- ETH’s leverage has surged to $10B in two months.

- Historical trends indicated high leverage could negatively impact ETH’s value.

Despite Q1 being historically bullish for Ethereum [ETH], the altcoin’s massive $10B leverage could expose it to liquidation risks and cap upside potential.

Andrew Kang, Co-Founder of crypto VC firm Mechanism Capital, projected ETH could remain range-bound ($2K-$4K) due to this leverage risk. He stated,

“$ETH has added $10b+ in leverage since the election. This unwind will be painful, but $ETH won’t go to zero. It will simply range from $2k to $4k for a very long time”

Source: X

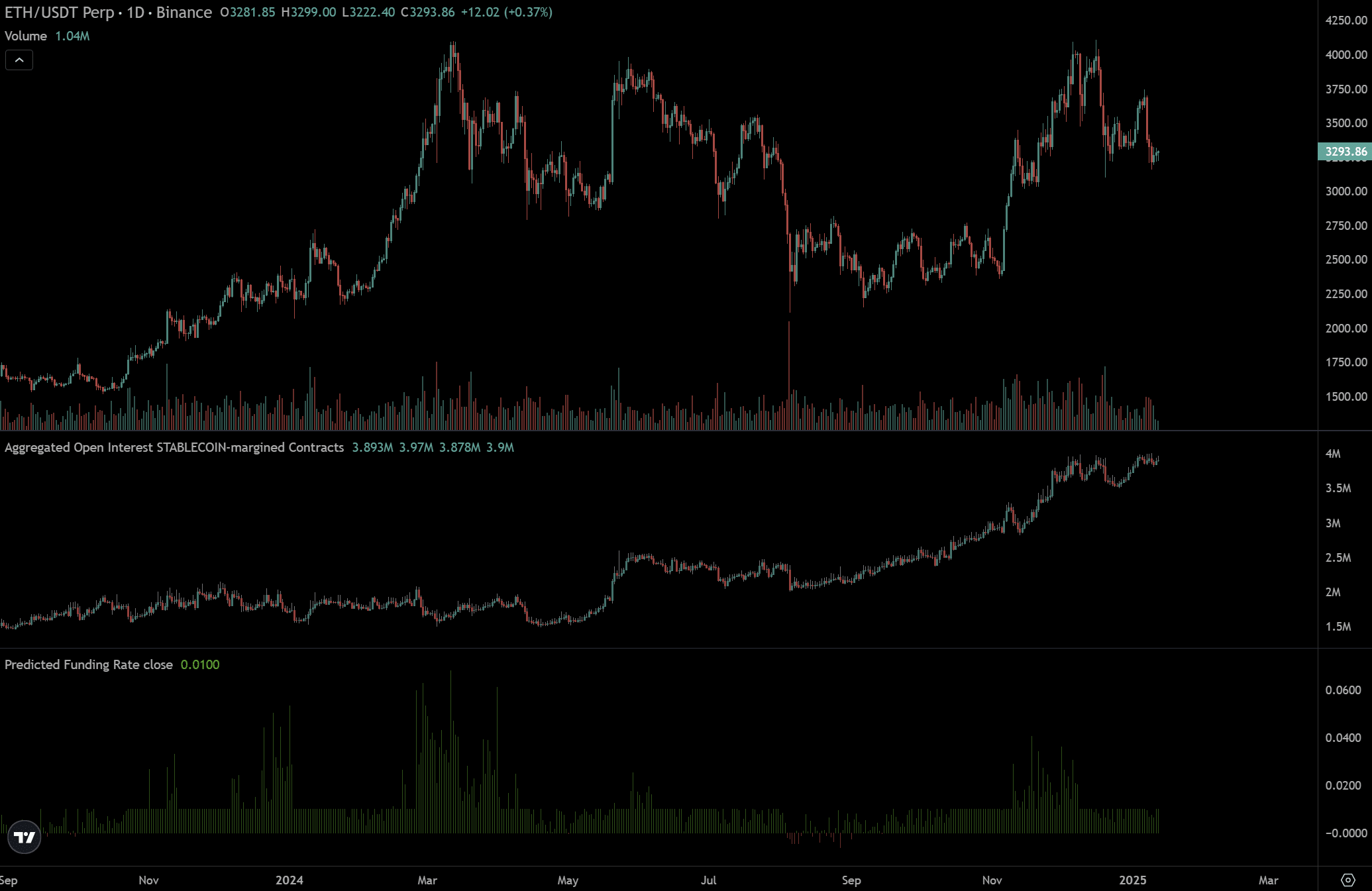

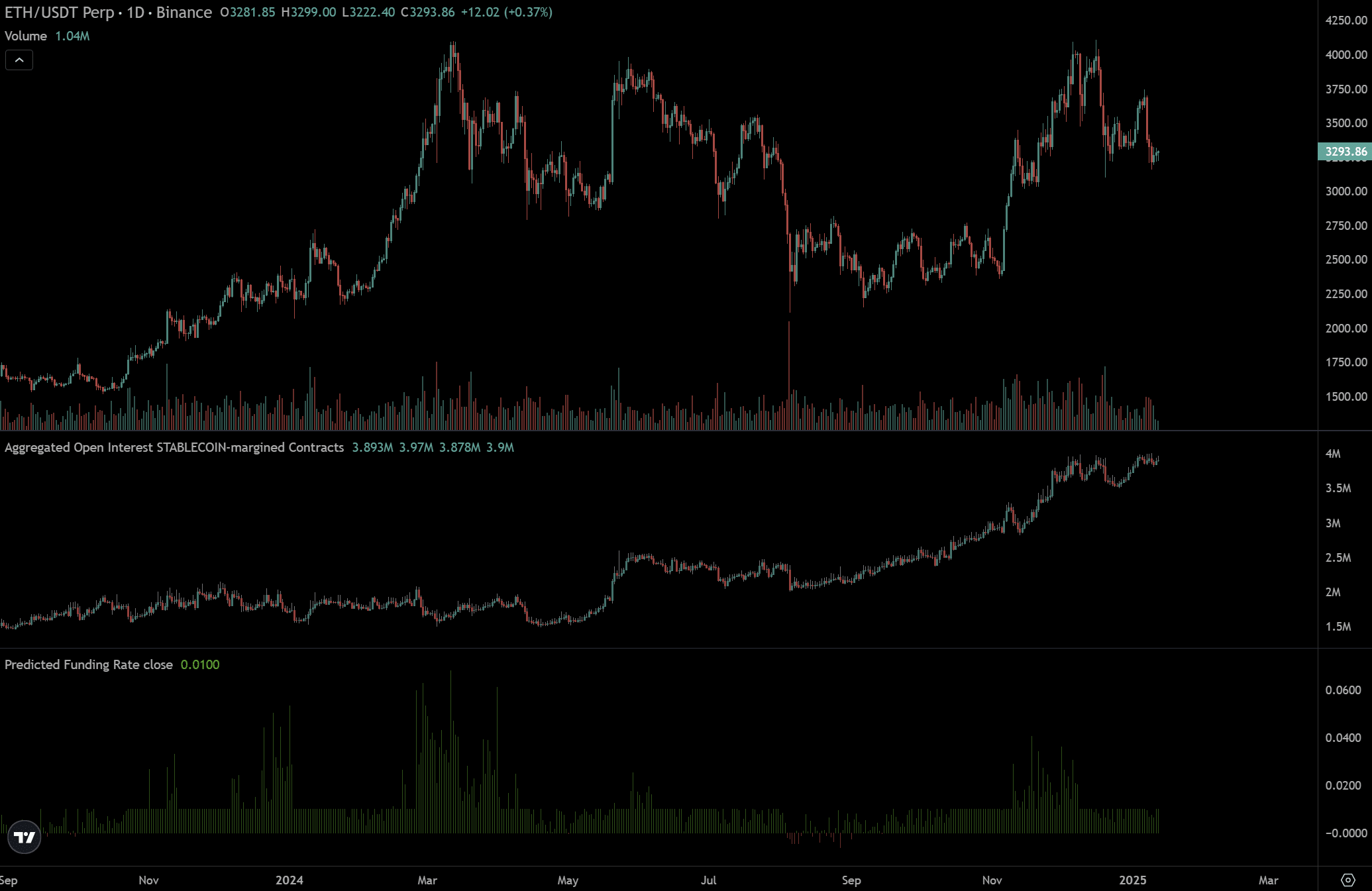

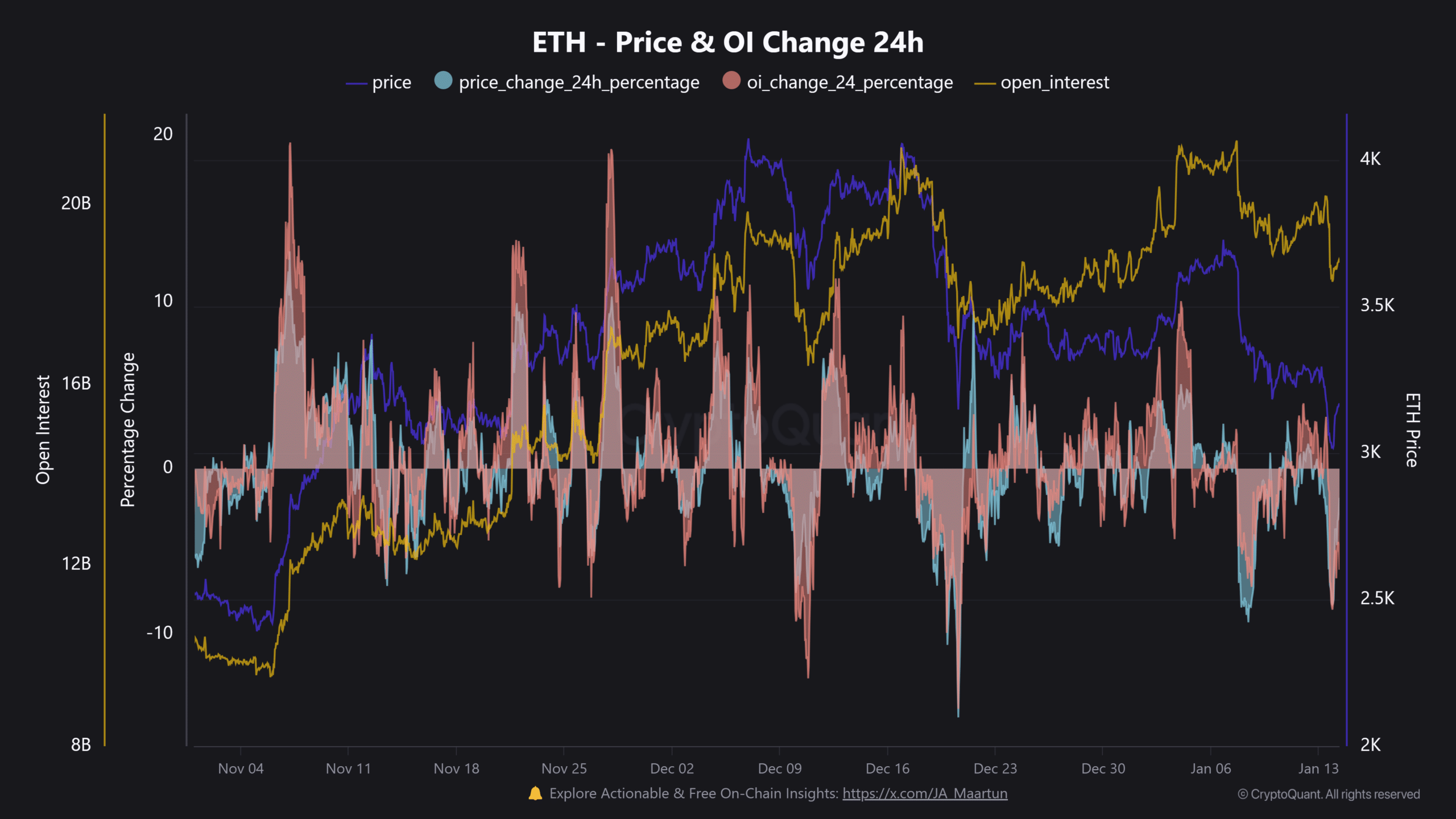

Before the US elections, ETH leverage (borrowed asset for speculative trading) stood at $9B. It shot up to over $19B in December.

Afterward, the sharp price decline liquidated several positions and dragged ETH to around $3.1K.

Will leverage derail ETH’s upside?

Kang added that the ETH ‘basis trade’ driven by CME Futures had little impact on the massive leverage since it was ‘delta-neutral’—every ETH bought in the spot market is shorted in the Futures market. Instead, he blamed speculative traders for the excessive leverage.

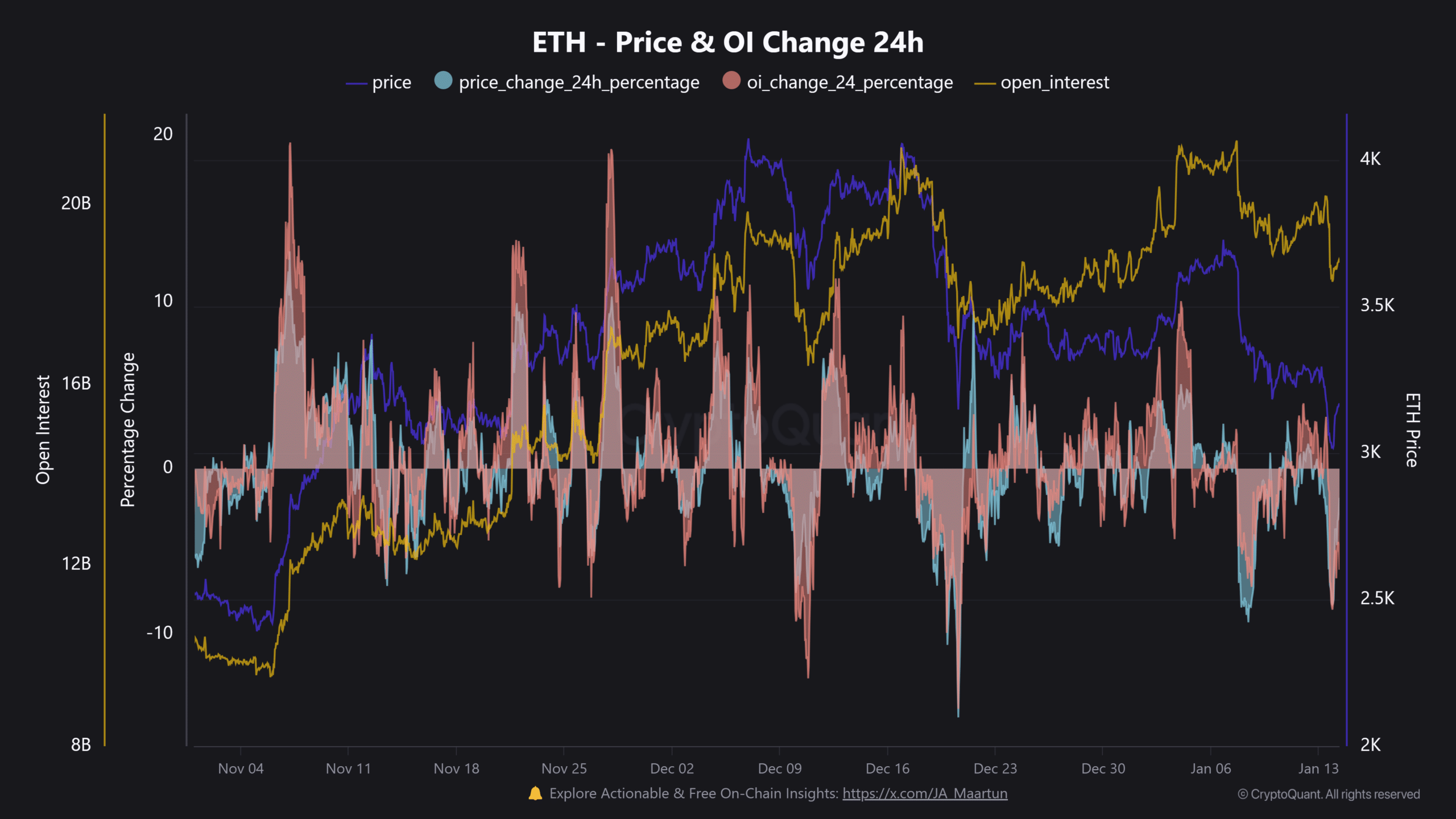

The historical ETH-leverage-driven pump confirmed Kang’s concerns. In most cases, whenever leverage Open Interest increased more than price during the rally, a pullback and local top followed.

Source: CryptoQuant

This was evident in early November and late December. They both escalated ETH liquidations.

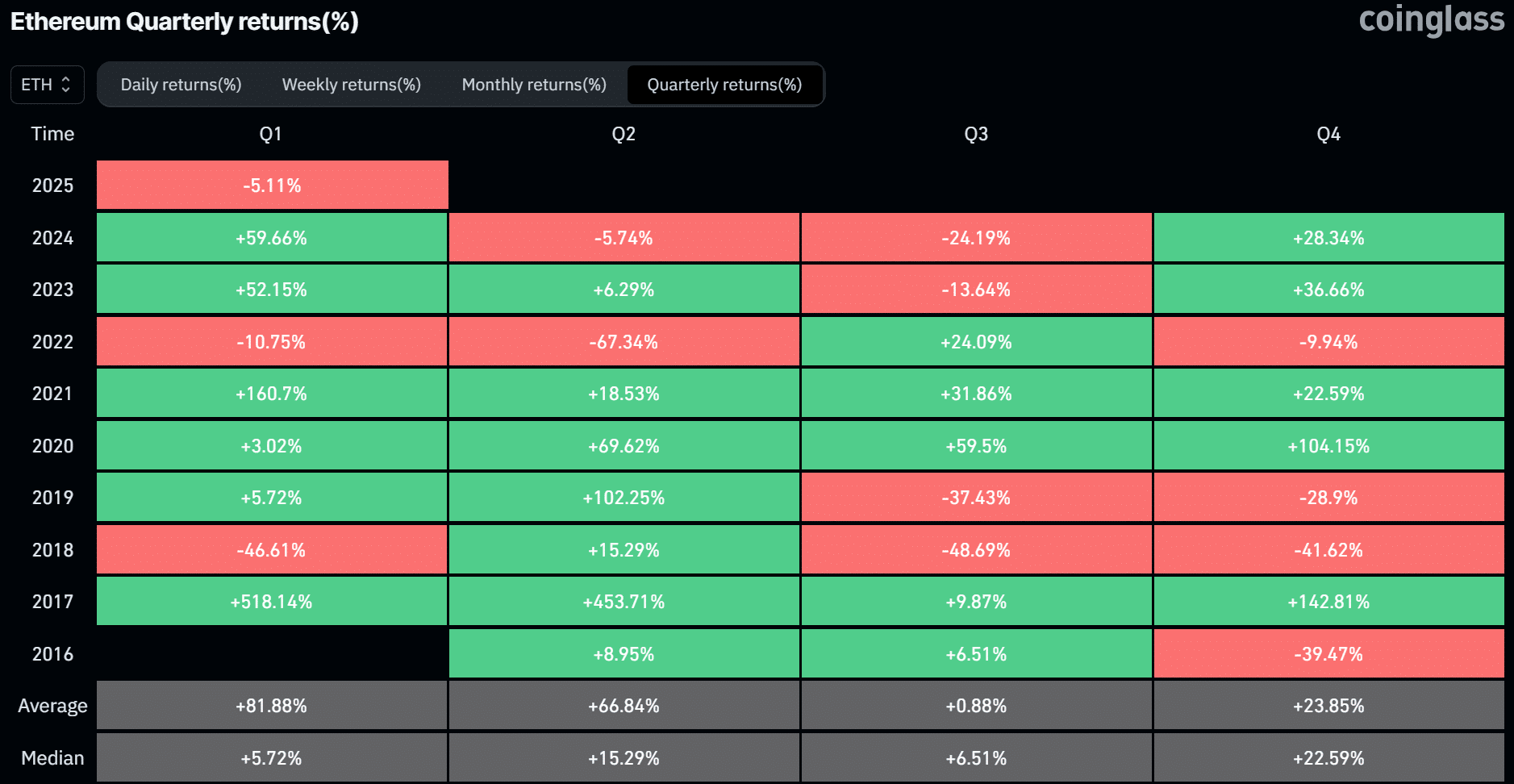

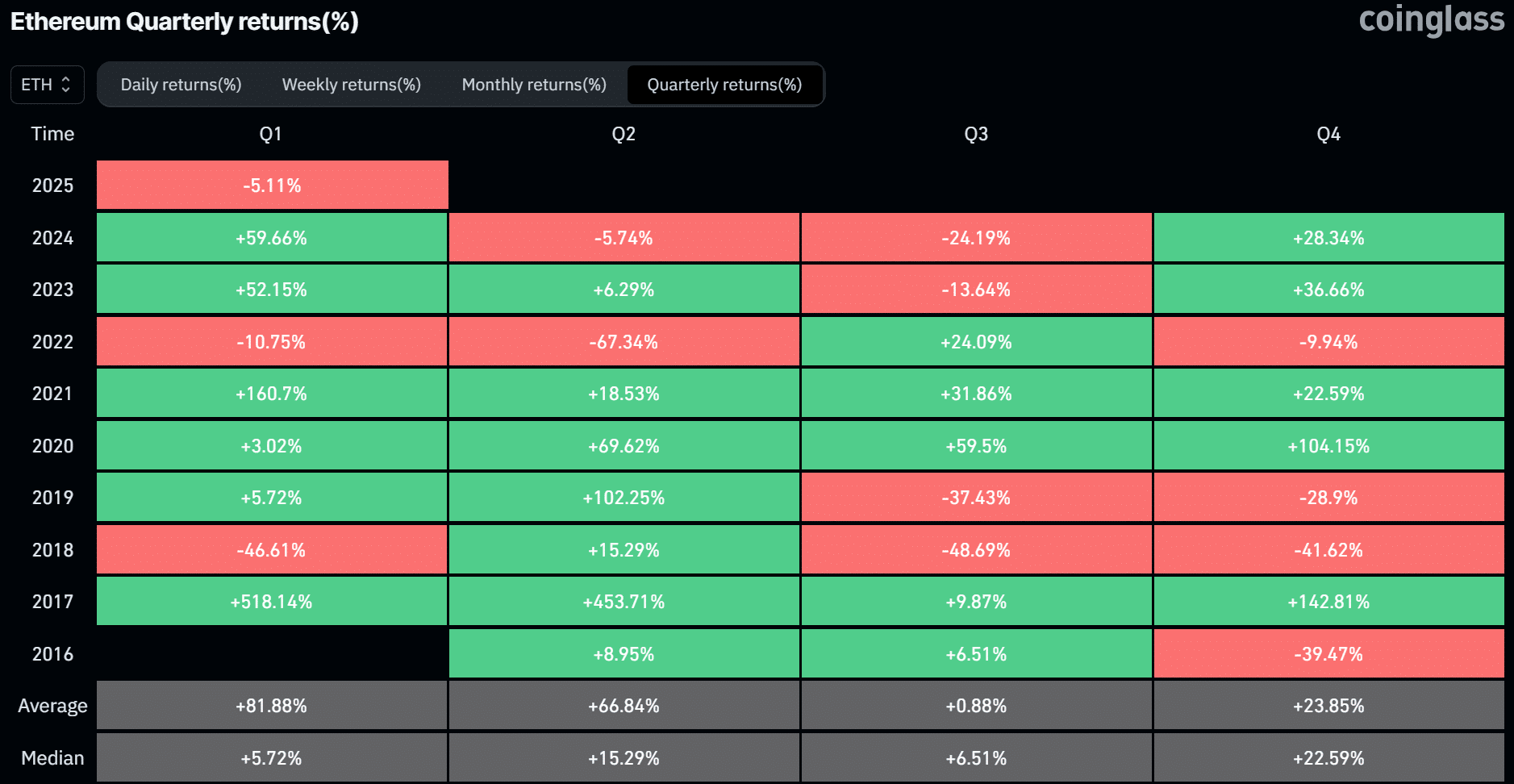

In fact, on the 20th of December, ETH recorded over $300M of liquidations, and long positions dominated the losses. That said, Coinglass data revealed that Q1 has always been ETH’s strongest performer, with an average of 81% gain.

Out of the past seven years, ETH closed only two quarters (Q1s) in the red. Simply put, if historical trends repeat, ETH could record significant gains in Q1 2025.

Source: Coinglass

However, the lurking liquidation risk could cap the upside expectation. At press time, ETH was back above $3K after a sharp drop to $2.9K following Monday’s bearish move.

- ETH’s leverage has surged to $10B in two months.

- Historical trends indicated high leverage could negatively impact ETH’s value.

Despite Q1 being historically bullish for Ethereum [ETH], the altcoin’s massive $10B leverage could expose it to liquidation risks and cap upside potential.

Andrew Kang, Co-Founder of crypto VC firm Mechanism Capital, projected ETH could remain range-bound ($2K-$4K) due to this leverage risk. He stated,

“$ETH has added $10b+ in leverage since the election. This unwind will be painful, but $ETH won’t go to zero. It will simply range from $2k to $4k for a very long time”

Source: X

Before the US elections, ETH leverage (borrowed asset for speculative trading) stood at $9B. It shot up to over $19B in December.

Afterward, the sharp price decline liquidated several positions and dragged ETH to around $3.1K.

Will leverage derail ETH’s upside?

Kang added that the ETH ‘basis trade’ driven by CME Futures had little impact on the massive leverage since it was ‘delta-neutral’—every ETH bought in the spot market is shorted in the Futures market. Instead, he blamed speculative traders for the excessive leverage.

The historical ETH-leverage-driven pump confirmed Kang’s concerns. In most cases, whenever leverage Open Interest increased more than price during the rally, a pullback and local top followed.

Source: CryptoQuant

This was evident in early November and late December. They both escalated ETH liquidations.

In fact, on the 20th of December, ETH recorded over $300M of liquidations, and long positions dominated the losses. That said, Coinglass data revealed that Q1 has always been ETH’s strongest performer, with an average of 81% gain.

Out of the past seven years, ETH closed only two quarters (Q1s) in the red. Simply put, if historical trends repeat, ETH could record significant gains in Q1 2025.

Source: Coinglass

However, the lurking liquidation risk could cap the upside expectation. At press time, ETH was back above $3K after a sharp drop to $2.9K following Monday’s bearish move.

where to get clomiphene pill clomid contraindications name brand for clomiphene how to get cheap clomid no prescription can you buy clomid online where can i buy cheap clomiphene tablets can you buy clomid without a prescription

More posts like this would add up to the online space more useful.

With thanks. Loads of knowledge!

order zithromax 500mg – buy floxin no prescription buy flagyl 400mg online cheap

buy semaglutide 14mg for sale – buy generic rybelsus over the counter cyproheptadine cost

order motilium 10mg online cheap – buy generic cyclobenzaprine buy cyclobenzaprine no prescription

cost propranolol – methotrexate 10mg us buy methotrexate 2.5mg for sale

amoxicillin generic – amoxicillin for sale online ipratropium 100 mcg oral

buy zithromax 250mg generic – tinidazole 500mg cost nebivolol canada

buy clavulanate cheap – atbioinfo.com buy ampicillin for sale

esomeprazole online order – nexiumtous buy nexium 20mg sale

coumadin ca – https://coumamide.com/ losartan over the counter

meloxicam 7.5mg tablet – moboxsin.com buy meloxicam online cheap

oral prednisone – aprep lson prednisone 40mg drug

best ed pills non prescription – fastedtotake.com otc ed pills that work

buy generic amoxil over the counter – https://combamoxi.com/ amoxil without prescription

diflucan 100mg oral – https://gpdifluca.com/ how to get forcan without a prescription

cenforce 100mg canada – cost cenforce cenforce 100mg canada

how long does it take cialis to start working – https://ciltadgn.com/# cialis super active real online store

cialis for daily use reviews – cialis stopped working cialis patent expiration 2016

buy ranitidine 150mg for sale – click buy ranitidine 300mg online cheap

order viagra in uk – https://strongvpls.com/# cheap viagra vipps

Facts blog you possess here.. It’s obdurate to espy high calibre article like yours these days. I truly recognize individuals like you! Withstand care!! https://gnolvade.com/

This website exceedingly has all of the tidings and facts I needed about this subject and didn’t identify who to ask. cost furosemide

With thanks. Loads of expertise! https://ursxdol.com/doxycycline-antibiotic/

The depth in this tune is exceptional. https://prohnrg.com/product/acyclovir-pills/

Thanks recompense sharing. It’s top quality. https://aranitidine.com/fr/acheter-fildena/

Thanks on putting this up. It’s understandably done. https://ondactone.com/spironolactone/

More articles like this would remedy the blogosphere richer.

propranolol usa

The thoroughness in this break down is noteworthy. http://www.dbgjjs.com/home.php?mod=space&uid=531988

buy dapagliflozin 10 mg generic – order forxiga 10 mg pills buy dapagliflozin paypal

order xenical pills – janozin.com order orlistat 120mg pill