- Bybit lost $1.4 billion following a major ETH hack linked to the Lazarus group

- There are now calls for Vitalik Buterin to roll back the chain to help Bybit recover the funds

Bybit’s $1.4 billion Ethereum hack has been reportedly linked to the notorious Lazarus group. As expected, this triggered a withdrawal frenzy as investors exited the crypto exchange en masse.

In fact, according to Bybit’s founder and CEO Ben Zhou, the exchange saw record withdrawal requests, but they were all handled smoothly.

“Since the hack, Bybit has experienced the most number of withdraws that we have ever seen, We have had a total number of more than 350k withdrawal requests.”

So, how was the exchange compromised, and can it retrieve the >$1 billion lost funds?

All the details

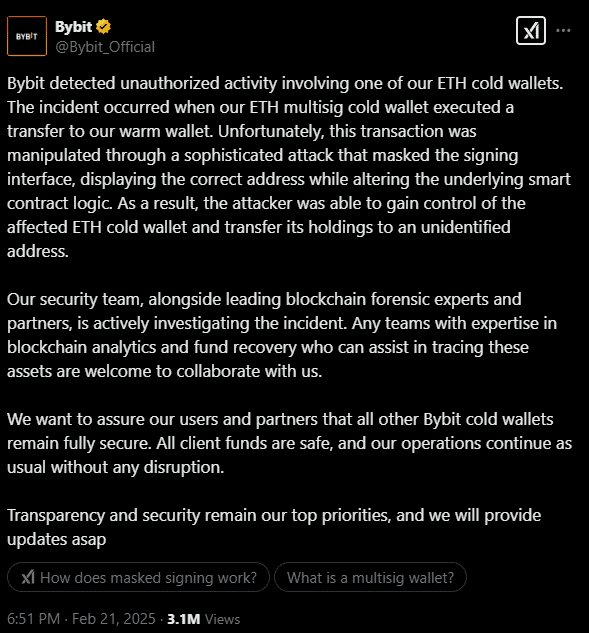

According to the exchange, the compromise was a sophisticated attack that tricked signers into unknowingly giving control of its multi-signature (multi-sig) cold wallet.

Source: X

About 400k ETH was siphoned from the compromised cold wallet to the attacker’s address, and split into 10k ETH chunks to several other addresses. Renowned on-chain sleuth ZachXBT has since established and linked these addresses to the North Korean Lazarus group.

According to CryptoQuant, following the incident, Bybit’s ETH reserves sharply dropped from 443k ETH to about 39k ETH.

Source: CryptoQuant

The incident didn’t stop at ETH investors though. According to CryptoQuant analyst Dark Frost, investors also withdrew 713 BTC from the exchange as fear intensified.

“The shadow of FTX loomed over the market, triggering a wave of fear and prompting investors to accelerate withdrawals from Bybit. This was evident in BTC, with 713 BTC withdrawn at the same time.”

Will Bybit recover the funds?

According to reports, Bybit received ETH loans from Bitget and Binance to support the withdrawal pressures amid its low ETH reserves. For example – SpotOnChain reported that Bybit received +$170M ETH loans. It stated,

“Bybit has received $172.5M in loans from various exchanges/institutions to manage customer withdrawals in the past 7 hours, including 40,000 $ETH ($107M) from Bitget 12,652 $stETH ($33.9M) from a #MEXC’s hot wallet and 11,800 $ETH ($31.6M) from Binance’s hot wallet.”

Source: Etherscan

Worth noting, however, that this still leaves it short of the $1.2 billion in stolen funds. Bybit’s CEO, however, has maintained that the exchange is solvent and can cover all user losses.

“Bybit is solvent even if this hack loss is not recovered, all of clients assets are 1 to 1 backed, we can cover the loss.”

Even so, the main question is – Can Bybit recover the stolen funds?

According to ZachXBT,

“Partial recovery is more common (15-30% in a good scenario?) but it’ll also be a bit harder to launder $1.46B I think depending on how patient they are.”

Some top figures like Samson Mow and Arthur Hayes have urged Ethereum’s founder Vitalik Buterin to roll back the chain to recover funds. Mow stated,

“I fully support rolling back Ethereum’s chain (again) so the stolen ETH is returned to Bybit_Official and also to prevent the North Korean government from using those funds to finance their nuclear weapons program. It must be done Vitalik Buterin.”

At press time though, Buterin was yet to make a statement. For its part, ETH dropped by about 7%, before stabilizing at $2.68k.

- Bybit lost $1.4 billion following a major ETH hack linked to the Lazarus group

- There are now calls for Vitalik Buterin to roll back the chain to help Bybit recover the funds

Bybit’s $1.4 billion Ethereum hack has been reportedly linked to the notorious Lazarus group. As expected, this triggered a withdrawal frenzy as investors exited the crypto exchange en masse.

In fact, according to Bybit’s founder and CEO Ben Zhou, the exchange saw record withdrawal requests, but they were all handled smoothly.

“Since the hack, Bybit has experienced the most number of withdraws that we have ever seen, We have had a total number of more than 350k withdrawal requests.”

So, how was the exchange compromised, and can it retrieve the >$1 billion lost funds?

All the details

According to the exchange, the compromise was a sophisticated attack that tricked signers into unknowingly giving control of its multi-signature (multi-sig) cold wallet.

Source: X

About 400k ETH was siphoned from the compromised cold wallet to the attacker’s address, and split into 10k ETH chunks to several other addresses. Renowned on-chain sleuth ZachXBT has since established and linked these addresses to the North Korean Lazarus group.

According to CryptoQuant, following the incident, Bybit’s ETH reserves sharply dropped from 443k ETH to about 39k ETH.

Source: CryptoQuant

The incident didn’t stop at ETH investors though. According to CryptoQuant analyst Dark Frost, investors also withdrew 713 BTC from the exchange as fear intensified.

“The shadow of FTX loomed over the market, triggering a wave of fear and prompting investors to accelerate withdrawals from Bybit. This was evident in BTC, with 713 BTC withdrawn at the same time.”

Will Bybit recover the funds?

According to reports, Bybit received ETH loans from Bitget and Binance to support the withdrawal pressures amid its low ETH reserves. For example – SpotOnChain reported that Bybit received +$170M ETH loans. It stated,

“Bybit has received $172.5M in loans from various exchanges/institutions to manage customer withdrawals in the past 7 hours, including 40,000 $ETH ($107M) from Bitget 12,652 $stETH ($33.9M) from a #MEXC’s hot wallet and 11,800 $ETH ($31.6M) from Binance’s hot wallet.”

Source: Etherscan

Worth noting, however, that this still leaves it short of the $1.2 billion in stolen funds. Bybit’s CEO, however, has maintained that the exchange is solvent and can cover all user losses.

“Bybit is solvent even if this hack loss is not recovered, all of clients assets are 1 to 1 backed, we can cover the loss.”

Even so, the main question is – Can Bybit recover the stolen funds?

According to ZachXBT,

“Partial recovery is more common (15-30% in a good scenario?) but it’ll also be a bit harder to launder $1.46B I think depending on how patient they are.”

Some top figures like Samson Mow and Arthur Hayes have urged Ethereum’s founder Vitalik Buterin to roll back the chain to recover funds. Mow stated,

“I fully support rolling back Ethereum’s chain (again) so the stolen ETH is returned to Bybit_Official and also to prevent the North Korean government from using those funds to finance their nuclear weapons program. It must be done Vitalik Buterin.”

At press time though, Buterin was yet to make a statement. For its part, ETH dropped by about 7%, before stabilizing at $2.68k.

can you buy cheap clomiphene without insurance can i buy clomiphene without prescription zei: cost clomid for sale can i purchase cheap clomid without a prescription where can i buy clomiphene price can you buy cheap clomid prices can you buy clomiphene prices

More articles like this would remedy the blogosphere richer.

order azithromycin 500mg sale – buy azithromycin 500mg pills buy flagyl pill

order semaglutide generic – cheap semaglutide where to buy periactin without a prescription

domperidone 10mg sale – cyclobenzaprine pills generic cyclobenzaprine 15mg

order augmentin 625mg generic – atbio info buy ampicillin online cheap

buy esomeprazole 40mg online – nexiumtous nexium us

order warfarin 5mg pills – https://coumamide.com/ buy losartan online cheap

cheap meloxicam 7.5mg – https://moboxsin.com/ meloxicam 15mg brand

order generic prednisone 10mg – corticosteroid purchase deltasone pills

buy generic ed pills over the counter – fast ed to take medication for ed dysfunction

oral amoxil – buy amoxil online cheap amoxicillin generic

order diflucan 100mg online cheap – flucoan order forcan

price of cialis at walmart – cialis online without prescription buy liquid tadalafil online

buy zantac 150mg generic – https://aranitidine.com/# buy ranitidine 150mg generic

cialis online without perscription – https://strongtadafl.com/# overnight cialis

The thoroughness in this break down is noteworthy. https://gnolvade.com/es/lasix-comprar-espana/

Thanks recompense sharing. It’s top quality. order zithromax online cheap

I am in truth thrilled to gleam at this blog posts which consists of tons of profitable facts, thanks towards providing such data. https://ursxdol.com/get-cialis-professional/

Thanks on sharing. It’s first quality. https://prohnrg.com/product/cytotec-online/

This is the compassionate of writing I truly appreciate. https://aranitidine.com/fr/acheter-fildena/

More posts like this would persuade the online space more useful. https://ondactone.com/product/domperidone/

Good blog you possess here.. It’s severely to find high worth script like yours these days. I really respect individuals like you! Withstand vigilance!!

how to buy cheap flexeril pill

I couldn’t hold back commenting. Adequately written! http://anja.pf-control.de/Musik-Wellness/member.php?action=profile&uid=4705

buy cheap dapagliflozin – order dapagliflozin pills brand dapagliflozin 10mg