- ETH Options traders have begun bullish positioning for the Pectra upgrade

- Markets are pricing a 14% chance altcoin would hit $4k by the end of April

Traders have begun positioning for Ethereum’s Pectra upgrade, raising questions about whether the historical “buy the rumor, sell the news” idea will play out again. As it stands, the upgrade is scheduled for early April if the tesnet set for 24 February and 5 March goes as planned.

According to the crypto options trading desk QCP Capital, traders’ positioning leaned on this bullish play, at press time. The firm noted,

“Traders are positioning for another volatility event, with volatility skewed in favor of calls from March 28 onward. This could set the stage for the next major positioning theme.”

Will Pectra upgrade pump ETH?

QCP Capital added that previous upgrades have always been front-run before sell-offs after the events. The only exception would be the Shanghai upgrade in April 2024. The firm highlighted,

“The Merge (Sep 2022) → Classic “buy the rumor, sell the news”. ETH rallied 100%+ from June lows before selling off post-event. Shanghai (Apr 2023) → Markets feared excess supply, but when selling pressure failed to materialize, ETH climbed 30% in the following months.”

For those unfamiliar, the Pectra upgrade aims to ship eleven key features, including blob expansion and smart wallet capabilities.

The aforementioned scalability efforts have begun to pay off too. For instance, recently, Ethereum’s average transaction cost has been rivalling Solana with sub 1 gwei in gas charges.

However, despite these efforts, there hasn’t been a notable uptick in demand for L1. Hence, whether the Pectra upgrade will accelerate L1 demand remains to be seen.

Will ETH reclaim $4k?

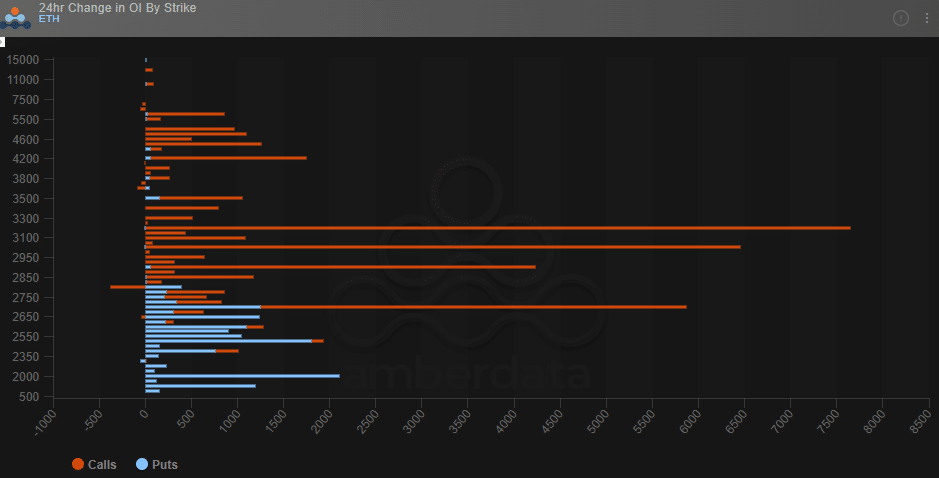

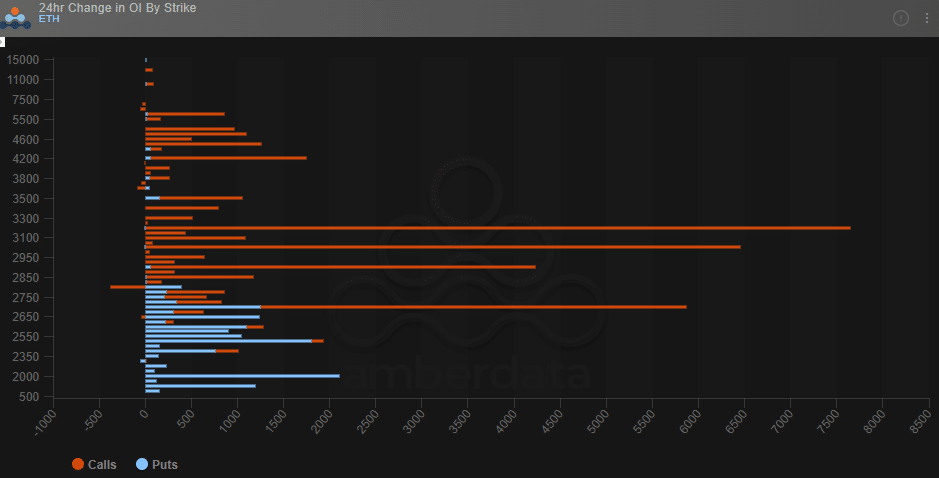

That being said, in the last 24 hours, calls (bullish bets) eyeing the $3.2k and $3k price targets were the most bought.

For protection, puts (bearish bets) were piled at the $2k target. This suggested that Options traders, in the short term, expected a surge to $3.2k with $2k as support in the wake of extremely bearish moves.

Source: Amberdata

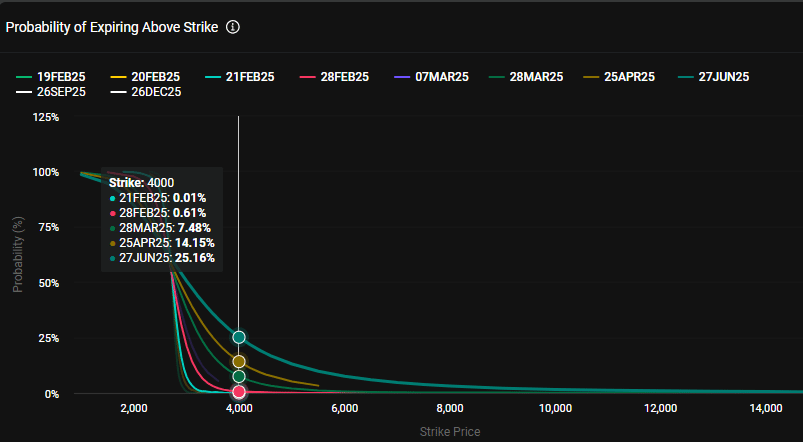

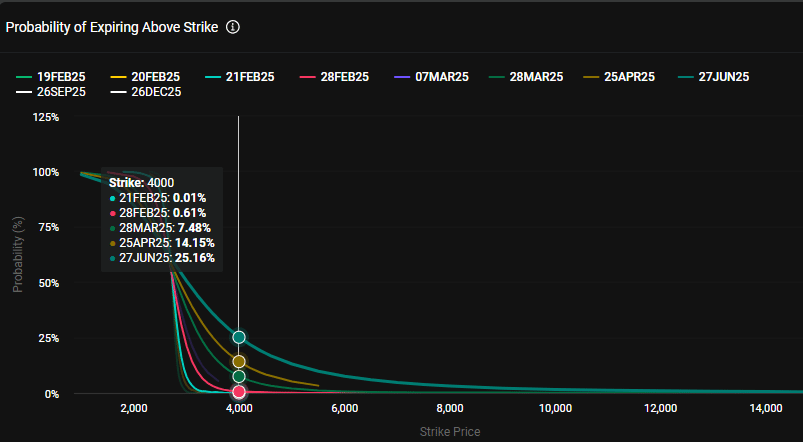

However, the Options market was relatively less optimistic about ETH hitting $4k by the end of April after the Pectra upgrade.

At press time, the traders were only pricing a 14% chance that the king altcoin could reclaim $4,000. The odds of hitting $4k by June jumped to 25%, suggesting that the altcoin had a higher chance of eyeing that level in the summer.

Source: Deribit

Hike in ETH accumulation

Despite ETH’s muted price action, there has been significant accumulation as investors moved ETH off exchanges.

On 5 February alone, 367k ETH were moved from exchanges – A sign of a strong accumulation trend as the altcoin dropped below $3k on the charts.

Source: CryptoQuant

Whether the strong accumulation trend will push ETH’s price higher would depend on improvement in the broader market sentiment.

- ETH Options traders have begun bullish positioning for the Pectra upgrade

- Markets are pricing a 14% chance altcoin would hit $4k by the end of April

Traders have begun positioning for Ethereum’s Pectra upgrade, raising questions about whether the historical “buy the rumor, sell the news” idea will play out again. As it stands, the upgrade is scheduled for early April if the tesnet set for 24 February and 5 March goes as planned.

According to the crypto options trading desk QCP Capital, traders’ positioning leaned on this bullish play, at press time. The firm noted,

“Traders are positioning for another volatility event, with volatility skewed in favor of calls from March 28 onward. This could set the stage for the next major positioning theme.”

Will Pectra upgrade pump ETH?

QCP Capital added that previous upgrades have always been front-run before sell-offs after the events. The only exception would be the Shanghai upgrade in April 2024. The firm highlighted,

“The Merge (Sep 2022) → Classic “buy the rumor, sell the news”. ETH rallied 100%+ from June lows before selling off post-event. Shanghai (Apr 2023) → Markets feared excess supply, but when selling pressure failed to materialize, ETH climbed 30% in the following months.”

For those unfamiliar, the Pectra upgrade aims to ship eleven key features, including blob expansion and smart wallet capabilities.

The aforementioned scalability efforts have begun to pay off too. For instance, recently, Ethereum’s average transaction cost has been rivalling Solana with sub 1 gwei in gas charges.

However, despite these efforts, there hasn’t been a notable uptick in demand for L1. Hence, whether the Pectra upgrade will accelerate L1 demand remains to be seen.

Will ETH reclaim $4k?

That being said, in the last 24 hours, calls (bullish bets) eyeing the $3.2k and $3k price targets were the most bought.

For protection, puts (bearish bets) were piled at the $2k target. This suggested that Options traders, in the short term, expected a surge to $3.2k with $2k as support in the wake of extremely bearish moves.

Source: Amberdata

However, the Options market was relatively less optimistic about ETH hitting $4k by the end of April after the Pectra upgrade.

At press time, the traders were only pricing a 14% chance that the king altcoin could reclaim $4,000. The odds of hitting $4k by June jumped to 25%, suggesting that the altcoin had a higher chance of eyeing that level in the summer.

Source: Deribit

Hike in ETH accumulation

Despite ETH’s muted price action, there has been significant accumulation as investors moved ETH off exchanges.

On 5 February alone, 367k ETH were moved from exchanges – A sign of a strong accumulation trend as the altcoin dropped below $3k on the charts.

Source: CryptoQuant

Whether the strong accumulation trend will push ETH’s price higher would depend on improvement in the broader market sentiment.

where to buy clomid no prescription can i order cheap clomid without a prescription can you get generic clomid without rx get clomid pills cost generic clomiphene without rx buy cheap clomiphene pill clomid tablete

With thanks. Loads of erudition!

More text pieces like this would create the web better.

order zithromax pill – floxin 200mg pills buy flagyl cheap

rybelsus online – rybelsus online cyproheptadine 4mg oral

domperidone oral – buy motilium without prescription cheap flexeril

amoxicillin over the counter – purchase amoxil without prescription order ipratropium for sale

purchase zithromax online – bystolic 5mg uk nebivolol online

amoxiclav cost – atbioinfo ampicillin ca

order nexium generic – https://anexamate.com/ esomeprazole brand

order coumadin 2mg online cheap – cou mamide cost cozaar

mobic over the counter – https://moboxsin.com/ buy meloxicam pills for sale

deltasone 40mg without prescription – aprep lson buy generic prednisone

top erection pills – ed pills where to buy medicine for impotence

purchase amoxicillin pills – purchase amoxil sale purchase amoxicillin online

buy fluconazole cheap – site fluconazole pill

lexapro 10mg price – https://escitapro.com/# lexapro pills

cenforce us – order cenforce 100mg generic buy cenforce generic

order cialis no prescription – https://ciltadgn.com/# cialis bestellen deutschland

buy tadalafil online canada – https://strongtadafl.com/# cialis tadalafil tablets

cost zantac 300mg – https://aranitidine.com/# buy zantac medication

buy legal viagra – https://strongvpls.com/# viagra super force 100mg 60mg pills

The thoroughness in this break down is noteworthy. https://ursxdol.com/get-cialis-professional/

This is the kind of content I have reading. https://prohnrg.com/product/cytotec-online/

I’ll certainly bring to be familiar with more. https://aranitidine.com/fr/acheter-cenforce/

More peace pieces like this would create the интернет better. https://ondactone.com/simvastatin/

This is the kind of literature I rightly appreciate. http://web.symbol.rs/forum/member.php?action=profile&uid=1171369

buy dapagliflozin generic – https://janozin.com/ forxiga where to buy

More posts like this would persuade the online play more useful. http://www.orlandogamers.org/forum/member.php?action=profile&uid=29964