Buterin has proposed a new roadmap aimed at enhancing the scalability, finality, and security of Ethereum’s Layer 2 solutions.

Vitalik Buterin’s new roadmap for Ethereum introduces a “2-of-3” model, combining optimistic proofs, zero-knowledge (ZK) proofs, and trusted execution environment (TEE) provers.

Transactions are finalized when two of these proofs agree, reducing reliance on one method and addressing security and fraud concerns.

The proposal targets long-standing Layer 2 scaling issues while preserving Ethereum’s decentralization.

A key feature is the development of “Stage 2 rollups,” which promise faster confirmations, better finality, and increased resilience in semi-trusted environments.

Ethereum’s liquidation concerns

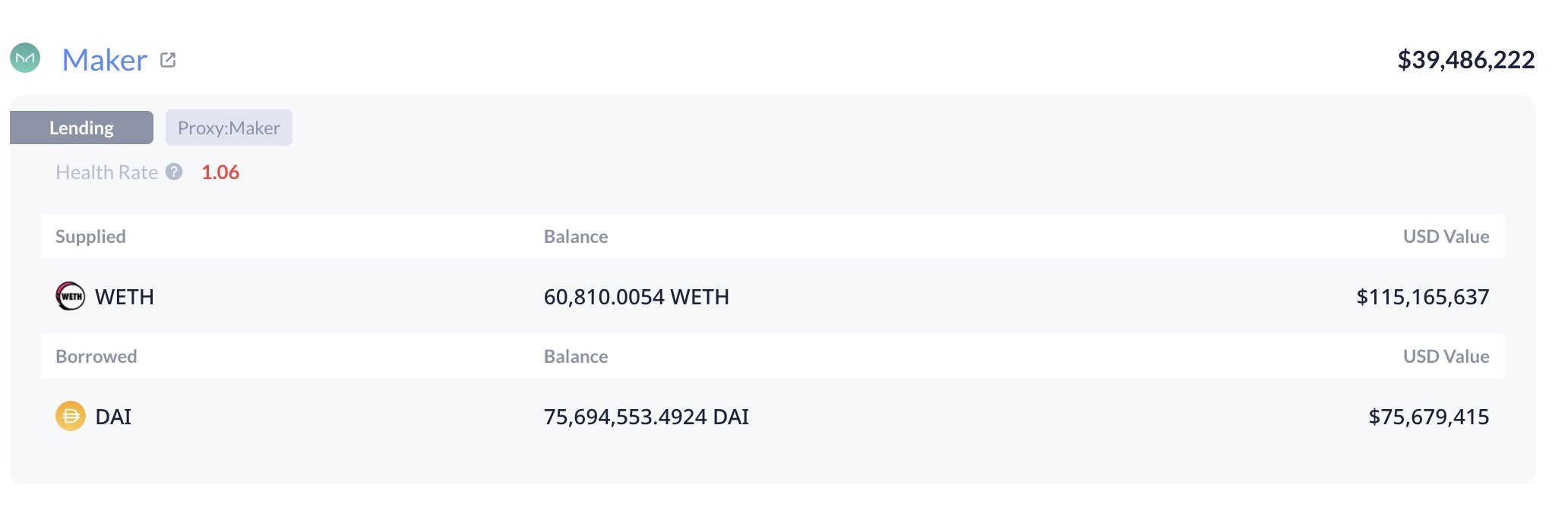

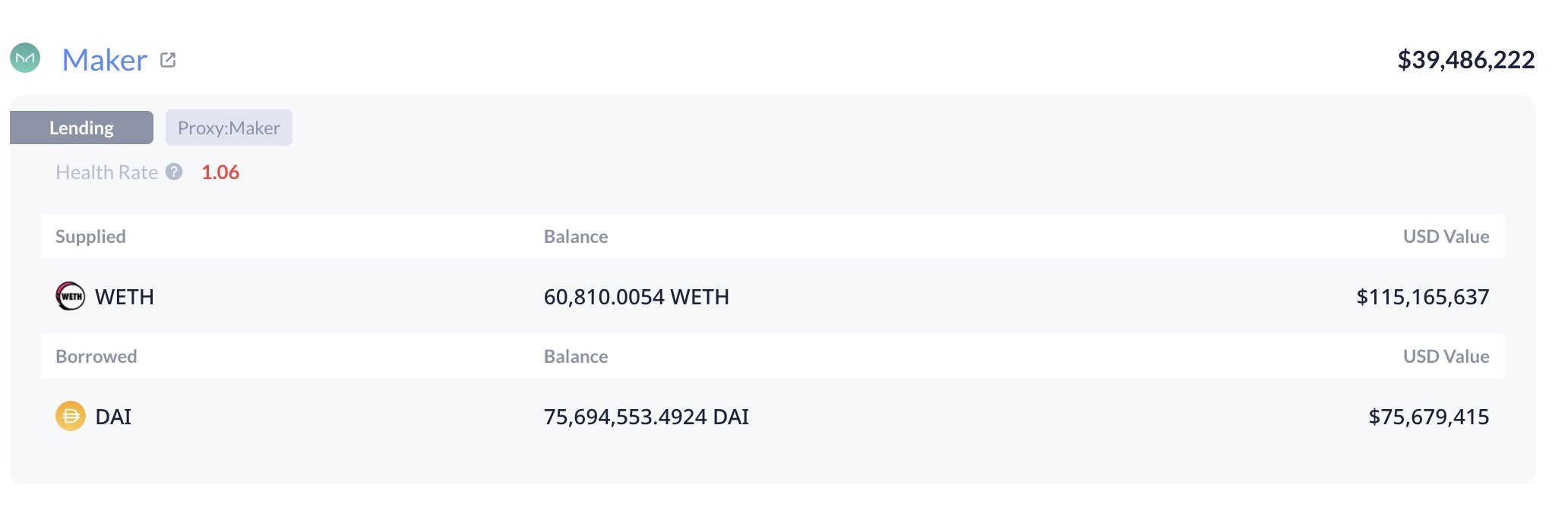

While Ethereum’s Layer 2 innovations focus on improving scalability and security, the broader ecosystem still faces significant financial risks. One such concern is the liquidation risk tied to large ETH holdings on MakerDAO.

Source: X

As the price of ETH fluctuates, the 125,603 ETH (approximately $238M) held by two major whales on Maker is at risk of liquidation.

With the health rate dropping to 1.07 and critical liquidation prices at $1,805 and $1,787, a further decline in ETH’s price could trigger forced liquidations, potentially impacting market stability.

Ethereum price outlook

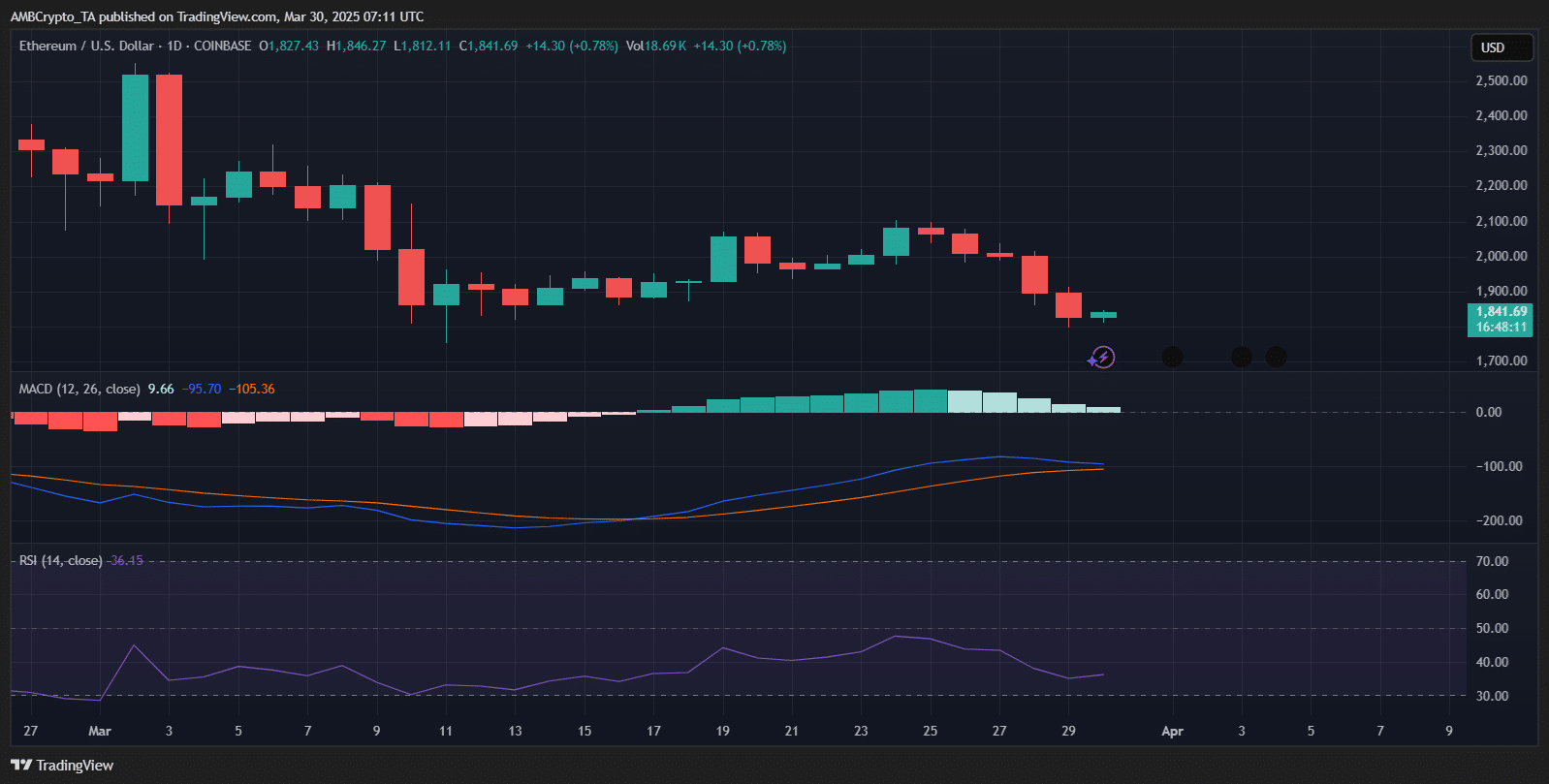

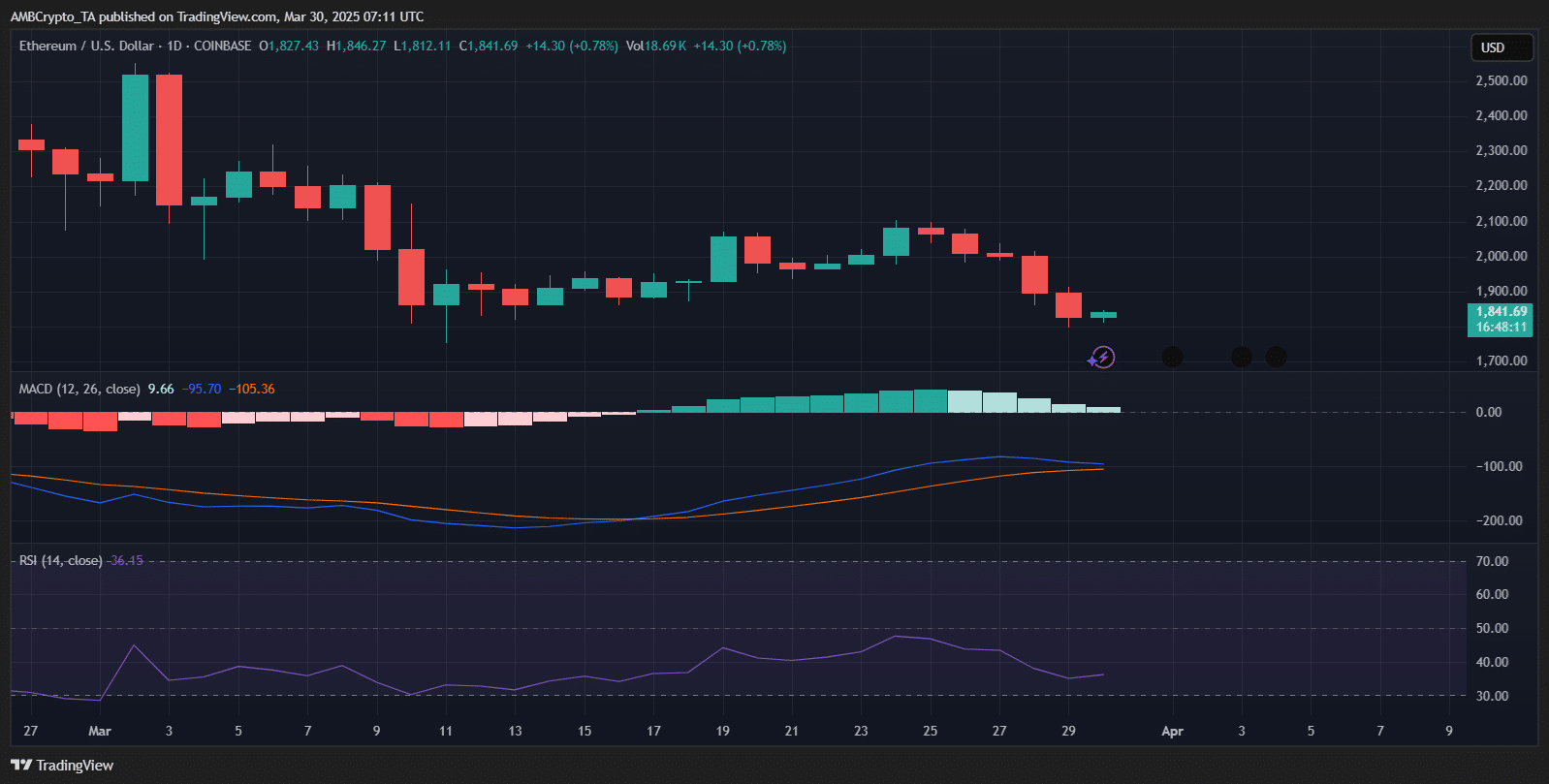

The Ethereum daily chart shows a slight recovery after an 8% drop in the last week, trading at $1,841.69 at press time.

The MACD indicator remains bearish, with the line below the signal line, suggesting ongoing selling pressure. The RSI at 36.45 indicated oversold conditions, hinting at a potential reversal if buying volume increases.

Source: TradingView

The recent price action shows a consolidation phase after a sharp decline, with support likely around $1,750-$1,700. If bullish momentum builds, resistance is expected near $1,900-$2,000.

The overall trend remains uncertain, with further downside possible unless a strong buying push materializes.

Buterin has proposed a new roadmap aimed at enhancing the scalability, finality, and security of Ethereum’s Layer 2 solutions.

Vitalik Buterin’s new roadmap for Ethereum introduces a “2-of-3” model, combining optimistic proofs, zero-knowledge (ZK) proofs, and trusted execution environment (TEE) provers.

Transactions are finalized when two of these proofs agree, reducing reliance on one method and addressing security and fraud concerns.

The proposal targets long-standing Layer 2 scaling issues while preserving Ethereum’s decentralization.

A key feature is the development of “Stage 2 rollups,” which promise faster confirmations, better finality, and increased resilience in semi-trusted environments.

Ethereum’s liquidation concerns

While Ethereum’s Layer 2 innovations focus on improving scalability and security, the broader ecosystem still faces significant financial risks. One such concern is the liquidation risk tied to large ETH holdings on MakerDAO.

Source: X

As the price of ETH fluctuates, the 125,603 ETH (approximately $238M) held by two major whales on Maker is at risk of liquidation.

With the health rate dropping to 1.07 and critical liquidation prices at $1,805 and $1,787, a further decline in ETH’s price could trigger forced liquidations, potentially impacting market stability.

Ethereum price outlook

The Ethereum daily chart shows a slight recovery after an 8% drop in the last week, trading at $1,841.69 at press time.

The MACD indicator remains bearish, with the line below the signal line, suggesting ongoing selling pressure. The RSI at 36.45 indicated oversold conditions, hinting at a potential reversal if buying volume increases.

Source: TradingView

The recent price action shows a consolidation phase after a sharp decline, with support likely around $1,750-$1,700. If bullish momentum builds, resistance is expected near $1,900-$2,000.

The overall trend remains uncertain, with further downside possible unless a strong buying push materializes.

A code promo 1xBet est un moyen populaire pour les parieurs d’obtenir des bonus exclusifs sur la plateforme de paris en ligne 1xBet. Ces codes promotionnels offrent divers avantages tels que des bonus de dépôt, des paris gratuits, et des réductions spéciales pour les nouveaux joueurs ainsi que les utilisateurs réguliers.code promo 1xbet afrique

order clomiphene pills where can i get cheap clomid price buy generic clomiphene no prescription get cheap clomid online get generic clomid without a prescription name brand for clomiphene buying generic clomid pill

This is the tolerant of advise I unearth helpful.

This is the big-hearted of writing I rightly appreciate.

where to buy azithromycin without a prescription – order tetracycline 500mg sale flagyl 200mg cheap

buy semaglutide without a prescription – buy periactin generic cyproheptadine 4 mg canada

where to buy motilium without a prescription – tetracycline 500mg without prescription purchase cyclobenzaprine for sale

order inderal 10mg pill – oral inderal methotrexate online buy

amoxicillin oral – valsartan 160mg uk ipratropium 100 mcg cost

buy azithromycin online – buy zithromax online order nebivolol 20mg for sale

augmentin for sale – at bio info acillin cost

order nexium without prescription – https://anexamate.com/ buy esomeprazole generic

medex order – https://coumamide.com/ order hyzaar sale

buy meloxicam no prescription – https://moboxsin.com/ mobic online

cheap amoxicillin pills – buy amoxil online buy amoxicillin

buy fluconazole 100mg – oral diflucan 200mg purchase diflucan generic

buy cenforce 50mg for sale – https://cenforcers.com/ purchase cenforce generic

sanofi cialis – https://ciltadgn.com/ tadalafil with latairis

cialis daily side effects – cialis generic overnite shipping generic cialis tadalafil 20mg reviews

More articles like this would pretence of the blogosphere richer. buy nolvadex generic

cheap viagra next day – https://strongvpls.com/# buy viagra 50 mg

The thoroughness in this section is noteworthy. purchase azithromycin without prescription

This is a keynote which is in to my heart… Many thanks! Faithfully where can I find the acquaintance details in the course of questions? https://ursxdol.com/prednisone-5mg-tablets/

Thanks on putting this up. It’s understandably done. https://prohnrg.com/product/get-allopurinol-pills/

With thanks. Loads of conception! fildena prix

I’ll certainly carry back to read more. https://ondactone.com/spironolactone/