- Michael Saylor’s statement was in line with what the Bitcoin MACD indicator showed.

- Tether treasury mints $1B USDT with zero fees.

The founder and former Microstrategy CEO, Michael Saylor’s tweet, “By my calculations, Bitcoin [BTC] is going up forever,” resonated strongly with the crypto community, fueling anticipation for a 2024 bull run.

Saylor’s comments coincided with 60% of top US hedge funds gaining Bitcoin exposure in the first half of 2024. This surge in institutional interest has driven up Bitcoin ETF prices and Bitcoin itself.

On the charts, Bitcoin has shown intention to go higher after wicking above the 4-hour resistance while the 3-day chart shows a bullish double bottom with a significant engulfing candle, indicating a strong upward momentum.

Source: Tardigrade/TradingView

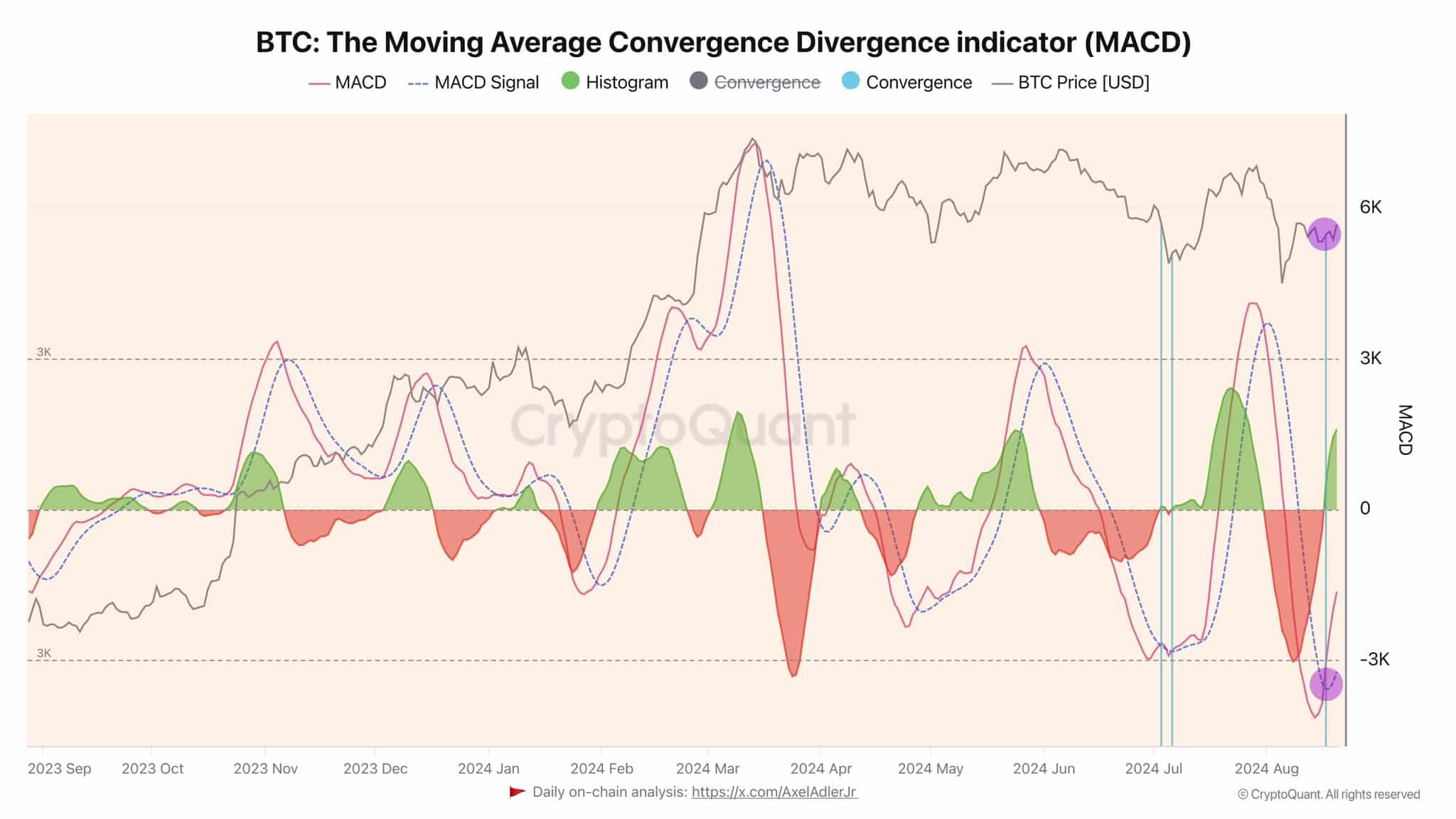

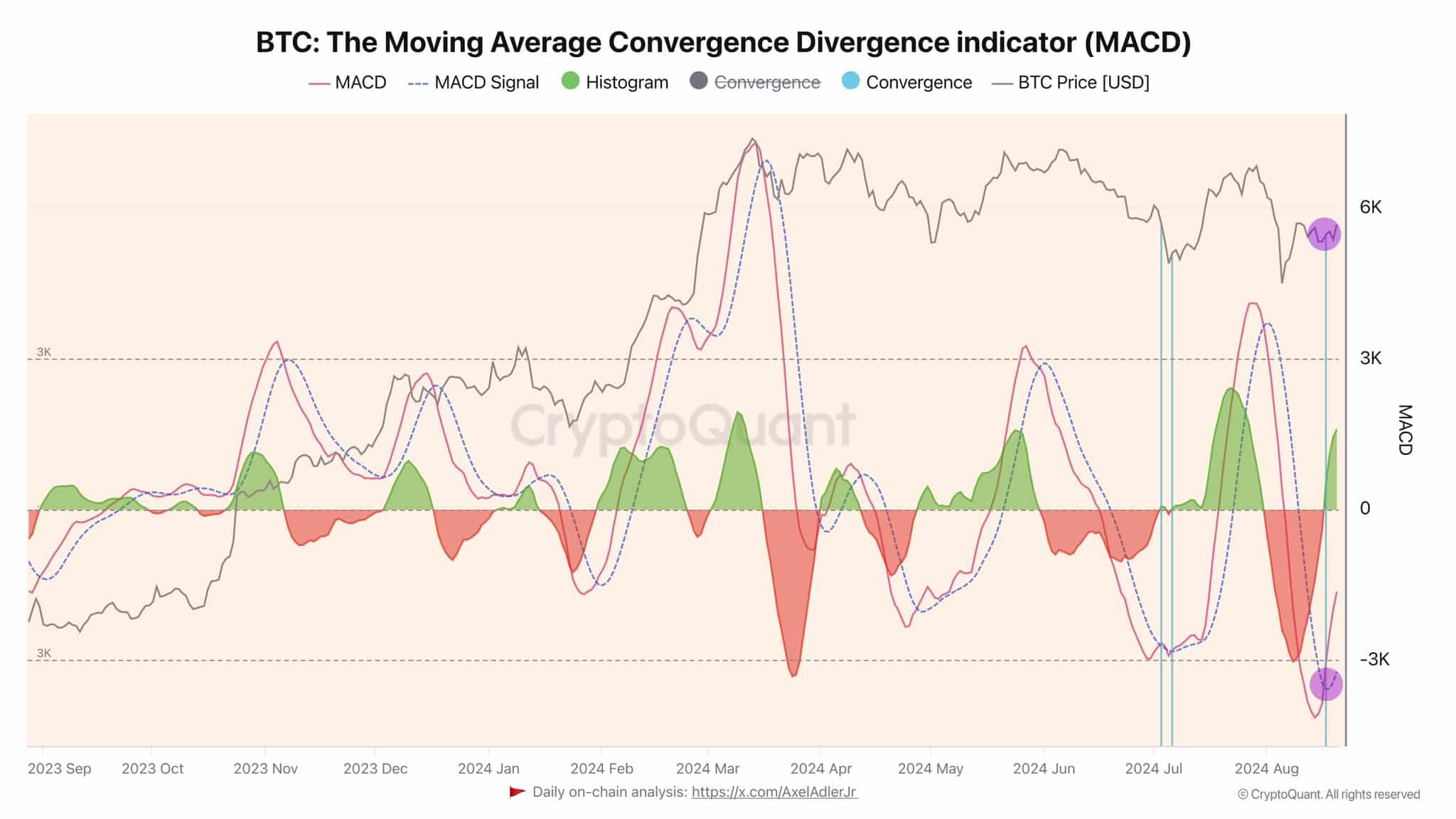

Moreover, Bitcoin MACD indicator on the daily time frame began forming a bullish pattern five days ago and has now fully flipped bullish.

The market has steadily moved towards a bullish convergence on the MACD, signaling potential upward momentum.

This shift in the MACD suggests a strengthening trend that could lead to further gains, as more traders are starting to notice this bullish signal.

Source: CryptoQuant

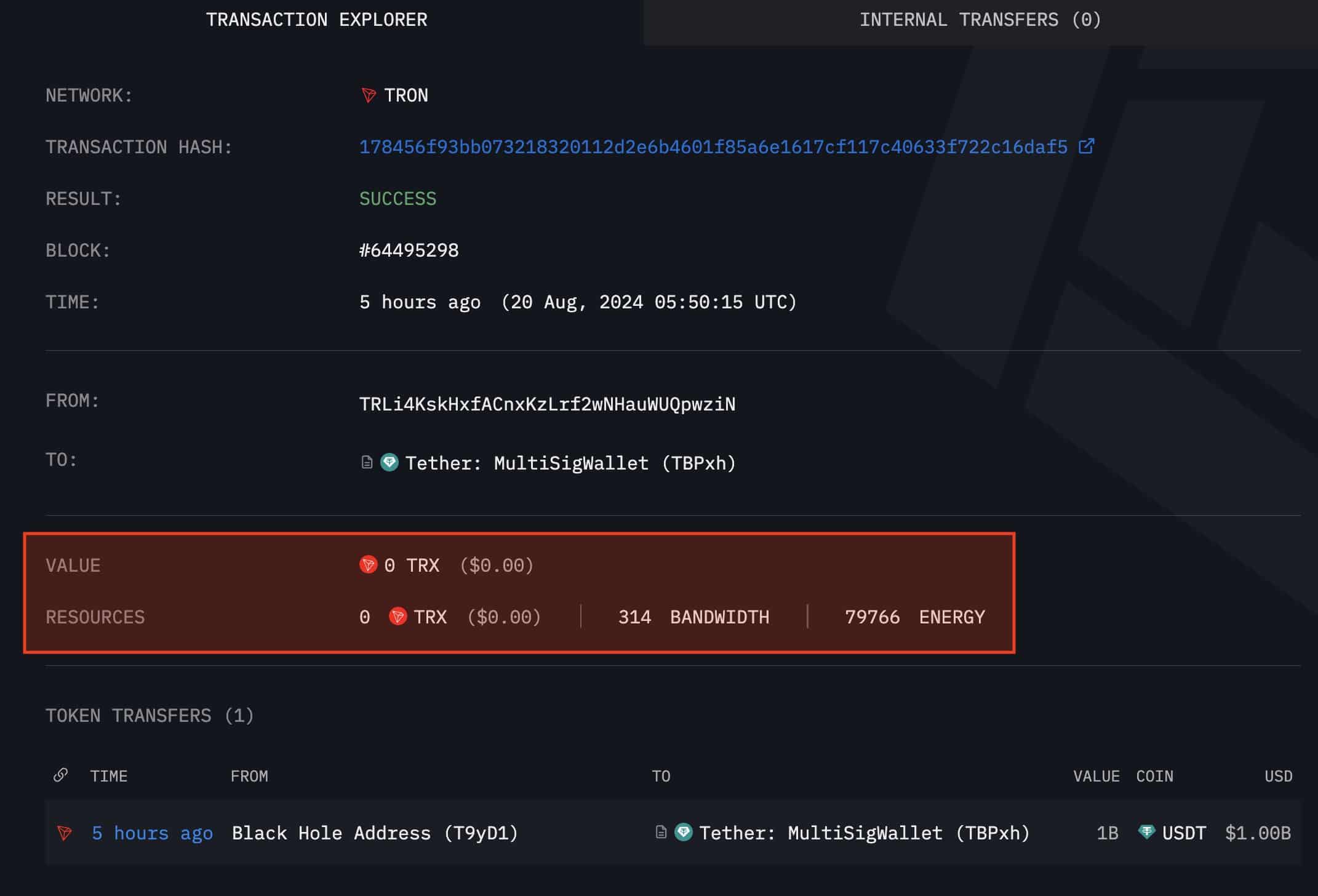

Tether treasury mints another $1B USDT

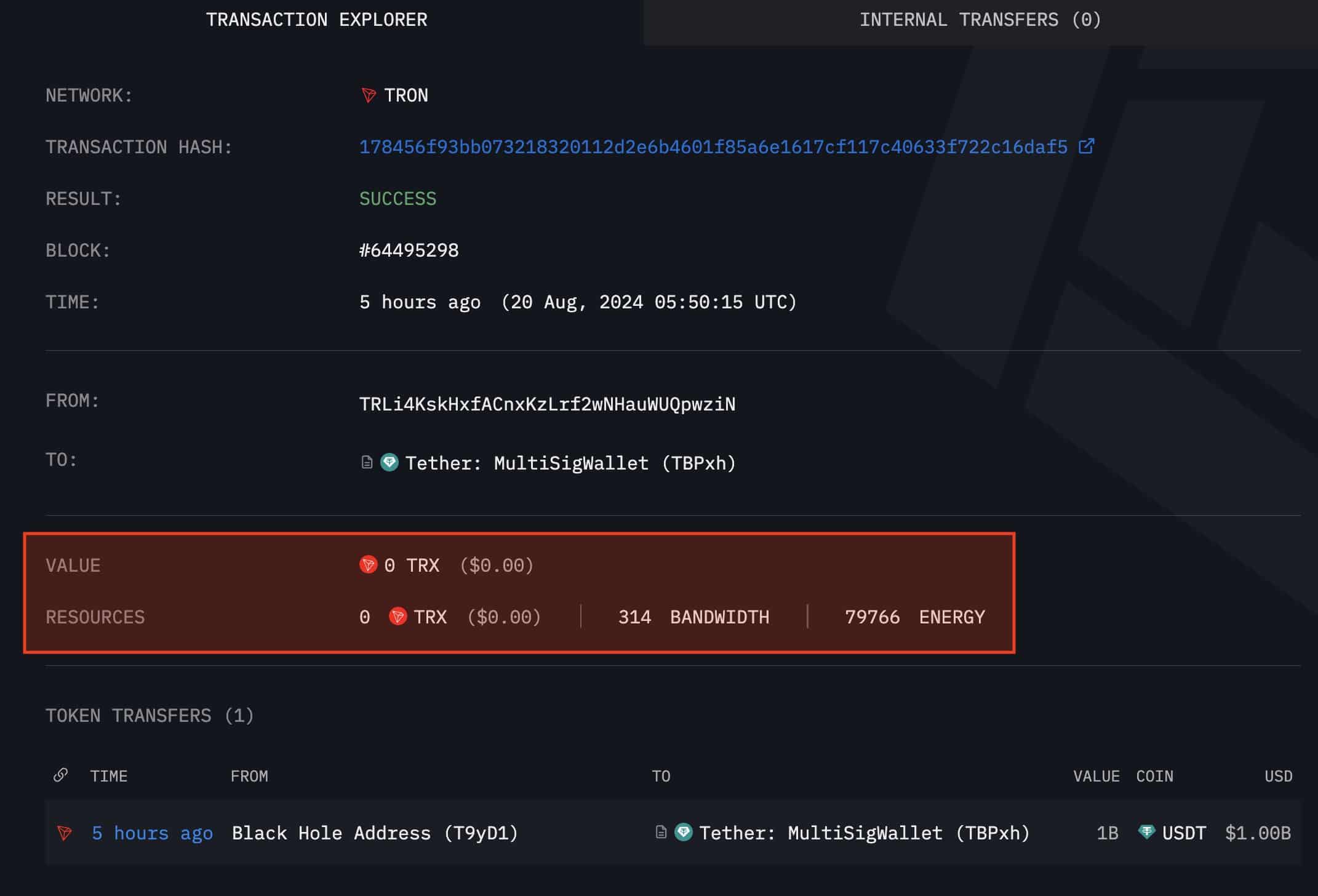

Tether, which operates like the Federal Reserve of crypto, influencing market trends whenever new USDT is minted. Tether Treasury minted $1 billion USDT on TRON with zero fees.

During the latest Bitcoin correction, Tether’s printers were highly active as Whale Alert noted on X with the total minted USDT distributed as $85 million transferred to Bitfinex and $50 million to an unknown wallet.

Source: Arkham

The continued minting of USDT is expected to drive Bitcoin prices higher in the upcoming bull market.

Strong accumulation as open interest rises

Bitcoin is in a strong accumulation phase, with Metaplanet purchasing 500 million Yen ($3.4 million) worth of Bitcoin, raising its holdings to 360.368 BTC as Karan Singh noted on X.

This move, alongside rising institutional confidence, has driven Metaplanet stocks up by 13%. Additionally, Glassnode reports that the Bitcoin accumulation index has peaked at 1.0, indicating a surge in buying activity.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

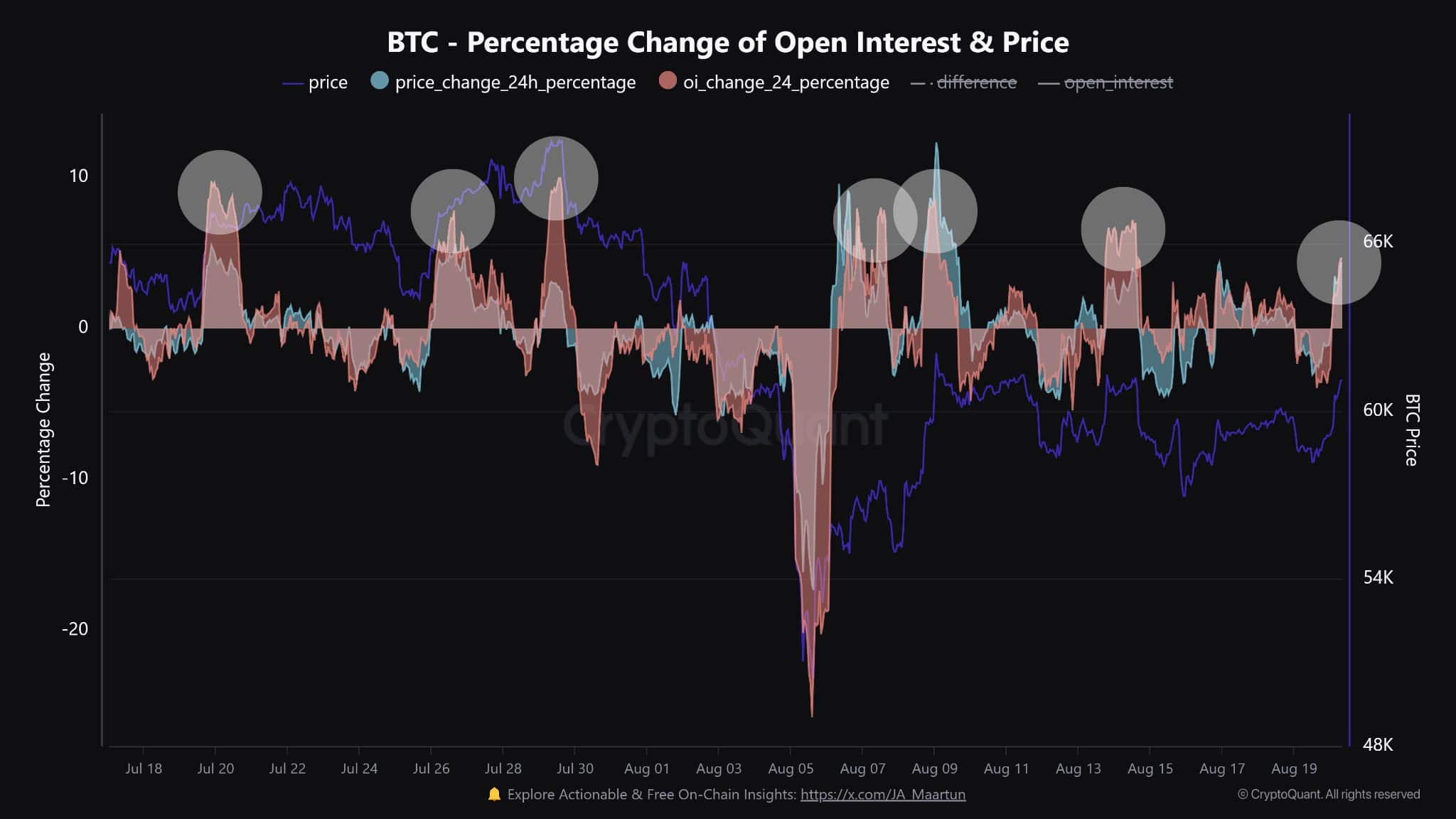

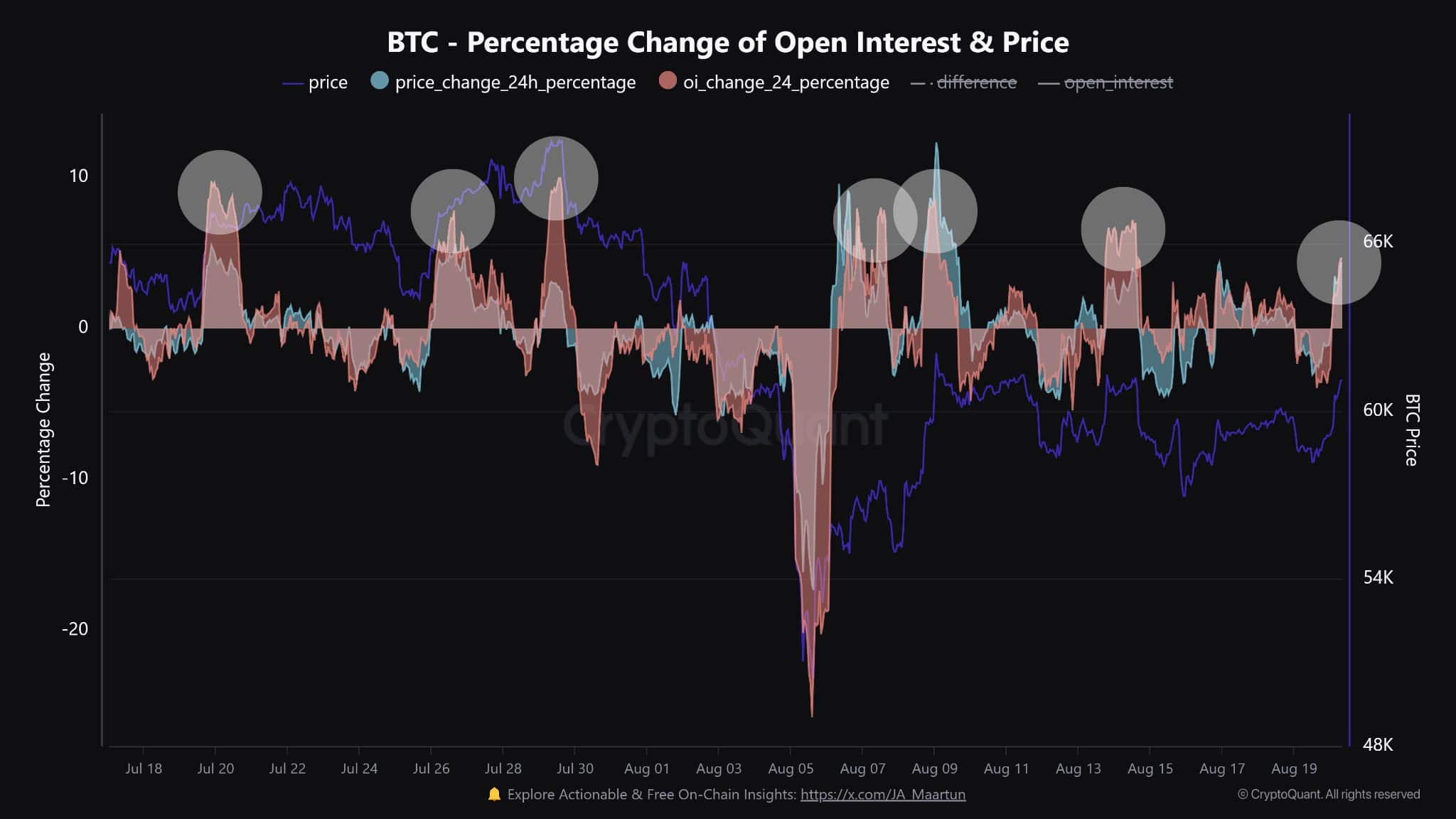

Investors are increasingly accumulating more positions following BTC’s open interest increase by 5%, driven by leverage.

Source: CryptoQuant

Historically, leverage-fueled pumps have often led to price reversals, though there’s no certainty it will happen again.

- Michael Saylor’s statement was in line with what the Bitcoin MACD indicator showed.

- Tether treasury mints $1B USDT with zero fees.

The founder and former Microstrategy CEO, Michael Saylor’s tweet, “By my calculations, Bitcoin [BTC] is going up forever,” resonated strongly with the crypto community, fueling anticipation for a 2024 bull run.

Saylor’s comments coincided with 60% of top US hedge funds gaining Bitcoin exposure in the first half of 2024. This surge in institutional interest has driven up Bitcoin ETF prices and Bitcoin itself.

On the charts, Bitcoin has shown intention to go higher after wicking above the 4-hour resistance while the 3-day chart shows a bullish double bottom with a significant engulfing candle, indicating a strong upward momentum.

Source: Tardigrade/TradingView

Moreover, Bitcoin MACD indicator on the daily time frame began forming a bullish pattern five days ago and has now fully flipped bullish.

The market has steadily moved towards a bullish convergence on the MACD, signaling potential upward momentum.

This shift in the MACD suggests a strengthening trend that could lead to further gains, as more traders are starting to notice this bullish signal.

Source: CryptoQuant

Tether treasury mints another $1B USDT

Tether, which operates like the Federal Reserve of crypto, influencing market trends whenever new USDT is minted. Tether Treasury minted $1 billion USDT on TRON with zero fees.

During the latest Bitcoin correction, Tether’s printers were highly active as Whale Alert noted on X with the total minted USDT distributed as $85 million transferred to Bitfinex and $50 million to an unknown wallet.

Source: Arkham

The continued minting of USDT is expected to drive Bitcoin prices higher in the upcoming bull market.

Strong accumulation as open interest rises

Bitcoin is in a strong accumulation phase, with Metaplanet purchasing 500 million Yen ($3.4 million) worth of Bitcoin, raising its holdings to 360.368 BTC as Karan Singh noted on X.

This move, alongside rising institutional confidence, has driven Metaplanet stocks up by 13%. Additionally, Glassnode reports that the Bitcoin accumulation index has peaked at 1.0, indicating a surge in buying activity.

Source: Glassnode

Read Bitcoin’s [BTC] Price Prediction 2024-25

Investors are increasingly accumulating more positions following BTC’s open interest increase by 5%, driven by leverage.

Source: CryptoQuant

Historically, leverage-fueled pumps have often led to price reversals, though there’s no certainty it will happen again.

I used to be suggested this blog by means of my cousin. I am not positive whether or not this post is written by way of him as nobody else understand such exact about my problem. You’re wonderful! Thanks!

Simply wanna remark on few general things, The website layout is perfect, the content is real great : D.

I haven’t checked in here for some time since I thought it was getting boring, but the last several posts are great quality so I guess I will add you back to my everyday bloglist. You deserve it my friend 🙂

clomid for sale in usa where buy generic clomid no prescription order clomiphene prices cheap clomid pills can you get cheap clomiphene without rx can i get clomiphene for sale can you get generic clomiphene without insurance

I’ll certainly bring back to read more.

More posts like this would bring about the blogosphere more useful.

buy semaglutide without prescription – where can i buy cyproheptadine order periactin 4mg sale

As a Newbie, I am permanently browsing online for articles that can aid me. Thank you

order generic augmentin 1000mg – atbioinfo.com order ampicillin sale

esomeprazole 20mg over the counter – nexiumtous cheap nexium

buy warfarin 5mg online – https://coumamide.com/ losartan generic

order mobic 7.5mg without prescription – relieve pain mobic 7.5mg for sale

Hey very cool web site!! Guy .. Beautiful .. Wonderful .. I’ll bookmark your site and take the feeds also…I’m glad to find so many useful information right here in the submit, we want develop extra strategies in this regard, thanks for sharing. . . . . .

prednisone canada – aprep lson brand prednisone 20mg

buy ed pills best price – fastedtotake pills erectile dysfunction

fluconazole 100mg uk – order forcan generic diflucan order

cialis com coupons – https://ciltadgn.com/# us pharmacy prices for cialis

buy generic cialis online – https://strongtadafl.com/# who makes cialis

zantac 300mg brand – https://aranitidine.com/# buy zantac pills

do they sale viagra – https://strongvpls.com/# viagra online

More posts like this would make the online space more useful. https://gnolvade.com/

More posts like this would force the blogosphere more useful. https://buyfastonl.com/amoxicillin.html

Facts blog you procure here.. It’s severely to espy strong status article like yours these days. I justifiably respect individuals like you! Rent vigilance!! https://ursxdol.com/synthroid-available-online/

The depth in this ruined is exceptional. buy generic prilosec

Very interesting information!Perfect just what I was looking for!

More posts like this would prosper the blogosphere more useful. viagra naturel puissant et rapide pour femme

More posts like this would add up to the online time more useful. https://ondactone.com/simvastatin/

Some really good blog posts on this internet site, regards for contribution. “A conservative is a man who sits and thinks, mostly sits.” by Woodrow Wilson.

This is a keynote which is in to my heart… Diverse thanks! Exactly where can I find the contact details an eye to questions? http://ledyardmachine.com/forum/User-Vuhkkr

Nice post. I used to be checking constantly this weblog and I’m impressed! Extremely useful info specifically the ultimate section 🙂 I maintain such info a lot. I was seeking this certain information for a very lengthy time. Thanks and best of luck.

buy dapagliflozin pills – order forxiga for sale dapagliflozin medication

xenical medication – https://asacostat.com/ xenical 120mg brand

Facts blog you have here.. It’s obdurate to assign great quality writing like yours these days. I honestly respect individuals like you! Rent guardianship!! http://www.orlandogamers.org/forum/member.php?action=profile&uid=29925