- Novice crypto traders are overwhelmed by fear, but seasoned market analysts advise otherwise.

- A combination of different ETH metrics indicate strong bullish sentiment due to increased wallet activities.

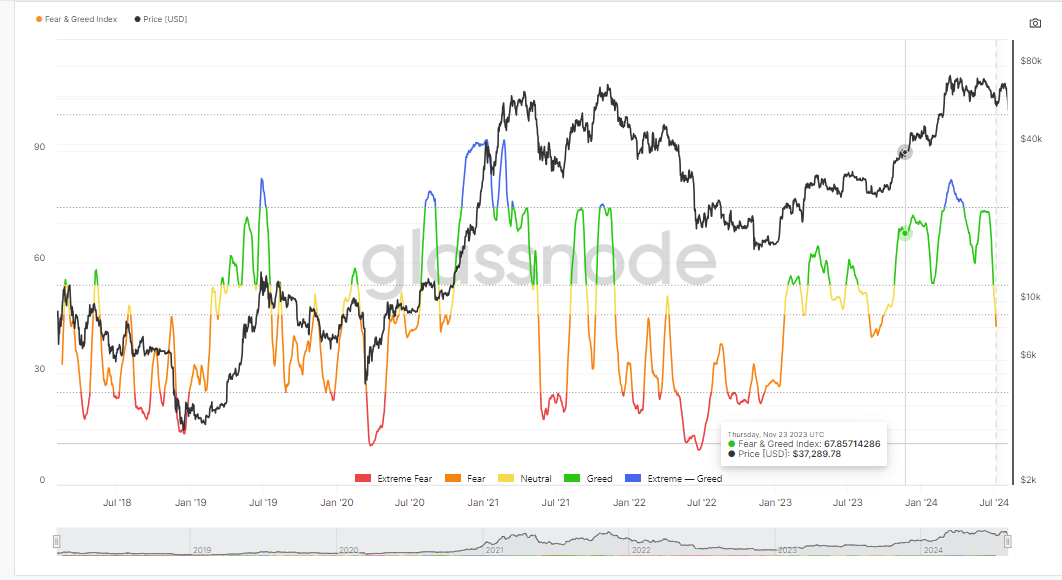

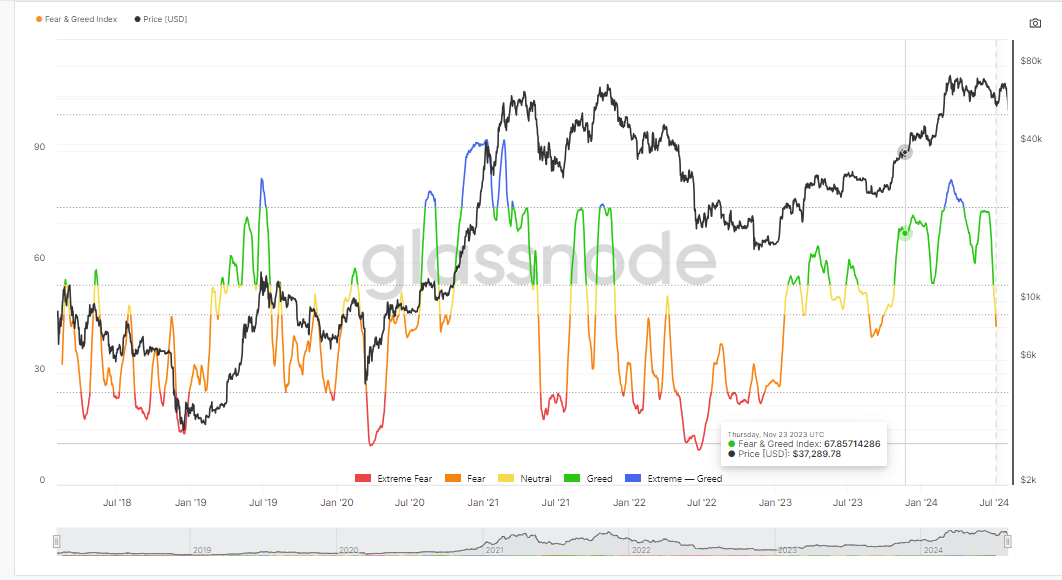

Fear is dominating the crypto markets right now, and seasoned analysts often advise to “be greedy when others are fearful.”

This strategy has proven effective over time, as it taps into emotional intelligence to navigate market cycles.

Market analyst Quinten cited on X (formerly Twitter) that the current fear in the market is a signal to buy more crypto.

Historical patterns show that such fear often precedes major price rallies, as seen when most cryptos previously surged to new ATHs, according to Glassnode data.

Source: Glassnode

What is Ethereum up to?

Despite concerns about a global recession and potential world conflicts, Ethereum [ETH] showed promising signs of growth, as wallet activity on the Ethereum blockchain has surged recently.

Combined key metrics including active wallet addresses in the last 30 days, circulation, network growth, and transaction volume, are all on the rise as the graph from Santiment indicates.

This upward trend suggests that now is not the time to panic, but rather an opportunity to invest in ETH assets.

Source: Santiment

ETH: Covid crash vs. now

During the Covid-19 crash, Ethereum hit a low that scared many new investors, causing them to sell during the market’s drop.

However, shortly after, Ethereum’s price surged as the market recovered. The recent crash in the past 24 hours resembles the Covid-19 downturn, suggesting that we might see a similar rally soon.

The current market fear could signal an upcoming upward trend for Ethereum, mirroring the recovery pattern seen previously.

Source: ETH/USD index on TradingView

Ascending triangle retested

The recent market sell-off is viewed as a significant test of Ethereum’s previous price patterns.

Is your portfolio green? Check out the ETH Profit Calculator

Technically, Ethereum’s price action is revisiting the old breakout level and could potentially rise to a new all-time high by the third quarter of 2024.

The strategy is to buy Ethereum aggressively whenever the price falls below $2300 and hold, anticipating future gains as the market recovers.

Source: TradingView

- Novice crypto traders are overwhelmed by fear, but seasoned market analysts advise otherwise.

- A combination of different ETH metrics indicate strong bullish sentiment due to increased wallet activities.

Fear is dominating the crypto markets right now, and seasoned analysts often advise to “be greedy when others are fearful.”

This strategy has proven effective over time, as it taps into emotional intelligence to navigate market cycles.

Market analyst Quinten cited on X (formerly Twitter) that the current fear in the market is a signal to buy more crypto.

Historical patterns show that such fear often precedes major price rallies, as seen when most cryptos previously surged to new ATHs, according to Glassnode data.

Source: Glassnode

What is Ethereum up to?

Despite concerns about a global recession and potential world conflicts, Ethereum [ETH] showed promising signs of growth, as wallet activity on the Ethereum blockchain has surged recently.

Combined key metrics including active wallet addresses in the last 30 days, circulation, network growth, and transaction volume, are all on the rise as the graph from Santiment indicates.

This upward trend suggests that now is not the time to panic, but rather an opportunity to invest in ETH assets.

Source: Santiment

ETH: Covid crash vs. now

During the Covid-19 crash, Ethereum hit a low that scared many new investors, causing them to sell during the market’s drop.

However, shortly after, Ethereum’s price surged as the market recovered. The recent crash in the past 24 hours resembles the Covid-19 downturn, suggesting that we might see a similar rally soon.

The current market fear could signal an upcoming upward trend for Ethereum, mirroring the recovery pattern seen previously.

Source: ETH/USD index on TradingView

Ascending triangle retested

The recent market sell-off is viewed as a significant test of Ethereum’s previous price patterns.

Is your portfolio green? Check out the ETH Profit Calculator

Technically, Ethereum’s price action is revisiting the old breakout level and could potentially rise to a new all-time high by the third quarter of 2024.

The strategy is to buy Ethereum aggressively whenever the price falls below $2300 and hold, anticipating future gains as the market recovers.

Source: TradingView

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Uau, maravilhoso layout do blog Há quanto tempo você bloga para você fazer o blog parecer fácil A aparência geral do seu site é ótima, assim como o conteúdo

how to buy cheap clomid no prescription can you buy clomiphene pills clomiphene sleep apnea get generic clomiphene pills how to get generic clomid pill where can i get cheap clomiphene tablets how to get clomid without prescription

More peace pieces like this would make the интернет better.

This is the big-hearted of writing I rightly appreciate.

purchase azithromycin generic – buy cheap generic tetracycline order flagyl 200mg generic

purchase semaglutide pills – semaglutide online buy buy cyproheptadine 4 mg pill

cost motilium – motilium 10mg oral buy flexeril

oral propranolol – order inderal online how to get methotrexate without a prescription