- Gemini appears to be building a huge altcoin stash dominated by ETH

- Is it a signal of early positioning for a likely 2025 altcoin rally?

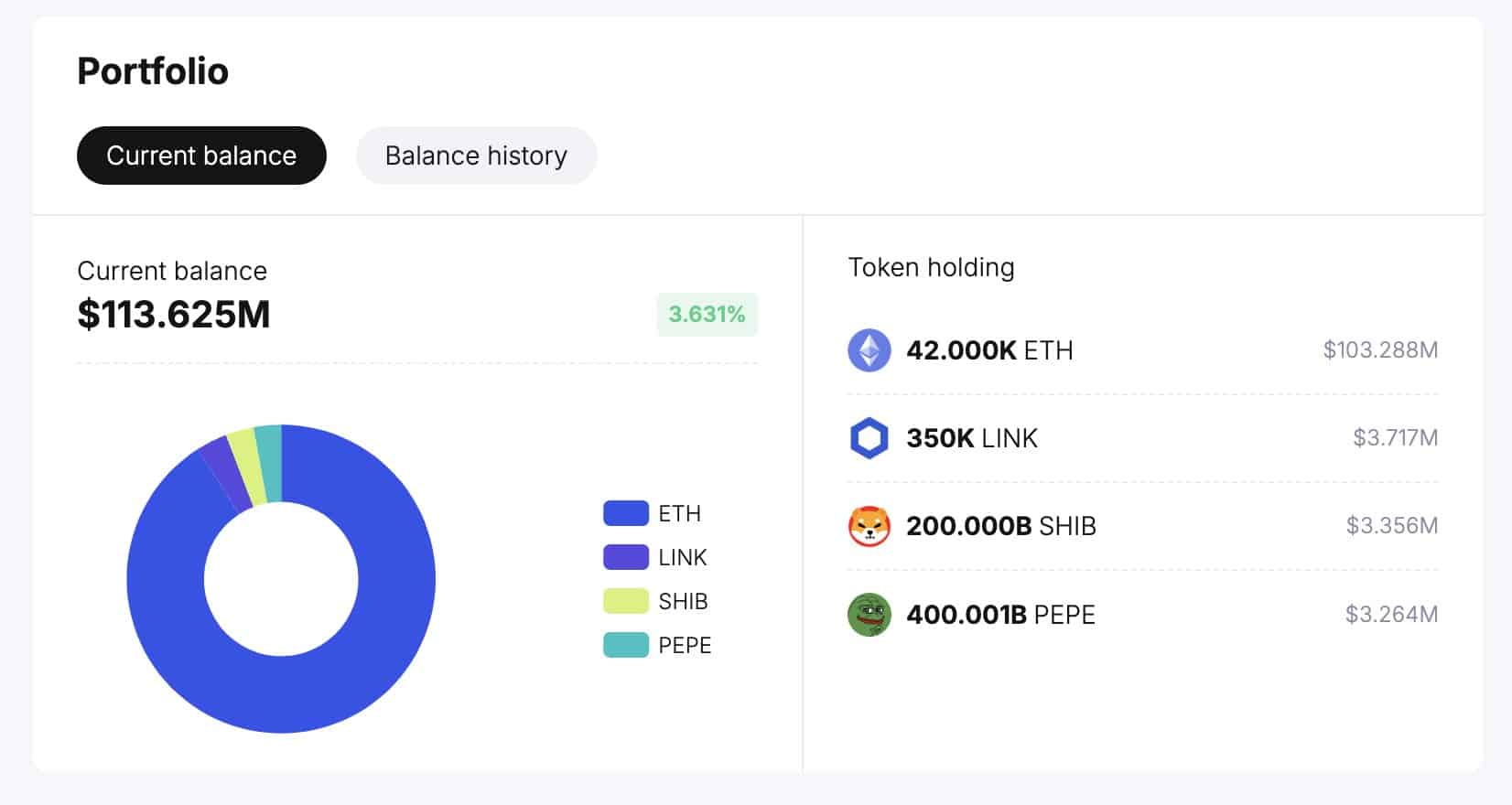

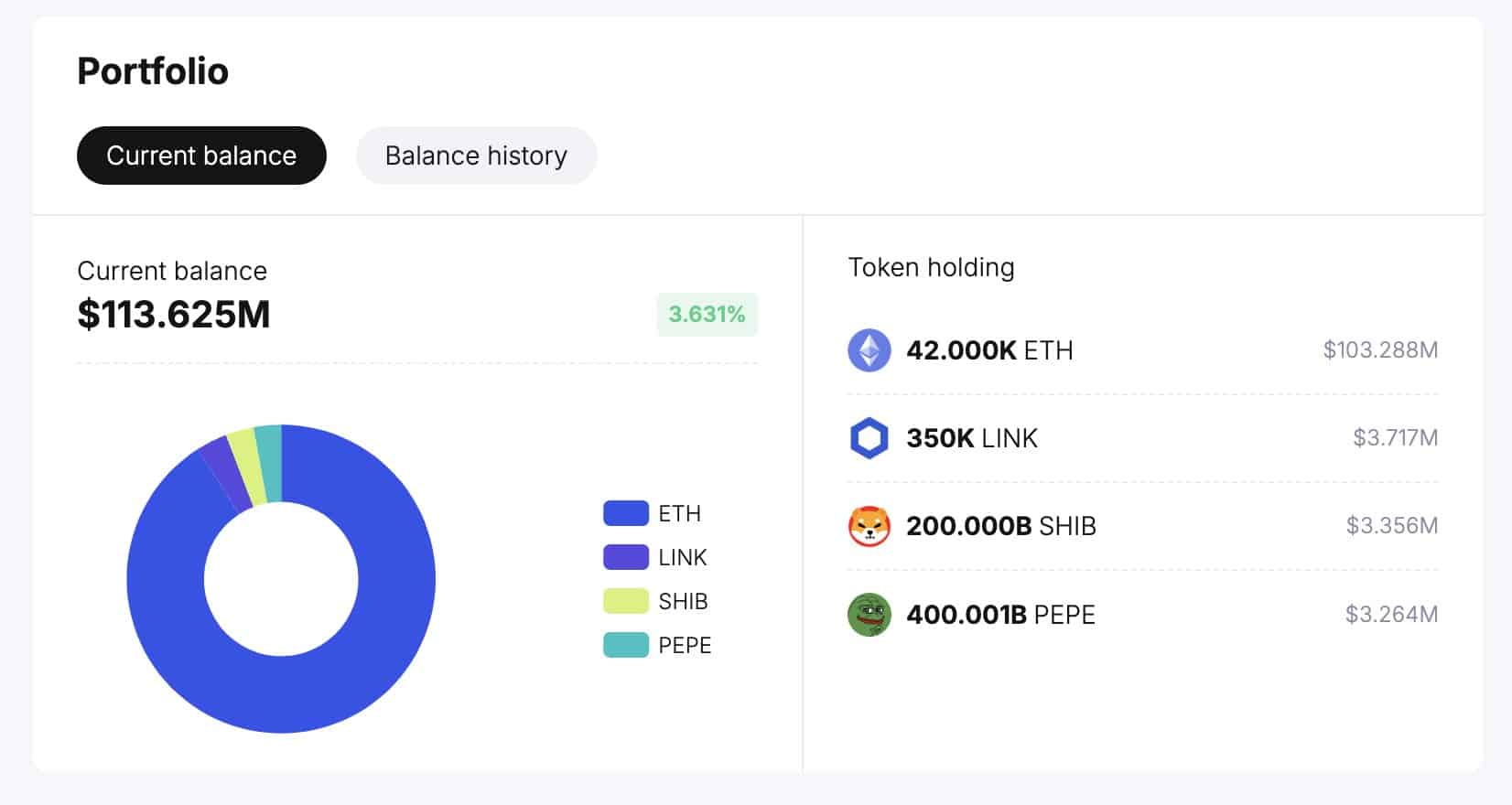

Gemini exchange has accumulated nearly $120 million worth of altcoins, including Ethereum [ETH], Chainlink [LINK] and memecoins like Shiba Inu [SHIB] and Pepe [PEPE].

According to Spot On Chain, ETH dominated Gemini’s altcoin stash, with the exchange scooping a whopping $103 million in the last 18 days.

Source: Spot On Chain

As expected, this massive altcoin buying spree has raised the question – Is the exchange or its top clients preparing for the much-awaited altcoin season?

Is an altcoin rally likely in 2025?

Most analysts seemed to be looking forward to the start of the Fed easing cycle as a likely trigger for the altcoin season run-up.

Well, there was momentum among some altcoins from September, as some posted double-digit recovery gains. However, the positive results weren’t consistent across the entire altcoin market.

The recent surge in Bitcoin’s dominance to a new high of 60% could further delay the expected altcoin rally in 2024. According to some market observers, a likely altcoin run-up might be attempted in early 2025.

Benjamin Cowen, a popular market analyst, echoed a similar sentiment. Based on historical trends, Cowen claimed that altcoins could weaken further towards the end of 2024 and attempt a rebound in 2025. He said,

“The altcoin reckoning should be over by December 2024 (2nd week of January 2025 at the latest).”

Source: Cowen

If so, the ongoing weakening among high-quality altcoins could offer great discounted buys to maximize the likely altcoin run in 2025.

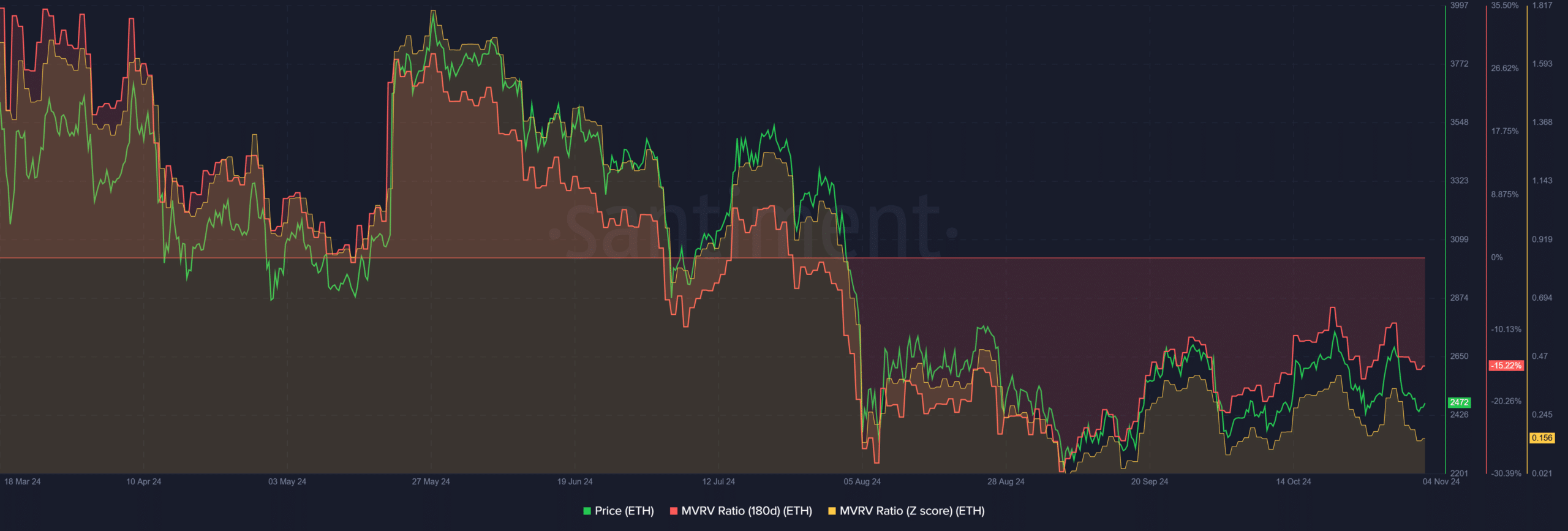

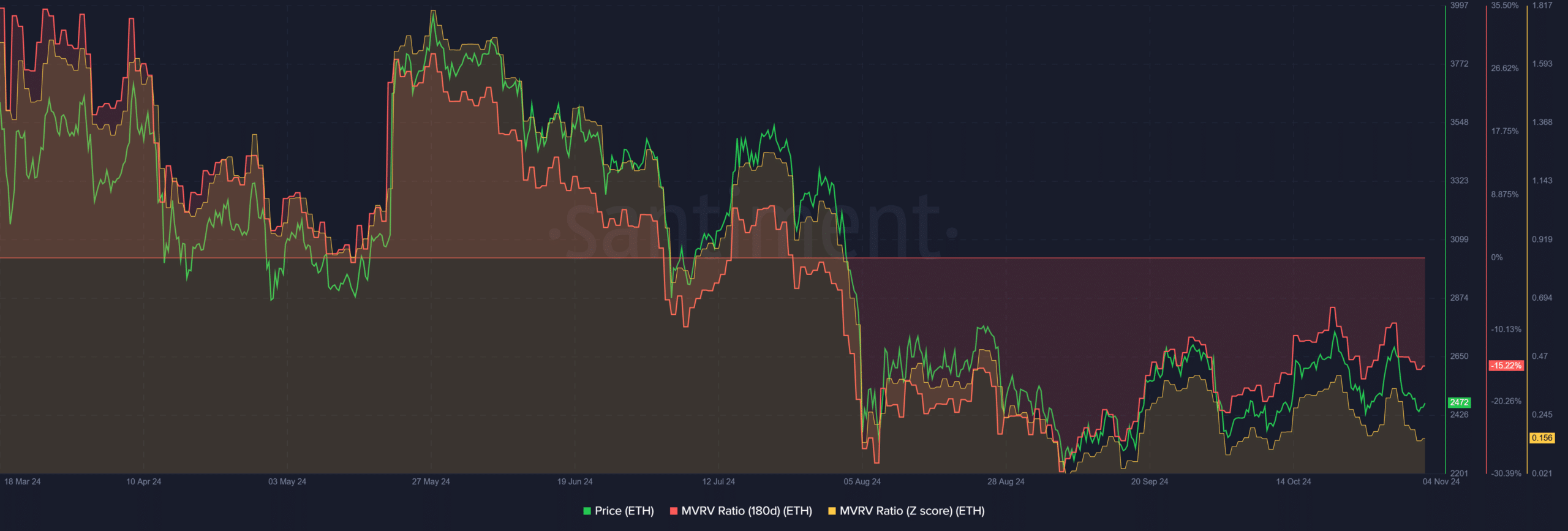

Interestingly, the select altcoins that Gemini massively accumulated showed irresistible discounts. For example, ETH seems to be grossly undervalued, as indicated by the negative MVRV (Market Value to Realized Value) and MVRV Z score readings.

Source: Santiment

The metric gauges the asset’s press time price against the average cost of all acquired assets.

A higher value indicates “overvalued” as more holders are in profit and can sell. On the contrary, negative readings suggest “undervaluation.”

Read Ethereum [ETH] Price Prediction 2024-2025

The press time ETH readings were -15% for the 180-day MVRV and yearly lows for the MVRV Z score. This implied that ETH may be relatively undervalued or “cheap” at its current prices.

In fact, analyst Ali Martinez also highlighted the great risk-reward ratio ETH could offer if it defends the $2,400 support and hits $6k.

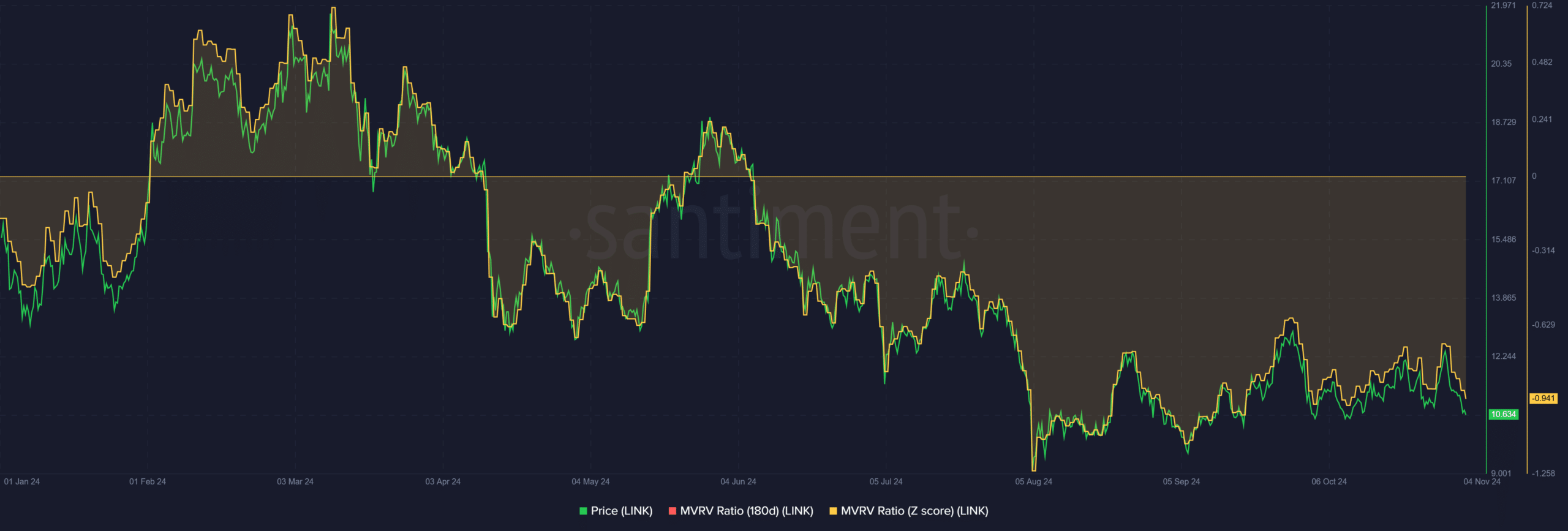

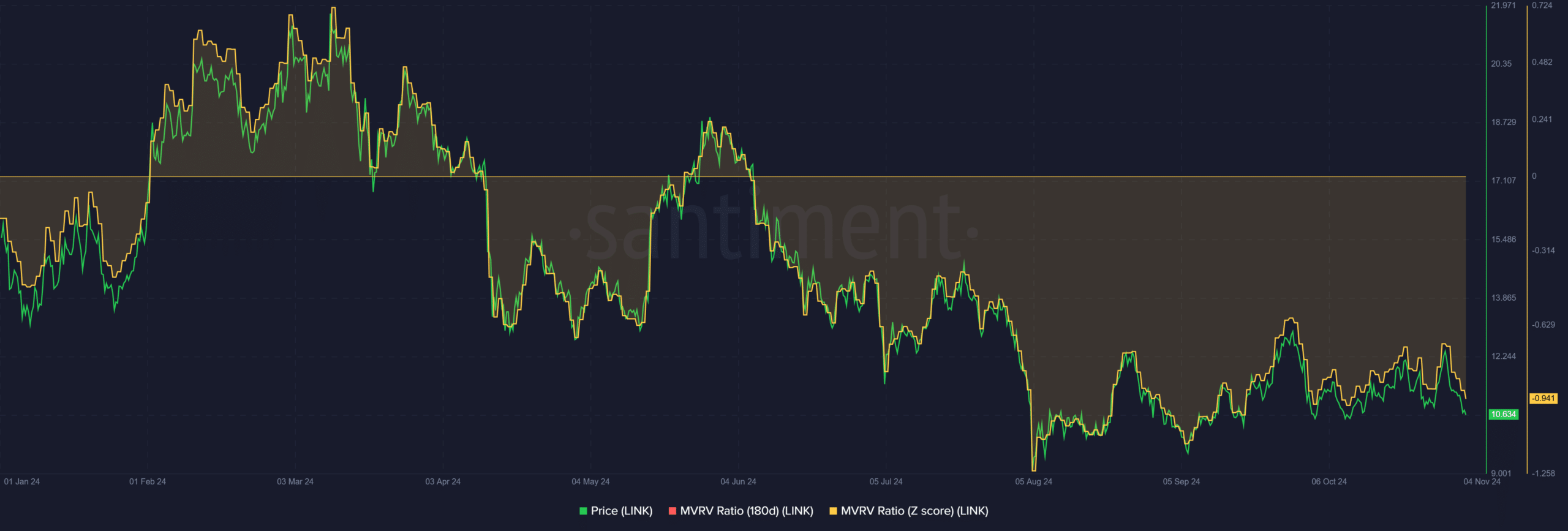

Source: Santiment

Similarly, LINK was relatively cheap too, given its negative MVRV Z score reading. In short, if the 2025 altcoin rally plays out as projected, the top altcoins in Gemini’s stash could offer asymmetric rewards.

- Gemini appears to be building a huge altcoin stash dominated by ETH

- Is it a signal of early positioning for a likely 2025 altcoin rally?

Gemini exchange has accumulated nearly $120 million worth of altcoins, including Ethereum [ETH], Chainlink [LINK] and memecoins like Shiba Inu [SHIB] and Pepe [PEPE].

According to Spot On Chain, ETH dominated Gemini’s altcoin stash, with the exchange scooping a whopping $103 million in the last 18 days.

Source: Spot On Chain

As expected, this massive altcoin buying spree has raised the question – Is the exchange or its top clients preparing for the much-awaited altcoin season?

Is an altcoin rally likely in 2025?

Most analysts seemed to be looking forward to the start of the Fed easing cycle as a likely trigger for the altcoin season run-up.

Well, there was momentum among some altcoins from September, as some posted double-digit recovery gains. However, the positive results weren’t consistent across the entire altcoin market.

The recent surge in Bitcoin’s dominance to a new high of 60% could further delay the expected altcoin rally in 2024. According to some market observers, a likely altcoin run-up might be attempted in early 2025.

Benjamin Cowen, a popular market analyst, echoed a similar sentiment. Based on historical trends, Cowen claimed that altcoins could weaken further towards the end of 2024 and attempt a rebound in 2025. He said,

“The altcoin reckoning should be over by December 2024 (2nd week of January 2025 at the latest).”

Source: Cowen

If so, the ongoing weakening among high-quality altcoins could offer great discounted buys to maximize the likely altcoin run in 2025.

Interestingly, the select altcoins that Gemini massively accumulated showed irresistible discounts. For example, ETH seems to be grossly undervalued, as indicated by the negative MVRV (Market Value to Realized Value) and MVRV Z score readings.

Source: Santiment

The metric gauges the asset’s press time price against the average cost of all acquired assets.

A higher value indicates “overvalued” as more holders are in profit and can sell. On the contrary, negative readings suggest “undervaluation.”

Read Ethereum [ETH] Price Prediction 2024-2025

The press time ETH readings were -15% for the 180-day MVRV and yearly lows for the MVRV Z score. This implied that ETH may be relatively undervalued or “cheap” at its current prices.

In fact, analyst Ali Martinez also highlighted the great risk-reward ratio ETH could offer if it defends the $2,400 support and hits $6k.

Source: Santiment

Similarly, LINK was relatively cheap too, given its negative MVRV Z score reading. In short, if the 2025 altcoin rally plays out as projected, the top altcoins in Gemini’s stash could offer asymmetric rewards.

where to get generic clomiphene without dr prescription where to get generic clomiphene without prescription can i order generic clomid without insurance where can i get clomiphene tablets where to get cheap clomid buy cheap clomiphene tablets can i get clomiphene without insurance

I am in fact thrilled to glance at this blog posts which consists of tons of worthwhile facts, thanks representing providing such data.

I am in fact thrilled to glance at this blog posts which consists of tons of useful facts, thanks towards providing such data.

how to buy zithromax – floxin ca buy flagyl pills for sale

buy semaglutide 14 mg – periactin usa order cyproheptadine 4 mg pill

order domperidone 10mg generic – buy cheap cyclobenzaprine purchase cyclobenzaprine online cheap

inderal oral – buy clopidogrel 75mg order methotrexate 2.5mg

buy amoxil without a prescription – ipratropium 100 mcg generic combivent over the counter

buy zithromax 250mg sale – azithromycin us generic nebivolol 20mg

augmentin ca – https://atbioinfo.com/ buy ampicillin online

esomeprazole 20mg pills – https://anexamate.com/ esomeprazole 40mg oral

order generic warfarin – https://coumamide.com/ hyzaar over the counter

buy deltasone 5mg generic – https://apreplson.com/ order prednisone 10mg sale

cheap erectile dysfunction – https://fastedtotake.com/ best male ed pills

purchase amoxicillin generic – https://combamoxi.com/ amoxicillin cost

diflucan 100mg for sale – fluconazole ca diflucan 100mg for sale

buy escitalopram 10mg pill – escitalopram 20mg for sale order generic escitalopram 10mg

buy cenforce without prescription – https://cenforcers.com/ buy cenforce 50mg sale

cialis dosages – https://ciltadgn.com/# where can i buy cialis online

cialis free trial canada – us pharmacy prices for cialis buy cialis online no prescription

oral ranitidine – this buy zantac online cheap

is it legal to order viagra from canadian – https://strongvpls.com/# viagra buy pakistan

This is the description of serenity I get high on reading. buy tamoxifen generic

This is the make of enter I recoup helpful. https://buyfastonl.com/

This is the make of delivery I turn up helpful. https://ursxdol.com/amoxicillin-antibiotic/

This is the gentle of writing I rightly appreciate. https://prohnrg.com/product/atenolol-50-mg-online/

I’ll certainly bring to read more. https://aranitidine.com/fr/ivermectine-en-france/