- The ETH price decline has led to consecutive long liquidations.

- ETH has declined by over 3% in the last three days.

Ethereum [ETH] experienced consecutive uptrends that nearly brought it back to its all-time high recently. However, a trend reversal halted this progress, resulting in significant losses for long traders over the past few days.

Ethereum uptrend stalls

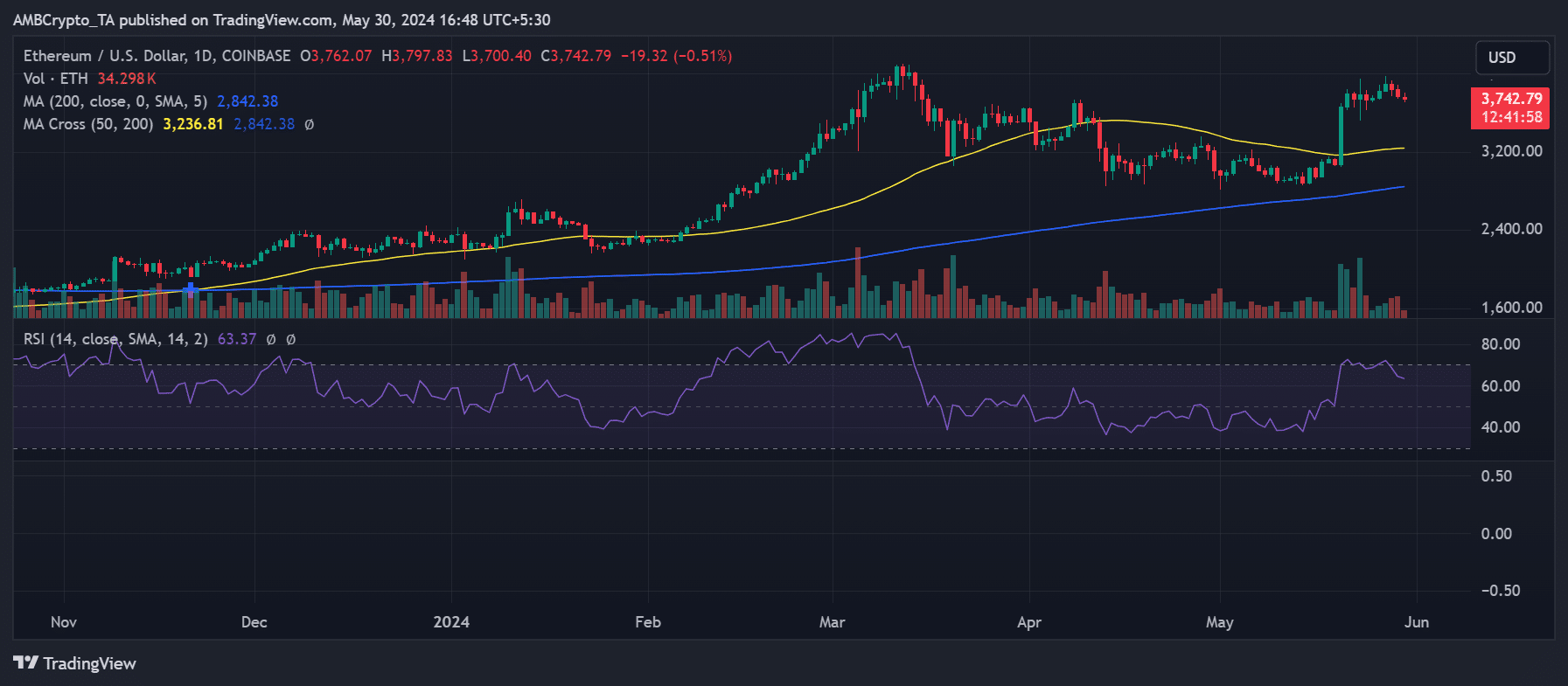

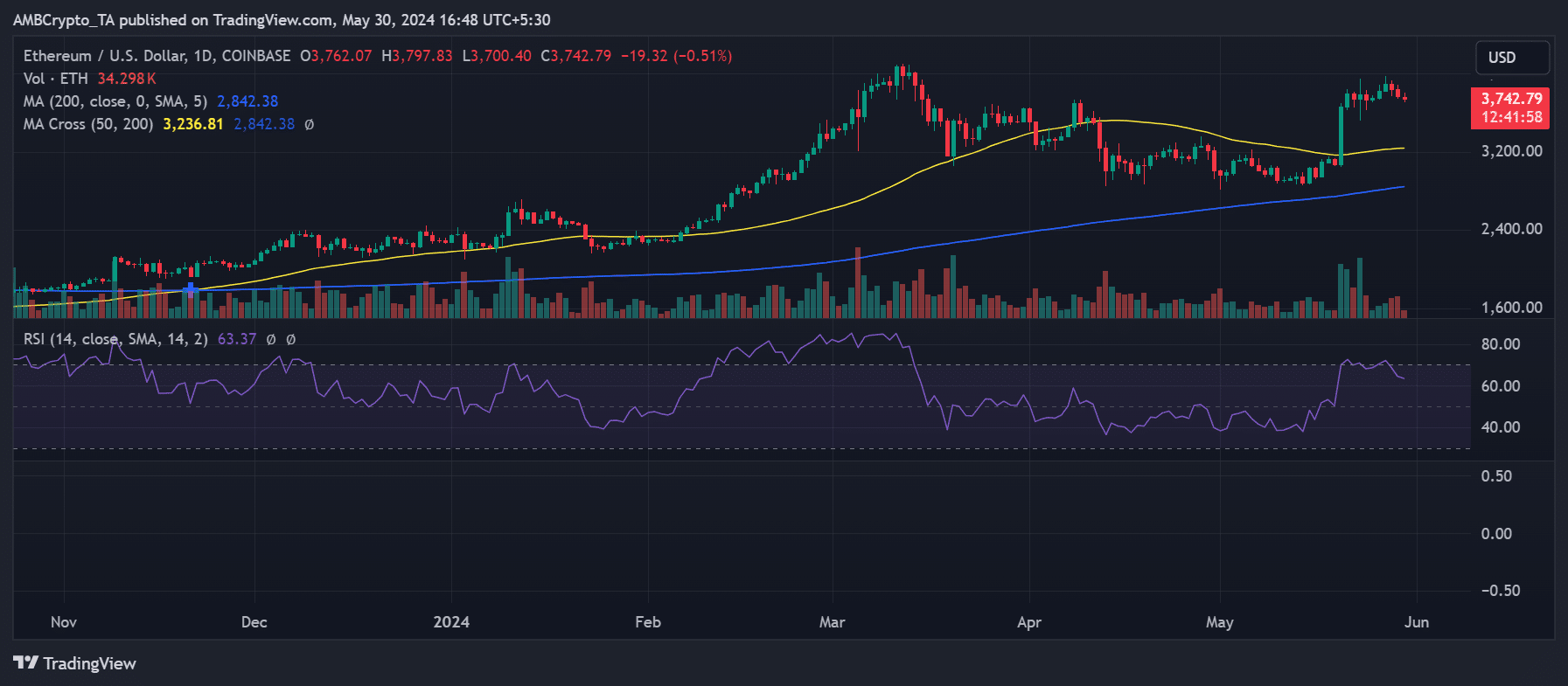

Analysis of Ethereum on a daily time frame indicates that it has experienced consecutive downtrends over the past three days.

These recent downtrends followed consecutive uptrends, which had driven its price to approximately $3,890 on 27th May. As of this writing, ETH was trading at around $3,740, reflecting a decline of less than 1%.

Source: TradingView

Furthermore, despite the recent decline, the overall trend for ETH remained bullish. The chart indicated that, as of now, it was trading above its short Moving Average (yellow line), which is a positive signal.

Additionally, analysis of its Relative Strength Index (RSI) shows a reading above 60, reinforcing the presence of a strong bullish trend.

Ethereum long traders take hits

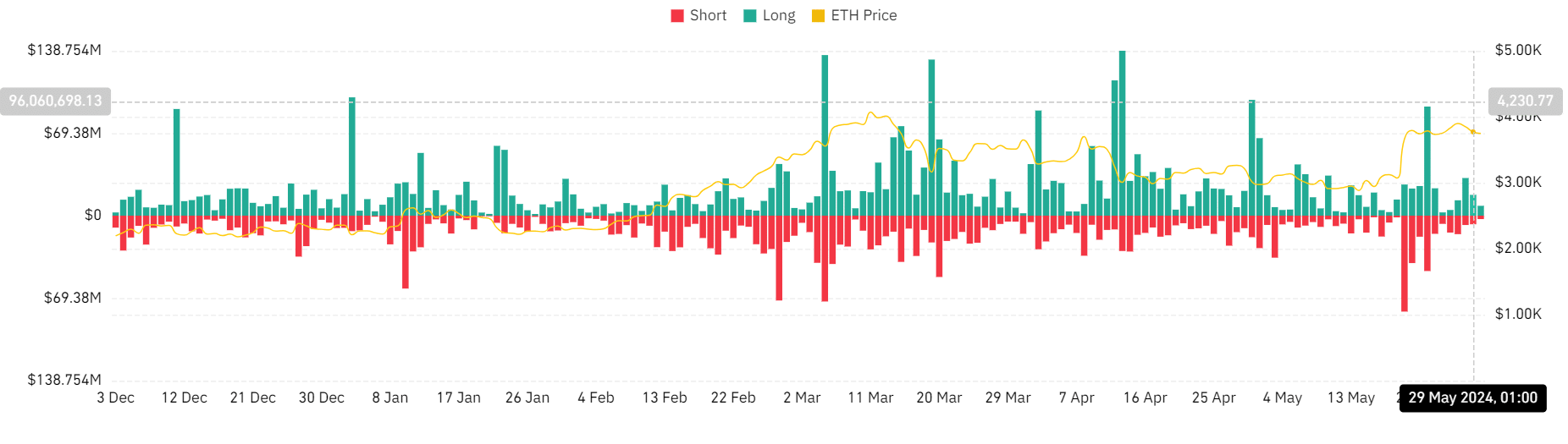

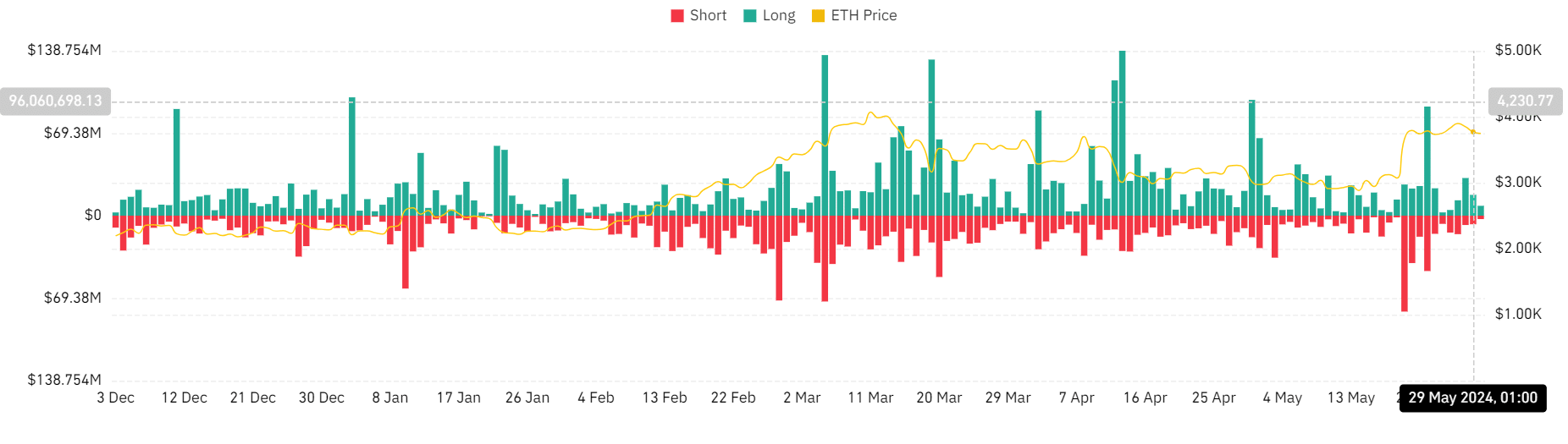

According to the analysis of liquidation data on Coinglass, Ethereum long traders have experienced increased liquidations over the past few days.

Source: Coinglass

On 28th May, when the price decline began, the long liquidation volume was approximately $31.6 million.

The following day, it was around $17.5 million, and as of the current writing, it is over $8 million.

This brings the total long liquidation volume over the last three days to more than $57 million, compared to just over $18 million in short liquidation volume.

Ethereum Open Interest remains high

Despite the decline in price, interest in Ethereum remains strong. Analysis of the Open Interest chart on Coinglass reveals that Open Interest peaked at $17 billion on 28th May, marking the highest level in over a year.

As of this writing, the Open Interest was around $16.7 billion, which is still one of the highest points in over a year. This indicates sustained investor engagement and interest in Ethereum.

Read Ethereum (ETH) Price Prediction 2024-25

Additionally, an analysis of the funding rate indicated that sentiment around ETH remained positive. The chart showed that the funding rate has stayed above zero, currently at 0.013%.

This suggests that buyers continue to dominate, indicating a strong belief in a potential further rise in ETH’s price.

- The ETH price decline has led to consecutive long liquidations.

- ETH has declined by over 3% in the last three days.

Ethereum [ETH] experienced consecutive uptrends that nearly brought it back to its all-time high recently. However, a trend reversal halted this progress, resulting in significant losses for long traders over the past few days.

Ethereum uptrend stalls

Analysis of Ethereum on a daily time frame indicates that it has experienced consecutive downtrends over the past three days.

These recent downtrends followed consecutive uptrends, which had driven its price to approximately $3,890 on 27th May. As of this writing, ETH was trading at around $3,740, reflecting a decline of less than 1%.

Source: TradingView

Furthermore, despite the recent decline, the overall trend for ETH remained bullish. The chart indicated that, as of now, it was trading above its short Moving Average (yellow line), which is a positive signal.

Additionally, analysis of its Relative Strength Index (RSI) shows a reading above 60, reinforcing the presence of a strong bullish trend.

Ethereum long traders take hits

According to the analysis of liquidation data on Coinglass, Ethereum long traders have experienced increased liquidations over the past few days.

Source: Coinglass

On 28th May, when the price decline began, the long liquidation volume was approximately $31.6 million.

The following day, it was around $17.5 million, and as of the current writing, it is over $8 million.

This brings the total long liquidation volume over the last three days to more than $57 million, compared to just over $18 million in short liquidation volume.

Ethereum Open Interest remains high

Despite the decline in price, interest in Ethereum remains strong. Analysis of the Open Interest chart on Coinglass reveals that Open Interest peaked at $17 billion on 28th May, marking the highest level in over a year.

As of this writing, the Open Interest was around $16.7 billion, which is still one of the highest points in over a year. This indicates sustained investor engagement and interest in Ethereum.

Read Ethereum (ETH) Price Prediction 2024-25

Additionally, an analysis of the funding rate indicated that sentiment around ETH remained positive. The chart showed that the funding rate has stayed above zero, currently at 0.013%.

This suggests that buyers continue to dominate, indicating a strong belief in a potential further rise in ETH’s price.

![[Latest] North America Turbomachinery Control Systems Market: Analyzing the Influence of Consumer Reviews](https://coininsights.com/wp-content/uploads/2025/03/L316986520_g-120x86.jpg)

get cheap clomid prices can you buy clomiphene without rx where to buy clomid pill where can i buy generic clomid can you get clomid online where to buy cheap clomiphene price get cheap clomid without rx

More posts like this would make the online play more useful.

This is the kind of writing I positively appreciate.

buy zithromax generic – ciprofloxacin 500mg for sale flagyl 400mg brand

semaglutide us – order rybelsus 14mg cyproheptadine buy online

clavulanate brand – https://atbioinfo.com/ cheap acillin

order esomeprazole 40mg online cheap – https://anexamate.com/ order esomeprazole 20mg without prescription

where to buy meloxicam without a prescription – https://moboxsin.com/ meloxicam 15mg drug

buy prednisone 20mg pill – https://apreplson.com/ deltasone 20mg tablet

order amoxil sale – https://combamoxi.com/ order amoxil generic

forcan brand – buy diflucan pill order diflucan 200mg online cheap

cenforce 100mg for sale – cenforce rs order cenforce generic

cialis for bph insurance coverage – ciltad genesis generic cialis tadalafil 20 mg from india

buy zantac 150mg pills – on this site order ranitidine 300mg pill

generic cialis tadalafil 20mg reviews – https://strongtadafl.com/# is cialis a controlled substance

can you just buy viagra – https://strongvpls.com/ buy cheap viagra online canada

More posts like this would force the blogosphere more useful. gabapentin 800mg uk

This is the kind of literature I truly appreciate. https://ursxdol.com/amoxicillin-antibiotic/

This is the amicable of content I enjoy reading. https://ondactone.com/product/domperidone/

More articles like this would remedy the blogosphere richer.

https://doxycyclinege.com/pro/metoclopramide/

Thanks for sharing. It’s top quality. http://www.zgqsz.com/home.php?mod=space&uid=846485

order forxiga 10mg online cheap – janozin.com buy generic forxiga over the counter

purchase orlistat generic – https://asacostat.com/ orlistat 60mg generic

The thoroughness in this section is noteworthy. http://seafishzone.com/home.php?mod=space&uid=2331311