- Ethereum needs to flip $1895 for a potential rally to $2k.

- Conviction buyers have dominated the market, with the RSI holding at 80.

Over the past three days, Ethereum [ETH] has experienced a strong upswing, rising from $1.5k to surpass the highly awaited level of $1.8k.

Source: Glassnode

Conviction buyers primarily drive the latest uptick, according to Glassnode.

As such, Ethereum’s supply mapping shows that momentum buyers have not made any major move, while conviction buyers have been active since late March 2025.

This cohort has seen a huge uptick in its RSI, which still holds at 80, signaling strong dominance. By contrast, sellers—who peaked around the 16th of April, saw their RSI drop sharply to 50.

The positive imbalance here suggests that conviction buyers are currently holding strong and anticipate markets to rally to higher levels.

Source: IntoTheBlock

Market cap expands as resistance thins ahead

With conviction buyers pushing Ethereum above $1.8k, the altcoin saw an uptick in its market cap, rising by 12%, reaching $219 billion.

With this uptick, on-chain data shows only modest resistance ahead. The recent price pump has left analysts eyeing a major move. Inasmuch so, according to IntoTheBlock, the next significant sell wall is around $1860.

If that zone gives way, Ethereum could make a move back toward the psychological $2k level.

Is a move toward $2k plausible for ETH?

According to AMBCrypto’s analysis, Ethereum is seeing strong organic demand build, signaling a potential move to the upside.

For starters, looking at sellers in the market, they have almost disappeared and are outweighed by buyers.

In fact, signs of organic demand are everywhere.

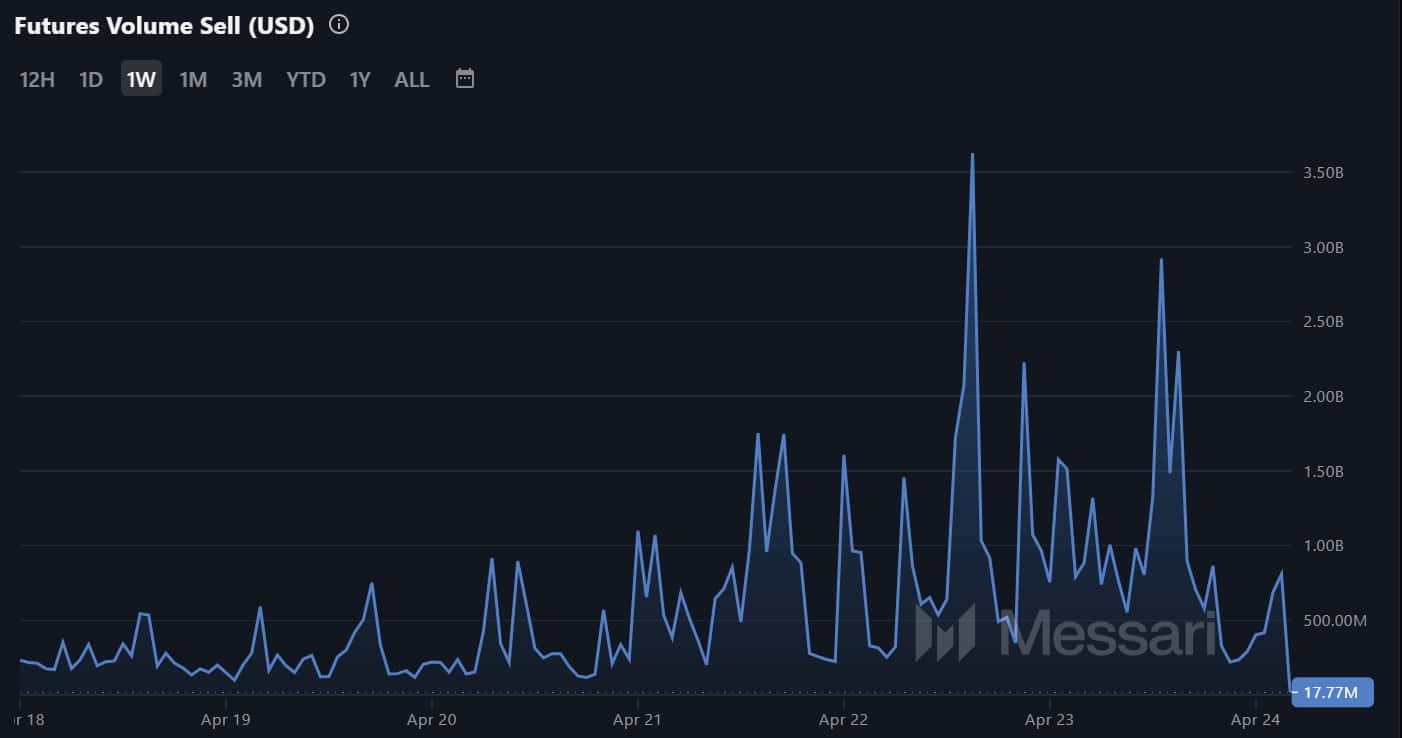

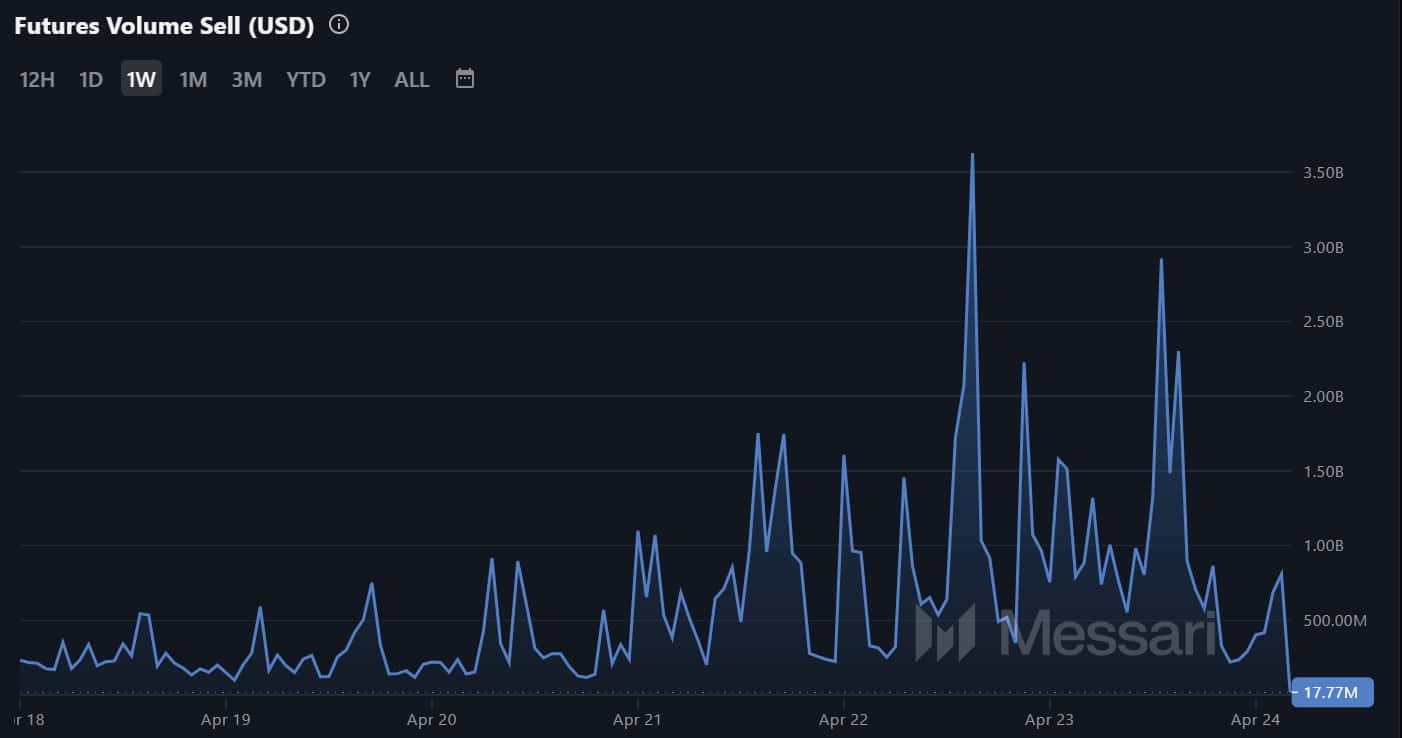

Futures Volume Sell has declined to $17.7 million over the past week, while buy volume is $20 million, a difference of $3 million.

Source: Messari

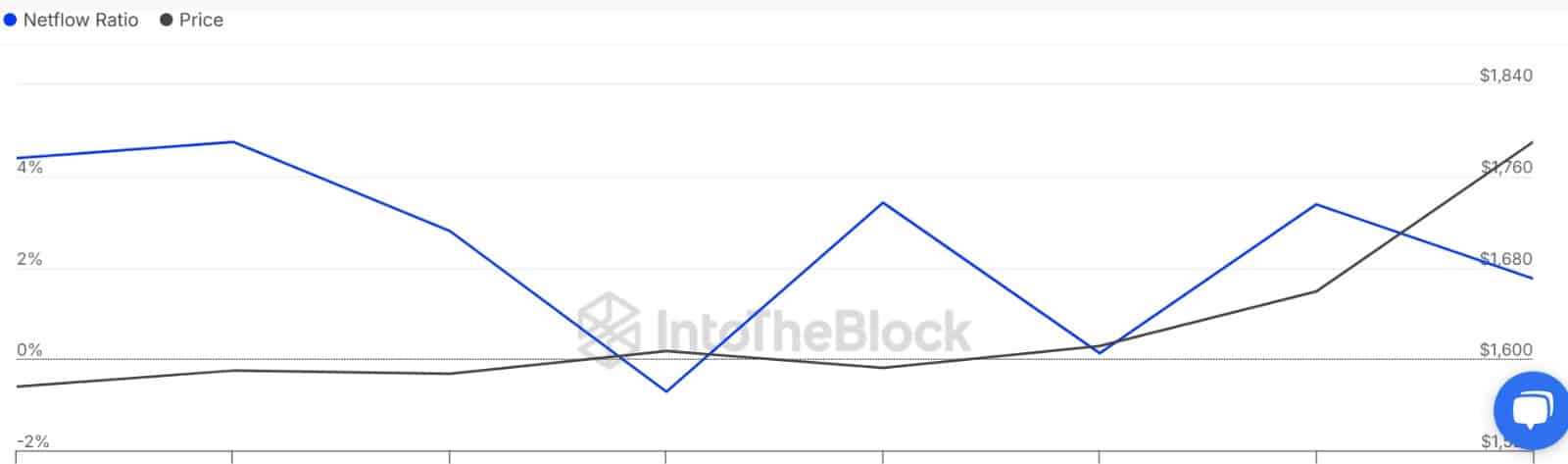

On top of that, whales aren’t exiting.

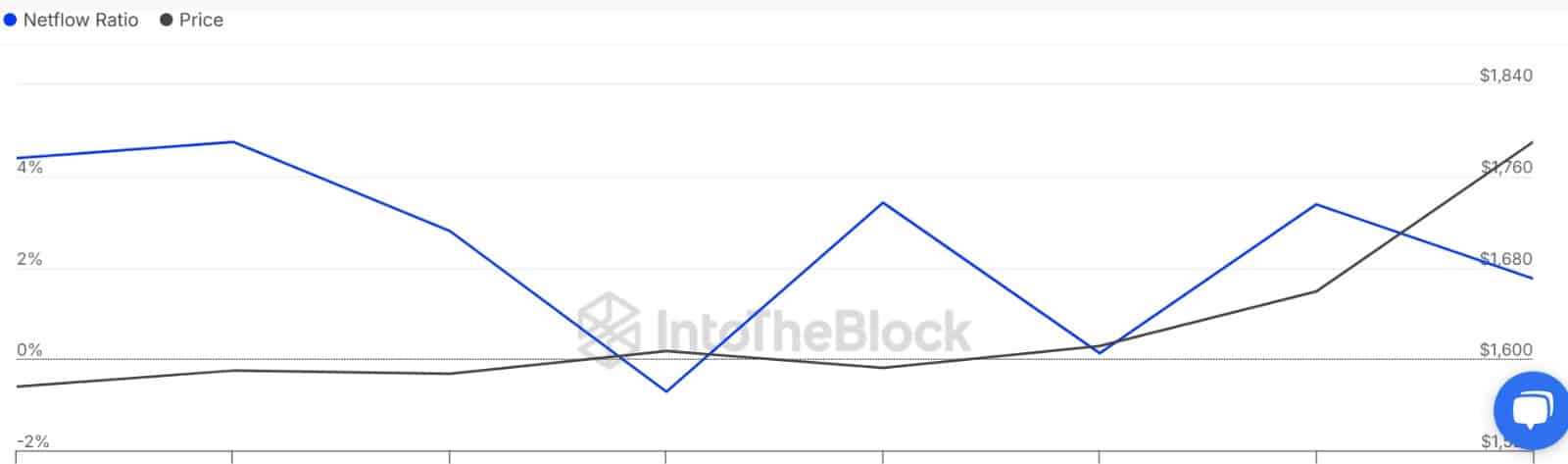

Because ETH Large Holders Netflow to Exchange Netflow Ratio has declined to 1.76%. A drop here indicates that whales are sending less ETH into exchange, reflecting accumulation behavior from large holders.

Source: IntoTheBlock

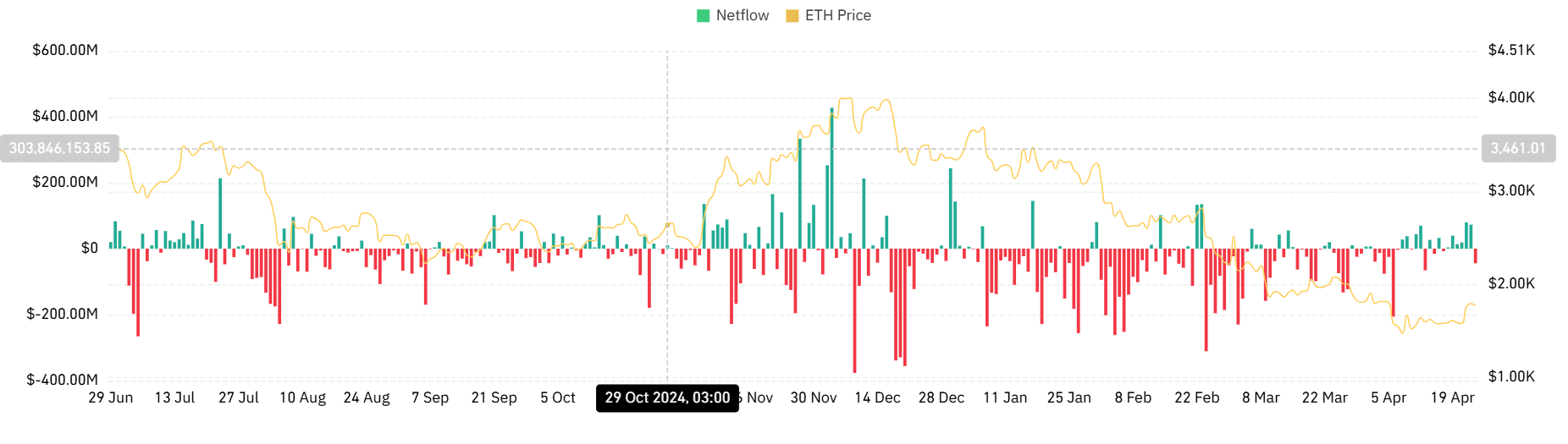

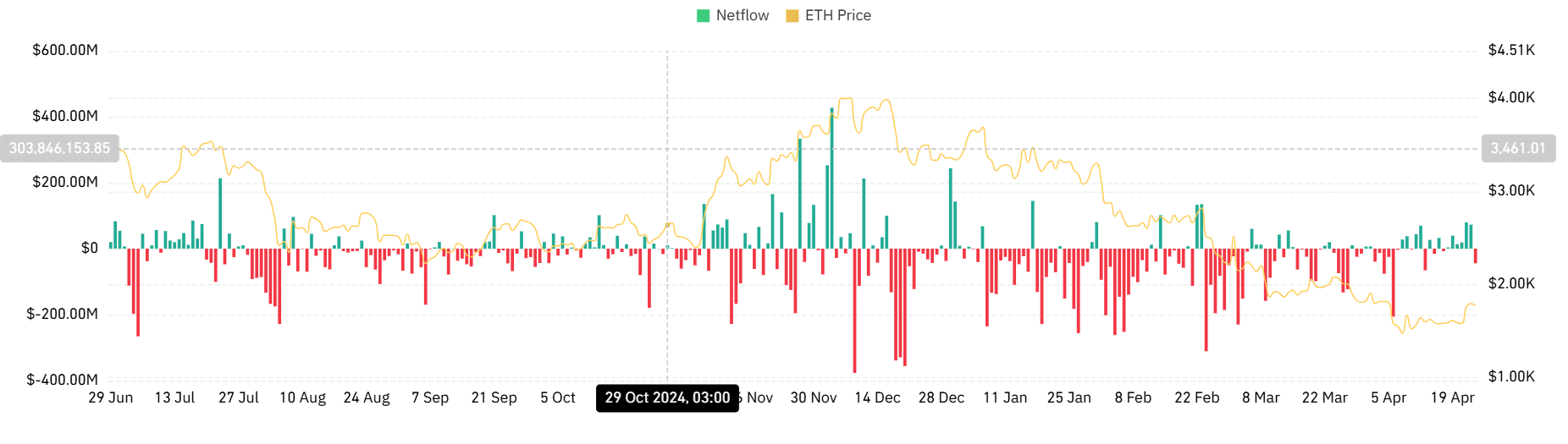

Finally, Ethereum’s Spot Market has cooled down and ETH is recording negative exchange netflow.

Over the past day, Netflow has dropped to -$44.4 million, after six days of consecutive positive netflow.

Such a huge shift suggests that investors are currently buying more than they are selling reflecting an accumulation trend.

Source: CoinGlass

ETH must reclaim $1.8K to keep the rally alive

Having said that, ETH still needs to hold above $1.8K for this bullish setup to stay intact.

According to Glassnode, if price flips the $1,895 cost-basis cluster—where 1.64 million ETH is concentrated—a clean run toward $2K is likely.

However, if bulls lose steam here, ETH risks revisiting the $1.6K support zone.

- Ethereum needs to flip $1895 for a potential rally to $2k.

- Conviction buyers have dominated the market, with the RSI holding at 80.

Over the past three days, Ethereum [ETH] has experienced a strong upswing, rising from $1.5k to surpass the highly awaited level of $1.8k.

Source: Glassnode

Conviction buyers primarily drive the latest uptick, according to Glassnode.

As such, Ethereum’s supply mapping shows that momentum buyers have not made any major move, while conviction buyers have been active since late March 2025.

This cohort has seen a huge uptick in its RSI, which still holds at 80, signaling strong dominance. By contrast, sellers—who peaked around the 16th of April, saw their RSI drop sharply to 50.

The positive imbalance here suggests that conviction buyers are currently holding strong and anticipate markets to rally to higher levels.

Source: IntoTheBlock

Market cap expands as resistance thins ahead

With conviction buyers pushing Ethereum above $1.8k, the altcoin saw an uptick in its market cap, rising by 12%, reaching $219 billion.

With this uptick, on-chain data shows only modest resistance ahead. The recent price pump has left analysts eyeing a major move. Inasmuch so, according to IntoTheBlock, the next significant sell wall is around $1860.

If that zone gives way, Ethereum could make a move back toward the psychological $2k level.

Is a move toward $2k plausible for ETH?

According to AMBCrypto’s analysis, Ethereum is seeing strong organic demand build, signaling a potential move to the upside.

For starters, looking at sellers in the market, they have almost disappeared and are outweighed by buyers.

In fact, signs of organic demand are everywhere.

Futures Volume Sell has declined to $17.7 million over the past week, while buy volume is $20 million, a difference of $3 million.

Source: Messari

On top of that, whales aren’t exiting.

Because ETH Large Holders Netflow to Exchange Netflow Ratio has declined to 1.76%. A drop here indicates that whales are sending less ETH into exchange, reflecting accumulation behavior from large holders.

Source: IntoTheBlock

Finally, Ethereum’s Spot Market has cooled down and ETH is recording negative exchange netflow.

Over the past day, Netflow has dropped to -$44.4 million, after six days of consecutive positive netflow.

Such a huge shift suggests that investors are currently buying more than they are selling reflecting an accumulation trend.

Source: CoinGlass

ETH must reclaim $1.8K to keep the rally alive

Having said that, ETH still needs to hold above $1.8K for this bullish setup to stay intact.

According to Glassnode, if price flips the $1,895 cost-basis cluster—where 1.64 million ETH is concentrated—a clean run toward $2K is likely.

However, if bulls lose steam here, ETH risks revisiting the $1.6K support zone.

Команда специалистов по административным и гражданским делам, связанным с автотранспортом. Примеры решаемых задач:

Анализ схем ДТП, составленных на перекрестках Невского проспекта — выявление ошибок в замерах и оформлении.

Подготовка жалоб в ГУВД СПб при отказе в страховании КАСКО.

Экспертная оценка ущерба после аварий с участием такси-парков.

География работы: Всеволожск, Гатчина, Выборг. Статистика за 2023 год: 92% дел по оспариванию штрафов завершились в пользу клиентов.Автоюрист спб

where can i buy clomid no prescription can you buy generic clomid without rx where can i get clomid no prescription where can i buy clomid price how to buy generic clomiphene without dr prescription cost of cheap clomid for sale clomiphene for sale

This website absolutely has all of the information and facts I needed there this thesis and didn’t positive who to ask.

The sagacity in this piece is exceptional.

buy generic zithromax – tetracycline 250mg generic buy flagyl 400mg generic

buy semaglutide 14 mg pill – periactin 4 mg generic cyproheptadine 4 mg drug

domperidone usa – sumycin for sale flexeril canada

buy clavulanate – atbioinfo buy acillin generic

nexium pill – https://anexamate.com/ order esomeprazole pills

coumadin cheap – anticoagulant order losartan 50mg sale

buy mobic 15mg for sale – mobo sin meloxicam 15mg tablet

deltasone over the counter – aprep lson buy prednisone without prescription

herbal ed pills – natural ed pills buy generic ed pills over the counter

amoxil for sale – https://combamoxi.com/ amoxil online order

forcan tablet – https://gpdifluca.com/# buy diflucan 100mg generic

buy cenforce 50mg online cheap – cenforce buy online order cenforce 100mg generic

cialis how to use – ciltad gn cheap t jet 60 cialis online

ranitidine online buy – https://aranitidine.com/ ranitidine buy online

cialis free trial voucher – https://strongtadafl.com/# cialis free trial voucher

This is the make of post I unearth helpful. https://gnolvade.com/

buy viagra cheap line – https://strongvpls.com/ buy viagra online now

With thanks. Loads of erudition! https://ursxdol.com/prednisone-5mg-tablets/

I’ll certainly bring to be familiar with more. https://buyfastonl.com/gabapentin.html

I couldn’t resist commenting. Profoundly written! https://prohnrg.com/product/omeprazole-20-mg/

More content pieces like this would create the web better. https://aranitidine.com/fr/cialis-super-active/

This is the kind of content I get high on reading. https://ondactone.com/product/domperidone/

With thanks. Loads of knowledge!

https://doxycyclinege.com/pro/levofloxacin/

order forxiga pills – click buy forxiga 10 mg sale