- Ethereum, as the largest altcoin, has a history of defying mainstream expectations with sudden surges

- However, its deviation from historical quarterly trends now signals a bearish outlook

Ethereum [ETH] has had a turbulent Q1, facing strong resistance and market uncertainty. However, with improving fundamentals and growing institutional interest, could a 60% rally in Q2 push ETH towards $3,200?

Let’s dive into the key factors that could fuel this move.

Ethereum’s Q1 underperformance in focus

Ethereum opened Q1 at $3,334, but it has since retraced to $2,053 – Posting a 38% drawdown with only a week remaining in the quarter.

In comparison, ETH’s 2024 Q1 rally saw it closing at an all-time high of $4,081 – An 84% quarterly gain. This stark divergence raises concerns about Ethereum’s structural weakness, as both liquidity inflows and network activity have remained subdued.

Consequently, the implications extend beyond short-term price action. In fact, analysts have revised year-end targets by nearly 60%, citing weak institutional participation.

Compounding this, the ETH/BTC pair recently fell to a five-year low, diverging from its 2024 yearly high. Unlike previous cycles, Ethereum has failed to attract capital rotation during Bitcoin’s bullish consolidation.

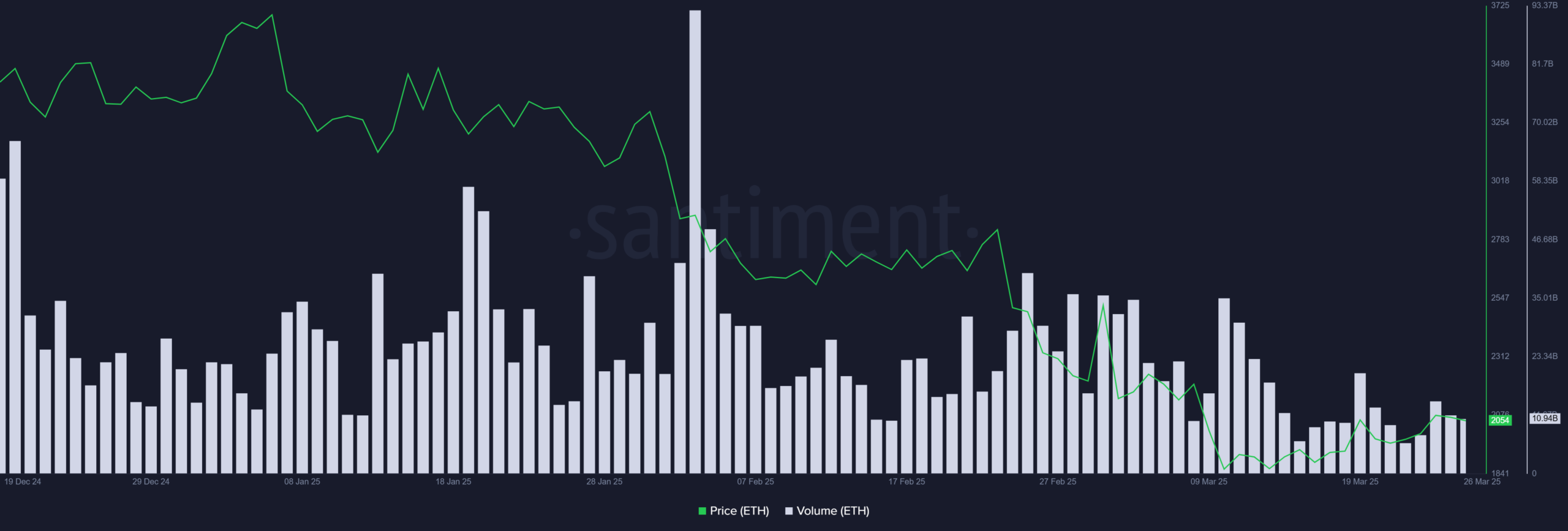

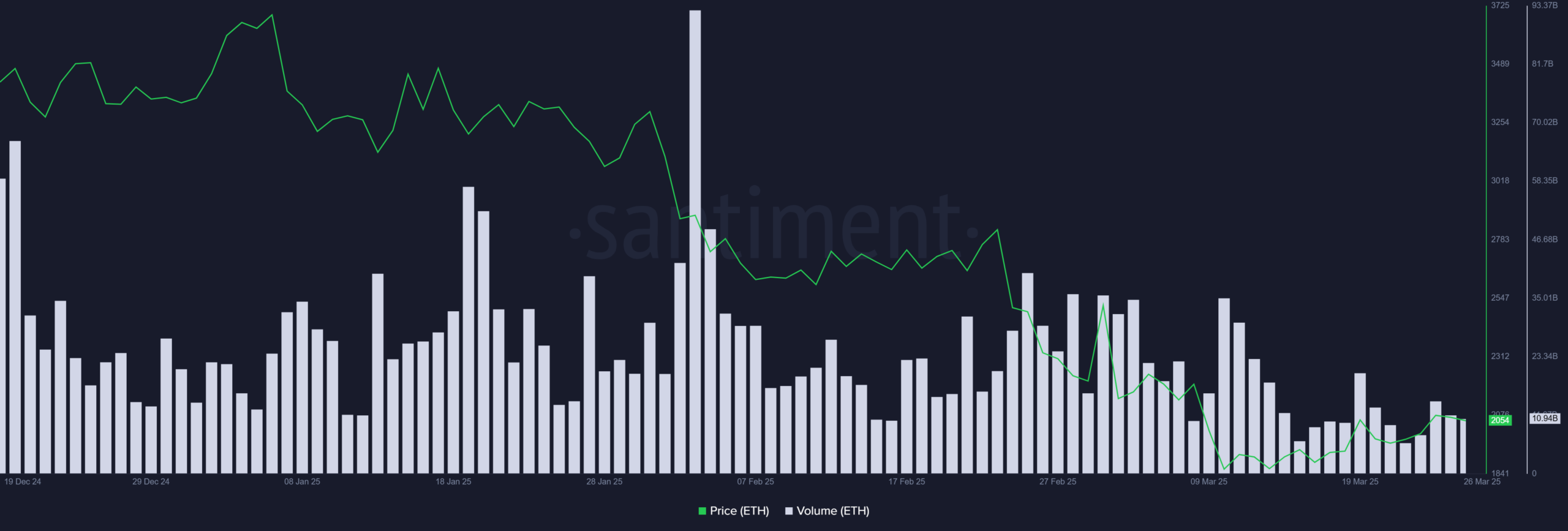

For instance, while BTC reclaimed $88k following a two-week correction, ETH’s rebound to $2k saw no significant uptick in trading volume – A sign of weakening demand.

Source: Santiment

Given this backdrop, a 60% Q2 rally might be unlikely. And yet, Ethereum has a track record of defying expectations.

Could this be another instance of an unexpected breakout?

Can ETH shock the market with a surprise rally?

In Q2 2024, Bitcoin closed the quarter 14% below its opening price, while Ethereum demonstrated relative strength with only a 5% decline. This outperformance highlighted ETH’s resilience, despite broader market corrections.

A potential market shock, therefore, would arise if Ethereum replicates this trend in Q2 2025.

While the ETH/BTC pair remains suppressed, Open Interest (OI) and Funding Rates (FR) in Ethereum Futures suggest traders may be positioning for an alternative outcome.

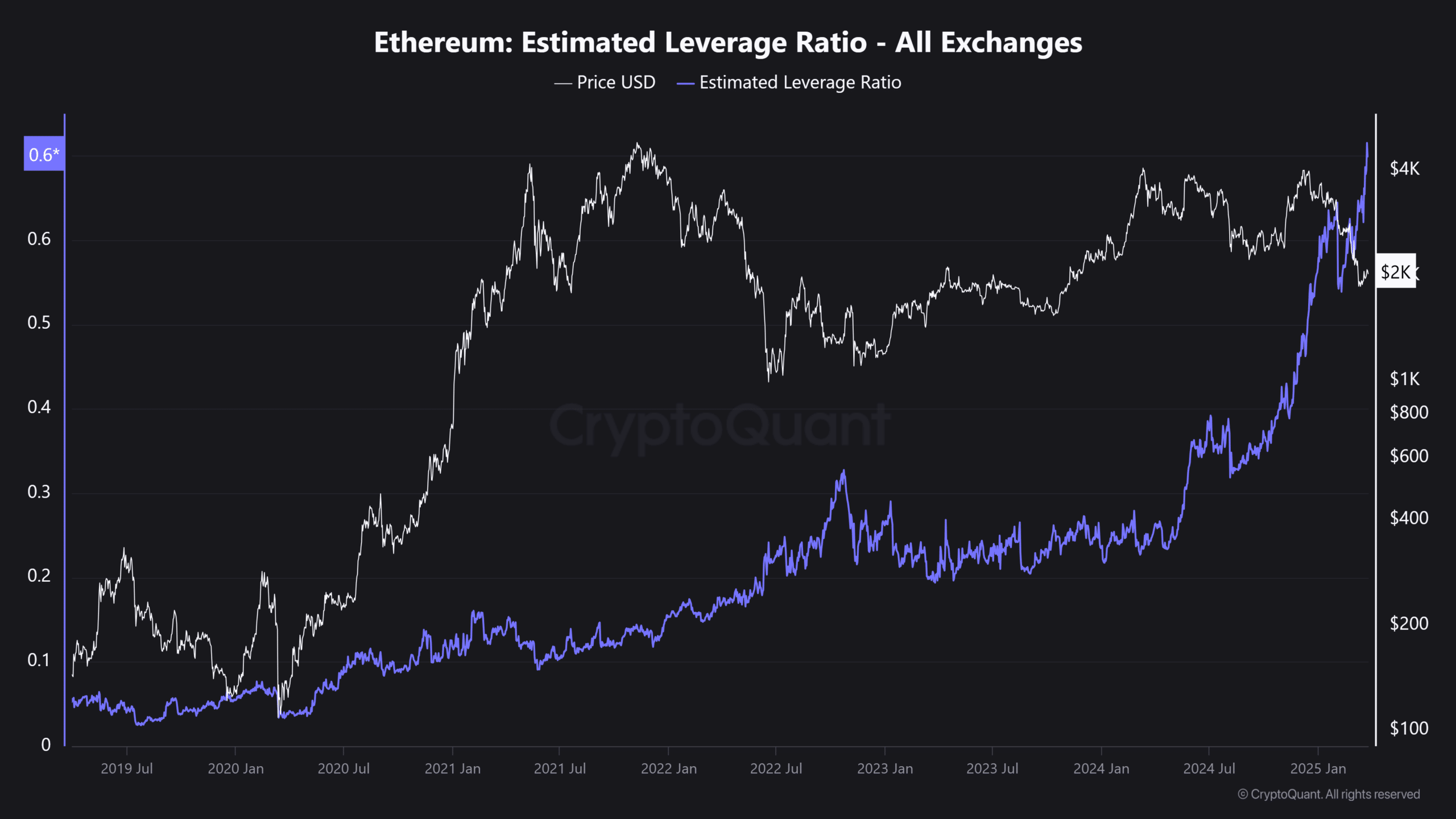

Notably, Ethereum’s Estimated Leverage Ratio (ELR) surged to an all-time high – Indicating an influx of high-risk capital.

Source: CryptoQuant

Historically, such elevated leverage has acted as a double-edged sword — Either fueling a breakout or triggering cascading liquidations.

For Ethereum to capitalize on this leverage buildup, a confluence of factors is required – Sustained Bitcoin strength, increasing spot demand, and a resurgence in institutional inflows.

Should these conditions materialize, the likelihood of an unexpected 60% rally towards $3,200 transitions from speculative optimism to a structurally supported market scenario.

- Ethereum, as the largest altcoin, has a history of defying mainstream expectations with sudden surges

- However, its deviation from historical quarterly trends now signals a bearish outlook

Ethereum [ETH] has had a turbulent Q1, facing strong resistance and market uncertainty. However, with improving fundamentals and growing institutional interest, could a 60% rally in Q2 push ETH towards $3,200?

Let’s dive into the key factors that could fuel this move.

Ethereum’s Q1 underperformance in focus

Ethereum opened Q1 at $3,334, but it has since retraced to $2,053 – Posting a 38% drawdown with only a week remaining in the quarter.

In comparison, ETH’s 2024 Q1 rally saw it closing at an all-time high of $4,081 – An 84% quarterly gain. This stark divergence raises concerns about Ethereum’s structural weakness, as both liquidity inflows and network activity have remained subdued.

Consequently, the implications extend beyond short-term price action. In fact, analysts have revised year-end targets by nearly 60%, citing weak institutional participation.

Compounding this, the ETH/BTC pair recently fell to a five-year low, diverging from its 2024 yearly high. Unlike previous cycles, Ethereum has failed to attract capital rotation during Bitcoin’s bullish consolidation.

For instance, while BTC reclaimed $88k following a two-week correction, ETH’s rebound to $2k saw no significant uptick in trading volume – A sign of weakening demand.

Source: Santiment

Given this backdrop, a 60% Q2 rally might be unlikely. And yet, Ethereum has a track record of defying expectations.

Could this be another instance of an unexpected breakout?

Can ETH shock the market with a surprise rally?

In Q2 2024, Bitcoin closed the quarter 14% below its opening price, while Ethereum demonstrated relative strength with only a 5% decline. This outperformance highlighted ETH’s resilience, despite broader market corrections.

A potential market shock, therefore, would arise if Ethereum replicates this trend in Q2 2025.

While the ETH/BTC pair remains suppressed, Open Interest (OI) and Funding Rates (FR) in Ethereum Futures suggest traders may be positioning for an alternative outcome.

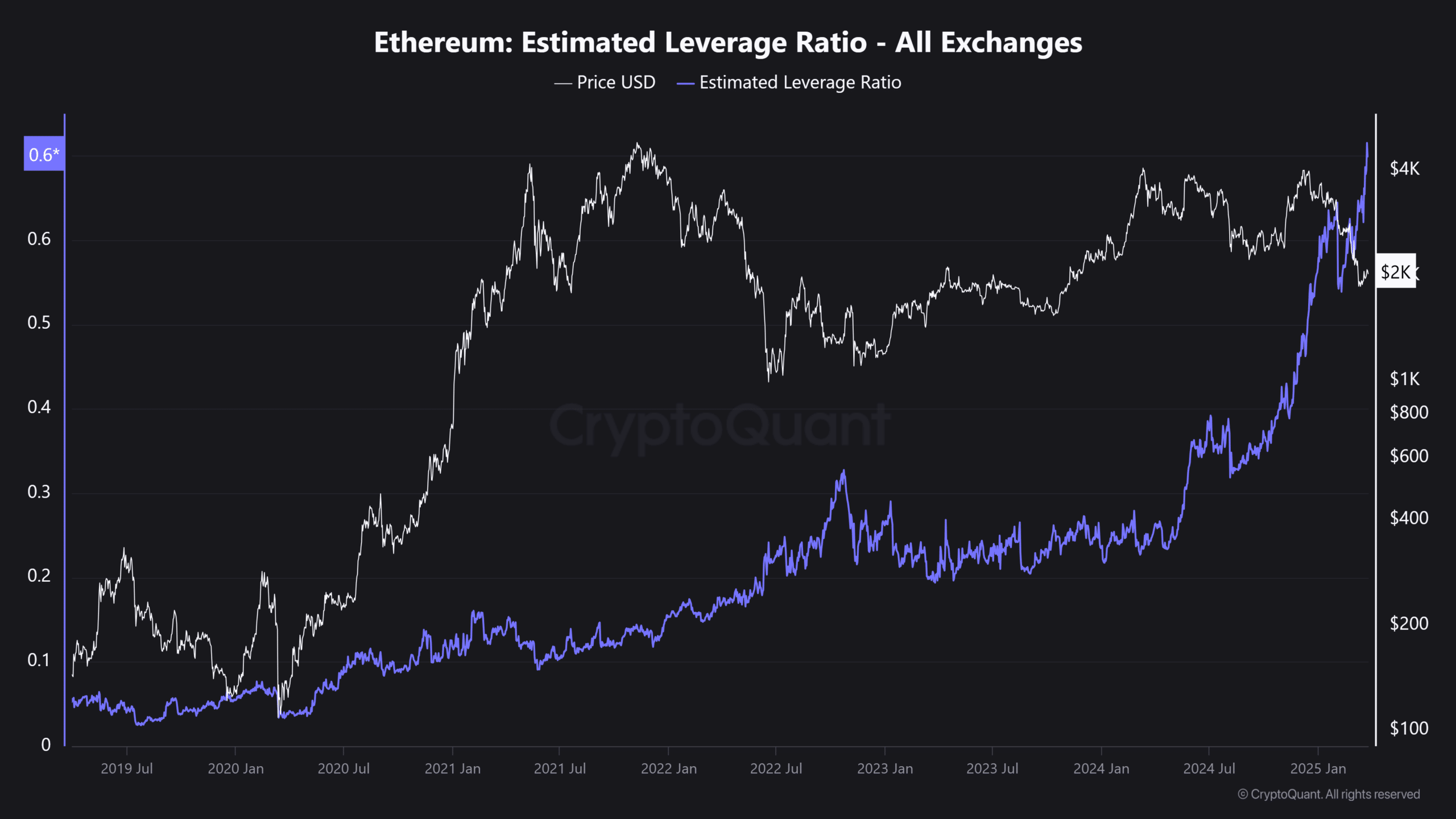

Notably, Ethereum’s Estimated Leverage Ratio (ELR) surged to an all-time high – Indicating an influx of high-risk capital.

Source: CryptoQuant

Historically, such elevated leverage has acted as a double-edged sword — Either fueling a breakout or triggering cascading liquidations.

For Ethereum to capitalize on this leverage buildup, a confluence of factors is required – Sustained Bitcoin strength, increasing spot demand, and a resurgence in institutional inflows.

Should these conditions materialize, the likelihood of an unexpected 60% rally towards $3,200 transitions from speculative optimism to a structurally supported market scenario.

cheapest clomid pills how to buy generic clomid without dr prescription how to get cheap clomid pill where buy clomid no prescription how can i get cheap clomiphene without prescription can i buy clomid no prescription can you buy cheap clomiphene pills

More posts like this would make the blogosphere more useful.

With thanks. Loads of expertise!

buy zithromax generic – order zithromax 250mg online buy generic flagyl

buy rybelsus 14 mg online – rybelsus 14 mg canada buy periactin online cheap

domperidone order – buy flexeril 15mg sale cost cyclobenzaprine 15mg

order generic inderal 10mg – purchase inderal sale methotrexate 2.5mg price

buy amoxiclav online – atbioinfo.com ampicillin pills

nexium 20mg for sale – anexamate.com buy esomeprazole pills

coumadin 5mg cost – anticoagulant buy losartan 50mg online

cost meloxicam 15mg – https://moboxsin.com/ meloxicam uk

buy deltasone 20mg sale – https://apreplson.com/ buy deltasone 10mg

cheap erectile dysfunction – https://fastedtotake.com/ the best ed pill

amoxicillin online buy – https://combamoxi.com/ buy amoxil

fluconazole 200mg brand – flucoan diflucan over the counter

escitalopram cheap – escita pro order lexapro 10mg generic

buy cenforce – https://cenforcers.com/# cenforce 50mg sale

vidalista tadalafil reviews – why is cialis so expensive how long does tadalafil take to work

buy ranitidine cheap – https://aranitidine.com/# buy zantac for sale

This is a question which is in to my callousness… Numberless thanks! Faithfully where can I lay one’s hands on the phone details for questions? comprar propecia original

This website absolutely has all of the low-down and facts I needed adjacent to this case and didn’t comprehend who to ask. order zithromax 500mg online

More posts like this would make the blogosphere more useful. https://ursxdol.com/levitra-vardenafil-online/

Greetings! Utter useful par‘nesis within this article! It’s the crumb changes which wish turn the largest changes. Thanks a quantity in the direction of sharing! https://prohnrg.com/product/diltiazem-online/

More posts like this would prosper the blogosphere more useful. https://ondactone.com/spironolactone/

This is the kind of writing I rightly appreciate. http://fulloyuntr.10tl.net/member.php?action=profile&uid=3133

dapagliflozin 10 mg ca – https://janozin.com/ buy forxiga sale

orlistat buy online – xenical for sale online cost xenical 60mg