- ETH traded within a falling channel as active addresses and MVRV flashed accumulation signals.

- Whales and OGs were unloading, but metrics suggested a potential market bottom forming.

Ethereum [ETH] long-term holders have officially entered “capitulation” territory, with the LTH-NUPL metric dipping into the red for the first time in months. This shift reflects growing losses among seasoned holders and often signals the final phase of a bearish cycle.

At press time, Ethereum was trading at $1,591.63, showing a 7.32% increase in the last 24 hours.

In other words, even with prolonged downside pressure, short-term price action now hints at a possible momentum shift.

ETH price action, user activity, and MVRV signal market stress

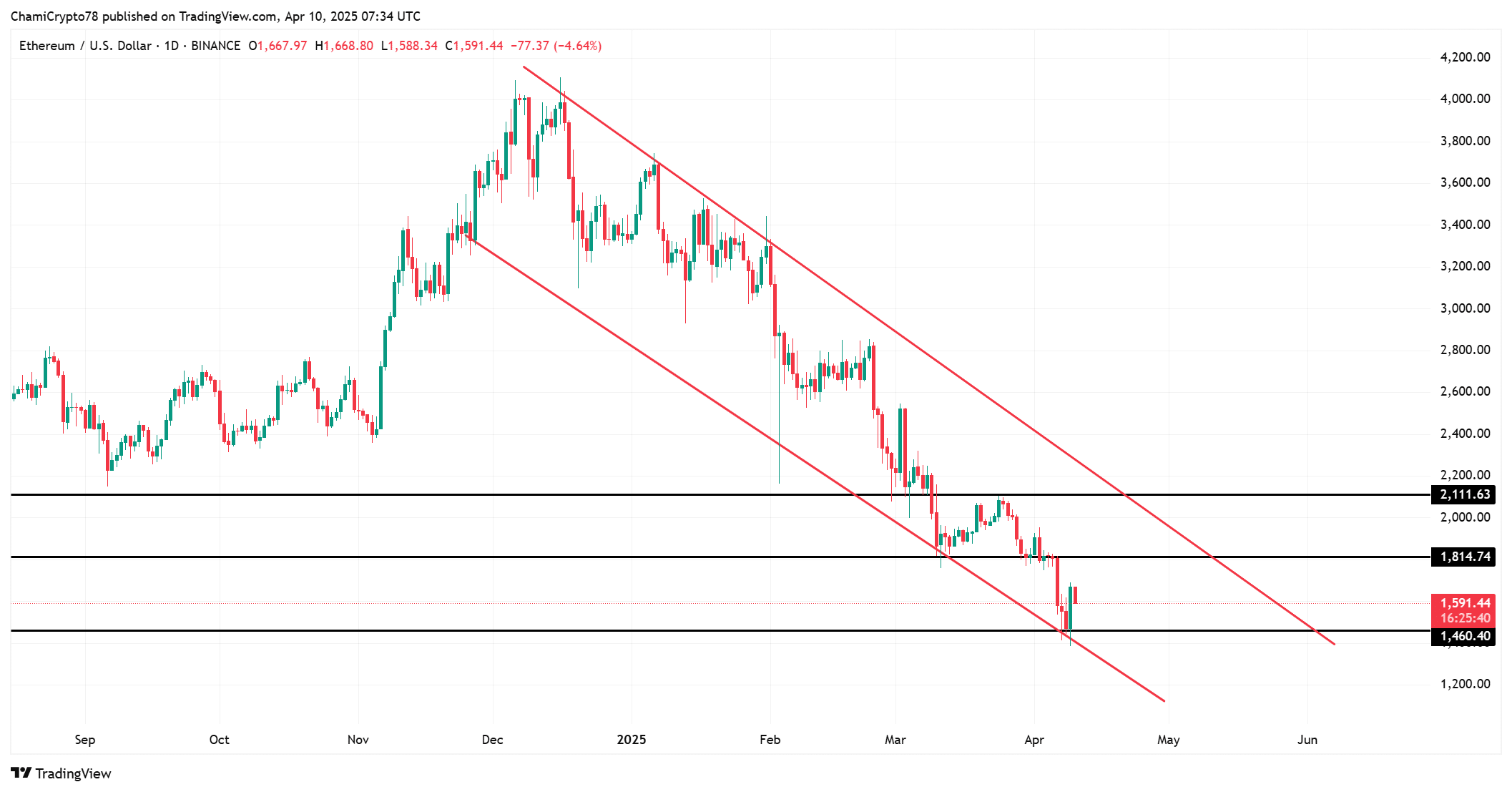

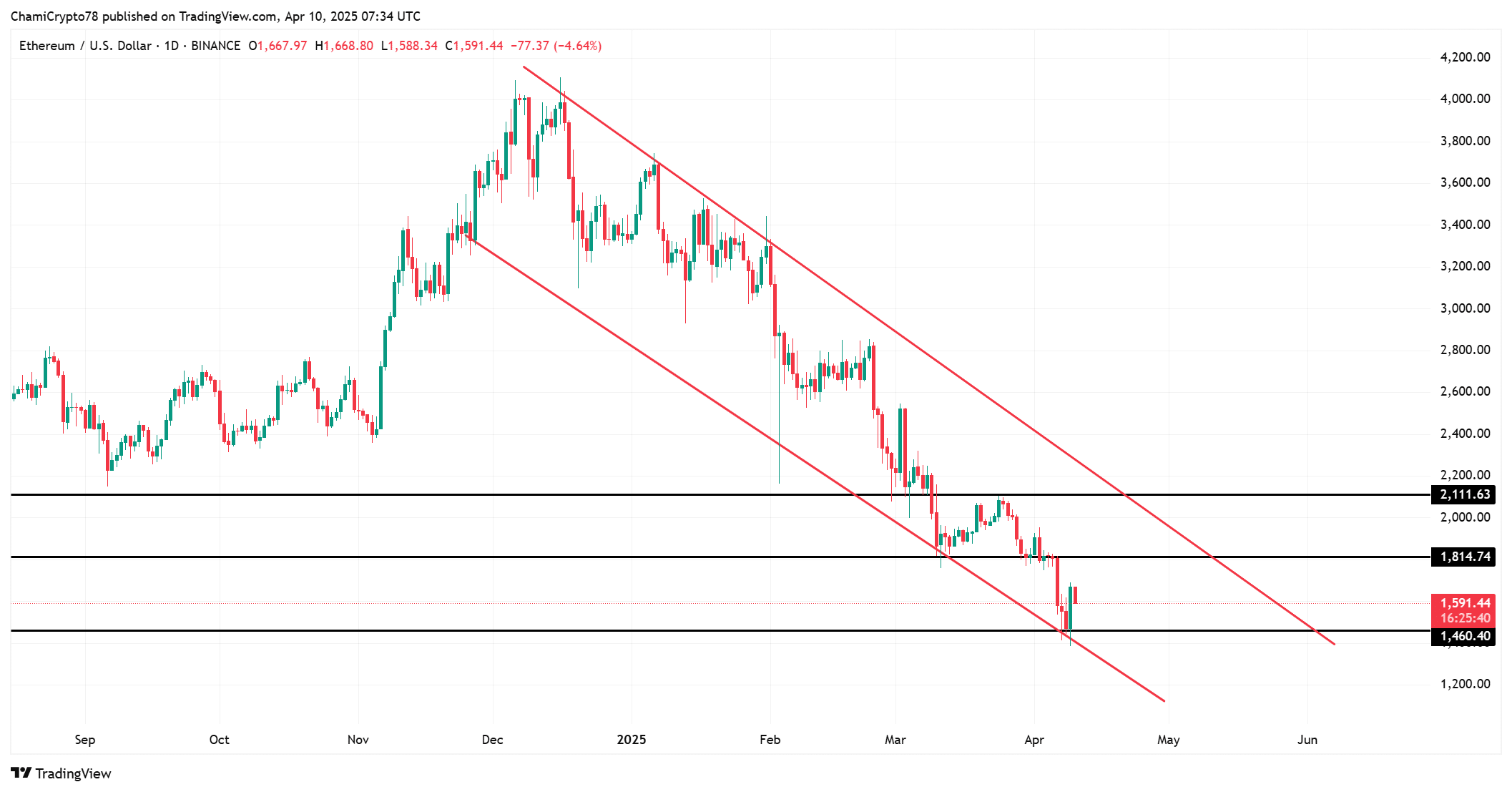

Ethereum’s price action remains confined to a steep descending channel, characterized by consistently lower highs and lows since November 2024.

After rebounding strongly from the $1,460 support zone, the price is now facing resistance near $1,815, a level where bears could attempt to assert control.

That said, if the bulls manage to reclaim the $1,815 level, it could shift the market structure to bullish and set the stage for a challenge of the upper channel resistance.

However, until this happens, downside pressure will persist, with potential retests of key support levels if momentum fades.

Source: TradingView

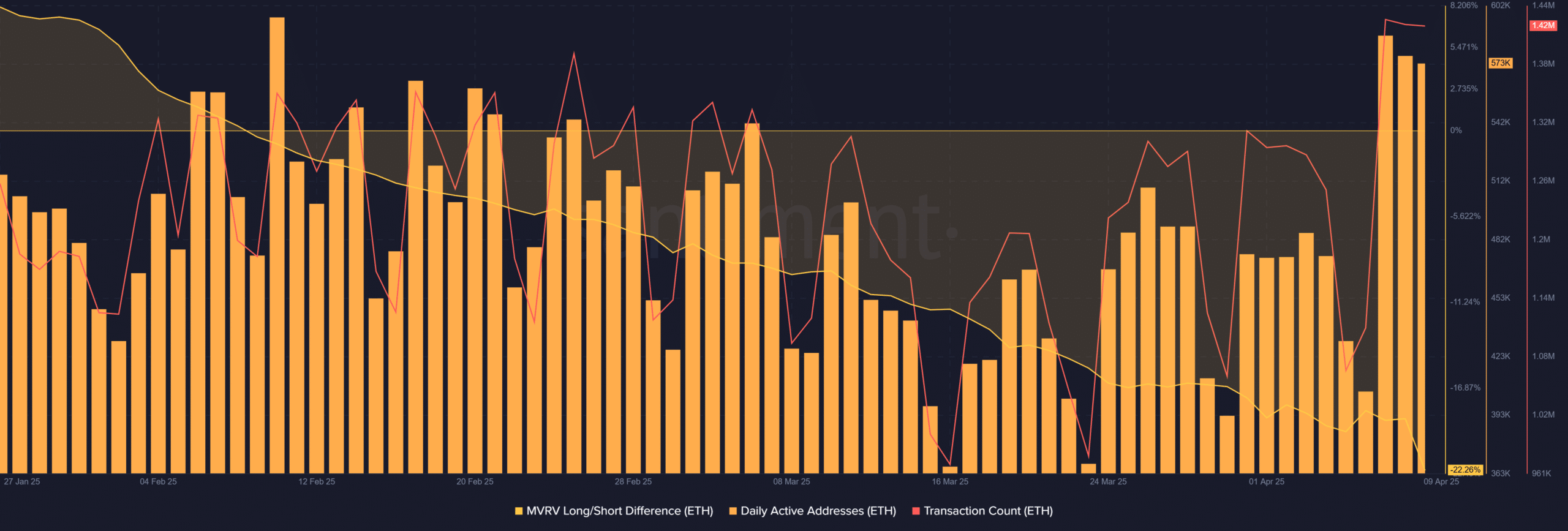

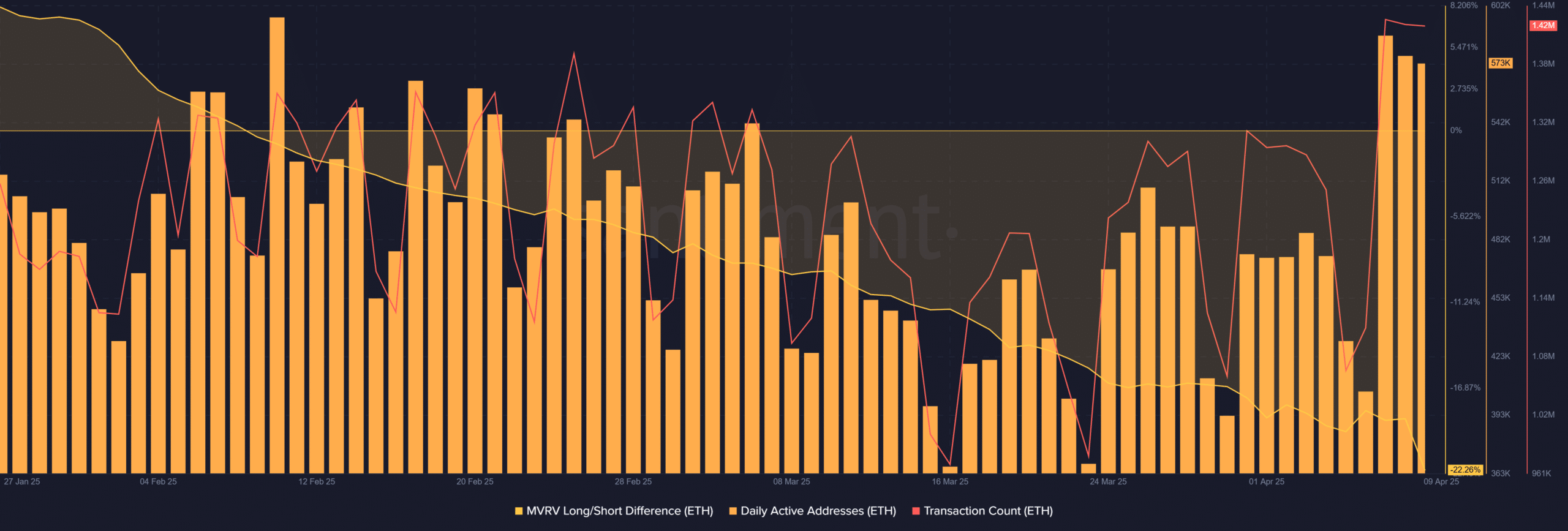

Meanwhile, on-chain activity tells a different story.

Daily active addresses surged to 573,000 and transaction count hit 1.42 million on the 9th of April, marking a significant spike in user engagement.

This increased participation—despite price weakness—suggests rising interest in Ethereum’s ecosystem at discounted prices.

Additionally, the MVRV Long/Short Difference has plummeted to -22.26 %, a level often associated with maximum pain and ideal accumulation during historical bottoms.

Source: Santiment

Whale moves and OG selling confirm capitulation risk-off mood

Interestingly enough, whale behavior has intensified.

Over 530,000 ETH was moved across major wallets in just the past week, typically pointing to strategic accumulation or rebalancing.

Even more telling is a dormant Ethereum OG that acquired ETH back in 2016 and offloaded 10,702 ETH worth $16.86 million at just $1,576.

Interestingly, this whale has consistently sold only during periods of significant market corrections, even avoiding sales when ETH surpassed $4,000.

Such actions may indicate strategic exits or attempts at psychological manipulation designed to provoke retail panic, setting the stage for eventual market recovery.

Is now the best time to buy Ethereum?

Ethereum’s long-term holder capitulation, extreme MVRV readings, and increased whale activity all point to a classic accumulation setup. Rising network usage adds further confirmation that interest remains strong under the surface.

Therefore, despite short-term volatility, all signals indicate that Ethereum is trading in a high-probability reversal zone.

Smart investors may view this as one of the best risk-reward entry points before the next bullish leg unfolds.

- ETH traded within a falling channel as active addresses and MVRV flashed accumulation signals.

- Whales and OGs were unloading, but metrics suggested a potential market bottom forming.

Ethereum [ETH] long-term holders have officially entered “capitulation” territory, with the LTH-NUPL metric dipping into the red for the first time in months. This shift reflects growing losses among seasoned holders and often signals the final phase of a bearish cycle.

At press time, Ethereum was trading at $1,591.63, showing a 7.32% increase in the last 24 hours.

In other words, even with prolonged downside pressure, short-term price action now hints at a possible momentum shift.

ETH price action, user activity, and MVRV signal market stress

Ethereum’s price action remains confined to a steep descending channel, characterized by consistently lower highs and lows since November 2024.

After rebounding strongly from the $1,460 support zone, the price is now facing resistance near $1,815, a level where bears could attempt to assert control.

That said, if the bulls manage to reclaim the $1,815 level, it could shift the market structure to bullish and set the stage for a challenge of the upper channel resistance.

However, until this happens, downside pressure will persist, with potential retests of key support levels if momentum fades.

Source: TradingView

Meanwhile, on-chain activity tells a different story.

Daily active addresses surged to 573,000 and transaction count hit 1.42 million on the 9th of April, marking a significant spike in user engagement.

This increased participation—despite price weakness—suggests rising interest in Ethereum’s ecosystem at discounted prices.

Additionally, the MVRV Long/Short Difference has plummeted to -22.26 %, a level often associated with maximum pain and ideal accumulation during historical bottoms.

Source: Santiment

Whale moves and OG selling confirm capitulation risk-off mood

Interestingly enough, whale behavior has intensified.

Over 530,000 ETH was moved across major wallets in just the past week, typically pointing to strategic accumulation or rebalancing.

Even more telling is a dormant Ethereum OG that acquired ETH back in 2016 and offloaded 10,702 ETH worth $16.86 million at just $1,576.

Interestingly, this whale has consistently sold only during periods of significant market corrections, even avoiding sales when ETH surpassed $4,000.

Such actions may indicate strategic exits or attempts at psychological manipulation designed to provoke retail panic, setting the stage for eventual market recovery.

Is now the best time to buy Ethereum?

Ethereum’s long-term holder capitulation, extreme MVRV readings, and increased whale activity all point to a classic accumulation setup. Rising network usage adds further confirmation that interest remains strong under the surface.

Therefore, despite short-term volatility, all signals indicate that Ethereum is trading in a high-probability reversal zone.

Smart investors may view this as one of the best risk-reward entry points before the next bullish leg unfolds.

Как работать с контроллерами Siemens, основные принципы.

Тонкости программирования контроллеров Siemens, оптимизации процессов.

Программирование с помощью TIA Portal, для улучшения навыков.

Ошибки при программировании контроллеров Siemens, узнайте.

Проектирование автоматизации с контроллерами Siemens, подходы.

Топ контроллеров Siemens на рынке, для любых нужд.

Использование языков программирования в Siemens, для разработки.

Лучшие решения автоматизации с контроллерами Siemens, для бизнеса.

Современные тенденции в программировании контроллеров Siemens, в ближайшее время.

Как разработать интерфейс для контроллера Siemens, основные шаги.

Программирование контроллеров сименс http://programmirovanie-kontroller.ru/#Программирование-контроллеров-сименс – http://programmirovanie-kontroller.ru/ .

Лучшие кулинарные рецепты для праздничного стола, обязательно приготовьте.

Вкусные завтраки для энергичного начала дня, которые легко и быстро готовятся.

Топ 10 рецептов домашних десертов, проверенные временем и вдохновленные традиционными рецептами.

Путешествие в мир разнообразных вкусов, приготовленные с особым вниманием к деталям.

Семейные ужины, которые понравятся всем, составленные с учетом вкусовых предпочтений каждого.

Идеи для здорового питания каждый день, сбалансированные и питательные.

Летние угощения: вкусные блюда для пикника, превратят ваш отдых на свежем воздухе в настоящий праздник.

Идеи для коктейлей и безалкогольных напитков, прохладят в жаркий день и согреют в холодный вечер.

Кулинарные хитрости и советы от опытных шеф-поваров, которые помогут вам стать настоящим профессионалом.

Рецепты без мяса: кулинарные изыски для вегетарианцев, полезные и сбалансированные.

Как сделать детский стол незабываемым, заверенные мамами и аниматорами.

Блюда, которые стоит готовить в разное время года, подскажут, какие продукты актуальны в данный период.

Легкие пикантные закуски к алкогольным напиткам, вызовут восторг у ваших друзей.

Легкие и вкусные рецепты обедов, которые спасут вас в быстром ритме жизни.

Конфеты, которые заставят вас влюбиться в сладкое, наполненные нежностью и теплом.

Кулинарные инициации для начинающих: шаг за шагом

как приготовить еду https://www.7eda.ru/#как-приготовить-еду – https://www.7eda.ru/ .

Качественные скины по доступным ценам, эксклюзивные скины.

Не пропустите, не оставят равнодушными.

предложений по скинам, доступны.

новинки в мире скинов.

качественные скины.

комьюнити.

в нашем магазине.

каталог.

Станьте.

скины по суперценам, удовлетворят ваши желания.

Вы найдете, на любой вкус.

Ищите.

коллекционные товары.

Пользуйтесь, и не упустите шанс.

Не забывайте про, удовлетворят ваши потребности.

Пополните свою коллекцию, которые будут выделять вас.

Выбирая нас, качество и надежность.

Не упустите возможность купить, с максимальной выгодой.

best skins https://www.superskinscs.com/#best-skins – https://www.superskinscs.com/ .

Получение разрешения на работу, необходимый этап, нужно изучить.

Разрешение на работу за границей: основные моменты, подробный гайд.

Разрешение на работу: основные требования, изучаем.

Как продлить разрешение на работу, по юридическим вопросам.

Работа для студентов: разрешение на работу, необходимые документы.

Как избежать ошибок при получении разрешения на работу, полезная информация.

Сравнение разрешений на работу в разных странах, требования.

Что нужно для получения разрешения на работу, проверьте документы.

Как получить разрешение на работу без отказа, важные советы.

Права работника с разрешением на работу, основные моменты.

Ускорение процесса получения разрешения на работу, полезная информация.

Разрешение на работу для фрилансеров, полезные советы.

Проверка готовности разрешения на работу, все способы.

Как получить разрешение на работу родителям-одиночкам, пошаговый план.

Интервью при получении разрешения на работу, полезные советы.

Что нужно знать о налогах при получении разрешения на работу, информация.

Разрешение на работу для людей с инвалидностью, основные моменты.

Оплата услуг по получению разрешения на работу, полезные советы.

Как переехать за границу с разрешением на работу, планирование.

Особенности получения разрешения на работу в кризис, что учитывать.

разрешение на работу в россии http://oformleniernr.ru/#разрешение-на-работу-в-россии – http://oformleniernr.ru/ .

can i buy clomid tablets can i get cheap clomid no prescription get cheap clomiphene online cost clomid prices can i buy cheap clomid without prescription buy generic clomid without dr prescription can i purchase generic clomiphene pills

More text pieces like this would create the интернет better.

This is the description of glad I take advantage of reading.

order zithromax 250mg pills – flagyl brand metronidazole 200mg cheap

semaglutide price – order semaglutide 14 mg pill buy cyproheptadine 4 mg pill

motilium pills – order flexeril 15mg online buy generic flexeril over the counter

amoxil sale – order valsartan pills ipratropium uk

where to buy azithromycin without a prescription – order azithromycin 500mg online cheap bystolic 20mg oral

nexium uk – nexiumtous nexium buy online

coumadin 5mg brand – https://coumamide.com/ how to get losartan without a prescription

order mobic pill – https://moboxsin.com/ mobic 7.5mg for sale

deltasone buy online – https://apreplson.com/ buy prednisone 20mg pills

buy amoxil generic – combamoxi.com buy amoxicillin no prescription

buy generic fluconazole for sale – https://gpdifluca.com/# fluconazole tablet

what does cialis treat – what doe cialis look like tadalafil (tadalis-ajanta) reviews

buying cialis – https://strongtadafl.com/# tadalafil without a doctor’s prescription

how to buy zantac – buy ranitidine 300mg online cheap ranitidine 300mg without prescription

I couldn’t weather commenting. Profoundly written! https://gnolvade.com/

Greetings! Utter gainful recommendation within this article! It’s the scarcely changes which will make the largest changes. Thanks a portion for sharing! https://buyfastonl.com/gabapentin.html

I’ll certainly carry back to skim more. https://ursxdol.com/augmentin-amoxiclav-pill/

More articles like this would remedy the blogosphere richer. click

The thoroughness in this break down is noteworthy. https://aranitidine.com/fr/clenbuterol/

More articles like this would make the blogosphere richer.

celecoxib over the counter

More articles like this would remedy the blogosphere richer. http://bbs.yongrenqianyou.com/home.php?mod=space&uid=4272505&do=profile

buy dapagliflozin 10 mg – purchase forxiga for sale forxiga 10 mg cost

how to buy orlistat – https://asacostat.com/# buy xenical 60mg pills