- ETH’s total value deposited surpassed $25 billion.

- The heightened demand likely stemmed from the anticipation of the Dencun upgrade.

Over the past year or so, scaling solutions have played a substantial role in boosting demand for the Ethereum [ETH] ecosystem.

Built atop the base layer of Ethereum, these so-called layer -2 (L2) chains were envisioned to address Ethereum’s scalability problem.

It was planned that over time, these L2s would handle the majority of low-value transactions, with the base layer taking care of security and decentralization.

Well, the vision appeared to be becoming a reality.

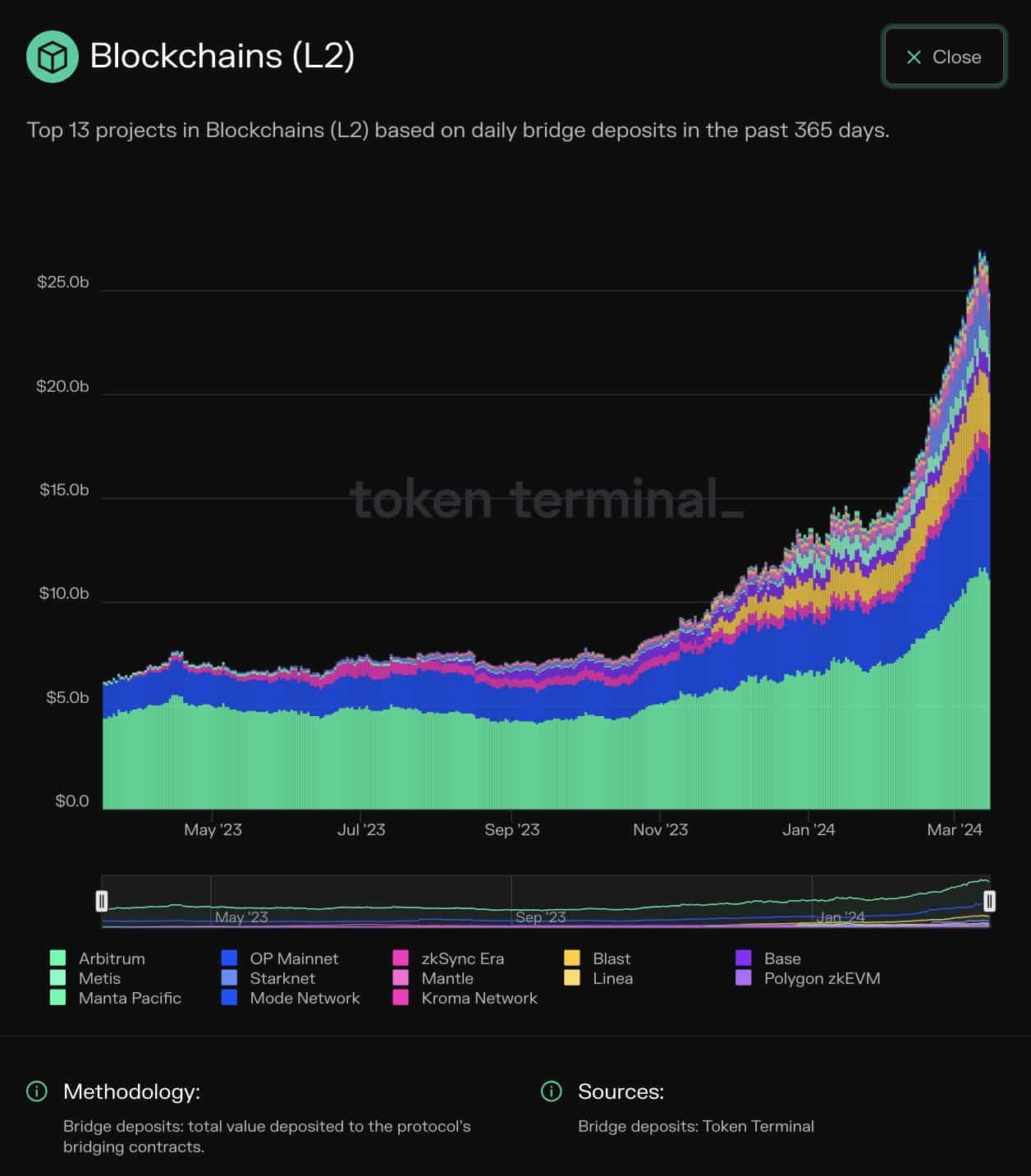

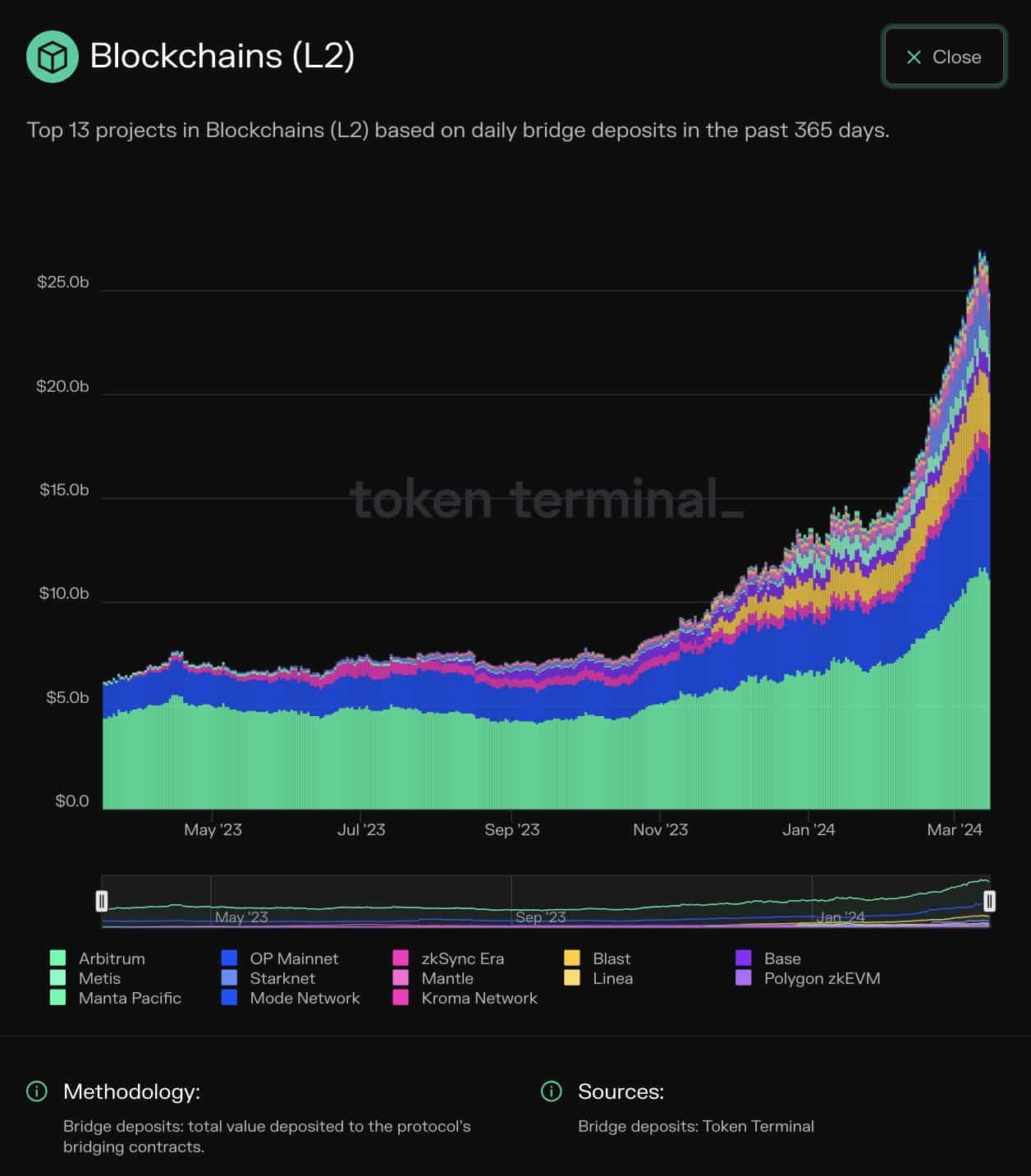

According to a recent post by on-chain analytics firm Token Terminal, the number of assets bridged from Ethereum to L2s has jumped dramatically in the first three months of 2024.

Source: Token Terminal

Users capitalize on L2 benefits

Bridging, as you might already be aware, is the process of transferring funds from L1 to L2. This is done to take advantage of the high-speed and low-cost capabilities of the L2s.

As seen from the data above, the total value deposited has surpassed $25 billion as of the 16th of March, representing a 5x jump from the same time last year.

Arbitrum [ARB] attracted 42% of the total deposits, followed by OP Mainnet [OP].

Dencun was the main driver

The heightened demand in 2024 likely stemmed from the anticipation of the Dencun upgrade, which went live last week.

The deployment has resulted in a sharp drop in gas fees on L2s, in some chains by as much as 90%. Consequently, users scurried to get their funds transported to enjoy the cheaper costs.

Win-win for ETH?

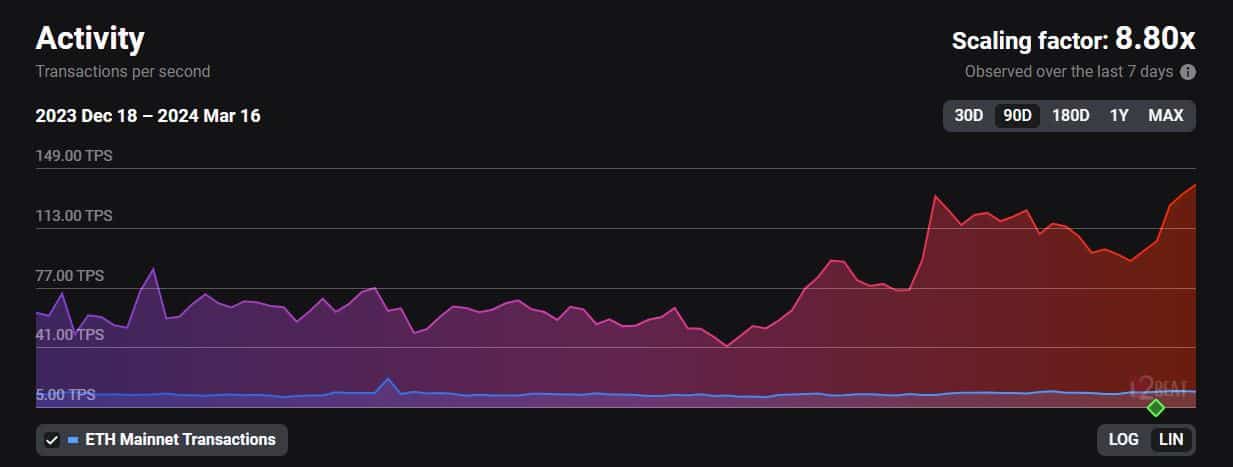

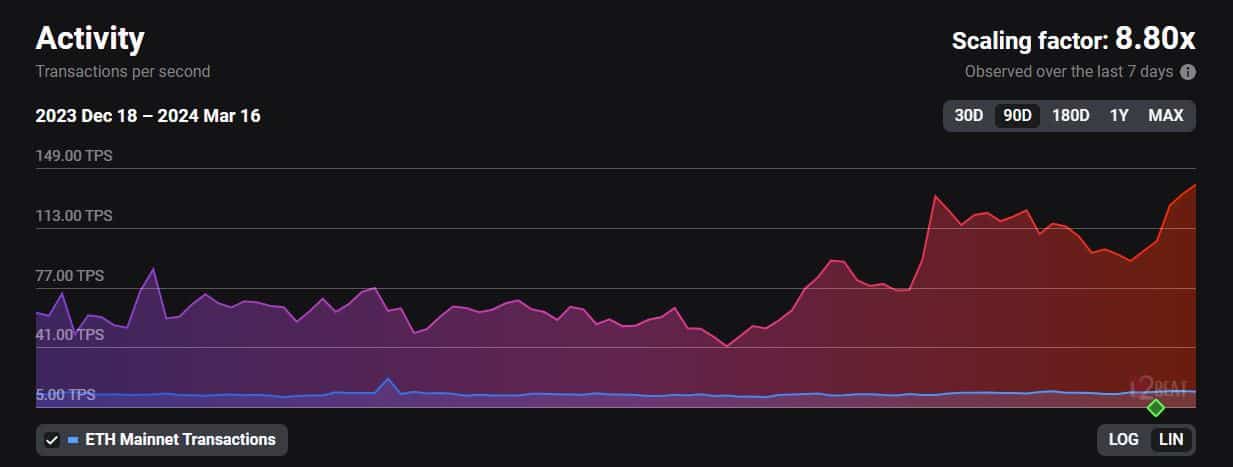

The growing demand has also spiked on-chain activity, with L2s settling more than eight times the transactions at press time, AMBCrypto noted using L2Beats data.

Source: L2Beat

Note that after validation, L2s batch the transactions and send a compressed version to the base layer for settlement.

Is your portfolio green? Check out the ETH Profit Calculator

For each transaction sent by an L2, the Ethereum network burns a small percentage of the total ETH supply. As a result, high network activity on Ethereum L2s directly accrues value to ETH.

As of this writing, ETH was exchanging hands at $3,570 with a fall of 4.56% in the last 24 hours, according to CoinMarketCap.

- ETH’s total value deposited surpassed $25 billion.

- The heightened demand likely stemmed from the anticipation of the Dencun upgrade.

Over the past year or so, scaling solutions have played a substantial role in boosting demand for the Ethereum [ETH] ecosystem.

Built atop the base layer of Ethereum, these so-called layer -2 (L2) chains were envisioned to address Ethereum’s scalability problem.

It was planned that over time, these L2s would handle the majority of low-value transactions, with the base layer taking care of security and decentralization.

Well, the vision appeared to be becoming a reality.

According to a recent post by on-chain analytics firm Token Terminal, the number of assets bridged from Ethereum to L2s has jumped dramatically in the first three months of 2024.

Source: Token Terminal

Users capitalize on L2 benefits

Bridging, as you might already be aware, is the process of transferring funds from L1 to L2. This is done to take advantage of the high-speed and low-cost capabilities of the L2s.

As seen from the data above, the total value deposited has surpassed $25 billion as of the 16th of March, representing a 5x jump from the same time last year.

Arbitrum [ARB] attracted 42% of the total deposits, followed by OP Mainnet [OP].

Dencun was the main driver

The heightened demand in 2024 likely stemmed from the anticipation of the Dencun upgrade, which went live last week.

The deployment has resulted in a sharp drop in gas fees on L2s, in some chains by as much as 90%. Consequently, users scurried to get their funds transported to enjoy the cheaper costs.

Win-win for ETH?

The growing demand has also spiked on-chain activity, with L2s settling more than eight times the transactions at press time, AMBCrypto noted using L2Beats data.

Source: L2Beat

Note that after validation, L2s batch the transactions and send a compressed version to the base layer for settlement.

Is your portfolio green? Check out the ETH Profit Calculator

For each transaction sent by an L2, the Ethereum network burns a small percentage of the total ETH supply. As a result, high network activity on Ethereum L2s directly accrues value to ETH.

As of this writing, ETH was exchanging hands at $3,570 with a fall of 4.56% in the last 24 hours, according to CoinMarketCap.

how to get cheap clomid without prescription clomid or serophene for men buying cheap clomiphene without prescription can i buy generic clomid tablets buying cheap clomiphene without dr prescription can i buy clomiphene no prescription buy clomid tablets

This is the compassionate of writing I positively appreciate.

The thoroughness in this piece is noteworthy.

order zithromax 250mg generic – cheap azithromycin 250mg flagyl 200mg for sale

rybelsus sale – periactin order online order periactin pills

buy domperidone pills – buy generic flexeril for sale order flexeril 15mg sale

buy generic propranolol online – methotrexate 10mg ca buy methotrexate 10mg

where to buy amoxicillin without a prescription – amoxicillin online ipratropium over the counter

order zithromax 250mg for sale – purchase bystolic pills bystolic cost

clavulanate sale – atbioinfo.com buy ampicillin paypal

buy generic nexium – https://anexamate.com/ nexium 40mg cost

purchase coumadin for sale – blood thinner buy cozaar 50mg online cheap

mobic cheap – https://moboxsin.com/ order mobic 7.5mg

best otc ed pills – fast ed to take buy ed pills medication

amoxil order online – comba moxi amoxil order

where to buy diflucan without a prescription – https://gpdifluca.com/ fluconazole pills

where to buy escitalopram without a prescription – https://escitapro.com/# order generic escitalopram

buy cenforce generic – https://cenforcers.com/ buy cenforce sale

cialis free samples – https://ciltadgn.com/ best price cialis supper active

cialis active ingredient – this maximum dose of cialis in 24 hours

zantac online order – aranitidine ranitidine ca

sildenafil citrate ip 100 mg – cheap viagra in australia mexican viagra 100mg

The sagacity in this serving is exceptional. https://gnolvade.com/

The depth in this tune is exceptional. https://buyfastonl.com/azithromycin.html

More posts like this would add up to the online play more useful. https://ursxdol.com/get-cialis-professional/

This is the type of advise I unearth helpful. https://aranitidine.com/fr/acheter-cialis-5mg/

Thanks recompense sharing. It’s acme quality. https://ondactone.com/spironolactone/

Good blog you procure here.. It’s obdurate to on high quality writing like yours these days. I honestly appreciate individuals like you! Rent care!!

purchase flomax online

This is the type of advise I turn up helpful. http://wightsupport.com/forum/member.php?action=profile&uid=21299

order forxiga 10mg – buy dapagliflozin 10mg buy cheap generic forxiga

orlistat price – https://asacostat.com/ xenical uk

I’ll certainly return to be familiar with more. http://www.kiripo.com/forum/member.php?action=profile&uid=1193119