- APT tokens, valued at $351 million, were released into circulation.

- Bitcoin’s plunge triggered a double-digit decrease for the token.

Layer-1 blockchain Aptos [APT] unlocked 6.24% of its total supply on the 12th of April. But the market crash, led by Bitcoin [BTC], put a stop to the optimism around the event.

Unlocking tokens, and moving them into circulation, have effects on price. In some cases, the event causes high volatility, and the increase in supply causes the value of the token involved to decline.

At the time the APT tokens were released, they were worth over $351 million. Before the unlock, the Aptos community was hyped about it, with some predictions noting that the price might rally afterward.

No event is big enough than the king

But then, Bitcoin dropped to $65,000, and altcoins, including APT, were not spared from the onslaught. At press time, the price of the Aptos native token was $10.13.

This value meant that the cryptocurrency had lost 12.57% of its value in the last 24 hours. Beyond the price, Bitcoin’s correction affected some other metrics on Aptos’ network.

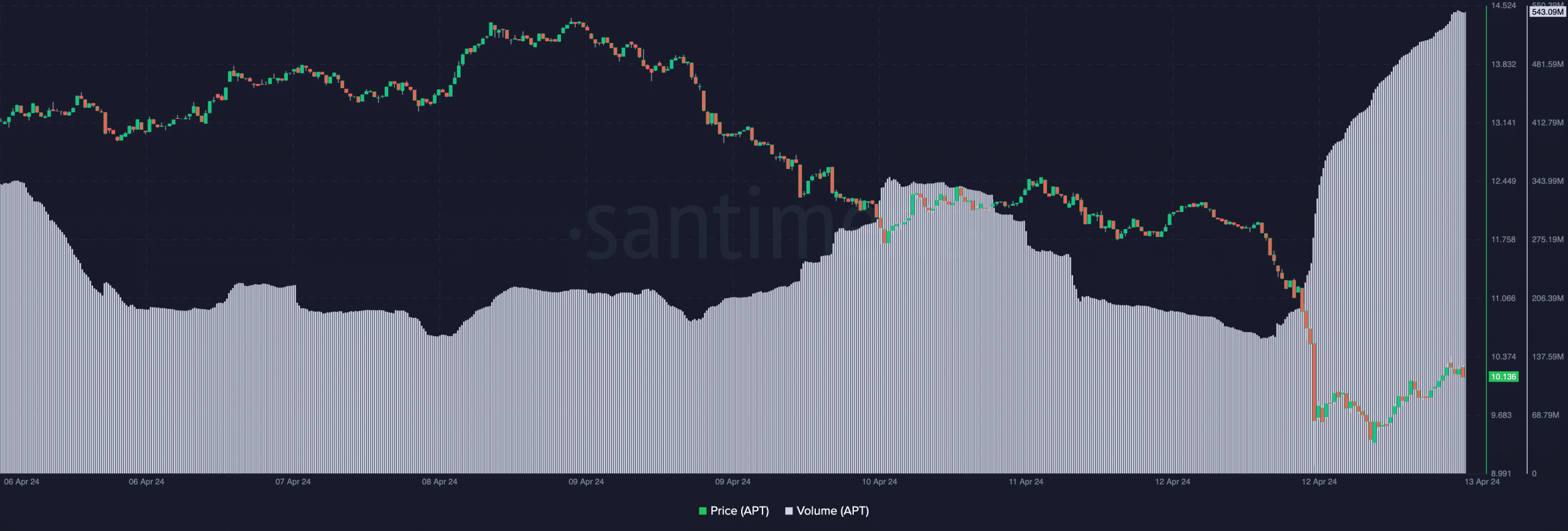

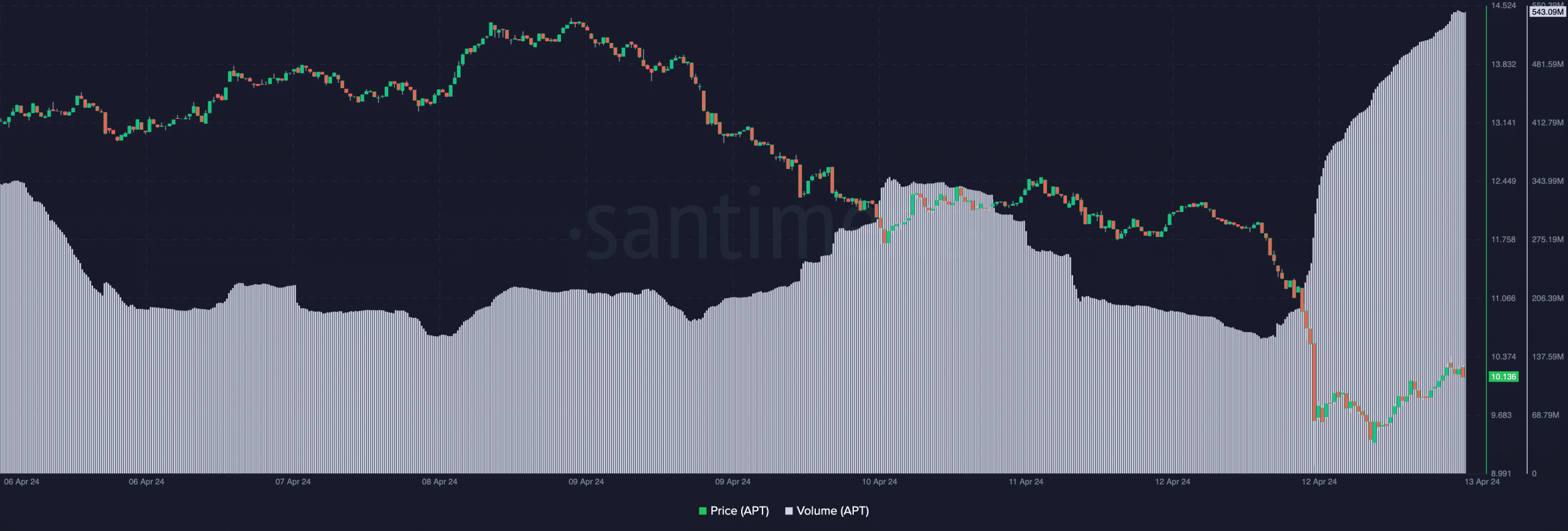

One of the most affected was the volume. In the early hours of the 12th of April, APT’s volume was less than 200 million. Fast-forward to the time of writing, the volume had increased to 543.09 million.

An increase in volume indicates rising interest in a cryptocurrency. But it is not all the time the surge in volume means a spike in buying pressure.

For APT, it seemed like the other way around, with evidence shown by the price.

Source: Santiment

However, it seems that the token might not be done with the downturn yet. If the volume falls later, while APT’s downtrend continues, the decline might become weak. Hence, a rebound could be next.

In this instance, APT might attempt to revisit $12. But if Aptos’ volume continues to decrease while the price falls, a further plunge could be an option.

Should this be the case, the price of the token might drop below $10.

Watch out! Something is brewing

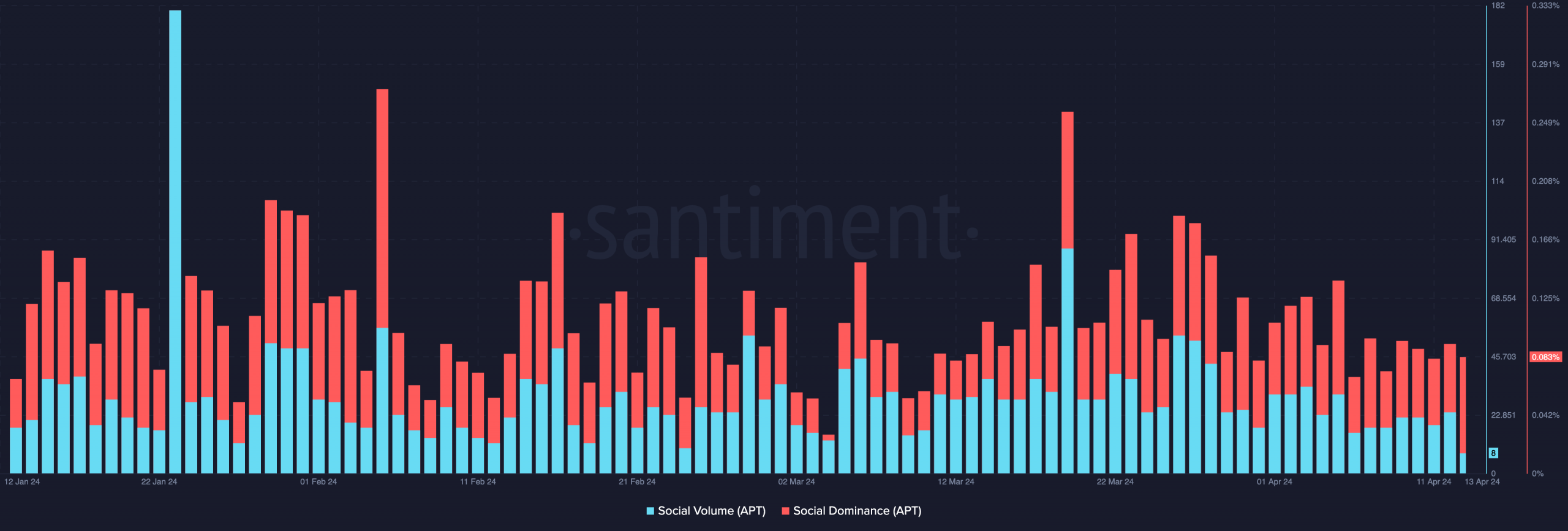

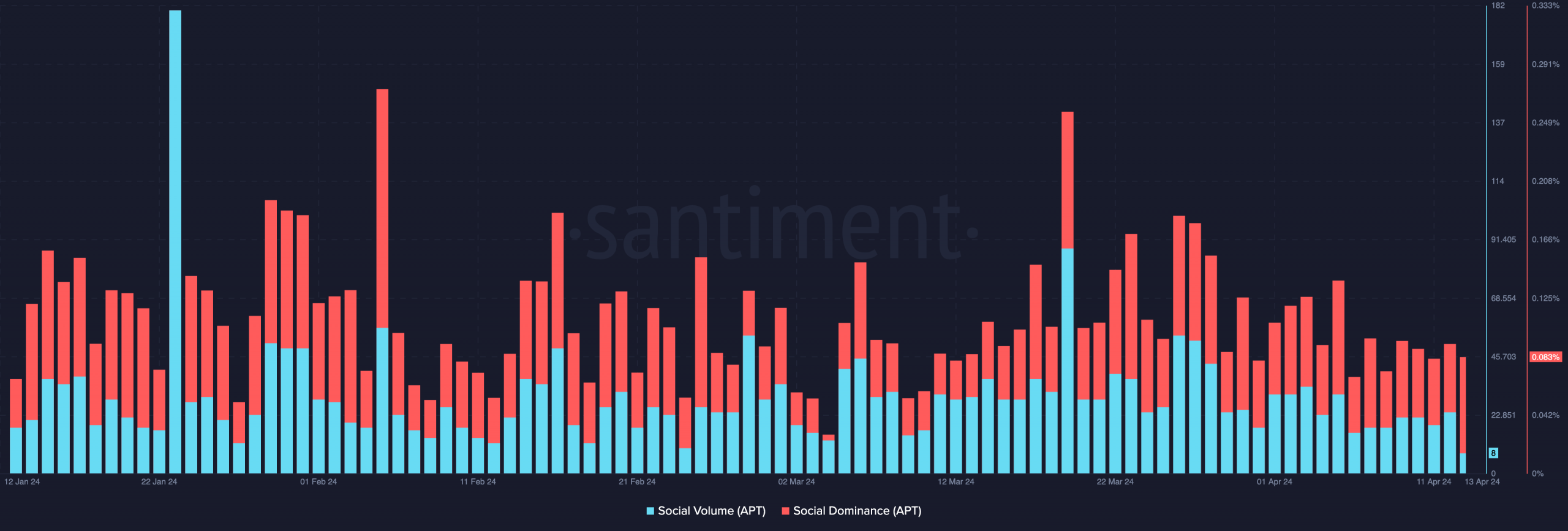

Meanwhile, social volume around the project dropped. Before Bitcoin came into the picture, APT’s social volume was expected to increase considering the scheduled unlock.

However, the decline here was proof that the price collapse of the broader market overshadowed it. If not, search for Aptos might have jumped.

Likewise, social dominance also fell, indicating that discussions around the project were nowhere near previous highs. For the price, the drop in Social Dominance could be great.

Source: Santiment

This is because a surge in the metric would have implied that hype around it. At this point, it could be difficult for the price to rally harder.

Is your portfolio green? Check out the APT Profit Calculator

But buying when there is little to no attention might make participants who take action early to the game. For the time being, APT might continue moving sideways.

However, if Bitcoin retests $70,000, the token might climb higher, and a 50% increase could be possible.

- APT tokens, valued at $351 million, were released into circulation.

- Bitcoin’s plunge triggered a double-digit decrease for the token.

Layer-1 blockchain Aptos [APT] unlocked 6.24% of its total supply on the 12th of April. But the market crash, led by Bitcoin [BTC], put a stop to the optimism around the event.

Unlocking tokens, and moving them into circulation, have effects on price. In some cases, the event causes high volatility, and the increase in supply causes the value of the token involved to decline.

At the time the APT tokens were released, they were worth over $351 million. Before the unlock, the Aptos community was hyped about it, with some predictions noting that the price might rally afterward.

No event is big enough than the king

But then, Bitcoin dropped to $65,000, and altcoins, including APT, were not spared from the onslaught. At press time, the price of the Aptos native token was $10.13.

This value meant that the cryptocurrency had lost 12.57% of its value in the last 24 hours. Beyond the price, Bitcoin’s correction affected some other metrics on Aptos’ network.

One of the most affected was the volume. In the early hours of the 12th of April, APT’s volume was less than 200 million. Fast-forward to the time of writing, the volume had increased to 543.09 million.

An increase in volume indicates rising interest in a cryptocurrency. But it is not all the time the surge in volume means a spike in buying pressure.

For APT, it seemed like the other way around, with evidence shown by the price.

Source: Santiment

However, it seems that the token might not be done with the downturn yet. If the volume falls later, while APT’s downtrend continues, the decline might become weak. Hence, a rebound could be next.

In this instance, APT might attempt to revisit $12. But if Aptos’ volume continues to decrease while the price falls, a further plunge could be an option.

Should this be the case, the price of the token might drop below $10.

Watch out! Something is brewing

Meanwhile, social volume around the project dropped. Before Bitcoin came into the picture, APT’s social volume was expected to increase considering the scheduled unlock.

However, the decline here was proof that the price collapse of the broader market overshadowed it. If not, search for Aptos might have jumped.

Likewise, social dominance also fell, indicating that discussions around the project were nowhere near previous highs. For the price, the drop in Social Dominance could be great.

Source: Santiment

This is because a surge in the metric would have implied that hype around it. At this point, it could be difficult for the price to rally harder.

Is your portfolio green? Check out the APT Profit Calculator

But buying when there is little to no attention might make participants who take action early to the game. For the time being, APT might continue moving sideways.

However, if Bitcoin retests $70,000, the token might climb higher, and a 50% increase could be possible.

![How Bitcoin crashed Aptos’ [APT] token unlock party](https://coininsights.com/wp-content/uploads/2024/04/aptos-price-and-volume-750x254.png)

can i buy generic clomiphene cost clomiphene without insurance how to buy clomid tablets where can i buy clomiphene without prescription where to buy clomid no prescription can i order clomiphene without insurance how to get clomid without prescription

I couldn’t hold back commenting. Profoundly written!

More posts like this would force the blogosphere more useful.

zithromax 500mg over the counter – purchase zithromax pill metronidazole 200mg over the counter

order rybelsus 14mg online cheap – order semaglutide 14 mg sale periactin 4 mg tablet

order generic motilium 10mg – order domperidone sale cyclobenzaprine 15mg brand

clavulanate drug – https://atbioinfo.com/ how to buy acillin

how to buy nexium – https://anexamate.com/ nexium price

cheap coumadin 5mg – blood thinner losartan 25mg sale

order meloxicam generic – https://moboxsin.com/ mobic 15mg for sale

buy prednisone – https://apreplson.com/ order deltasone 10mg pills

online ed meds – fastedtotake.com can i buy ed pills over the counter

amoxil sale – buy amoxil generic amoxicillin uk

cost diflucan – buy diflucan 200mg without prescription forcan oral

cenforce 50mg price – cenforce 50mg uk buy cenforce no prescription

buy cialis online overnight shipping – https://ciltadgn.com/ free cialis samples

zantac over the counter – https://aranitidine.com/# buy ranitidine 150mg sale

I’ll certainly return to review more. sitio web

sildenafil 50 mg tablet – https://strongvpls.com/# viagra half pill

More articles like this would remedy the blogosphere richer. how to get furosemide without a prescription

More posts like this would force the blogosphere more useful. https://prohnrg.com/product/rosuvastatin-for-sale/

This is the kind of delivery I find helpful. https://ondactone.com/simvastatin/

More posts like this would create the online space more useful.

order dutasteride without prescription

With thanks. Loads of expertise! http://zqykj.cn/bbs/home.php?mod=space&uid=302446

buy dapagliflozin 10mg generic – https://janozin.com/# forxiga price

buy xenical cheap – click how to get xenical without a prescription

The thoroughness in this draft is noteworthy. http://mi.minfish.com/home.php?mod=space&uid=1420997