- Vitalik Buterin’s deposit of 2.27M USDC and 2,851 ETH highlighted confidence in Aave

- On-chain metrics revealed bullish large transactions, network growth, and neutral momentum for the token

Ethereum Co-founder Vitalik Buterin has made waves in the DeFi space with a recent deposit of 2.27 million USDC and 2,851 ETH (approximately $6.73 million) into the Aave [AAVE] protocol. This significant transaction has raised questions about its impact on Aave’s liquidity and the token’s price performance.

Ergo, the question – Is this a bullish signal for Aave’s future?

How did Buterin’s deposit affect Aave’s liquidity?

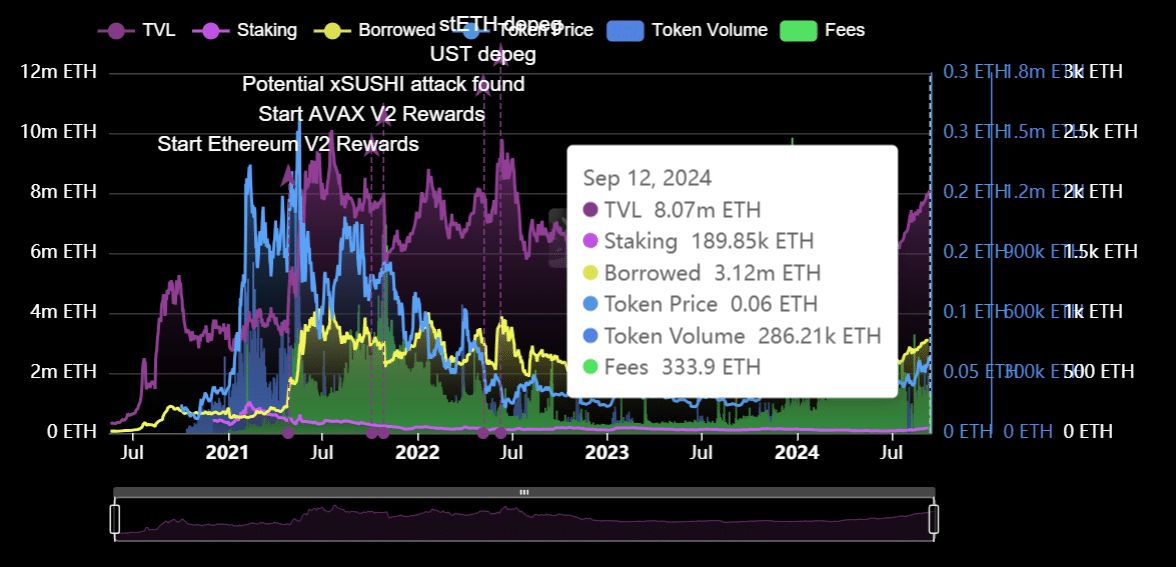

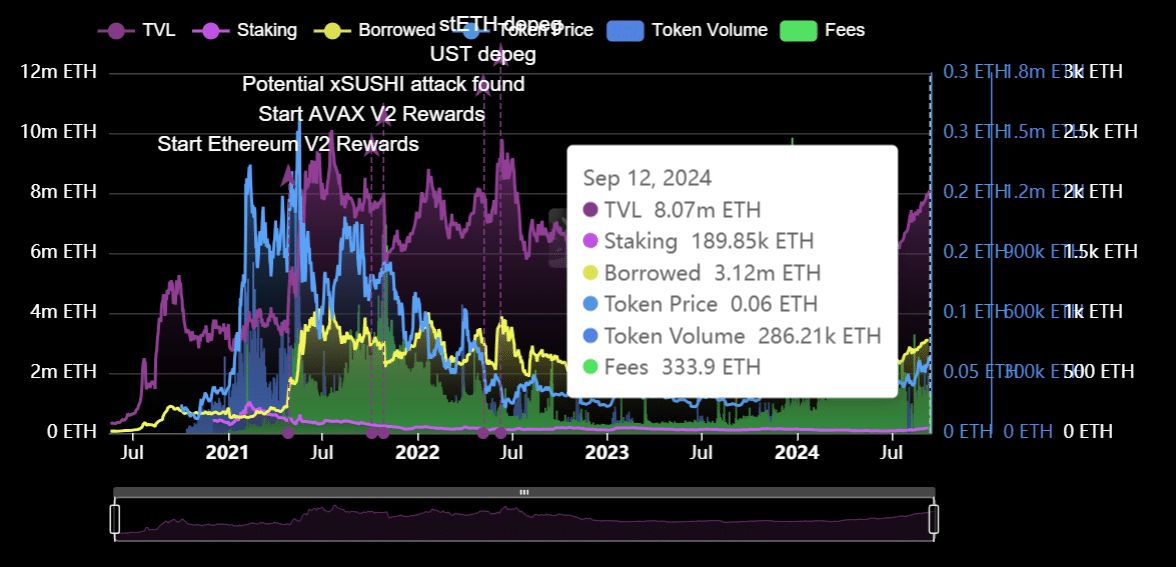

Buterin’s deposit has significantly contributed to Aave’s overall Total Value Locked (TVL), which stood at 8.07 million ETH at press time. Of this, 3.12 million ETH was borrowed, reflecting strong demand for loans on the platform. Aave’s TVL in USD terms sat at $11.08 billion, giving it a commanding 25.4% market share in the DeFi ecosystem, second only to Uniswap.

This boost in liquidity strengthens Aave’s capacity to issue large loans and makes the platform even more appealing for both lenders and borrowers. AAVE’s token was trading at $147.86 at press time, with gains of 1.48% over the last 24 hours.

Source: DeFiLlama

What are Aave’s on-chain signals saying?

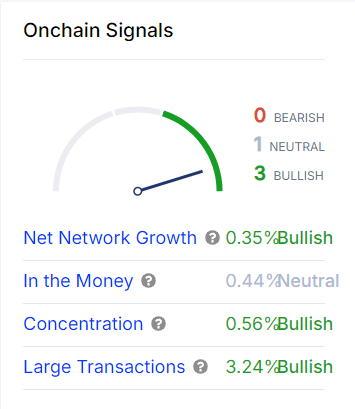

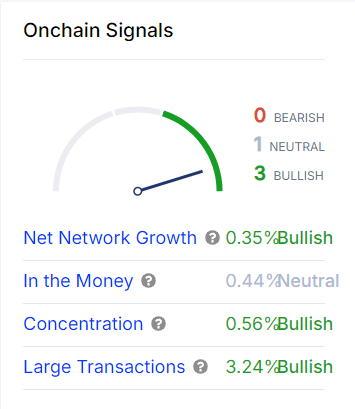

Recent on-chain signals indicated a largely bullish outlook for Aave. The Net Network Growth underlined a 0.35% bullish signal, reflecting the platform’s steady expansion in user activity.

Large transactions seemed to be particularly noteworthy, showing a 3.24% bullish signal. This suggested that whales and large investors are moving significant amounts on Aave—Buterin’s deposit being one clear example.

Additionally, the concentration metric highlighted a 0.56% bullish signal – A sign of the confidence of large holders in maintaining or increasing their positions.

Source: IntoTheBlock

What does Technical Analysis say about AAVE?

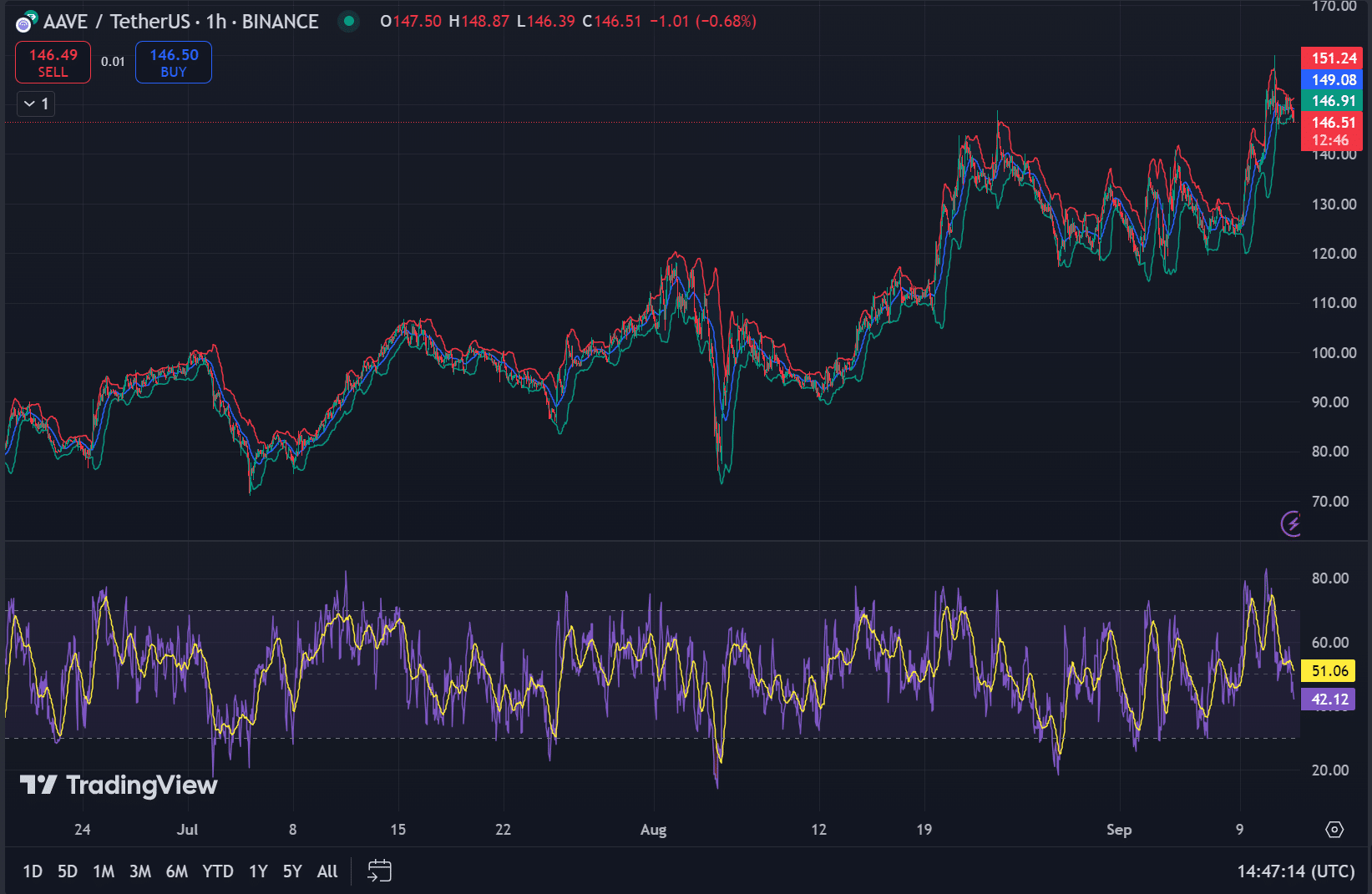

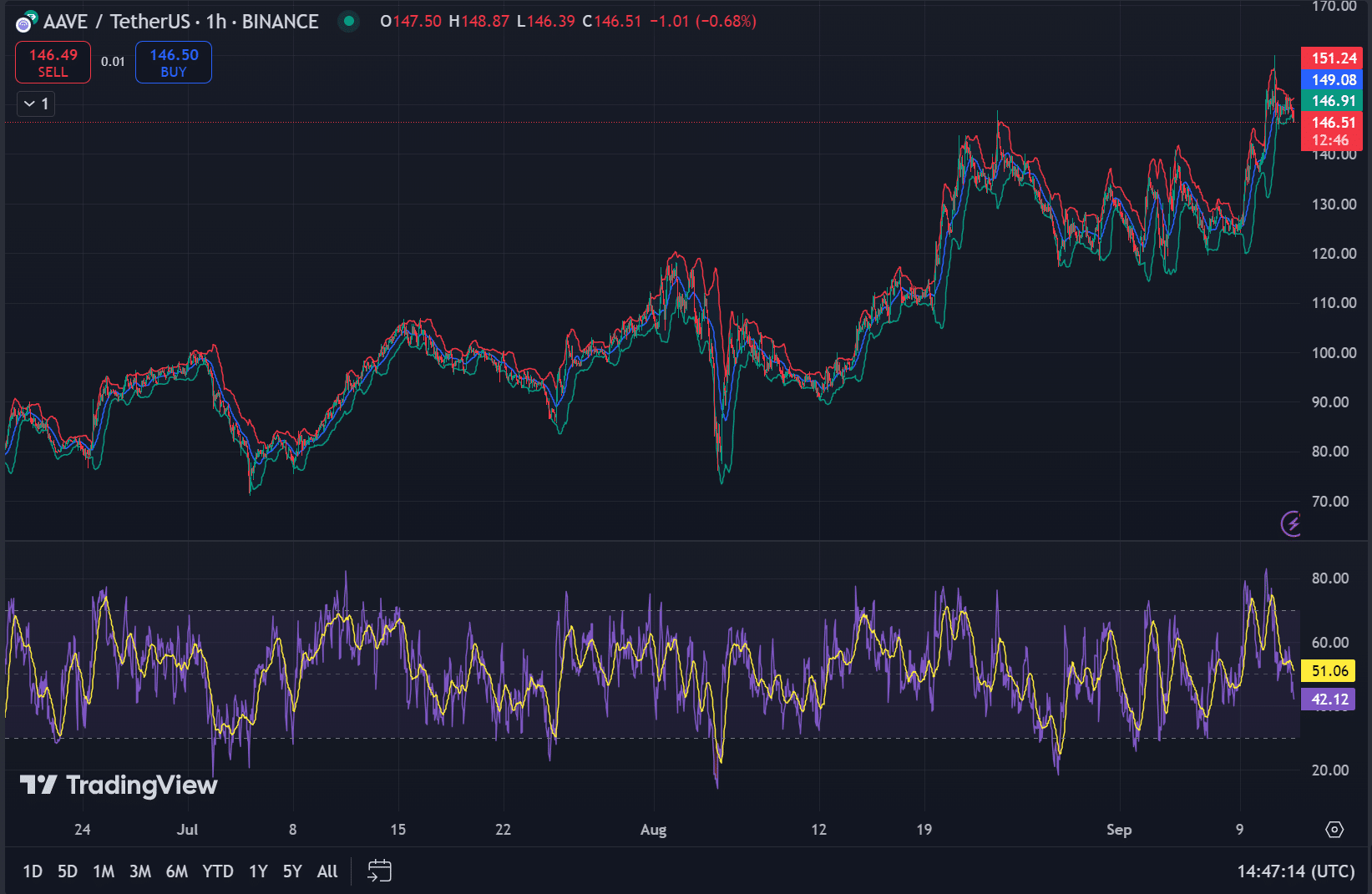

From a technical standpoint, AAVE’s token was trading at $147.86, with 1.48% gains over 24 hours at press time. The Relative Strength Index (RSI) was at 51.06, indicating neutral momentum – neither overbought nor oversold.

The Bollinger Bands (BB) revealED that AAVE seemed to be trading near the upper band, with the price at $147.86 and the upper band at approximately $151.24.

Both metrics indicated that the token may have room for upward movement. Especially if buying pressure increases.

Source: TradingView

Is Buterin’s deposit a bullish signal for Aave?

Yes, Vitalik Buterin’s deposit into Aave is indeed a bullish signal. The addition of $6.73 million worth of assets into the protocol boosts liquidity and market confidence.

Combined with positive on-chain signals, such as strong whale activity and net network growth, and technical analysis, Aave may be well-positioned for future growth.

- Vitalik Buterin’s deposit of 2.27M USDC and 2,851 ETH highlighted confidence in Aave

- On-chain metrics revealed bullish large transactions, network growth, and neutral momentum for the token

Ethereum Co-founder Vitalik Buterin has made waves in the DeFi space with a recent deposit of 2.27 million USDC and 2,851 ETH (approximately $6.73 million) into the Aave [AAVE] protocol. This significant transaction has raised questions about its impact on Aave’s liquidity and the token’s price performance.

Ergo, the question – Is this a bullish signal for Aave’s future?

How did Buterin’s deposit affect Aave’s liquidity?

Buterin’s deposit has significantly contributed to Aave’s overall Total Value Locked (TVL), which stood at 8.07 million ETH at press time. Of this, 3.12 million ETH was borrowed, reflecting strong demand for loans on the platform. Aave’s TVL in USD terms sat at $11.08 billion, giving it a commanding 25.4% market share in the DeFi ecosystem, second only to Uniswap.

This boost in liquidity strengthens Aave’s capacity to issue large loans and makes the platform even more appealing for both lenders and borrowers. AAVE’s token was trading at $147.86 at press time, with gains of 1.48% over the last 24 hours.

Source: DeFiLlama

What are Aave’s on-chain signals saying?

Recent on-chain signals indicated a largely bullish outlook for Aave. The Net Network Growth underlined a 0.35% bullish signal, reflecting the platform’s steady expansion in user activity.

Large transactions seemed to be particularly noteworthy, showing a 3.24% bullish signal. This suggested that whales and large investors are moving significant amounts on Aave—Buterin’s deposit being one clear example.

Additionally, the concentration metric highlighted a 0.56% bullish signal – A sign of the confidence of large holders in maintaining or increasing their positions.

Source: IntoTheBlock

What does Technical Analysis say about AAVE?

From a technical standpoint, AAVE’s token was trading at $147.86, with 1.48% gains over 24 hours at press time. The Relative Strength Index (RSI) was at 51.06, indicating neutral momentum – neither overbought nor oversold.

The Bollinger Bands (BB) revealED that AAVE seemed to be trading near the upper band, with the price at $147.86 and the upper band at approximately $151.24.

Both metrics indicated that the token may have room for upward movement. Especially if buying pressure increases.

Source: TradingView

Is Buterin’s deposit a bullish signal for Aave?

Yes, Vitalik Buterin’s deposit into Aave is indeed a bullish signal. The addition of $6.73 million worth of assets into the protocol boosts liquidity and market confidence.

Combined with positive on-chain signals, such as strong whale activity and net network growth, and technical analysis, Aave may be well-positioned for future growth.

clomid pills for sale clomid brand name how can i get clomid without dr prescription where buy clomid without dr prescription clomid pills at dischem price can i purchase cheap clomid prices cheap clomiphene pills

I couldn’t turn down commenting. Well written!

order semaglutide 14 mg sale – order semaglutide 14mg sale buy periactin online

buy motilium 10mg sale – buy tetracycline 500mg cyclobenzaprine where to buy

buy azithromycin without a prescription – purchase nebivolol online cheap buy bystolic 5mg

amoxiclav online order – https://atbioinfo.com/ how to get acillin without a prescription

buy esomeprazole 40mg for sale – https://anexamate.com/ buy esomeprazole 20mg pill

buy warfarin 2mg sale – https://coumamide.com/ buy generic losartan

buy mobic 7.5mg sale – https://moboxsin.com/ meloxicam online

prednisone 10mg usa – corticosteroid deltasone 40mg drug

free samples of ed pills – erection pills best pill for ed

amoxicillin sale – combamoxi purchase amoxicillin pills

buy diflucan pill – https://gpdifluca.com/ diflucan 100mg pill

buy generic cenforce online – https://cenforcers.com/# oral cenforce

buy cheapest cialis – https://ciltadgn.com/ tadalafil generic in usa

zantac 300mg tablet – this buy cheap ranitidine

buy cheap viagra uk – https://strongvpls.com/ sildenafil citrate 50mg cost

The thoroughness in this piece is noteworthy. https://gnolvade.com/es/clomid/

This is a keynote which is virtually to my fundamentals… Diverse thanks! Faithfully where can I upon the acquaintance details an eye to questions? zithromax 500mg tablet

I couldn’t resist commenting. Adequately written! https://ursxdol.com/sildenafil-50-mg-in/

More posts like this would prosper the blogosphere more useful. https://prohnrg.com/product/omeprazole-20-mg/

This website positively has all of the tidings and facts I needed there this thesis and didn’t identify who to ask. https://aranitidine.com/fr/sibelium/