- Ethereum’s price drops to $3,867 amid increased exchange withdrawals, signaling potential market volatility.

- Active addresses and leverage ratios suggest heightened retail interest and possible short-term market shifts for ETH.

Ethereum [ETH] has seen a notable price adjustment after reaching the $4,000 threshold late last week. At the time of writing, ETH traded at $3,867, marking a 2.2% dip in the past day.

While the asset remains nearly 30% higher for the month, the drop below $4,000 positions ETH 20.5% away from its all-time high of $4,878, recorded in 2021.

Despite this correction, market activity surrounding Ethereum offers some compelling insights. According to a CryptoQuant analyst known as Mignolet, there has been a noticeable surge in Ethereum withdrawal transactions from exchanges.

While some might interpret this as a bearish indicator, Mignolet suggests that it signals the possibility of “increased market volatility.”

The analyst highlights a pattern of heightened activity in Ethereum transactions often correlating with declines in Bitcoin dominance, potentially indicating a broader market pullback as investors take profits.

Key metrics highlight U-turn for Ethereum

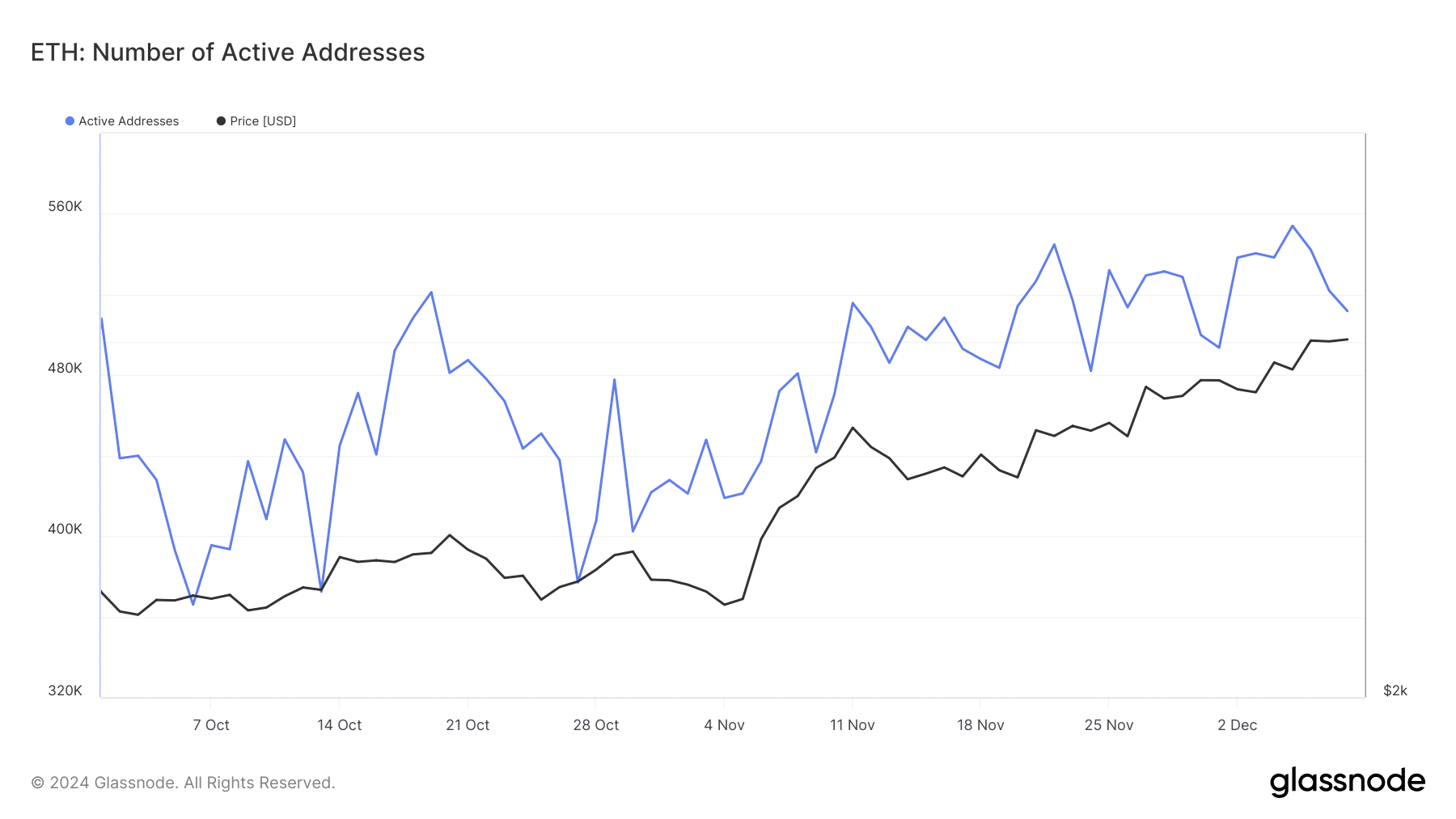

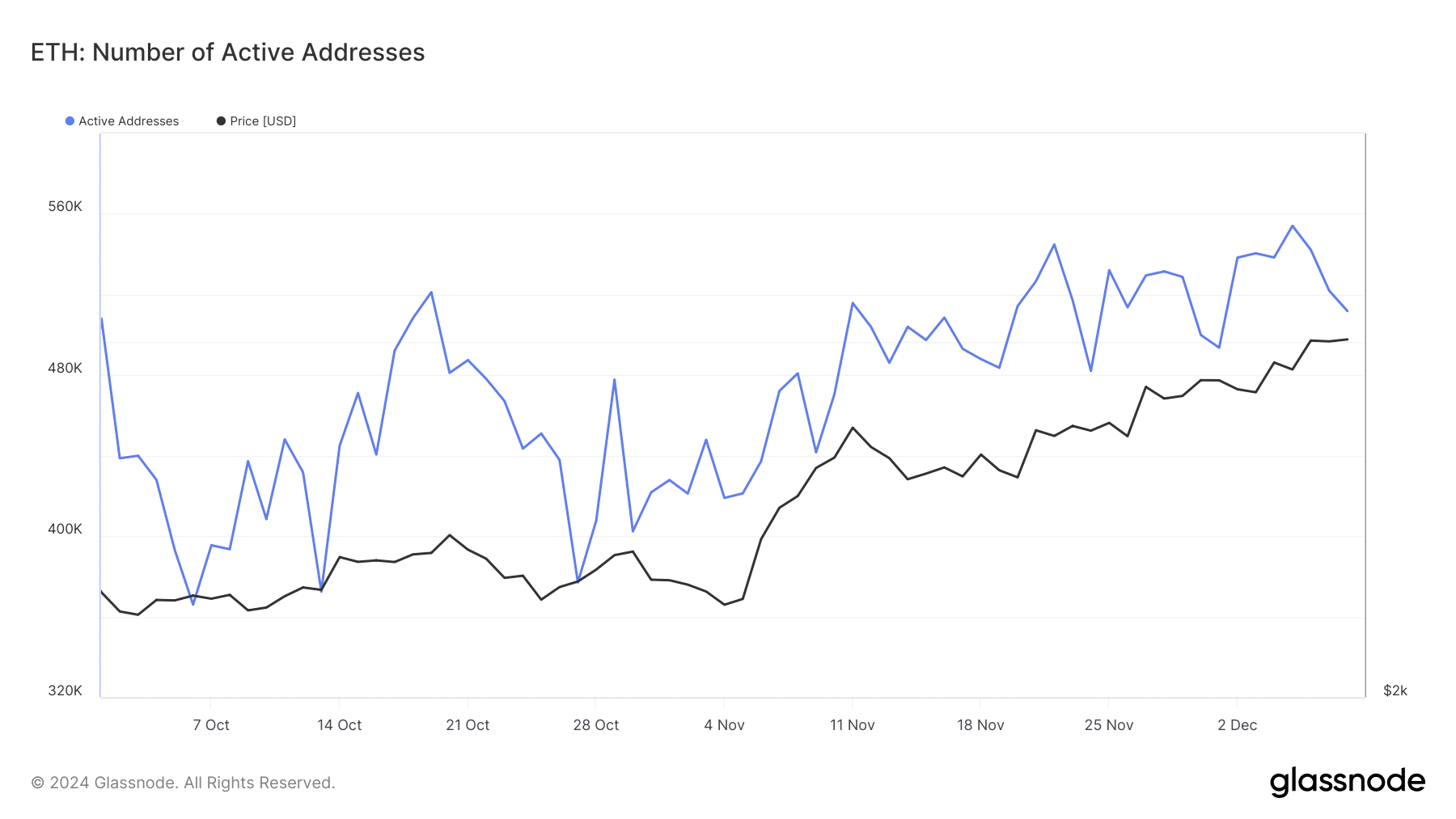

Meanwhile, Ethereum’s active addresses, a critical indicator of retail investor interest, have demonstrated an upward trend in recent months.

Data from Coinglass revealed that Ethereum’s active addresses have risen from below 400,000 in early October to surpassing 500,000 as of press time.

Source: Glassnode

This increase suggests growing participation from smaller, retail-focused investors. A rise in active addresses typically reflects heightened network activity, which can contribute to Ethereum’s price stability and long-term growth.

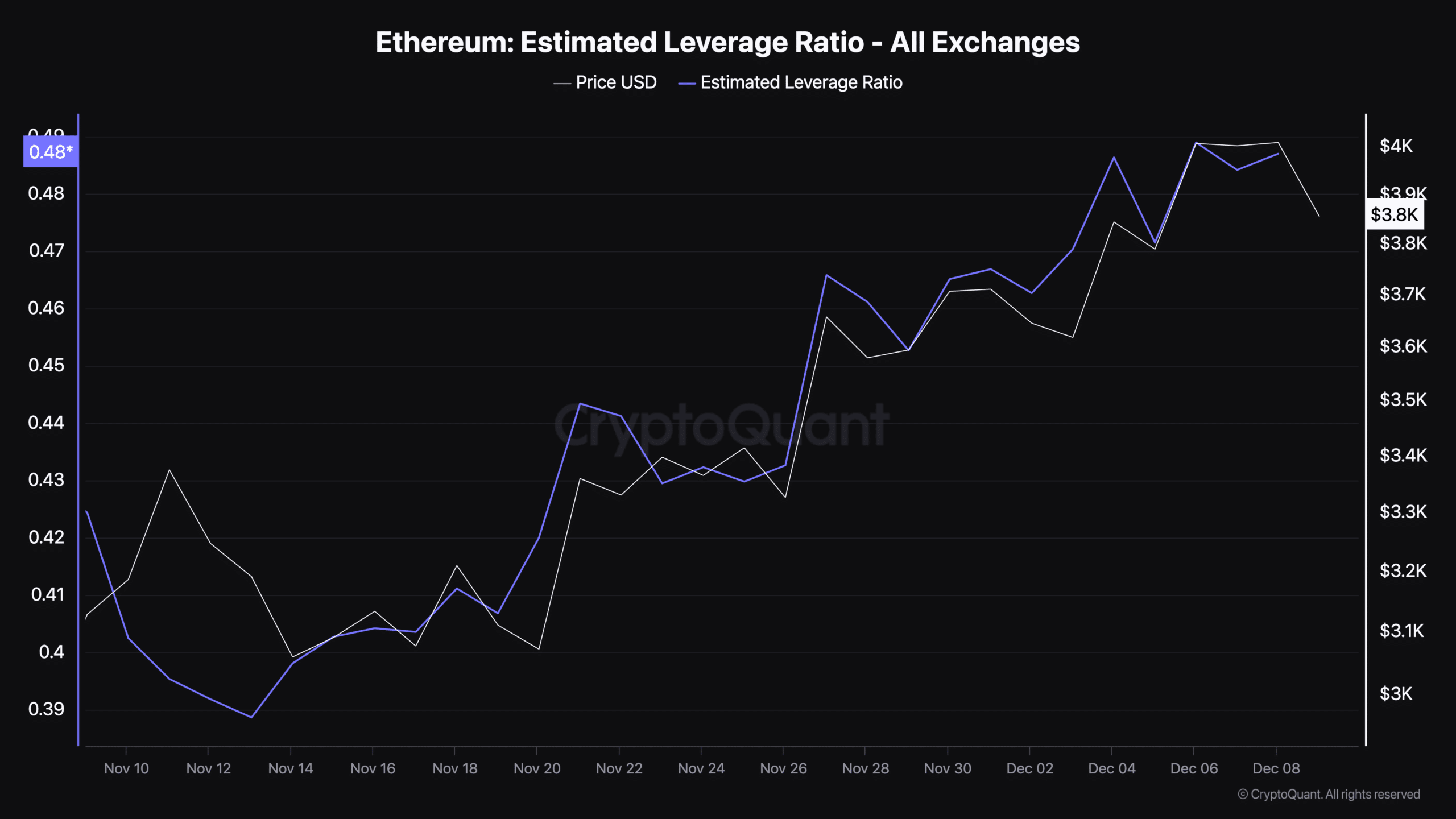

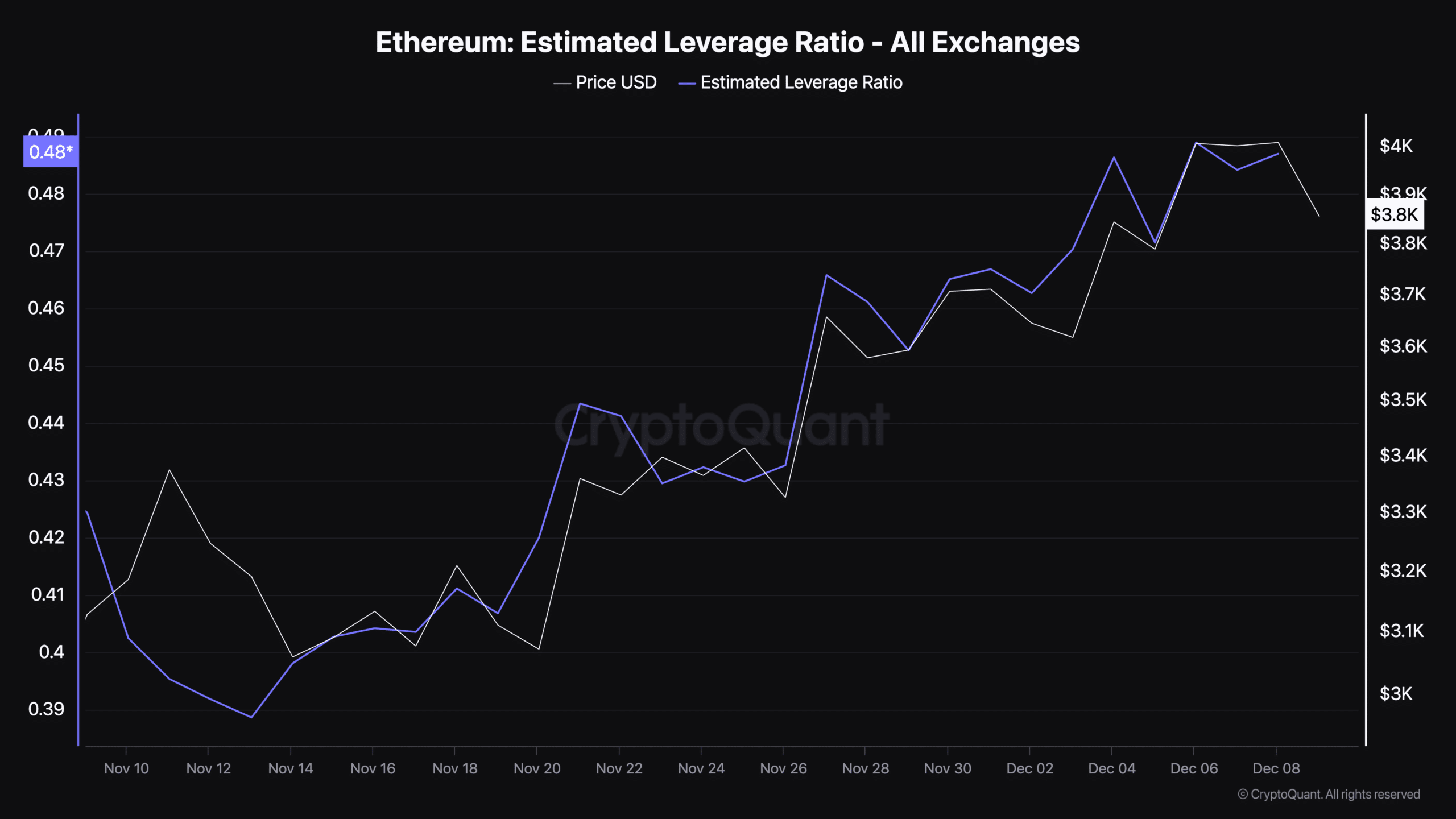

Another key metric, Ethereum’s estimated leverage ratio, currently stands at 0.487, according to CryptoQuant.

The estimated leverage ratio measures the level of leverage used by traders in the derivatives market, calculated as the ratio of open interest to the total coin balance held on exchanges.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

A higher leverage ratio indicates increased risk-taking, as more traders use borrowed funds to amplify their positions. At its current level, Ethereum’s leverage ratio suggests moderate leverage in the market.

While not excessively high, it highlights the potential for sharper price movements as traders position themselves for future market trends.

- Ethereum’s price drops to $3,867 amid increased exchange withdrawals, signaling potential market volatility.

- Active addresses and leverage ratios suggest heightened retail interest and possible short-term market shifts for ETH.

Ethereum [ETH] has seen a notable price adjustment after reaching the $4,000 threshold late last week. At the time of writing, ETH traded at $3,867, marking a 2.2% dip in the past day.

While the asset remains nearly 30% higher for the month, the drop below $4,000 positions ETH 20.5% away from its all-time high of $4,878, recorded in 2021.

Despite this correction, market activity surrounding Ethereum offers some compelling insights. According to a CryptoQuant analyst known as Mignolet, there has been a noticeable surge in Ethereum withdrawal transactions from exchanges.

While some might interpret this as a bearish indicator, Mignolet suggests that it signals the possibility of “increased market volatility.”

The analyst highlights a pattern of heightened activity in Ethereum transactions often correlating with declines in Bitcoin dominance, potentially indicating a broader market pullback as investors take profits.

Key metrics highlight U-turn for Ethereum

Meanwhile, Ethereum’s active addresses, a critical indicator of retail investor interest, have demonstrated an upward trend in recent months.

Data from Coinglass revealed that Ethereum’s active addresses have risen from below 400,000 in early October to surpassing 500,000 as of press time.

Source: Glassnode

This increase suggests growing participation from smaller, retail-focused investors. A rise in active addresses typically reflects heightened network activity, which can contribute to Ethereum’s price stability and long-term growth.

Another key metric, Ethereum’s estimated leverage ratio, currently stands at 0.487, according to CryptoQuant.

The estimated leverage ratio measures the level of leverage used by traders in the derivatives market, calculated as the ratio of open interest to the total coin balance held on exchanges.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

A higher leverage ratio indicates increased risk-taking, as more traders use borrowed funds to amplify their positions. At its current level, Ethereum’s leverage ratio suggests moderate leverage in the market.

While not excessively high, it highlights the potential for sharper price movements as traders position themselves for future market trends.

cost generic clomid for sale how to get cheap clomiphene price clomid tablets price in pakistan clomid for sale get clomid for sale where to get generic clomiphene pill how to get generic clomid

The depth in this piece is exceptional.

azithromycin tablet – order generic ciprofloxacin 500 mg buy generic metronidazole 200mg

rybelsus 14mg canada – order periactin for sale buy cyproheptadine 4 mg

domperidone 10mg brand – buy domperidone 10mg without prescription order flexeril 15mg generic

oral inderal 20mg – buy methotrexate paypal methotrexate pills

buy amoxil paypal – combivent sale combivent 100mcg price

order zithromax sale – tindamax price purchase bystolic without prescription

buy augmentin cheap – atbioinfo where can i buy ampicillin

buy nexium generic – https://anexamate.com/ esomeprazole capsules

coumadin 2mg price – https://coumamide.com/ losartan online order

buy prednisone cheap – https://apreplson.com/ order generic prednisone 10mg

best ed drugs – fast ed to take site medication for ed

amoxicillin pills – comba moxi order amoxil pill

fluconazole 200mg sale – cost diflucan 200mg order fluconazole 200mg generic

lexapro pills – buy escitalopram 10mg online cheap buy lexapro 10mg for sale

cenforce order – this cenforce 100mg price

how much does cialis cost at walgreens – cialis sales in victoria canada cialis dosages

cialis patent expiration – https://strongtadafl.com/# canadian online pharmacy cialis

Proof blog you have here.. It’s intricate to on elevated status belles-lettres like yours these days. I truly comprehend individuals like you! Go through vigilance!! clomar palencia

order viagra online overnight delivery – https://strongvpls.com/# can you buy viagra chemist

This website really has all of the information and facts I needed to this case and didn’t know who to ask. https://buyfastonl.com/furosemide.html

This is the kind of topic I get high on reading. buy amoxil tablets

This is the compassionate of scribble literary works I truly appreciate. https://prohnrg.com/product/omeprazole-20-mg/

More posts like this would make the online play more useful. diurГ©tique lasix