- FET’s price has rallied by 30% in the past 24 hours.

- Despite this, token holders continue to record losses.

Fetch.ai [FET] has recorded a 30% price surge in the past 24 hours, to lead as the cryptocurrency asset with the most gains during that period. As of this writing, the artificial intelligence-based token exchanged hands at a seven-day high of $1.61.

FET’s double-digit rally follows Nvidia [NVDA], a leading AI chipmaker, becoming the world’s most valuable company.

On 18th June, it surpassed Microsoft (MSFT) to become the world’s most valuable company, just two weeks after overtaking Apple (AAPL) for the second position.

Fetch.ai is the talk of the town

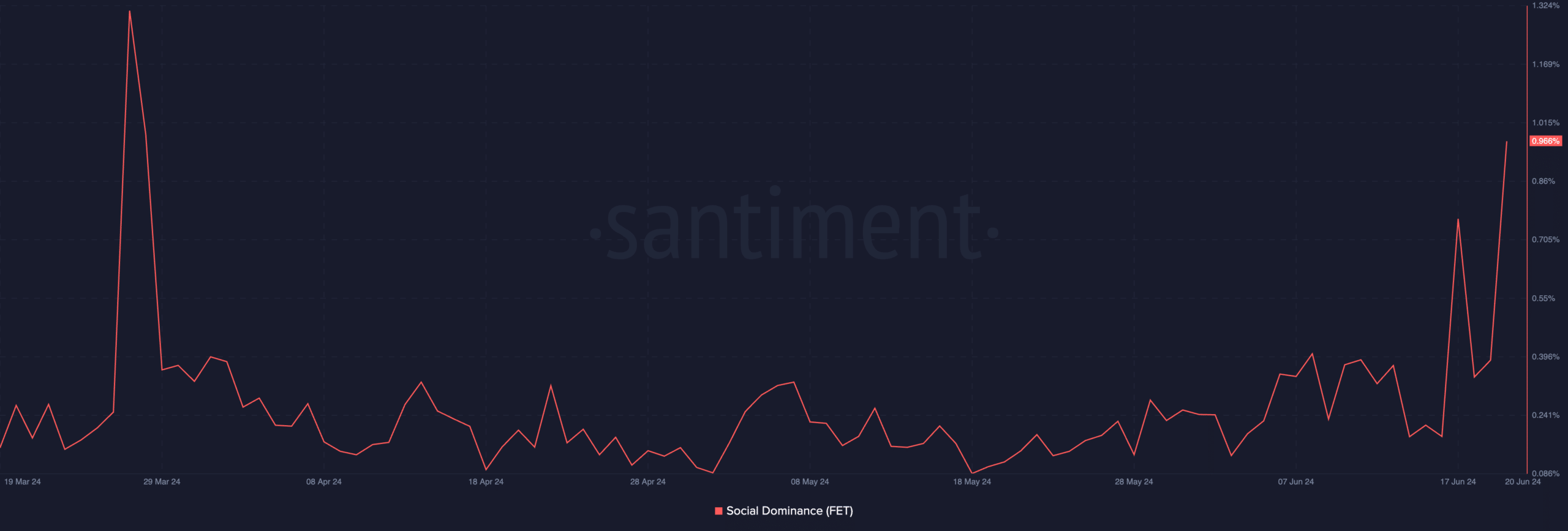

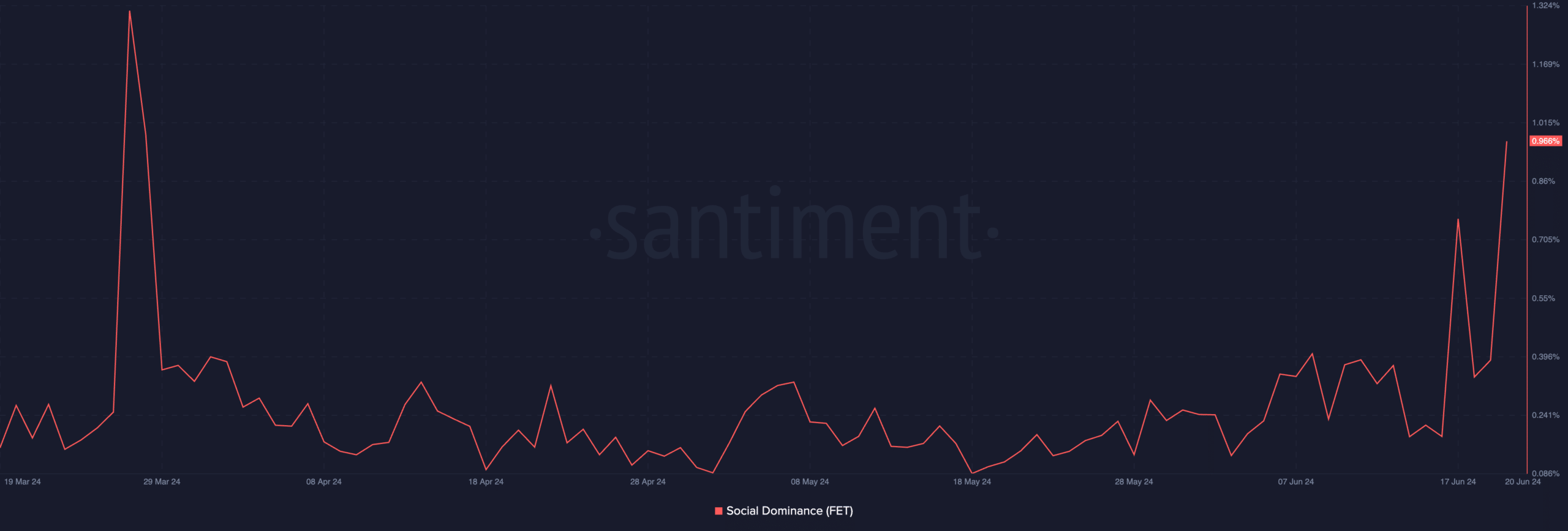

FET’s performance in the past 24 hours has led to an uptick in its social dominance, data from Santiment showed. At press time, FET’s social dominance was 0.96%, a level last observed in March.

Source: Santiment

An asset’s social dominance measures its share of online discussions that mention it relative to the total discussions about the top 100 cryptocurrencies by market capitalization.

When it rises like this, it means that discussions about the asset in question form a significant part of the overall conversations happening in the crypto market compared to before.

FET’s social dominance indicates that, as of this writing, 0.96% of all online discussions about the top 100 cryptocurrencies by market capitalization specifically mention it.

This has also led to a spike in the token’s trading volume. In the last 24 hours, FET’s trading volume has totaled $377 million, rising by 92%

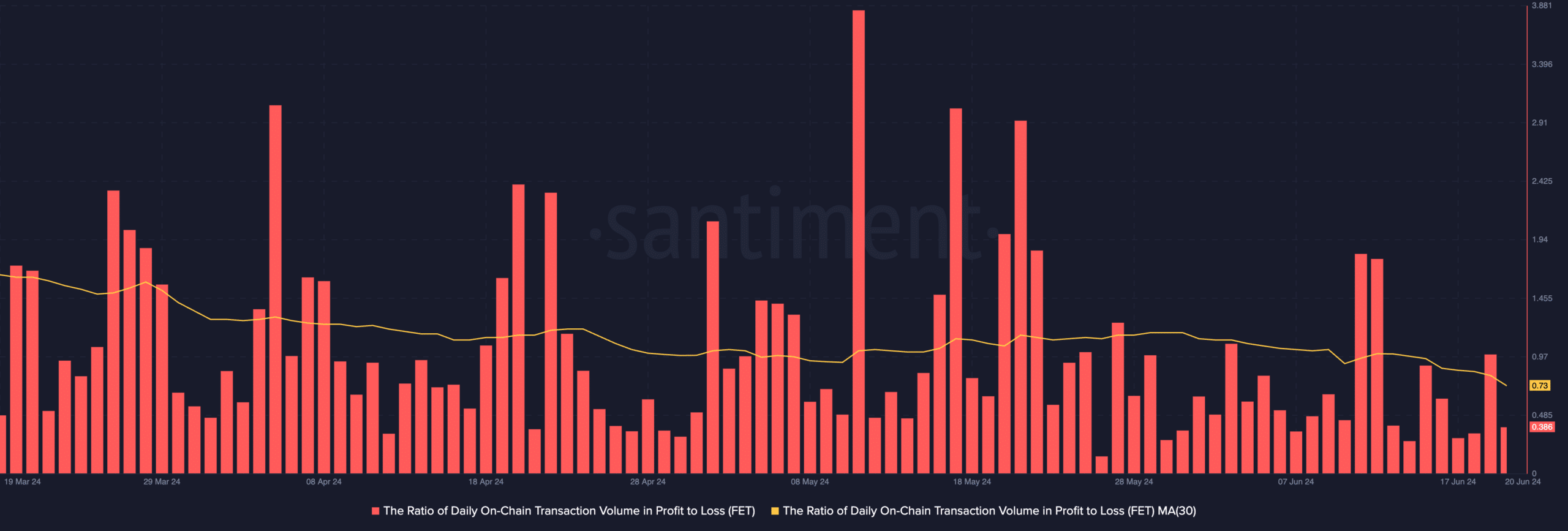

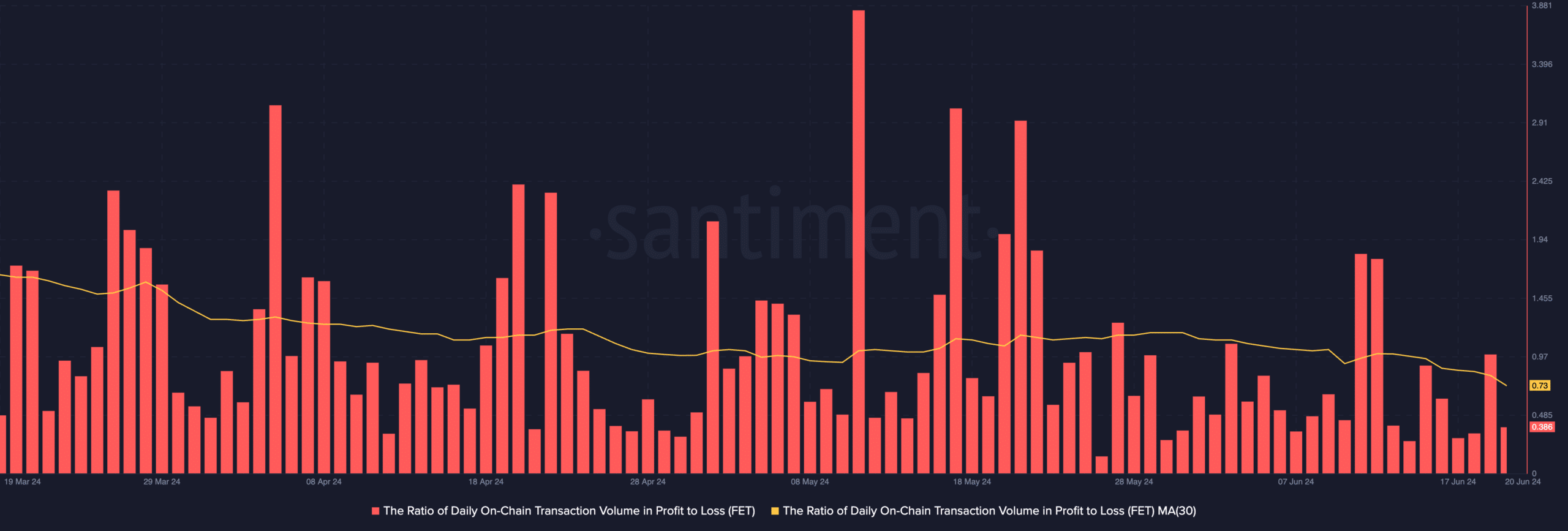

Interestingly, despite the double-digit surge in FET’s value and its social dominance climbing to a multi-month high, its holders have failed to record profits on their transactions.

AMBCrypto assessed the daily ratio of FET’s transaction volume in profit to loss and found that on 19 June, this was 0.98. At press time, it was 0.38. Assessed on a 30-day moving average, the metric’s value was 0.73.

Source: Santiment

Read Fetch.ai [FET] Price Prediction 2024-25

This suggested that in the past 30 days, for every FET transaction that ended in a loss, only 0.73 transactions returned a profit.

It suggests that FET holders have recorded more losses than they have seen profit in the past 30 days, and the current price surge has not changed that.

- FET’s price has rallied by 30% in the past 24 hours.

- Despite this, token holders continue to record losses.

Fetch.ai [FET] has recorded a 30% price surge in the past 24 hours, to lead as the cryptocurrency asset with the most gains during that period. As of this writing, the artificial intelligence-based token exchanged hands at a seven-day high of $1.61.

FET’s double-digit rally follows Nvidia [NVDA], a leading AI chipmaker, becoming the world’s most valuable company.

On 18th June, it surpassed Microsoft (MSFT) to become the world’s most valuable company, just two weeks after overtaking Apple (AAPL) for the second position.

Fetch.ai is the talk of the town

FET’s performance in the past 24 hours has led to an uptick in its social dominance, data from Santiment showed. At press time, FET’s social dominance was 0.96%, a level last observed in March.

Source: Santiment

An asset’s social dominance measures its share of online discussions that mention it relative to the total discussions about the top 100 cryptocurrencies by market capitalization.

When it rises like this, it means that discussions about the asset in question form a significant part of the overall conversations happening in the crypto market compared to before.

FET’s social dominance indicates that, as of this writing, 0.96% of all online discussions about the top 100 cryptocurrencies by market capitalization specifically mention it.

This has also led to a spike in the token’s trading volume. In the last 24 hours, FET’s trading volume has totaled $377 million, rising by 92%

Interestingly, despite the double-digit surge in FET’s value and its social dominance climbing to a multi-month high, its holders have failed to record profits on their transactions.

AMBCrypto assessed the daily ratio of FET’s transaction volume in profit to loss and found that on 19 June, this was 0.98. At press time, it was 0.38. Assessed on a 30-day moving average, the metric’s value was 0.73.

Source: Santiment

Read Fetch.ai [FET] Price Prediction 2024-25

This suggested that in the past 30 days, for every FET transaction that ended in a loss, only 0.73 transactions returned a profit.

It suggests that FET holders have recorded more losses than they have seen profit in the past 30 days, and the current price surge has not changed that.

buy generic clomid without dr prescription how can i get cheap clomiphene clomid price walmart where to get generic clomid tablets buy generic clomiphene price can i get generic clomid online can you get clomid prices

This is a question which is in to my fundamentals… Many thanks! Exactly where can I find the phone details an eye to questions?

More posts like this would force the blogosphere more useful.

zithromax 500mg price – buy sumycin 500mg generic metronidazole pills

purchase semaglutide online – cost cyproheptadine 4mg cheap periactin 4 mg

domperidone pills – buy generic motilium order flexeril for sale

buy inderal online cheap – purchase methotrexate generic buy generic methotrexate 5mg

buy generic amoxicillin – valsartan 80mg tablet ipratropium 100 mcg without prescription

buy azithromycin 500mg online cheap – tindamax buy online generic nebivolol

augmentin 625mg for sale – atbioinfo acillin cheap

order esomeprazole 40mg – https://anexamate.com/ purchase esomeprazole for sale

purchase warfarin without prescription – https://coumamide.com/ brand hyzaar

order generic meloxicam 15mg – moboxsin.com order generic mobic

prednisone 5mg uk – corticosteroid order prednisone 5mg pill

ed pills online – site how to get ed pills without a prescription

purchase amoxicillin pill – combamoxi.com amoxil without prescription

order fluconazole generic – https://gpdifluca.com/ buy cheap forcan

order cenforce 100mg generic – https://cenforcers.com/# buy cenforce for sale

cialis tadalafil cheapest online – https://ciltadgn.com/ difference between sildenafil and tadalafil

cialis australia online shopping – on this site cialis dapoxetine overnight shipment

purchase ranitidine generic – ranitidine drug ranitidine for sale online

buy viagra gold coast – strong vpls herbal viagra sale uk

More posts like this would make the blogosphere more useful. clomid 50 mg comprar

I am in point of fact thrilled to glitter at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. prednisone withdrawal symptoms

I couldn’t resist commenting. Adequately written! https://ursxdol.com/get-metformin-pills/

More text pieces like this would make the web better. https://prohnrg.com/product/rosuvastatin-for-sale/

This is a question which is virtually to my fundamentals… Myriad thanks! Exactly where can I lay one’s hands on the connection details due to the fact that questions? https://aranitidine.com/fr/acheter-cialis-5mg/

This website positively has all of the low-down and facts I needed about this participant and didn’t comprehend who to ask. https://ondactone.com/product/domperidone/

More articles like this would remedy the blogosphere richer.

what pill is flexeril

More text pieces like this would insinuate the web better. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4271944&do=profile

dapagliflozin 10 mg price – on this site order forxiga 10 mg without prescription

purchase xenical online – https://asacostat.com/ xenical order online

I am actually happy to gleam at this blog posts which consists of tons of worthwhile facts, thanks for providing such data. http://zgyhsj.com/space-uid-979407.html