- Galaxy Digital purchases $23.4 million worth of BTC.

- Institutional investment sees Bitwise expand to European market.

Throughout the year, corporate Bitcoin [BTC] holders have been on a buying spree. Since the launch of BTC spot ETFs and a price spike to a record high, companies have tried to accumulate the king coin further.

In recent developments, Galaxy Digital has purchased 400 BTC.

Galaxy Digital purchases $23.4M worth of BTC

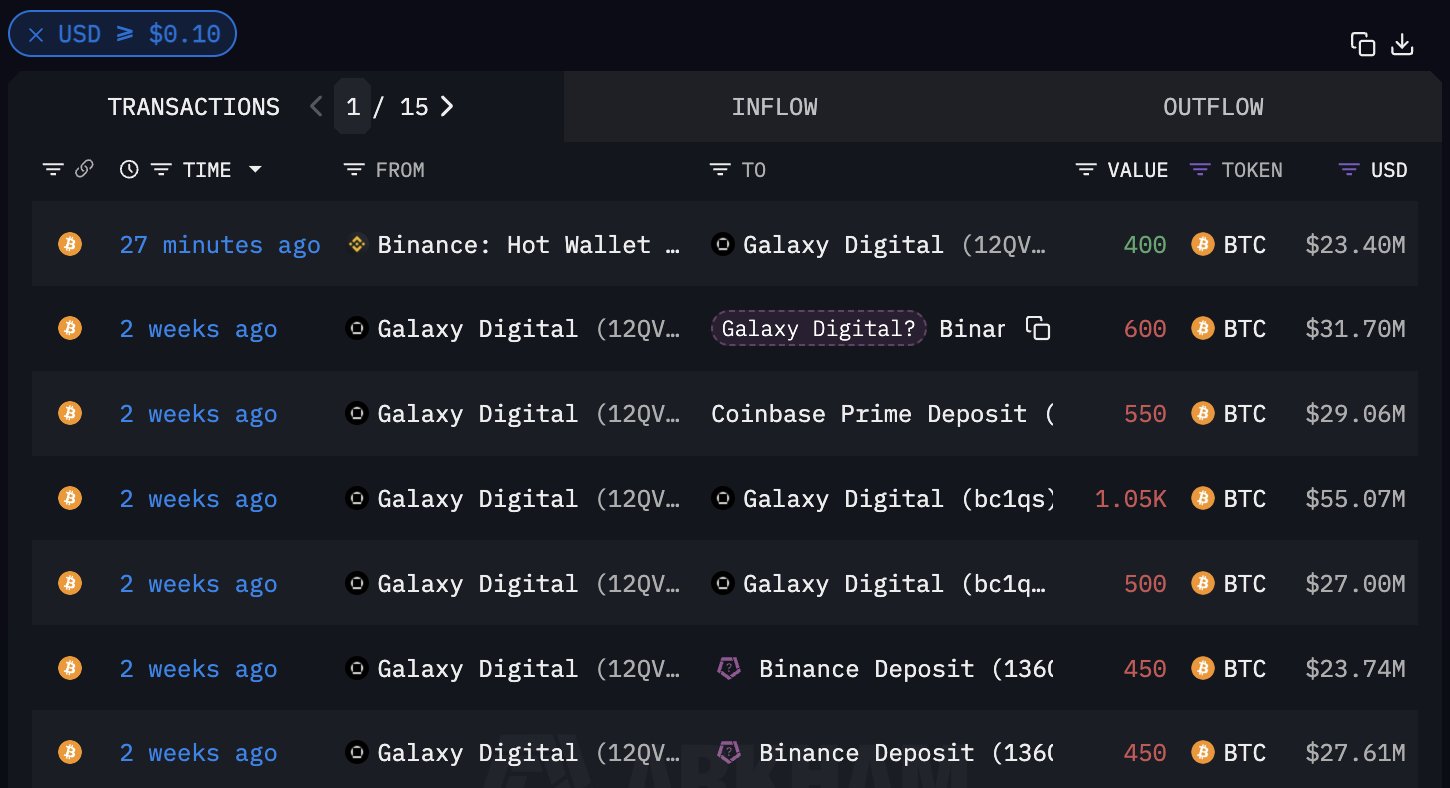

According to a report from Arkham Intelligence, the asset manager’s wallet 12QVsf received 400 BTC from Binance.

Based on market rates, the purchase was worth $23.4 million. The transaction was reported by On-chain analyst ai_9684xtpa through the X page, noting that,

“Galaxy Digital ( @galaxyhq) is suspected to have increased its holdings by 400 BTC half an hour ago, worth 23.4 million US dollars.”

Source: X

The recent purchase suggests the company’s shift in its investment strategy, especially when the crypto market is experiencing extreme volatility.

Galaxy Digital’s BTC Strategy

Galaxy Digital’s move to bolster its holdings arises when it has been on a selling spree. According to the On-chain analyst report, the firm has recently made major sales. Through X, ai_9684xtpa reported that,

“The agency has withdrawn a total of 6,950 BTC from #Binance between 07.27 and 08.02, with a value of up to 464 million US dollars and an average price of $66,776.Then, in the week from 08.03 to 08.06, another 2050 coins (about 112 million US dollars) were recharged to the exchange. If they were sold, they would lose 24.78 million US dollars.”

Galaxy Digital has a unique approach to Bitcoin as it makes sales without capitalizing on favorable market conditions. The company’s approach to BTC is broadly dynamic as it sells and then purchases.

The company employs an acquisition and redistribution strategy for its Bitcoin holding. Therefore, the recent acquisition shows the firm’s confidence in the long-term value of the crypto.

What it Means for BTC?

The latest move by Galaxy Digital reflects the broader market sentiment of institutions. Institutional investors have increased their investment in Bitcoin.

As reported earlier by AMBCrypto, BTC corporate holders such as Marathon, Microstrategy and Metaplanet have all shifted to accumulation. Therefore, institutions are staking on BTC future value with increased buying activities, further driving BTC prices up.

Bitwise expands in Europe with ETC Group

Galaxy Digital’s recent purchase follows the overall market interest on the crypto market among major companies. For instance, Bitwise has made a huge move by expanding its operations within the European market.

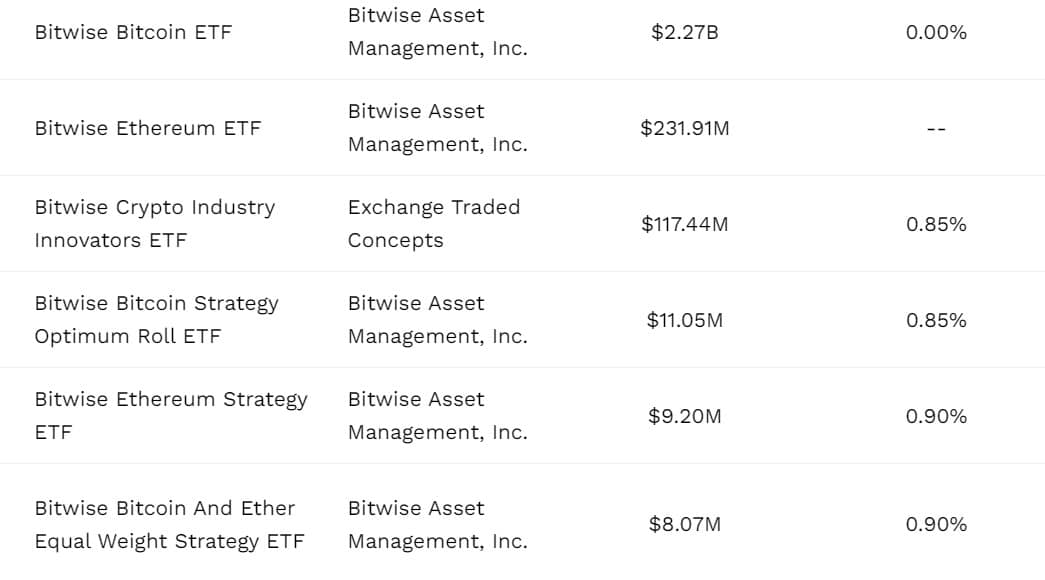

The San Francisco-based asset manager Bitwise has announced the purchase of ETC Group, a London-based crypto ETP issuer. ETC Group is a major crypto asset manager with more than $1 billion in assets under management.

Therefore, the purchase marks Bitwise’s expansion into Europe, adding 9 European-listed Crypto ETPs to its suite of ETPs.

Source: ETFs.com

- Galaxy Digital purchases $23.4 million worth of BTC.

- Institutional investment sees Bitwise expand to European market.

Throughout the year, corporate Bitcoin [BTC] holders have been on a buying spree. Since the launch of BTC spot ETFs and a price spike to a record high, companies have tried to accumulate the king coin further.

In recent developments, Galaxy Digital has purchased 400 BTC.

Galaxy Digital purchases $23.4M worth of BTC

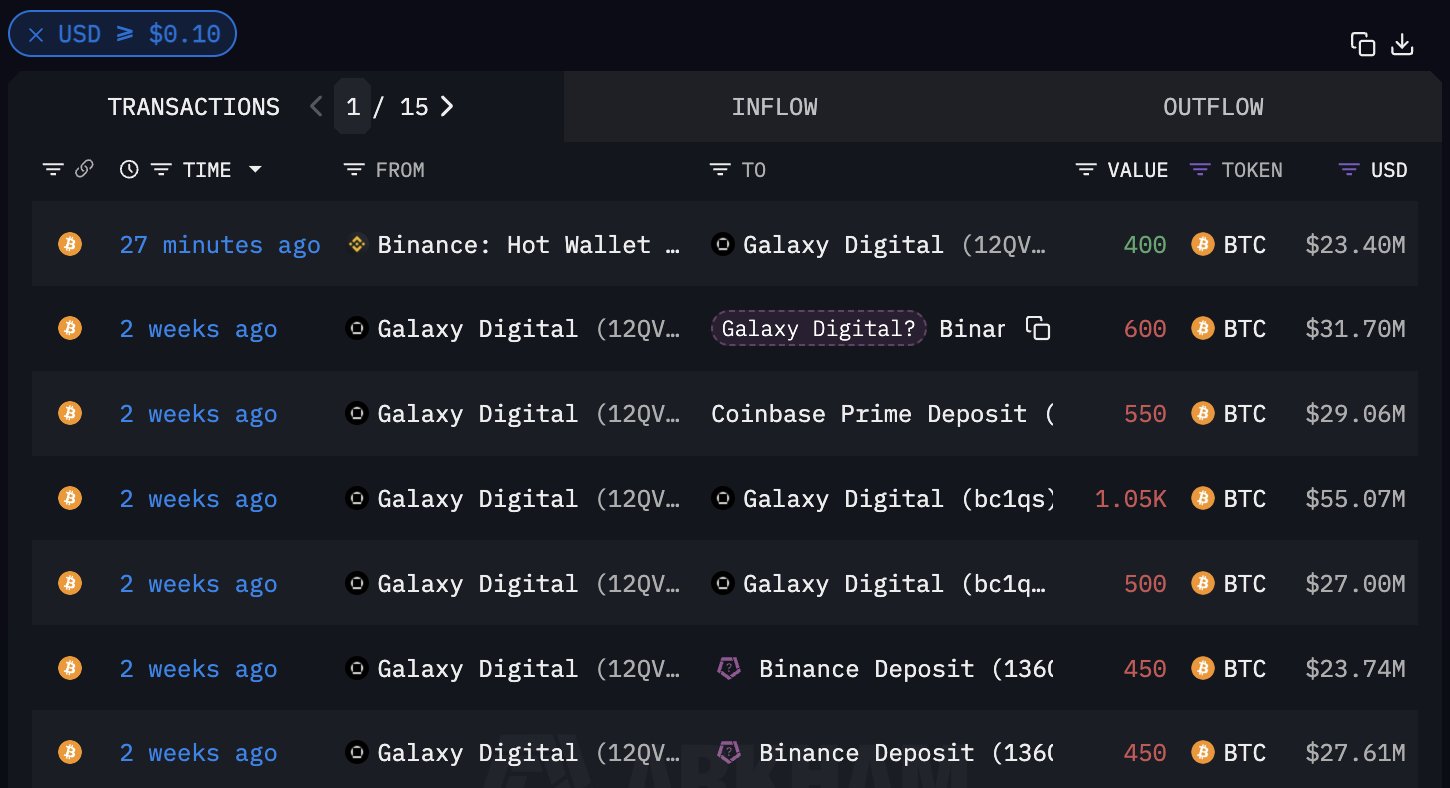

According to a report from Arkham Intelligence, the asset manager’s wallet 12QVsf received 400 BTC from Binance.

Based on market rates, the purchase was worth $23.4 million. The transaction was reported by On-chain analyst ai_9684xtpa through the X page, noting that,

“Galaxy Digital ( @galaxyhq) is suspected to have increased its holdings by 400 BTC half an hour ago, worth 23.4 million US dollars.”

Source: X

The recent purchase suggests the company’s shift in its investment strategy, especially when the crypto market is experiencing extreme volatility.

Galaxy Digital’s BTC Strategy

Galaxy Digital’s move to bolster its holdings arises when it has been on a selling spree. According to the On-chain analyst report, the firm has recently made major sales. Through X, ai_9684xtpa reported that,

“The agency has withdrawn a total of 6,950 BTC from #Binance between 07.27 and 08.02, with a value of up to 464 million US dollars and an average price of $66,776.Then, in the week from 08.03 to 08.06, another 2050 coins (about 112 million US dollars) were recharged to the exchange. If they were sold, they would lose 24.78 million US dollars.”

Galaxy Digital has a unique approach to Bitcoin as it makes sales without capitalizing on favorable market conditions. The company’s approach to BTC is broadly dynamic as it sells and then purchases.

The company employs an acquisition and redistribution strategy for its Bitcoin holding. Therefore, the recent acquisition shows the firm’s confidence in the long-term value of the crypto.

What it Means for BTC?

The latest move by Galaxy Digital reflects the broader market sentiment of institutions. Institutional investors have increased their investment in Bitcoin.

As reported earlier by AMBCrypto, BTC corporate holders such as Marathon, Microstrategy and Metaplanet have all shifted to accumulation. Therefore, institutions are staking on BTC future value with increased buying activities, further driving BTC prices up.

Bitwise expands in Europe with ETC Group

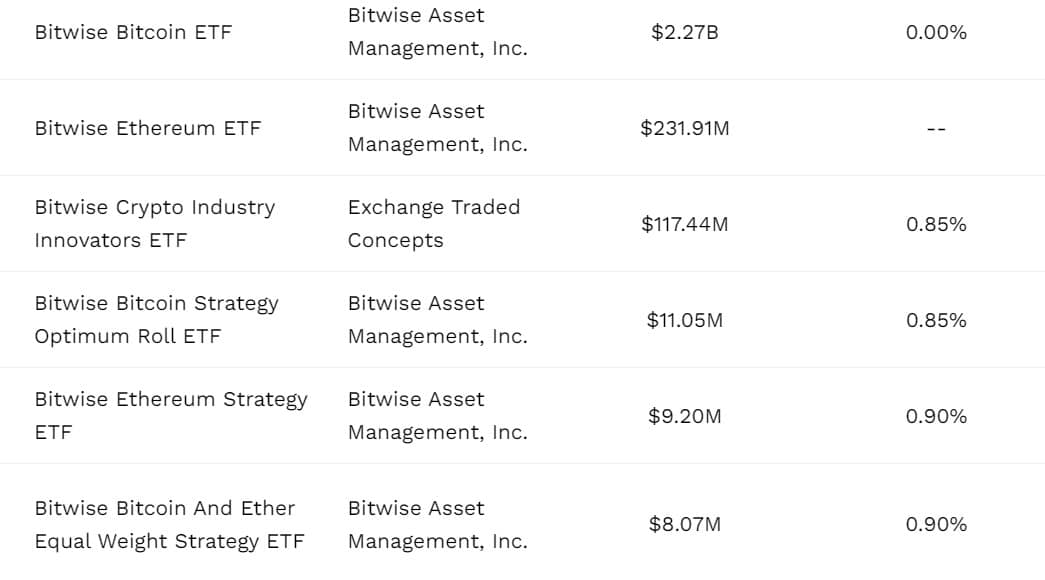

Galaxy Digital’s recent purchase follows the overall market interest on the crypto market among major companies. For instance, Bitwise has made a huge move by expanding its operations within the European market.

The San Francisco-based asset manager Bitwise has announced the purchase of ETC Group, a London-based crypto ETP issuer. ETC Group is a major crypto asset manager with more than $1 billion in assets under management.

Therefore, the purchase marks Bitwise’s expansion into Europe, adding 9 European-listed Crypto ETPs to its suite of ETPs.

Source: ETFs.com

buy clomid tablets can i get clomiphene without insurance cost of generic clomiphene without rx average cost of clomid buy clomiphene pill clomid generic brand can i get generic clomiphene for sale

I am actually enchant‚e ‘ to gleam at this blog posts which consists of tons of useful facts, thanks object of providing such data.

buy zithromax 500mg sale – buy floxin tablets buy flagyl 400mg online cheap

buy generic domperidone – buy domperidone generic flexeril canada

purchase inderal generic – buy propranolol without a prescription buy methotrexate cheap

how to buy amoxil – buy amoxicillin tablets ipratropium 100 mcg over the counter

buy azithromycin 250mg – tindamax online buy bystolic 5mg brand

brand augmentin 1000mg – https://atbioinfo.com/ ampicillin online buy

nexium 40mg oral – https://anexamate.com/ buy esomeprazole 20mg without prescription

order warfarin 5mg – https://coumamide.com/ cozaar 25mg canada

buy meloxicam 7.5mg online – swelling brand meloxicam

deltasone 5mg cost – https://apreplson.com/ order deltasone 5mg for sale

best non prescription ed pills – https://fastedtotake.com/ where can i buy ed pills

cenforce 50mg brand – https://cenforcers.com/# cenforce pill

order zantac 300mg without prescription – https://aranitidine.com/# zantac online

buying cialis online safely – buy tadalafil no prescription sunrise pharmaceutical tadalafil

This is the stripe of topic I get high on reading. site

50 mg sildenafil – https://strongvpls.com/ where to buy viagra online

More content pieces like this would urge the web better. order gabapentin 100mg online

This is a keynote which is forthcoming to my verve… Many thanks! Faithfully where can I upon the contact details for questions? https://ursxdol.com/augmentin-amoxiclav-pill/

I’ll certainly carry back to review more. https://prohnrg.com/product/orlistat-pills-di/

This is a topic which is forthcoming to my heart… Numberless thanks! Exactly where can I find the connection details for questions? https://aranitidine.com/fr/acheter-cialis-5mg/