- Ethereum experiences its second-largest buying day, with long-term holders accumulating significantly.

- Market indicators show mixed signals, with decreases in open interest and exchange reserves hitting an eight-year low.

Ethereum [ETH], the second-largest cryptocurrency by market capitalization, has recently exhibited some interesting market movements.

Despite an 8% decline over the past week, Ethereum saw a slight uptick of 0.3% in the last 24 hours, bringing its current trading price to $3,519.

This minor increase comes during a period of overall market uncertainty, particularly following the approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission in May.

Long-term holders capitalize on market dips

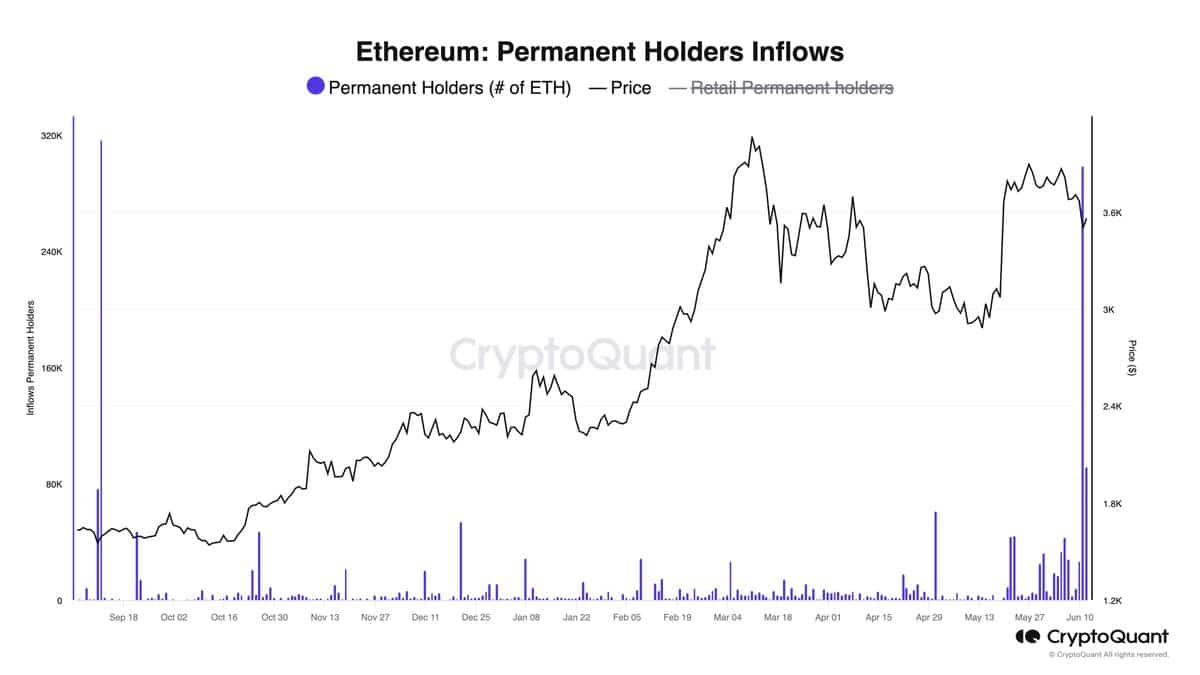

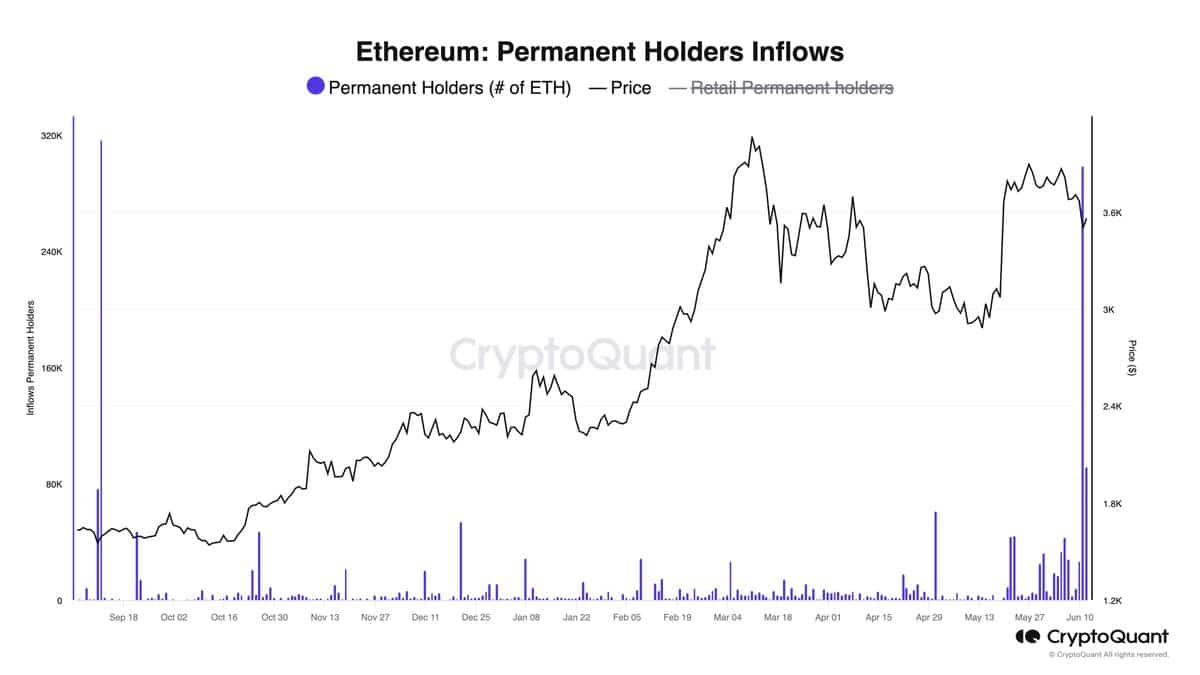

Amid these price adjustments, Ethereum has experienced a significant surge in long-term holder accumulation. According to Julio Moreno, CryptoQuant’s head of research, Ethereum just witnessed its second-largest buying day by long-term holders.

On June 12, about 298,000 Ethereum tokens, valued at approximately $1.34 billion, were purchased by these steadfast investors, capitalizing on a slight 2% price dip within the same 24-hour period.

Source: CryptoQuant

This noteworthy accumulation was not far off from the record set on 11th September, 2023, when 317,000 Ether tokens were acquired as prices dipped below $1,600.

This pattern of strategic buying during price drops highlights the confidence long-term investors have in Ethereum’s value.

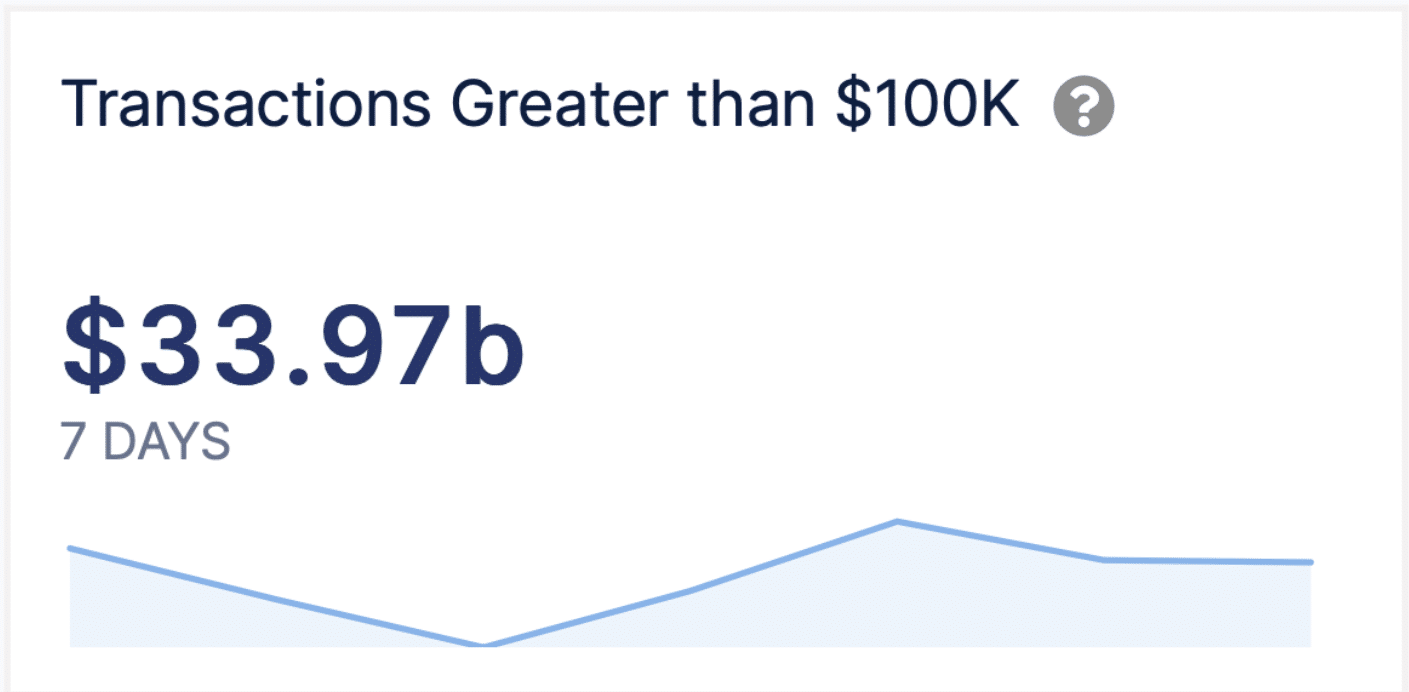

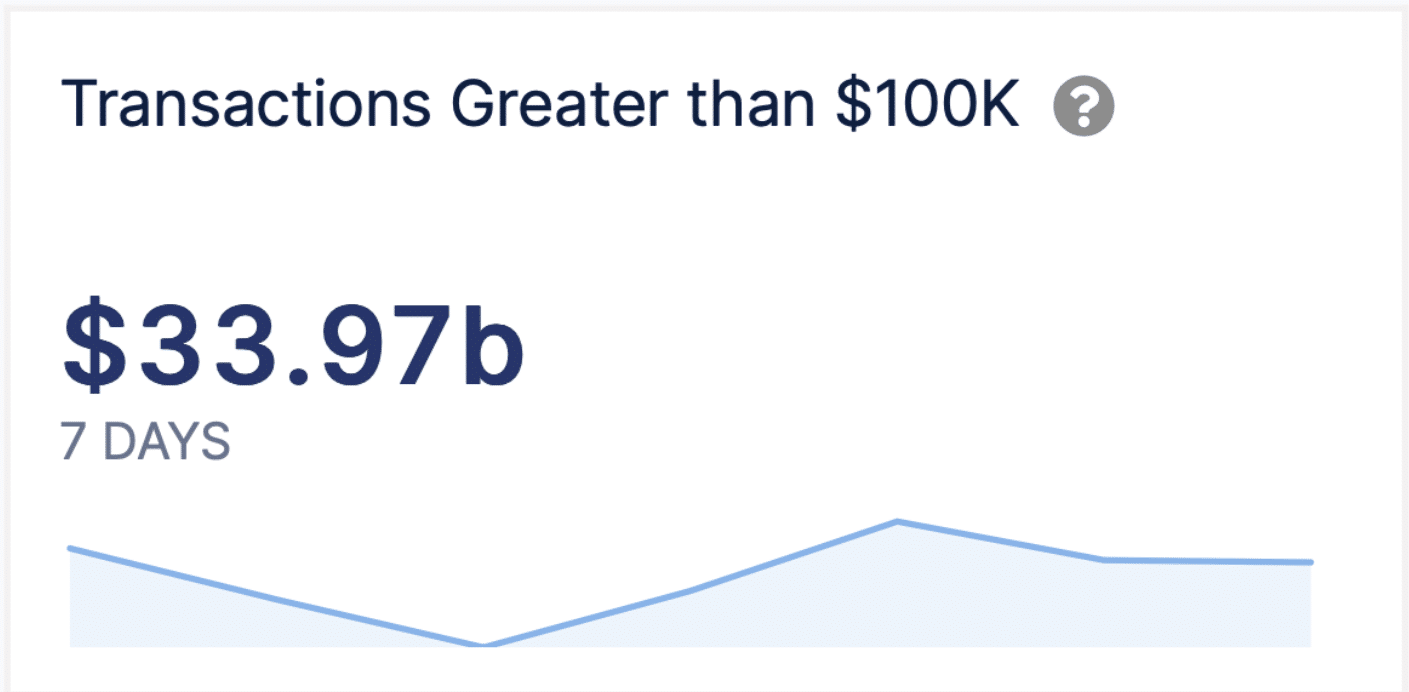

Furthermore, this trend corresponds with an increase in large transactions over $100,000, as shown in IntoTheBlock data, where such transactions rose from below 4,000 earlier in the week to over 6,000

This indicates active accumulation by whales regardless of the prevailing market conditions.

Source: IntoTheBlock

Market caution and technical outlook

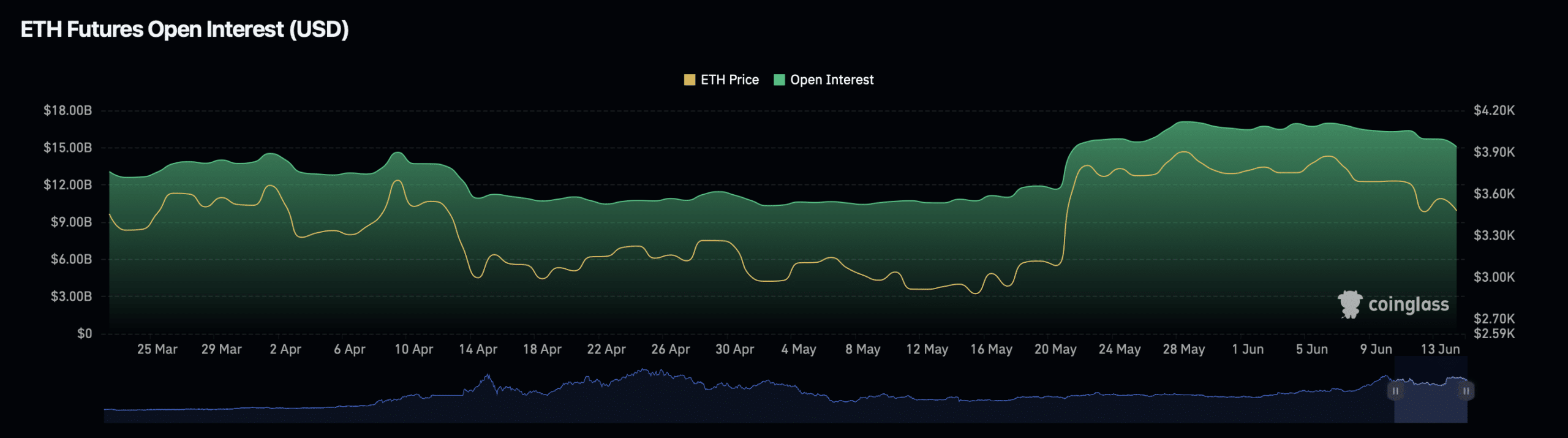

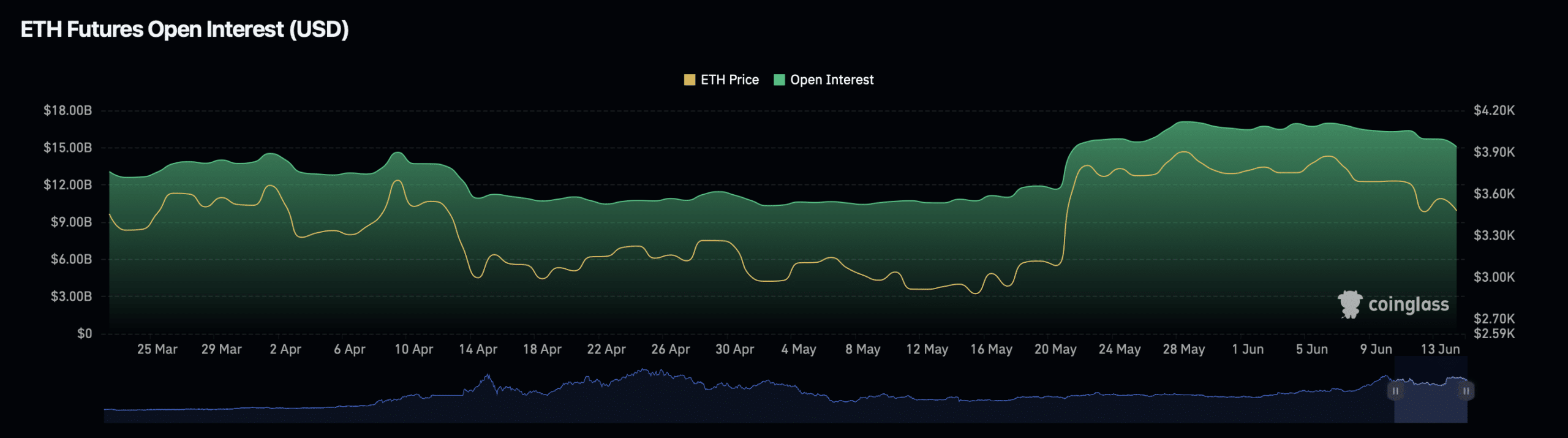

However, contrasting this bullish accumulation activity, Ethereum’s market metrics such as open interest and trading volume present a more subdued outlook.

Open interest in Ethereum has decreased by nearly 2% to $15.41 billion, while trading volume saw a significant decline of 25.77%, now standing at $24.19 billion. These metrics suggest a cautious stance among some market participants, potentially anticipating further price adjustments.

Source: Coinglass

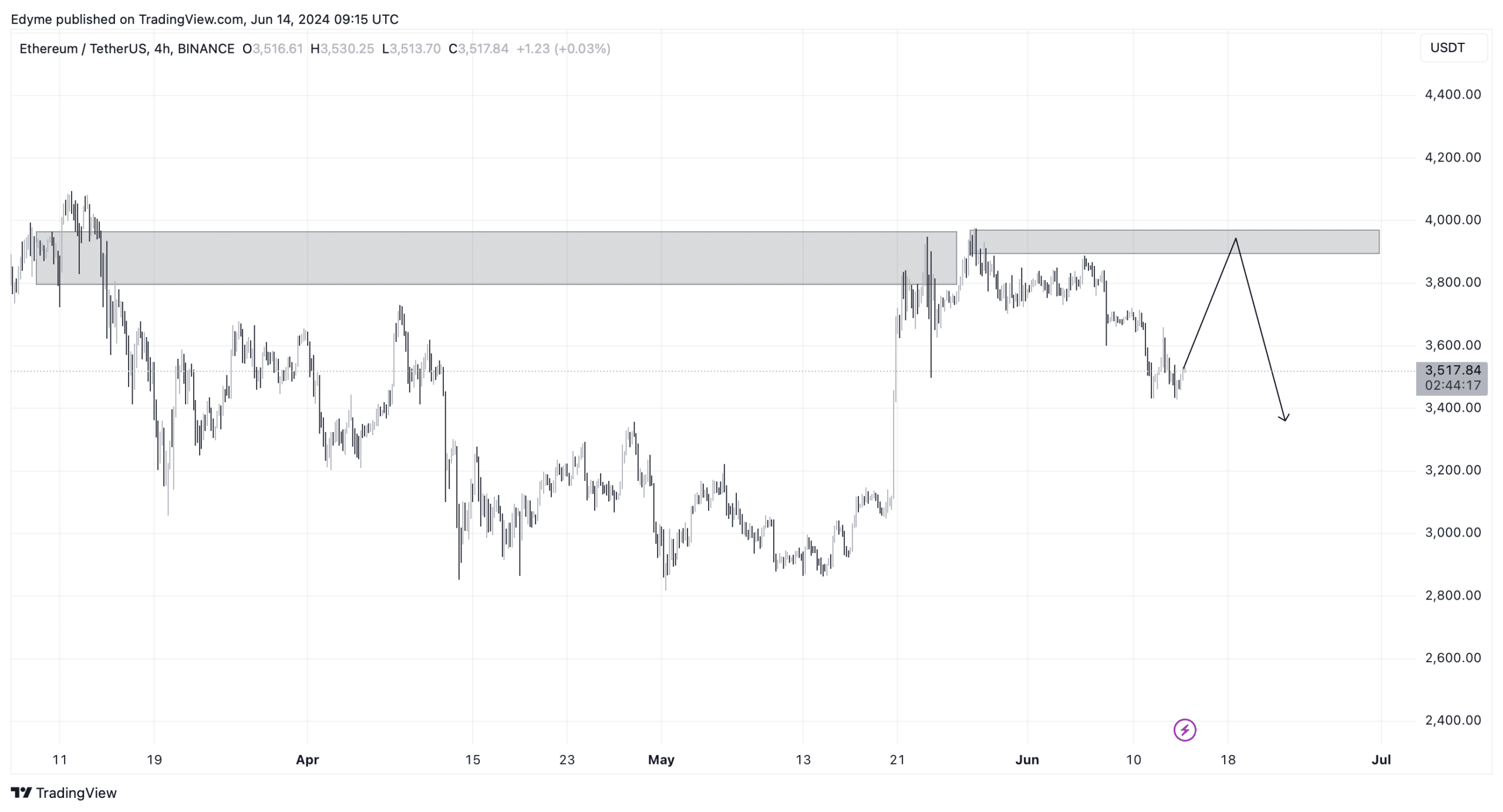

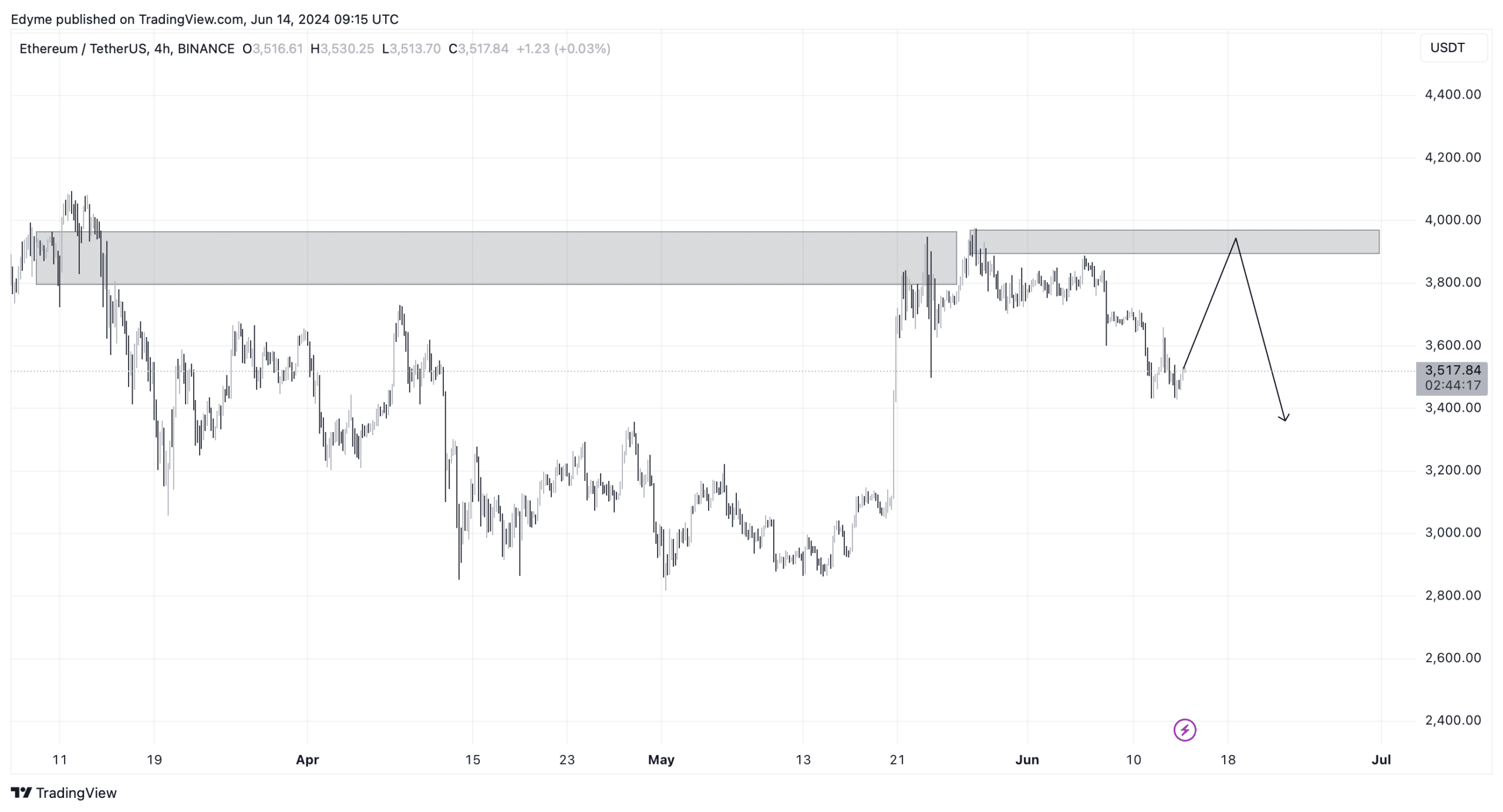

On the technical front, Ethereum’s inability to surpass its March highs has activated a sell setup on its daily chart, hinting at possible continued downward pressure.

However, a shorter-term perspective from the 4-hour chart suggests there might be a temporary rise to around $3,800, potentially providing liquidity for an ongoing downtrend.

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024-25

In another vital aspect of market dynamics, the amount of Ethereum held on exchanges has hit an eight-year low, as noted by AMBCrypto.

This reduction in exchange-held Ethereum, coupled with the launch of spot ETFs, may lead to a significant supply shock, which could, in turn, trigger a sharp price increase.

- Ethereum experiences its second-largest buying day, with long-term holders accumulating significantly.

- Market indicators show mixed signals, with decreases in open interest and exchange reserves hitting an eight-year low.

Ethereum [ETH], the second-largest cryptocurrency by market capitalization, has recently exhibited some interesting market movements.

Despite an 8% decline over the past week, Ethereum saw a slight uptick of 0.3% in the last 24 hours, bringing its current trading price to $3,519.

This minor increase comes during a period of overall market uncertainty, particularly following the approval of spot Ethereum ETFs by the U.S. Securities and Exchange Commission in May.

Long-term holders capitalize on market dips

Amid these price adjustments, Ethereum has experienced a significant surge in long-term holder accumulation. According to Julio Moreno, CryptoQuant’s head of research, Ethereum just witnessed its second-largest buying day by long-term holders.

On June 12, about 298,000 Ethereum tokens, valued at approximately $1.34 billion, were purchased by these steadfast investors, capitalizing on a slight 2% price dip within the same 24-hour period.

Source: CryptoQuant

This noteworthy accumulation was not far off from the record set on 11th September, 2023, when 317,000 Ether tokens were acquired as prices dipped below $1,600.

This pattern of strategic buying during price drops highlights the confidence long-term investors have in Ethereum’s value.

Furthermore, this trend corresponds with an increase in large transactions over $100,000, as shown in IntoTheBlock data, where such transactions rose from below 4,000 earlier in the week to over 6,000

This indicates active accumulation by whales regardless of the prevailing market conditions.

Source: IntoTheBlock

Market caution and technical outlook

However, contrasting this bullish accumulation activity, Ethereum’s market metrics such as open interest and trading volume present a more subdued outlook.

Open interest in Ethereum has decreased by nearly 2% to $15.41 billion, while trading volume saw a significant decline of 25.77%, now standing at $24.19 billion. These metrics suggest a cautious stance among some market participants, potentially anticipating further price adjustments.

Source: Coinglass

On the technical front, Ethereum’s inability to surpass its March highs has activated a sell setup on its daily chart, hinting at possible continued downward pressure.

However, a shorter-term perspective from the 4-hour chart suggests there might be a temporary rise to around $3,800, potentially providing liquidity for an ongoing downtrend.

Source: TradingView

Read Ethereum’s [ETH] Price Prediction 2024-25

In another vital aspect of market dynamics, the amount of Ethereum held on exchanges has hit an eight-year low, as noted by AMBCrypto.

This reduction in exchange-held Ethereum, coupled with the launch of spot ETFs, may lead to a significant supply shock, which could, in turn, trigger a sharp price increase.

where buy cheap clomiphene no prescription cost of generic clomiphene without rx clomiphene for sale in usa buy cheap clomid pill can you get cheap clomiphene without insurance where to get cheap clomid without dr prescription where buy clomiphene price

Greetings! Utter productive advice within this article! It’s the crumb changes which will make the largest changes. Thanks a a quantity in the direction of sharing!

The sagacity in this serving is exceptional.

azithromycin cheap – purchase ofloxacin without prescription buy metronidazole for sale

semaglutide sale – order semaglutide pill buy generic cyproheptadine 4mg

order generic domperidone – generic motilium 10mg order cyclobenzaprine 15mg online

buy clavulanate generic – https://atbioinfo.com/ acillin usa

nexium generic – nexium to us order nexium 40mg without prescription

buy coumadin pills for sale – coumamide.com order hyzaar pill

buy mobic pills – moboxsin generic mobic 7.5mg

purchase prednisone sale – asthma purchase prednisone without prescription

hims ed pills – red ed pill pills for erection

diflucan 100mg price – https://gpdifluca.com/# fluconazole tablet

order generic escitalopram – escita pro purchase lexapro generic

buy generic cenforce 50mg – https://cenforcers.com/# cenforce without prescription

what is the difference between cialis and tadalafil – https://ciltadgn.com/# where can i buy cialis online in australia

cialis and grapefruit enhance – strong tadafl cialis generic overnite shipping

buy generic ranitidine 300mg – online purchase zantac generic

viagra sale new zealand – on this site buy cheap viagra with mastercard

More posts like this would prosper the blogosphere more useful. order gabapentin 800mg online

With thanks. Loads of conception! ceftriaxone doxycycline gonorrhea

Good blog you be undergoing here.. It’s severely to on great worth script like yours these days. I honestly comprehend individuals like you! Withstand vigilance!! https://ursxdol.com/azithromycin-pill-online/

More posts like this would add up to the online space more useful. viagra professional sans ordonnance livraison 48h

This is the tolerant of advise I find helpful. https://ondactone.com/spironolactone/

More posts like this would make the blogosphere more useful.

https://doxycyclinege.com/pro/levofloxacin/

More posts like this would persuade the online elbow-room more useful. http://zqykj.cn/bbs/home.php?mod=space&uid=302440

buy forxiga pills – https://janozin.com/# generic dapagliflozin 10 mg

buy cheap orlistat – click orlistat 60mg pills