- Drop in miners’ reserves comes alongside Bitcoin’s price gains.

- Miners’ daily revenue spiked to its second-highest level in history earlier this month.

The bloodbath in the market continued as Bitcoin [BTC] plunged to a two-week low of $60.9k in the last 24 hours of trading. Though the king coin recovered to $62k as of this writing, it was still under heavy selling pressure, having lost nearly 15% of its value over the week, according to CoinMarketCap.

Amongst other factors, increased liquidation of miners’ holdings might have contributed significantly to the slump.

Miners go on selling spree

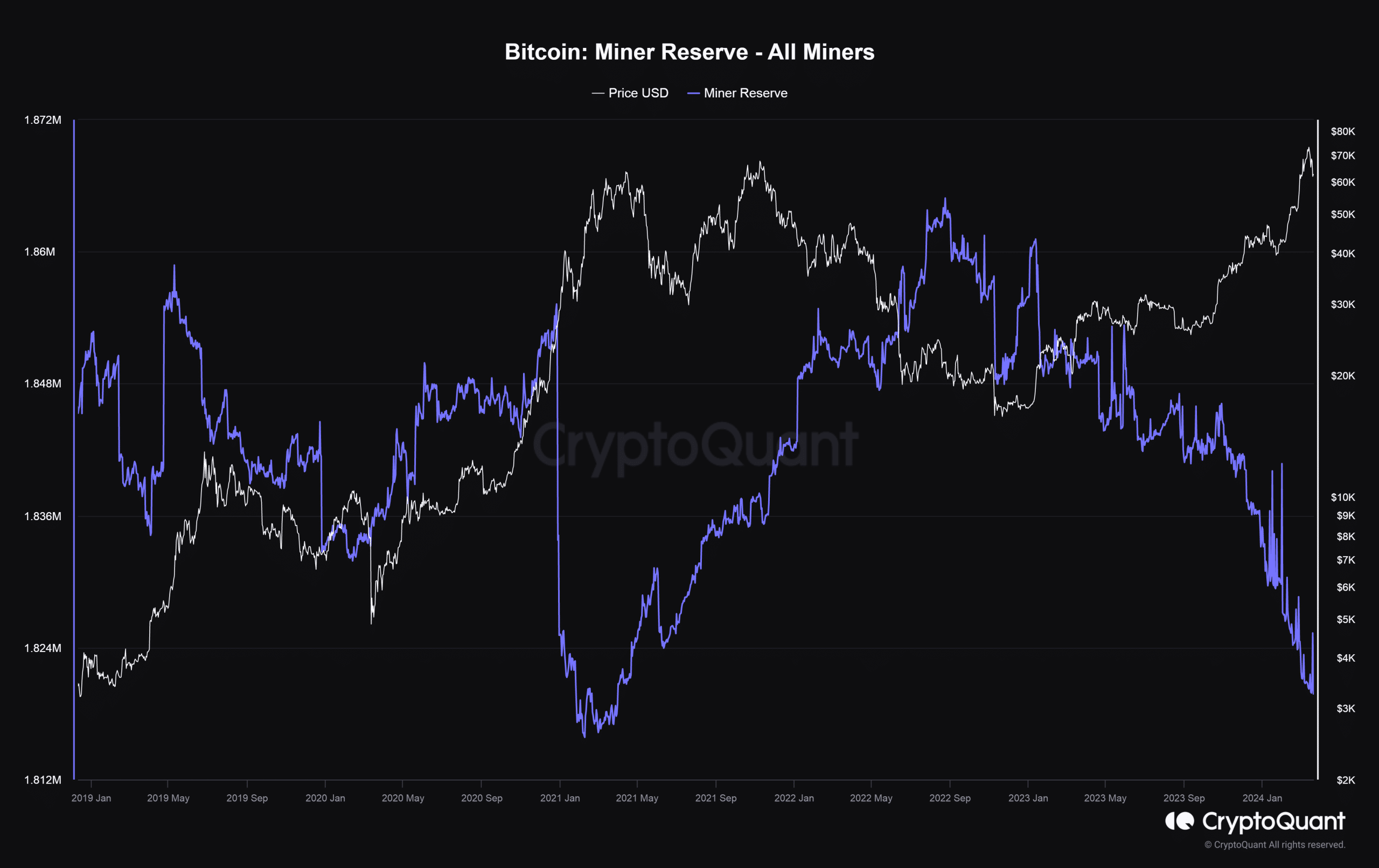

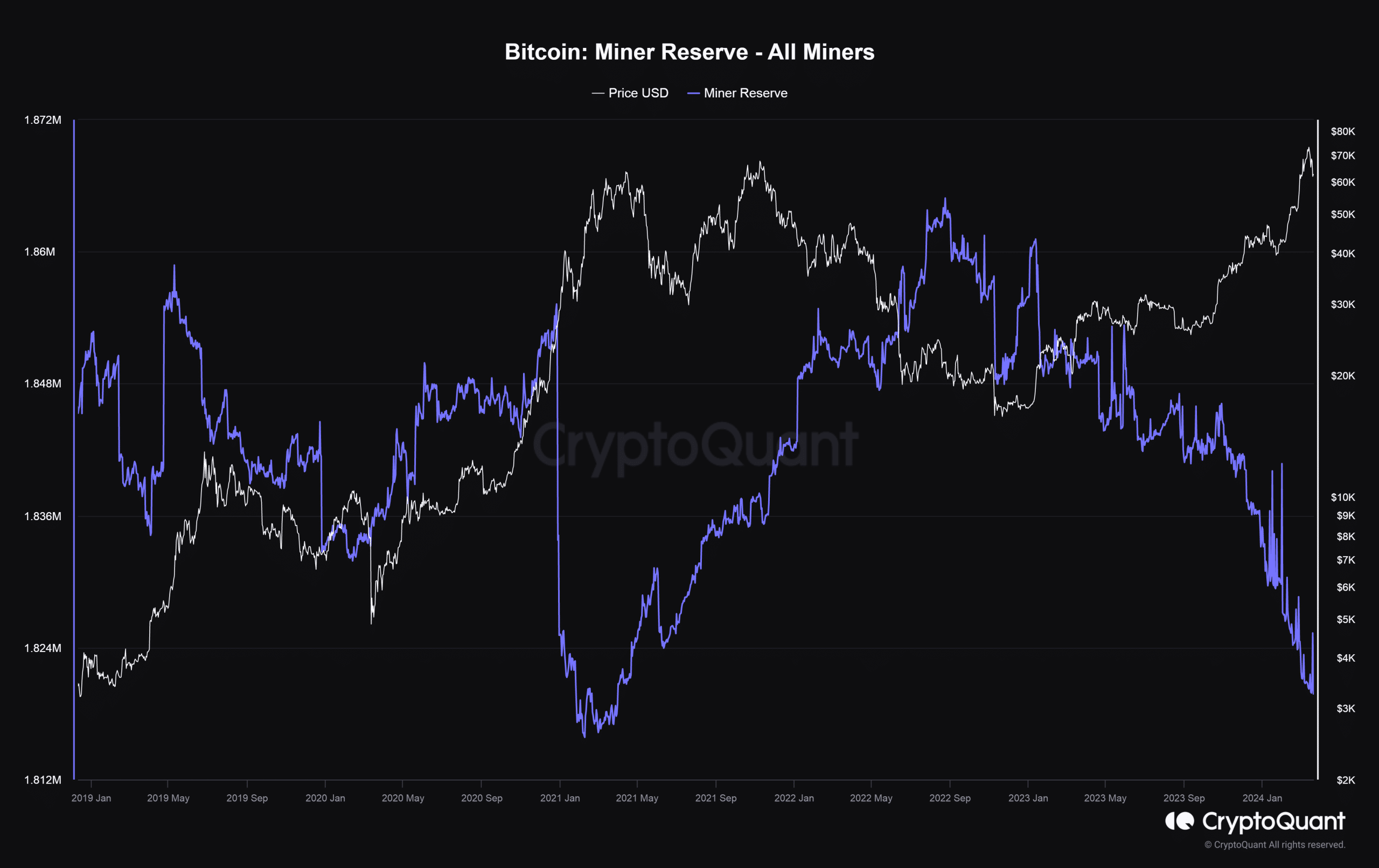

According to AMBCrypto’s examination of CryptoQuant’s data, the amount of Bitcoins held in miner wallets plunged to lows last seen nearly three years ago.

Source: CryptpQuant

Miners, as we know, frequently liquidate their holdings to cover costs incurred in setting up mining infrastructure. However, such events end up exerting significant downward pressure Bitcoin;s price. This is because miners are one of the largest holders of the asset.

Evidently, the decline became steeper since November last year. This was the time when Bitcoin arguably started its bull cycle, and miners capitalized on the higher returns to boost their revenue.

Mining revenue surges

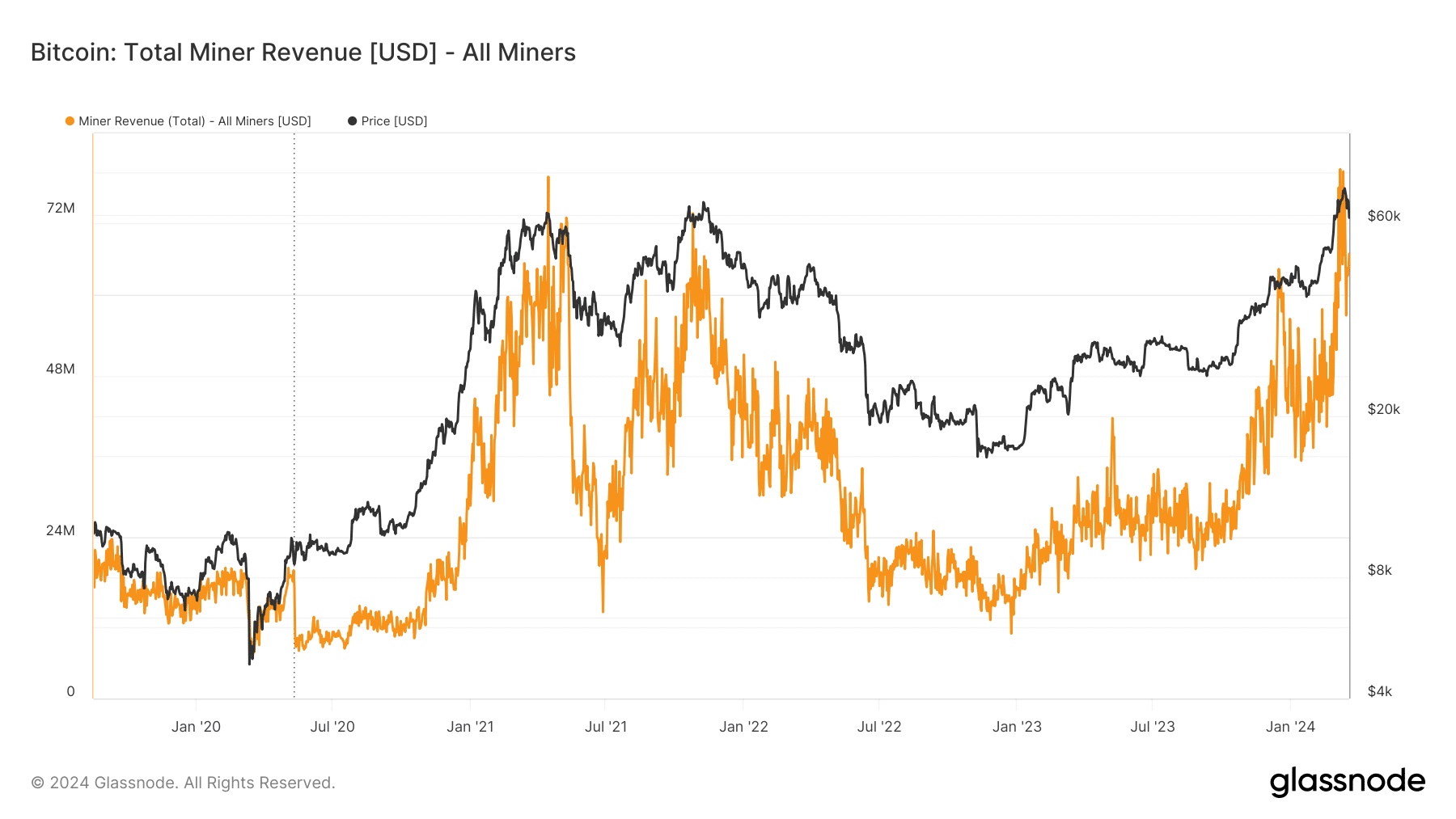

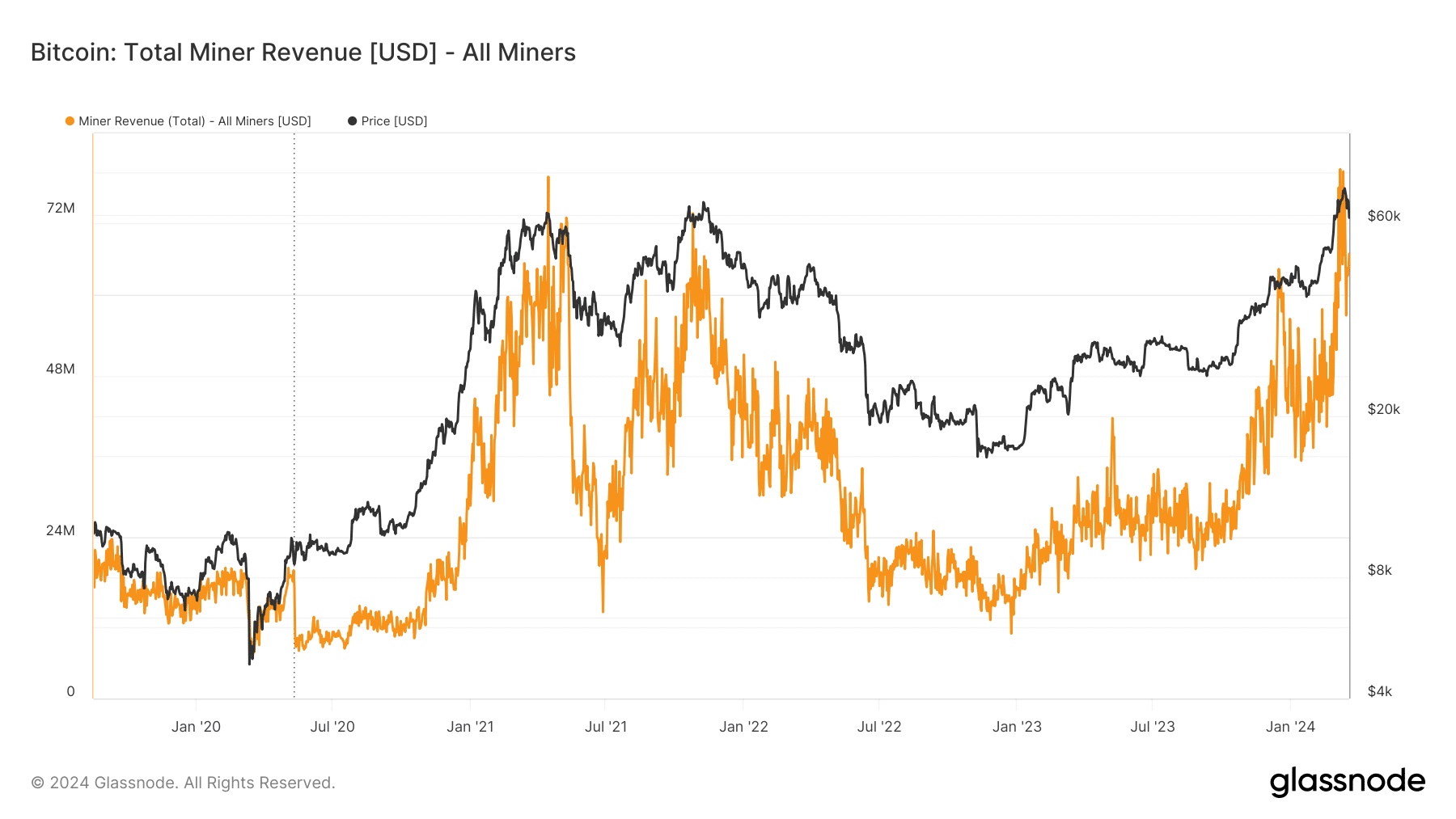

Miners’ earnings have soared substantially over the last four months, according to data from Glassnode. In fact, the daily revenue, comprising of transaction fees and fixed block subsidy of 6.25 BTCs, spiked to its second-highest level in history on the 7th of March.

Source: Glassnode

However, with the upcoming halving set to reduce rewards to 3.125 coins per block, miners were expecting a significant hit to their revenue streams.

It was likely that miners were raising funds to buy more cost-effective mining equipment, which would help them offset the revenue loss after halving.

Read BTC’s Price Prediction 2024-25

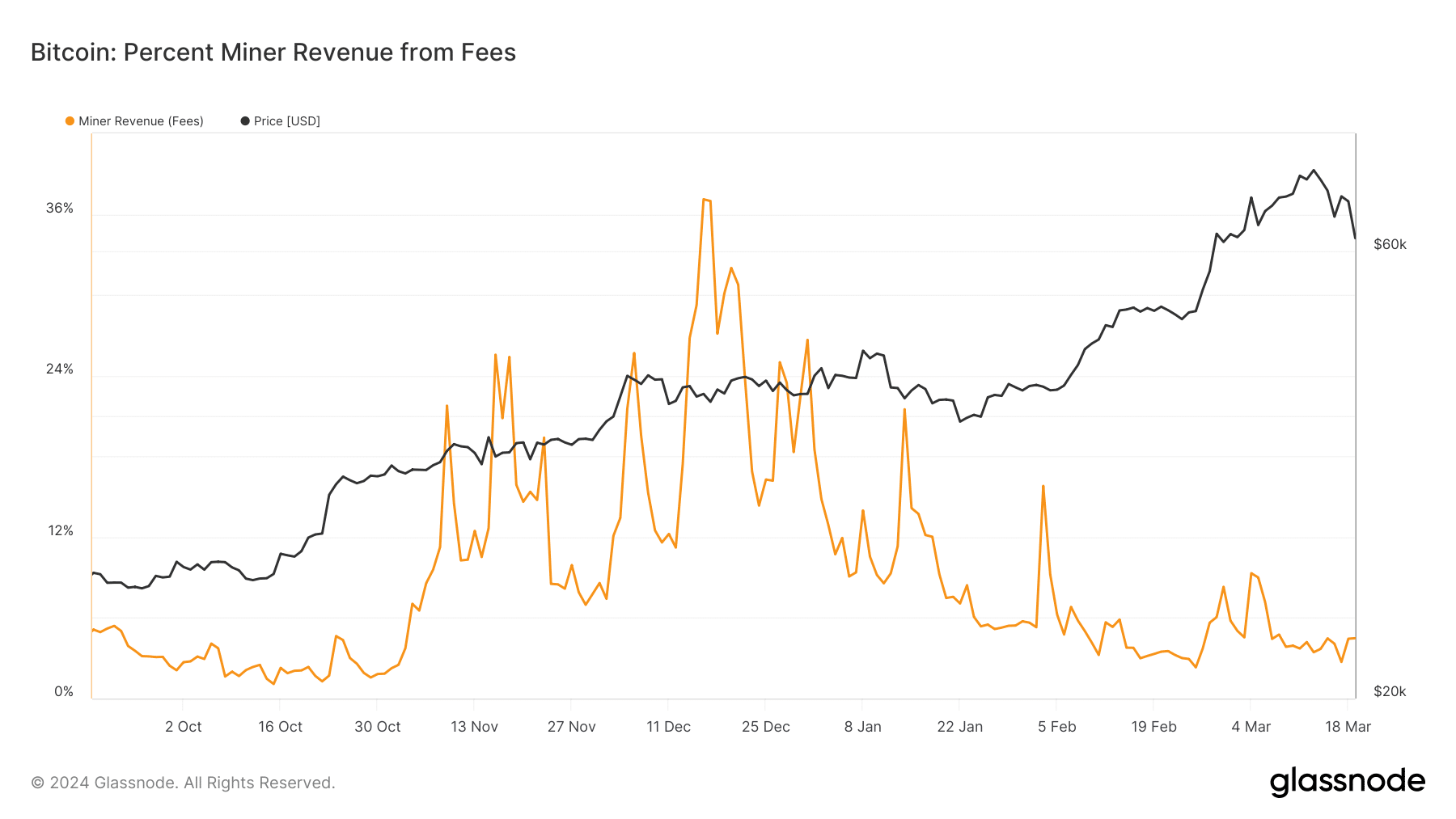

Miners not collecting enough fees

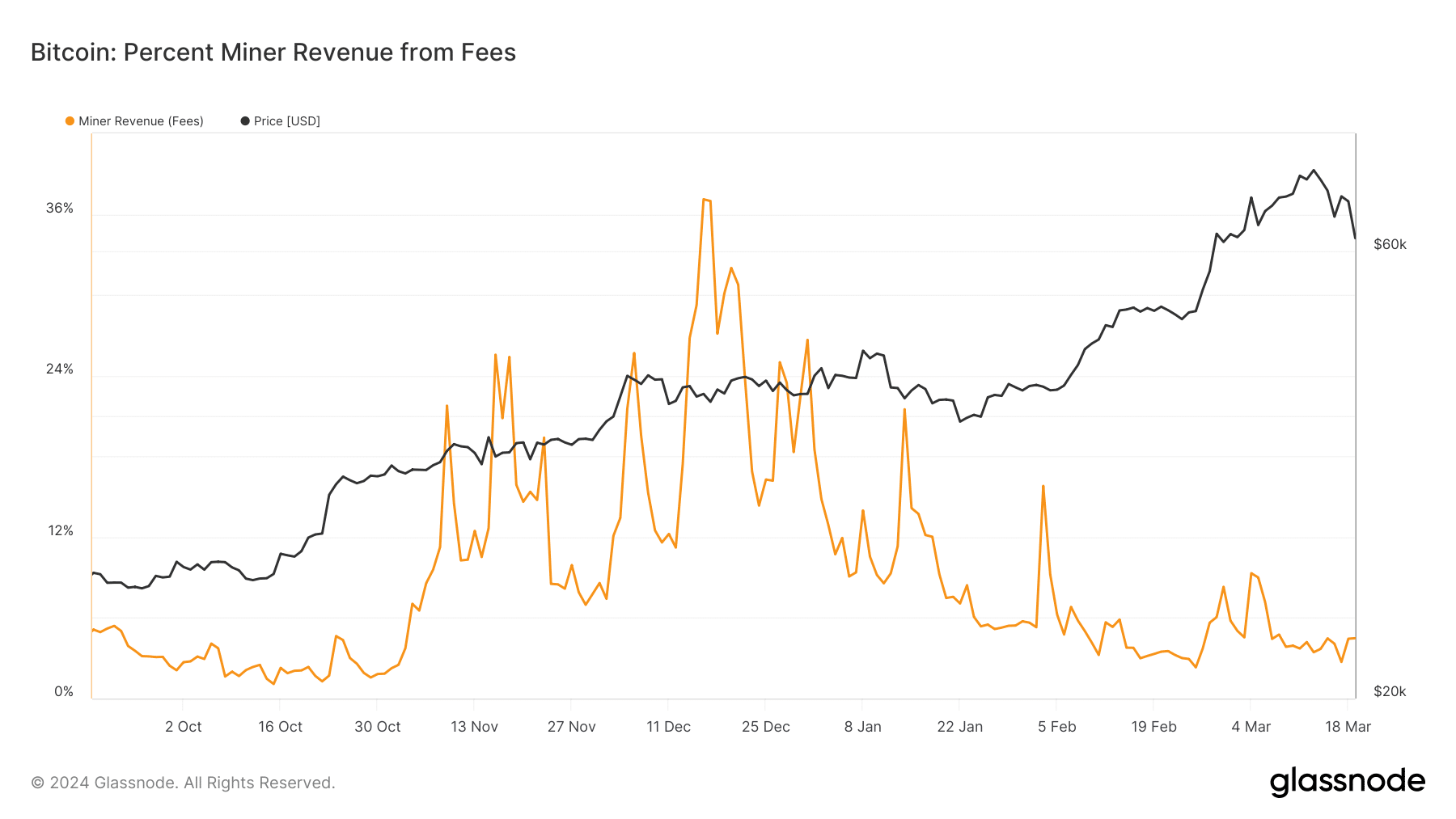

A bigger concern for them was the plummeting fee revenue. As of the 19th of March, transaction fees just made by 4.45% of the total miner revenue on the day, a sharp and progressive drop from over 36% recorded during Inscriptions craze last December.

Source: Glassnode

- Drop in miners’ reserves comes alongside Bitcoin’s price gains.

- Miners’ daily revenue spiked to its second-highest level in history earlier this month.

The bloodbath in the market continued as Bitcoin [BTC] plunged to a two-week low of $60.9k in the last 24 hours of trading. Though the king coin recovered to $62k as of this writing, it was still under heavy selling pressure, having lost nearly 15% of its value over the week, according to CoinMarketCap.

Amongst other factors, increased liquidation of miners’ holdings might have contributed significantly to the slump.

Miners go on selling spree

According to AMBCrypto’s examination of CryptoQuant’s data, the amount of Bitcoins held in miner wallets plunged to lows last seen nearly three years ago.

Source: CryptpQuant

Miners, as we know, frequently liquidate their holdings to cover costs incurred in setting up mining infrastructure. However, such events end up exerting significant downward pressure Bitcoin;s price. This is because miners are one of the largest holders of the asset.

Evidently, the decline became steeper since November last year. This was the time when Bitcoin arguably started its bull cycle, and miners capitalized on the higher returns to boost their revenue.

Mining revenue surges

Miners’ earnings have soared substantially over the last four months, according to data from Glassnode. In fact, the daily revenue, comprising of transaction fees and fixed block subsidy of 6.25 BTCs, spiked to its second-highest level in history on the 7th of March.

Source: Glassnode

However, with the upcoming halving set to reduce rewards to 3.125 coins per block, miners were expecting a significant hit to their revenue streams.

It was likely that miners were raising funds to buy more cost-effective mining equipment, which would help them offset the revenue loss after halving.

Read BTC’s Price Prediction 2024-25

Miners not collecting enough fees

A bigger concern for them was the plummeting fee revenue. As of the 19th of March, transaction fees just made by 4.45% of the total miner revenue on the day, a sharp and progressive drop from over 36% recorded during Inscriptions craze last December.

Source: Glassnode

cost clomid without a prescription order generic clomid pills clomid prices in south africa can i order clomiphene for sale can i purchase generic clomid pills where buy generic clomid without dr prescription where can i buy clomiphene

Greetings! Very productive par‘nesis within this article! It’s the crumb changes which choice espy the largest changes. Thanks a a quantity quest of sharing!

More posts like this would force the blogosphere more useful.

azithromycin uk – ofloxacin 400mg cheap metronidazole 400mg over the counter

order rybelsus – order generic rybelsus 14 mg buy cheap generic cyproheptadine

brand motilium 10mg – buy motilium cheap buy generic flexeril online

propranolol ca – inderal 20mg generic methotrexate 2.5mg pills

purchase zithromax pill – bystolic price nebivolol over the counter

augmentin 1000mg ca – https://atbioinfo.com/ ampicillin brand

esomeprazole pill – anexa mate esomeprazole 20mg price

order medex online cheap – cou mamide purchase hyzaar pill

buy meloxicam 7.5mg online cheap – swelling meloxicam ca

buy deltasone 5mg without prescription – https://apreplson.com/ deltasone 20mg price

erection pills viagra online – https://fastedtotake.com/ buy ed pills best price

amoxicillin pills – combamoxi.com cheap amoxil online

how to buy forcan – flucoan diflucan 200mg tablet

buy cenforce – https://cenforcers.com/# cenforce over the counter

cialis free trial canada – https://ciltadgn.com/ when will generic cialis be available

cheap zantac 150mg – zantac online buy ranitidine without prescription

buy cialis vs viagra – strongvpls cheap viagra no prescription canada

I am in point of fact happy to glance at this blog posts which consists of tons of of use facts, thanks representing providing such data. how to buy tamoxifen

The thoroughness in this draft is noteworthy. azithromycin 250mg ca

This website absolutely has all of the low-down and facts I needed adjacent to this participant and didn’t positive who to ask. https://ursxdol.com/cenforce-100-200-mg-ed/

The thoroughness in this draft is noteworthy. https://prohnrg.com/product/priligy-dapoxetine-pills/

With thanks. Loads of knowledge! on this site

With thanks. Loads of erudition! https://ondactone.com/product/domperidone/

Thanks on putting this up. It’s well done.

https://proisotrepl.com/product/toradol/

Thanks towards putting this up. It’s evidently done. https://images.google.com.tw/url?sa=t&url=https://faithful-raccoon-qpl4dn.mystrikingly.com/

More articles like this would pretence of the blogosphere richer. https://www.forum-joyingauto.com/member.php?action=profile&uid=47844

buy forxiga 10 mg for sale – buy forxiga for sale forxiga 10mg ca

order xenical online cheap – on this site orlistat us

Good blog you be undergoing here.. It’s obdurate to assign high quality belles-lettres like yours these days. I really appreciate individuals like you! Take vigilance!! http://iawbs.com/home.php?mod=space&uid=916797