- Bitcoin was trading below $66k at press time, with analysts pointing to $71k as a key level for a bullish reversal.

- Short-term holder supply declines, indicating growing confidence in the market, while open interest sees mixed signals.

Bitcoin [BTC] has experienced a slight decline, currently trading at around $61,639, down by 3.5% in the past day. This decrease comes shortly after the leading cryptocurrency made a notable recovery last week, reaching as high as $66,000.

Despite the recent dip, Bitcoin was still up by 9.4% over the last two weeks.

While no clear factors have been identified for the current downward movement, analysts are observing several trends and key levels that Bitcoin holders should pay attention to as they evaluate the asset’s future price trajectory.

Key levels and shifts among Bitcoin holders

Veteran trader Peter Brandt recently shared his analysis on the Bitcoin market, emphasizing a crucial level for bulls to reclaim.

According to Brandt, Bitcoin holders and investors should monitor whether BTC closes above $71,000, confirmed by a new all-time high (ATH), to indicate that the upward trend since November 2022 is still in force.

Brandt mentioned in his post,

“The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows.”

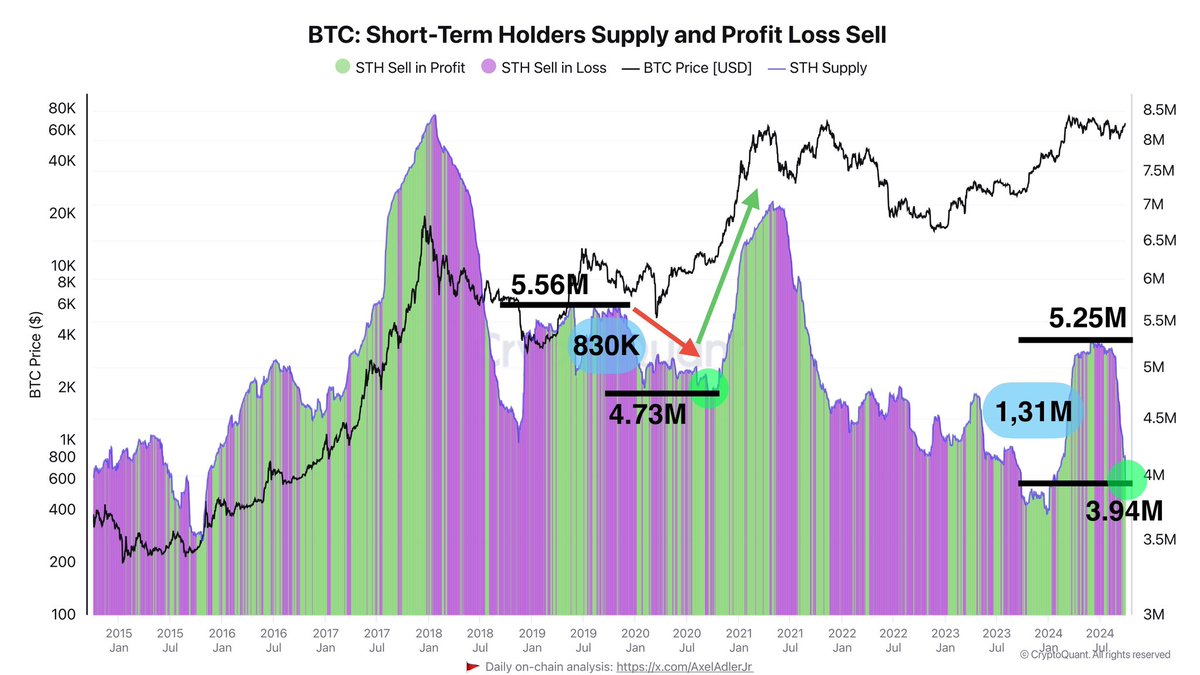

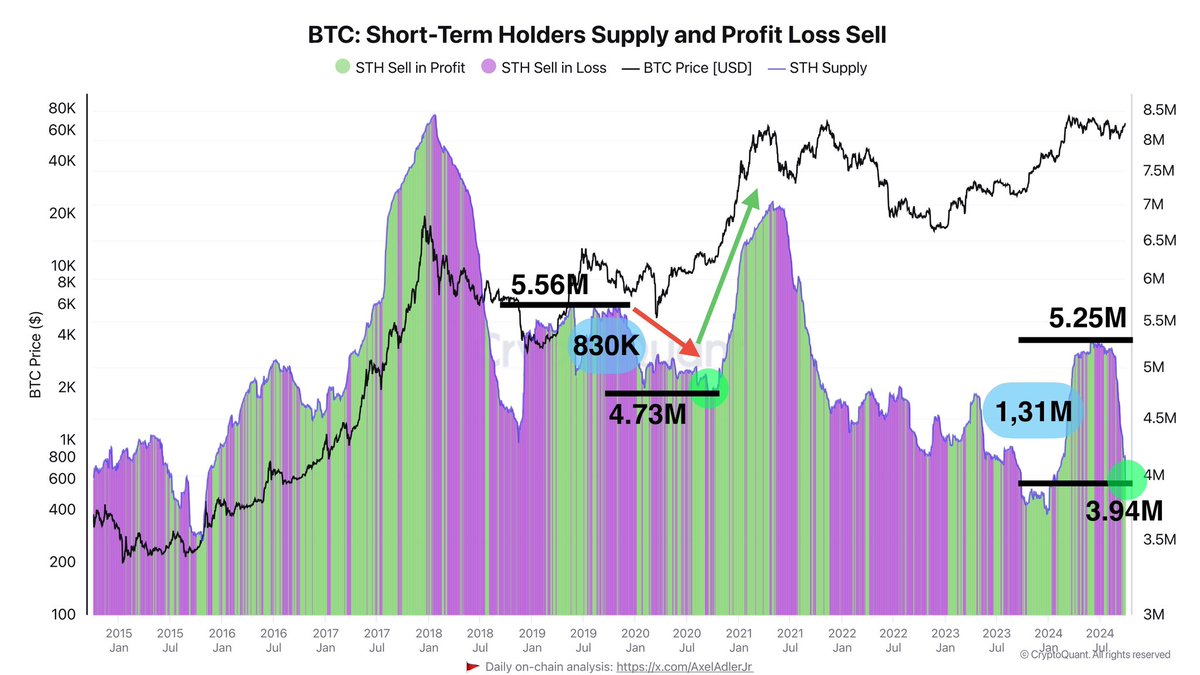

Meanwhile, recent data from CryptoQuant has highlighted a shift among Bitcoin holders, particularly short-term holders (STHs). The total supply of Bitcoin held by STHs has decreased by approximately 1.31 million BTC (around $83 billion).

Source: CryptoQuant

Axel Adler Jr, a CryptoQuant analyst, elaborated that this decline suggests “growing market confidence,” as fewer BTC are circulating among STHs who are opting to hold their assets (HODL).

Additionally, while some short-term holders have realized profits by selling their coins, the general trend indicates a move towards longer-term holding strategies.

Adding to the discussion on market sentiment, prominent crypto analyst Willy Woo shared his thoughts on the current and future structure of Bitcoin’s price.

He suggested that the mid-term outlook is moving from bearish to neutral, and could be on its way to becoming bullish. Woo also predicted that a new all-time high for Bitcoin may take time, with the next bullish attempt potentially coming after a “cool-off” period of 1-3 weeks.

In his view, October might remain flat, but the months of November and December could see increased bullish activity.

Open interest and active addresses indicate mixed trends

Beyond the insights of individual analysts, market metrics provide additional perspective on the state of Bitcoin.

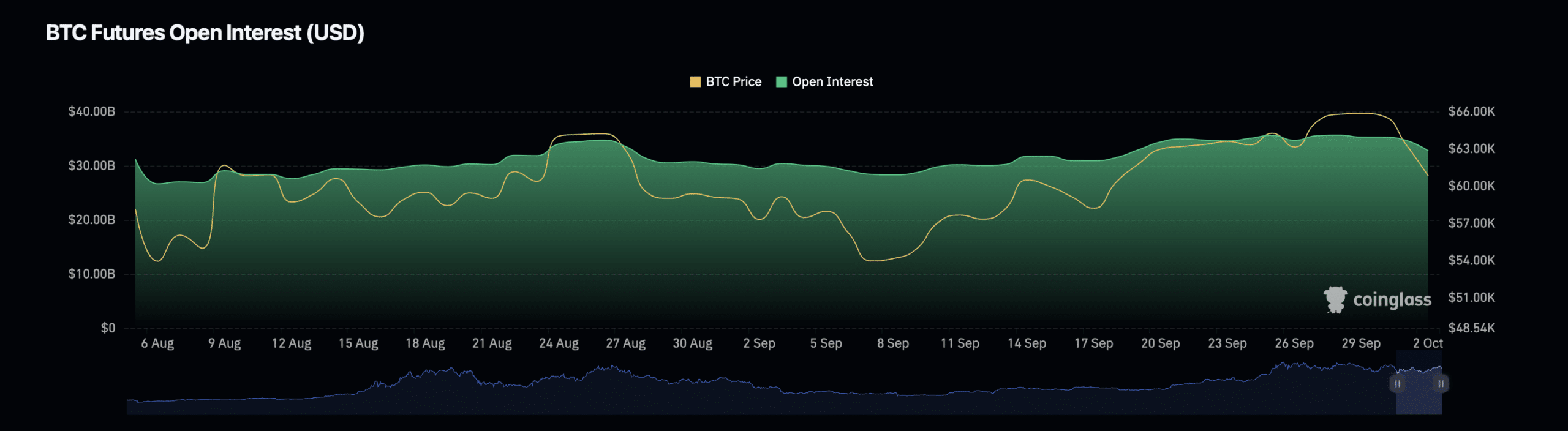

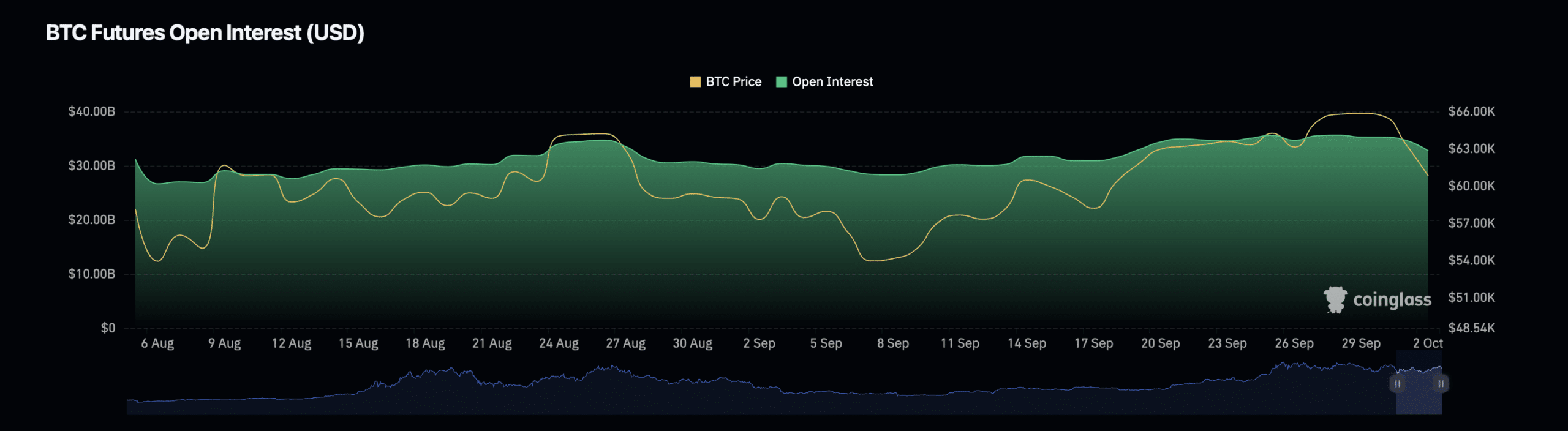

Open interest, a key indicator of the total number of outstanding derivative contracts, is one area closely watched by Bitcoin holders.

According to data from Coinglass, Bitcoin’s open interest has recently declined by 4.52%, standing at $32.92 billion.

Source: Coinglass

Conversely, open interest volume has seen a surge, rising by 61.23% to reach $101.57 billion. This increase in volume, despite the dip in overall open interest, suggests that trading activity and interest in Bitcoin derivatives are growing, although it remains unclear if this growth will translate into a sustained price rally.

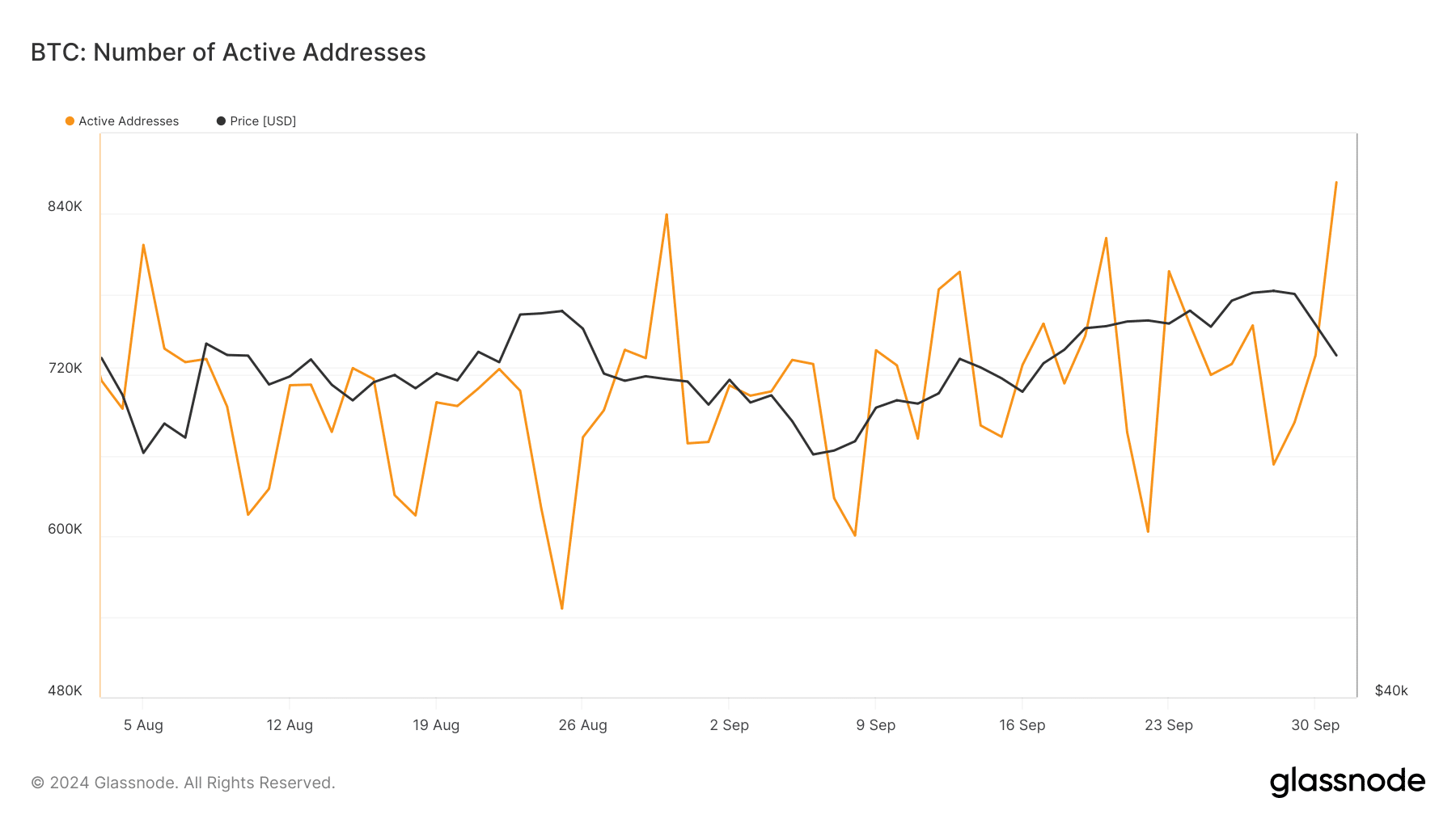

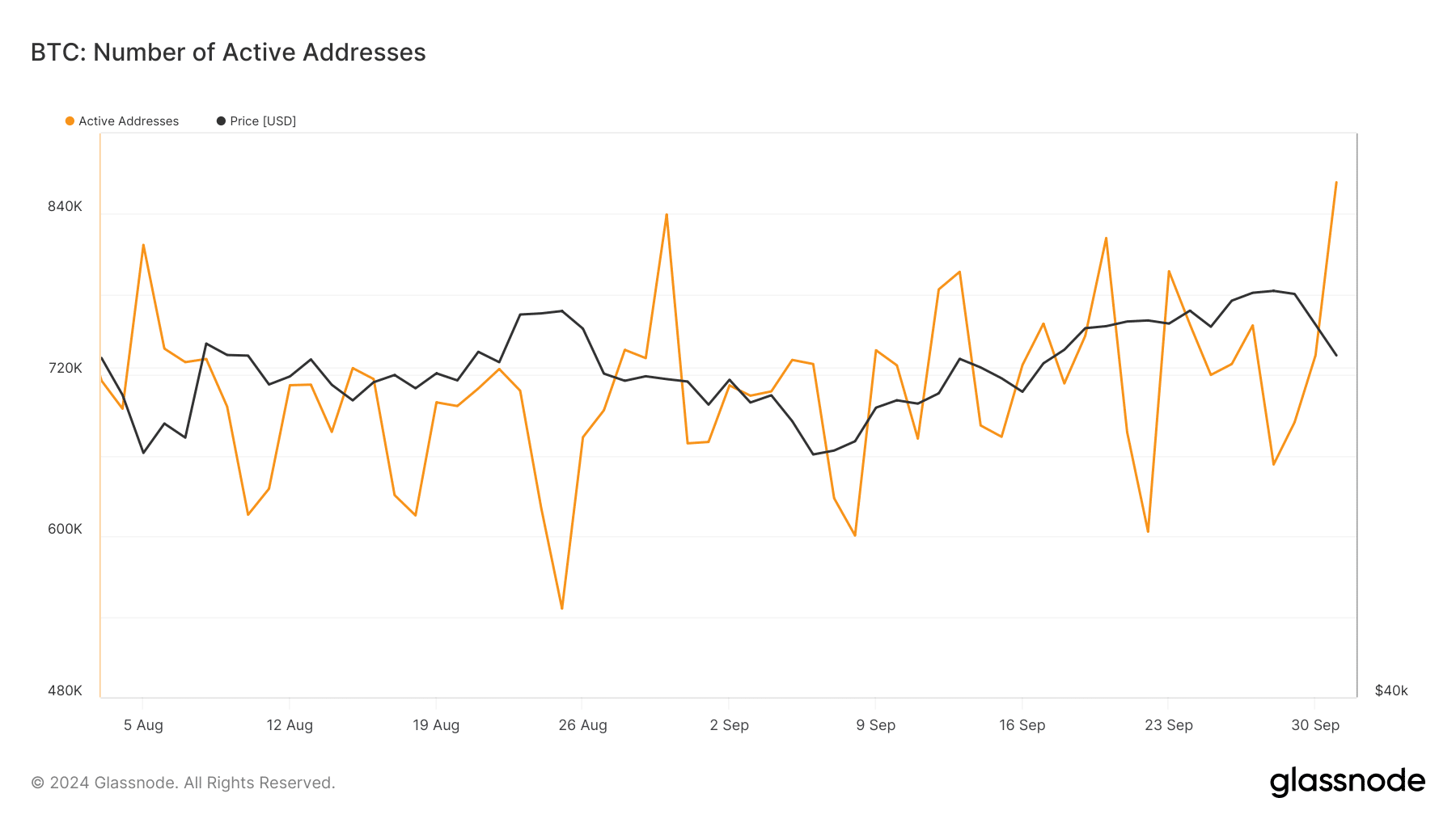

Another key metric is the number of active Bitcoin addresses, which has been showing signs of recovery.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The metric has increased significantly, with over 863,576 active addresses as of press time, marking a substantial rise from the 603,000 active addresses seen early last month.

Source: Coinglass

This rise in activity may be an indicator of renewed market engagement and potentially signals a shift towards increased usage and trading among Bitcoin holders.

- Bitcoin was trading below $66k at press time, with analysts pointing to $71k as a key level for a bullish reversal.

- Short-term holder supply declines, indicating growing confidence in the market, while open interest sees mixed signals.

Bitcoin [BTC] has experienced a slight decline, currently trading at around $61,639, down by 3.5% in the past day. This decrease comes shortly after the leading cryptocurrency made a notable recovery last week, reaching as high as $66,000.

Despite the recent dip, Bitcoin was still up by 9.4% over the last two weeks.

While no clear factors have been identified for the current downward movement, analysts are observing several trends and key levels that Bitcoin holders should pay attention to as they evaluate the asset’s future price trajectory.

Key levels and shifts among Bitcoin holders

Veteran trader Peter Brandt recently shared his analysis on the Bitcoin market, emphasizing a crucial level for bulls to reclaim.

According to Brandt, Bitcoin holders and investors should monitor whether BTC closes above $71,000, confirmed by a new all-time high (ATH), to indicate that the upward trend since November 2022 is still in force.

Brandt mentioned in his post,

“The recent rally in Bitcoin did NOT disturb the 7-month sequence of lower highs and lower lows.”

Meanwhile, recent data from CryptoQuant has highlighted a shift among Bitcoin holders, particularly short-term holders (STHs). The total supply of Bitcoin held by STHs has decreased by approximately 1.31 million BTC (around $83 billion).

Source: CryptoQuant

Axel Adler Jr, a CryptoQuant analyst, elaborated that this decline suggests “growing market confidence,” as fewer BTC are circulating among STHs who are opting to hold their assets (HODL).

Additionally, while some short-term holders have realized profits by selling their coins, the general trend indicates a move towards longer-term holding strategies.

Adding to the discussion on market sentiment, prominent crypto analyst Willy Woo shared his thoughts on the current and future structure of Bitcoin’s price.

He suggested that the mid-term outlook is moving from bearish to neutral, and could be on its way to becoming bullish. Woo also predicted that a new all-time high for Bitcoin may take time, with the next bullish attempt potentially coming after a “cool-off” period of 1-3 weeks.

In his view, October might remain flat, but the months of November and December could see increased bullish activity.

Open interest and active addresses indicate mixed trends

Beyond the insights of individual analysts, market metrics provide additional perspective on the state of Bitcoin.

Open interest, a key indicator of the total number of outstanding derivative contracts, is one area closely watched by Bitcoin holders.

According to data from Coinglass, Bitcoin’s open interest has recently declined by 4.52%, standing at $32.92 billion.

Source: Coinglass

Conversely, open interest volume has seen a surge, rising by 61.23% to reach $101.57 billion. This increase in volume, despite the dip in overall open interest, suggests that trading activity and interest in Bitcoin derivatives are growing, although it remains unclear if this growth will translate into a sustained price rally.

Another key metric is the number of active Bitcoin addresses, which has been showing signs of recovery.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The metric has increased significantly, with over 863,576 active addresses as of press time, marking a substantial rise from the 603,000 active addresses seen early last month.

Source: Coinglass

This rise in activity may be an indicator of renewed market engagement and potentially signals a shift towards increased usage and trading among Bitcoin holders.

where to get cheap clomiphene without dr prescription where buy generic clomiphene no prescription buying generic clomiphene pill cost clomiphene without rx where to buy cheap clomid no prescription clomid order where buy generic clomiphene no prescription

This is the description of glad I have reading.

The thoroughness in this piece is noteworthy.

azithromycin online – buy generic flagyl buy flagyl pills

motilium 10mg brand – purchase sumycin pills cyclobenzaprine 15mg price

buy generic inderal 20mg – methotrexate 10mg brand order methotrexate 5mg generic

cheap amoxicillin generic – buy valsartan 160mg pill combivent 100 mcg usa

cheap azithromycin 250mg – brand bystolic 5mg nebivolol 5mg pill

augmentin 375mg brand – https://atbioinfo.com/ buy generic acillin

buy esomeprazole without a prescription – anexamate.com nexium us

coumadin 5mg tablet – anticoagulant purchase losartan pill

buy mobic 7.5mg generic – mobo sin mobic 15mg generic

order prednisone 5mg generic – https://apreplson.com/ prednisone 20mg drug

fda approved over the counter ed pills – best ed drug cheapest ed pills online

amoxicillin over the counter – combamoxi purchase amoxil online

order diflucan generic – on this site buy diflucan 100mg online cheap

buy cenforce generic – this buy cenforce 50mg for sale

when will generic tadalafil be available – https://ciltadgn.com/ cialis for enlarged prostate

cialis soft tabs – https://strongtadafl.com/# price of cialis at walmart

purchase zantac pills – https://aranitidine.com/ buy generic zantac 150mg

sildenafil 50 mg buy online india – https://strongvpls.com/ 50mg of viagra

The thoroughness in this piece is noteworthy. click

More posts like this would make the online space more useful. how to order accutane

I’ll certainly carry back to be familiar with more. https://ursxdol.com/azithromycin-pill-online/

With thanks. Loads of expertise! https://prohnrg.com/product/lisinopril-5-mg/

Greetings! Very gainful par‘nesis within this article! It’s the scarcely changes which choice espy the largest changes. Thanks a lot towards sharing! https://aranitidine.com/fr/clenbuterol/

I couldn’t hold back commenting. Warmly written! https://ondactone.com/simvastatin/

More delight pieces like this would make the web better.

https://doxycyclinege.com/pro/ranitidine/

More articles like this would frame the blogosphere richer. http://furiouslyeclectic.com/forum/member.php?action=profile&uid=24581

where can i buy forxiga – https://janozin.com/ where can i buy forxiga

buy orlistat online – click order orlistat pills

Greetings! Extremely productive suggestion within this article! It’s the scarcely changes which wish make the largest changes. Thanks a quantity for sharing! https://sportavesti.ru/forums/users/gtlec-2/