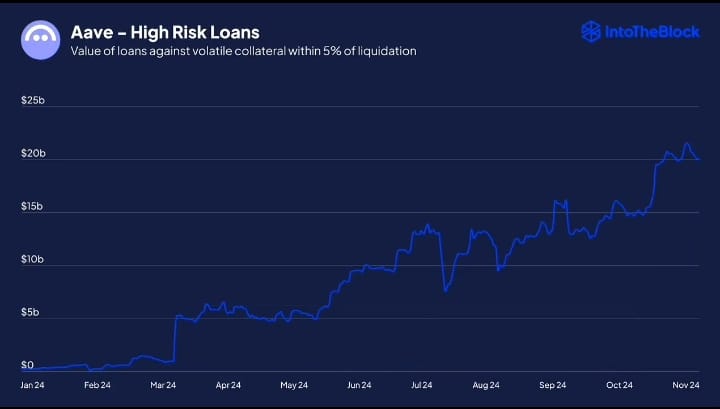

- High-risk DeFi loans surged as market sentiment drove demand for leverage.

- DeFi tokens active addresses hitting new all-time highs.

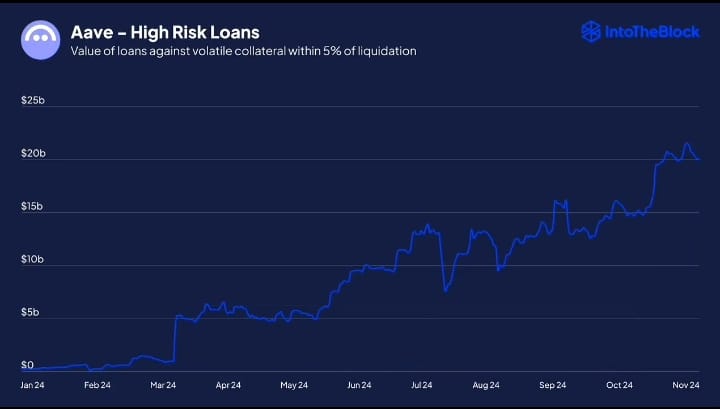

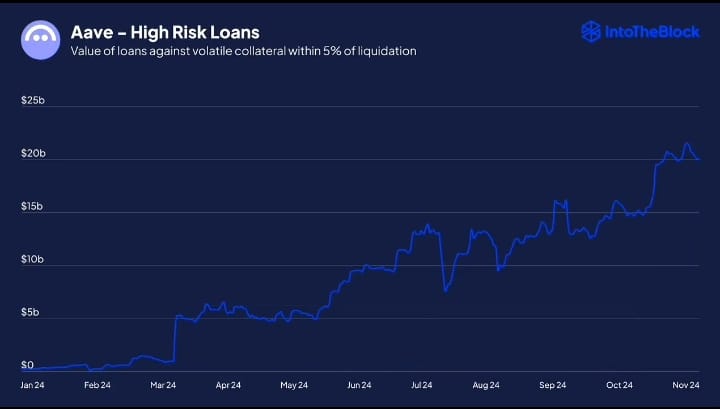

High risk loans surged as Bitcoin [BTC] hit new ATH driving demand for leverage. DeFi lending platforms Aave and Moonwell showed a significant uptrend in the value of high-risk loans as per IntoTheBlock, where the collateral was within 5% of being liquidated.

The upward trend suggested an increased appetite for leverage within the crypto market as participants seek higher returns, especially during bullish phases.

Notably, the rise in high-risk loans suggested that similar behaviors were prevalent across other DeFi lending platforms. This meant that broader market sentiment was inclined towards aggressive investment strategies.

Source: IntoTheBlock

However, the recent conclusion of the U.S. elections introduced potential volatility that could affect these leveraged positions adversely.

Large-scale political events often lead to unpredictable market movements, increasing the risk of liquidations for these high-stake loans.

The scenario illustrated the precarious balance DeFi participants navigate between seeking high returns and managing significant risks in an ever-volatile market environment.

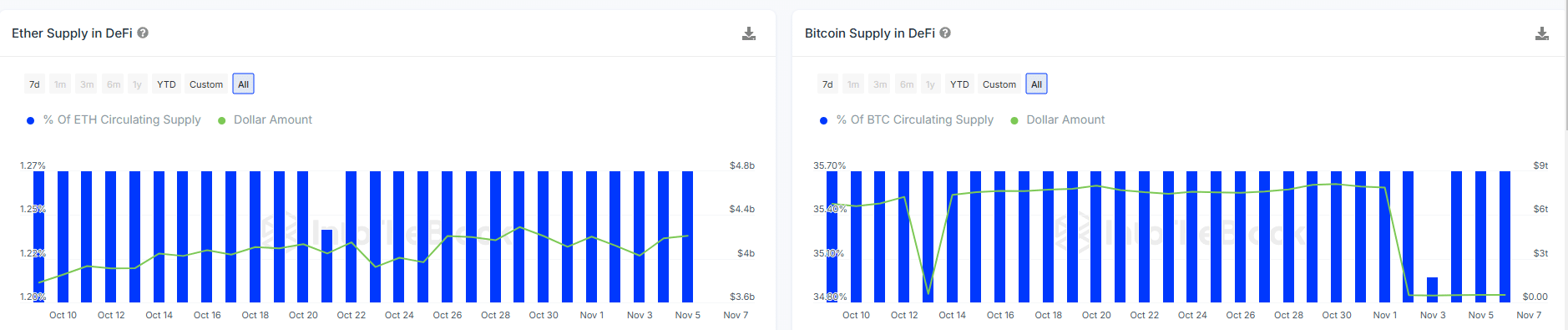

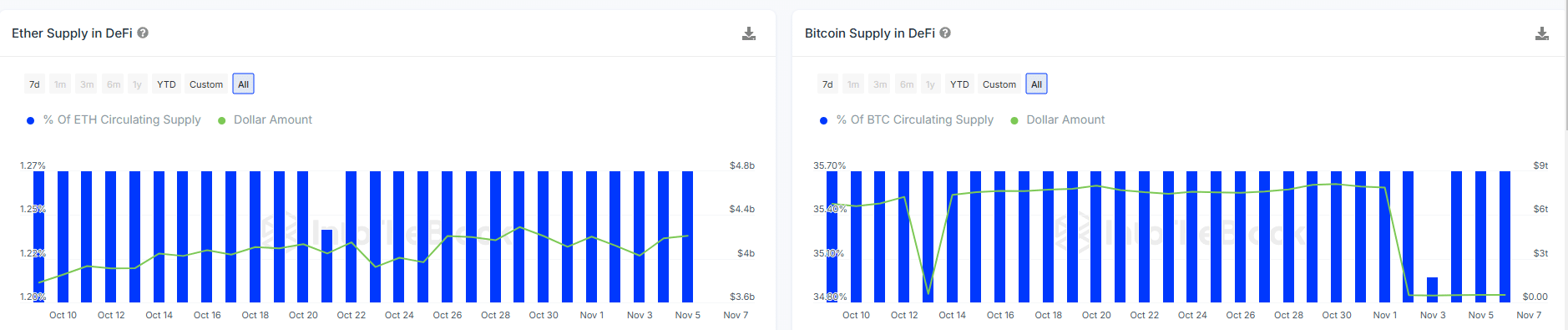

Difference in supply of ETH and BTC in DeFi

Despite slight decrease in total dollar value of Bitcoin in DeFi, it remained substantially higher than that of Ethereum. This suggested a deeper market penetration and higher stake by participants leveraging Bitcoin in DeFi platforms.

This indicated that Bitcoin could be more susceptible to the impacts of high-risk loans, especially as market sentiment pushes demand for leverage.

Source: IntoTheBlock

With Bitcoin’s larger presence in DeFi, any significant market corrections or volatility could lead to more pronounced effects on Bitcoin’s price and stability compared to Ether.

Thus, stakeholders in Bitcoin should stay particularly vigilant about potential market movements that these high-risk financial activities in the DeFi space may drive.

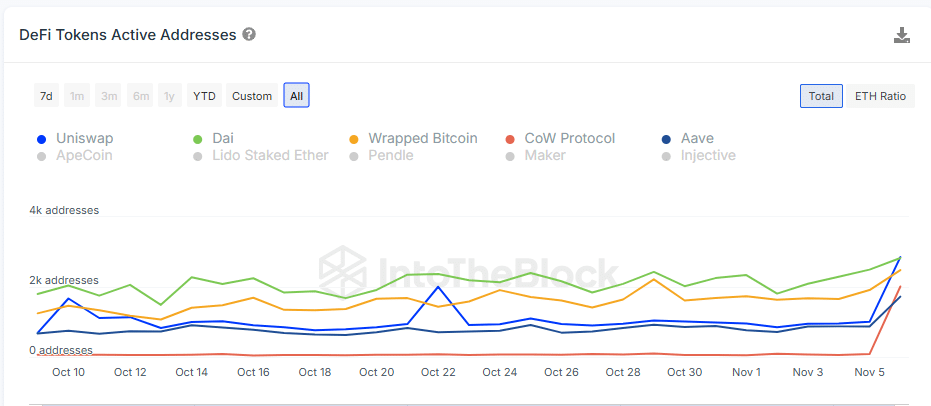

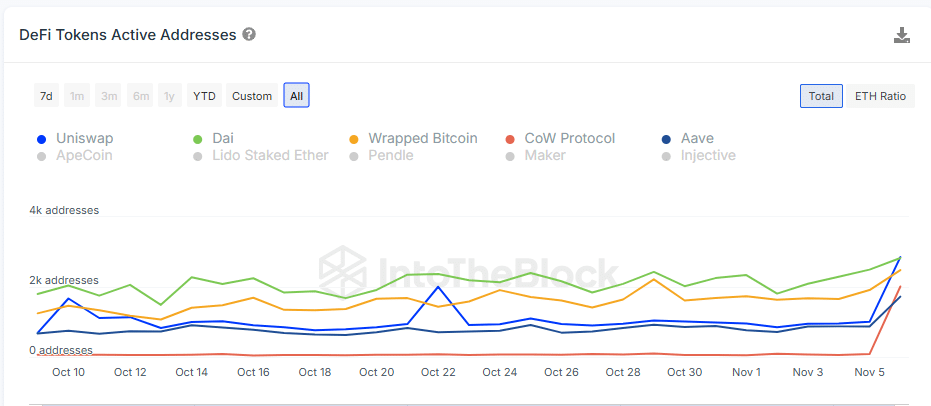

DeFi tokens active addresses at ATH

The chart showed a big rise in active addresses for several DeFi tokens, likely due to more users speculating and seeking high-leverage opportunities in DeFi.

The notable increase in activity, especially with Wrapped Bitcoin (WBTC), highlighted the market’s growing use of leverage and fear of missing out, which could inflate asset prices.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, increased activity often came before market peaks. A sudden awareness of overpricing or a big economic event could quickly drive down BTC prices.

Investors and traders need to be careful. The current rise in active addresses and leveraging shows higher volatility risk. This could affect Bitcoin’s movements soon and may lead to a local top that could ignite a correction.

- High-risk DeFi loans surged as market sentiment drove demand for leverage.

- DeFi tokens active addresses hitting new all-time highs.

High risk loans surged as Bitcoin [BTC] hit new ATH driving demand for leverage. DeFi lending platforms Aave and Moonwell showed a significant uptrend in the value of high-risk loans as per IntoTheBlock, where the collateral was within 5% of being liquidated.

The upward trend suggested an increased appetite for leverage within the crypto market as participants seek higher returns, especially during bullish phases.

Notably, the rise in high-risk loans suggested that similar behaviors were prevalent across other DeFi lending platforms. This meant that broader market sentiment was inclined towards aggressive investment strategies.

Source: IntoTheBlock

However, the recent conclusion of the U.S. elections introduced potential volatility that could affect these leveraged positions adversely.

Large-scale political events often lead to unpredictable market movements, increasing the risk of liquidations for these high-stake loans.

The scenario illustrated the precarious balance DeFi participants navigate between seeking high returns and managing significant risks in an ever-volatile market environment.

Difference in supply of ETH and BTC in DeFi

Despite slight decrease in total dollar value of Bitcoin in DeFi, it remained substantially higher than that of Ethereum. This suggested a deeper market penetration and higher stake by participants leveraging Bitcoin in DeFi platforms.

This indicated that Bitcoin could be more susceptible to the impacts of high-risk loans, especially as market sentiment pushes demand for leverage.

Source: IntoTheBlock

With Bitcoin’s larger presence in DeFi, any significant market corrections or volatility could lead to more pronounced effects on Bitcoin’s price and stability compared to Ether.

Thus, stakeholders in Bitcoin should stay particularly vigilant about potential market movements that these high-risk financial activities in the DeFi space may drive.

DeFi tokens active addresses at ATH

The chart showed a big rise in active addresses for several DeFi tokens, likely due to more users speculating and seeking high-leverage opportunities in DeFi.

The notable increase in activity, especially with Wrapped Bitcoin (WBTC), highlighted the market’s growing use of leverage and fear of missing out, which could inflate asset prices.

Source: IntoTheBlock

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, increased activity often came before market peaks. A sudden awareness of overpricing or a big economic event could quickly drive down BTC prices.

Investors and traders need to be careful. The current rise in active addresses and leveraging shows higher volatility risk. This could affect Bitcoin’s movements soon and may lead to a local top that could ignite a correction.

clomiphene tablets where to get clomiphene price get clomid without a prescription where can i buy clomid where can i buy cheap clomiphene no prescription where buy generic clomid no prescription can i order cheap clomid pills

This is the big-hearted of criticism I truly appreciate.

More text pieces like this would make the web better.

generic zithromax – order floxin 400mg pill order flagyl pill

buy generic semaglutide 14mg – rybelsus 14 mg over the counter buy generic cyproheptadine over the counter

generic domperidone – domperidone price where can i buy flexeril

buy augmentin 1000mg without prescription – atbio info ampicillin brand

buy esomeprazole without a prescription – anexamate.com buy esomeprazole 20mg pills

order warfarin 2mg generic – https://coumamide.com/ buy cheap cozaar

purchase mobic online – mobo sin buy meloxicam 15mg online cheap

order prednisone 5mg for sale – aprep lson prednisone 10mg usa

best ed drug – https://fastedtotake.com/ buying ed pills online

purchase amoxil online – combamoxi.com order amoxil

buy diflucan without a prescription – purchase fluconazole generic forcan where to buy

cenforce canada – on this site cenforce for sale

pregnancy category for tadalafil – cialis generic overnite shipping buying cialis without a prescription

buy zantac without prescription – order ranitidine 150mg generic buy ranitidine without prescription

50 mg sildenafil citrate – https://strongvpls.com/# buy priligy viagra online

Thanks towards putting this up. It’s well done. synthroid comprar online

More posts like this would add up to the online play more useful. https://buyfastonl.com/furosemide.html

Thanks for putting this up. It’s understandably done. https://ursxdol.com/amoxicillin-antibiotic/

With thanks. Loads of expertise! https://prohnrg.com/product/metoprolol-25-mg-tablets/

This is the amicable of content I enjoy reading. propecia prix france

Good blog you be undergoing here.. It’s obdurate to on strong status belles-lettres like yours these days. I really comprehend individuals like you! Withstand guardianship!! https://ondactone.com/product/domperidone/

With thanks. Loads of expertise!

https://proisotrepl.com/product/toradol/

Proof blog you procure here.. It’s intricate to find high calibre article like yours these days. I truly recognize individuals like you! Take vigilance!! https://maps.google.com.bz/url?q=http://https://doselect.com/@decab16353abf074be022fa5f

forxiga 10 mg over the counter – order forxiga 10mg online cheap purchase forxiga online cheap

buy orlistat sale – https://asacostat.com/# order orlistat without prescription

The depth in this serving is exceptional. http://ledyardmachine.com/forum/User-Kpjjac