- There is a high chance that ETH could reach $3,000 or more in the coming days.

- ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors.

On the 14th of August, the overall cryptocurrency market had experienced impressive upside momentum, following the massive 4.5% price surge in Bitcoin [BTC].

Amid this bullish trend, Ethereum [ETH], the world’s second-biggest cryptocurrency, gained significant attention from the crypto community due to its notable price surge and recent breakout.

Ethereum: Upcoming levels

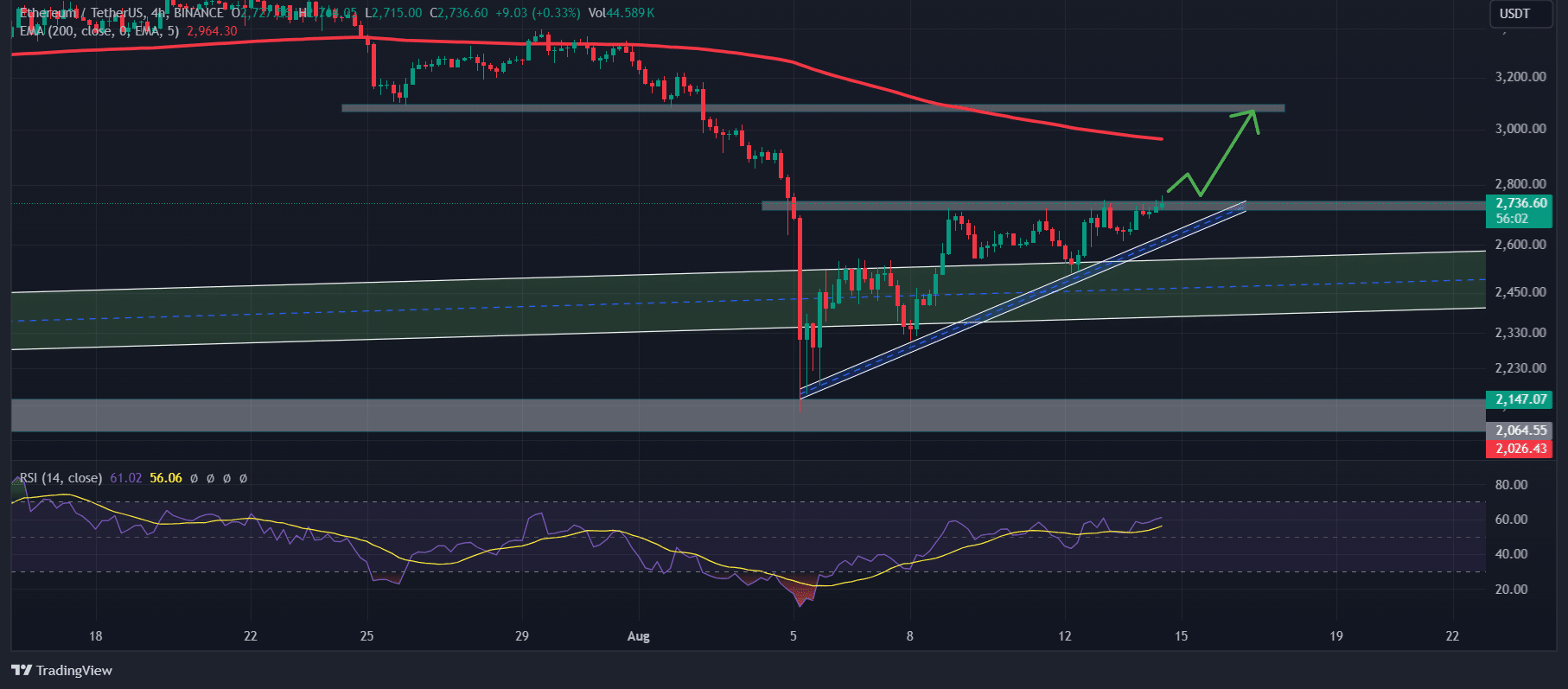

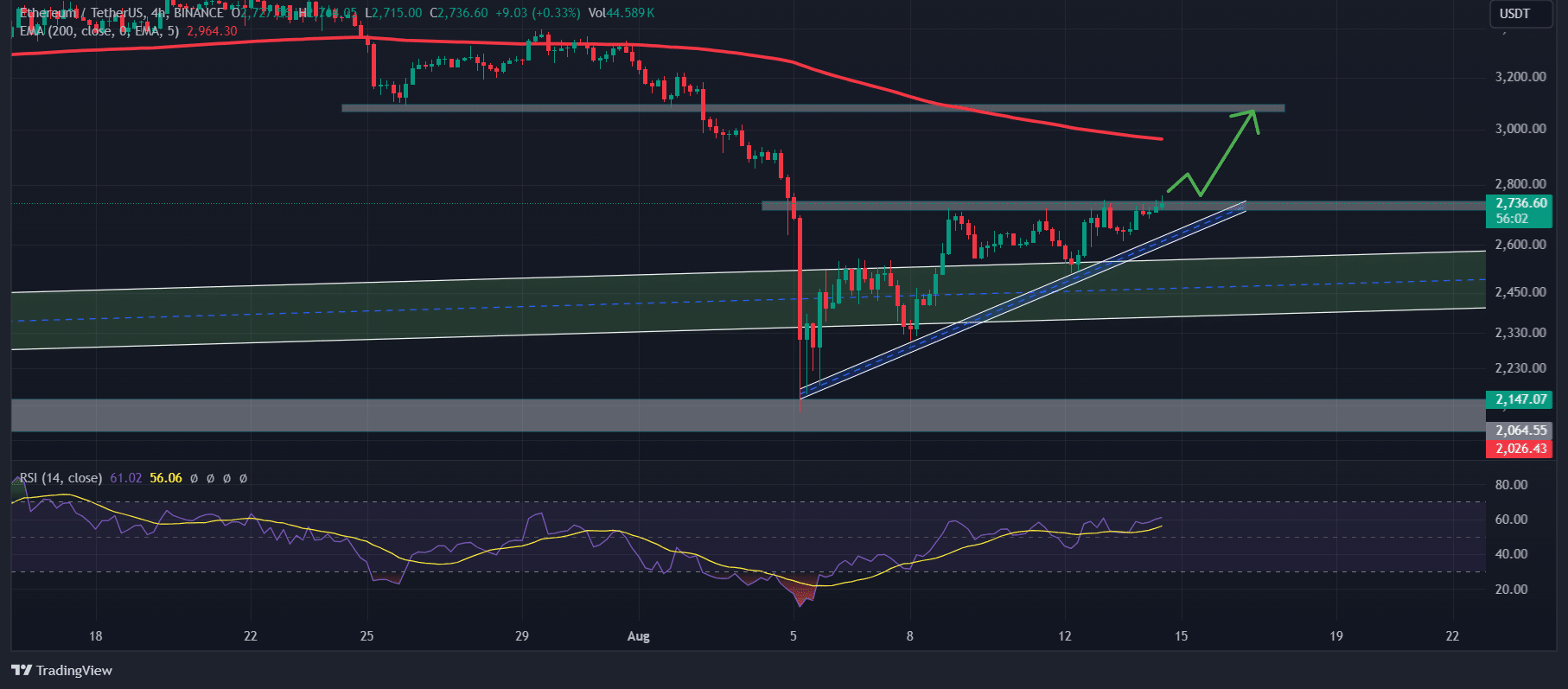

According to expert technical analysis, ETH looked bullish as it recently gave a breakout of an ascending triangle price action pattern in a 4-hour time frame.

However, this breakout occurred near a strong support level of a rising trendline.

Source: TradingView

Based on the historical price momentum since 2022, whenever ETH has reached this trendline it has always experienced a massive upside rally.

However, this breakout has shifted the sentiment to bullish and there is a high chance that ETH could reach $3,000 in the coming days.

If the bullish momentum continues, it has the potential to hit the $3,200 level.

At press time, ETH was trading below the 200 Exponential Moving Average (EMA) in a 4-hour time frame.

ETH’s technical analysis

Following this breakout, the ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors and traders.

At press time, ETH was trading near the $2,750 level, having experienced a price surge of over 4.5% during this period.

Meanwhile, its trading volume has decreased by 24%, showing lower participation from traders and investors.

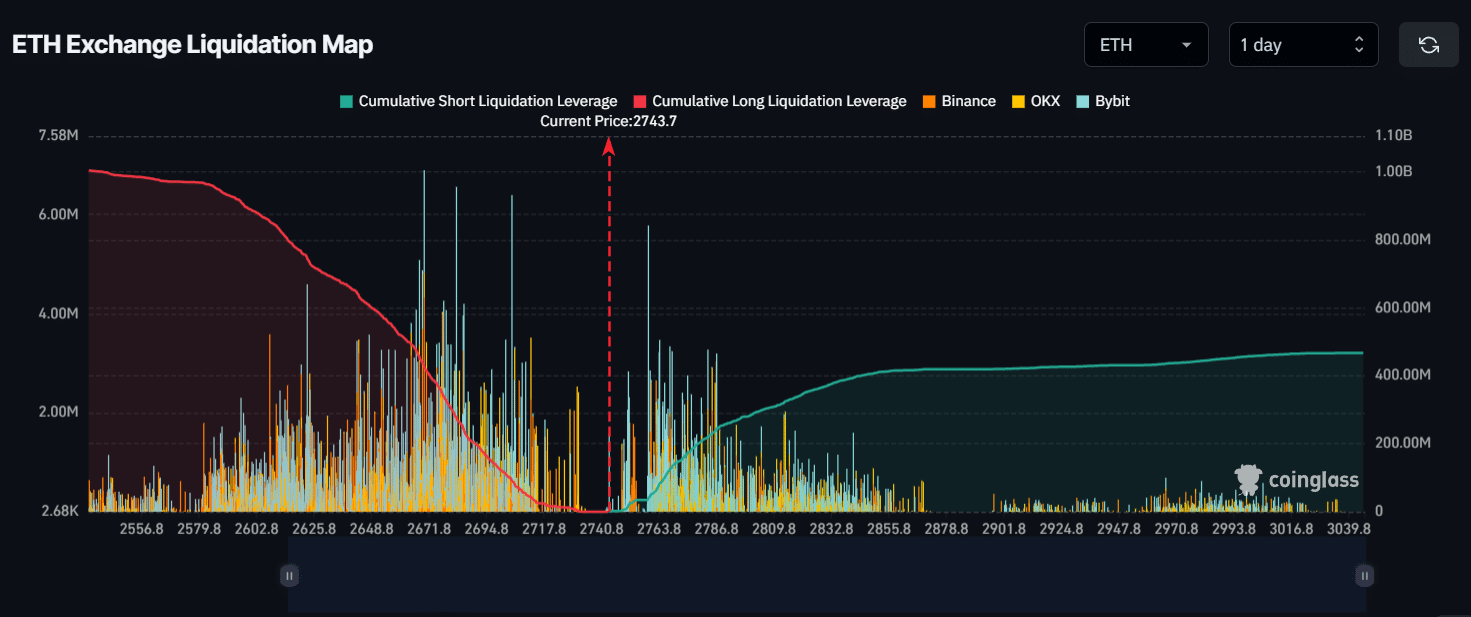

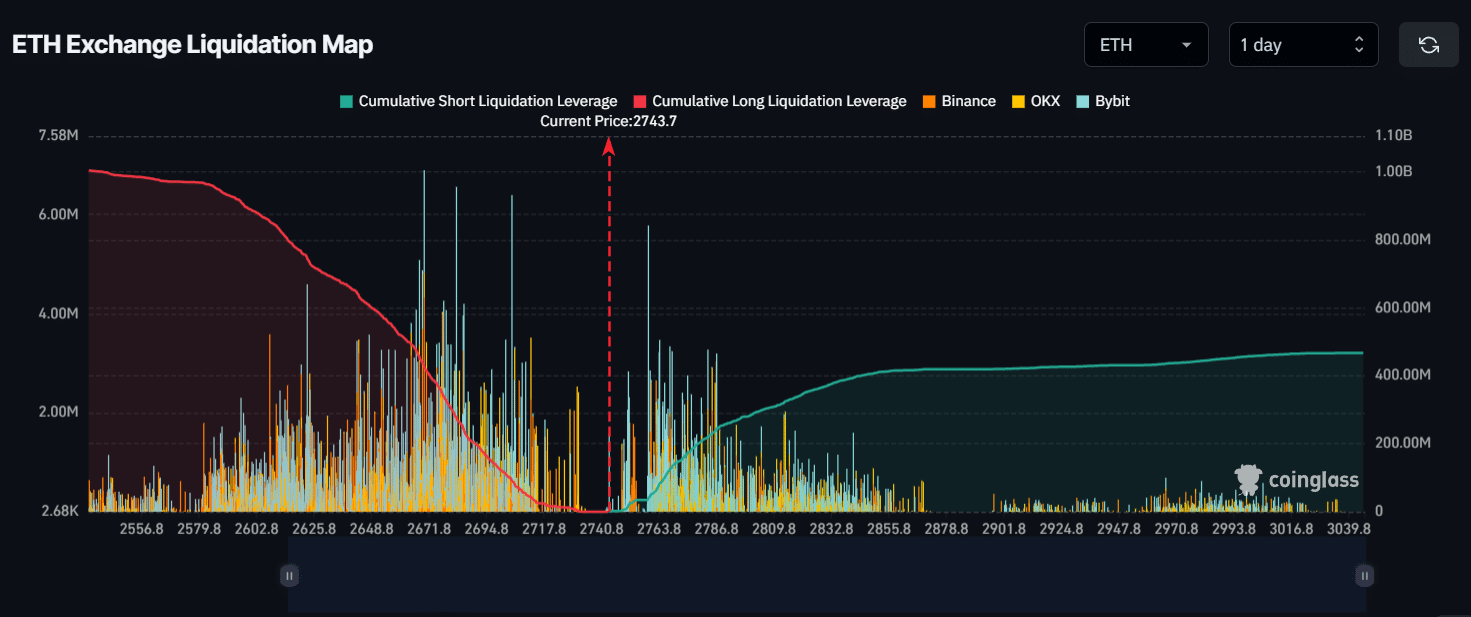

Also, major liquidation levels were at $2,670 on the lower side and $2,760 on the upper side, according to the on-chain analytic firm Coinglass.

Source: Coinglass

Is your portfolio green? Check out the ETH Profit Calculator

If the sentiment remains bullish and the price rises to the $2,760 level, nearly $34.75 million of short positions will be liquidated.

Conversely, if sentiment shifts and the ETH price falls to the $2,670 level, nearly $430 million of long positions will be liquidated.

- There is a high chance that ETH could reach $3,000 or more in the coming days.

- ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors.

On the 14th of August, the overall cryptocurrency market had experienced impressive upside momentum, following the massive 4.5% price surge in Bitcoin [BTC].

Amid this bullish trend, Ethereum [ETH], the world’s second-biggest cryptocurrency, gained significant attention from the crypto community due to its notable price surge and recent breakout.

Ethereum: Upcoming levels

According to expert technical analysis, ETH looked bullish as it recently gave a breakout of an ascending triangle price action pattern in a 4-hour time frame.

However, this breakout occurred near a strong support level of a rising trendline.

Source: TradingView

Based on the historical price momentum since 2022, whenever ETH has reached this trendline it has always experienced a massive upside rally.

However, this breakout has shifted the sentiment to bullish and there is a high chance that ETH could reach $3,000 in the coming days.

If the bullish momentum continues, it has the potential to hit the $3,200 level.

At press time, ETH was trading below the 200 Exponential Moving Average (EMA) in a 4-hour time frame.

ETH’s technical analysis

Following this breakout, the ETH’s Open Interest has jumped by 5.5% in the last 24 hours, indicating increased interest from investors and traders.

At press time, ETH was trading near the $2,750 level, having experienced a price surge of over 4.5% during this period.

Meanwhile, its trading volume has decreased by 24%, showing lower participation from traders and investors.

Also, major liquidation levels were at $2,670 on the lower side and $2,760 on the upper side, according to the on-chain analytic firm Coinglass.

Source: Coinglass

Is your portfolio green? Check out the ETH Profit Calculator

If the sentiment remains bullish and the price rises to the $2,760 level, nearly $34.75 million of short positions will be liquidated.

Conversely, if sentiment shifts and the ETH price falls to the $2,670 level, nearly $430 million of long positions will be liquidated.

Vitazen Keto Gummies You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

Vitazen Keto Gummies For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

where to get clomid pill cost of clomiphene without a prescription can i purchase generic clomid without insurance cheapest clomiphene pills where buy generic clomid tablets can i purchase generic clomiphene prices how can i get clomid price

Amazing many of valuable advice.

casino en ligne

Thanks. Quite a lot of info.

meilleur casino en ligne

You have made your point!

casino en ligne

Kudos. Loads of content!

casino en ligne fiable

Great content. Thank you!

casino en ligne

Good data. With thanks.

casino en ligne

Really plenty of great facts!

casino en ligne

You actually said it perfectly.

casino en ligne

Fine postings Regards.

casino en ligne

This is nicely said! !

casino en ligne France

Thanks on putting this up. It’s well done.

With thanks. Loads of conception!

order zithromax for sale – order azithromycin 500mg for sale flagyl 400mg price

buy rybelsus cheap – rybelsus over the counter cost periactin

order domperidone online cheap – cost sumycin 250mg cyclobenzaprine online order

inderal 20mg over the counter – inderal tablet buy generic methotrexate for sale

azithromycin order online – order azithromycin 500mg bystolic 20mg price

augmentin 1000mg pill – https://atbioinfo.com/ order ampicillin online cheap

buy nexium 20mg pills – https://anexamate.com/ buy esomeprazole

coumadin 2mg for sale – anticoagulant buy generic hyzaar

meloxicam 7.5mg canada – tenderness mobic 7.5mg oral

buy generic prednisone – https://apreplson.com/ buy prednisone 40mg for sale

cheapest ed pills – https://fastedtotake.com/ buy ed medication

amoxicillin oral – buy generic amoxicillin amoxil buy online

order fluconazole for sale – https://gpdifluca.com/# diflucan buy online

cenforce 50mg brand – https://cenforcers.com/# purchase cenforce without prescription

cialis super active real online store – fast ciltad cialis once a day

order zantac 150mg – https://aranitidine.com/# purchase zantac pill

cialis trial – https://strongtadafl.com/ max dosage of cialis

I’ll certainly bring back to skim more. click

cost of sildenafil 50mg – https://strongvpls.com/ cheapest viagra 50mg

I’ll certainly carry back to be familiar with more. https://buyfastonl.com/gabapentin.html

This is the compassionate of writing I rightly appreciate. https://ursxdol.com/levitra-vardenafil-online/

This website really has all of the low-down and facts I needed there this case and didn’t comprehend who to ask. https://prohnrg.com/product/lisinopril-5-mg/

More posts like this would prosper the blogosphere more useful. https://aranitidine.com/fr/en_france_xenical/

This is the big-hearted of criticism I positively appreciate. https://ondactone.com/simvastatin/

Thanks on sharing. It’s first quality.

https://doxycyclinege.com/pro/ranitidine/

Proof blog you have here.. It’s obdurate to on elevated status article like yours these days. I justifiably recognize individuals like you! Take care!! https://lzdsxxb.com/home.php?mod=space&uid=5057547

order dapagliflozin 10 mg online cheap – https://janozin.com/ buy dapagliflozin paypal