- Voluntary exit on Ethereum fell to a one-month low.

- Despite last week’s price rally, bearish sentiments remain significant in the ETH market.

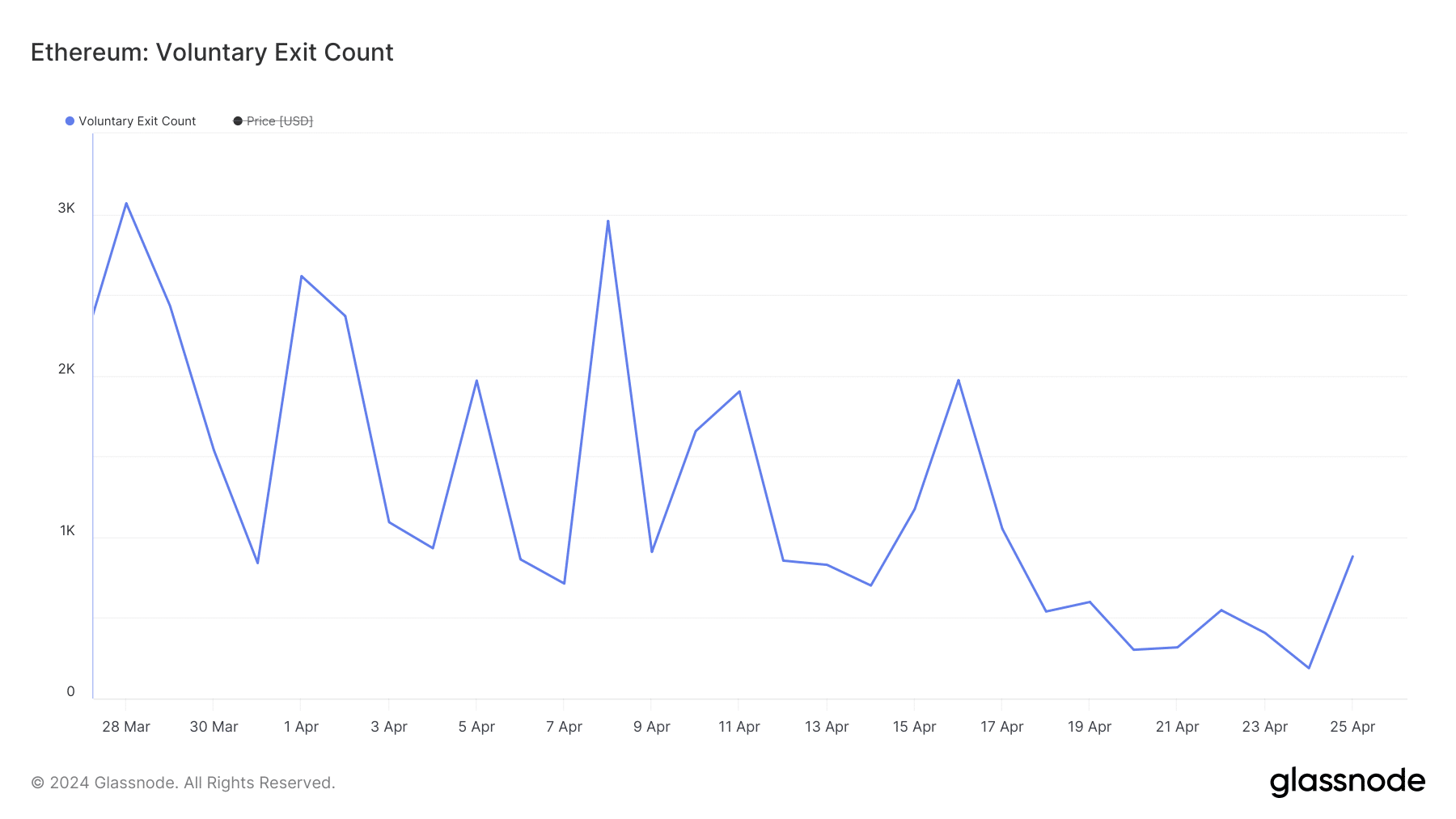

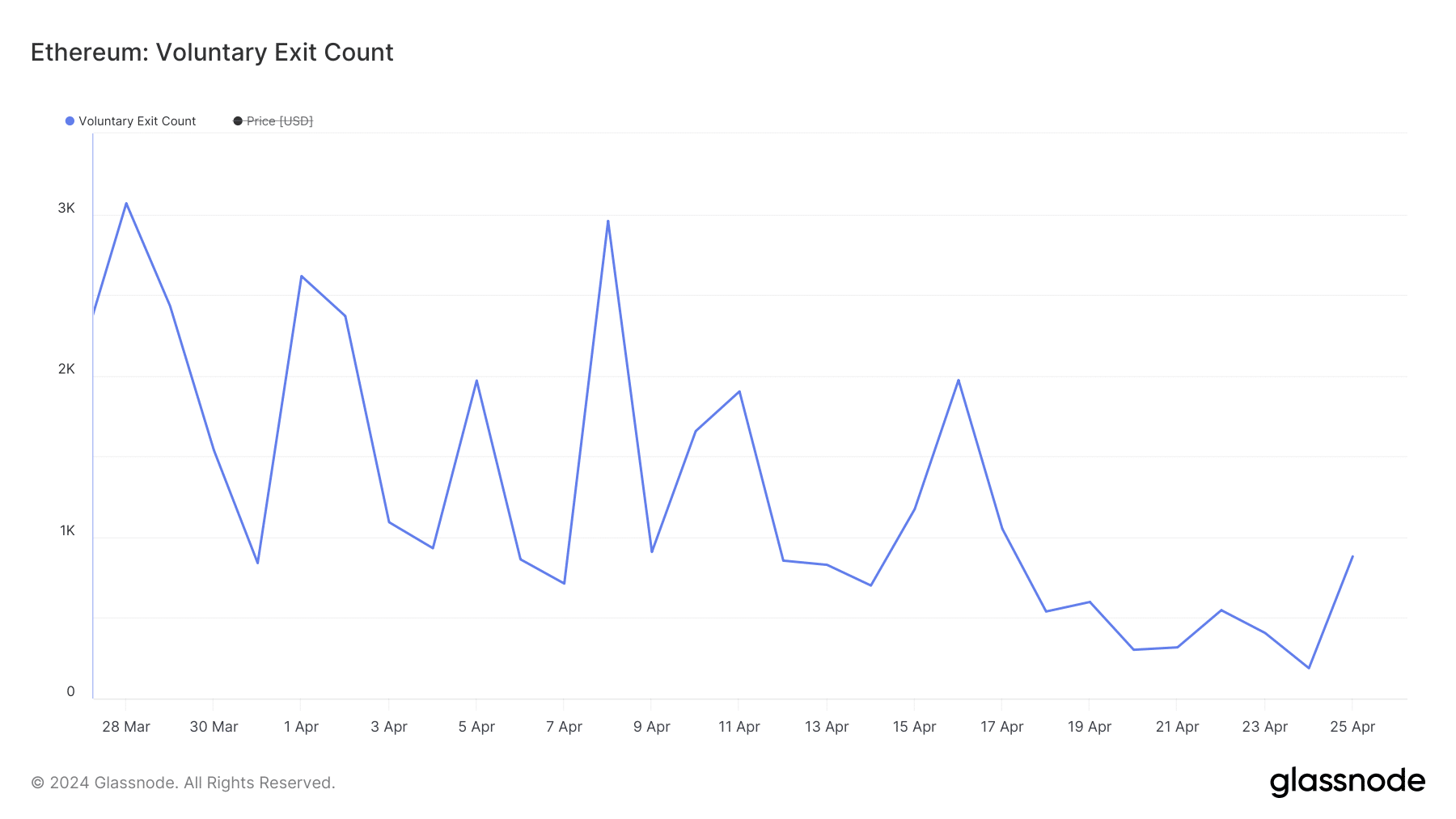

The daily count of validators exiting the Ethereum [ETH] network recently cratered to a 30-day low, data from Glassnode showed.

Source: Glassnode

This occurred due to the recent decline in demand for the proof-of-stake (PoS) network. AMBCrypto previously reported that user activity on Ethereum has declined over the last month.

This resulted in a low ETH burn rate, which has increased the coin’s supply and made it inflationary once again.

When ETH becomes inflationary, its price experiences significant downward pressure. According to CoinMarketCap’s data, the coin’s value has dropped by 13% in the last month.

Due to ETH’s low price action, validators on the Ethereum network have not been incentivized to unstake their coins for onward sales.

The network typically witnesses a surge in validator exit when ETH price climbs, causing validators to attempt to capture gains on their previously staked coins.

With fewer validators leaving the network, the participation rate among validators has also risen to its highest in the last month.

Validators must participate in the network to ensure that Ethereum runs optimally. A high participation rate indicates reliable validator node uptime, fewer missed blocks, and superior blockspace efficiency.

As of this writing, the validators’ participation rate on the network was 99.6%.

ETH gains, but at what cost?

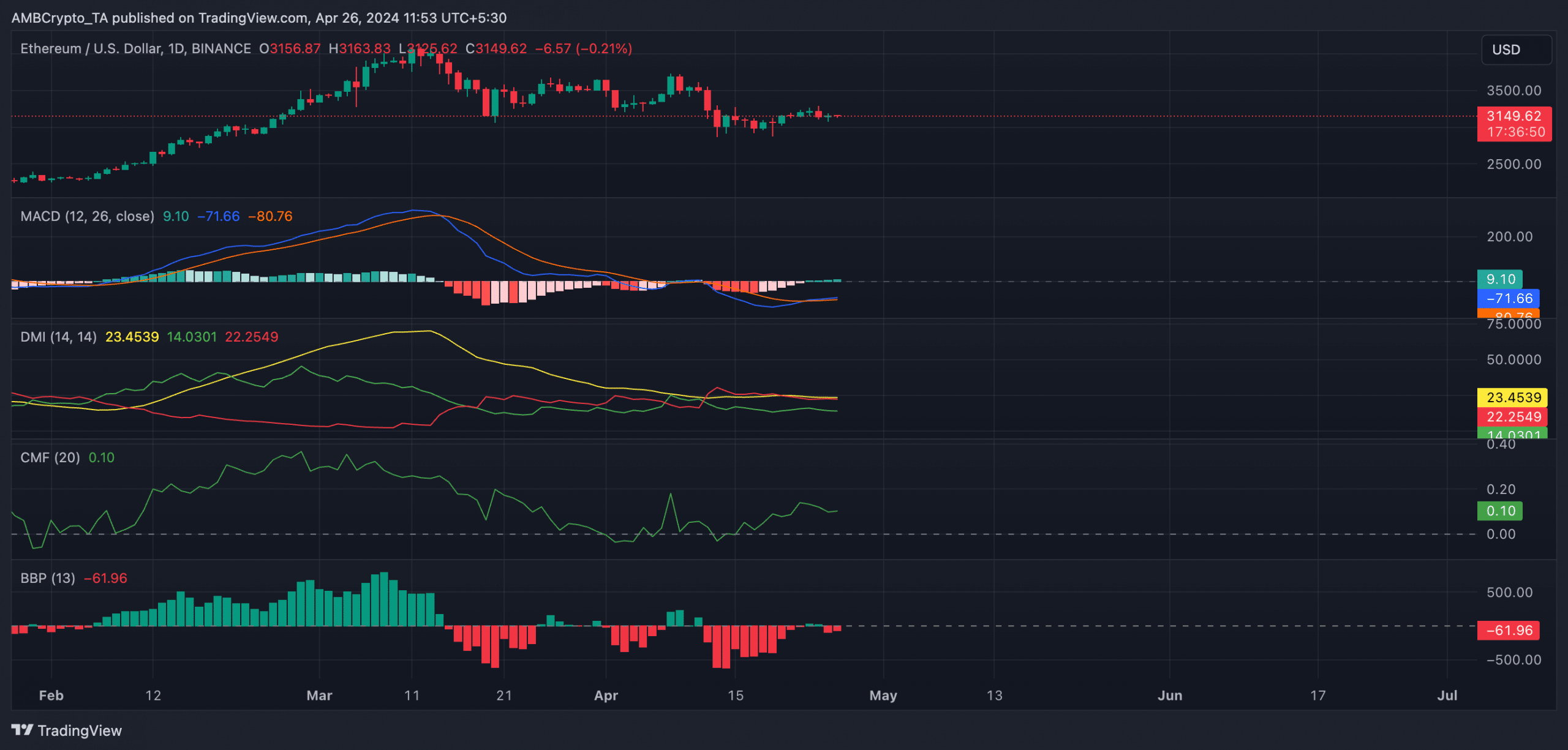

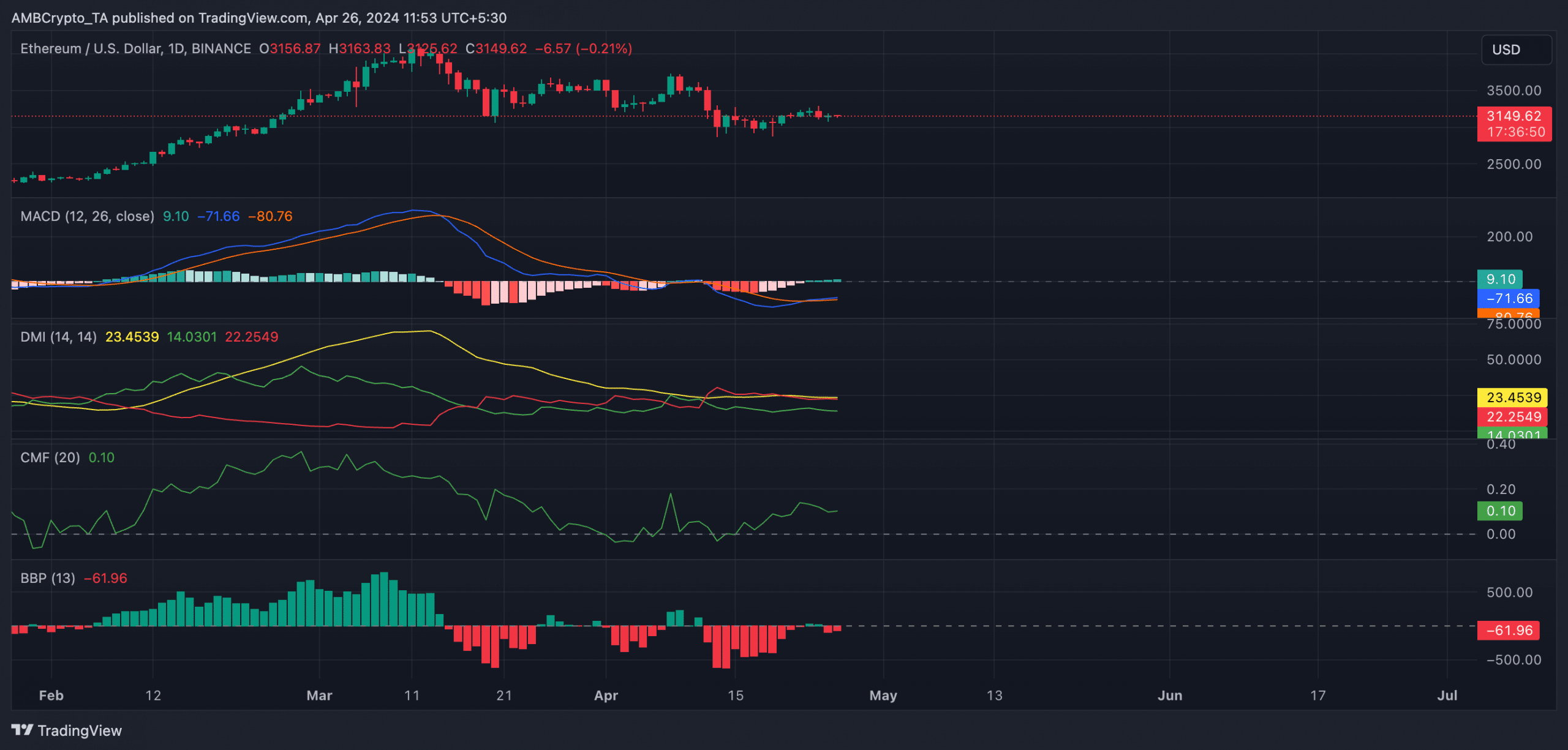

At press time, ETH traded at $3,150, recording a 5% value uptick in the last week. This price growth has been due to a minor resurgence in bullish sentiments among market participants, which AMBCrypto gleaned from its readings of the coin’s key technical indicators on a one-day chart.

For example, the coin’s MACD line rested above its signal line at press time. This signaled that ETH’s short-term moving average is above its long-term moving average. It is viewed as a bullish signal and interpreted as an indication to take long and exit short positions.

Likewise, the coin’s Chaikin Money Flow (CMF), which measures the flow of money into and out of the market, returned a positive value at press time. This showed that the ETH market had a steady liquidity supply.

However, bearish sentiments lingered in the market. The value of the coin’s Elder-Ray Index was -61.96 at the time of press. This indicator measures the relationship between the strength of buyers and sellers in the market.

Is your portfolio green? Check the Ethereum Profit Calculator

When its value is negative, bear power is dominant in the market.

Confirming the strength of ETH bears, its negative directional index (red) was positioned above its positive index. This showed that coin sellers had more presence in the market than buyers.

Source: ETH/USDT on TradingView

- Voluntary exit on Ethereum fell to a one-month low.

- Despite last week’s price rally, bearish sentiments remain significant in the ETH market.

The daily count of validators exiting the Ethereum [ETH] network recently cratered to a 30-day low, data from Glassnode showed.

Source: Glassnode

This occurred due to the recent decline in demand for the proof-of-stake (PoS) network. AMBCrypto previously reported that user activity on Ethereum has declined over the last month.

This resulted in a low ETH burn rate, which has increased the coin’s supply and made it inflationary once again.

When ETH becomes inflationary, its price experiences significant downward pressure. According to CoinMarketCap’s data, the coin’s value has dropped by 13% in the last month.

Due to ETH’s low price action, validators on the Ethereum network have not been incentivized to unstake their coins for onward sales.

The network typically witnesses a surge in validator exit when ETH price climbs, causing validators to attempt to capture gains on their previously staked coins.

With fewer validators leaving the network, the participation rate among validators has also risen to its highest in the last month.

Validators must participate in the network to ensure that Ethereum runs optimally. A high participation rate indicates reliable validator node uptime, fewer missed blocks, and superior blockspace efficiency.

As of this writing, the validators’ participation rate on the network was 99.6%.

ETH gains, but at what cost?

At press time, ETH traded at $3,150, recording a 5% value uptick in the last week. This price growth has been due to a minor resurgence in bullish sentiments among market participants, which AMBCrypto gleaned from its readings of the coin’s key technical indicators on a one-day chart.

For example, the coin’s MACD line rested above its signal line at press time. This signaled that ETH’s short-term moving average is above its long-term moving average. It is viewed as a bullish signal and interpreted as an indication to take long and exit short positions.

Likewise, the coin’s Chaikin Money Flow (CMF), which measures the flow of money into and out of the market, returned a positive value at press time. This showed that the ETH market had a steady liquidity supply.

However, bearish sentiments lingered in the market. The value of the coin’s Elder-Ray Index was -61.96 at the time of press. This indicator measures the relationship between the strength of buyers and sellers in the market.

Is your portfolio green? Check the Ethereum Profit Calculator

When its value is negative, bear power is dominant in the market.

Confirming the strength of ETH bears, its negative directional index (red) was positioned above its positive index. This showed that coin sellers had more presence in the market than buyers.

Source: ETH/USDT on TradingView

can i purchase cheap clomid for sale can i purchase generic clomiphene without insurance can i buy clomiphene tablets cost of clomid for men can i order generic clomid without rx where can i buy generic clomid without prescription where to get generic clomiphene without prescription

The vividness in this tune is exceptional.

The vividness in this ruined is exceptional.

order azithromycin 500mg online – buy flagyl 200mg generic buy flagyl 200mg for sale

rybelsus cost – order periactin 4mg generic order cyproheptadine pills

domperidone for sale online – cyclobenzaprine 15mg for sale buy cheap generic flexeril

amoxiclav uk – atbioinfo.com acillin uk

nexium 40mg without prescription – https://anexamate.com/ buy nexium without a prescription

cost coumadin 5mg – coumamide cost hyzaar

buy meloxicam 15mg online cheap – https://moboxsin.com/ cost meloxicam 15mg

order deltasone pill – https://apreplson.com/ order deltasone 40mg pill

best ed pills at gnc – medicine for impotence free samples of ed pills

cost amoxil – combamoxi how to get amoxicillin without a prescription

brand diflucan 200mg – site forcan usa

buy generic cenforce – https://cenforcers.com/ order cenforce 50mg online cheap

cialis online aust – https://ciltadgn.com/# how long for cialis to take effect

where can i buy ranitidine – click order zantac 300mg generic

how much does cialis cost per pill – cialis soft tabs canadian pharmacy cialis directions

buy viagra walgreens – https://strongvpls.com/ viagra 100mg price per pill

This is the stripe of glad I take advantage of reading. https://buyfastonl.com/furosemide.html

This website exceedingly has all of the tidings and facts I needed there this subject and didn’t positive who to ask. https://ursxdol.com/sildenafil-50-mg-in/

This is the compassionate of literature I positively appreciate. https://prohnrg.com/product/lisinopril-5-mg/

The thoroughness in this break down is noteworthy. aranitidine.com

This is the gentle of writing I positively appreciate. https://ondactone.com/simvastatin/

I couldn’t resist commenting. Adequately written!

https://doxycyclinege.com/pro/spironolactone/

This is the kind of serenity I enjoy reading. http://zqykj.com/bbs/home.php?mod=space&uid=302441

buy generic forxiga 10 mg – site order forxiga 10mg for sale

xenical pills – xenical tablet xenical 120mg pill

The thoroughness in this piece is noteworthy. http://wightsupport.com/forum/member.php?action=profile&uid=22038