- Evaluating Ethereum vs Solana to find out which one has a more competitive edge.

- The tokenomics may even out the score, leading to a surprising conclusion.

The Ethereum [ETH] versus Solana[SOL] showdown is here. Ethereum has been holding it down as the number 1 altcoin for quite a while.

However, Solana’s performance has been impressive over the last few months. But between the two networks, which one stands to deliver the most gains?

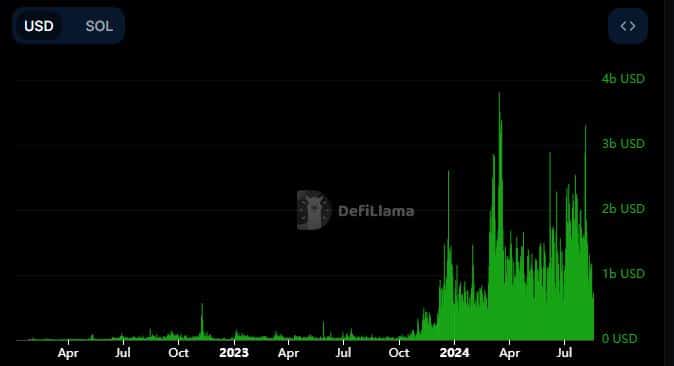

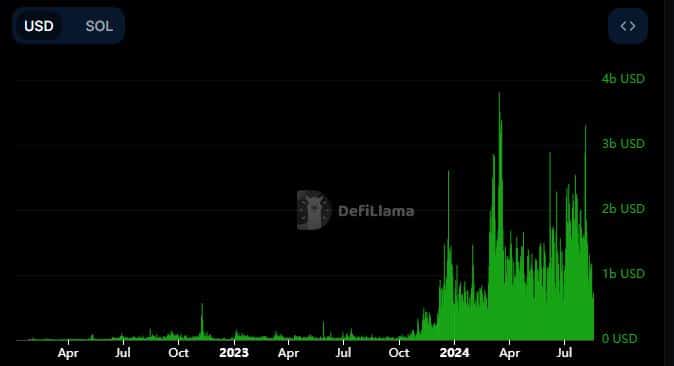

Solana demonstrated strong growth in the DeFi segment in the last 12 months, making the Ethereum vs Solana comparison more effective. This is because Ethereum previously dominated the DeFi segment.

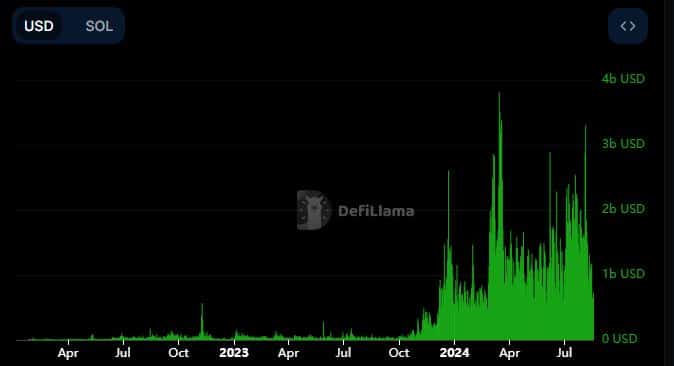

For starters, Solana’s on-chain volume saw explosive growth since October last year. The highest daily volume was recorded at around $3.4 billion.

Source: DeFiLlama

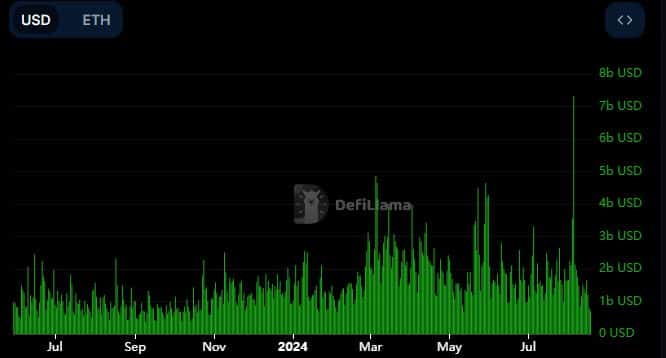

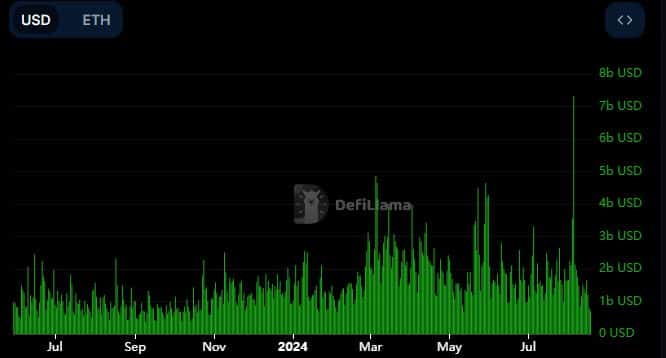

In comparison, Ethereum has also maintained significant daily volumes, mostly within the same range as Solana during the same period.

However, Ethereum was able to achieve over $7 billion in daily transactions on 5th August during the peak of the recent crash.

Source: DeFiLlama

While these charts may indicate a bit of a lead for Ethereum, they highlight how far Solana has come during the last few months. Especially in terms of sizing up the Ethereum network in terms of volume.

We decided to compare the two networks from a user growth or activity perspective. For example, Ethereum had a tad over 454,000 active users in the last 24 hours while Solana had 0ver 979,000 active addresses.

Solana was also ahead in terms of transactions. It achieved 33.08 million transactions in the last 24 hours while Ethereum’s daily transaction count in the same period was 1.03 million transactions.

Ethereum versus Solana tokenomics

Ethereum has been maintaining a lead over Solana in term of marketcap. For example, Ethereum had a $311.9 billion marketcap which was about 4.6 times higher than Solana’s $66.7 billion marketcap.

However, if we map the two together, we observed that Solana’s marketcap has also been growing at a faster pace compared to that of Ethereum.

Source: Coinmarketcap

Based on these findings, one would easily conclude that Solana has the most growth potential. But does this Translate to their native cryptocurrencies?

ETH’s marketcap is 4 times that of Solana but Solana has a lower price tag and a more active DeFi ecosystem. From a tokenomics perspective, ETH has a much lower supply at 120.28 million coins.

On the other hand, SOL has 466.2 million SOL coins in circulation. Roughly 3.8 times fewer than ETH.

Is there a clear winner?

Based on our assessment of Ethereum vs Solana, it is clear that Solana is putting up a good fight. Our analysis of the tokenomics did not offer much of a clear advantage since Solana has a higher circulating supply.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The short term outlook may favor SOL’s price action more than ETH based on network activity and growth.

The long-term outlook might favor Ethereum if it can sustain robust DeFi activity and demand for ETH. This is because Solana has a 30% inflation but Ethereum is deflationary.

- Evaluating Ethereum vs Solana to find out which one has a more competitive edge.

- The tokenomics may even out the score, leading to a surprising conclusion.

The Ethereum [ETH] versus Solana[SOL] showdown is here. Ethereum has been holding it down as the number 1 altcoin for quite a while.

However, Solana’s performance has been impressive over the last few months. But between the two networks, which one stands to deliver the most gains?

Solana demonstrated strong growth in the DeFi segment in the last 12 months, making the Ethereum vs Solana comparison more effective. This is because Ethereum previously dominated the DeFi segment.

For starters, Solana’s on-chain volume saw explosive growth since October last year. The highest daily volume was recorded at around $3.4 billion.

Source: DeFiLlama

In comparison, Ethereum has also maintained significant daily volumes, mostly within the same range as Solana during the same period.

However, Ethereum was able to achieve over $7 billion in daily transactions on 5th August during the peak of the recent crash.

Source: DeFiLlama

While these charts may indicate a bit of a lead for Ethereum, they highlight how far Solana has come during the last few months. Especially in terms of sizing up the Ethereum network in terms of volume.

We decided to compare the two networks from a user growth or activity perspective. For example, Ethereum had a tad over 454,000 active users in the last 24 hours while Solana had 0ver 979,000 active addresses.

Solana was also ahead in terms of transactions. It achieved 33.08 million transactions in the last 24 hours while Ethereum’s daily transaction count in the same period was 1.03 million transactions.

Ethereum versus Solana tokenomics

Ethereum has been maintaining a lead over Solana in term of marketcap. For example, Ethereum had a $311.9 billion marketcap which was about 4.6 times higher than Solana’s $66.7 billion marketcap.

However, if we map the two together, we observed that Solana’s marketcap has also been growing at a faster pace compared to that of Ethereum.

Source: Coinmarketcap

Based on these findings, one would easily conclude that Solana has the most growth potential. But does this Translate to their native cryptocurrencies?

ETH’s marketcap is 4 times that of Solana but Solana has a lower price tag and a more active DeFi ecosystem. From a tokenomics perspective, ETH has a much lower supply at 120.28 million coins.

On the other hand, SOL has 466.2 million SOL coins in circulation. Roughly 3.8 times fewer than ETH.

Is there a clear winner?

Based on our assessment of Ethereum vs Solana, it is clear that Solana is putting up a good fight. Our analysis of the tokenomics did not offer much of a clear advantage since Solana has a higher circulating supply.

Read Ethereum’s [ETH] Price Prediction 2024-2025

The short term outlook may favor SOL’s price action more than ETH based on network activity and growth.

The long-term outlook might favor Ethereum if it can sustain robust DeFi activity and demand for ETH. This is because Solana has a 30% inflation but Ethereum is deflationary.

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

Loving the information on this web site, you have done outstanding job on the blog posts.

Your place is valueble for me. Thanks!…

me encantei com este site. Pra saber mais detalhes acesse o site e descubra mais. Todas as informações contidas são conteúdos relevantes e diferentes. Tudo que você precisa saber está ta lá.

Oh my goodness! a tremendous article dude. Thank you Nevertheless I am experiencing subject with ur rss . Don’t know why Unable to subscribe to it. Is there anybody getting identical rss downside? Anyone who knows kindly respond. Thnkx

It is the best time to make a few plans for the longer term and it is time to be happy. I’ve read this put up and if I may just I wish to suggest you some interesting things or tips. Maybe you can write next articles relating to this article. I want to read even more things about it!

where to get cheap clomid price where can i buy generic clomid no prescription where to buy cheap clomid price can you buy clomiphene without insurance can you buy generic clomid without rx cost cheap clomiphene pills generic clomiphene without dr prescription

I am in point of fact enchant‚e ‘ to glitter at this blog posts which consists of tons of profitable facts, thanks object of providing such data.

More content pieces like this would make the web better.

buy cheap generic rybelsus – semaglutide 14 mg generic order cyproheptadine 4mg sale

purchase domperidone for sale – brand tetracycline 250mg cyclobenzaprine ca

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!