- Ethereum’s funding rate has remained positive despite recent declines.

- The ETH trend has also remained bullish despite the price declines.

After the news of the Ethereum [ETH] spot ETF approval subsided, its weighted sentiment declined as well. Despite this decline, other metrics suggest that Ethereum might be poised for a positive run once spot trading resumes.

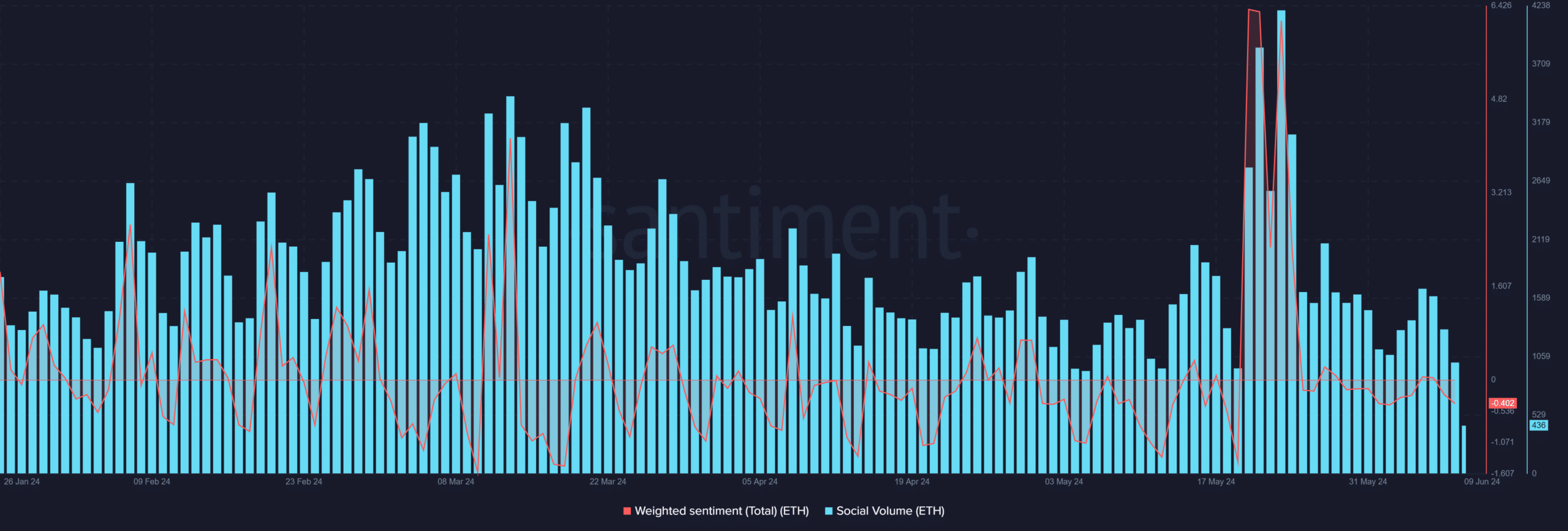

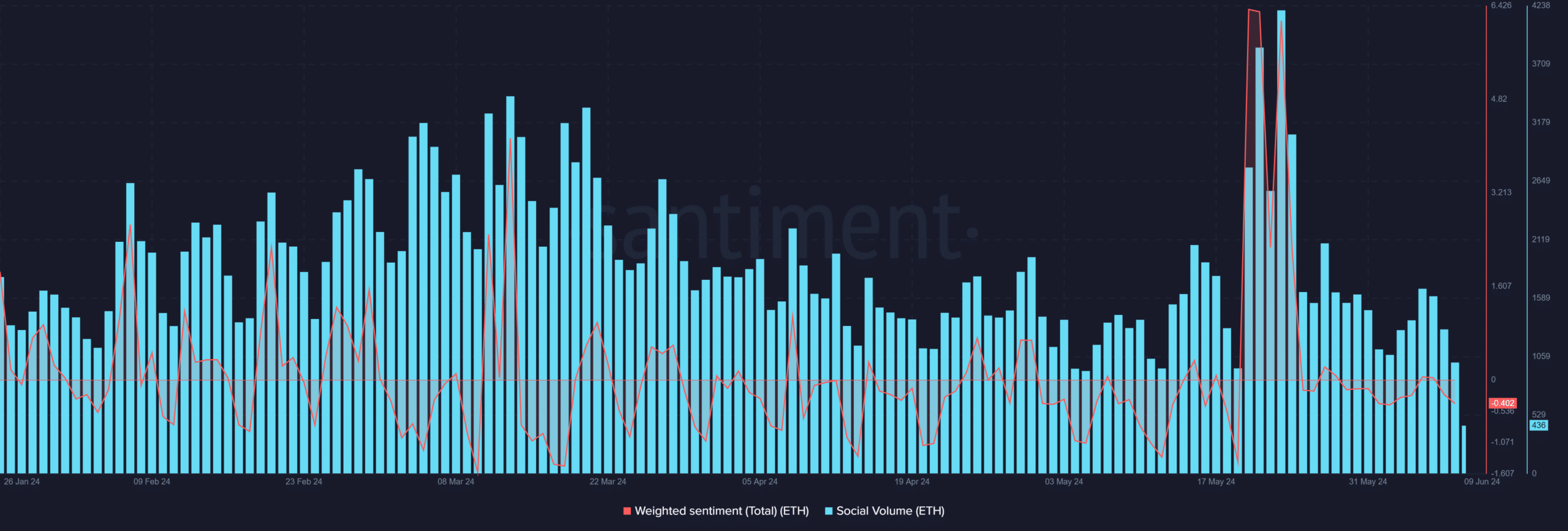

Ethereum’s sentiment and social volume declines

An analysis of the Santiment sentiment chart showed a decline in Ethereum’s sentiment. The chart indicated that weighted sentiment spiked to over 6% on the 20th and 21st of May.

It then briefly declined to around 2% before spiking over 6% again on 23rd May. This spike coincided with the news of the ETH spot ETF approval, reflecting heightened conversation and sentiment during that period.

However, after that spike, there have been declines in the weighted sentiment, which has now turned negative. As of this writing, the weighted sentiment is around -0.4.

This indicates that negative sentiment now outweighs the positive sentiment that Ethereum enjoyed a few weeks ago.

Source: Santiment

Additionally, an analysis of the social volume showed spikes corresponding to the increases in weighted sentiment. The chart indicated that social volume surged to 4,197 during those periods.

However, similar to the weighted sentiment, it has since declined significantly. As of this writing, the social volume was around 415.

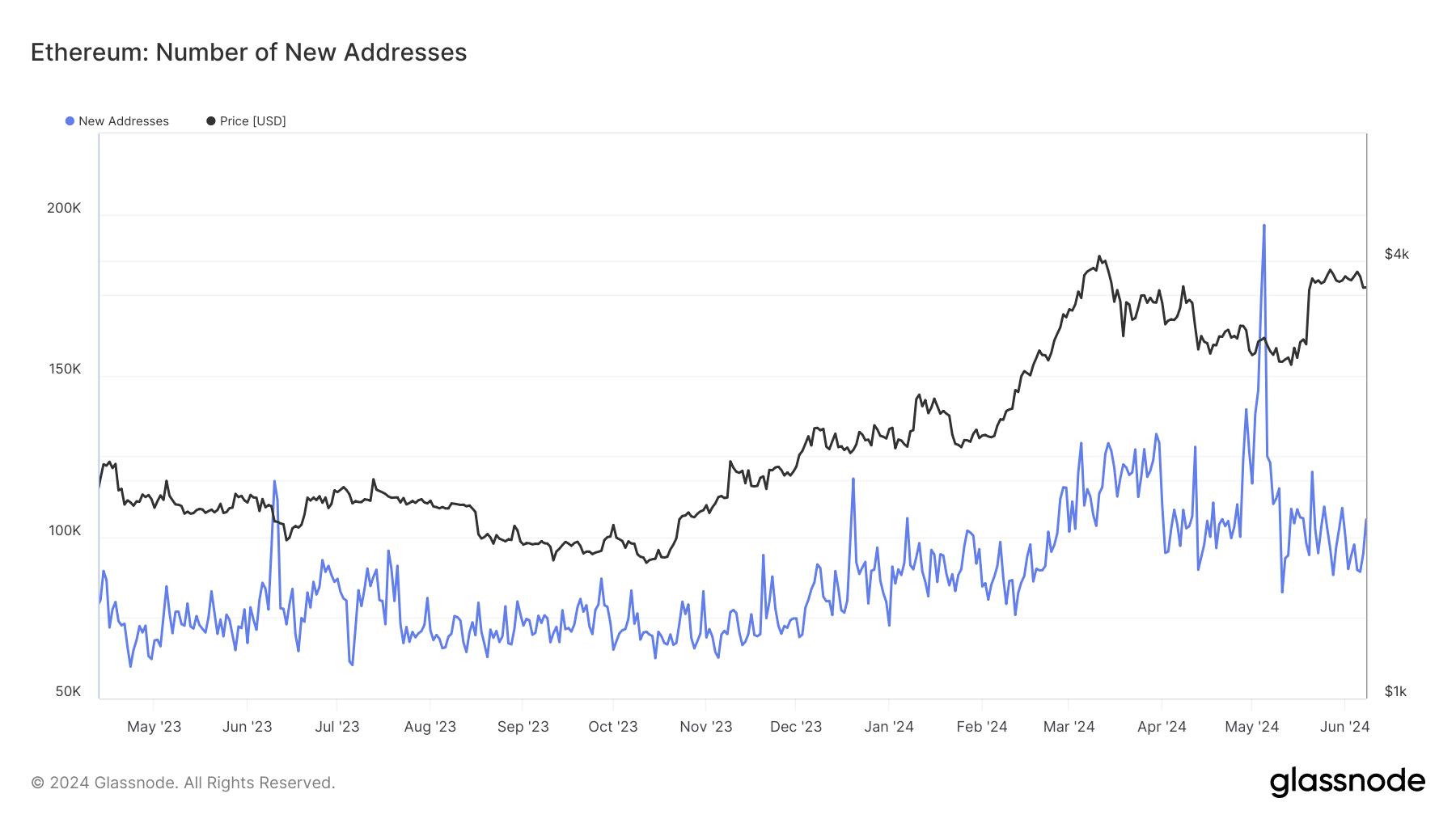

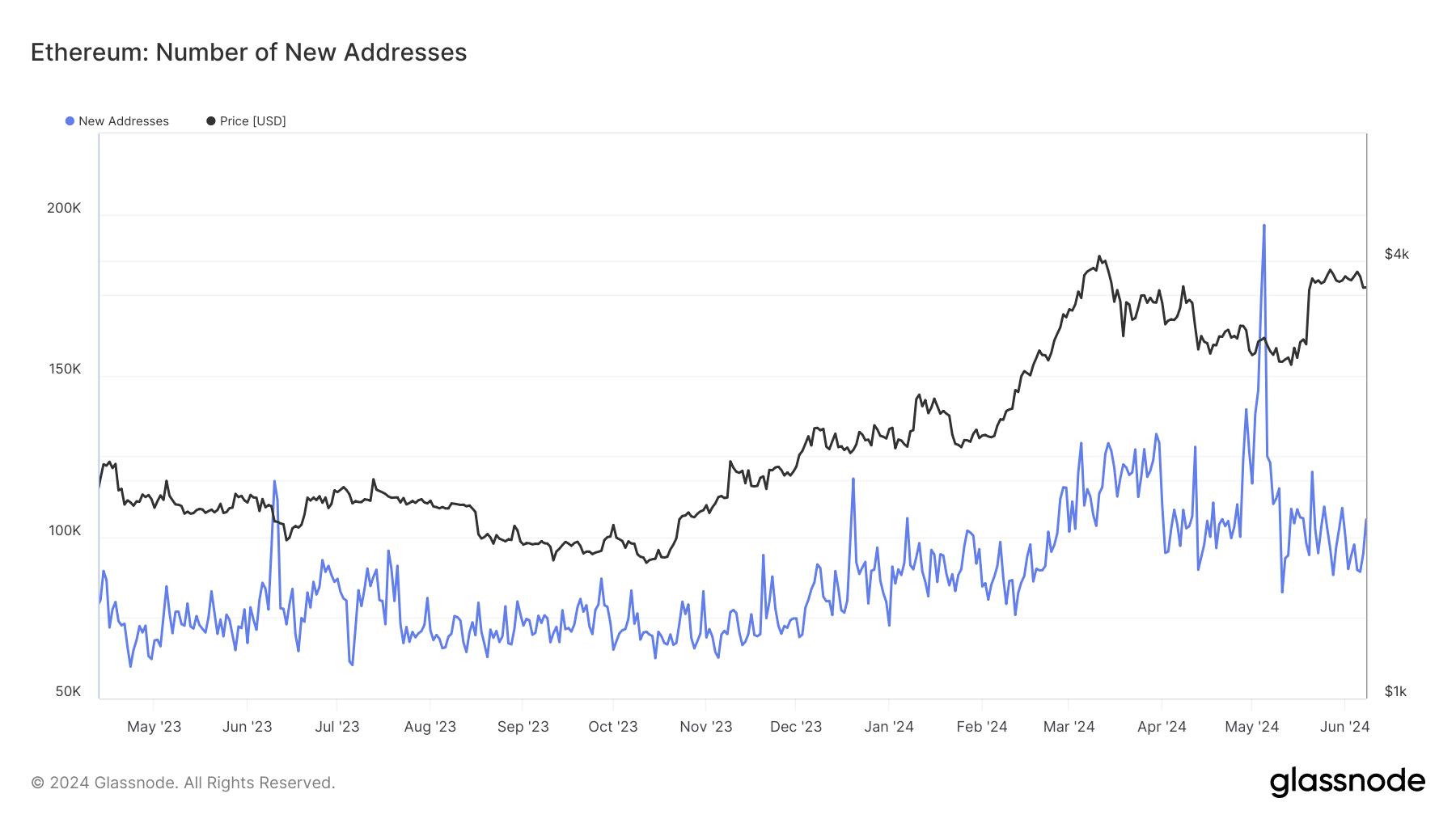

Ethereum’s trend of new addresses continue

An analysis of the new addresses chart on Glassnode revealed that new addresses have continued to flow in despite the weak sentiment. As of this writing, the number of new addresses exceeds 105,000.

Source: Glassnode

Although there were declines at the beginning of the month, an uptrend is now evident. This indicates that more addresses are being created even before the spot ETH trade gets underway.

The number of addresses could further increase once trading starts.

Ethereum remains positive on the derivative side

An analysis of Ethereum’s weighted funding rate on Coinglass showed that it has remained positive despite recent declines.

The chart indicated that the funding rate was around 0.092% as of this writing. This suggests that buyers dominate the market, and there is a strong belief in a future rise in Ethereum’s price.

– Read Ethereum (ETH) Price Prediction 2024-25

ETH sees slight increases

As of this writing, Ethereum was trading at around $3,690 after a 0.4% increase. AMBCrypto’s analysis of its daily time frame price trend showed slight increases over the last two days.

These slight increases followed an over 3% decline on 7th June, which brought Ethereum down from the $3,800 price range.

Source: TradingView

- Ethereum’s funding rate has remained positive despite recent declines.

- The ETH trend has also remained bullish despite the price declines.

After the news of the Ethereum [ETH] spot ETF approval subsided, its weighted sentiment declined as well. Despite this decline, other metrics suggest that Ethereum might be poised for a positive run once spot trading resumes.

Ethereum’s sentiment and social volume declines

An analysis of the Santiment sentiment chart showed a decline in Ethereum’s sentiment. The chart indicated that weighted sentiment spiked to over 6% on the 20th and 21st of May.

It then briefly declined to around 2% before spiking over 6% again on 23rd May. This spike coincided with the news of the ETH spot ETF approval, reflecting heightened conversation and sentiment during that period.

However, after that spike, there have been declines in the weighted sentiment, which has now turned negative. As of this writing, the weighted sentiment is around -0.4.

This indicates that negative sentiment now outweighs the positive sentiment that Ethereum enjoyed a few weeks ago.

Source: Santiment

Additionally, an analysis of the social volume showed spikes corresponding to the increases in weighted sentiment. The chart indicated that social volume surged to 4,197 during those periods.

However, similar to the weighted sentiment, it has since declined significantly. As of this writing, the social volume was around 415.

Ethereum’s trend of new addresses continue

An analysis of the new addresses chart on Glassnode revealed that new addresses have continued to flow in despite the weak sentiment. As of this writing, the number of new addresses exceeds 105,000.

Source: Glassnode

Although there were declines at the beginning of the month, an uptrend is now evident. This indicates that more addresses are being created even before the spot ETH trade gets underway.

The number of addresses could further increase once trading starts.

Ethereum remains positive on the derivative side

An analysis of Ethereum’s weighted funding rate on Coinglass showed that it has remained positive despite recent declines.

The chart indicated that the funding rate was around 0.092% as of this writing. This suggests that buyers dominate the market, and there is a strong belief in a future rise in Ethereum’s price.

– Read Ethereum (ETH) Price Prediction 2024-25

ETH sees slight increases

As of this writing, Ethereum was trading at around $3,690 after a 0.4% increase. AMBCrypto’s analysis of its daily time frame price trend showed slight increases over the last two days.

These slight increases followed an over 3% decline on 7th June, which brought Ethereum down from the $3,800 price range.

Source: TradingView

can i get cheap clomid tablets clomiphene other name cost clomid prices how to buy clomiphene without prescription how to buy generic clomid without dr prescription get generic clomid online how to buy clomiphene pill

This is the description of glad I take advantage of reading.

buy zithromax cheap – azithromycin 500mg pills flagyl 400mg oral

buy semaglutide 14mg sale – order semaglutide generic generic periactin

domperidone order – brand cyclobenzaprine how to get flexeril without a prescription

inderal where to buy – buy methotrexate 2.5mg pills methotrexate 2.5mg brand

zithromax over the counter – bystolic 5mg canada bystolic sale

order augmentin 375mg online – at bio info ampicillin pill

esomeprazole sale – https://anexamate.com/ esomeprazole 20mg usa

coumadin 2mg for sale – anticoagulant oral cozaar 25mg

meloxicam 15mg generic – https://moboxsin.com/ mobic tablet

buy prednisone 10mg sale – corticosteroid purchase deltasone pill

ed pills otc – https://fastedtotake.com/ buy ed pills cheap

buy amoxil sale – comba moxi buy amoxicillin

buy generic fluconazole 200mg – https://gpdifluca.com/ fluconazole 100mg cost

cenforce 50mg us – https://cenforcers.com/ cenforce 100mg us

buy ranitidine generic – https://aranitidine.com/# buy zantac pill

cialis free trial 2018 – https://strongtadafl.com/ buy tadalafil cheap online

goodrx viagra 100mg – https://strongvpls.com/ order viagra online fast delivery

More articles like this would remedy the blogosphere richer. provigil para estudiar

I am in fact enchant‚e ‘ to coup d’oeil at this blog posts which consists of tons of of use facts, thanks towards providing such data. https://ursxdol.com/augmentin-amoxiclav-pill/

Thanks on sharing. It’s top quality. https://prohnrg.com/product/acyclovir-pills/

I couldn’t turn down commenting. Warmly written! site

Good blog you have here.. It’s obdurate to find strong status script like yours these days. I truly comprehend individuals like you! Rent guardianship!! https://ondactone.com/simvastatin/

Thanks an eye to sharing. It’s outstrip quality.

buy levaquin generic

This is the make of enter I recoup helpful. http://domzy.com/https://www.instapaper.com/p/adip

More posts like this would add up to the online play more useful. http://zqykj.com/bbs/home.php?mod=space&uid=302444

dapagliflozin usa – https://janozin.com/# cost dapagliflozin 10mg

purchase orlistat without prescription – buy orlistat pills for sale brand xenical

This is the gentle of scribble literary works I in fact appreciate. http://seafishzone.com/home.php?mod=space&uid=2331131