- Ethereum’s funding rate signals a potential rebound for ETH.

- ETH has declined by 16.48% over the past 7 days.

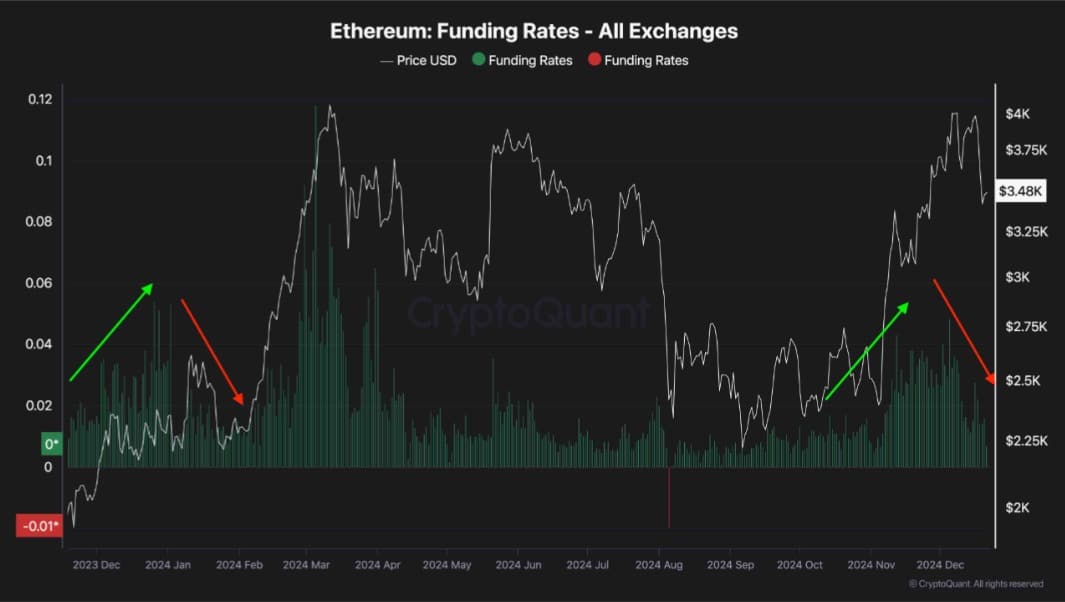

Since hitting $4109, Ethereum [ETH] has experienced strong downward pressure. As such, over the past week, the altcoin has declined to a low of $3095 dropping by 16.48%.

Despite the recent dip, Ethereum seems positioned for a comeback to $3,300. This is because Ethereum’s funding rate has cooled since facing two rejections at $4k.

Ethereum’s Futures market cools after $4k rejection

According to Cryptoquant, Ethereum’s failure to reclaim the $4k resistance resulted in massive liquidations in the futures markets.

Source: Cryptoquant

This resulted in a huge market crash with ETH hitting lows. While ETH’s funding rate surged last week, the altcoin’s failure to hold above $4k brought the funding rate back to healthy levels. These levels are well suitable for a bullish trend.

Therefore, the cooling effect from this could potentially pave the way for a more sustainable rally in the coming weeks.

Historically, such a pattern occurred in January 2024 when the drop in funding rates cooled the futures market strengthening ETH for a major uptrend.

During this rally, Ethereum rallied from $2169 to $4091. This historical precedent indicates that the current market reset could mark the beginning of another bullish phase.

What ETH charts suggest

While Ethereum has experienced strong downward pressure over the past week, the prevailing market conditions point towards recovery.

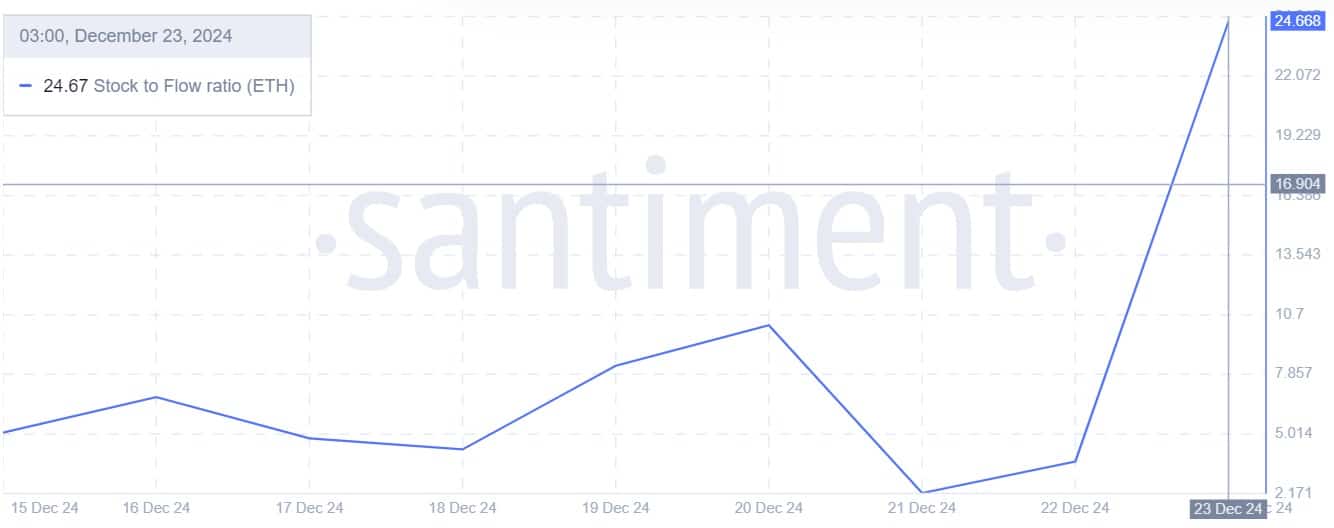

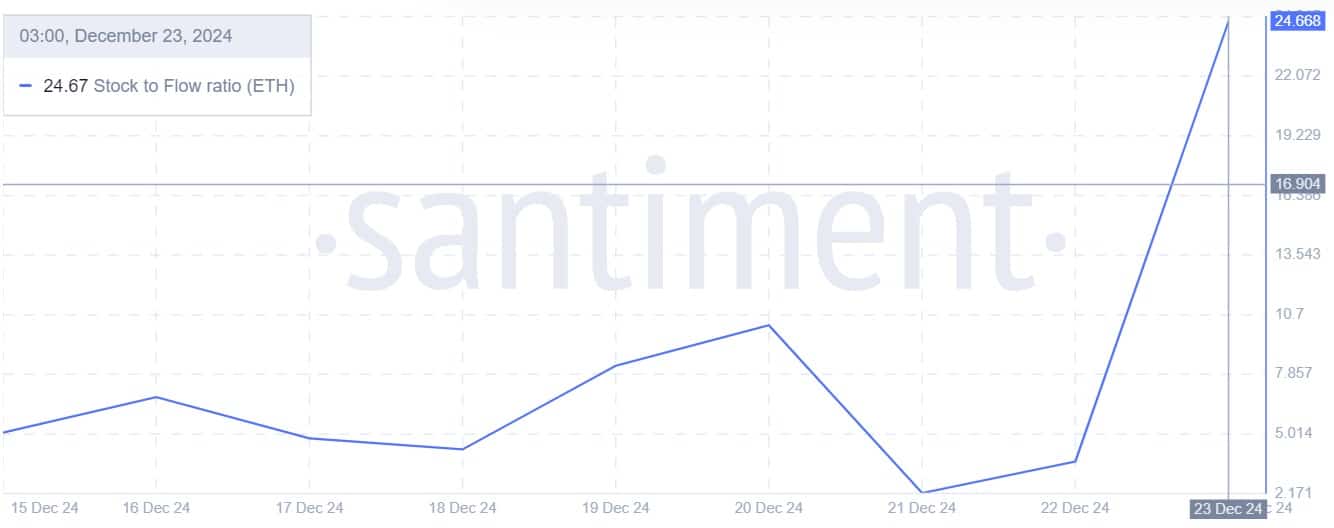

Source: Santiment

For starters, Ethereum’s stock-to-flow ratio has surged over the past week from 2.19 to 24.67. When SFR rises it implies that ETH has become more scarce amidst increased accumulation by large holders.

As such, the altcoin has become more scarce. Coupled with rising demand, this pushes prices up through supply squeeze.

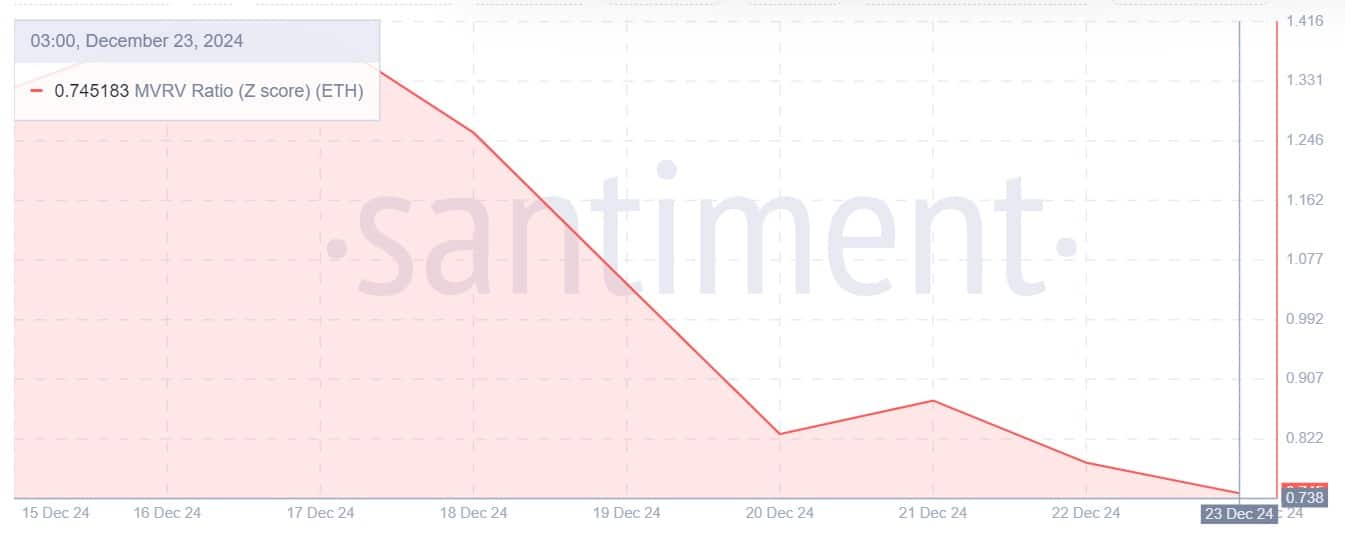

Source: Santiment

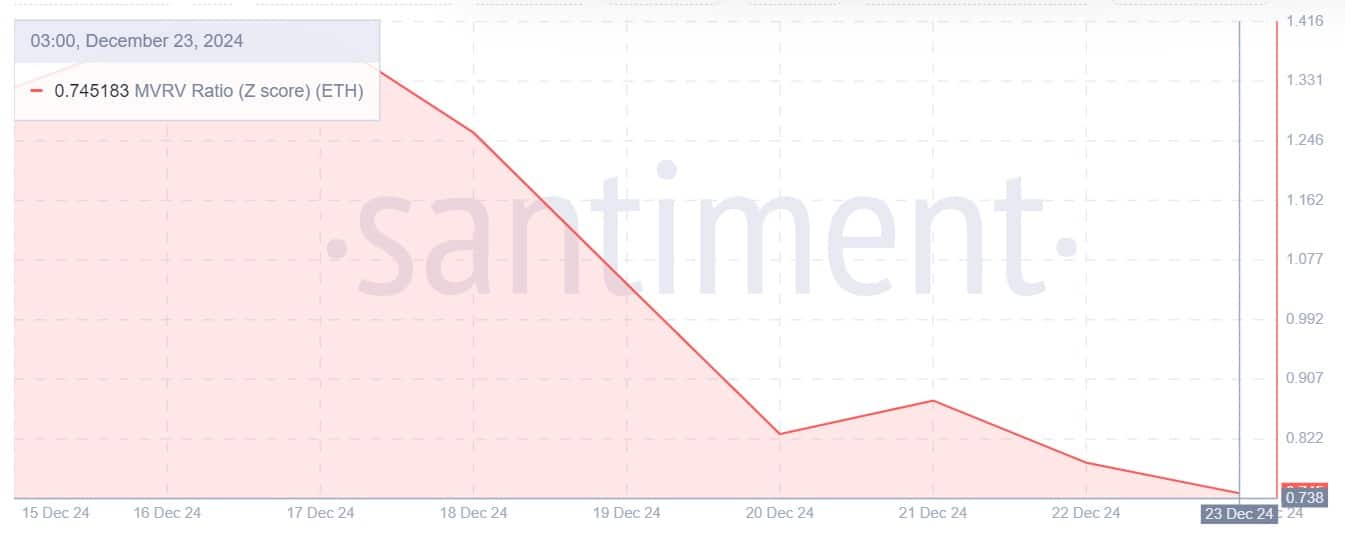

Additionally, the Ethereum MVRV Z score ratio has declined over the past week to 0.745. When the MVRV score hits such low levels, it signals ETH is currently undervalued providing a good signal for accumulation among long-term holders.

This trend has been witnessed over the past week with whales turning to buy the dip. Increased accumulation usually creates a higher buying pressure which causes upward pressure on prices through high demand.

Source: Santiment

Finally, Ethereum’s Bitmex basis ratio has surged over the past few days from -0.22 to 0.07. When this ratio turns positive, it reflects optimism in the futures market as traders expect prices to rise after the dip.

Is a comeback likely?

As observed above futures market is bullish and expects ETH prices to recover. Equally, the spot demand for Ethereum is constantly rising creating healthy conditions for price gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

With the market optimistic, ETH could recover from the $3300 dip and reclaim higher resistance. If these conditions hold, ETH will reclaim the $3700 resistance.

A move from here could strengthen Ethereum to move towards $3900. However, with bears still strong, if bulls fail to retake the market, ETH will drop to $3160.

- Ethereum’s funding rate signals a potential rebound for ETH.

- ETH has declined by 16.48% over the past 7 days.

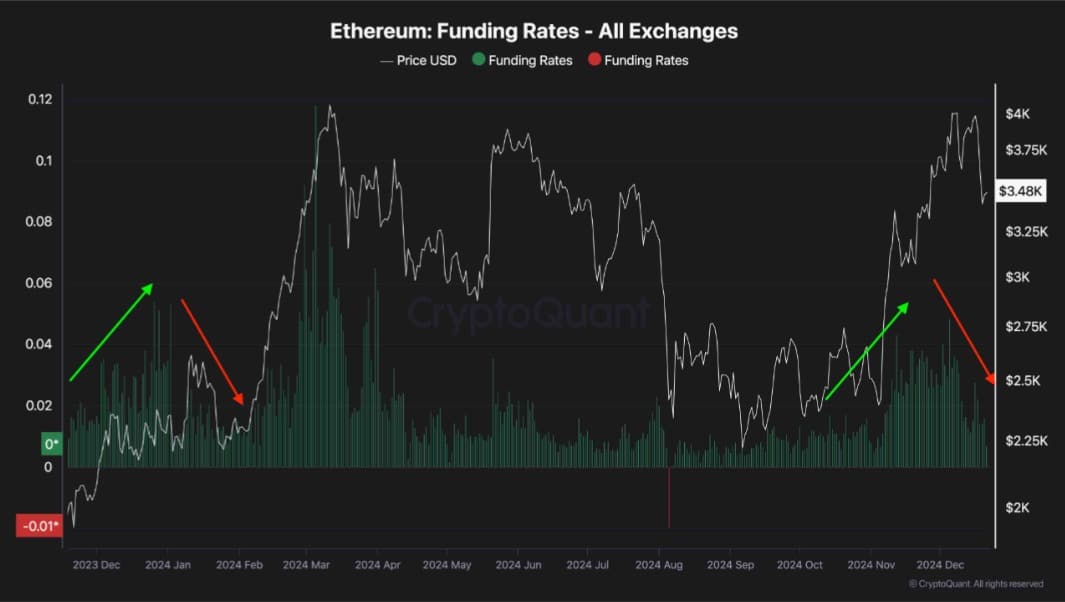

Since hitting $4109, Ethereum [ETH] has experienced strong downward pressure. As such, over the past week, the altcoin has declined to a low of $3095 dropping by 16.48%.

Despite the recent dip, Ethereum seems positioned for a comeback to $3,300. This is because Ethereum’s funding rate has cooled since facing two rejections at $4k.

Ethereum’s Futures market cools after $4k rejection

According to Cryptoquant, Ethereum’s failure to reclaim the $4k resistance resulted in massive liquidations in the futures markets.

Source: Cryptoquant

This resulted in a huge market crash with ETH hitting lows. While ETH’s funding rate surged last week, the altcoin’s failure to hold above $4k brought the funding rate back to healthy levels. These levels are well suitable for a bullish trend.

Therefore, the cooling effect from this could potentially pave the way for a more sustainable rally in the coming weeks.

Historically, such a pattern occurred in January 2024 when the drop in funding rates cooled the futures market strengthening ETH for a major uptrend.

During this rally, Ethereum rallied from $2169 to $4091. This historical precedent indicates that the current market reset could mark the beginning of another bullish phase.

What ETH charts suggest

While Ethereum has experienced strong downward pressure over the past week, the prevailing market conditions point towards recovery.

Source: Santiment

For starters, Ethereum’s stock-to-flow ratio has surged over the past week from 2.19 to 24.67. When SFR rises it implies that ETH has become more scarce amidst increased accumulation by large holders.

As such, the altcoin has become more scarce. Coupled with rising demand, this pushes prices up through supply squeeze.

Source: Santiment

Additionally, the Ethereum MVRV Z score ratio has declined over the past week to 0.745. When the MVRV score hits such low levels, it signals ETH is currently undervalued providing a good signal for accumulation among long-term holders.

This trend has been witnessed over the past week with whales turning to buy the dip. Increased accumulation usually creates a higher buying pressure which causes upward pressure on prices through high demand.

Source: Santiment

Finally, Ethereum’s Bitmex basis ratio has surged over the past few days from -0.22 to 0.07. When this ratio turns positive, it reflects optimism in the futures market as traders expect prices to rise after the dip.

Is a comeback likely?

As observed above futures market is bullish and expects ETH prices to recover. Equally, the spot demand for Ethereum is constantly rising creating healthy conditions for price gains.

Read Ethereum’s [ETH] Price Prediction 2024-25

With the market optimistic, ETH could recover from the $3300 dip and reclaim higher resistance. If these conditions hold, ETH will reclaim the $3700 resistance.

A move from here could strengthen Ethereum to move towards $3900. However, with bears still strong, if bulls fail to retake the market, ETH will drop to $3160.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Плохая кредитная история – больше не проблема. Мы подготовили подборку займов, которые доступны каждому по паспорту. Ставка фиксирована – 0,8%, а продление возможно без штрафных санкций. Простота оформления и удобство гарантированы.

срочные деньги без проверки

займы онлайн на карту

займы с возможностью продления

займы круглосуточно

займы без отказа

Тарелка Collage мелкая 150мм: Элегантность и Удобство в Каждой Детали

Представляем вашему вниманию тарелку Collage мелкую диаметром 150 мм – идеальное решение для сервировки блюд в вашем доме или ресторане. Эта тарелка станет настоящим украшением любого стола, добавляя нотку утонченности и стиля в каждую трапезу. В данной статье мы подробно рассмотрим все преимущества и особенности этой великолепной тарелки, а также поделимся идеями по её использованию.

Совершенство дизайна

Тарелка Collage выполнена в стильном и современном дизайне, который легко впишется в любой интерьер. Её лаконичные формы и нейтральные цвета позволяют использовать её как для подачи закусок, так и для основных блюд. Уникальный дизайн тарелки делает её универсальной для любого случая: будь то романтический ужин, семейный обед или торжественное мероприятие.

Качество материалов

Изготовленная из высококачественного фарфора, тарелка Collage обеспечивает долговечность и устойчивость к повреждениям. Фарфор не только выглядит элегантно, но и легко чистится, что делает его идеальным выбором для ежедневного использования. Кроме того, тарелка устойчива к высоким температурам, что позволяет использовать её в микроволновой печи.

Практичность и функциональность

Тарелка диаметром 150 мм идеально подходит для подачи порционных блюд, закусок и десертов. Она прекрасно смотрится как на праздничном столе, так и в повседневной жизни. Удобная форма и размер делают её легкой в использовании, а также позволяют удобно складывать и хранить тарелки в шкафу.

Идеи для сервировки

Тарелка Collage предлагает безграничные возможности для креативной сервировки. Вот несколько идей:

Уход за тарелкой

Чтобы ваша тарелка Collage служила долго и радовала вас своим безупречным видом, важно следовать нескольким простым правилам ухода:

Заключение

Тарелка Collage мелкая 150 мм – это не просто элемент сервировки, а настоящая находка для тех, кто ценит качество, стиль и функциональность. Она станет верным спутником на вашем столе, добавляя элегантности и красоты в каждую трапезу. Не упустите возможность сделать вашу кухню более привлекательной и уютной с помощью этой великолепной тарелки!

Тарелка Collage мелкая 150мм

Полное оснащение пиццерий и фаст-фуд точек

generic clomid pill clomiphene price uk where can i buy cheap clomiphene without prescription get generic clomiphene prices where to buy generic clomid price can i get generic clomid for sale where can i buy generic clomid without prescription

This is the amicable of serenity I enjoy reading.

This website really has all of the information and facts I needed to this thesis and didn’t identify who to ask.

azithromycin 250mg drug – tinidazole 500mg over the counter buy flagyl without a prescription

order rybelsus – order rybelsus 14 mg order cyproheptadine 4 mg pills

buy motilium paypal – domperidone over the counter flexeril 15mg without prescription