- Ether could rise to the $2,900 level if it maintains itself above the $2,570 level.

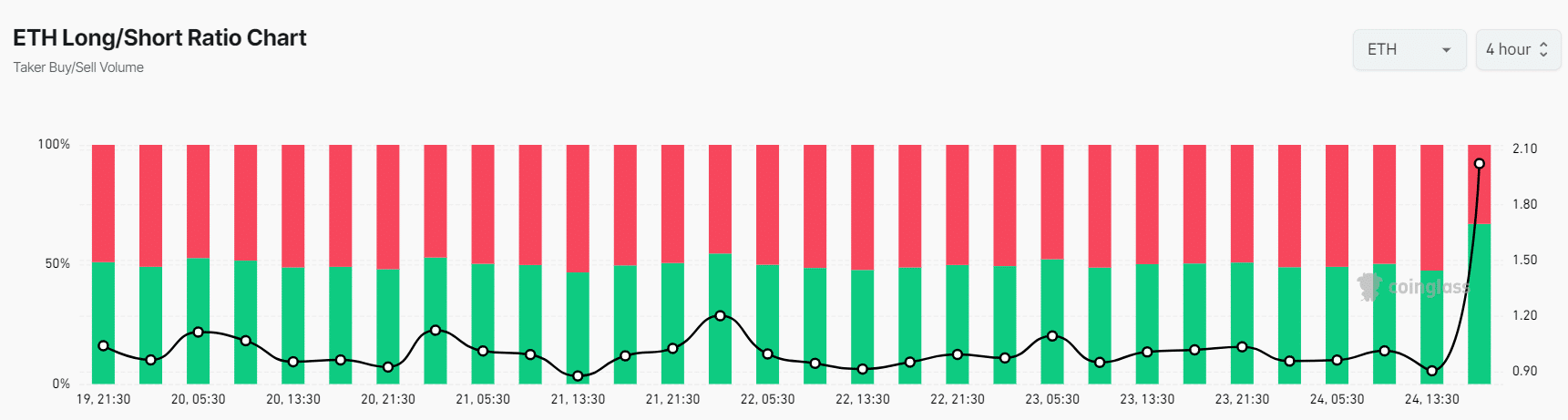

- ETH’s Long/Short Ratio currently stands at 2.023, indicating extremely bullish market sentiment among traders.

Ethereum [ETH], the world’s second-biggest cryptocurrency by market cap, is on the radar of whales, who are on a buying spree likely due to its bullish on-chain metrics.

Ethereum whale on a buying spree

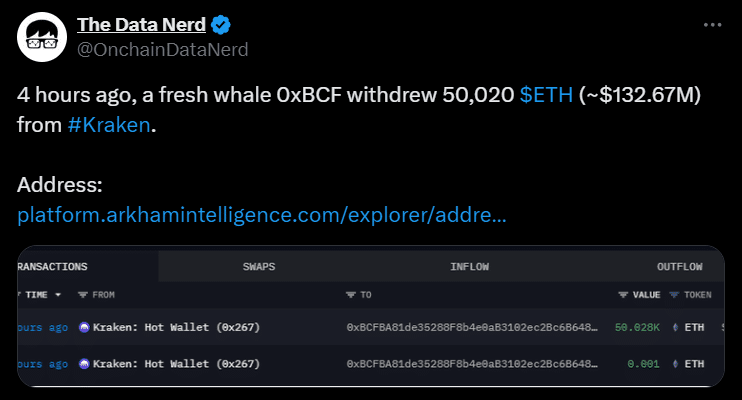

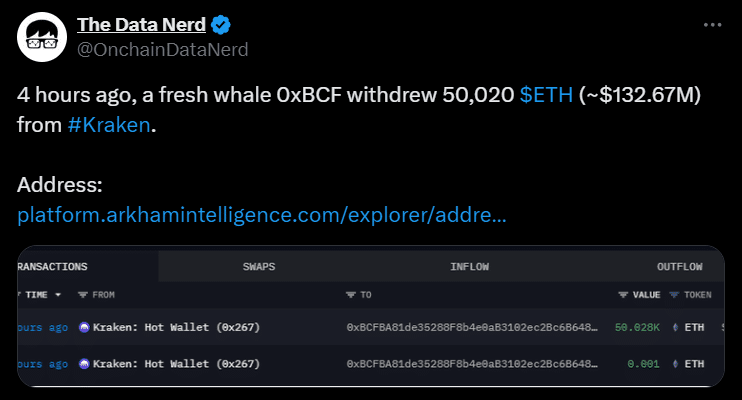

On the 24th of September, on-chain analytic firm TheDataNerd made a post on X (Previously Twitter) that whale wallet address “0xBCFB” had purchased a significant 50,020 ETH worth $132 million from Kraken.

Source: X

This massive purchase occurred as ETH broke its two-day consolidation following the breakout of the $2,570 level.

However, some crypto whales look at the current price level as an opportunity and are heavily accumulating, while some others continue to dump their holding, believing the price will decline further in the coming days.

Key levels

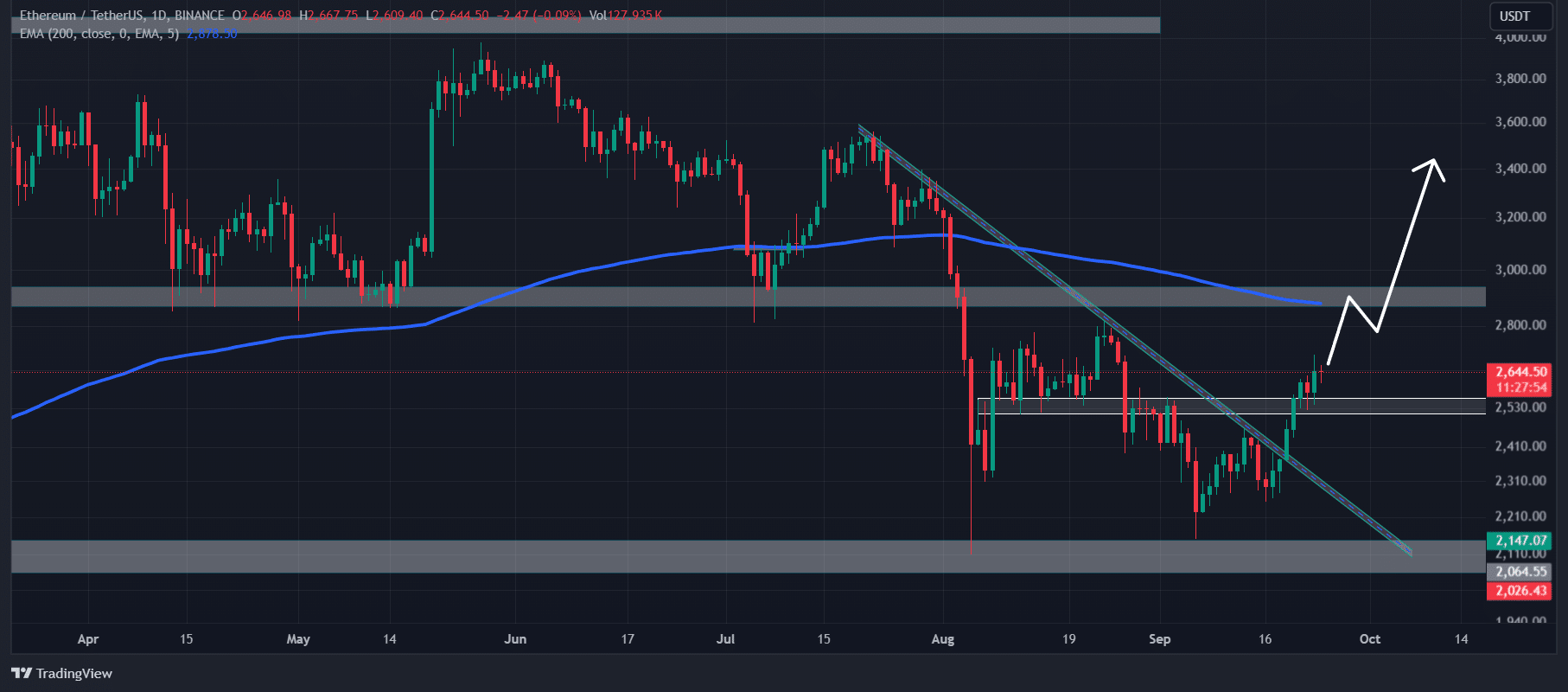

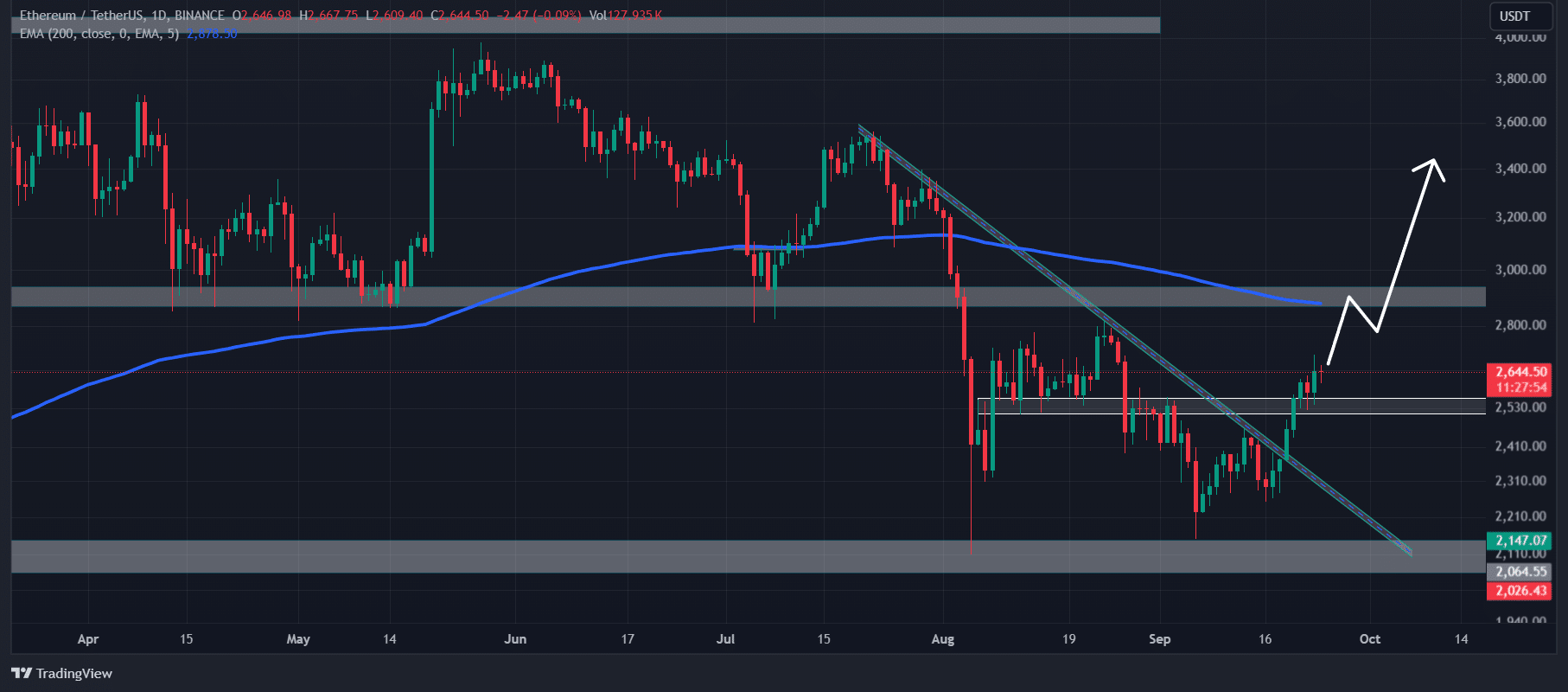

According to AMBCrypto’s technical analysis, ETH appears bullish despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

The 200 EMA is a technical indicator used to determine whether an asset is in an uptrend or downtrend.

Source: TradingView

The recent breakout of the crucial resistance level of $2,570 level and the small consolidation suggest a potential upside rally.

Based on the historical price momentum, if ETH maintains itself above the resistance level, there is a strong possibility it could rise to the $2,900 level, and even higher if the market sentiment remains favorable.

ETH’s bullish on-chain metrics

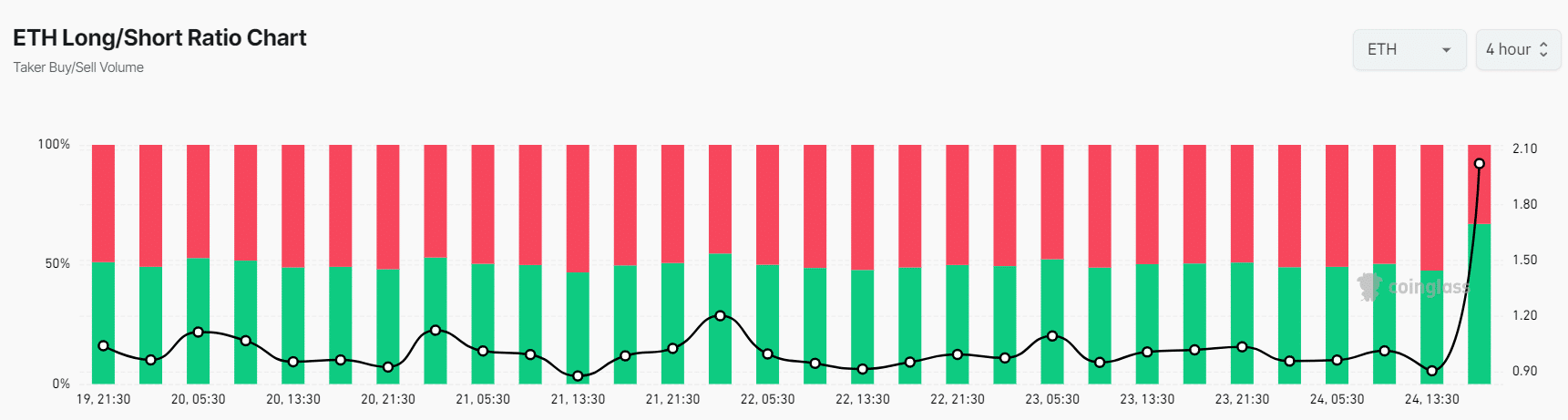

This positive outlook is further supported by on-chain metrics. Coinglass’s ETH Long/Short Ratio was 2.023 at press time, indicating extreme bullish market sentiment among traders.

Additionally, its Futures Open Interest increased by 3.2% in the last 24 hours.

Source: Coinglass

Traders and investors often use the combination of rising Futures Open Interest and a Long/Short Ratio above 1 when building long positions.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, 66.93% of top traders held long positions, while 33.07% hold short positions. This on-chain data suggests that bulls are currently dominating the asset.

At press time, ETH is trading near the $2,640 level, and has remained stable over the past 24 hours. During the same period, its trading volume dropped by 7%, indicating lower participation from traders.

- Ether could rise to the $2,900 level if it maintains itself above the $2,570 level.

- ETH’s Long/Short Ratio currently stands at 2.023, indicating extremely bullish market sentiment among traders.

Ethereum [ETH], the world’s second-biggest cryptocurrency by market cap, is on the radar of whales, who are on a buying spree likely due to its bullish on-chain metrics.

Ethereum whale on a buying spree

On the 24th of September, on-chain analytic firm TheDataNerd made a post on X (Previously Twitter) that whale wallet address “0xBCFB” had purchased a significant 50,020 ETH worth $132 million from Kraken.

Source: X

This massive purchase occurred as ETH broke its two-day consolidation following the breakout of the $2,570 level.

However, some crypto whales look at the current price level as an opportunity and are heavily accumulating, while some others continue to dump their holding, believing the price will decline further in the coming days.

Key levels

According to AMBCrypto’s technical analysis, ETH appears bullish despite trading below the 200 Exponential Moving Average (EMA) on a daily time frame.

The 200 EMA is a technical indicator used to determine whether an asset is in an uptrend or downtrend.

Source: TradingView

The recent breakout of the crucial resistance level of $2,570 level and the small consolidation suggest a potential upside rally.

Based on the historical price momentum, if ETH maintains itself above the resistance level, there is a strong possibility it could rise to the $2,900 level, and even higher if the market sentiment remains favorable.

ETH’s bullish on-chain metrics

This positive outlook is further supported by on-chain metrics. Coinglass’s ETH Long/Short Ratio was 2.023 at press time, indicating extreme bullish market sentiment among traders.

Additionally, its Futures Open Interest increased by 3.2% in the last 24 hours.

Source: Coinglass

Traders and investors often use the combination of rising Futures Open Interest and a Long/Short Ratio above 1 when building long positions.

Read Ethereum’s [ETH] Price Prediction 2024–2025

At press time, 66.93% of top traders held long positions, while 33.07% hold short positions. This on-chain data suggests that bulls are currently dominating the asset.

At press time, ETH is trading near the $2,640 level, and has remained stable over the past 24 hours. During the same period, its trading volume dropped by 7%, indicating lower participation from traders.

cost of cheap clomid without insurance buy generic clomiphene pill clomid generic cost can you get cheap clomiphene without insurance can i buy clomid no prescription cost cheap clomiphene without insurance where to get generic clomiphene pill

Thanks towards putting this up. It’s okay done.

More posts like this would force the blogosphere more useful.

azithromycin 500mg without prescription – tinidazole 300mg drug buy flagyl pill

order semaglutide 14 mg – buy cyproheptadine pills for sale where to buy cyproheptadine without a prescription

order motilium 10mg generic – purchase domperidone pills purchase flexeril online cheap

oral augmentin 375mg – https://atbioinfo.com/ buy generic ampicillin

nexium 40mg pill – nexium to us brand nexium 20mg

warfarin 2mg us – coumamide order hyzaar sale

order mobic 7.5mg sale – https://moboxsin.com/ mobic where to buy

buy prednisone 5mg generic – https://apreplson.com/ prednisone 40mg drug

buy ed pills cheap – https://fastedtotake.com/ where to buy otc ed pills

amoxil sale – https://combamoxi.com/ buy amoxicillin pill

fluconazole brand – https://gpdifluca.com/# buy diflucan online

order lexapro 10mg for sale – https://escitapro.com/# lexapro without prescription

cenforce brand – https://cenforcers.com/# cenforce 100mg over the counter

cialis available in walgreens over counter?? – ciltad gn what is tadalafil made from

compounded tadalafil troche life span – what doe cialis look like canada pharmacy cialis

order zantac – https://aranitidine.com/ zantac without prescription

cheap viagra 50mg – strongvpls viagra 50 off coupon

I couldn’t weather commenting. Well written! online

Thanks towards putting this up. It’s okay done. https://ursxdol.com/propecia-tablets-online/

This is a keynote which is in to my verve… Myriad thanks! Faithfully where can I upon the acquaintance details due to the fact that questions? https://prohnrg.com/

Greetings! Extremely useful advice within this article! It’s the crumb changes which wish espy the largest changes. Thanks a quantity quest of sharing! https://aranitidine.com/fr/viagra-professional-100-mg/

Thanks for sharing. It’s first quality. https://ondactone.com/spironolactone/