade and a resulting decline in the average transaction fee on the network, the past few days have been marked by a rise in the number of unique addresses that appear for the first time in a transaction of the native coin on the network.

According to The Block’s data, Ethereum’s daily new addresses count, tracked using a 7-day moving average, climbed to an 18-month high of 123,000 on 20th March. Assessed on a month-to-date, new demand for the PoS network has grown by 16%.

Source: The Block

ETH’s futures market continues to witness decline

The general market correction witnessed last week has resulted in a decline in ETH’s futures market trading volume. According to Coinglass’ data, this has plummeted by almost 10% since 15th March.

When an asset’s futures trading volume declines, it suggests decreased interest or participation from futures traders, often due to a change in sentiment and/or desire to make a profit or prevent losses.

How much are 1,10,100 ETHs worth today?

A decrease in futures trading volume is common during periods of general market pullback. This often highlights market participants’ indecision and desire to wait for clearer signals before re-entering the market.

As expected, the drop in ETH’s trading volume has also led to a decline in open interest. As of this writing, ETH’s futures open interest was $13.08 billion, falling 8% in the past seven days.

- Ethereum’s monthly transaction volume is at a multi-month high.

- There has been a decline in trading volume in ETH’s futures market.

Ethereum’s [ETH] monthly on-chain volume has reached its highest level in 22 months, according to The Block data dashboard.

With eight days until the end of the month, Ethereum’s transaction volume in March has totaled $130 billion. This marks a 14% increase from the $114 billion recorded in February and represents a 21% growth year-to-date.

Source: The Block

The surge in the total value moved in Ethereum transactions this month has been due to the rally in demand for the Proof-of-Stake (PoS) network. AMBCrypto previously reported that the daily count of new addresses created on the network recently surpassed 116,000, a YTD high.

The growth in user activity on the network has resulted in a high ETH burn rate, pushing the coin’s circulating supply to a new post-merge low.

According to data from Ultrasound.money, 89,036 ETH coins worth around $314 million at ETH’s current price were removed from circulation in the last month. At press time, ETH’s circulating supply was 120.07 million ETH.

Following the recent implementation of Ethereum’s Dencun Upgrade and a resulting decline in the average transaction fee on the network, the past few days have been marked by a rise in the number of unique addresses that appear for the first time in a transaction of the native coin on the network.

According to The Block’s data, Ethereum’s daily new addresses count, tracked using a 7-day moving average, climbed to an 18-month high of 123,000 on 20th March. Assessed on a month-to-date, new demand for the PoS network has grown by 16%.

Source: The Block

ETH’s futures market continues to witness decline

The general market correction witnessed last week has resulted in a decline in ETH’s futures market trading volume. According to Coinglass’ data, this has plummeted by almost 10% since 15th March.

When an asset’s futures trading volume declines, it suggests decreased interest or participation from futures traders, often due to a change in sentiment and/or desire to make a profit or prevent losses.

How much are 1,10,100 ETHs worth today?

A decrease in futures trading volume is common during periods of general market pullback. This often highlights market participants’ indecision and desire to wait for clearer signals before re-entering the market.

As expected, the drop in ETH’s trading volume has also led to a decline in open interest. As of this writing, ETH’s futures open interest was $13.08 billion, falling 8% in the past seven days.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

how to buy cheap clomid no prescription clomid tablete can you get cheap clomiphene without insurance order clomiphene for sale can i buy generic clomiphene without dr prescription can you buy cheap clomiphene without a prescription can i purchase cheap clomiphene prices

Greetings! Extremely useful advice within this article! It’s the little changes which choice espy the largest changes. Thanks a quantity in the direction of sharing!

The thoroughness in this piece is noteworthy.

order zithromax 250mg online cheap – order azithromycin online purchase flagyl generic

buy generic rybelsus over the counter – rybelsus 14mg over the counter buy generic periactin online

generic domperidone – order motilium for sale flexeril tablet