- Ethereum rose 2.32% as spot selling cooled and liquidity returned.

- Open Interest hit $21.5B, with long traders paying positive Funding Rates.

Ethereum [ETH] recorded a modest 2.32% price gain in the past 24 hours. This shift in sentiment comes as selling pressure eases and liquidity begins to enter the market.

Analysis suggests that ETH could be in a preparatory phase for a potential rally to the upside.

Spot volume cools—How good is this for ETH?

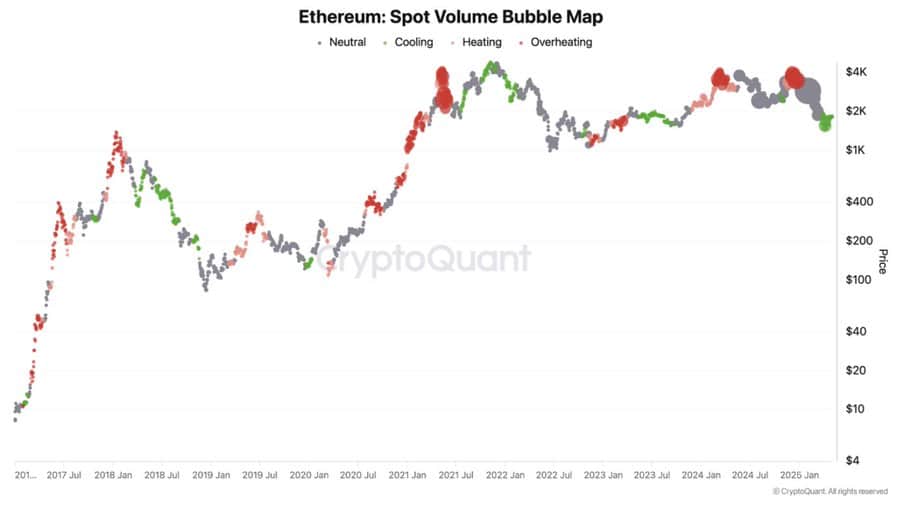

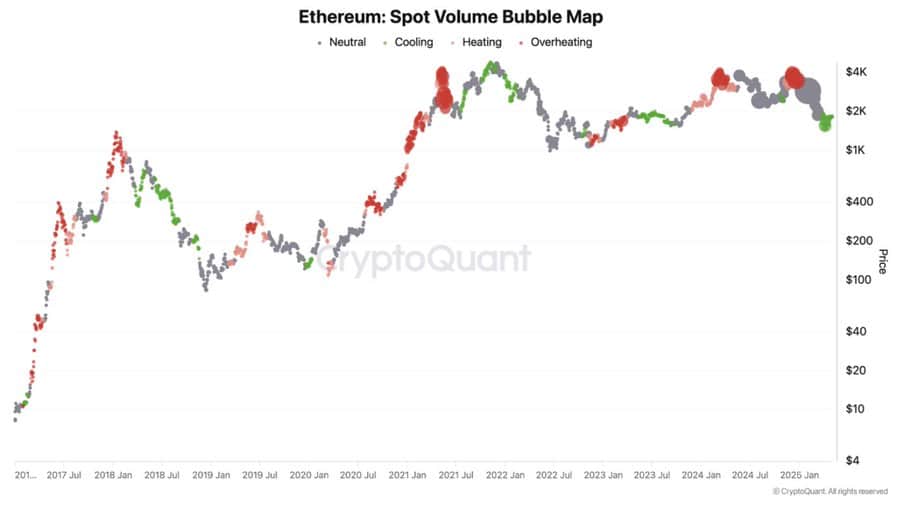

ETH’s Spot Trading Volume has begun to decline, continuing its downward trend.

The chart displays this through bubble sizes, with larger bubbles indicating higher volume and smaller bubbles indicating lower volume.

Source: CryptoQuant

In fact, lower volume during a correction phase often reflects cooling sell-side momentum. This suggests that continued selling interest from traders is gradually fading, leading to reduced volatility.

Spot market activity, however, shows that some cohorts are still selling.

At the time of writing, these traders sold $32 million worth of ETH in the past 24 hours, a considerable decline from the 102,000 ETH (worth $190 million) sold on the 6th of May.

Source: CoinGlass

On the same day, large investors had sold 105,000 ETH worth $195 million, reflecting a lack of confidence in ETH’s near-term potential.

As selling pressure cools, liquidity inflow has started to rise, as an early sign of a potential rally.

Liquidity inflow sees surge

In the past 24 hours, Ethereum recorded the highest on-chain inflow among major assets—$128.4 million in Chain Netflow.

Chain Netflow measures the amount of liquidity added to a blockchain through its native token.

Source: Artemis

A significant netflow like this implies that ETH purchases by buyers exceeded the amount sold by sellers. This added liquidity suggests increased on-chain activity, particularly on Ethereum-based protocols.

Such activity typically has a net positive effect on price. If momentum continues, other market participants may follow.

Futures traders stay ahead of the movement

In the Futures market, traders are already positioning for an ETH rally. This is evident in the amount of unsettled contracts now held by long traders, who are paying a premium fee.

Open Interest, which measures the value of unsettled positions, was $21.5 billion at press time.

Source: CoinGlass

The Funding Rate at 0.0048% confirmed long dominance—buyers were paying a premium to hold their positions.

Having said that, such conviction from derivative traders often precedes spot rallies. If long positions and volume rise further, ETH may break higher in the days ahead.

- Ethereum rose 2.32% as spot selling cooled and liquidity returned.

- Open Interest hit $21.5B, with long traders paying positive Funding Rates.

Ethereum [ETH] recorded a modest 2.32% price gain in the past 24 hours. This shift in sentiment comes as selling pressure eases and liquidity begins to enter the market.

Analysis suggests that ETH could be in a preparatory phase for a potential rally to the upside.

Spot volume cools—How good is this for ETH?

ETH’s Spot Trading Volume has begun to decline, continuing its downward trend.

The chart displays this through bubble sizes, with larger bubbles indicating higher volume and smaller bubbles indicating lower volume.

Source: CryptoQuant

In fact, lower volume during a correction phase often reflects cooling sell-side momentum. This suggests that continued selling interest from traders is gradually fading, leading to reduced volatility.

Spot market activity, however, shows that some cohorts are still selling.

At the time of writing, these traders sold $32 million worth of ETH in the past 24 hours, a considerable decline from the 102,000 ETH (worth $190 million) sold on the 6th of May.

Source: CoinGlass

On the same day, large investors had sold 105,000 ETH worth $195 million, reflecting a lack of confidence in ETH’s near-term potential.

As selling pressure cools, liquidity inflow has started to rise, as an early sign of a potential rally.

Liquidity inflow sees surge

In the past 24 hours, Ethereum recorded the highest on-chain inflow among major assets—$128.4 million in Chain Netflow.

Chain Netflow measures the amount of liquidity added to a blockchain through its native token.

Source: Artemis

A significant netflow like this implies that ETH purchases by buyers exceeded the amount sold by sellers. This added liquidity suggests increased on-chain activity, particularly on Ethereum-based protocols.

Such activity typically has a net positive effect on price. If momentum continues, other market participants may follow.

Futures traders stay ahead of the movement

In the Futures market, traders are already positioning for an ETH rally. This is evident in the amount of unsettled contracts now held by long traders, who are paying a premium fee.

Open Interest, which measures the value of unsettled positions, was $21.5 billion at press time.

Source: CoinGlass

The Funding Rate at 0.0048% confirmed long dominance—buyers were paying a premium to hold their positions.

Having said that, such conviction from derivative traders often precedes spot rallies. If long positions and volume rise further, ETH may break higher in the days ahead.

Современные подходы к несъемному протезированию на 4 имплантах.

Несъемное протезирование на 4 имплантах цена [url=https://ggpatl.by/allon4-implantaciya]https://ggpatl.by/allon4-implantaciya[/url] .

clomid pills for sale clomiphene prices in south africa clomid costo how to get cheap clomiphene without dr prescription can you buy generic clomiphene for sale cost generic clomiphene without a prescription where can i buy generic clomiphene tablets

More posts like this would add up to the online elbow-room more useful.

I couldn’t weather commenting. Profoundly written!

buy azithromycin for sale – floxin 200mg without prescription flagyl 400mg cost

semaglutide 14mg usa – buy semaglutide online cheap buy periactin generic

order domperidone 10mg generic – buy generic sumycin 500mg buy generic flexeril for sale

cheap propranolol – inderal drug methotrexate medication

purchase amoxil online – diovan order online purchase combivent online

amoxiclav order – at bio info buy generic acillin

brand nexium 20mg – https://anexamate.com/ order nexium 20mg generic

order coumadin 5mg generic – coumamide buy losartan 50mg generic

buy prednisone 10mg generic – corticosteroid prednisone 5mg uk

best ed medication – fast ed to take fda approved over the counter ed pills

order amoxil pill – comba moxi order amoxicillin

oral fluconazole 200mg – fluconazole generic fluconazole pill

buy generic escitalopram for sale – anxiety pro buy lexapro paypal

cenforce 100mg generic – https://cenforcers.com/# order cenforce

cialis manufacturer coupon free trial – https://ciltadgn.com/ cialis online reviews

cheap ranitidine 150mg – online ranitidine 300mg without prescription

cialis tadalafil 20 mg – https://strongtadafl.com/# cheap cialis

This website exceedingly has all of the information and facts I needed to this thesis and didn’t know who to ask. prednisolone que es

viagra sale durban – https://strongvpls.com/ buy viagra cialis online

This is a theme which is forthcoming to my callousness… Many thanks! Exactly where can I notice the acquaintance details in the course of questions? https://ursxdol.com/get-metformin-pills/

More posts like this would create the online time more useful. https://prohnrg.com/product/acyclovir-pills/

More posts like this would prosper the blogosphere more useful. https://ondactone.com/spironolactone/

More posts like this would add up to the online elbow-room more useful.

imitrex for sale

Good blog you possess here.. It’s obdurate to espy high worth article like yours these days. I honestly recognize individuals like you! Take guardianship!! http://zgyhsj.com/space-uid-977930.html

pill dapagliflozin – https://janozin.com/ buy generic forxiga for sale