- Total inflows in 2024 were 24% higher than 2021’s yearly record.

- Bitcoin accounted for 97% of the total inflows in 2024.

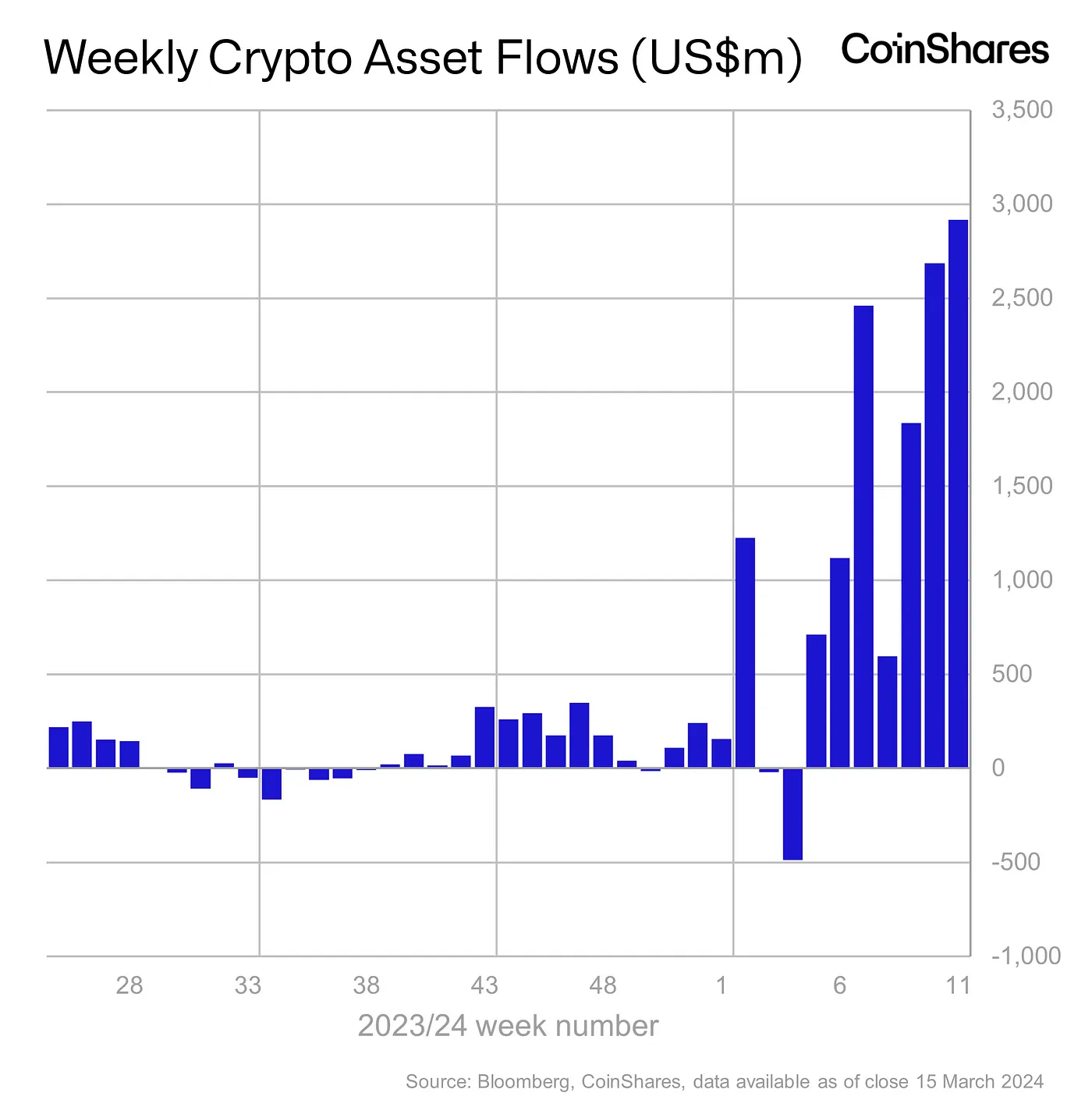

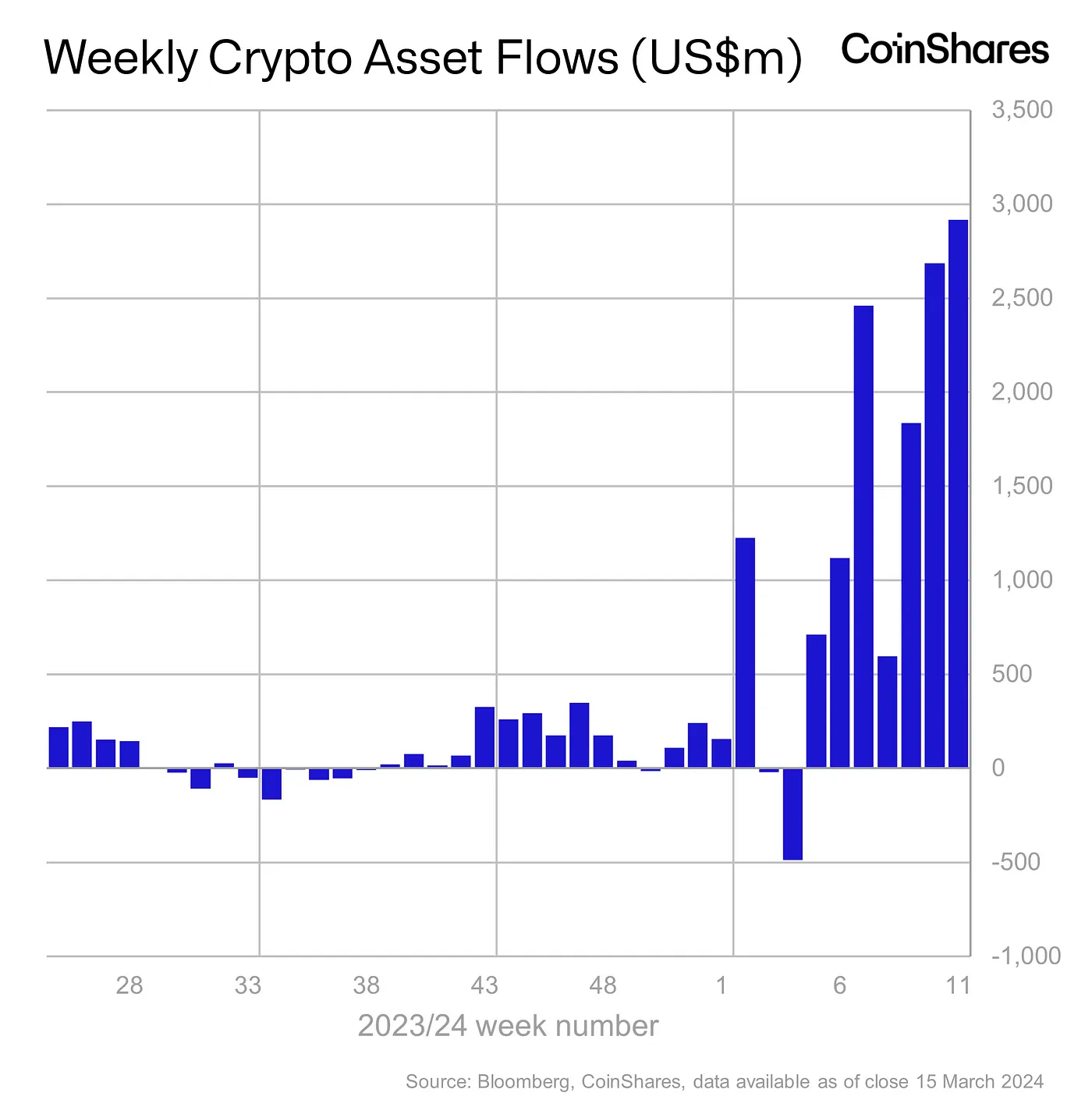

Inflows into digital asset investment products reached a new high last week, eclipsing the previous week’s figures.

According to the latest report by crypto asset management firm CoinShares, institutional investors poured $2.9 billion into the cryptocurrency funds last week, extending the winning streak to the seventh week.

Source: CoinShares

2024: The record-shattering year

With this, year-to-date (YTD) inflows surged to a whopping $13.2 billion, 24% higher than the total inflows recorded in the whole of 2021.

During the week, the total assets under management (AuM) hit the magical $100 billion mark for the first time in history. However, due to the price correction at the end of the week, it fell slightly to $97 billion.

Note that AuM is considered an important performance gradient of a fund. A higher AuM typically attracts higher investments.

Demand for U.S. spot ETFs continues unabated

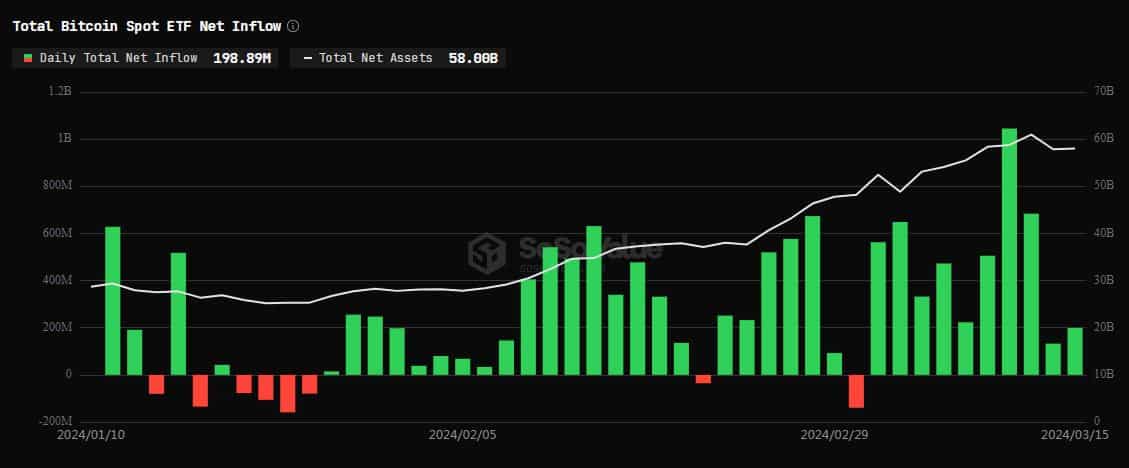

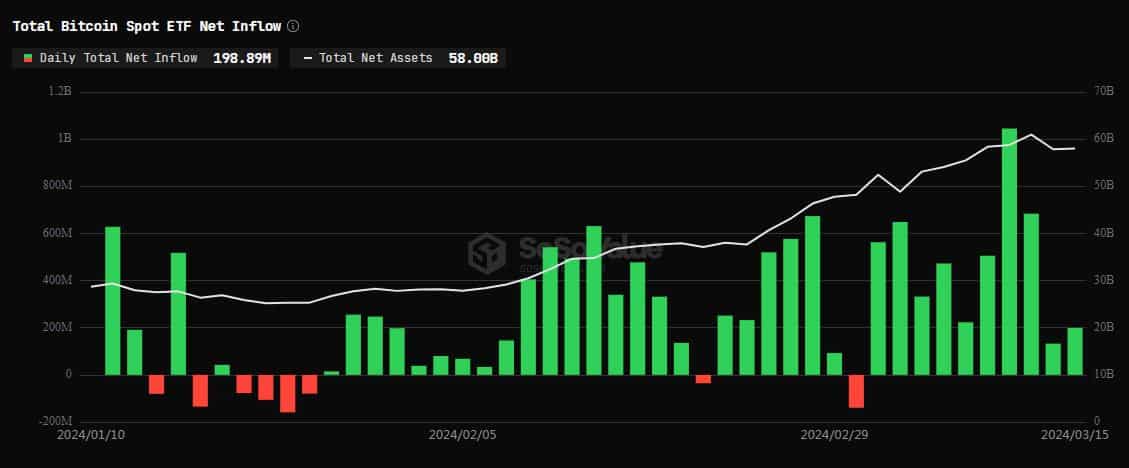

As observed in previous weeks, the spike was fueled by significant investments into new spot Bitcoin [BTC] ETFs in the United States.

According to AMBCrypto’s analysis of SoSo Value data, these issuers netted $2.57 billion in inflows last week.

Source: SoSo Value

To the market’s relief, outflows from Grayscale Bitcoin Trust (GBTC) trailed inflows into other spot ETFs yet again, with BlackRock and Fidelity cornering the major chunk of investments.

As of the 15th of March, the combined AUM of all the U.S. spot bitcoin ETFs was $58 billion, accounting for 4.35% of Bitcoin’s total supply.

Assessing the performance of different products

The largest institutional crypto product Bitcoin saw inflows worth $2.86 billion last week, taking its YTD inflows to a whopping $12.86 billion.

Needless to say, Bitcoin has dominated total inflows into the digital asset market this year, accounting for 97%.

On the other hand, popular smart contracts-linked cryptocurrencies like Ethereum [ETH] and Solana [SOL] experienced outflows last week.

While $14 million was plugged out of Ethereum-linked funds, Solana-based crypto products witnessed a capital exit of $2.7 million.

- Total inflows in 2024 were 24% higher than 2021’s yearly record.

- Bitcoin accounted for 97% of the total inflows in 2024.

Inflows into digital asset investment products reached a new high last week, eclipsing the previous week’s figures.

According to the latest report by crypto asset management firm CoinShares, institutional investors poured $2.9 billion into the cryptocurrency funds last week, extending the winning streak to the seventh week.

Source: CoinShares

2024: The record-shattering year

With this, year-to-date (YTD) inflows surged to a whopping $13.2 billion, 24% higher than the total inflows recorded in the whole of 2021.

During the week, the total assets under management (AuM) hit the magical $100 billion mark for the first time in history. However, due to the price correction at the end of the week, it fell slightly to $97 billion.

Note that AuM is considered an important performance gradient of a fund. A higher AuM typically attracts higher investments.

Demand for U.S. spot ETFs continues unabated

As observed in previous weeks, the spike was fueled by significant investments into new spot Bitcoin [BTC] ETFs in the United States.

According to AMBCrypto’s analysis of SoSo Value data, these issuers netted $2.57 billion in inflows last week.

Source: SoSo Value

To the market’s relief, outflows from Grayscale Bitcoin Trust (GBTC) trailed inflows into other spot ETFs yet again, with BlackRock and Fidelity cornering the major chunk of investments.

As of the 15th of March, the combined AUM of all the U.S. spot bitcoin ETFs was $58 billion, accounting for 4.35% of Bitcoin’s total supply.

Assessing the performance of different products

The largest institutional crypto product Bitcoin saw inflows worth $2.86 billion last week, taking its YTD inflows to a whopping $12.86 billion.

Needless to say, Bitcoin has dominated total inflows into the digital asset market this year, accounting for 97%.

On the other hand, popular smart contracts-linked cryptocurrencies like Ethereum [ETH] and Solana [SOL] experienced outflows last week.

While $14 million was plugged out of Ethereum-linked funds, Solana-based crypto products witnessed a capital exit of $2.7 million.

![[PART 1] The Ethereum Layer-2 Wars (They’re a Thing, They’ve Begun, Here’s How)](https://coininsights.com/wp-content/uploads/2024/03/unnamed-84-75x75.gif)

can you get cheap clomiphene prices order generic clomid without rxРіРѕРІРѕСЂРёС‚: can you buy clomiphene without insurance can i buy generic clomid tablets can you get clomiphene online how to get cheap clomiphene price can i purchase cheap clomid online

More delight pieces like this would insinuate the интернет better.

I am in point of fact enchant‚e ‘ to gleam at this blog posts which consists of tons of of use facts, thanks representing providing such data.

zithromax drug – tinidazole 300mg drug buy flagyl tablets

generic rybelsus 14 mg – where can i buy rybelsus buy periactin generic

order motilium for sale – cheap tetracycline cyclobenzaprine cheap

order augmentin 1000mg – atbioinfo.com ampicillin pill

buy esomeprazole 40mg pill – https://anexamate.com/ order esomeprazole online cheap

coumadin 2mg ca – coumamide generic losartan

meloxicam 15mg usa – https://moboxsin.com/ meloxicam 15mg usa

prednisone 40mg without prescription – aprep lson deltasone ca

ed remedies – https://fastedtotake.com/ best male ed pills

diflucan over the counter – buy generic forcan buy fluconazole generic

cenforce 100mg oral – https://cenforcers.com/# order cenforce 50mg sale

cheap t jet 60 cialis online – how many 5mg cialis can i take at once cialis coupon 2019

ranitidine ca – https://aranitidine.com/# zantac 300mg cheap

viagra sale liverpool – https://strongvpls.com/ generic viagra for cheap

This website exceedingly has all of the information and facts I needed adjacent to this subject and didn’t know who to ask. order accutane without prescription

This website absolutely has all of the bumf and facts I needed about this subject and didn’t know who to ask. buy doxycycline generic

More posts like this would create the online play more useful. https://prohnrg.com/product/orlistat-pills-di/

I’ll certainly bring to be familiar with more. https://aranitidine.com/fr/en_france_xenical/

This website positively has all of the information and facts I needed adjacent to this thesis and didn’t positive who to ask. https://ondactone.com/spironolactone/

This is the kind of enter I find helpful.

gloperba ca

I couldn’t weather commenting. Profoundly written! http://mi.minfish.com/home.php?mod=space&uid=1412621