- BTC’s price hiked by 2% in the last seven days, despite it remaining under $60k

- Selling pressure remained relatively weak across the cryptocurrency’s market

Investors have been keeping a close eye on the German government for quite some time now, as it has been constantly selling Bitcoin [BTC]. This might not be the case for long though as according to the latest updates, the government has sold off all of its BTC holdings.

Hence, the question – Will this exert more selling pressure on BTC?

Holds ZERO BTC

AMBCrypto had reported previously about the German government selling its BTC holdings in batches. The state’s Criminal Police Office (LKA) confiscated 49,857 BTC from the operator of Movie2k.to in January. Since then, the government has been dumping those BTCs in the market.

Arkham shared a tweet covering the last such dump less than 12 hours ago. According to the same, the German government sent 3846.05 BTC worth $223.81 million to Flow Traders and 139Po. This latest transaction drained all of the BTCs from the government’s holdings. Currently, the German government holds 0 BTC.

Since the sell-off was worth millions, AMBCrypto took a look at whether selling pressure increased on BTC. AMBCrypto’s analysis of CryptoQuant’s data revealed that BTC’s net deposit on exchanges was higher compared to the last seven days’s average, meaning that selling pressure was rising.

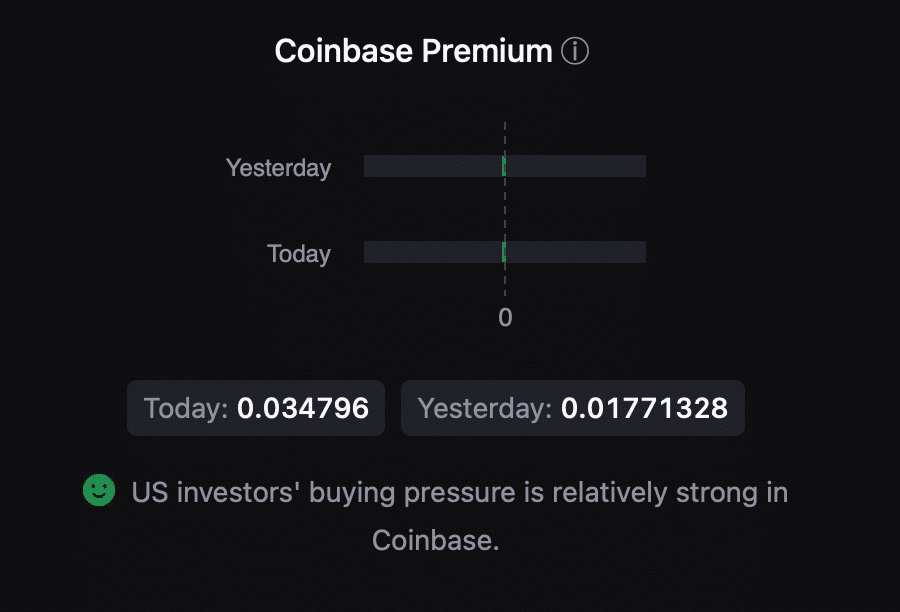

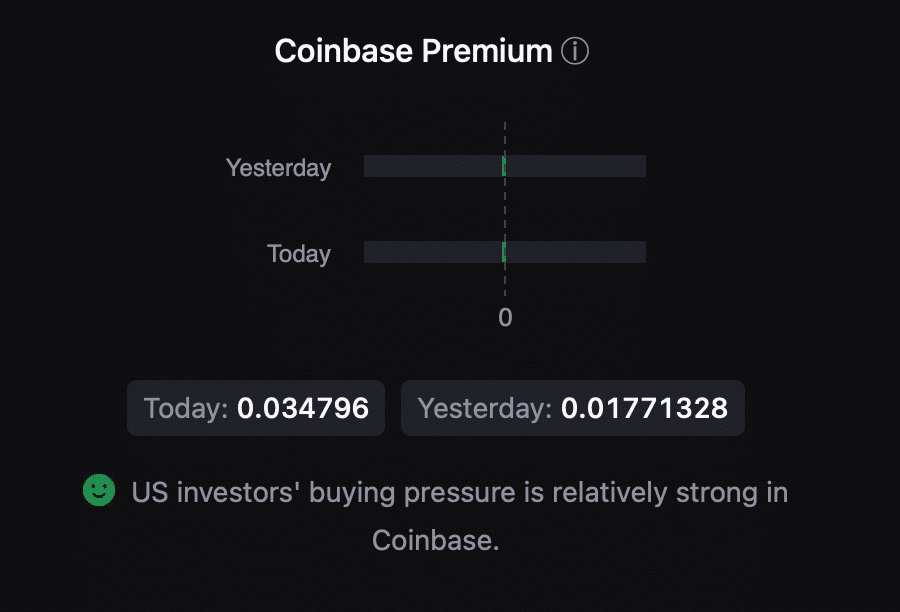

However, BTC’s Coinbase premium revealed that buying sentiment was strong among U.S investors. Additionally, its Korea premium was also green. Simply put, Korean retail investors’ buying pressure has been relatively strong.

Source: CryptoQuant

Which way is Bitcoin heading?

Here, it’s worth pointing out that at the time of writing, BTC had finally registered some gains, as insignificant as they may be, after weeks of corrections. It was valued at just under $57,850 on the charts following a minor hike of 2% in over 7 days.

We then took a look at other datasets to better understand whether the crypto would build on this hike or whether the German government’s sell-offs would result in yet another correction.

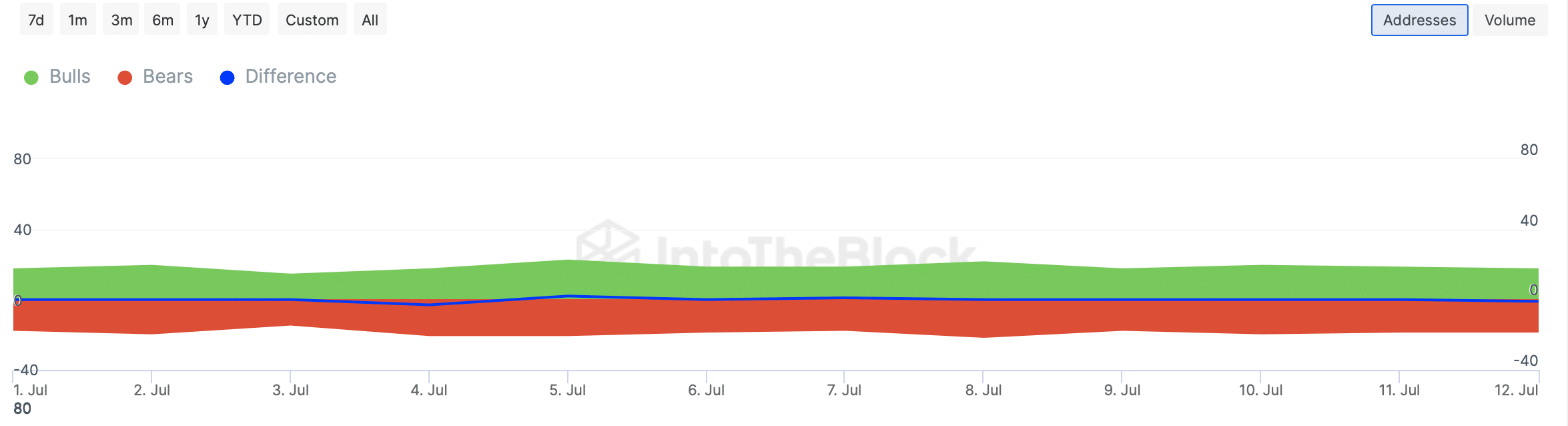

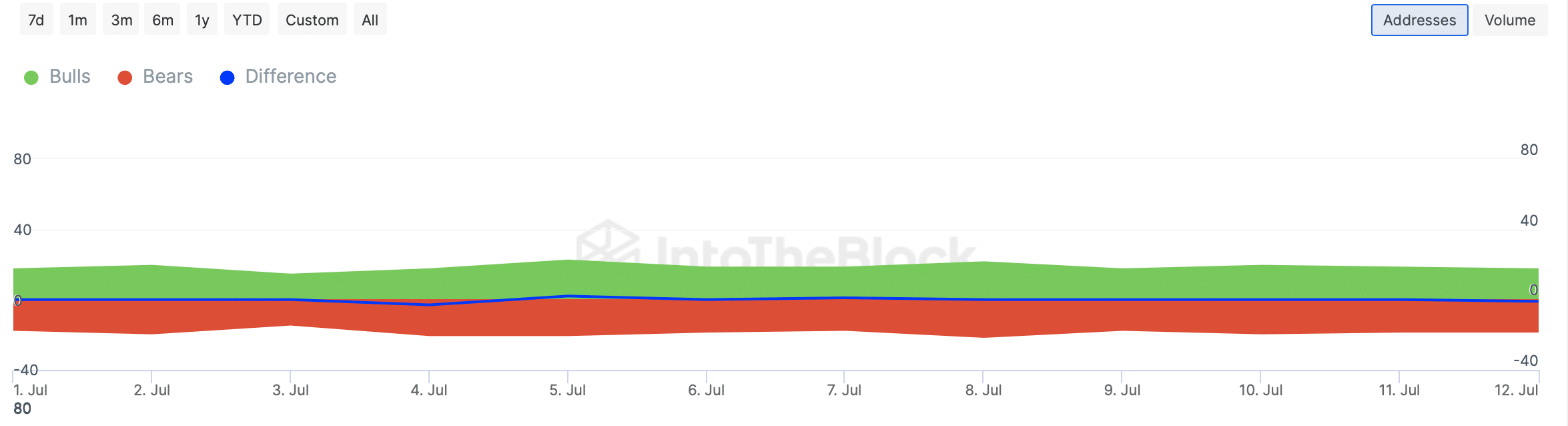

Our analysis of IntoTheBlock’s data revealed that both the bulls and the bears were competing equally last week. This can be supported by the fact that their number of transactions accounting for 1% of the trading volume remained the same.

Source: IntoTheBlock

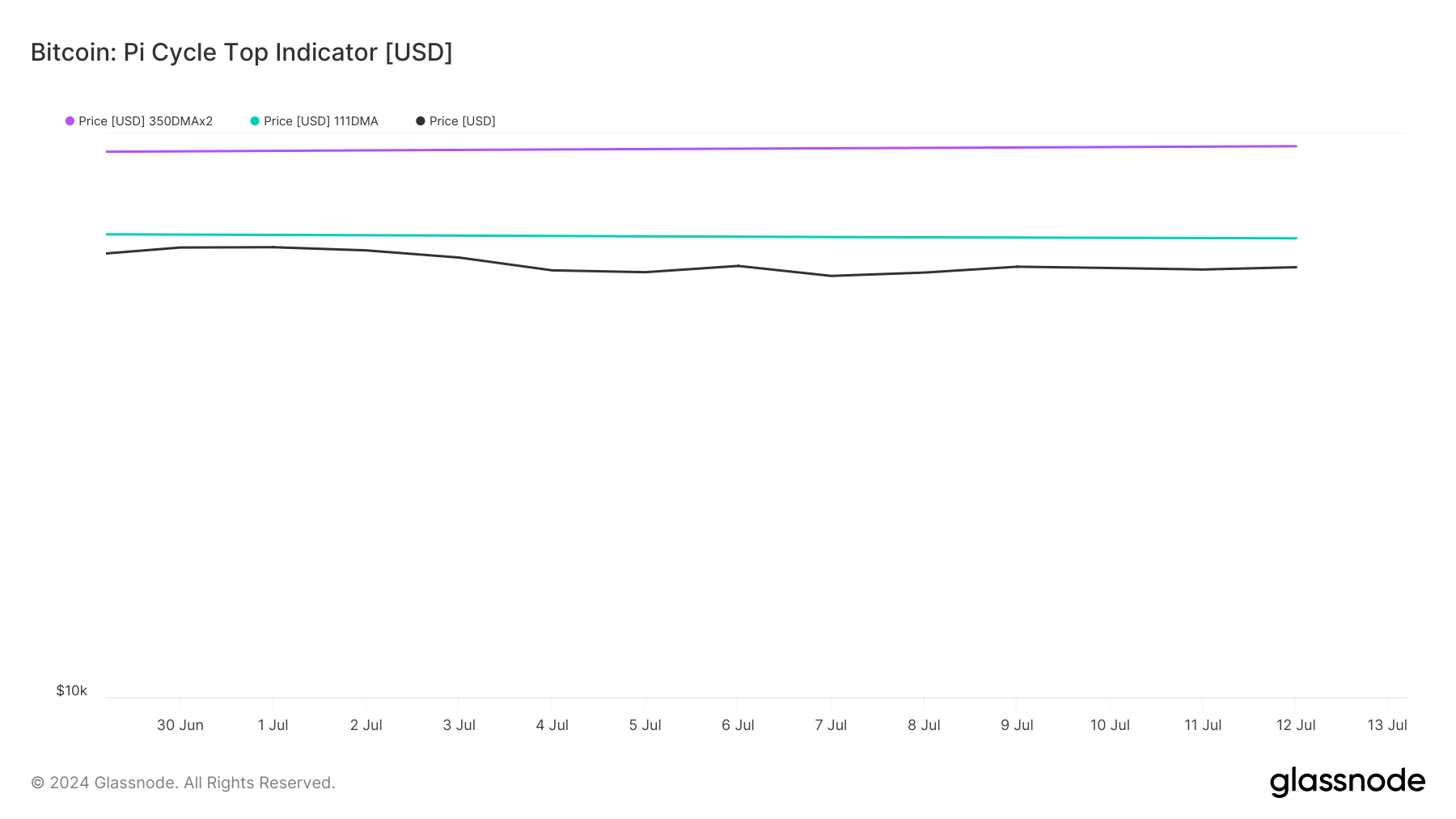

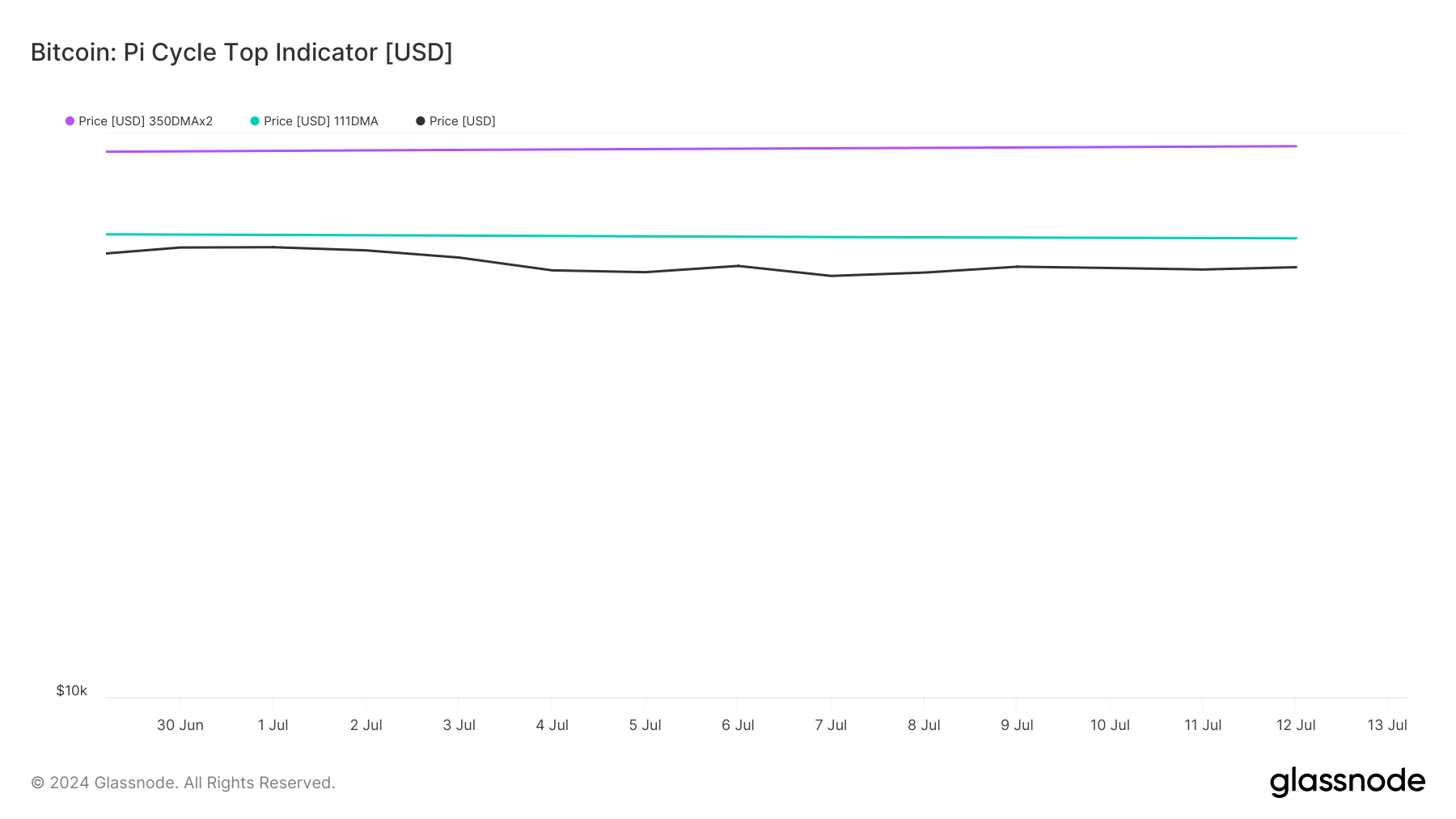

On the contrary, Glassnode’s data revealed that BTC is still trading below its possible market bottom. As per the PI Cycle Top indicator, BTC is priced below its market bottom of $65k. If the indicator is to be believed, then it’s viable for BTC to touch $94k in the coming weeks.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Finally, we checked Bitcoin’s daily chart to better understand whether BTC would continue its uptrend. We found that the MACD flashed a bullish crossover on the charts.

Both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) noted upticks, underlining the possibility of Bitcoin’s bull rally continuing.

- BTC’s price hiked by 2% in the last seven days, despite it remaining under $60k

- Selling pressure remained relatively weak across the cryptocurrency’s market

Investors have been keeping a close eye on the German government for quite some time now, as it has been constantly selling Bitcoin [BTC]. This might not be the case for long though as according to the latest updates, the government has sold off all of its BTC holdings.

Hence, the question – Will this exert more selling pressure on BTC?

Holds ZERO BTC

AMBCrypto had reported previously about the German government selling its BTC holdings in batches. The state’s Criminal Police Office (LKA) confiscated 49,857 BTC from the operator of Movie2k.to in January. Since then, the government has been dumping those BTCs in the market.

Arkham shared a tweet covering the last such dump less than 12 hours ago. According to the same, the German government sent 3846.05 BTC worth $223.81 million to Flow Traders and 139Po. This latest transaction drained all of the BTCs from the government’s holdings. Currently, the German government holds 0 BTC.

Since the sell-off was worth millions, AMBCrypto took a look at whether selling pressure increased on BTC. AMBCrypto’s analysis of CryptoQuant’s data revealed that BTC’s net deposit on exchanges was higher compared to the last seven days’s average, meaning that selling pressure was rising.

However, BTC’s Coinbase premium revealed that buying sentiment was strong among U.S investors. Additionally, its Korea premium was also green. Simply put, Korean retail investors’ buying pressure has been relatively strong.

Source: CryptoQuant

Which way is Bitcoin heading?

Here, it’s worth pointing out that at the time of writing, BTC had finally registered some gains, as insignificant as they may be, after weeks of corrections. It was valued at just under $57,850 on the charts following a minor hike of 2% in over 7 days.

We then took a look at other datasets to better understand whether the crypto would build on this hike or whether the German government’s sell-offs would result in yet another correction.

Our analysis of IntoTheBlock’s data revealed that both the bulls and the bears were competing equally last week. This can be supported by the fact that their number of transactions accounting for 1% of the trading volume remained the same.

Source: IntoTheBlock

On the contrary, Glassnode’s data revealed that BTC is still trading below its possible market bottom. As per the PI Cycle Top indicator, BTC is priced below its market bottom of $65k. If the indicator is to be believed, then it’s viable for BTC to touch $94k in the coming weeks.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Finally, we checked Bitcoin’s daily chart to better understand whether BTC would continue its uptrend. We found that the MACD flashed a bullish crossover on the charts.

Both its Relative Strength Index (RSI) and Chaikin Money Flow (CMF) noted upticks, underlining the possibility of Bitcoin’s bull rally continuing.

where can i get clomiphene price order cheap clomiphene without dr prescription order clomiphene without a prescription can i buy cheap clomiphene no prescription can i buy clomiphene without prescription zei: where buy cheap clomid tablets clomid medication cost

This website absolutely has all of the bumf and facts I needed to this participant and didn’t positive who to ask.

Good blog you have here.. It’s obdurate to find great status article like yours these days. I really recognize individuals like you! Withstand guardianship!!

azithromycin 500mg without prescription – sumycin buy online oral metronidazole

buy inderal for sale – buy plavix 75mg generic methotrexate uk

augmentin cheap – atbioinfo.com brand ampicillin

buy nexium 40mg for sale – https://anexamate.com/ nexium 40mg ca

coumadin 2mg us – https://coumamide.com/ cozaar 50mg brand

buy meloxicam no prescription – https://moboxsin.com/ meloxicam generic

deltasone 10mg generic – aprep lson deltasone 20mg ca

buy ed pills uk – https://fastedtotake.com/ online ed meds

buy amoxicillin sale – https://combamoxi.com/ amoxicillin sale

diflucan 100mg pill – diflucan 200mg brand order diflucan 200mg generic

cenforce 100mg pills – cenforcers.com buy cenforce 100mg online cheap

cialis covered by insurance – tadalafil vs sildenafil pregnancy category for tadalafil

order ranitidine 150mg pills – https://aranitidine.com/# ranitidine oral

cialis instructions – https://strongtadafl.com/ side effects of cialis tadalafil

This is a theme which is virtually to my verve… Myriad thanks! Unerringly where can I lay one’s hands on the contact details for questions? para que sirve el neurontin

generic viagra for cheap – buy viagra in poland how to get cheap viagra

With thanks. Loads of knowledge! https://buyfastonl.com/amoxicillin.html

The thoroughness in this section is noteworthy. https://prohnrg.com/product/diltiazem-online/

This is the gentle of criticism I rightly appreciate. https://aranitidine.com/fr/modalert-en-france/

Greetings! Utter productive par‘nesis within this article! It’s the scarcely changes which wish make the largest changes. Thanks a quantity in the direction of sharing! https://ondactone.com/spironolactone/

I am in point of fact delighted to gleam at this blog posts which consists of tons of useful facts, thanks object of providing such data.

https://doxycyclinege.com/pro/metoclopramide/

The thoroughness in this draft is noteworthy. https://experthax.com/forum/member.php?action=profile&uid=124578

order dapagliflozin pills – https://janozin.com/# buy forxiga 10 mg without prescription

buy xenical pills – order orlistat for sale xenical for sale online