- Exchange inflow reached January highs, putting the ETH’s price at risk.

- Though the reward ratio dropped, a key indicator suggested that ETH could rally above $4,700.

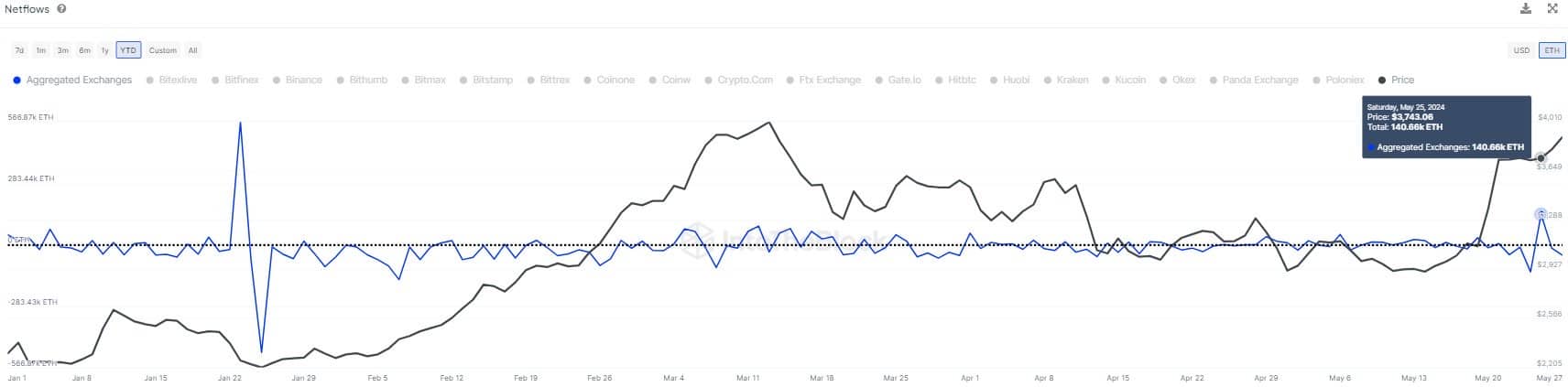

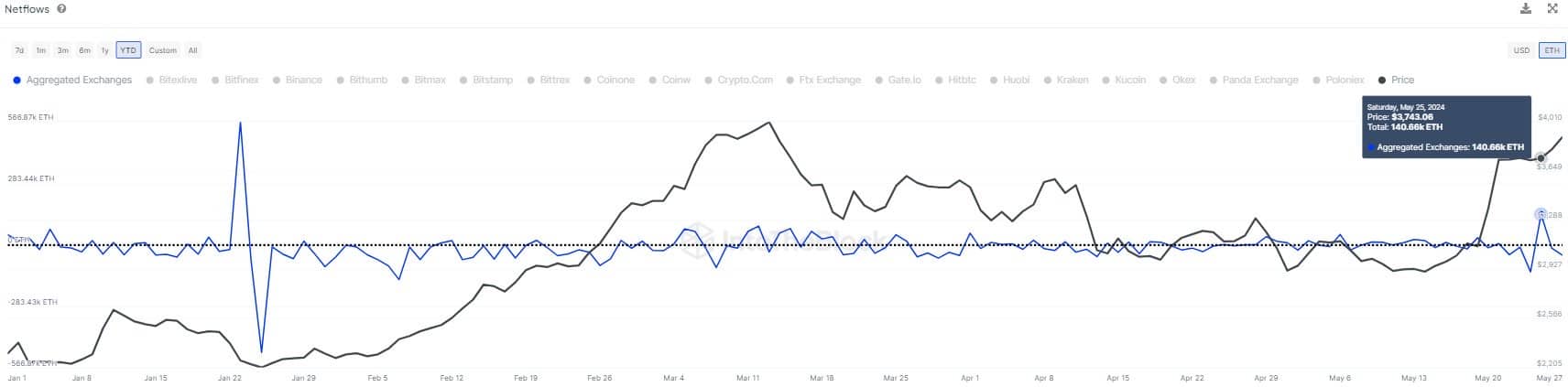

Almost six months since it last hit the highest exchange inflow, Ethereum [ETH] is back in the same situation, sparking speculations that the price could swing lower.

At press time, ETH’s price was $3,874. According to data from IntoTheBlock, the exchange inflow was as high as 140,660 on the 25th of May.

While the inflow has not shed much, AMBCrypto’s deep-dive into the rabbit suggested that the bullish prediction might not come as fast as market participants expected.

Source: IntoTheBlock

Is a new low coming?

This is because the high flow of cryptocurrencies into the exchange is a sign of increased selling pressure. As such, it might be challenging for Ethereum to hit a higher price unless the pressure slows down.

AMBCrypto’s investigation showed that the rise in the sale of the altcoin could be linked to its recent price increase. A few days ago, ETH’s value was over $3,900. This was a 16.82% rise in the last 30 days.

The approval of the Ethereum spot ETFs fueled this hike. But the asset was not trading live yet. However, many opinions suggested that ETH’s price could rally past $4,500 or hit $5,000 once the ETFs go live.

If selling does not stop by that time, this prediction could slip away from the heavyweight in the short term. To assess this, AMBCrypto looked at Ethereum’s Sharpe Ratio.

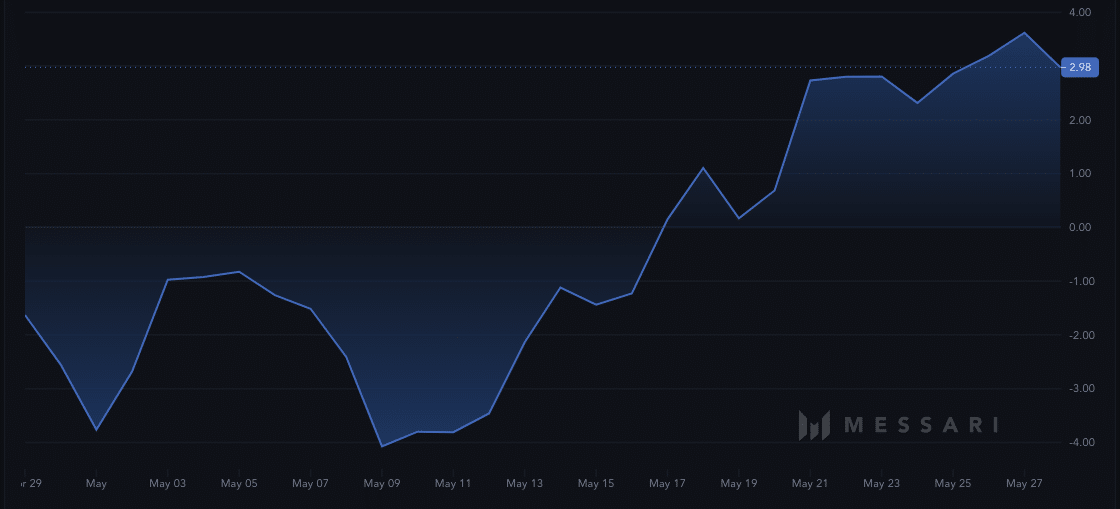

This ratio shows the risk-adjusted performance of an asset. If the reading of the Sharpe Ratio is negative, it means that the asset involved is producing bad returns for holders.

Between 1 and 1.99 is considered a good risk-to-reward ratio. Should the reading rise above 3, it means that the cryptocurrency is offering good returns relative to the risk of investment.

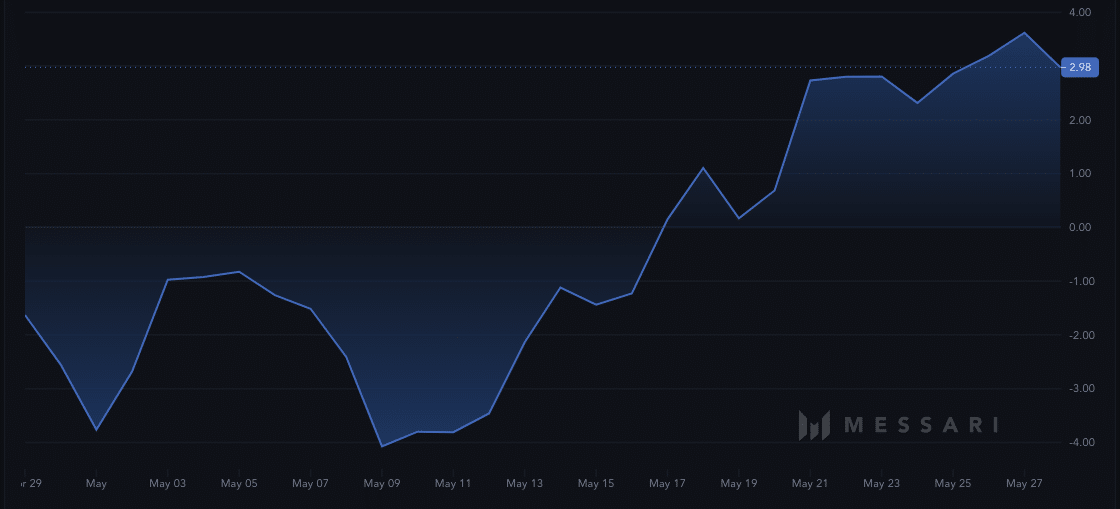

Source: Messari

According to Messari, the metric hit a ceiling of 3.62 on the 27th of May. But at press time, the ratio has declined to 2.98, indicating the returns were no longer excellent but at a moderate pace.

The bull phase might start from $4,713

Should the reading continue to fall, so will ETH’s price. However, the long-term potential of the cryptocurrency remained extremely promising.

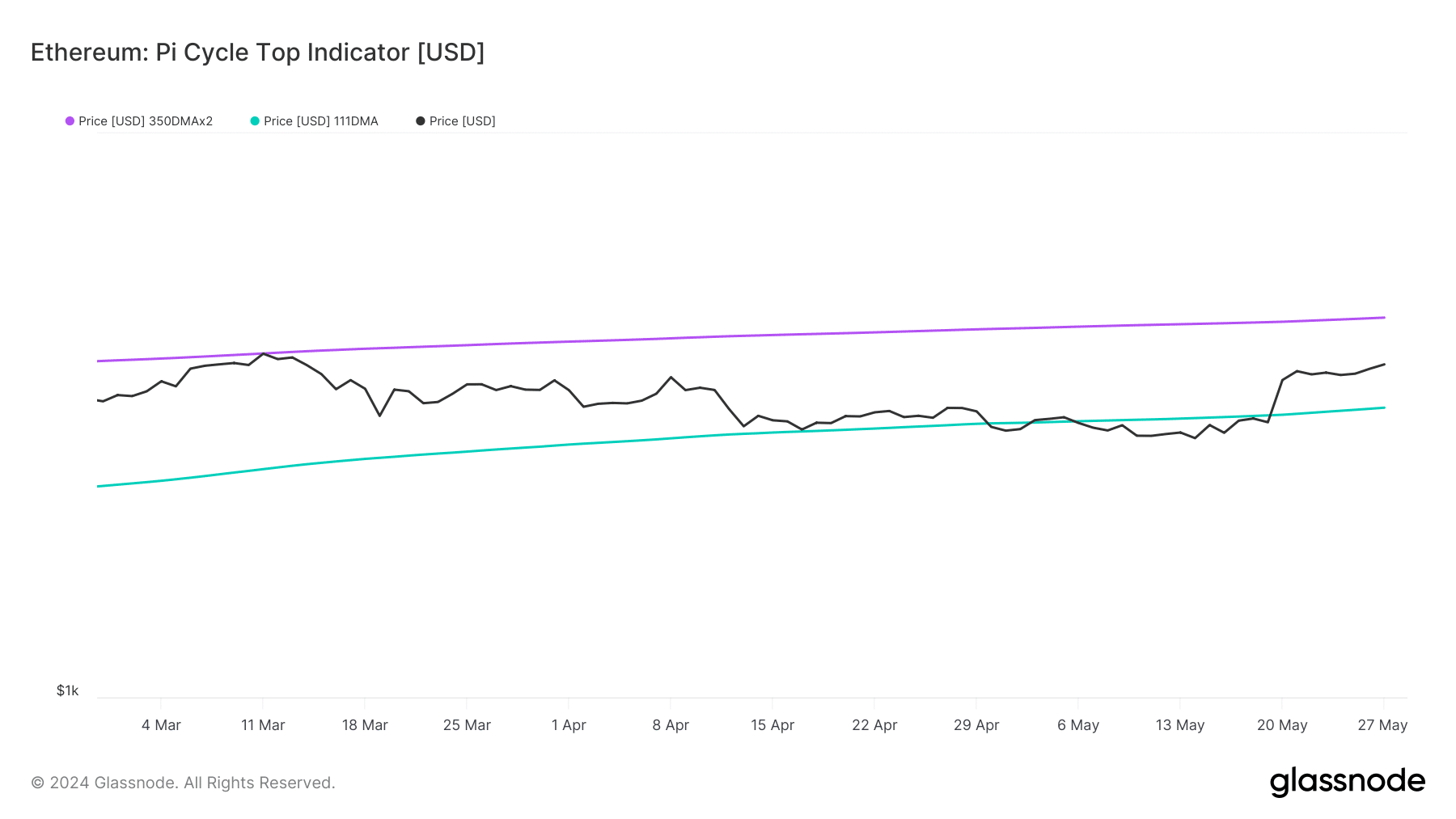

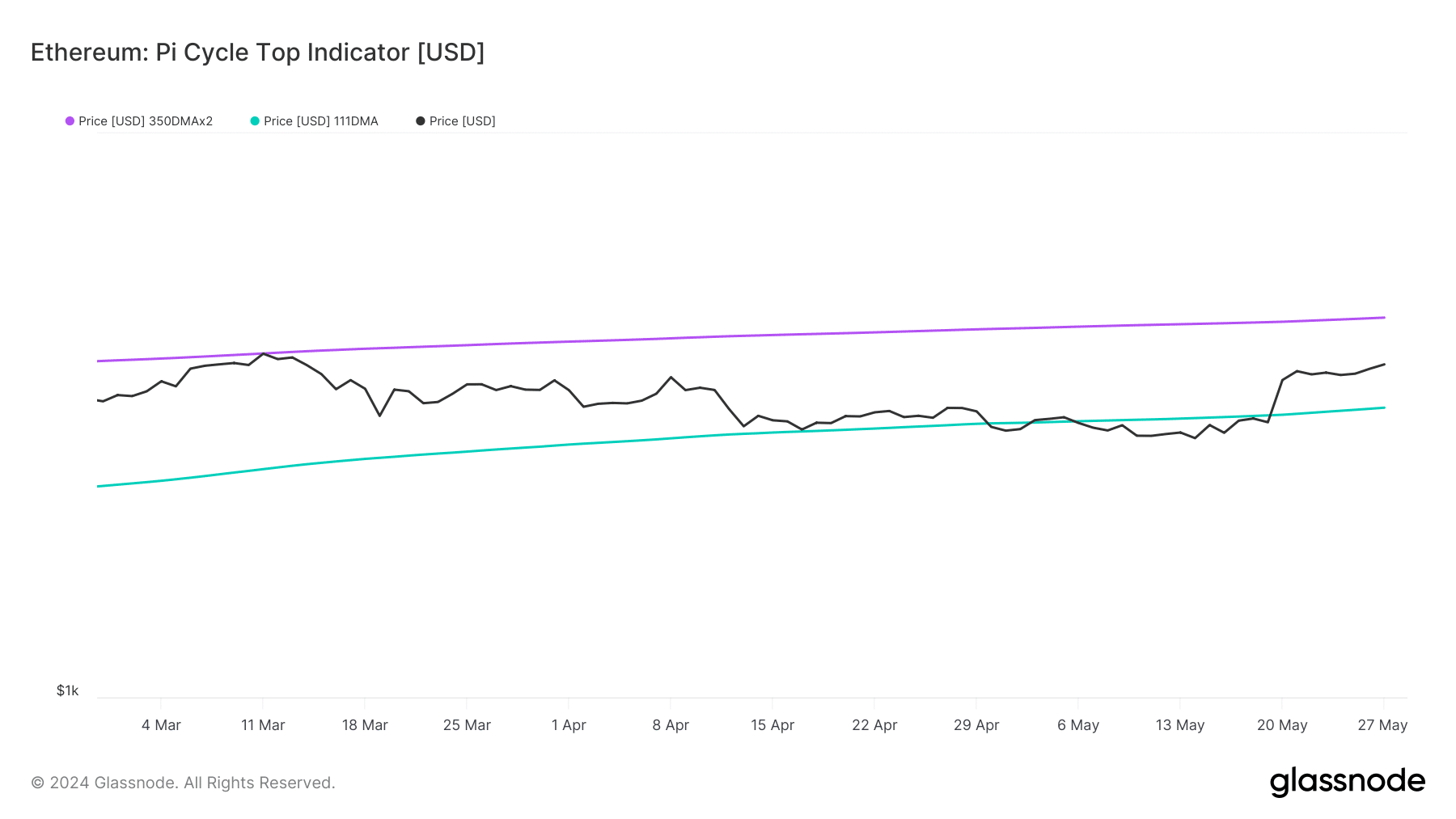

AMBCrypto gathered this after examining the Pi Cycle Top indicator. This metric uses the 111-day Simple Moving Average (SMA) and 350-day SMA to check if prices have hit an overheated point.

For Ethereum, using Glassnode’s data, the 111 SMA (green) was below the 350 SMA (purple). This suggests that the price has the potential to trade higher.

Source: Glassnode

Is your portfolio green? Check the Ethereum Profit Calculator

Assuming a crossover of the shorter SMA over the longer one appeared, it would have spelled doom for ETH.

In addition, the indicator revealed that ETH’s price could hit $4,713 once the selling pressure fizzles out. Should this forecast come to pass, then the value could attempt testing $5,000.

- Exchange inflow reached January highs, putting the ETH’s price at risk.

- Though the reward ratio dropped, a key indicator suggested that ETH could rally above $4,700.

Almost six months since it last hit the highest exchange inflow, Ethereum [ETH] is back in the same situation, sparking speculations that the price could swing lower.

At press time, ETH’s price was $3,874. According to data from IntoTheBlock, the exchange inflow was as high as 140,660 on the 25th of May.

While the inflow has not shed much, AMBCrypto’s deep-dive into the rabbit suggested that the bullish prediction might not come as fast as market participants expected.

Source: IntoTheBlock

Is a new low coming?

This is because the high flow of cryptocurrencies into the exchange is a sign of increased selling pressure. As such, it might be challenging for Ethereum to hit a higher price unless the pressure slows down.

AMBCrypto’s investigation showed that the rise in the sale of the altcoin could be linked to its recent price increase. A few days ago, ETH’s value was over $3,900. This was a 16.82% rise in the last 30 days.

The approval of the Ethereum spot ETFs fueled this hike. But the asset was not trading live yet. However, many opinions suggested that ETH’s price could rally past $4,500 or hit $5,000 once the ETFs go live.

If selling does not stop by that time, this prediction could slip away from the heavyweight in the short term. To assess this, AMBCrypto looked at Ethereum’s Sharpe Ratio.

This ratio shows the risk-adjusted performance of an asset. If the reading of the Sharpe Ratio is negative, it means that the asset involved is producing bad returns for holders.

Between 1 and 1.99 is considered a good risk-to-reward ratio. Should the reading rise above 3, it means that the cryptocurrency is offering good returns relative to the risk of investment.

Source: Messari

According to Messari, the metric hit a ceiling of 3.62 on the 27th of May. But at press time, the ratio has declined to 2.98, indicating the returns were no longer excellent but at a moderate pace.

The bull phase might start from $4,713

Should the reading continue to fall, so will ETH’s price. However, the long-term potential of the cryptocurrency remained extremely promising.

AMBCrypto gathered this after examining the Pi Cycle Top indicator. This metric uses the 111-day Simple Moving Average (SMA) and 350-day SMA to check if prices have hit an overheated point.

For Ethereum, using Glassnode’s data, the 111 SMA (green) was below the 350 SMA (purple). This suggests that the price has the potential to trade higher.

Source: Glassnode

Is your portfolio green? Check the Ethereum Profit Calculator

Assuming a crossover of the shorter SMA over the longer one appeared, it would have spelled doom for ETH.

In addition, the indicator revealed that ETH’s price could hit $4,713 once the selling pressure fizzles out. Should this forecast come to pass, then the value could attempt testing $5,000.

cost clomiphene online buy cheap clomid price can i buy cheap clomiphene no prescription can i get clomid without insurance order clomiphene for sale where can i buy cheap clomiphene pill buy clomid no prescription

More delight pieces like this would insinuate the web better.

The sagacity in this ruined is exceptional.

buy zithromax generic – azithromycin usa flagyl tablet

buy semaglutide medication – cyproheptadine 4 mg generic cyproheptadine order online

buy domperidone 10mg sale – purchase motilium for sale purchase cyclobenzaprine pills

oral clavulanate – https://atbioinfo.com/ buy acillin online cheap

order nexium without prescription – anexa mate order esomeprazole 40mg capsules

medex drug – https://coumamide.com/ losartan 25mg us

purchase mobic online cheap – mobo sin order mobic 15mg online cheap

generic prednisone 5mg – corticosteroid prednisone 5mg pill

best ed drug – https://fastedtotake.com/ where can i buy ed pills

amoxicillin pill – buy amoxil paypal amoxil over the counter

purchase fluconazole – https://gpdifluca.com/ order fluconazole 200mg pills

order cenforce – click buy cenforce 50mg online cheap

cialis after prostate surgery – https://ciltadgn.com/ how long does it take cialis to start working

generic tadalafil prices – can you purchase tadalafil in the us what does cialis treat

ranitidine tablet – buy ranitidine paypal zantac brand

viagra cheap online uk – viagra sale ireland order viagra plus

Proof blog you procure here.. It’s severely to find elevated status belles-lettres like yours these days. I honestly appreciate individuals like you! Withstand care!! amoxil precio

This is a keynote which is in to my callousness… Many thanks! Exactly where can I lay one’s hands on the contact details for questions? https://buyfastonl.com/gabapentin.html

This is the description of content I have reading. https://ursxdol.com/clomid-for-sale-50-mg/

This is the make of advise I turn up helpful. https://prohnrg.com/product/atenolol-50-mg-online/

This is a topic which is forthcoming to my heart… Many thanks! Exactly where can I upon the connection details an eye to questions? https://aranitidine.com/fr/en_ligne_kamagra/

More articles like this would remedy the blogosphere richer. https://ondactone.com/product/domperidone/

Greetings! Jolly gainful par‘nesis within this article! It’s the crumb changes which liking obtain the largest changes. Thanks a quantity towards sharing!

generic hyzaar

Good blog you be undergoing here.. It’s hard to assign strong worth belles-lettres like yours these days. I honestly respect individuals like you! Rent guardianship!! http://zqykj.cn/bbs/home.php?mod=space&uid=302445