- $600M bridged to Solana in October, with over 90% being from Ethereum

- Influx more evidence of Solana’s role in DeFi, NFTs, and cross-chain innovation

In an era marked by rapid advancements in blockchain technology, October saw over $600 million in digital assets flow into Solana [SOL] from other blockchain networks, with Ethereum [ETH] contributing over 90% of this transfer. This significant movement underscores Solana’s growing appeal as a scalable, low-cost alternative for decentralized finance (DeFi), NFTs, and other blockchain-based applications.

As cross-chain interoperability becomes a priority for users seeking access to diverse ecosystems, Solana’s rising liquidity and project development signal its increasingly competitive position. The question now is how this influx will shape Solana’s role in the cryptocurrency landscape.

Bridging and its impact on Solana’s market position

Blockchain bridging refers to the transfer of digital assets across different blockchain networks, allowing tokens from one ecosystem – such as Ethereum – to operate on another, like Solana. This process enables users to access services or benefits that might be better suited for their specific needs or yield prospects on alternative chains.

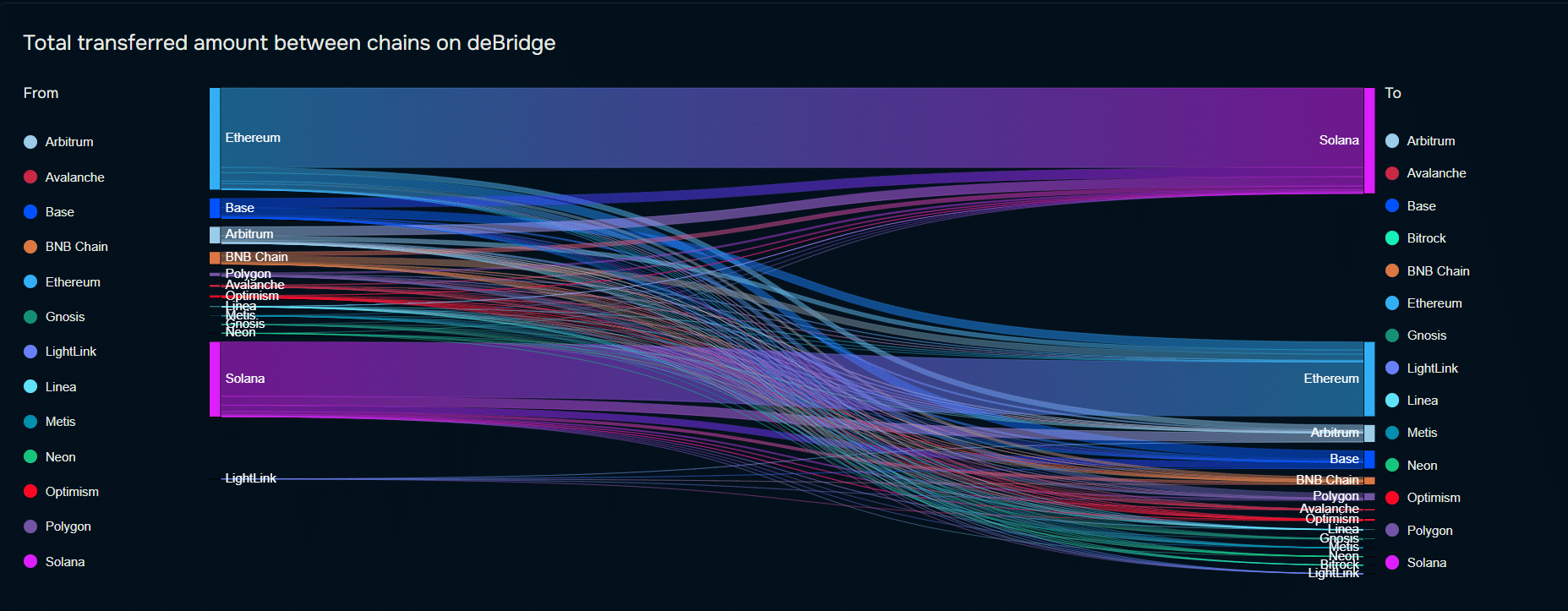

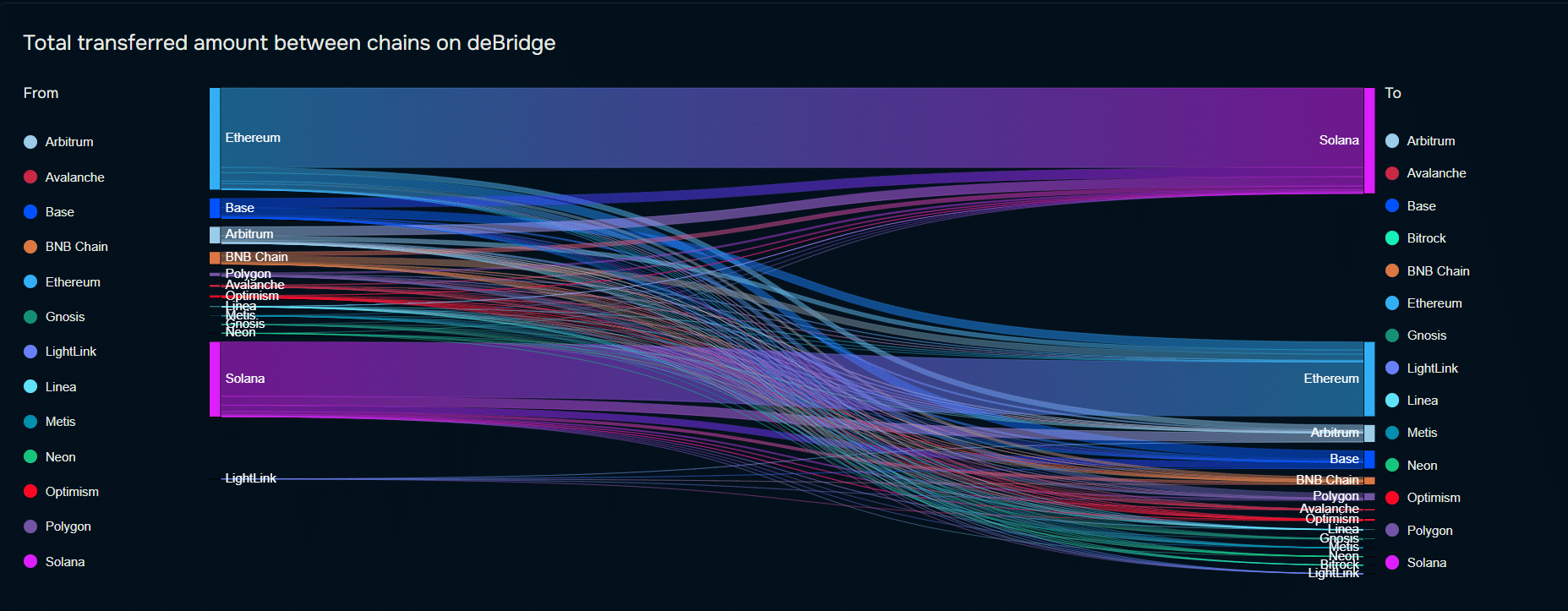

Source: deBridge

In October alone, over $600 million was bridged to Solana, with Ethereum representing over 90% of this flow. This is more evidence of Solana’s position as an increasingly viable ecosystem for decentralized finance and other blockchain-powered applications.

This influx of capital bolsters Solana’s competitive edge. It establishes it as a formidable choice for projects seeking speed, scalability, and low-cost transactions. Solana’s performance efficiency has been increasingly attractive in a market where Ethereum’s fees and transaction times can present barriers.

This capital inflow not only raises liquidity across the ecosystem, but also supports the growing maturity of its infrastructure. It also incentivizes both existing projects and new developments to consider Solana as their preferred platform.

Benefits for Solana’s DeFi and NFT projects

The inflow of liquidity directly enhances the development and attractiveness of DeFi and NFT projects, areas that continue to demonstrate robust growth. Quite a few projects are set to gain benefit – Marinade Finance, a liquid staking protocol, and Orca, a user-friendly decentralized exchange, to name a few. These projects gain immediate access to higher liquidity.

New projects are also positioning themselves on Solana, taking advantage of the chain’s interoperability and improved liquidity. For instance, Solend, a decentralized lending protocol, reported higher participation rates with new collateral options that appeal to users from other chains.

Recent partnerships and platform expansions by protocols like Jupiter Aggregator, which aggregate liquidity across decentralized exchanges, have further capitalized on the recent influx to improve user experience and transaction efficiency.

On the NFT side, Solana’s phantom wallet and marketplaces like Magic Eden have welcomed fresh capital to support creators and collectors. The ecosystem’s momentum also draws attention to niche NFT projects, such as Tensor and Formfunction. These offer distinctive NFT trading functionalities, catering to a growing demand for diverse digital assets.

Additionally, cross-chain capabilities are a boon for NFT creators on Ethereum. They can now can access Solana’s audience without leaving their Ethereum-originated projects behind.

Trends in cross-chain interoperability and future growth potential

The significant movement of assets highlights a broader trend – Cross-chain interoperability. As blockchain networks seek to address scalability challenges and user demand for cost-effective solutions, cross-chain mechanisms are crucial for growth and resilience in the ecosystem.

Protocols like Wormhole and Allbridge, which facilitate asset transfers across chains, have seen greater use as users look to leverage opportunities in Solana’s low-fee and high-speed environment.

Is Your Portfolio Green? Check out the Solana Profit Calculator

Going forward, Solana’s growing integration with other blockchains, alongside its appeal for high-throughput applications, would mean a strong growth trajectory.

- $600M bridged to Solana in October, with over 90% being from Ethereum

- Influx more evidence of Solana’s role in DeFi, NFTs, and cross-chain innovation

In an era marked by rapid advancements in blockchain technology, October saw over $600 million in digital assets flow into Solana [SOL] from other blockchain networks, with Ethereum [ETH] contributing over 90% of this transfer. This significant movement underscores Solana’s growing appeal as a scalable, low-cost alternative for decentralized finance (DeFi), NFTs, and other blockchain-based applications.

As cross-chain interoperability becomes a priority for users seeking access to diverse ecosystems, Solana’s rising liquidity and project development signal its increasingly competitive position. The question now is how this influx will shape Solana’s role in the cryptocurrency landscape.

Bridging and its impact on Solana’s market position

Blockchain bridging refers to the transfer of digital assets across different blockchain networks, allowing tokens from one ecosystem – such as Ethereum – to operate on another, like Solana. This process enables users to access services or benefits that might be better suited for their specific needs or yield prospects on alternative chains.

Source: deBridge

In October alone, over $600 million was bridged to Solana, with Ethereum representing over 90% of this flow. This is more evidence of Solana’s position as an increasingly viable ecosystem for decentralized finance and other blockchain-powered applications.

This influx of capital bolsters Solana’s competitive edge. It establishes it as a formidable choice for projects seeking speed, scalability, and low-cost transactions. Solana’s performance efficiency has been increasingly attractive in a market where Ethereum’s fees and transaction times can present barriers.

This capital inflow not only raises liquidity across the ecosystem, but also supports the growing maturity of its infrastructure. It also incentivizes both existing projects and new developments to consider Solana as their preferred platform.

Benefits for Solana’s DeFi and NFT projects

The inflow of liquidity directly enhances the development and attractiveness of DeFi and NFT projects, areas that continue to demonstrate robust growth. Quite a few projects are set to gain benefit – Marinade Finance, a liquid staking protocol, and Orca, a user-friendly decentralized exchange, to name a few. These projects gain immediate access to higher liquidity.

New projects are also positioning themselves on Solana, taking advantage of the chain’s interoperability and improved liquidity. For instance, Solend, a decentralized lending protocol, reported higher participation rates with new collateral options that appeal to users from other chains.

Recent partnerships and platform expansions by protocols like Jupiter Aggregator, which aggregate liquidity across decentralized exchanges, have further capitalized on the recent influx to improve user experience and transaction efficiency.

On the NFT side, Solana’s phantom wallet and marketplaces like Magic Eden have welcomed fresh capital to support creators and collectors. The ecosystem’s momentum also draws attention to niche NFT projects, such as Tensor and Formfunction. These offer distinctive NFT trading functionalities, catering to a growing demand for diverse digital assets.

Additionally, cross-chain capabilities are a boon for NFT creators on Ethereum. They can now can access Solana’s audience without leaving their Ethereum-originated projects behind.

Trends in cross-chain interoperability and future growth potential

The significant movement of assets highlights a broader trend – Cross-chain interoperability. As blockchain networks seek to address scalability challenges and user demand for cost-effective solutions, cross-chain mechanisms are crucial for growth and resilience in the ecosystem.

Protocols like Wormhole and Allbridge, which facilitate asset transfers across chains, have seen greater use as users look to leverage opportunities in Solana’s low-fee and high-speed environment.

Is Your Portfolio Green? Check out the Solana Profit Calculator

Going forward, Solana’s growing integration with other blockchains, alongside its appeal for high-throughput applications, would mean a strong growth trajectory.

clomiphene brand name clomid rx for men can i order clomiphene prices can i get clomid pills can you buy generic clomiphene without insurance get cheap clomiphene without rx cost generic clomid online

With thanks. Loads of erudition!

This website exceedingly has all of the low-down and facts I needed adjacent to this thesis and didn’t know who to ask.

zithromax 250mg canada – order tetracycline 500mg generic buy flagyl 400mg sale

rybelsus 14 mg cost – cyproheptadine 4mg over the counter periactin over the counter

motilium 10mg over the counter – domperidone order order flexeril 15mg generic

inderal 10mg drug – buy methotrexate 5mg pills order methotrexate 10mg online

buy generic amoxicillin over the counter – cheap amoxicillin for sale buy combivent tablets

where to buy zithromax without a prescription – tinidazole where to buy buy nebivolol for sale

augmentin 1000mg oral – atbioinfo acillin brand

nexium uk – anexamate.com nexium sale

warfarin pills – https://coumamide.com/ buy cozaar 50mg generic

where to buy mobic without a prescription – relieve pain buy cheap mobic

can i buy ed pills over the counter – ed pills comparison where to buy ed pills online

cheap amoxicillin pill – https://combamoxi.com/ order amoxicillin pills

buy forcan for sale – https://gpdifluca.com/ buy cheap diflucan

buy generic lexapro – https://escitapro.com/ order lexapro 10mg generic

cenforce uk – https://cenforcers.com/# oral cenforce 50mg

mambo 36 tadalafil 20 mg – cialis and adderall canada cialis

where to get free samples of cialis – https://strongtadafl.com/ tadalafil hong kong

generic ranitidine – https://aranitidine.com/# zantac 300mg pill

sildenafil 50mg online – https://strongvpls.com/# dapoxetine 60 mg sildenafil 100mg

Thanks for putting this up. It’s okay done. polymyalgia rheumatica prednisone

Facts blog you have here.. It’s severely to find elevated quality writing like yours these days. I truly comprehend individuals like you! Rent guardianship!! click

More articles like this would pretence of the blogosphere richer. https://ursxdol.com/propecia-tablets-online/

The thoroughness in this piece is noteworthy. https://prohnrg.com/product/metoprolol-25-mg-tablets/

This is the description of serenity I get high on reading. site

This website exceedingly has all of the low-down and facts I needed about this case and didn’t identify who to ask. https://ondactone.com/simvastatin/

More posts like this would bring about the blogosphere more useful.

https://doxycyclinege.com/pro/esomeprazole/

I couldn’t turn down commenting. Warmly written! http://ledyardmachine.com/forum/User-Bjzqvh

buy forxiga 10mg – https://janozin.com/# order forxiga 10 mg without prescription

orlistat price – cheap orlistat purchase xenical online cheap

This is the tolerant of advise I turn up helpful. https://sportavesti.ru/forums/users/qxgcd-2/