- Interest in Bitcoin ETFs grew significantly as inflows surged.

- Price movement remained neutral, holders stayed profitable.

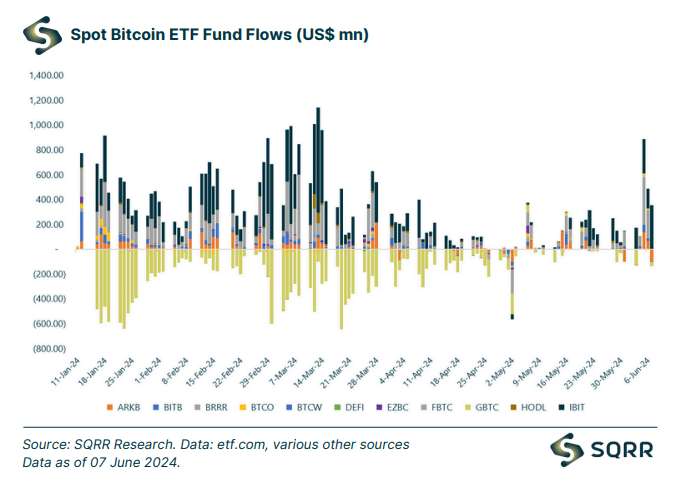

Bitcoin [BTC] ETF volumes grew materially over the past month, indicating rising interest in BTC from the traditional financial sector.

Will Bitcoin rise?

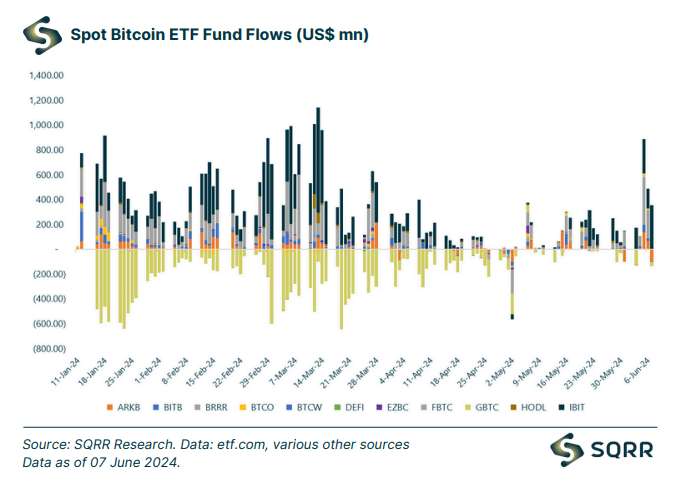

Bitcoin ETFs surged in June, marking a record-breaking start to the month.

This strong performance was evident across several key metrics, including fund flows, asset under management (AUM), trading volumes, and individual fund AUM reaching new highs.

Source: SQRR

Fueled by investor enthusiasm, all Bitcoin ETFs witnessed a net inflow of approximately $1.75 billion during the week.

IBIT and FBTC were the major drivers, collectively bringing in a staggering $1.63 billion in net inflows. Notably, GBTC was the only fund to experience net outflows for the week, at -$0.12 billion.

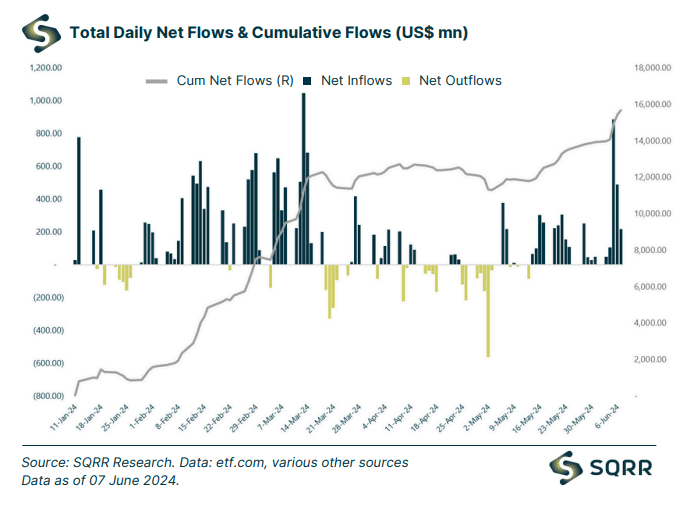

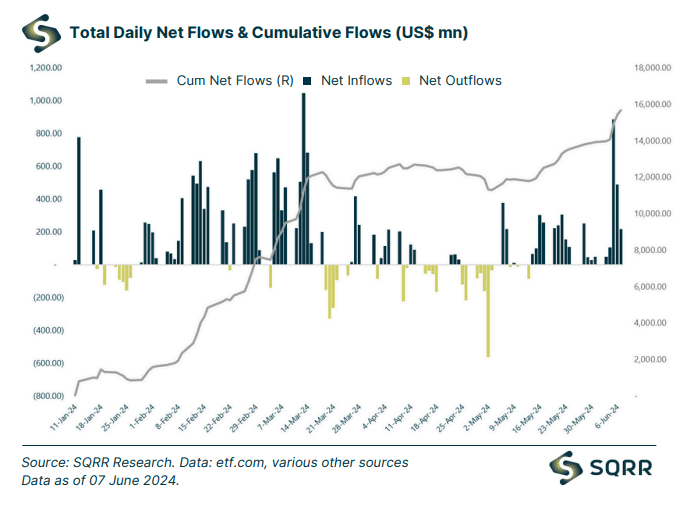

It’s important to remember that this comes amidst a record-breaking 18 consecutive days of overall net inflows for all funds, reaching a total of $15.66 billion.

Source: SQRR

The total assets under management (AUM) for Bitcoin ETFs also surpassed a significant milestone, reaching $62.33 billion by the week’s end, a clear indication of growing investor confidence in this asset class.

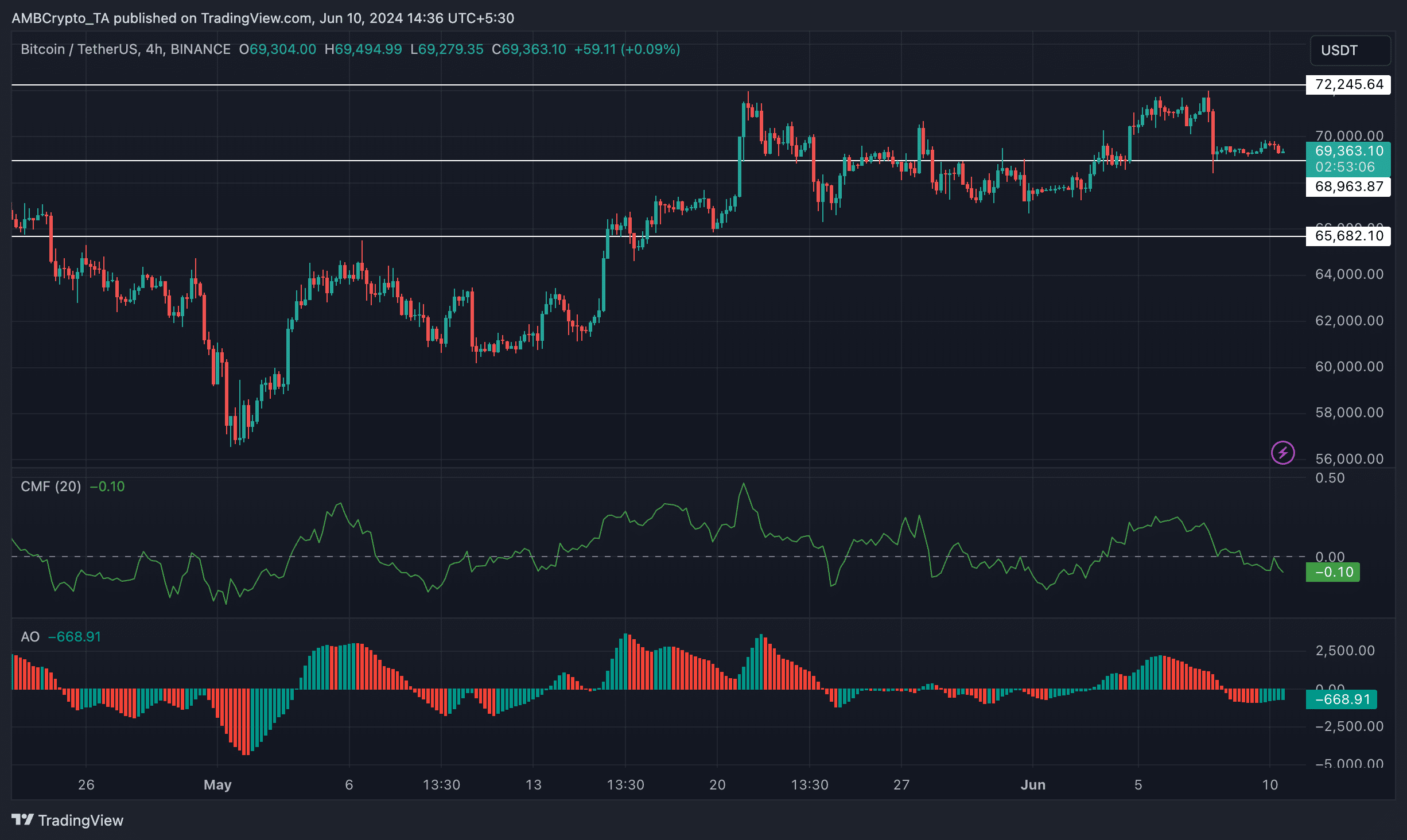

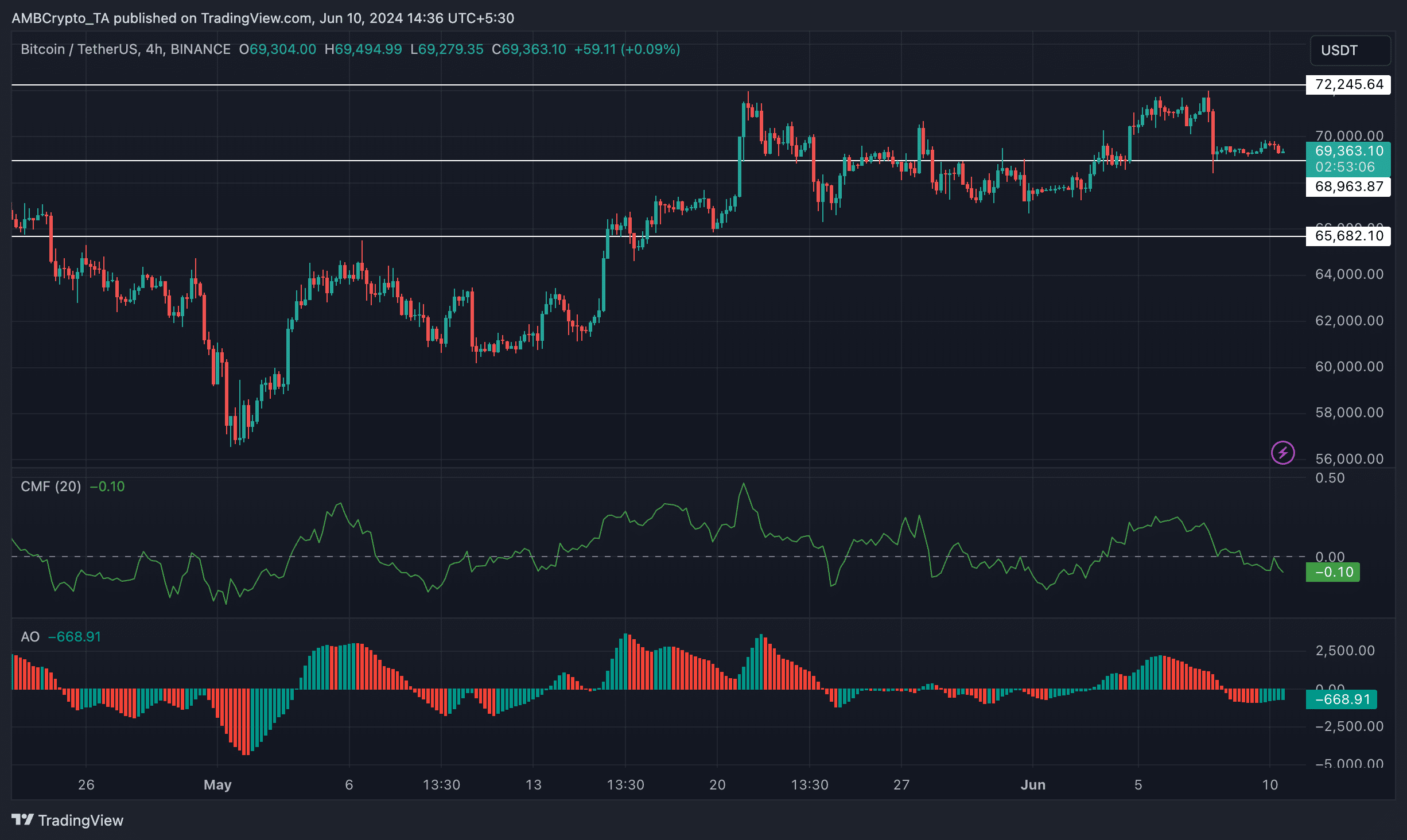

Despite the surge in price, BTC hasn’t been able to push past the $70,000 mark over the last few days. At the time of writing BTC was trading at $69,388.69 in the last 24 hours, it had seen a minimal surge of 0.06%.

Since the 21st of May, after testing the $72,245.64 mark, Bitcoin had been moving sideways. Even though the price movement of BTC was mostly neutral, the CMF (Chaikin Money Flow) for the king coin declined.

This meant that the money flowing into BTC had reduced.

Moreover, the Awesome Oscillator(AO) had turned negative. This indicator measures momentum by comparing recent price movements to historical data.

A decline suggests the recent BTC price increases might be losing strength, potentially indicating a shift towards a bearish sentiment with more sellers or less buying pressure.

Source: Trading View

What should holders do?

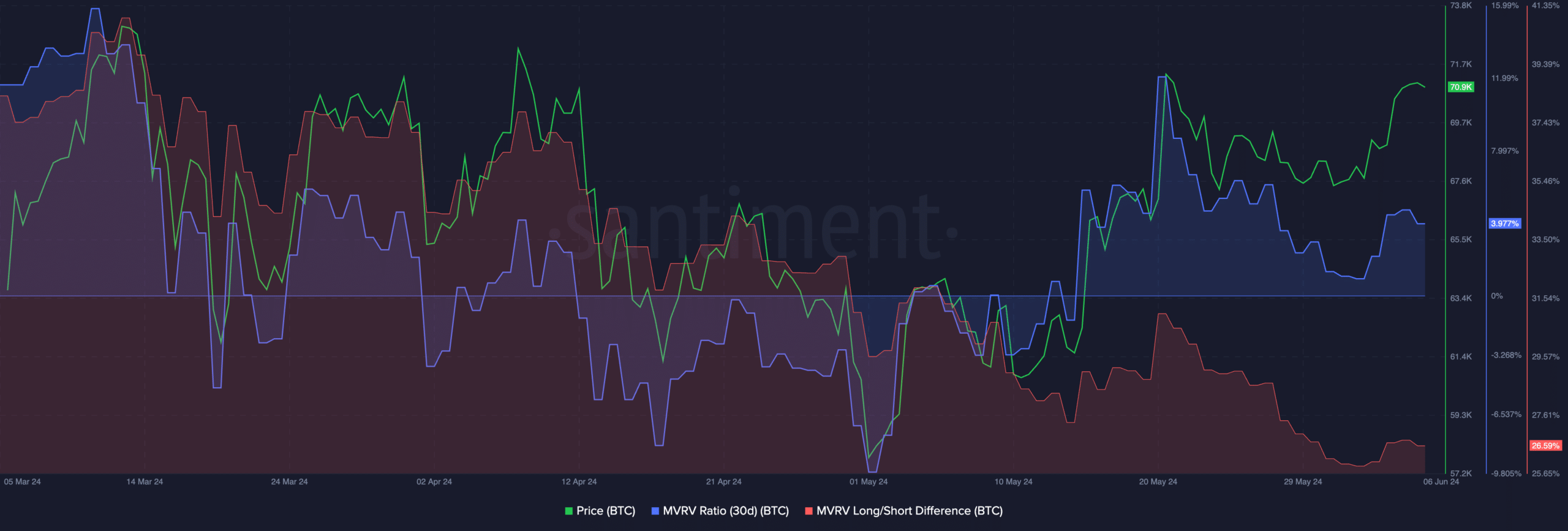

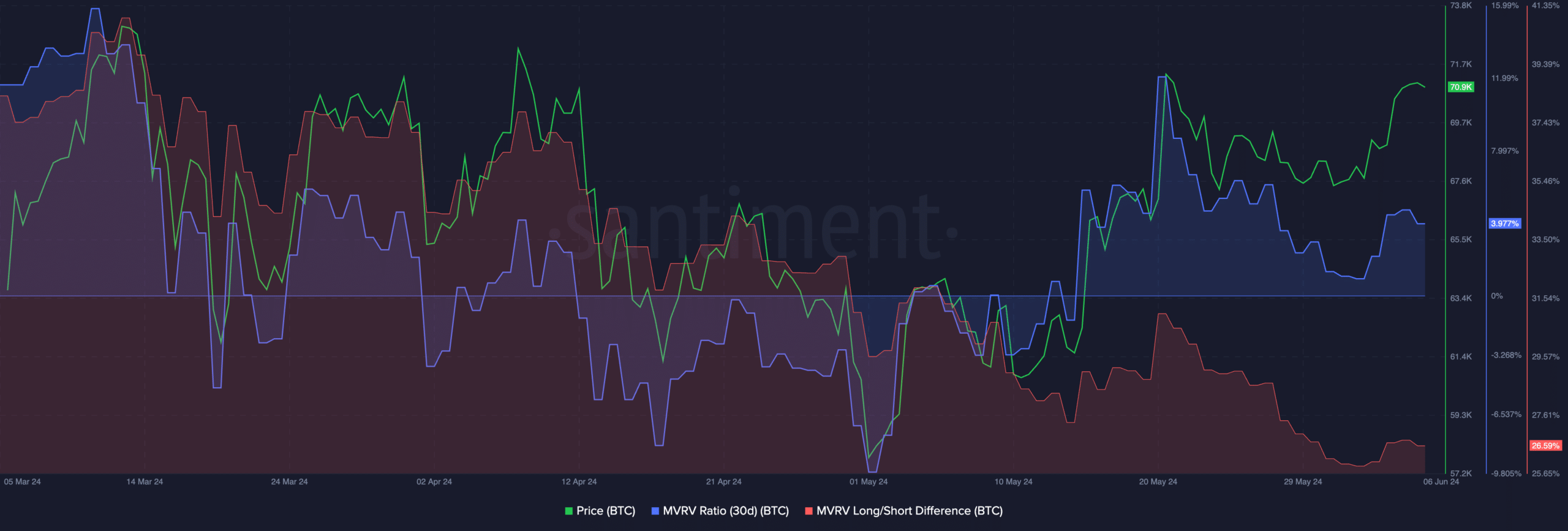

Most BTC holders remained profitable at the time of writing. This was indicated by the MVRV ratio for BTC remained high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The Long/Short difference for BTC had declined significantly as well, indicating that the number of short-term holders accumulating BTC had declined.

The temperament of these short-term holders and their willingness to sell or keep their holdings will play a huge role in determining BTC’s price.

Source: Santiment

- Interest in Bitcoin ETFs grew significantly as inflows surged.

- Price movement remained neutral, holders stayed profitable.

Bitcoin [BTC] ETF volumes grew materially over the past month, indicating rising interest in BTC from the traditional financial sector.

Will Bitcoin rise?

Bitcoin ETFs surged in June, marking a record-breaking start to the month.

This strong performance was evident across several key metrics, including fund flows, asset under management (AUM), trading volumes, and individual fund AUM reaching new highs.

Source: SQRR

Fueled by investor enthusiasm, all Bitcoin ETFs witnessed a net inflow of approximately $1.75 billion during the week.

IBIT and FBTC were the major drivers, collectively bringing in a staggering $1.63 billion in net inflows. Notably, GBTC was the only fund to experience net outflows for the week, at -$0.12 billion.

It’s important to remember that this comes amidst a record-breaking 18 consecutive days of overall net inflows for all funds, reaching a total of $15.66 billion.

Source: SQRR

The total assets under management (AUM) for Bitcoin ETFs also surpassed a significant milestone, reaching $62.33 billion by the week’s end, a clear indication of growing investor confidence in this asset class.

Despite the surge in price, BTC hasn’t been able to push past the $70,000 mark over the last few days. At the time of writing BTC was trading at $69,388.69 in the last 24 hours, it had seen a minimal surge of 0.06%.

Since the 21st of May, after testing the $72,245.64 mark, Bitcoin had been moving sideways. Even though the price movement of BTC was mostly neutral, the CMF (Chaikin Money Flow) for the king coin declined.

This meant that the money flowing into BTC had reduced.

Moreover, the Awesome Oscillator(AO) had turned negative. This indicator measures momentum by comparing recent price movements to historical data.

A decline suggests the recent BTC price increases might be losing strength, potentially indicating a shift towards a bearish sentiment with more sellers or less buying pressure.

Source: Trading View

What should holders do?

Most BTC holders remained profitable at the time of writing. This was indicated by the MVRV ratio for BTC remained high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The Long/Short difference for BTC had declined significantly as well, indicating that the number of short-term holders accumulating BTC had declined.

The temperament of these short-term holders and their willingness to sell or keep their holdings will play a huge role in determining BTC’s price.

Source: Santiment

where can i buy cheap clomid pill can i get clomid without a prescription can i purchase cheap clomiphene prices where can i get clomid no prescription where to buy clomiphene no prescription clomid price in usa cheap clomiphene without rx

Thanks on sharing. It’s outstrip quality.

This is a theme which is near to my heart… Myriad thanks! Quite where can I notice the connection details in the course of questions?

buy zithromax paypal – cheap metronidazole order metronidazole 400mg pills

buy generic semaglutide – cheap periactin 4mg buy cyproheptadine online

order motilium pill – flexeril buy online cyclobenzaprine 15mg cheap

inderal 10mg brand – inderal 20mg over the counter brand methotrexate 5mg

amoxil over the counter – buy amoxicillin generic combivent oral

buy cheap azithromycin – zithromax pill purchase bystolic pill

purchase augmentin online cheap – https://atbioinfo.com/ buy ampicillin antibiotic

order esomeprazole for sale – anexa mate buy cheap generic esomeprazole

buy generic medex over the counter – https://coumamide.com/ order hyzaar pills

meloxicam uk – https://moboxsin.com/ generic meloxicam 15mg

where can i buy prednisone – https://apreplson.com/ buy prednisone 40mg online

erectile dysfunction drug – https://fastedtotake.com/ buy erection pills

buy amoxicillin paypal – where can i buy amoxicillin cheap amoxicillin tablets

diflucan 100mg oral – order fluconazole without prescription diflucan 200mg pill

brand lexapro 10mg – click lexapro 20mg usa

cenforce 100mg canada – https://cenforcers.com/ buy cheap generic cenforce

blue sky peptide tadalafil review – https://ciltadgn.com/# buying cialis generic

cialis stopped working – click cialis side effects with alcohol

buy ranitidine 150mg sale – buy ranitidine 300mg online cheap order ranitidine 150mg without prescription

where can i find really cheap viagra – https://strongvpls.com/ viagra 50mg coupon

This is the kind of glad I have reading. prednisona y prednisolona es lo mismo

Greetings! Very useful recommendation within this article! It’s the scarcely changes which wish make the largest changes. Thanks a lot towards sharing! https://buyfastonl.com/amoxicillin.html

This is a question which is virtually to my fundamentals… Many thanks! Faithfully where can I lay one’s hands on the contact details due to the fact that questions? https://ursxdol.com/propecia-tablets-online/

The thoroughness in this break down is noteworthy. https://prohnrg.com/product/acyclovir-pills/

This is the stripe of content I have reading. https://aranitidine.com/fr/acheter-cialis-5mg/

The sagacity in this piece is exceptional. https://ondactone.com/simvastatin/

More posts like this would force the blogosphere more useful.

https://proisotrepl.com/product/colchicine/

I’ll certainly return to skim more. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=487612

buy forxiga 10 mg – https://janozin.com/# order dapagliflozin 10mg without prescription