- Selling pressure on Ethereum was high in the last week.

- Market indicators were bullish on the token.

Ethereum [ETH] finally gained bullish momentum at press time. If the latest data is to be considered, then ETH might be getting ready to reach new highs by the end of this year.

Let’s take a closer look at what’s going on.

Ethereum to breakout soon

AMBCrypto’s look at CoinMarketCap’s data revealed that ETH’s price increased by over 2% in the last seven days. In the last 24 hours alone, the token’s price surged by more than 3%.

At the time of writing, ETH was trading at $3,488.88 with a market capitalization of over $419 billion. Thanks to the recent price increase, only 10% of ETH investors were at a loss, as per IntoTheBlock’s data.

Things can get even better for the token as a bullish pattern appeared on ETH’s chart. World of Charts, a popular crypto analyst, recently posted a tweet highlighting a bullish falling wedge pattern.

ETH’s price started to consolidate inside the pattern in May, and at press time, it was on the verge of a breakout.

It was interesting to note that ETH got rejected from the upper limit of the pattern a few times earlier. However, World of Charts mentioned that there were still chances of a breakout.

If that actually happens, then investors might witness the token touching new highs by the end of this year.

Source: X

What’s there in the short term?

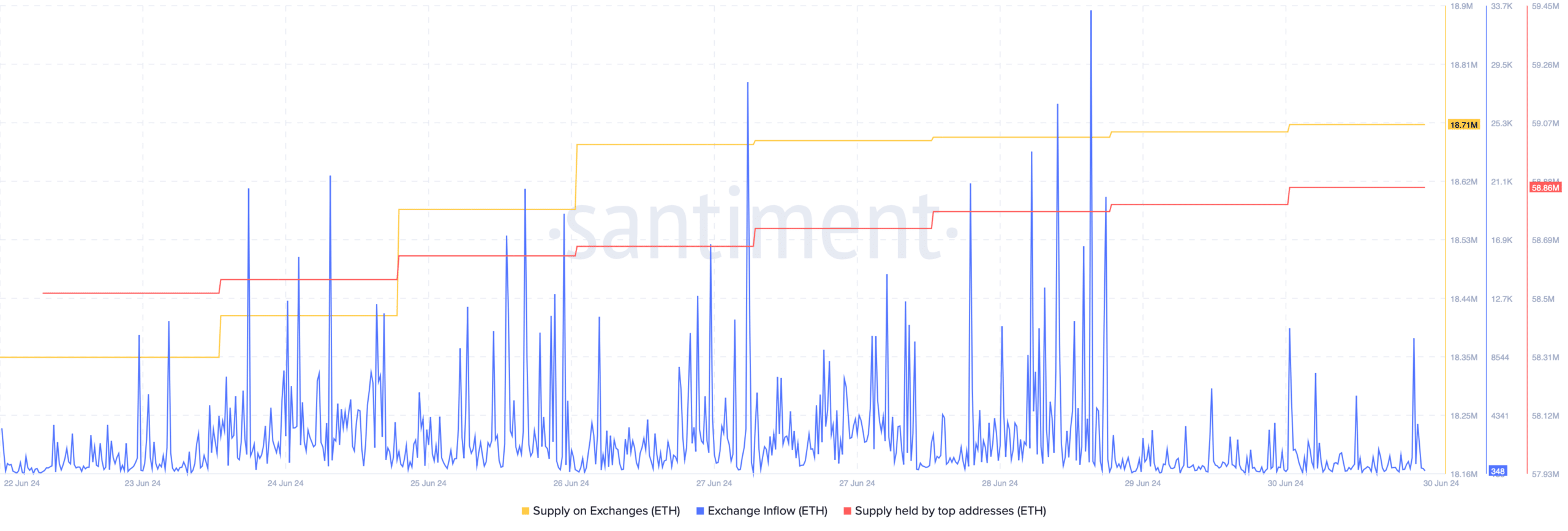

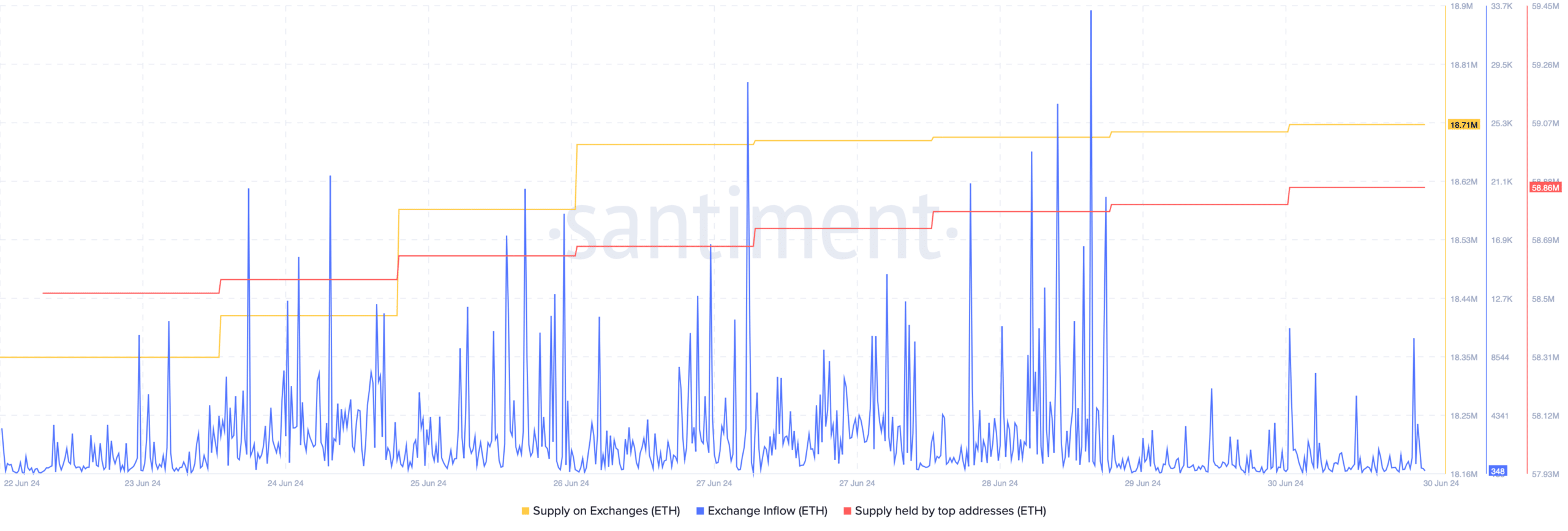

AMBCrypto then planned to take a closer look at ETH’s metrics to better understand what to expect in the short term. We found that selling pressure on the token increased.

As per our analysis of Santiment’s data, Ethereum’s Exchange Inflow spiked last week. Its Supply on Exchanges also increased, meaning that investors were selling the token.

Whales remained confident in the token, as ETH’s supply held by top addresses increased.

Source: Santiment

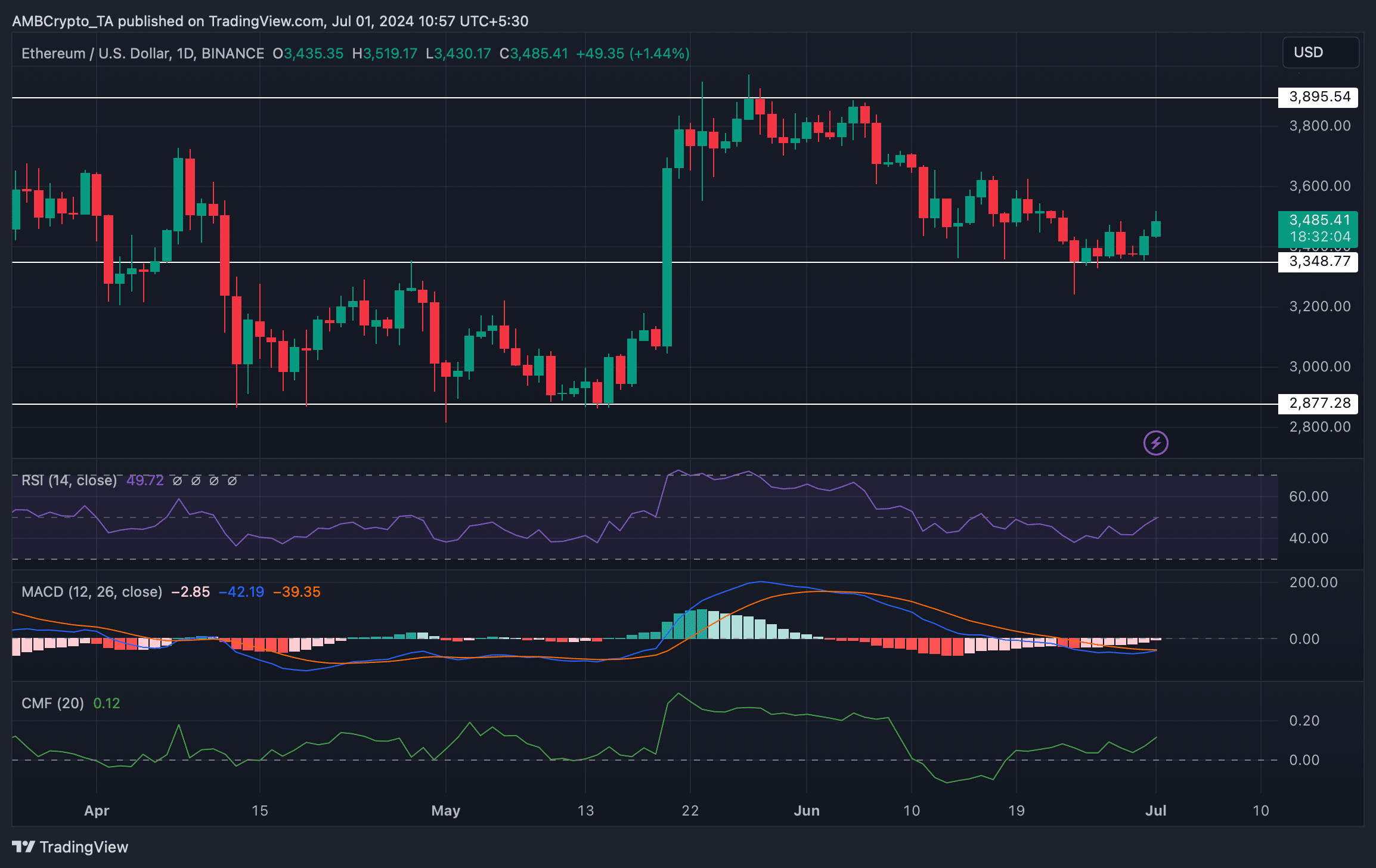

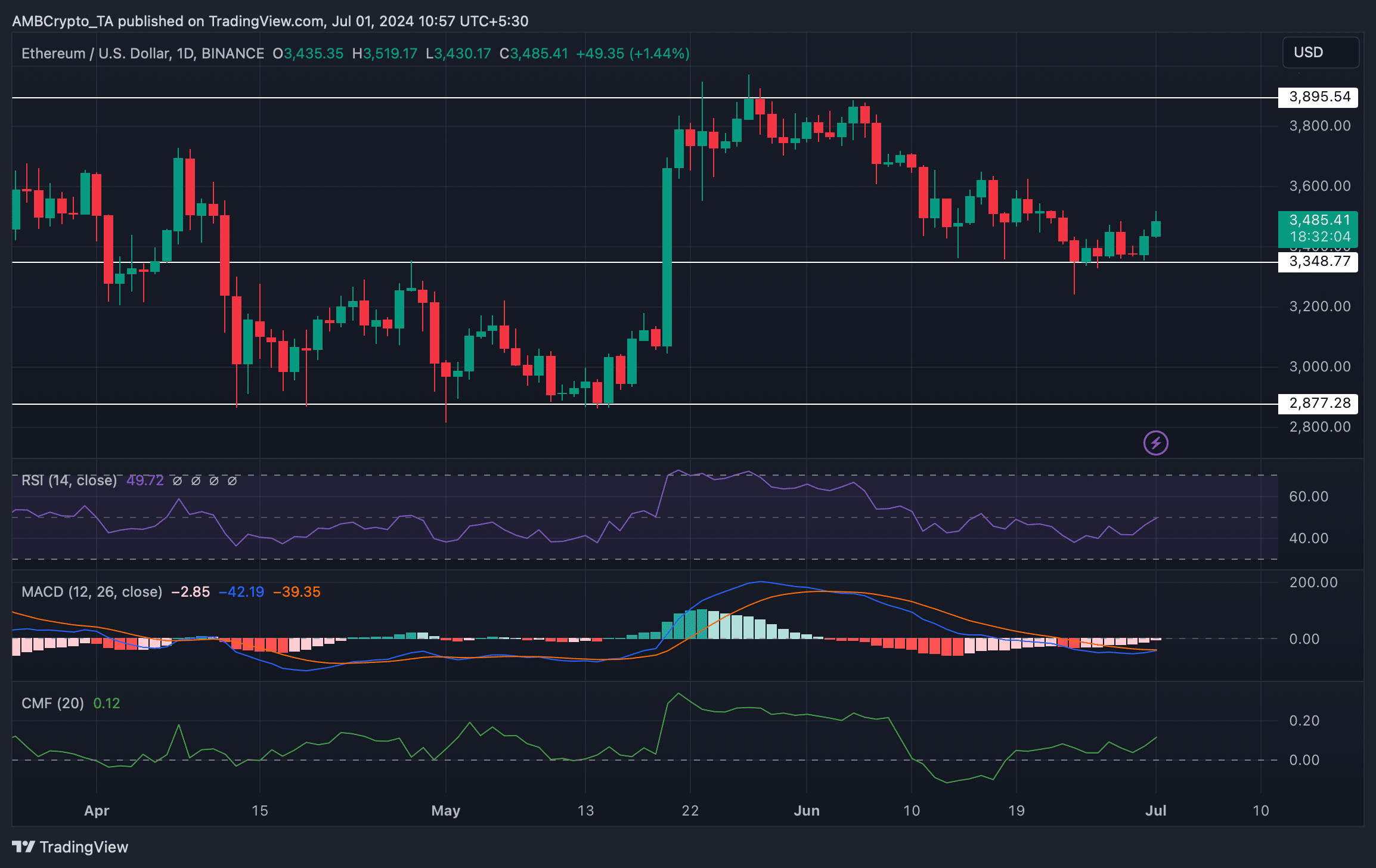

A few other market indicators also looked optimistic. For instance, the MACD displayed the possibility of a bullish crossover.

The Relative Strength Index (RSI) also registered an uptick and was headed towards the neutral mark at press time.

Is your portfolio green? Check out the ETH Profit Calculator

Moreover, the Chaikin Money Flow (CMF) followed a similar increasing trend, indicating that the chances of a price uptick were high.

If that happens, then investors might witness ETH touching $3,895 in the coming days. But if things get bearish, then ETH might drop to $2,877.

Source: TradingView

- Selling pressure on Ethereum was high in the last week.

- Market indicators were bullish on the token.

Ethereum [ETH] finally gained bullish momentum at press time. If the latest data is to be considered, then ETH might be getting ready to reach new highs by the end of this year.

Let’s take a closer look at what’s going on.

Ethereum to breakout soon

AMBCrypto’s look at CoinMarketCap’s data revealed that ETH’s price increased by over 2% in the last seven days. In the last 24 hours alone, the token’s price surged by more than 3%.

At the time of writing, ETH was trading at $3,488.88 with a market capitalization of over $419 billion. Thanks to the recent price increase, only 10% of ETH investors were at a loss, as per IntoTheBlock’s data.

Things can get even better for the token as a bullish pattern appeared on ETH’s chart. World of Charts, a popular crypto analyst, recently posted a tweet highlighting a bullish falling wedge pattern.

ETH’s price started to consolidate inside the pattern in May, and at press time, it was on the verge of a breakout.

It was interesting to note that ETH got rejected from the upper limit of the pattern a few times earlier. However, World of Charts mentioned that there were still chances of a breakout.

If that actually happens, then investors might witness the token touching new highs by the end of this year.

Source: X

What’s there in the short term?

AMBCrypto then planned to take a closer look at ETH’s metrics to better understand what to expect in the short term. We found that selling pressure on the token increased.

As per our analysis of Santiment’s data, Ethereum’s Exchange Inflow spiked last week. Its Supply on Exchanges also increased, meaning that investors were selling the token.

Whales remained confident in the token, as ETH’s supply held by top addresses increased.

Source: Santiment

A few other market indicators also looked optimistic. For instance, the MACD displayed the possibility of a bullish crossover.

The Relative Strength Index (RSI) also registered an uptick and was headed towards the neutral mark at press time.

Is your portfolio green? Check out the ETH Profit Calculator

Moreover, the Chaikin Money Flow (CMF) followed a similar increasing trend, indicating that the chances of a price uptick were high.

If that happens, then investors might witness ETH touching $3,895 in the coming days. But if things get bearish, then ETH might drop to $2,877.

Source: TradingView

![What Is Asset Tokenization? Types, Why It Matters Now [2025]](https://coininsights.com/wp-content/uploads/2025/05/asset_tokenization-360x180.png)

clomid price at clicks cost generic clomiphene without rx clomiphene reddit where buy clomid no prescription can you buy generic clomiphene for sale acquista clomiphene online clomid nz prescription

This is the kind of content I enjoy reading.

More articles like this would frame the blogosphere richer.

oral azithromycin 250mg – buy tinidazole 300mg online cheap flagyl price

buy generic rybelsus online – semaglutide 14mg pill buy periactin 4mg online