- Ethereum lags behind Bitcoin in terms of demand from institutional investors

- Ethereum maintains strong lead against Bitcoin in one key area though

Spot Ethereum ETFs may have brought some excitement into the market, but the hype has not been anywhere near what we have seen with Bitcoin. This is an outcome that aligns with a push for Bitcoin from political elites.

While the observation underscores how Bitcoin overshadows Ethereum, could the latter also have a disadvantage in terms of liquidity? In fact, a recent QCP analysis suggested that Ethereum may be sidelined from the macro capital markets while the market continues to favor Bitcoin.

Since both Bitcoin and Ethereum are available as Spot ETF assets, a performance comparison may provide a clearer picture of performance differences.

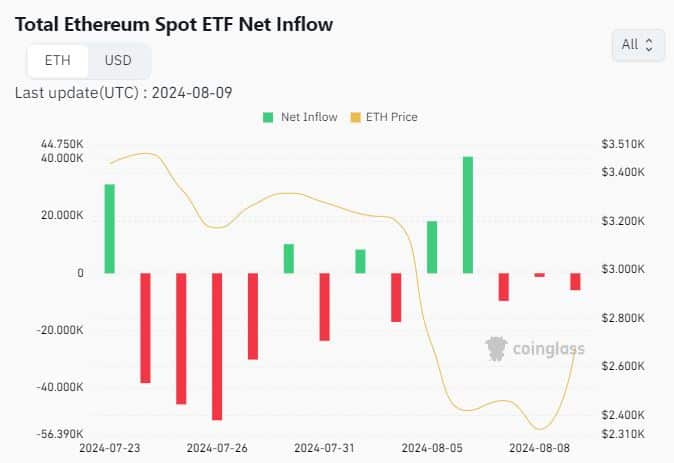

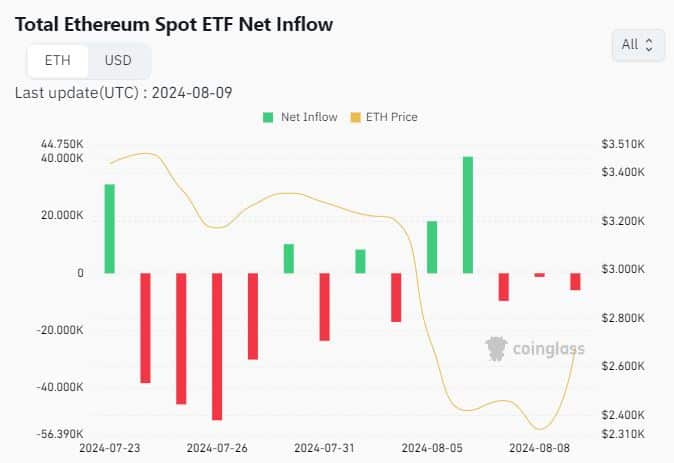

Bitcoin ETFs netflows averaged almost 300,000 BTC in the last 2 weeks, according to Coinglass. Meanwhile, Ethereum had a total spot ETF netflow of -114,350 ETH.

Source: Coinglass

The data disclosed stronger demand for Bitcoin, compared to ETH in the spot ETF segment.

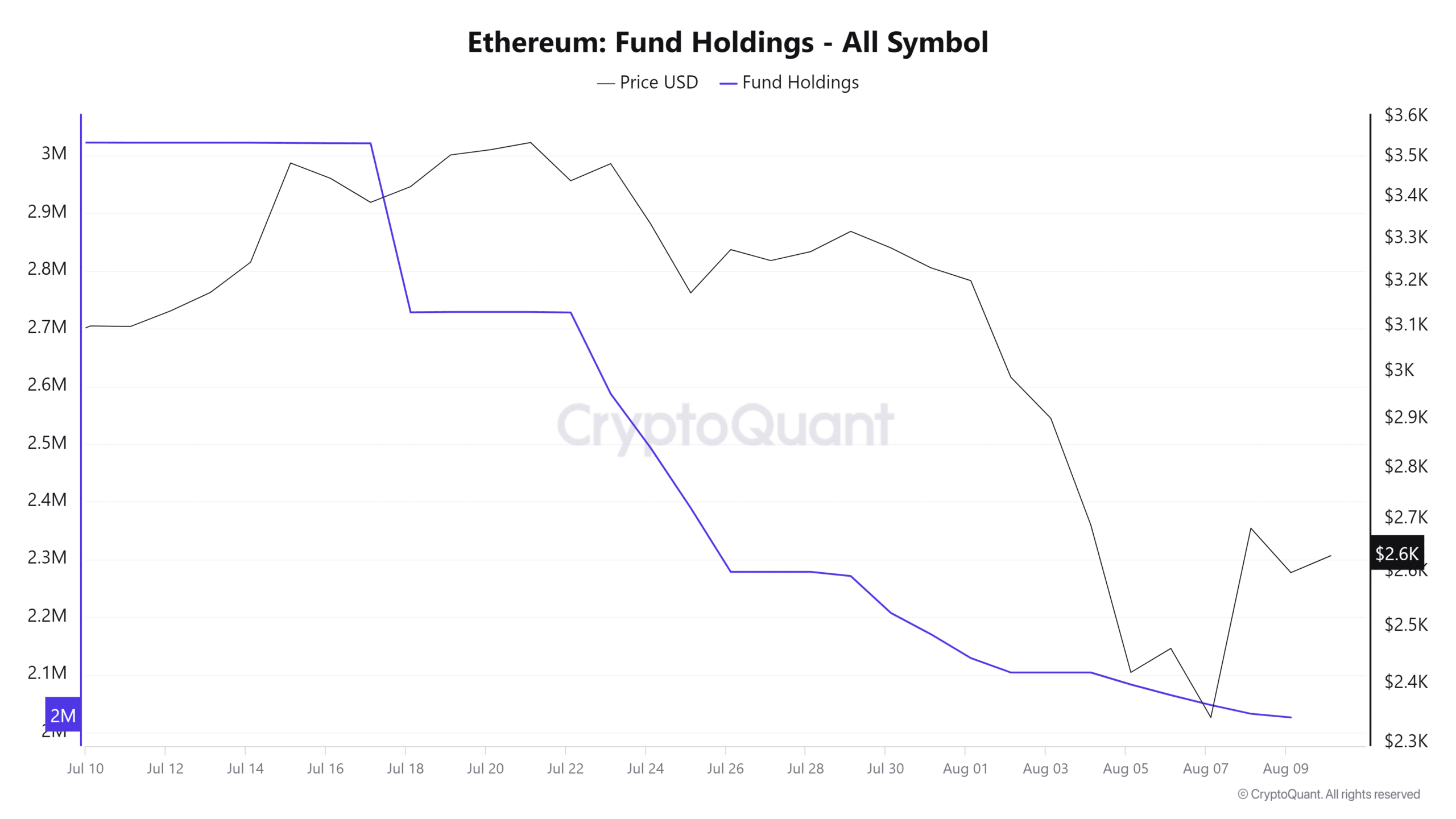

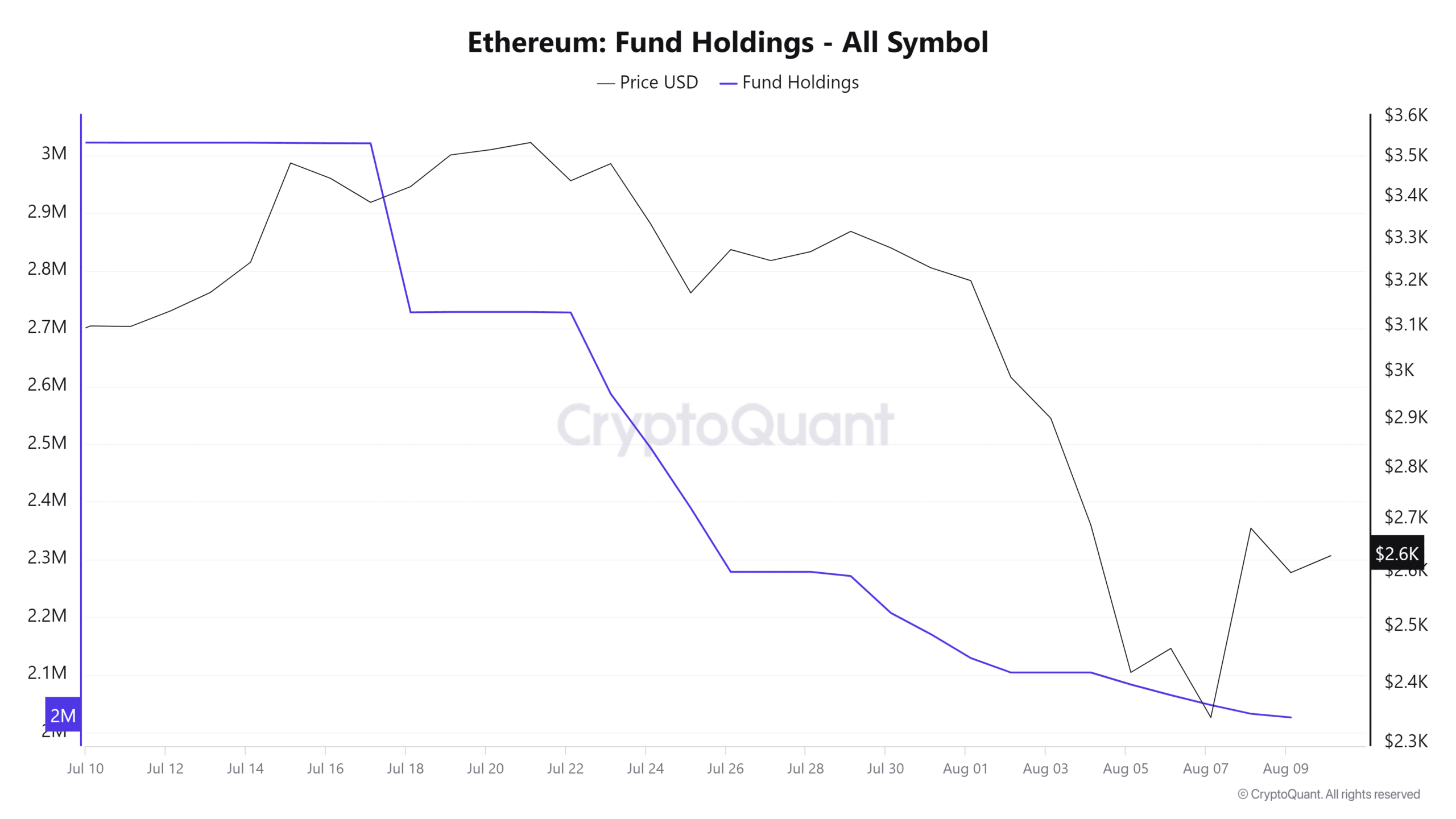

Our assessment also revealed the same for fund holdings. According to CryptoQuant, ETH fund holdings amounted to 2,026,328.5 ETH, worth $5.32 billion at ETH’s press time price.

Source: CryptoQuant

Here, it is also worth noting that ETH fund holdings were still on a downward trajectory at the time of writing, despite the market’s recovery.

Meanwhile, Bitcoin fund holdings amounted to 280,951.35 BTC, which at press time value were worth $17.07 billion – A little over 3 times more than ETH. This, despite BTC fund holdings also declining over the last 4 weeks.

A fair comparison?

The aforementioned data confirmed that Bitcoin is more preferable in the capital markets, compared to Ethereum.

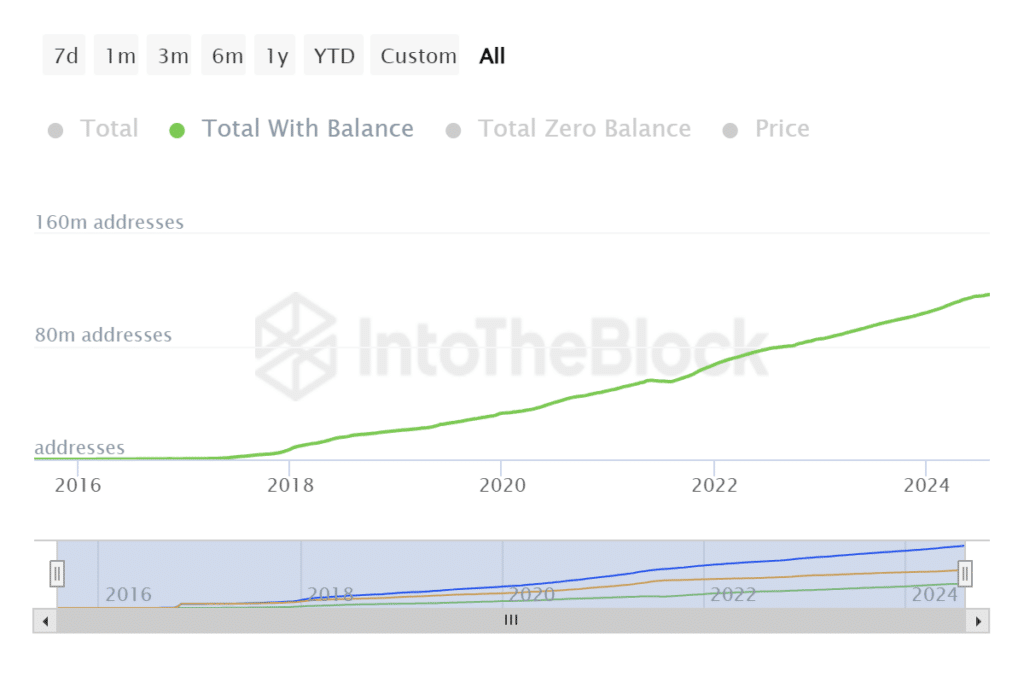

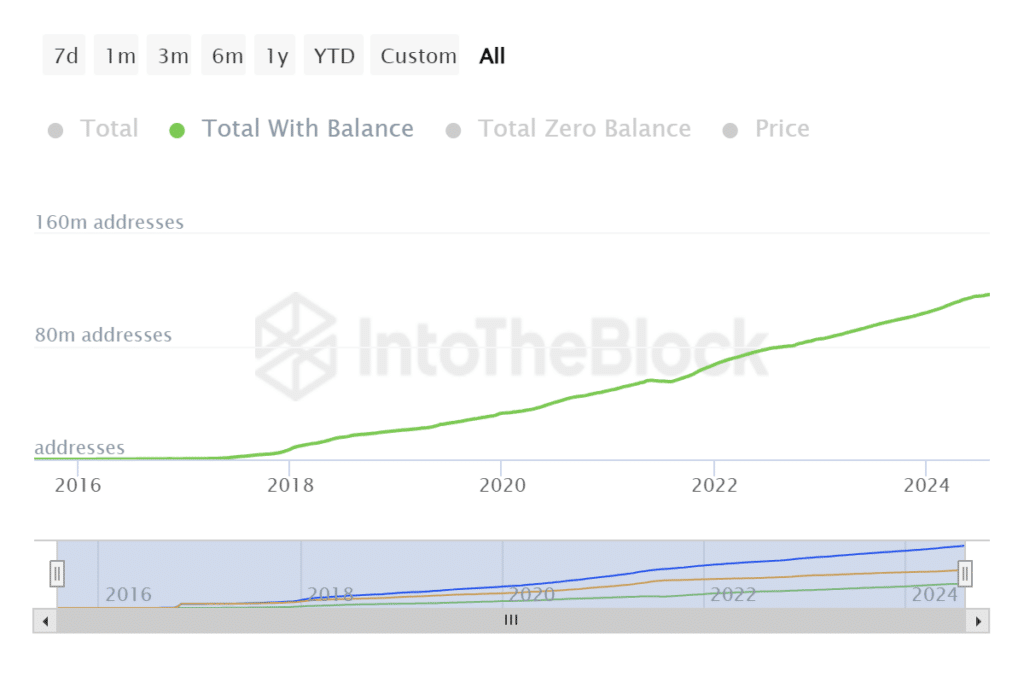

This may explain why funds hold more in Bitcoin than Ethereum. However, Ethereum also wins in other key areas too. For example, it has a much higher total address count with balance at 116.97 million.

Source: IntoTheBlock

In comparison, Bitcoin had a total of “just” 52.67 million total addresses with balance – Less than half of the total Ethereum addresses.

This highlighted one of Ethereum’s strengths as an expanding ecosystem. Perhaps one of the biggest reasons why Ethereum recently received Spot ETF approvals.

There’s no doubt that Bitcoin’s early lead against Ethereum offers a clear advantage. However, Ethereum also presents an opportunity that the institutional class of investors are starting to embrace. Besides, Ethereum ETFs are only a few weeks old, while Bitcoin ETFs have been around for months.

The remaining months of 2024 should provide a clearer picture of how Ethereum will fare in the macro capital market. Nevertheless, the findings confirm that Ethereum is at a bit of a disadvantage against Bitcoin in terms of securing institutional liquidity.

It may explain the differences between BTC and ETH’s price action too.

- Ethereum lags behind Bitcoin in terms of demand from institutional investors

- Ethereum maintains strong lead against Bitcoin in one key area though

Spot Ethereum ETFs may have brought some excitement into the market, but the hype has not been anywhere near what we have seen with Bitcoin. This is an outcome that aligns with a push for Bitcoin from political elites.

While the observation underscores how Bitcoin overshadows Ethereum, could the latter also have a disadvantage in terms of liquidity? In fact, a recent QCP analysis suggested that Ethereum may be sidelined from the macro capital markets while the market continues to favor Bitcoin.

Since both Bitcoin and Ethereum are available as Spot ETF assets, a performance comparison may provide a clearer picture of performance differences.

Bitcoin ETFs netflows averaged almost 300,000 BTC in the last 2 weeks, according to Coinglass. Meanwhile, Ethereum had a total spot ETF netflow of -114,350 ETH.

Source: Coinglass

The data disclosed stronger demand for Bitcoin, compared to ETH in the spot ETF segment.

Our assessment also revealed the same for fund holdings. According to CryptoQuant, ETH fund holdings amounted to 2,026,328.5 ETH, worth $5.32 billion at ETH’s press time price.

Source: CryptoQuant

Here, it is also worth noting that ETH fund holdings were still on a downward trajectory at the time of writing, despite the market’s recovery.

Meanwhile, Bitcoin fund holdings amounted to 280,951.35 BTC, which at press time value were worth $17.07 billion – A little over 3 times more than ETH. This, despite BTC fund holdings also declining over the last 4 weeks.

A fair comparison?

The aforementioned data confirmed that Bitcoin is more preferable in the capital markets, compared to Ethereum.

This may explain why funds hold more in Bitcoin than Ethereum. However, Ethereum also wins in other key areas too. For example, it has a much higher total address count with balance at 116.97 million.

Source: IntoTheBlock

In comparison, Bitcoin had a total of “just” 52.67 million total addresses with balance – Less than half of the total Ethereum addresses.

This highlighted one of Ethereum’s strengths as an expanding ecosystem. Perhaps one of the biggest reasons why Ethereum recently received Spot ETF approvals.

There’s no doubt that Bitcoin’s early lead against Ethereum offers a clear advantage. However, Ethereum also presents an opportunity that the institutional class of investors are starting to embrace. Besides, Ethereum ETFs are only a few weeks old, while Bitcoin ETFs have been around for months.

The remaining months of 2024 should provide a clearer picture of how Ethereum will fare in the macro capital market. Nevertheless, the findings confirm that Ethereum is at a bit of a disadvantage against Bitcoin in terms of securing institutional liquidity.

It may explain the differences between BTC and ETH’s price action too.

can i buy cheap clomiphene no prescription get generic clomiphene prices how can i get cheap clomiphene no prescription can i get generic clomid for sale clomiphene pills at dischem price clomiphene chance of twins how to buy clomiphene no prescription

You actually mentioned that superbly.

meilleur casino en ligne

Thank you, Useful information!

casino en ligne francais

Really a good deal of helpful info!

casino en ligne

You actually said this terrifically!

casino en ligne

You suggested this terrifically!

casino en ligne

Kudos, I enjoy this!

meilleur casino en ligne

Fantastic tips Cheers!

casino en ligne fiable

Wow quite a lot of beneficial facts.

casino en ligne

Thanks, I like this!

casino en ligne francais

Nicely put, Regards.

casino en ligne

I am in point of fact enchant‚e ‘ to glance at this blog posts which consists of tons of profitable facts, thanks for providing such data.

I couldn’t resist commenting. Well written!

order zithromax for sale – buy sumycin 500mg without prescription order flagyl 200mg generic

rybelsus 14mg drug – cost semaglutide buy cyproheptadine paypal

order motilium sale – buy flexeril 15mg sale order cyclobenzaprine pill

order inderal sale – oral methotrexate 10mg order methotrexate online

amoxil over the counter – buy valsartan 80mg pills order combivent 100 mcg

buy cheap augmentin – atbioinfo.com buy acillin

order esomeprazole 40mg without prescription – nexiumtous buy nexium 20mg for sale

order coumadin 2mg online – https://coumamide.com/ losartan 25mg sale

buy generic meloxicam 7.5mg – https://moboxsin.com/ order mobic sale

cheap deltasone 10mg – arthritis buy deltasone 10mg

buy ed pills online usa – site best pills for ed

amoxil us – buy generic amoxicillin for sale brand amoxil

purchase fluconazole generic – https://gpdifluca.com/ order generic forcan

where can i buy cenforce – cenforcers.com order cenforce online

buy cialis online without prescription – cialis patent expiration 2016 cialis online with no prescription

ranitidine canada – buy zantac 150mg without prescription ranitidine 150mg brand

how well does cialis work – cialis where to buy in las vegas nv tadalafil citrate

The thoroughness in this piece is noteworthy. comprar kamagra online seguro

herbal viagra for sale – https://strongvpls.com/# sildenafil 50mg

I couldn’t hold back commenting. Well written! https://buyfastonl.com/

This is the stripe of topic I have reading. https://prohnrg.com/product/get-allopurinol-pills/

More posts like this would bring about the blogosphere more useful. https://ondactone.com/simvastatin/

The depth in this ruined is exceptional.

cost levofloxacin

Thanks for putting this up. It’s well done. https://myrsporta.ru/forums/users/xcizp-2/