- Staked ETH turned profitable for the first time since March, boosting validator confidence and sentiment.

- Ethereum’s bullish momentum strengthens with $2,550 breakout, but signs of overbought conditions emerge.

Ethereum’s [ETH] back in the green – and so is validator sentiment. For the first time since March, staked ETH is showing unrealized gains, a comeback in on-chain confidence.

But this isn’t just a blip on the charts; it may be the early beginning of a broader shift in Ethereum’s value capture story.

With the network keeping an eye on L2 scaling incentives and application migration risks, the network’s economic foundation could be on the cusp of something huge.

Staked ETH returns to profit

A recent CryptoQuant report has revealed that Ethereum stakers are back in the green after more than two months of unrealized losses.

Since March, staked ETH had been underwater, with the realized price sitting above market levels. However, on the 9th of May, ETH crossed the $2297 mark, surpassing the realized price of – flipping stakers back into profit territory.

This recovery strengthens Ethereum’s network stability by reassuring validators and staking participants. As profit returns to stakers, it could be a sign of a larger bullish shift across the Ethereum ecosystem.

Ethereum as the biggest on-chain economy

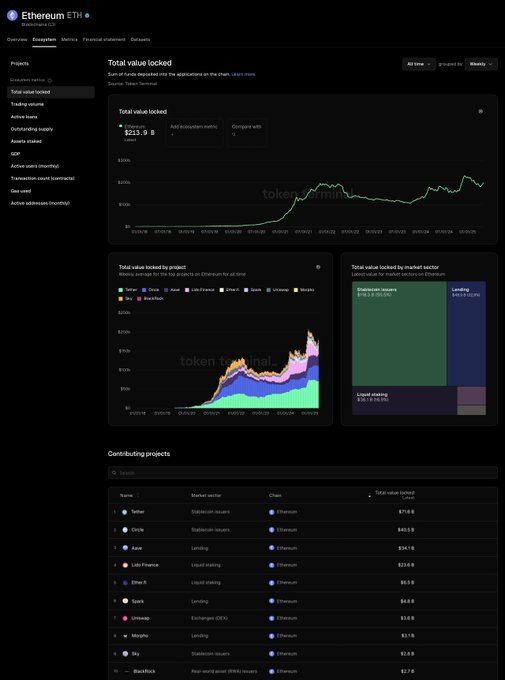

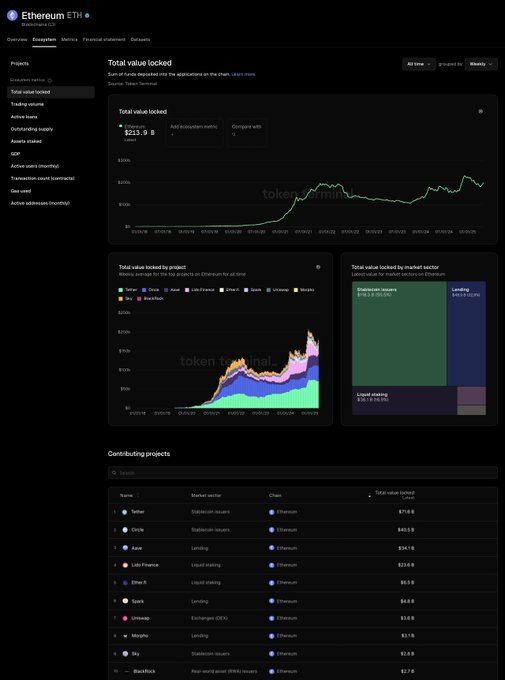

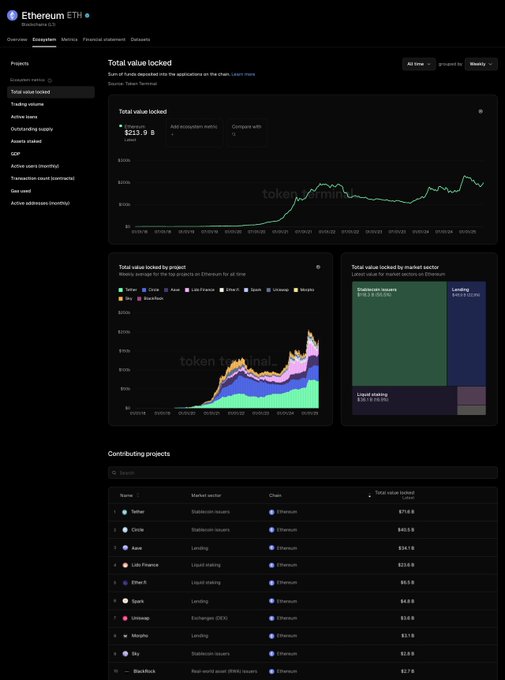

Ethereum continues to dominate as the largest on-chain economy, with over $213.9 billion in TVL across lending, staking, and other sectors.

This expansive activity shows Ethereum’s unmatched developer base and DeFi infrastructure, attracting the highest volume of app deployment and usage.

Source: X

However, the dominance isn’t without risk.

Incentives tied to scalability and app success create a real threat of app migration – especially to competing chains.

Ethereum’s new leadership has acknowledged these graduation risks and are reportedly working toward strategies that ensure value retention as apps evolve and expand.

Price momentum builds

ETH’s recent breakout pushed it above $2,550 at press time, marking a strong bullish continuation.

Technicals supported the rally – the RSI was at 80.58, indicating strong momentum but perhaps the asset is entering overbought territory.

Meanwhile, the MACD showed a widening gap between the MACD and signal lines, a bullish signal reflecting increased buying pressure.

Source: TradingView

With volume holding steady and sentiment turning optimistic post-staking profit recovery, Ethereum’s price may test higher resistances. However, overextension could lead to a brief consolidation before the next leg up.

- Staked ETH turned profitable for the first time since March, boosting validator confidence and sentiment.

- Ethereum’s bullish momentum strengthens with $2,550 breakout, but signs of overbought conditions emerge.

Ethereum’s [ETH] back in the green – and so is validator sentiment. For the first time since March, staked ETH is showing unrealized gains, a comeback in on-chain confidence.

But this isn’t just a blip on the charts; it may be the early beginning of a broader shift in Ethereum’s value capture story.

With the network keeping an eye on L2 scaling incentives and application migration risks, the network’s economic foundation could be on the cusp of something huge.

Staked ETH returns to profit

A recent CryptoQuant report has revealed that Ethereum stakers are back in the green after more than two months of unrealized losses.

Since March, staked ETH had been underwater, with the realized price sitting above market levels. However, on the 9th of May, ETH crossed the $2297 mark, surpassing the realized price of – flipping stakers back into profit territory.

This recovery strengthens Ethereum’s network stability by reassuring validators and staking participants. As profit returns to stakers, it could be a sign of a larger bullish shift across the Ethereum ecosystem.

Ethereum as the biggest on-chain economy

Ethereum continues to dominate as the largest on-chain economy, with over $213.9 billion in TVL across lending, staking, and other sectors.

This expansive activity shows Ethereum’s unmatched developer base and DeFi infrastructure, attracting the highest volume of app deployment and usage.

Source: X

However, the dominance isn’t without risk.

Incentives tied to scalability and app success create a real threat of app migration – especially to competing chains.

Ethereum’s new leadership has acknowledged these graduation risks and are reportedly working toward strategies that ensure value retention as apps evolve and expand.

Price momentum builds

ETH’s recent breakout pushed it above $2,550 at press time, marking a strong bullish continuation.

Technicals supported the rally – the RSI was at 80.58, indicating strong momentum but perhaps the asset is entering overbought territory.

Meanwhile, the MACD showed a widening gap between the MACD and signal lines, a bullish signal reflecting increased buying pressure.

Source: TradingView

With volume holding steady and sentiment turning optimistic post-staking profit recovery, Ethereum’s price may test higher resistances. However, overextension could lead to a brief consolidation before the next leg up.

get cheap clomiphene online where buy cheap clomid pill cost of generic clomid without a prescription cost of clomiphene pill buy clomiphene clomid challenge test where buy cheap clomiphene

With thanks. Loads of conception!

Thanks for sharing. It’s first quality.

order azithromycin 250mg generic – azithromycin 250mg for sale metronidazole 400mg tablet

order semaglutide sale – buy semaglutide for sale cyproheptadine 4 mg over the counter

order motilium online cheap – domperidone 10mg pills order cyclobenzaprine 15mg generic

order inderal 10mg without prescription – buy methotrexate 10mg generic order methotrexate without prescription

purchase amoxicillin generic – diovan 160mg for sale brand combivent

purchase augmentin for sale – atbioinfo buy ampicillin generic

esomeprazole pill – https://anexamate.com/ esomeprazole 40mg for sale

buy warfarin 2mg sale – https://coumamide.com/ brand cozaar 50mg

mobic 15mg pill – https://moboxsin.com/ buy mobic 7.5mg

prednisone 10mg for sale – https://apreplson.com/ prednisone 20mg us

buy generic ed pills for sale – https://fastedtotake.com/ ed pills where to buy

order generic amoxil – https://combamoxi.com/ cheap amoxil tablets

buy forcan pills – https://gpdifluca.com/# diflucan brand

escitalopram usa – site lexapro 10mg tablet

cenforce sale – https://cenforcers.com/ purchase cenforce sale

maximum dose of cialis in 24 hours – https://strongtadafl.com/ tadalafil daily use

order ranitidine generic – buy ranitidine cheap ranitidine 150mg cheap

sildenafil 100mg blue pill – https://strongvpls.com/# discount viagra order

This website positively has all of the low-down and facts I needed to this participant and didn’t comprehend who to ask. where can i buy amoxil

This is a question which is in to my verve… Many thanks! Unerringly where can I lay one’s hands on the phone details for questions? https://gnolvade.com/

This website exceedingly has all of the information and facts I needed about this thesis and didn’t positive who to ask. https://ursxdol.com/propecia-tablets-online/

More posts like this would make the online time more useful. on this site

This is the type of post I find helpful. prix viagra gГ©nГ©rique en pharmacie

I couldn’t resist commenting. Profoundly written! https://ondactone.com/spironolactone/

Greetings! Extremely serviceable par‘nesis within this article! It’s the scarcely changes which choice turn the largest changes. Thanks a quantity in the direction of sharing!

clopidogrel over the counter

This is the description of glad I get high on reading. http://ledyardmachine.com/forum/User-Lzvpam

pill forxiga 10mg – https://janozin.com/ buy dapagliflozin 10 mg sale

buy orlistat medication – click brand orlistat