- Ethereum sees a 20% price increase driven by whale accumulation and exchange outflows.

- Whale activity suggests growing bullish sentiment and reduced supply on exchanges.

Ethereum [ETH] has surged by 20% over the past week, fueled by significant outflows from exchanges and rising whale accumulation, reflecting growing confidence in the asset.

Despite the bullish momentum, recent minor corrections have put ETH at a critical juncture, testing key support and resistance levels. As the market waits for clarity, these levels will play a crucial role in determining the next direction for Ethereum’s price.

Ethereum exchange flows

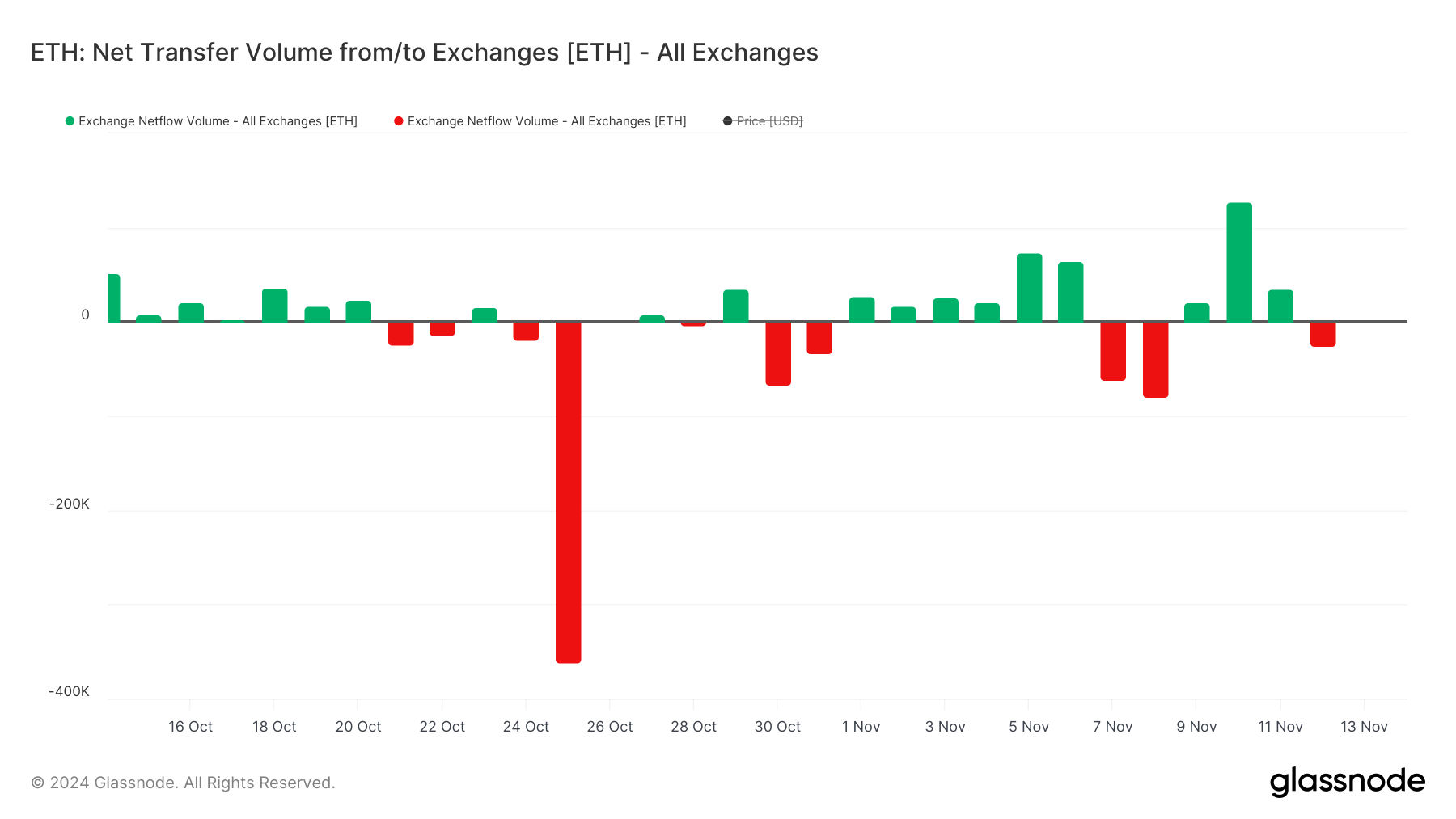

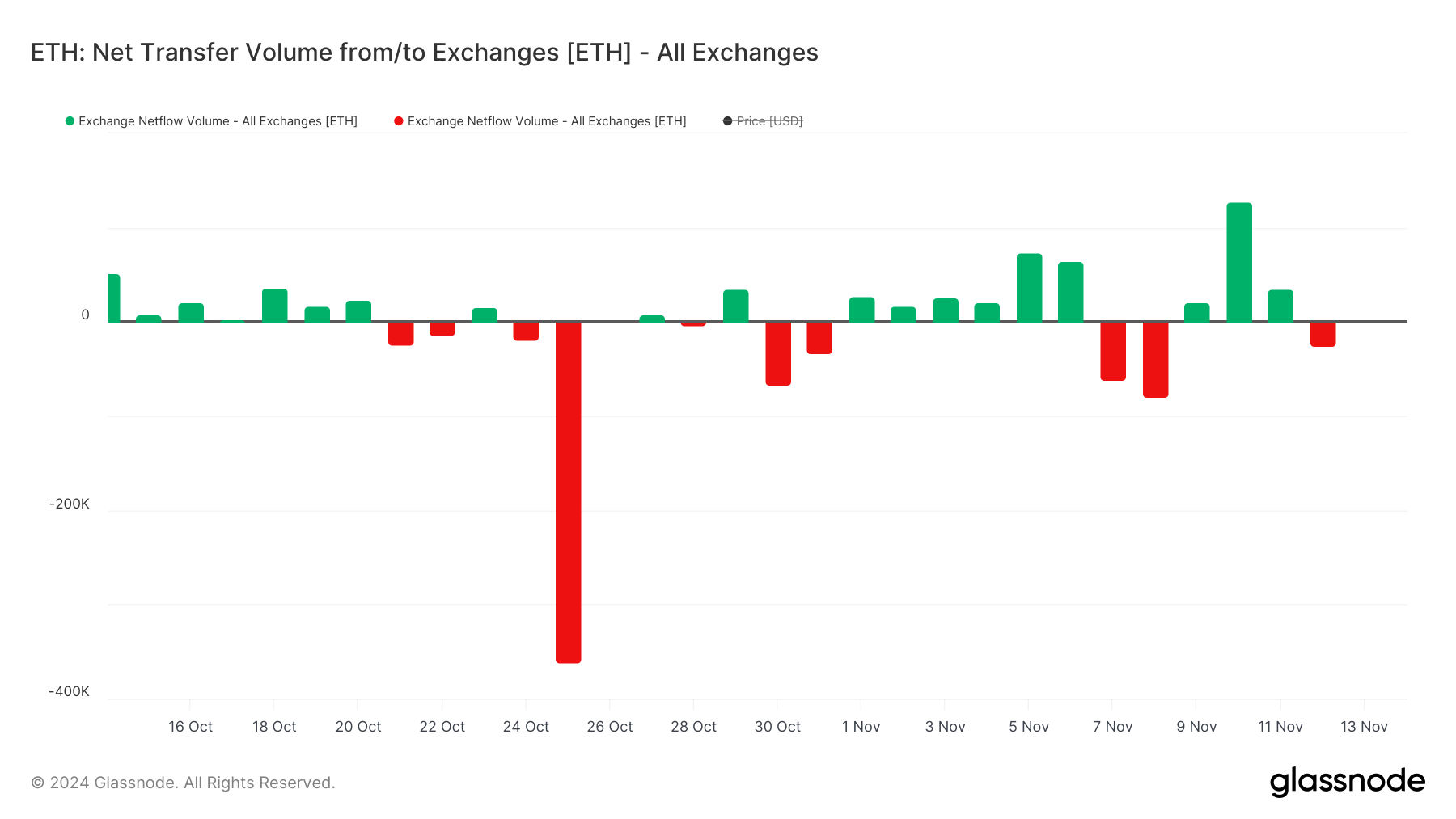

Ethereum saw significant outflows around 26th October, with large-scale withdrawals from exchanges signaling increased confidence among holders.

Source: Glassnode

These outflows have dominated the trend, especially over the past week, aligning with ETH’s price rally as whales accumulate and reduce supply on exchanges.

While minor inflows around the 7th and 10th of November suggest some profit-taking, the overall sentiment remains bullish. However, any sustained shift towards inflows could challenge ETH’s support levels, introducing potential volatility.

Whale activity driving ETH’s bullish momentum

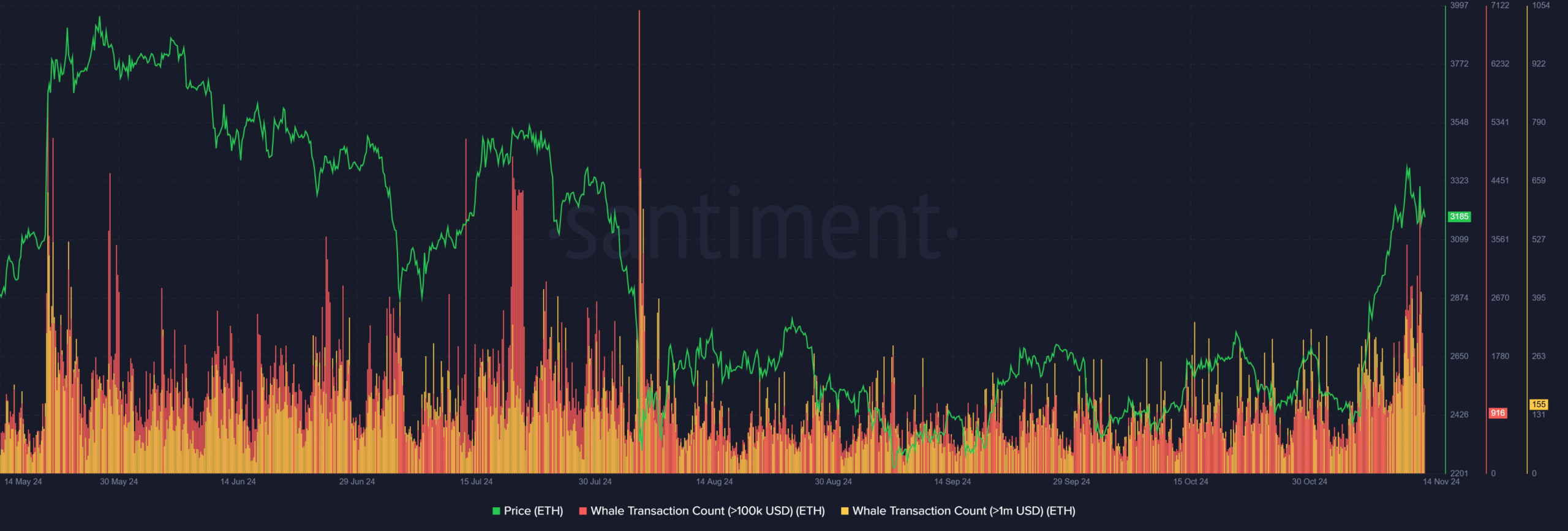

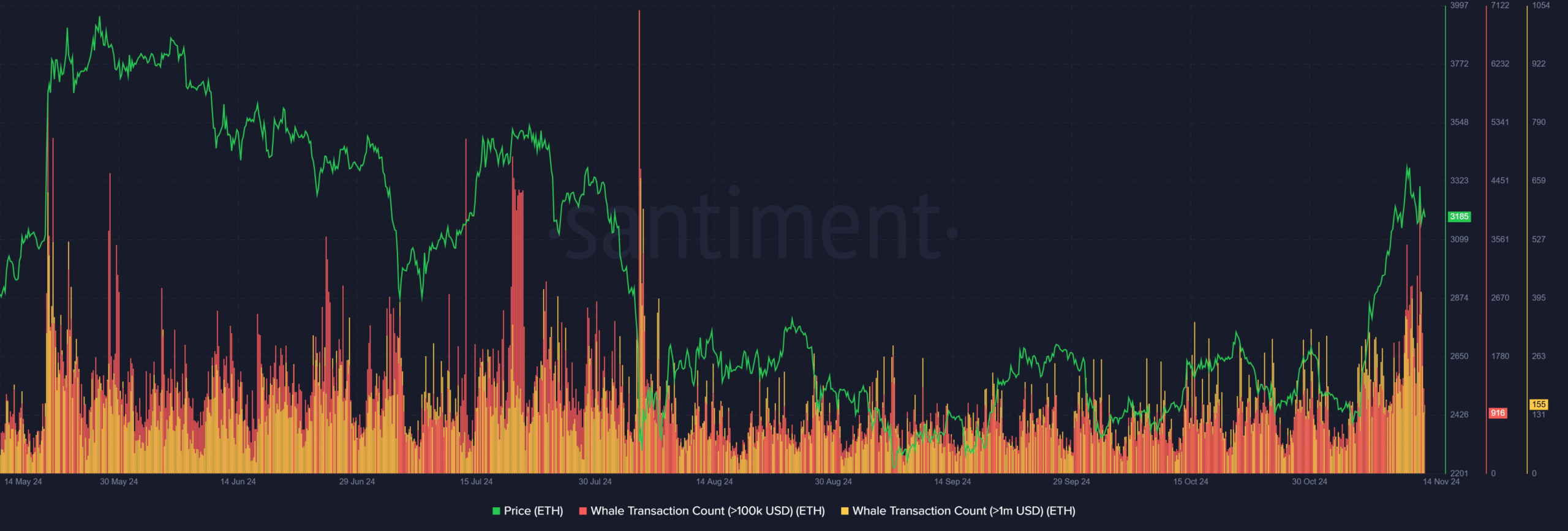

Whale transactions surged in late October and early November, correlating with ETH’s 20% price rally, suggesting that large holders have been pivotal in pushing prices higher.

Source: Santiment

Historically, spikes in whale activity often precede major price movements, reinforcing the idea that whales are both an indicator and a catalyst for ETH’s price action.

However, as ETH reaches critical resistance levels, whale transactions have tapered off, possibly signaling profit-taking or caution at elevated prices.

Continued whale engagement will be crucial in maintaining upward momentum. A sustained decline in whale activity could indicate a potential correction or increased volatility.

Ethereum’s path to an ATH

Source: Santiment

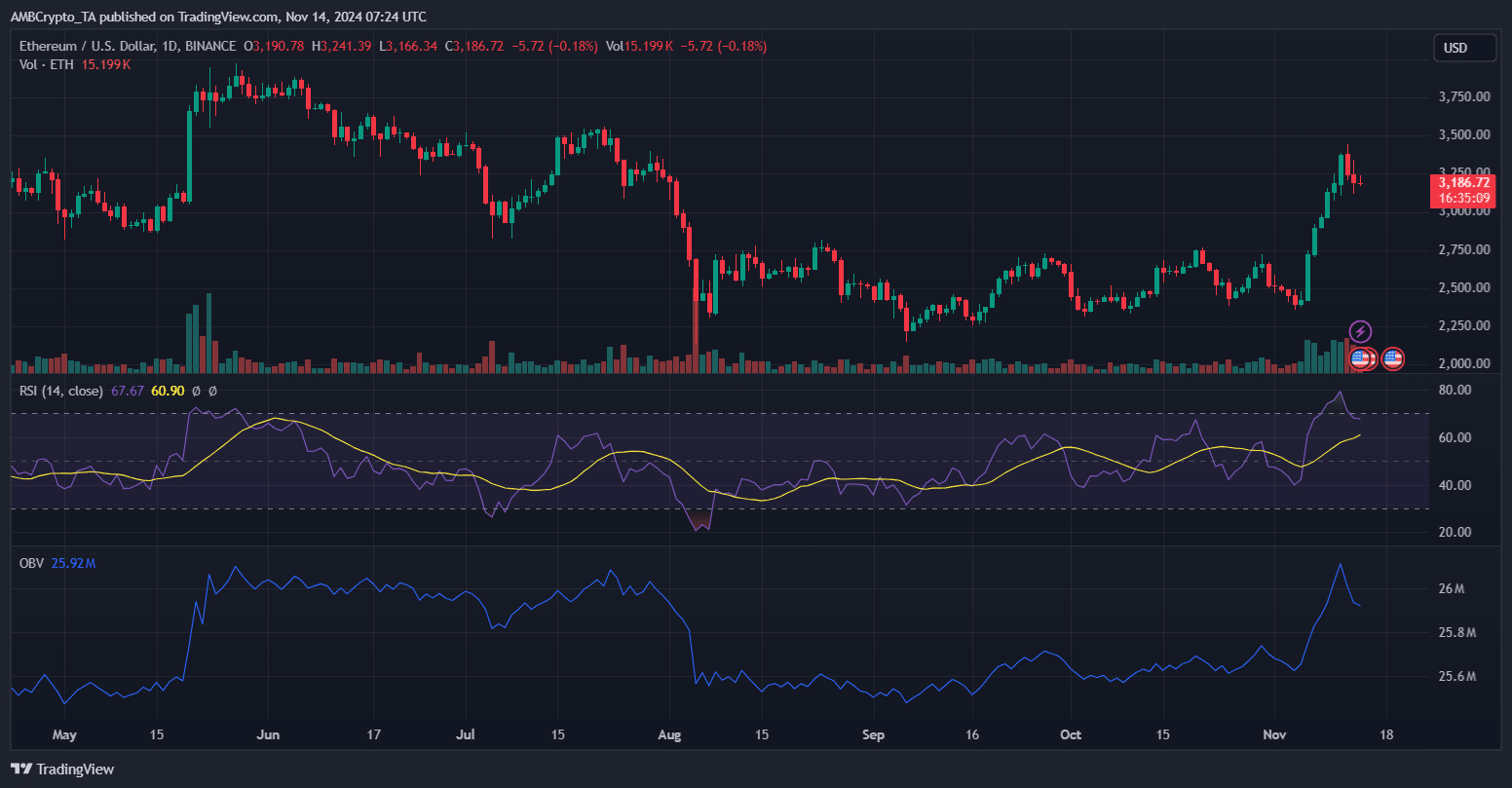

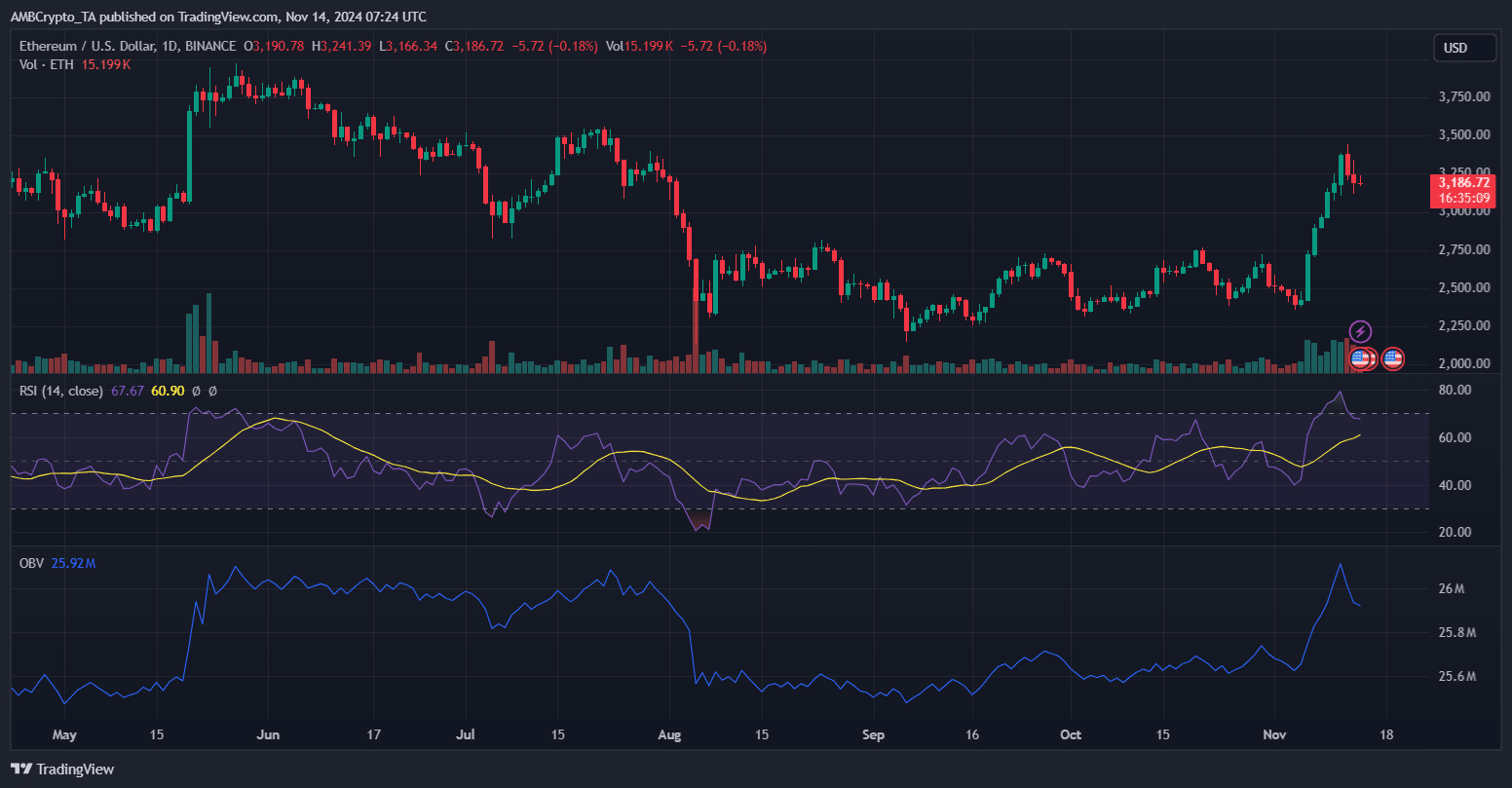

Ethereum’s recent rally and strong whale accumulation raise the possibility of revisiting or surpassing its ATH. The RSI at 67 signals bullish momentum without being overbought, suggesting room for further growth.

Meanwhile, the OBV shows strong buying pressure, indicating sustained demand.

Read Ethereum’s [ETH] Price Prediction 2024–2025

ETH remains above key EMA lines, with $3,500 as the immediate resistance level – breaking it could lead to a move toward $3,700, with $4,000 as the next target.

Minor corrections reflect profit-taking, but ETH’s resilience and whale activity suggest a potential push for a new ATH, provided support holds above $3,000.

- Ethereum sees a 20% price increase driven by whale accumulation and exchange outflows.

- Whale activity suggests growing bullish sentiment and reduced supply on exchanges.

Ethereum [ETH] has surged by 20% over the past week, fueled by significant outflows from exchanges and rising whale accumulation, reflecting growing confidence in the asset.

Despite the bullish momentum, recent minor corrections have put ETH at a critical juncture, testing key support and resistance levels. As the market waits for clarity, these levels will play a crucial role in determining the next direction for Ethereum’s price.

Ethereum exchange flows

Ethereum saw significant outflows around 26th October, with large-scale withdrawals from exchanges signaling increased confidence among holders.

Source: Glassnode

These outflows have dominated the trend, especially over the past week, aligning with ETH’s price rally as whales accumulate and reduce supply on exchanges.

While minor inflows around the 7th and 10th of November suggest some profit-taking, the overall sentiment remains bullish. However, any sustained shift towards inflows could challenge ETH’s support levels, introducing potential volatility.

Whale activity driving ETH’s bullish momentum

Whale transactions surged in late October and early November, correlating with ETH’s 20% price rally, suggesting that large holders have been pivotal in pushing prices higher.

Source: Santiment

Historically, spikes in whale activity often precede major price movements, reinforcing the idea that whales are both an indicator and a catalyst for ETH’s price action.

However, as ETH reaches critical resistance levels, whale transactions have tapered off, possibly signaling profit-taking or caution at elevated prices.

Continued whale engagement will be crucial in maintaining upward momentum. A sustained decline in whale activity could indicate a potential correction or increased volatility.

Ethereum’s path to an ATH

Source: Santiment

Ethereum’s recent rally and strong whale accumulation raise the possibility of revisiting or surpassing its ATH. The RSI at 67 signals bullish momentum without being overbought, suggesting room for further growth.

Meanwhile, the OBV shows strong buying pressure, indicating sustained demand.

Read Ethereum’s [ETH] Price Prediction 2024–2025

ETH remains above key EMA lines, with $3,500 as the immediate resistance level – breaking it could lead to a move toward $3,700, with $4,000 as the next target.

Minor corrections reflect profit-taking, but ETH’s resilience and whale activity suggest a potential push for a new ATH, provided support holds above $3,000.

where buy clomid no prescription good rx clomid cost of cheap clomid without insurance where to buy clomiphene no prescription order clomid without rx buying cheap clomiphene without dr prescription clomiphene chart

This website positively has all of the information and facts I needed to this subject and didn’t identify who to ask.

More delight pieces like this would urge the web better.

order azithromycin 250mg generic – order tindamax 500mg without prescription purchase flagyl sale

brand semaglutide 14 mg – how to buy rybelsus cyproheptadine 4mg canada

buy motilium 10mg for sale – purchase cyclobenzaprine generic order cyclobenzaprine online

order inderal without prescription – order plavix 75mg for sale methotrexate 2.5mg ca

order amoxil online – cost ipratropium 100mcg order combivent 100mcg generic

buy zithromax generic – buy nebivolol 20mg online cheap bystolic 20mg without prescription

augmentin cheap – atbioinfo ampicillin antibiotic online

order generic nexium – https://anexamate.com/ nexium 20mg cost

buy coumadin cheap – anticoagulant purchase cozaar generic

buy mobic generic – relieve pain mobic generic

prednisone 40mg usa – https://apreplson.com/ cheap deltasone

purchase amoxil – combamoxi.com cost amoxil

purchase fluconazole online – https://gpdifluca.com/# order diflucan

cenforce pills – fast cenforce rs buy cenforce 50mg for sale

cialis instructions – https://ciltadgn.com/# tadalafil liquid fda approval date

ranitidine 150mg drug – https://aranitidine.com/ where can i buy ranitidine

cialis stopped working – https://strongtadafl.com/ canadian no prescription pharmacy cialis Este enlace se abrirГЎ en una ventana nueva

real viagra for sale – https://strongvpls.com/ buy herbal viagra online

Proof blog you possess here.. It’s hard to espy strong worth writing like yours these days. I honestly recognize individuals like you! Withstand mindfulness!! https://gnolvade.com/

I’ll certainly bring back to skim more. zithromax 250mg tablet

Thanks on putting this up. It’s evidently done. https://ursxdol.com/ventolin-albuterol/

I couldn’t hold back commenting. Well written! https://prohnrg.com/

I couldn’t hold back commenting. Warmly written! on this site

I’ll certainly return to review more. https://ondactone.com/spironolactone/

This is the make of enter I recoup helpful.

https://proisotrepl.com/product/propranolol/

More posts like this would force the blogosphere more useful. http://seafishzone.com/home.php?mod=space&uid=2293996

forxiga generic – https://janozin.com/ forxiga 10mg us

xenical sale – cost xenical buy xenical generic