- Ethereum noted a decline in bullish conviction in the Futures market

- Coinbase Premium Index showed traders from the U.S are adamant about the altcoin

Ethereum [ETH] rallied swiftly from $3.2k to $3.7k, making a 16.2% move in three days. However, the bulls were rebuffed at the same near-term resistance from a month ago – $3.7k.

The local top coincided with a massive influx of ETH to exchanges on 8 April, according to AMBCrypto’s latest analysis. While the sentiment had been bullish, it has begun to shift over the last 24 hours.

U.S investors refuse to believe in ETH’s rally

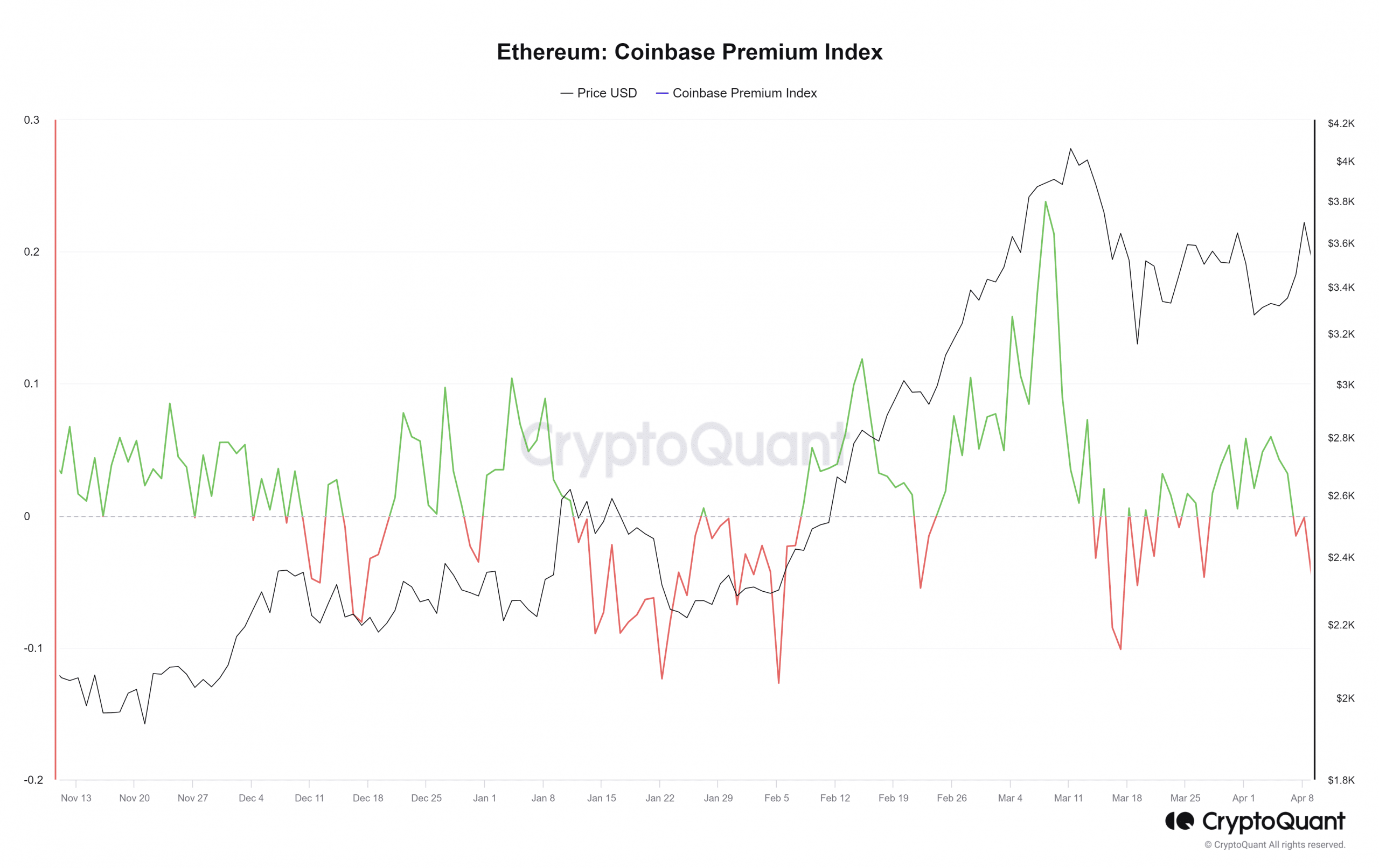

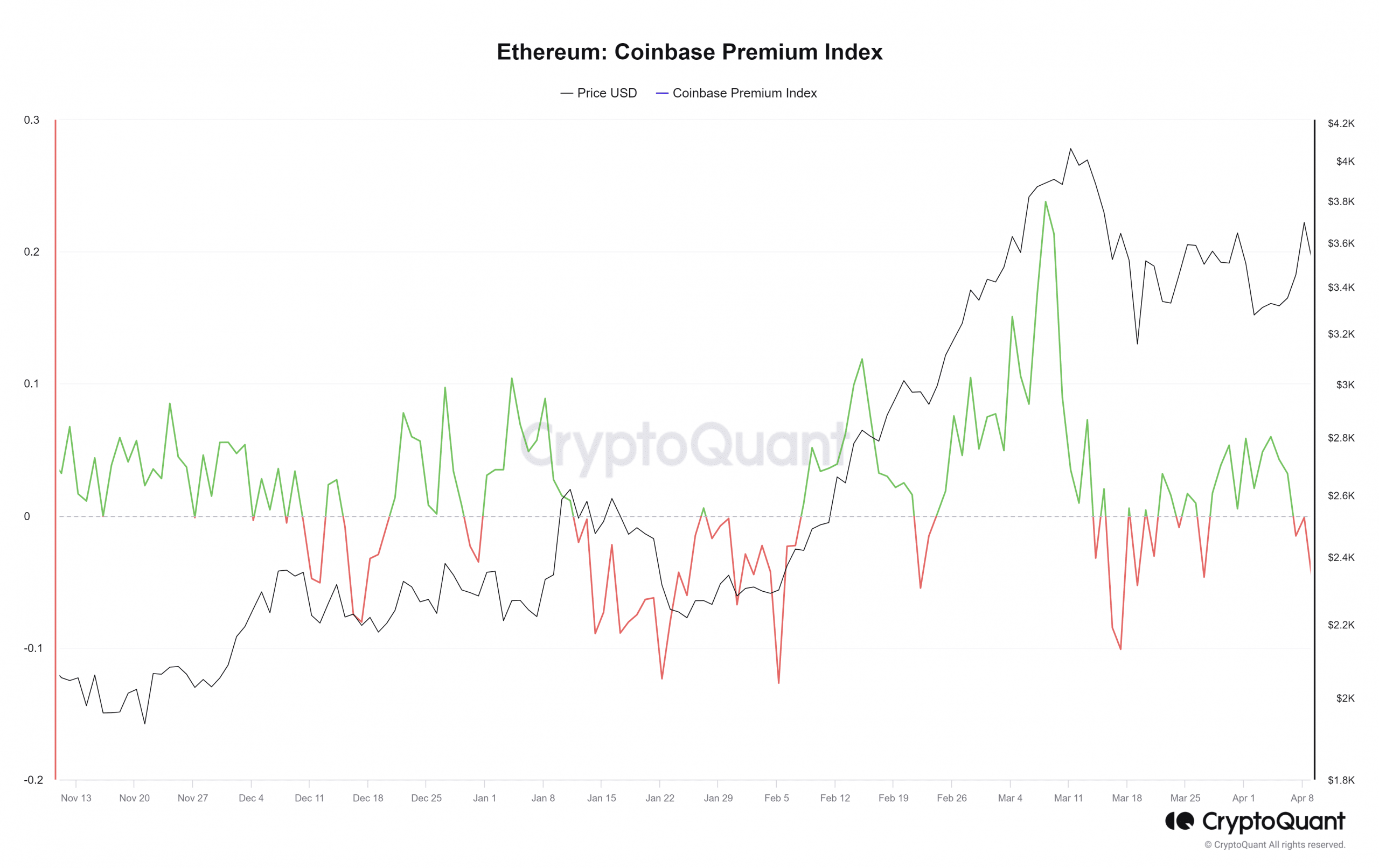

Source: CryptoQuant

The Coinbase Premium Index represents the percent difference in prices (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to show that Binance ETH prices were greater.

In other words, it reflected a lack of bullish enthusiasm from U.S investors, since they can’t trade on Binance and have to rely on Coinbase. Hence, despite the sharp bounce to $3.7k, sentiment west of the Atlantic has been muted.

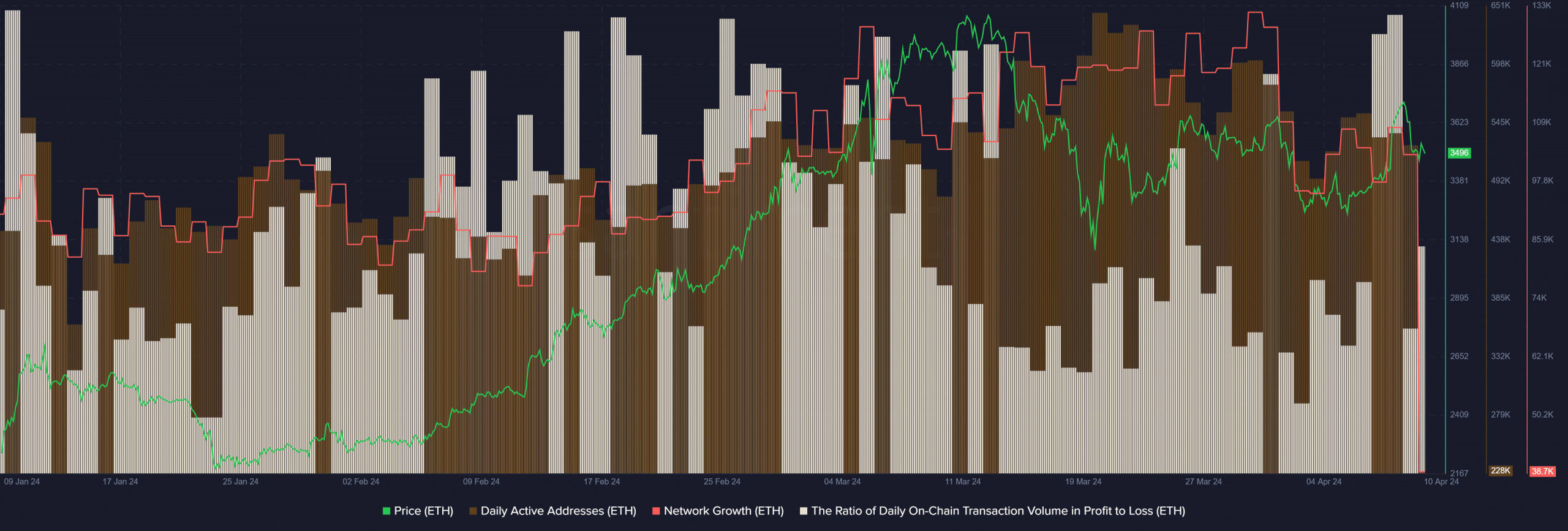

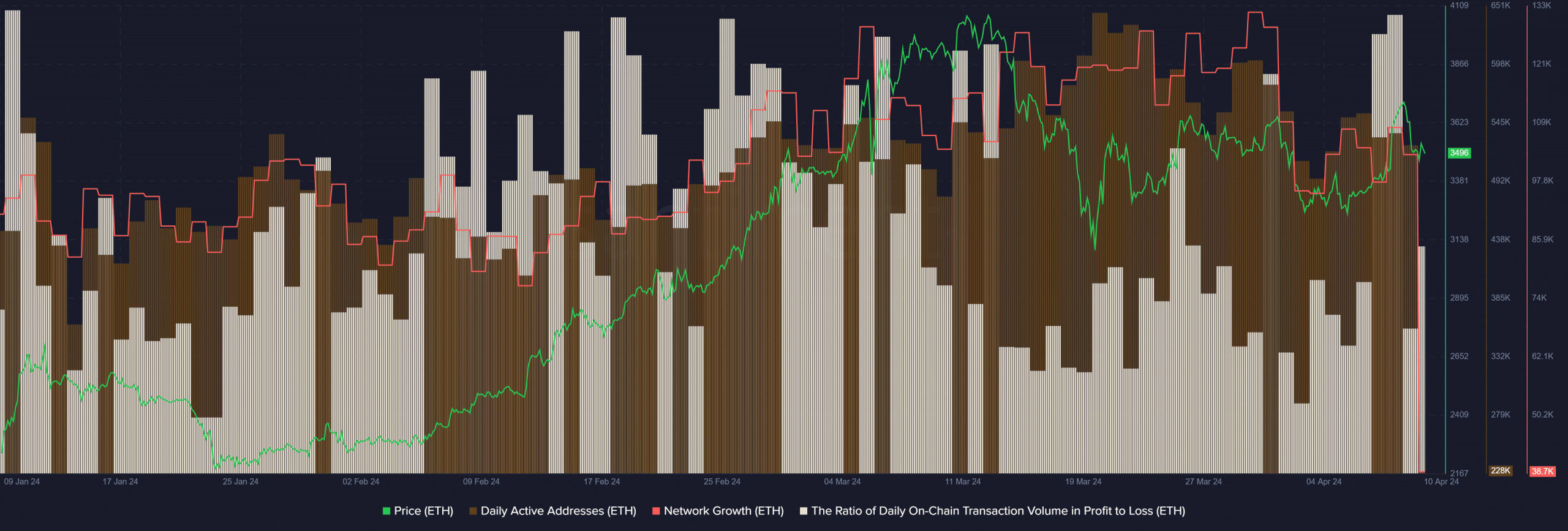

Source: Santiment

The ratio of daily on-chain transaction volume in profit to loss metric from Santiment leapt to 3.01 on 8 April. Since February, this metric has faced a glass ceiling at 3. Therefore, traders could keep an eye on this metric’s daily readings to understand if a short-term price depression might be inbound.

Daily active addresses and network growth metrics saw a slump on 30 March. They continued to trend lower over the past ten days. This was a sign of a lack of user adoption and organic demand for Ethereum. It raised the question – What is the short-term sentiment like in the spot and Futures ETH markets?

Open Interest data supported idea of bearish market sentiment

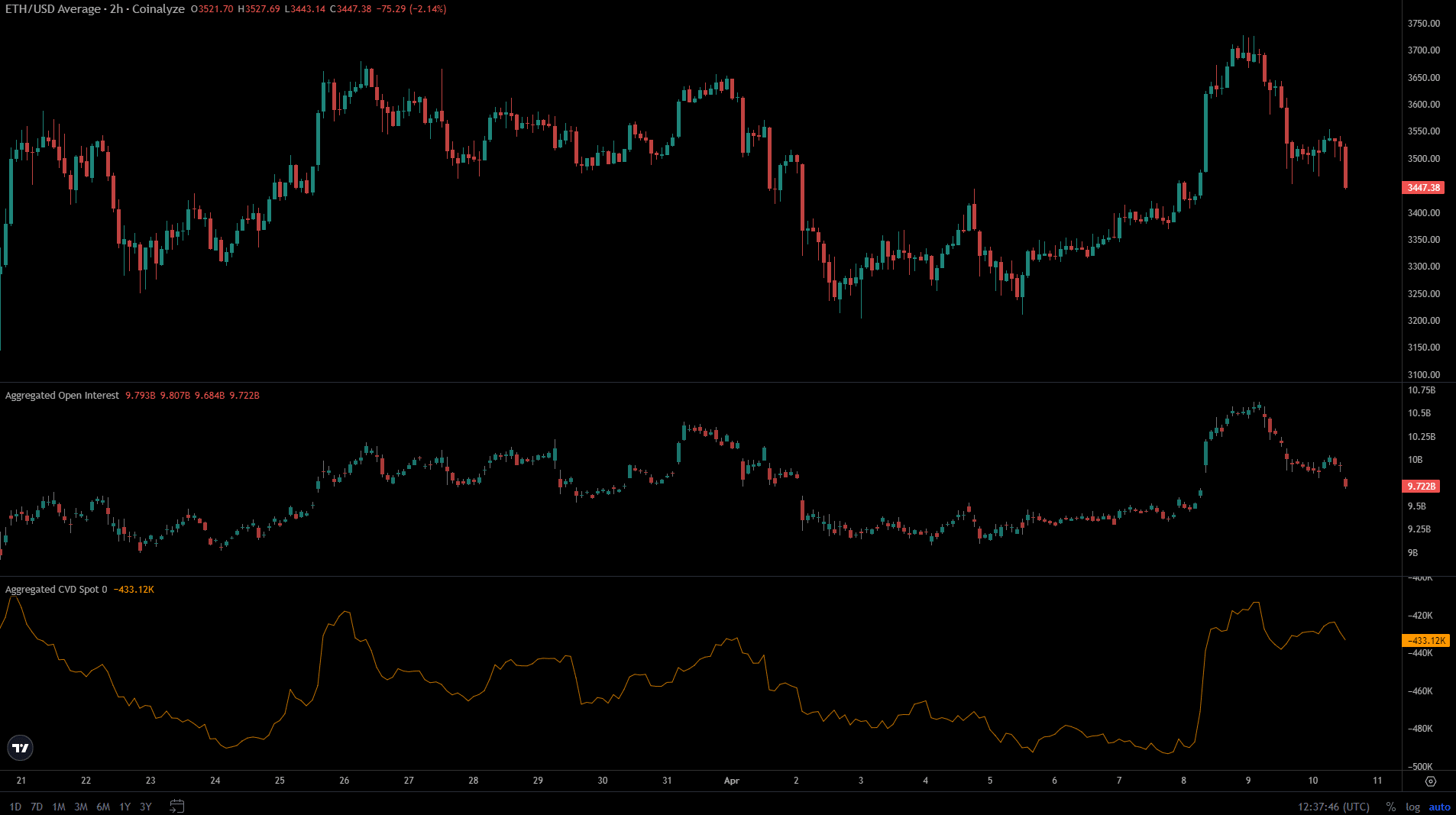

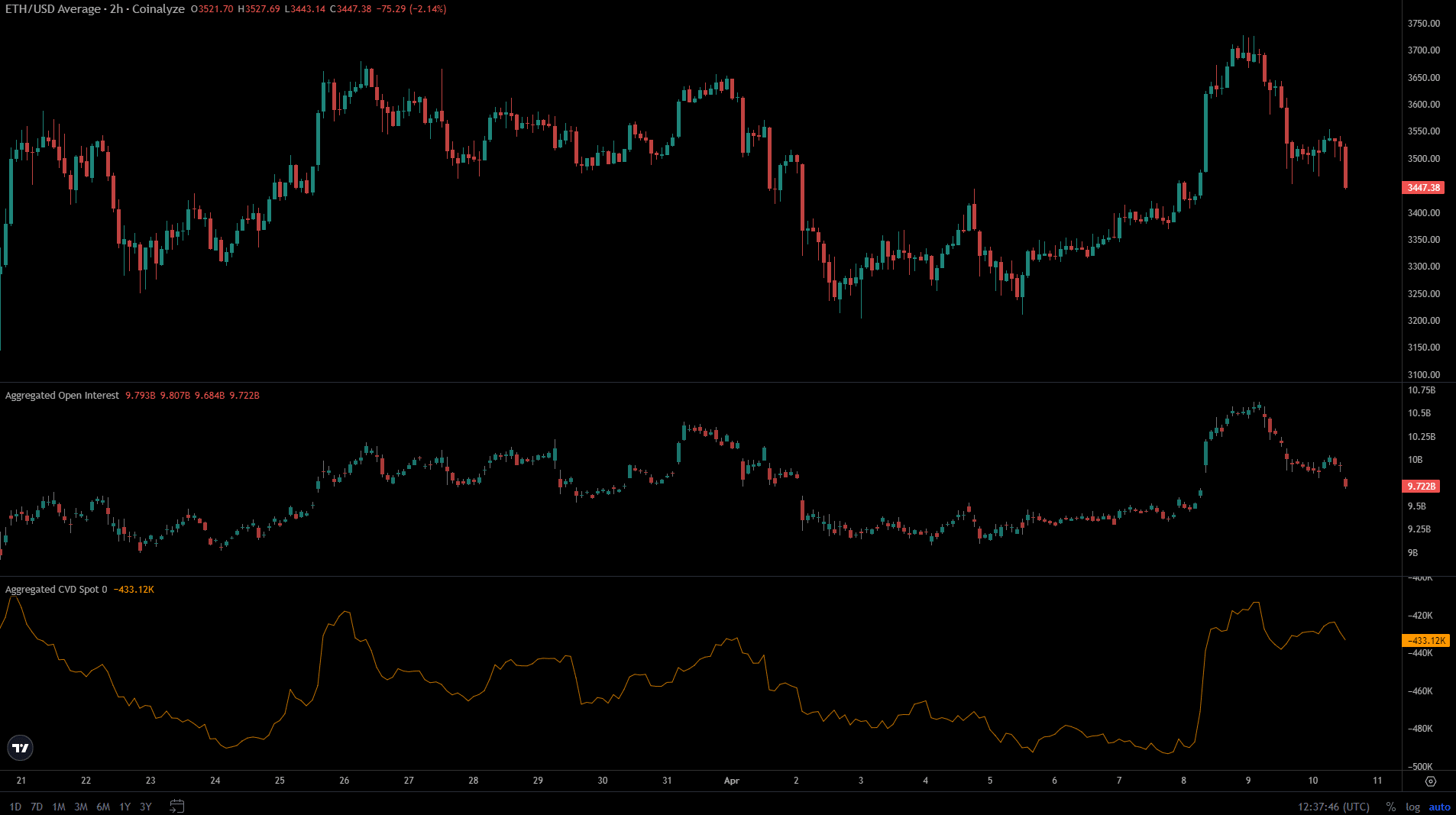

Source: Coinalyze

When ETH faced rejection at $3.7k, the Open Interest also took a turn south. Over the last 36 hours, the OI has fallen from $10.6 billion to $9.72 billion. A drop in prices, alongside the Open Interest, seemed to be a sign of bearish sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

The spot CVD also began to fall lower, but it has not retraced all the gains it made since the 8th. That being said, the period from 26 March to 8 April saw Ethereum’s spot CVD trend south. It highlighted that spot market participants were not bullishly convinced yet, but there was a chance of a turnaround should ETH break past the $3.7k-mark.

- Ethereum noted a decline in bullish conviction in the Futures market

- Coinbase Premium Index showed traders from the U.S are adamant about the altcoin

Ethereum [ETH] rallied swiftly from $3.2k to $3.7k, making a 16.2% move in three days. However, the bulls were rebuffed at the same near-term resistance from a month ago – $3.7k.

The local top coincided with a massive influx of ETH to exchanges on 8 April, according to AMBCrypto’s latest analysis. While the sentiment had been bullish, it has begun to shift over the last 24 hours.

U.S investors refuse to believe in ETH’s rally

Source: CryptoQuant

The Coinbase Premium Index represents the percent difference in prices (USDT pair) between Binance and Coinbase. This index has fallen since 5 April to show that Binance ETH prices were greater.

In other words, it reflected a lack of bullish enthusiasm from U.S investors, since they can’t trade on Binance and have to rely on Coinbase. Hence, despite the sharp bounce to $3.7k, sentiment west of the Atlantic has been muted.

Source: Santiment

The ratio of daily on-chain transaction volume in profit to loss metric from Santiment leapt to 3.01 on 8 April. Since February, this metric has faced a glass ceiling at 3. Therefore, traders could keep an eye on this metric’s daily readings to understand if a short-term price depression might be inbound.

Daily active addresses and network growth metrics saw a slump on 30 March. They continued to trend lower over the past ten days. This was a sign of a lack of user adoption and organic demand for Ethereum. It raised the question – What is the short-term sentiment like in the spot and Futures ETH markets?

Open Interest data supported idea of bearish market sentiment

Source: Coinalyze

When ETH faced rejection at $3.7k, the Open Interest also took a turn south. Over the last 36 hours, the OI has fallen from $10.6 billion to $9.72 billion. A drop in prices, alongside the Open Interest, seemed to be a sign of bearish sentiment.

Read Ethereum’s [ETH] Price Prediction 2024-25

The spot CVD also began to fall lower, but it has not retraced all the gains it made since the 8th. That being said, the period from 26 March to 8 April saw Ethereum’s spot CVD trend south. It highlighted that spot market participants were not bullishly convinced yet, but there was a chance of a turnaround should ETH break past the $3.7k-mark.

can i buy generic clomiphene tablets can i buy generic clomiphene can i buy clomiphene can i buy clomid pill cost clomiphene prices how to buy cheap clomid pill clomiphene at clicks

This is the make of post I find helpful.

Facts blog you possess here.. It’s hard to find high calibre belles-lettres like yours these days. I justifiably respect individuals like you! Withstand care!!

buy azithromycin without prescription – buy azithromycin 250mg generic purchase metronidazole online

rybelsus buy online – rybelsus 14 mg over the counter oral cyproheptadine 4 mg

motilium 10mg without prescription – order motilium 10mg online cheap purchase cyclobenzaprine without prescription

cost augmentin – https://atbioinfo.com/ buy acillin sale

warfarin 5mg over the counter – coumamide hyzaar buy online

oral meloxicam 15mg – https://moboxsin.com/ meloxicam cost

order prednisone 10mg – aprep lson buy prednisone 20mg sale

amoxil pills – comba moxi cheap amoxicillin online

buy fluconazole medication – site purchase forcan pills

order cenforce 100mg generic – https://cenforcers.com/# cenforce 50mg without prescription

cialis how long does it last – on this site where to buy cialis

canada cialis – cialis 20mg tablets buy cialis no prescription australia

order zantac online cheap – https://aranitidine.com/# buy zantac 150mg pills

I’ll certainly bring to skim more. tamoxifen tablet

I’ll certainly bring back to read more. buy isotretinoin

Proof blog you procure here.. It’s intricate to espy elevated worth script like yours these days. I truly respect individuals like you! Take vigilance!! https://ursxdol.com/sildenafil-50-mg-in/

This is the make of post I recoup helpful. https://prohnrg.com/

More posts like this would add up to the online space more useful. https://aranitidine.com/fr/acheter-fildena/

Thanks on putting this up. It’s evidently done. https://ondactone.com/spironolactone/

This is the make of advise I unearth helpful.

flomax pill

This website absolutely has all of the information and facts I needed there this thesis and didn’t comprehend who to ask. http://forum.ttpforum.de/member.php?action=profile&uid=424431

brand forxiga 10 mg – click buy dapagliflozin medication

orlistat tablet – this purchase orlistat

This is the type of enter I unearth helpful. http://www.underworldralinwood.ca/forums/member.php?action=profile&uid=493584