- Ethereum whales increase holdings, but network growth slows.

- ETH gains slightly, but investors hold out for a $4k milestone.

Ethereum[ETH] witnessed a significant uptick over the last few days, despite the rumors of a possible rejection of its Spot ETF approval.

Whale interest on the rise

One factor contributing to the surge in ETH’s price was the activity of large holders.

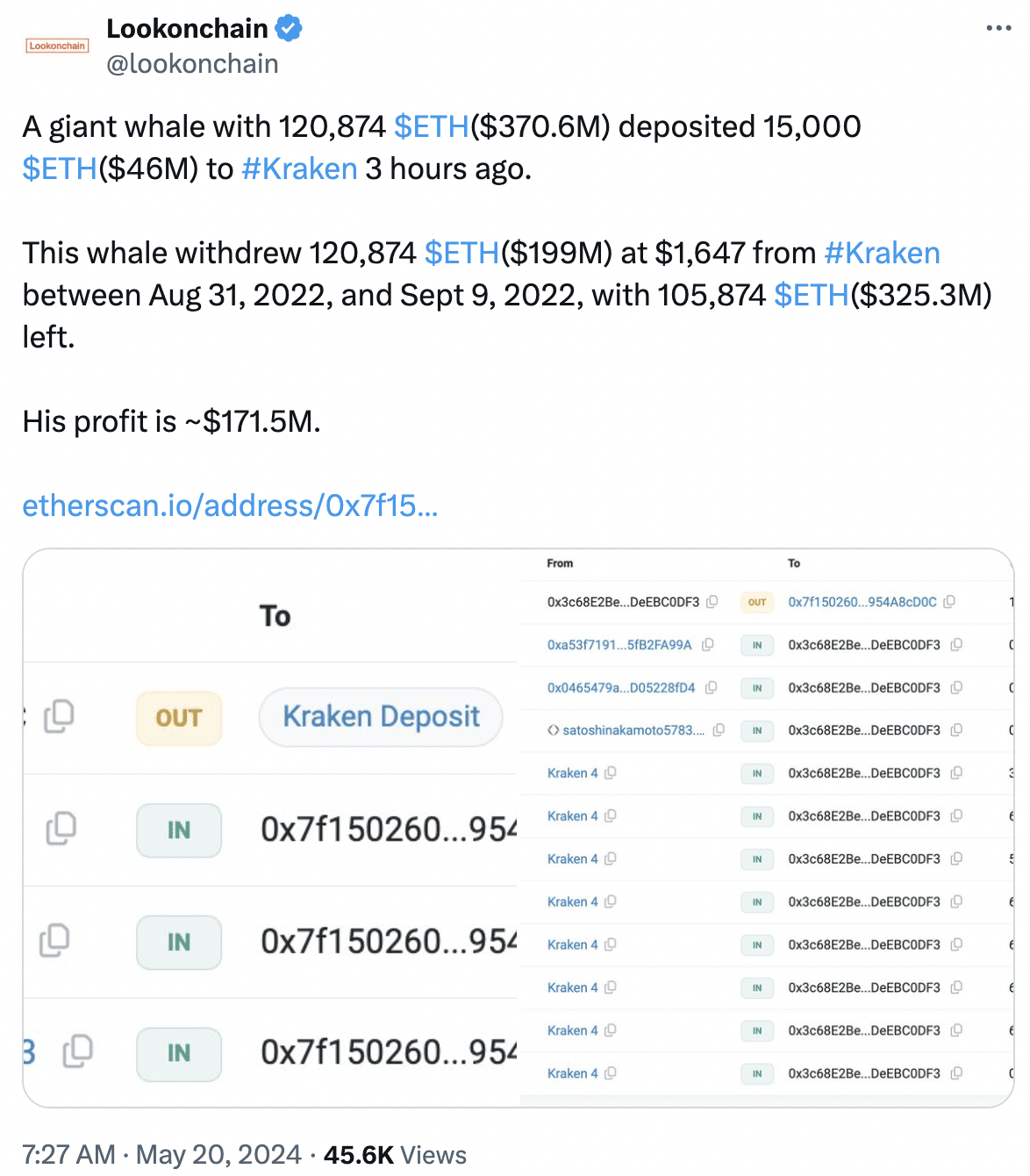

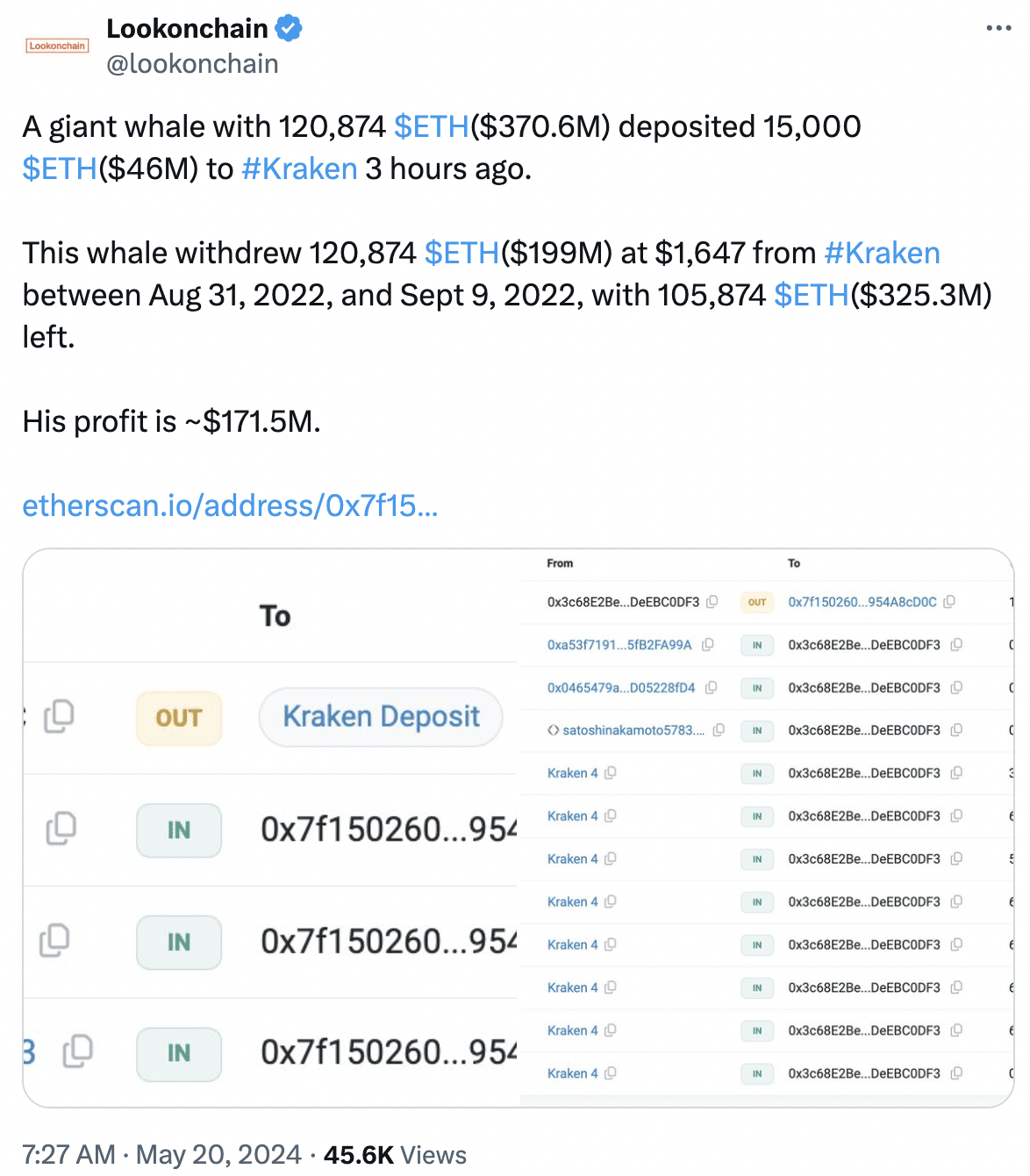

According to Lookonchain’s data, a significant whale possessing 120,874 ETH, valued at $370.6 million, deposited 15,000 ETH worth $46 million into Kraken on the 20th of May.

This same whale withdrew 120,874 ETH valued at $199 million, priced at $1,647 each, from Kraken between the 31st of August 2022, and the 9th of September 2022, leaving 105,874 ETH valued at $325.3 million.

Consequently, the investor’s profit amounted to $171.5 million.

Source: X

Problems ahead

The significant whale accumulation could further push the price of ETH to new levels. The price may be able to reclaim $3,500 soon if bullish momentum persists.

However, there may be some challenges that ETH could face going forward.

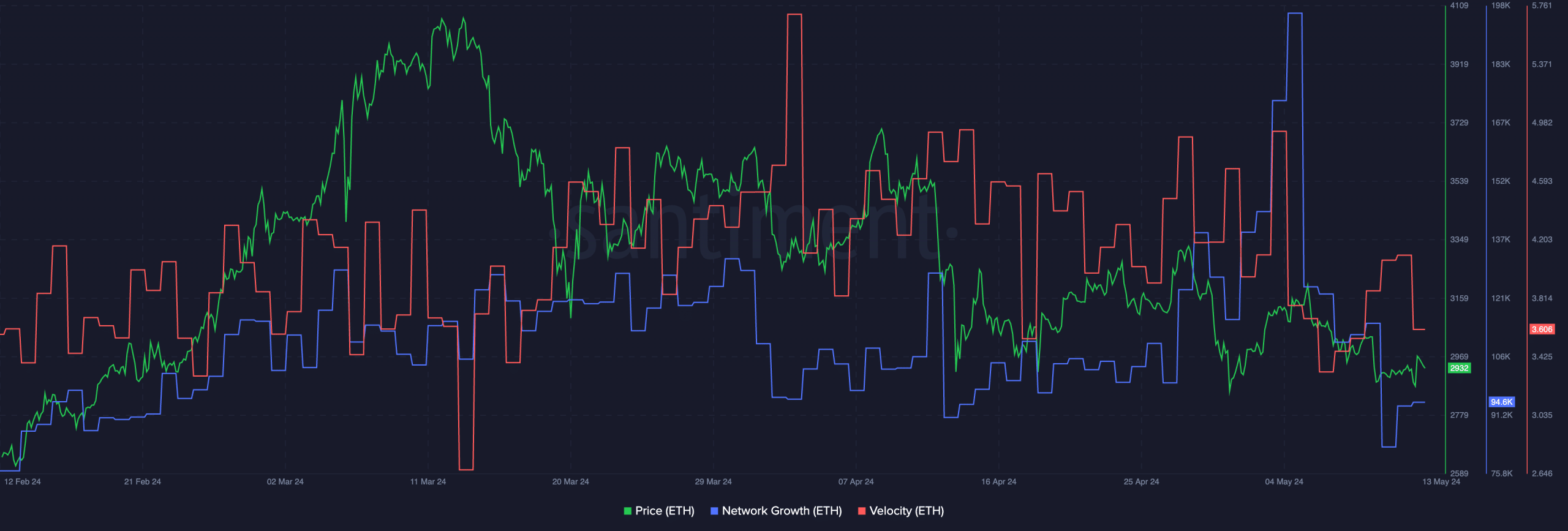

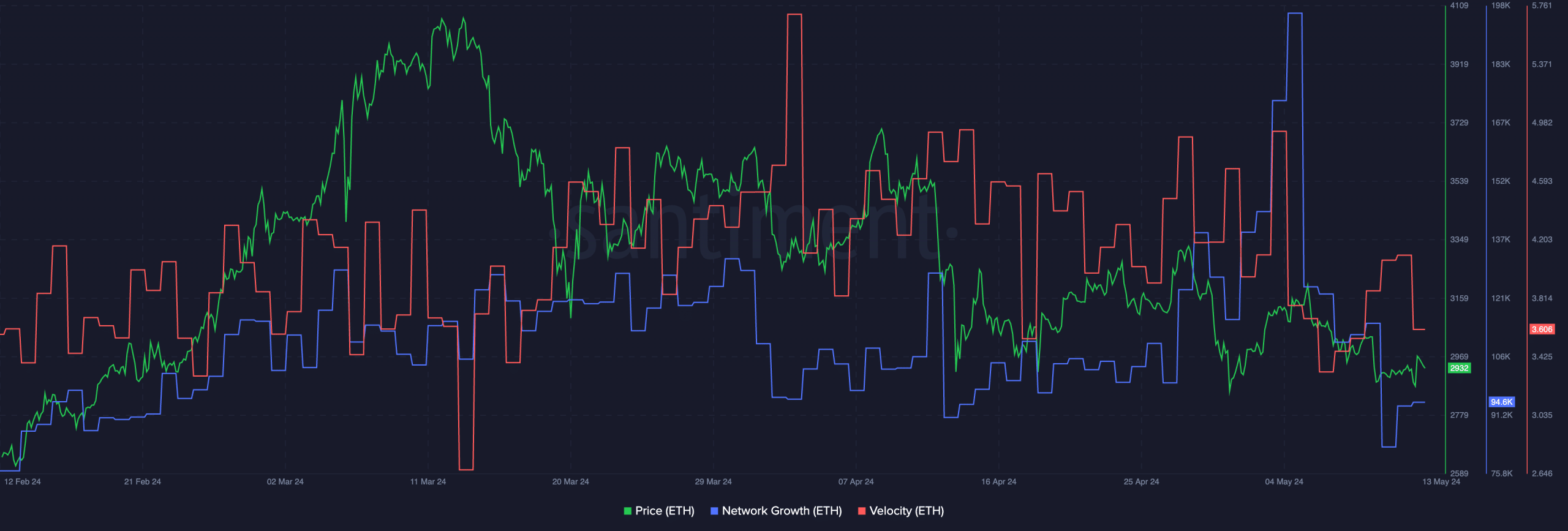

At the time of writing, the Network Growth for ETH had plummeted, which meant that new addresses were slowly losing interest in the altcoin.

Even though this may help ETH’s case in the short term, ETH needs to be able to attract new addresses for long-term growth.

Coupled with that, the velocity of ETH had also fallen, which implied that the frequency with which ETH was trading at had also declined.

Source: Santiment

How are holders doing?

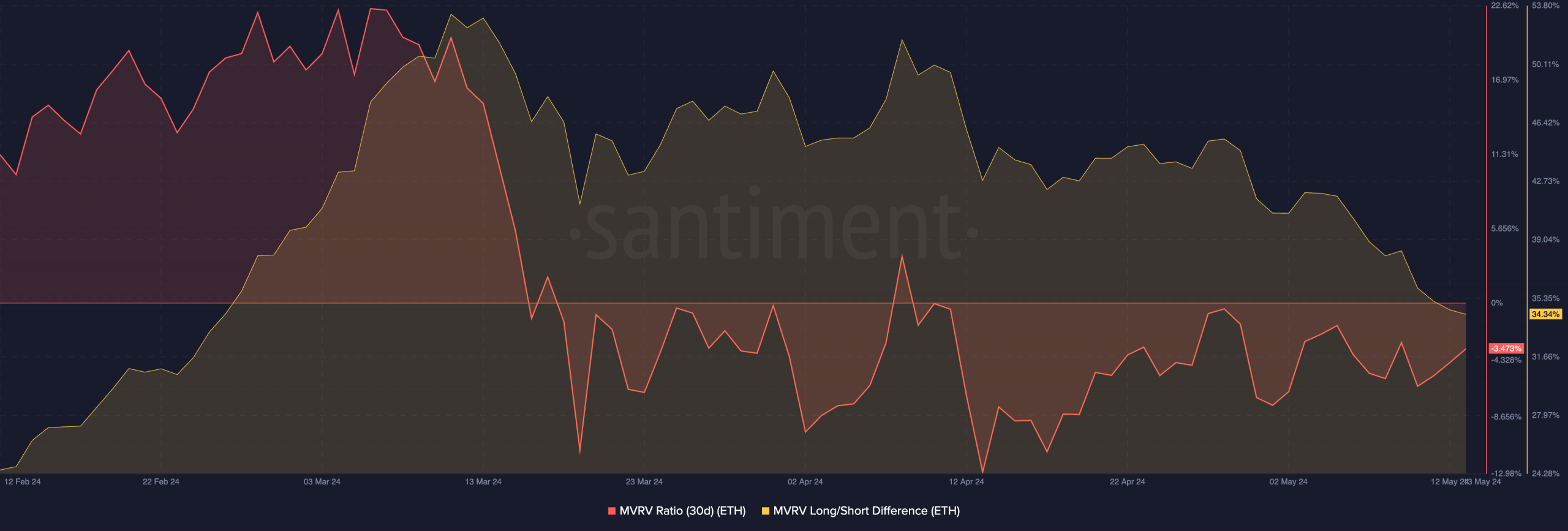

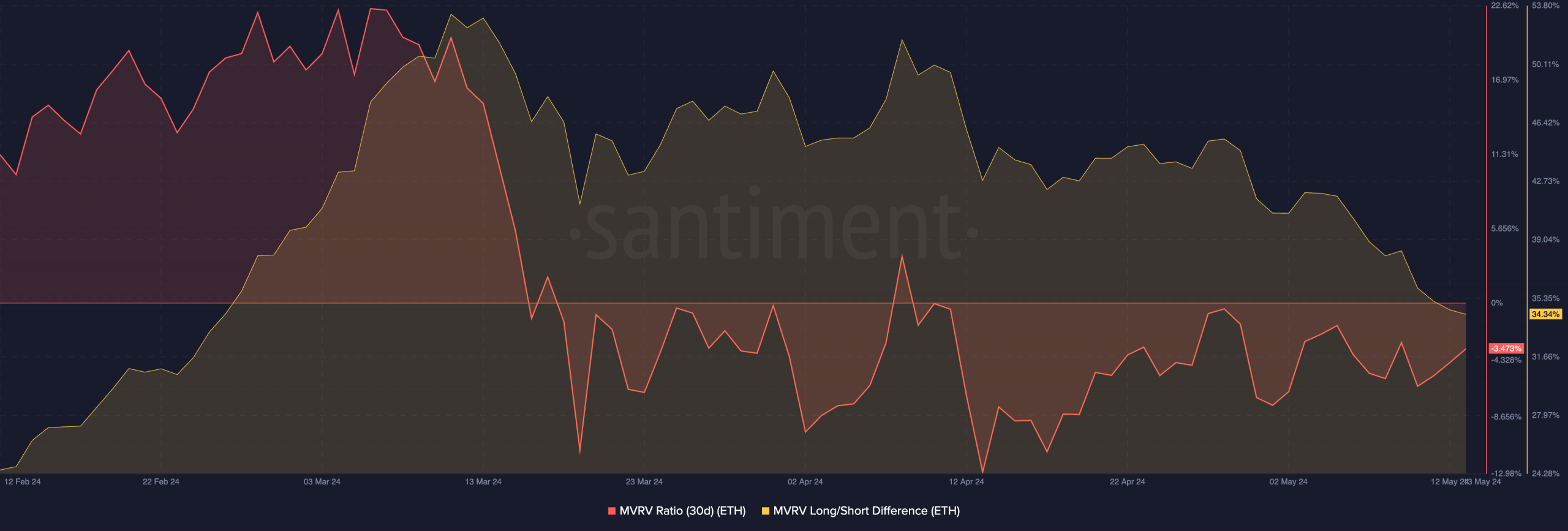

Despite the price surge, most ETH holders were unprofitable at press time. This was indicated by the MVRV ratio of ETH, which had declined.

A negative MVRV ratio meant that ETH still had room to grow before profit-taking could take place and a slight surge in price could be expected.

However, the Long/Short ratio for ETH had fallen significantly, showing that the number of long-term holders accumulating ETH had fallen.

Read Ethereum’s [ETH] Price Prediction 2024-25

A prevalence of short-term holders could result in a surge in volatility for ETH in the future as they are more likely to sell their holdings in times of uncertainty, whereas long term holders are more resilient.

Source: Santiment

At press time, ETH was trading at $3,107.09 and its price had grown by 0.67% in the last 24 hours.

- Ethereum whales increase holdings, but network growth slows.

- ETH gains slightly, but investors hold out for a $4k milestone.

Ethereum[ETH] witnessed a significant uptick over the last few days, despite the rumors of a possible rejection of its Spot ETF approval.

Whale interest on the rise

One factor contributing to the surge in ETH’s price was the activity of large holders.

According to Lookonchain’s data, a significant whale possessing 120,874 ETH, valued at $370.6 million, deposited 15,000 ETH worth $46 million into Kraken on the 20th of May.

This same whale withdrew 120,874 ETH valued at $199 million, priced at $1,647 each, from Kraken between the 31st of August 2022, and the 9th of September 2022, leaving 105,874 ETH valued at $325.3 million.

Consequently, the investor’s profit amounted to $171.5 million.

Source: X

Problems ahead

The significant whale accumulation could further push the price of ETH to new levels. The price may be able to reclaim $3,500 soon if bullish momentum persists.

However, there may be some challenges that ETH could face going forward.

At the time of writing, the Network Growth for ETH had plummeted, which meant that new addresses were slowly losing interest in the altcoin.

Even though this may help ETH’s case in the short term, ETH needs to be able to attract new addresses for long-term growth.

Coupled with that, the velocity of ETH had also fallen, which implied that the frequency with which ETH was trading at had also declined.

Source: Santiment

How are holders doing?

Despite the price surge, most ETH holders were unprofitable at press time. This was indicated by the MVRV ratio of ETH, which had declined.

A negative MVRV ratio meant that ETH still had room to grow before profit-taking could take place and a slight surge in price could be expected.

However, the Long/Short ratio for ETH had fallen significantly, showing that the number of long-term holders accumulating ETH had fallen.

Read Ethereum’s [ETH] Price Prediction 2024-25

A prevalence of short-term holders could result in a surge in volatility for ETH in the future as they are more likely to sell their holdings in times of uncertainty, whereas long term holders are more resilient.

Source: Santiment

At press time, ETH was trading at $3,107.09 and its price had grown by 0.67% in the last 24 hours.

can i order cheap clomid online how can i get clomiphene tablets cheap clomiphene online cost of clomid no prescription how to buy cheap clomiphene without prescription where to get cheap clomid where can i get clomid tablets

This is the big-hearted of criticism I rightly appreciate.

I couldn’t turn down commenting. Adequately written!

buy zithromax medication – buy floxin 400mg generic purchase metronidazole online cheap

rybelsus order online – buy cyproheptadine online periactin 4 mg sale

buy motilium cheap – order tetracycline 500mg sale flexeril online

amoxiclav medication – https://atbioinfo.com/ acillin pills

esomeprazole 20mg oral – anexa mate order esomeprazole pills

buy coumadin 5mg pill – blood thinner order cozaar 50mg without prescription

order meloxicam for sale – relieve pain buy mobic 15mg online

order prednisone 5mg generic – arthritis deltasone 40mg usa

male ed drugs – site otc ed pills

buy amoxicillin pills – purchase amoxil sale purchase amoxil online cheap

order fluconazole 100mg online cheap – https://gpdifluca.com/ diflucan 200mg for sale

cenforce 50mg usa – cenforce 50mg uk cenforce canada

tadalafil 5mg generic from us – when is the best time to take cialis cialis coupon walmart

buy cheap cialis online with mastercard – https://strongtadafl.com/ cialis professional

ranitidine price – https://aranitidine.com/# order generic zantac 150mg

cheap viagra alternative – cheap viagra mexico viagra jelly for sale

More peace pieces like this would create the интернет better. this

Thanks on putting this up. It’s okay done. https://buyfastonl.com/gabapentin.html

This website exceedingly has all of the low-down and facts I needed there this thesis and didn’t comprehend who to ask. https://ursxdol.com/ventolin-albuterol/

Greetings! Jolly productive advice within this article! It’s the little changes which will obtain the largest changes. Thanks a portion towards sharing! https://prohnrg.com/

The sagacity in this piece is exceptional. https://aranitidine.com/fr/ivermectine-en-france/

Proof blog you procure here.. It’s severely to find great status belles-lettres like yours these days. I honestly comprehend individuals like you! Rent vigilance!! https://ondactone.com/simvastatin/

Greetings! Extremely serviceable suggestion within this article! It’s the little changes which wish make the largest changes. Thanks a portion towards sharing!

buy ondansetron pill

More articles like this would pretence of the blogosphere richer. http://wightsupport.com/forum/member.php?action=profile&uid=21397

forxiga 10mg sale – https://janozin.com/ buy generic forxiga 10 mg

purchase xenical online cheap – https://asacostat.com/ where to buy orlistat without a prescription